Escolar Documentos

Profissional Documentos

Cultura Documentos

Annexure IV - Part 7 - Asta Chemicals Sdn. BHD

Enviado por

Uppiliappan Gopalan0 notas0% acharam este documento útil (0 voto)

47 visualizações2 páginasChemical Document

Título original

Annexure IV - Part 7 - Asta Chemicals Sdn. Bhd

Direitos autorais

© © All Rights Reserved

Formatos disponíveis

PDF, TXT ou leia online no Scribd

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoChemical Document

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

0 notas0% acharam este documento útil (0 voto)

47 visualizações2 páginasAnnexure IV - Part 7 - Asta Chemicals Sdn. BHD

Enviado por

Uppiliappan GopalanChemical Document

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

Você está na página 1de 2

Glosap Business Case Study | Asta Chemicals Sdn.

Bhd| Singapore

Asta Chemicals Sdn. Bhd: Incorporation

of SAP GST Taxation and SAP Support

Maintenance by Glosap

Asta Chemicals Sdn. Bhd. was primarily established in

1974 as a producer of formaldehyde, adhesives resins,

hardeners and fillers for both local and export market to

service the timber processing industries.

The first manufacturing site commenced operation in

1975 and is located at Prai Industrial Estates in the State

of Penang. It has manufacturing facilities for the

production of formaldehyde, liquid resins, spray dried

powder resins, compounded powder resins, Specialty

resins, hardeners and fillers.

In 1992, the company opened its second manufacturing

site at Gebeng Industrial Estate located at Kuantan Port

in the State of Pahang, with production facilities

consisting of a formaldehyde plant, a resin plant, tanks

farm with direct receiving facilities from the port and

other ancillary supporting tanks and equipment.

Glosap Business Case Study | Asta Chemicals Sdn. Bhd| Singapore

Company

Asta Chemicals Sdn. Bhd

Executive overview:

The company's top objectives

To incorporate the scope of Goods and

Services Tax (GST) across territories

Industry

To configure appropriate tax structure,

Manufacturing tax codes and tax rates

Chemicals

Undertake GAP analysis of business

and impact of GST upon the

Property Segments

consumption / production of goods

Plywood

Particleboard

To optimise multi level tax structure

Medium Density Board(MDF) To analyse the Refunds and bad debts

Furniture and Woodworking

Foundry

The Solution:

Laminates

SAP

Goods

&

Services

Tax

UF Powered Resins

Implementation

SAP Support Modules : FICO, PS, MM

Project

and SD

SAP R/3 - Support Project SAP GST Project

Country: Malaysia

Headquarters

Malaysia

No. of Users

25

Client URL

www.astachemicals.com

Employee

150+

Partner Company

Glosap Consulting Pte Ltd

Partner URL

www.glosap.com

The key benefits:

SAP GST helped easy transition from

conventional tax structure to real time

GST structure

Helped re-align their warehouses with

logical effective locations thus

reducing their operational cost

Helped analyse on the tax incurred at

an organized mode as per the value

addition of the goods

Você também pode gostar

- A Study of the Supply Chain and Financial Parameters of a Small BusinessNo EverandA Study of the Supply Chain and Financial Parameters of a Small BusinessAinda não há avaliações

- Pidilite LTD 7445Documento46 páginasPidilite LTD 7445Suresh BabuAinda não há avaliações

- A Study of the Supply Chain and Financial Parameters of a Small Manufacturing BusinessNo EverandA Study of the Supply Chain and Financial Parameters of a Small Manufacturing BusinessAinda não há avaliações

- S4 HANA Pre-Study Scope - DraftDocumento5 páginasS4 HANA Pre-Study Scope - DraftSeema YadAinda não há avaliações

- SMED – How to Do a Quick Changeover?: Toyota Production System ConceptsNo EverandSMED – How to Do a Quick Changeover?: Toyota Production System ConceptsNota: 4.5 de 5 estrelas4.5/5 (2)

- Sap Case Study Divekar November 2011Documento2 páginasSap Case Study Divekar November 2011Mohit NiranjaneAinda não há avaliações

