Escolar Documentos

Profissional Documentos

Cultura Documentos

Public Finance - Chap 1 Role and Scope of Public Finance

Enviado por

Sumpong Brgy0 notas0% acharam este documento útil (0 voto)

1K visualizações2 páginasBusiness Administration 4th year subject

Public Finance

(c) Ms Cathy

Direitos autorais

© © All Rights Reserved

Formatos disponíveis

DOCX, PDF, TXT ou leia online no Scribd

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoBusiness Administration 4th year subject

Public Finance

(c) Ms Cathy

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato DOCX, PDF, TXT ou leia online no Scribd

0 notas0% acharam este documento útil (0 voto)

1K visualizações2 páginasPublic Finance - Chap 1 Role and Scope of Public Finance

Enviado por

Sumpong BrgyBusiness Administration 4th year subject

Public Finance

(c) Ms Cathy

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato DOCX, PDF, TXT ou leia online no Scribd

Você está na página 1de 2

CHAPTER 1: ROLE AND SCOPE OF PUBLIC

FINANCE

Economics: deals with the utilization of scarce

resources

Public Finance:

-

a field of economics that have alternative

uses to satisfy human wants

Deals with the revenue and expenditure

patterns of the government and their effects

on the economy

Governments Finances

Basic goal: Satisfaction of human wants

DIFFERENCE BETWEEN PUBLIC & PRIVATE

Private wants: only an individual can satisfy the

need. Can be satisfied through the mechanism of

the market. Enjoyment can be made subject to

price payment.

Exclusion Principle: Money is insufficient to

satisfy needs and wants. A person is excluded from

satisfaction of commodity if he is not willing to pay

for it

Public wants: government will be the one to satisfy

the need. Cannot be satisfied through the working

of the market. Enjoyment is independent in his

payment

Classification of Public wants:

Social wants: satisfaction is subject

to the principle of consumer

sovereignty

o Provided by the government

but an individual has freedom

to avail or not

o Government provides PNP

for security but an individual

can still hire security guards

from private agencies

Merit wants: subject to the

exclusion principle and satisfied by

market within the limits of effective

demand

FINANCIAL MEANS AVAILABLE

Private Finance: Securities, Shares of

Stock, borrowing etc.

Public Finance: Taxation, Printing money,

borrowing or through sale of assets

BUDGETING PROCEDURE

Private Finance: starts from income side

then proceeds to individual expenditure item

Public Finance: determine first its

expenditure needs and the looks for

possible ways of financing them

PUBLIC FINANCE PRINCIPLES:

Keep expenditures at the lowest level as

possible (Efficiency)

Balance the budget annually

Taxes should be levied and collected in

such a way as to interfere at least within

allocation of resources and the distribution

of income

GOALS OF FREE ENTERPRISE SYSTEM

Strengthen economic freedom

Promote overall economic efficiency

Promote economic growth

Promote economic stability

Promote economic security

PUBLIC FINANCE FUNCTION:

1. Allocation Section: determine what goods

and services are to be produced, who is

going to pay and by how much for such

goods and services

2. Distribution Section: determination and

attainment of a proper state of income

distribution

3. Stabilization Section: maintaining a high

level of resource utilization that is full

employment of all factors of production

CHAPTER 2 DEVELOPMENT OF PUBLIC

FINANCE

ANCIENT PUBLIC FINANCE

The Slave Societies

State: comprised of the government, the

people, territory, and sovereignty

Public Finance: financed the activity of the

government

Trade and Commerce: potentially rich

sources of revenues were not yet

developed.

Asset Principle: direct taxation has to have

consent of the people

Budgeting: apportion revenues to perform

several functions

Borrowings: solicited gifts or levied limited

taxes

Ancient State Audit: concerned with

maintenance and inspection of financial

records

Ombudsman: executive-judicial

bureaucracies

Medieval Public Finance

Medieval public finance: followed the

changes in the political structure of the state

during middle ages

Medieval conditions:

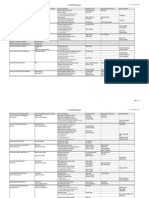

Você também pode gostar

- Understanding the Basics of Public FinanceDocumento101 páginasUnderstanding the Basics of Public FinanceFe P. ImbongAinda não há avaliações

- Public vs private financeDocumento13 páginasPublic vs private financeUlaga50% (2)

- Introduction To Public Finance 2 PDFDocumento6 páginasIntroduction To Public Finance 2 PDFChristopher Gates70% (10)

- Public FinanceDocumento87 páginasPublic FinanceMichelle Rotairo100% (1)

- Lesson I - The Role and Scope of Public FinanceDocumento3 páginasLesson I - The Role and Scope of Public Financemarygracepronquillo100% (10)

- Government Spending Theories Lecture NotesDocumento6 páginasGovernment Spending Theories Lecture NotesrichelAinda não há avaliações

- Philippine Public FinanceDocumento77 páginasPhilippine Public Financeflesteban100% (1)

- Public ExpenditureDocumento2 páginasPublic ExpenditureVin Gudluck Kadunco100% (2)