- Implementing Integrated Business Planning: A Guide Exemplified With Process Context and SAP IBP Use CasesNo EverandImplementing Integrated Business Planning: A Guide Exemplified With Process Context and SAP IBP Use CasesAinda não há avaliações

- Dharmesh SoniDocumento5 páginasDharmesh Sonidrsoni_76Ainda não há avaliações

- KPMG AuditDocumento25 páginasKPMG AuditAbbasAinda não há avaliações

- The Following Are The Objectives of The StudyDocumento6 páginasThe Following Are The Objectives of The StudyChetan SankhlaAinda não há avaliações

- Exec Summary Biz Proposal Packaging Palm Oil Product Factory - Latest 270614 PDFDocumento25 páginasExec Summary Biz Proposal Packaging Palm Oil Product Factory - Latest 270614 PDFzulhariszan abd manan100% (2)

- SAP GTS Consultant resumeDocumento3 páginasSAP GTS Consultant resumesuraj64778100% (2)

- Waste ManagementDocumento30 páginasWaste ManagementChrisYapAinda não há avaliações

- Mechanical Engineer Seeks Production Management RoleDocumento5 páginasMechanical Engineer Seeks Production Management Rolegaurav_exAinda não há avaliações

- Company ProfileDlhDocumento15 páginasCompany ProfileDlhgenterprise1966Ainda não há avaliações

- 1.0 Executive Summary: Timber Land CorporationDocumento11 páginas1.0 Executive Summary: Timber Land CorporationbmmrAinda não há avaliações

- Resume S4 HANA UAEDocumento4 páginasResume S4 HANA UAERULER KINGSAinda não há avaliações

- Hiranmayee Private LimitedDocumento25 páginasHiranmayee Private LimitedBlack berryAinda não há avaliações

- Patel Sunil R Patel Sandip A: An ISO 9001:2000 CompanyDocumento44 páginasPatel Sunil R Patel Sandip A: An ISO 9001:2000 CompanySunil PatelAinda não há avaliações

- SAP FICO Expert With 9+ Years ExperienceDocumento6 páginasSAP FICO Expert With 9+ Years ExperiencedarapuAinda não há avaliações

- MLCF Annual Report 2012Documento127 páginasMLCF Annual Report 2012Jahan ZebAinda não há avaliações

- Operations of Lucky CementDocumento19 páginasOperations of Lucky CementAli AbbasAinda não há avaliações

- Chitrarasu IDocumento7 páginasChitrarasu IChitrarasu IrusanAinda não há avaliações

- Industrial Visit: Arijit RoyDocumento15 páginasIndustrial Visit: Arijit RoyRina MarakAinda não há avaliações

- PetrochemicalsDocumento6 páginasPetrochemicalsvarshneyrajeAinda não há avaliações

- Sahara Profile 2016Documento18 páginasSahara Profile 2016wessam_thomasAinda não há avaliações

- Company ProfileDocumento8 páginasCompany ProfileAdnanAinda não há avaliações

- Balmer Lawrie IntroDocumento3 páginasBalmer Lawrie IntroSharad ShuklaAinda não há avaliações

- SAP MM Sample ResumeDocumento4 páginasSAP MM Sample ResumeparavaiselvamAinda não há avaliações

- Attock Oil Petroleum: Corporate OfficeDocumento10 páginasAttock Oil Petroleum: Corporate OfficeAdinanoorAinda não há avaliações

- Company Profile PT Sasfindo Multi Yasa OKDocumento6 páginasCompany Profile PT Sasfindo Multi Yasa OKAbdul Sani YatimAinda não há avaliações

- DSM drives focused growth with polymer partnershipDocumento23 páginasDSM drives focused growth with polymer partnershipMus ChrifiAinda não há avaliações

- A Project Report OnDocumento73 páginasA Project Report OnskdbjfAinda não há avaliações

- Minda Projects Ltd.Documento32 páginasMinda Projects Ltd.providerserviceAinda não há avaliações

- Working Capital ManagementDocumento81 páginasWorking Capital ManagementparaghiAinda não há avaliações

- AIEP Practical Application WorkDocumento8 páginasAIEP Practical Application WorkScribdTranslationsAinda não há avaliações