- CTT - Public Finance (Prelim Exam)Documento4 páginasCTT - Public Finance (Prelim Exam)geofrey gepitulanAinda não há avaliações

- Public Finance Principles OverviewDocumento12 páginasPublic Finance Principles OverviewShie RontaloAinda não há avaliações

- Public Finance Cycle in The PhilippinesDocumento21 páginasPublic Finance Cycle in The PhilippinesLin100% (3)

- What Is Bottom-Up Budgeting?Documento10 páginasWhat Is Bottom-Up Budgeting?Mikki Eugenio88% (16)

- Public FinanceDocumento38 páginasPublic FinanceRyan C. Villas100% (3)

- The Philippine Budget CycleDocumento4 páginasThe Philippine Budget CyclePalaboy67% (3)

- CHAPTER ONE Public Finanace (2) - 1Documento10 páginasCHAPTER ONE Public Finanace (2) - 1mani per100% (1)

- Public Finance: Faculty of Business & EconomicsDocumento12 páginasPublic Finance: Faculty of Business & Economicsjohn3dAinda não há avaliações

- Public FinanceDocumento33 páginasPublic FinanceRebeccaDorguAinda não há avaliações

- Public FinanceDocumento23 páginasPublic FinanceYasir Munir Afridi100% (10)

- Budgeting TheoriesDocumento7 páginasBudgeting TheoriesmonneAinda não há avaliações

- GOVT SPENDING BY FUNCTIONDocumento20 páginasGOVT SPENDING BY FUNCTIONLou Anthony A. CaliboAinda não há avaliações

- Chapter 5 - Public Choice and Political ProcessDocumento43 páginasChapter 5 - Public Choice and Political Processwatts183% (12)

- Course Syllabus DLSUDocumento12 páginasCourse Syllabus DLSUJM Hernandez Villanueva100% (1)

- Public FinanceDocumento2 páginasPublic Financemohamed sheikh yuusufAinda não há avaliações

- ResearchDocumento25 páginasResearchRuby Thea Sison100% (1)

- Public DebtDocumento9 páginasPublic DebtSamiksha SinghAinda não há avaliações

- INTRODUCTION TO PUBLIC FINANCE THEORYDocumento36 páginasINTRODUCTION TO PUBLIC FINANCE THEORYelizabeth nyasakaAinda não há avaliações

- Module 1 GovernanceDocumento10 páginasModule 1 GovernanceCarla Picardal67% (3)

- Public Finance and Taxation Final12345Documento134 páginasPublic Finance and Taxation Final12345ThomasGetye76% (29)

- Bangko Sentral NG PilipinasDocumento28 páginasBangko Sentral NG PilipinasJay Mar Isorena100% (1)

- Module-1.1 PUBLIC FINANCEDocumento5 páginasModule-1.1 PUBLIC FINANCEPauline Joy Lumibao100% (2)

- II. Taxation and Revenue AdministrationDocumento34 páginasII. Taxation and Revenue AdministrationMara Pancho100% (11)

- Public ExpenditureDocumento6 páginasPublic ExpenditureNaruChoudhary0% (1)

- Public FinanceDocumento48 páginasPublic FinanceJorge Labante100% (1)

- Introduction To Public FinanceDocumento32 páginasIntroduction To Public FinanceClaudine Aguiatan55% (11)

- Patterns of Philippine RevenueDocumento26 páginasPatterns of Philippine RevenueKenneth Delos SantosAinda não há avaliações

- Public ExpenditureDocumento18 páginasPublic ExpenditureFrank MaluluAinda não há avaliações

- Lesson 1 Governance What Is Governance? Getting To A DefinitionDocumento11 páginasLesson 1 Governance What Is Governance? Getting To A DefinitionLimario ManobanAinda não há avaliações

- PRELIM EXAM GOOD GOVERNANCE SOCIAL RESPONSIBILITYDocumento5 páginasPRELIM EXAM GOOD GOVERNANCE SOCIAL RESPONSIBILITYPaul Mark DizonAinda não há avaliações

- Public Finance CourseoutlineDocumento13 páginasPublic Finance CourseoutlineDuay Guadalupe Villaestiva0% (1)

- Public Finance.Documento15 páginasPublic Finance.Ali Sultan100% (3)

- Understanding the Meaning and Scope of Public FinanceDocumento47 páginasUnderstanding the Meaning and Scope of Public FinanceMaria Elena Sitoy BarroAinda não há avaliações

- Definition of Pricing StrategyDocumento7 páginasDefinition of Pricing StrategyYvonne WongAinda não há avaliações

- Revised Thesis ON BIRDocumento15 páginasRevised Thesis ON BIRStephanie Dulay SierraAinda não há avaliações

- Public Policy - First ClassDocumento74 páginasPublic Policy - First Classkallis5Ainda não há avaliações

- Accounting and Auditing in The PhilippinesDocumento15 páginasAccounting and Auditing in The Philippinesman leeAinda não há avaliações

- INSTRUCTIONAL MATERIALS FOR FIMA 40033 Public FinanceONLINEDocumento43 páginasINSTRUCTIONAL MATERIALS FOR FIMA 40033 Public FinanceONLINETaylor Tomlinson100% (1)