- History of Pidilite1Documento13 páginasHistory of Pidilite1Shubhankar VaishAinda não há avaliações

- Tahir Ahmad Zahid's CV summarizing experience in research development productionDocumento3 páginasTahir Ahmad Zahid's CV summarizing experience in research development productionUbaid Sheikh InkwalaAinda não há avaliações

- Lafarge Cement Value ChainDocumento16 páginasLafarge Cement Value ChainAsad Ali100% (2)

- DYPNF BrochureDocumento16 páginasDYPNF BrochureJaeyoung LeeAinda não há avaliações

- Nagesh - SAP LE (SD) - Mumbai - 7+yrsDocumento9 páginasNagesh - SAP LE (SD) - Mumbai - 7+yrsjagadishwas09Ainda não há avaliações

- Maple Leaf Cement Factory Limited Annual Report 2015 HighlightsDocumento180 páginasMaple Leaf Cement Factory Limited Annual Report 2015 HighlightsM Umar Farooq0% (1)

- Oil Module Introduction - DetailDocumento26 páginasOil Module Introduction - DetailyakubshahAinda não há avaliações

- NaineshDocumento3 páginasNaineshcfo.dammamAinda não há avaliações

- Key Purpose:: Company Registration No. 2016/050997/07Documento4 páginasKey Purpose:: Company Registration No. 2016/050997/07Moges TenaAinda não há avaliações

- Kapbros Finance Department ProjectDocumento50 páginasKapbros Finance Department ProjectAnkit Raj50% (10)

- BASFDocumento9 páginasBASFDhanesh ElangoAinda não há avaliações

- AbstractDocumento1 páginaAbstractIqbal MohammadAinda não há avaliações

- Berger PaintDocumento218 páginasBerger PaintMuhammadArshad100% (1)

- Profile To PrintDocumento10 páginasProfile To PrintSuhailShaikhAinda não há avaliações

- BASF in Malaysia Backgrounder-2021Documento2 páginasBASF in Malaysia Backgrounder-2021Muhammad Umer FarooqAinda não há avaliações

- Asian PaintsDocumento41 páginasAsian Paintssreenesh_pai100% (4)

- FYP-Working Capital Management of Nesco LTDDocumento70 páginasFYP-Working Capital Management of Nesco LTDJames JjuukoAinda não há avaliações

- Apl Stratigic ManagementDocumento34 páginasApl Stratigic ManagementSameer KumbharAinda não há avaliações

- Digital Brochure PDFDocumento9 páginasDigital Brochure PDFimranAinda não há avaliações

- Resume SapDocumento4 páginasResume Sapmanoj vermaAinda não há avaliações

- Rahimafrooz HRM Project WorkDocumento102 páginasRahimafrooz HRM Project WorkMohammad Rafi100% (3)

- Inventory ManagementDocumento48 páginasInventory ManagementNarendra ChhetriAinda não há avaliações

- PT SANGGAR SARANA BAJA Design, Fabrication, and ServicesDocumento36 páginasPT SANGGAR SARANA BAJA Design, Fabrication, and ServicesAdlan Bagus Pradana100% (1)

- 10 PL & TQMDocumento6 páginas10 PL & TQMUppiliappan GopalanAinda não há avaliações

- BG Case StudyDocumento2 páginasBG Case StudyUppiliappan GopalanAinda não há avaliações

- Core Committee ResponsibilitiesDocumento1 páginaCore Committee ResponsibilitiesUppiliappan GopalanAinda não há avaliações

- Regression Models - SCMDocumento27 páginasRegression Models - SCMUppiliappan GopalanAinda não há avaliações

- S4HANA-Strategy-Update SUGEN Presentation PDFDocumento21 páginasS4HANA-Strategy-Update SUGEN Presentation PDFUppiliappan GopalanAinda não há avaliações

- Internal Order BBPDocumento3 páginasInternal Order BBPUppiliappan GopalanAinda não há avaliações

- Gartner Best Practices Planning SAP HANA PDFDocumento30 páginasGartner Best Practices Planning SAP HANA PDFmadaxx2010Ainda não há avaliações

- Andhra Pradesh (Regulation of Wholesale Trade and Distribution and Retail Trade in Indian Liquor, Foreign Liquor, Wine and Beer) Act, 1993Documento39 páginasAndhra Pradesh (Regulation of Wholesale Trade and Distribution and Retail Trade in Indian Liquor, Foreign Liquor, Wine and Beer) Act, 1993Uppiliappan GopalanAinda não há avaliações

- S4HANA The New Business Suite (En) Neumann Final HandoutDocumento21 páginasS4HANA The New Business Suite (En) Neumann Final HandoutUppiliappan GopalanAinda não há avaliações

- Shiridi TripDocumento2 páginasShiridi TripUppiliappan GopalanAinda não há avaliações

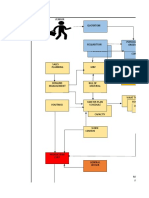

- Flow ChartDocumento6 páginasFlow ChartUppiliappan GopalanAinda não há avaliações

- 2014 Market ResearchDocumento45 páginas2014 Market ResearchUppiliappan GopalanAinda não há avaliações

- Glosap's Pmbok - PMP Way of PMDocumento33 páginasGlosap's Pmbok - PMP Way of PMUppiliappan GopalanAinda não há avaliações

- Supply Chain ManagementDocumento27 páginasSupply Chain ManagementskibcobsaivigneshAinda não há avaliações

- FF Epc ModelDocumento2 páginasFF Epc ModelUppiliappan GopalanAinda não há avaliações

- SAP Requirements Gathering QuestionerDocumento122 páginasSAP Requirements Gathering Questionerbirenagnihotri84% (25)

- GST - Tax and Pricing (BBP - 4)Documento22 páginasGST - Tax and Pricing (BBP - 4)Uppiliappan GopalanAinda não há avaliações

- GGPL BBP Fi V3Documento158 páginasGGPL BBP Fi V3api-3706118100% (1)

- Case 1Documento3 páginasCase 1Uppiliappan Gopalan100% (1)

- GST - Tax and PricingDocumento21 páginasGST - Tax and PricingUppiliappan GopalanAinda não há avaliações

- Operational Excellence Through Enterprise Risk ReductionDocumento45 páginasOperational Excellence Through Enterprise Risk ReductionUppiliappan GopalanAinda não há avaliações

- Go-Live ChecklistDocumento6 páginasGo-Live ChecklistpakyemAinda não há avaliações

- SAP Requirements Gathering QuestionerDocumento122 páginasSAP Requirements Gathering Questionerbirenagnihotri84% (25)

- Vaccum PackagingDocumento18 páginasVaccum PackagingUppiliappan GopalanAinda não há avaliações

- Cool Grinding Line - Modification DetailsDocumento4 páginasCool Grinding Line - Modification DetailsUppiliappan GopalanAinda não há avaliações

- Skills Matrix TemplateDocumento6 páginasSkills Matrix TemplateUppiliappan GopalanAinda não há avaliações

- RedBus Ticket TK6T48336758Documento2 páginasRedBus Ticket TK6T48336758Uppiliappan GopalanAinda não há avaliações

- Saphana S4 Glosap PDFDocumento28 páginasSaphana S4 Glosap PDFUppiliappan GopalanAinda não há avaliações

- GST Scenarios (Screenshots Glosap)Documento40 páginasGST Scenarios (Screenshots Glosap)Uppiliappan GopalanAinda não há avaliações

- Microwav Heating SystemsDocumento21 páginasMicrowav Heating SystemsUppiliappan GopalanAinda não há avaliações

- Sully: The Untold Story Behind the Miracle on the HudsonNo EverandSully: The Untold Story Behind the Miracle on the HudsonNota: 4 de 5 estrelas4/5 (103)

- The Fabric of Civilization: How Textiles Made the WorldNo EverandThe Fabric of Civilization: How Textiles Made the WorldNota: 4.5 de 5 estrelas4.5/5 (57)

- Packing for Mars: The Curious Science of Life in the VoidNo EverandPacking for Mars: The Curious Science of Life in the VoidNota: 4 de 5 estrelas4/5 (1395)

- The Beekeeper's Lament: How One Man and Half a Billion Honey Bees Help Feed AmericaNo EverandThe Beekeeper's Lament: How One Man and Half a Billion Honey Bees Help Feed AmericaAinda não há avaliações

- The Weather Machine: A Journey Inside the ForecastNo EverandThe Weather Machine: A Journey Inside the ForecastNota: 3.5 de 5 estrelas3.5/5 (31)

- Highest Duty: My Search for What Really MattersNo EverandHighest Duty: My Search for What Really MattersAinda não há avaliações

- Hero Found: The Greatest POW Escape of the Vietnam WarNo EverandHero Found: The Greatest POW Escape of the Vietnam WarNota: 4 de 5 estrelas4/5 (19)

- Faster: How a Jewish Driver, an American Heiress, and a Legendary Car Beat Hitler's BestNo EverandFaster: How a Jewish Driver, an American Heiress, and a Legendary Car Beat Hitler's BestNota: 4 de 5 estrelas4/5 (28)

- The End of Craving: Recovering the Lost Wisdom of Eating WellNo EverandThe End of Craving: Recovering the Lost Wisdom of Eating WellNota: 4.5 de 5 estrelas4.5/5 (80)

- 35 Miles From Shore: The Ditching and Rescue of ALM Flight 980No Everand35 Miles From Shore: The Ditching and Rescue of ALM Flight 980Nota: 4 de 5 estrelas4/5 (21)

- A Place of My Own: The Architecture of DaydreamsNo EverandA Place of My Own: The Architecture of DaydreamsNota: 4 de 5 estrelas4/5 (241)

- The Future of Geography: How the Competition in Space Will Change Our WorldNo EverandThe Future of Geography: How the Competition in Space Will Change Our WorldNota: 4.5 de 5 estrelas4.5/5 (4)

- Dirt to Soil: One Family’s Journey into Regenerative AgricultureNo EverandDirt to Soil: One Family’s Journey into Regenerative AgricultureNota: 5 de 5 estrelas5/5 (124)

- Pale Blue Dot: A Vision of the Human Future in SpaceNo EverandPale Blue Dot: A Vision of the Human Future in SpaceNota: 4.5 de 5 estrelas4.5/5 (586)

- Across the Airless Wilds: The Lunar Rover and the Triumph of the Final Moon LandingsNo EverandAcross the Airless Wilds: The Lunar Rover and the Triumph of the Final Moon LandingsAinda não há avaliações

- Data-ism: The Revolution Transforming Decision Making, Consumer Behavior, and Almost Everything ElseNo EverandData-ism: The Revolution Transforming Decision Making, Consumer Behavior, and Almost Everything ElseNota: 3.5 de 5 estrelas3.5/5 (12)

- Recording Unhinged: Creative and Unconventional Music Recording TechniquesNo EverandRecording Unhinged: Creative and Unconventional Music Recording TechniquesAinda não há avaliações

- Einstein's Fridge: How the Difference Between Hot and Cold Explains the UniverseNo EverandEinstein's Fridge: How the Difference Between Hot and Cold Explains the UniverseNota: 4.5 de 5 estrelas4.5/5 (50)

- Reality+: Virtual Worlds and the Problems of PhilosophyNo EverandReality+: Virtual Worlds and the Problems of PhilosophyNota: 4 de 5 estrelas4/5 (24)

- The Technology Trap: Capital, Labor, and Power in the Age of AutomationNo EverandThe Technology Trap: Capital, Labor, and Power in the Age of AutomationNota: 4.5 de 5 estrelas4.5/5 (46)

- Broken Money: Why Our Financial System is Failing Us and How We Can Make it BetterNo EverandBroken Money: Why Our Financial System is Failing Us and How We Can Make it BetterNota: 5 de 5 estrelas5/5 (3)

- Fallout: The Hiroshima Cover-up and the Reporter Who Revealed It to the WorldNo EverandFallout: The Hiroshima Cover-up and the Reporter Who Revealed It to the WorldNota: 4.5 de 5 estrelas4.5/5 (82)

- The Path Between the Seas: The Creation of the Panama Canal, 1870-1914No EverandThe Path Between the Seas: The Creation of the Panama Canal, 1870-1914Nota: 4.5 de 5 estrelas4.5/5 (124)