- Fundamental Principles of Public Finance 1Documento26 páginasFundamental Principles of Public Finance 1Louem Garceniego86% (7)

- Philippine Public DebtDocumento20 páginasPhilippine Public Debtmark genove100% (3)

- Case Study On The ManagementDocumento257 páginasCase Study On The ManagementMaria Krisna ParreraAinda não há avaliações

- Philippine Budget CycleDocumento35 páginasPhilippine Budget CycleJetJet Linso100% (11)

- Public Financial ManagementDocumento41 páginasPublic Financial ManagementDenalynn100% (1)

- Public Fiscal Administration Part 1-1Documento10 páginasPublic Fiscal Administration Part 1-1phoebeAinda não há avaliações

- Public Debt and Fiscal Consolidation: A Closer Look at Public DebtsDocumento7 páginasPublic Debt and Fiscal Consolidation: A Closer Look at Public DebtsVinn EcoAinda não há avaliações

- Factors Pushing For GovernanceDocumento21 páginasFactors Pushing For Governancemaria claveria100% (1)

- Theories of Public BorrowingsDocumento64 páginasTheories of Public BorrowingsJester Mabuti50% (2)

- Public ExpenditureDocumento7 páginasPublic ExpenditureHarsh ShahAinda não há avaliações

- Fiscal AdministrationDocumento8 páginasFiscal AdministrationMeg AldayAinda não há avaliações

- SOSC107 (Economics With LRT)Documento9 páginasSOSC107 (Economics With LRT)Jenica RiaAinda não há avaliações

- Module 6 Community Relations and Strategic PhilanthropyDocumento21 páginasModule 6 Community Relations and Strategic Philanthropychoose1Ainda não há avaliações

- Module 1.3 FIN112Documento3 páginasModule 1.3 FIN112Pauline Joy LumibaoAinda não há avaliações

- Leg EngDocumento3 páginasLeg EngSumpong BrgyAinda não há avaliações

- MyersDocumento8 páginasMyersSumpong BrgyAinda não há avaliações

- Unit Ii Test: The European Arrest Warrant and ExtraditionDocumento3 páginasUnit Ii Test: The European Arrest Warrant and ExtraditionSumpong BrgyAinda não há avaliações

- Caps SizesDocumento3 páginasCaps SizesSumpong BrgyAinda não há avaliações

- Global Chapter 1Documento6 páginasGlobal Chapter 1Sumpong BrgyAinda não há avaliações

- Class NotesDocumento11 páginasClass NotesSumpong BrgyAinda não há avaliações

- Freedom DigestsDocumento14 páginasFreedom DigestsSumpong BrgyAinda não há avaliações

- Global Chapter 1Documento6 páginasGlobal Chapter 1Sumpong BrgyAinda não há avaliações

- Global Chapter 1Documento6 páginasGlobal Chapter 1Sumpong BrgyAinda não há avaliações

- Negotiable Instruments-SummaryDocumento21 páginasNegotiable Instruments-SummarySumpong Brgy100% (2)

- Global Chapter 1Documento6 páginasGlobal Chapter 1Sumpong BrgyAinda não há avaliações

- TheoriesDocumento5 páginasTheoriesAssignmentLab.com100% (1)

- Laws Regulating Transportation EstablishmentDocumento18 páginasLaws Regulating Transportation Establishmentletisha BellyAinda não há avaliações

- ECB ManagersDocumento3 páginasECB Managersnikitas666Ainda não há avaliações

- Archbishop of Manila v. RoxasDocumento3 páginasArchbishop of Manila v. Roxasred gynAinda não há avaliações

- Hcampeau@ualberta - Ca: Typologies - 6th Edition. Toronto: NelsonDocumento6 páginasHcampeau@ualberta - Ca: Typologies - 6th Edition. Toronto: NelsonJacob BenjaminAinda não há avaliações

- CRIM 222 Introduction to Industrial Security ConceptDocumento10 páginasCRIM 222 Introduction to Industrial Security ConceptCarl Ian ClaperoAinda não há avaliações

- RoHs Certificate - Stainless Steel Flat ProductsDocumento1 páginaRoHs Certificate - Stainless Steel Flat ProductsVictor camacho100% (1)

- Chapter 7 - Construction ContractsDocumento17 páginasChapter 7 - Construction ContractsMikael James VillanuevaAinda não há avaliações

- Standard Catalog of Provincial Banknotes of England & WalesDocumento538 páginasStandard Catalog of Provincial Banknotes of England & WalesAumair Malik100% (2)

- Sample Covering Letter - Canada PRDocumento5 páginasSample Covering Letter - Canada PRPreeti BediAinda não há avaliações

- CPWA Cash Book FormsDocumento168 páginasCPWA Cash Book Formsovishalz100% (1)

- Evaluating Collaborative Public-Private Partnerships - The Case of Toronto's Smart CityDocumento13 páginasEvaluating Collaborative Public-Private Partnerships - The Case of Toronto's Smart CityBusri BusriAinda não há avaliações

- Test Bank: Human Resource Management, 9 EditionDocumento19 páginasTest Bank: Human Resource Management, 9 EditionThuận PhạmAinda não há avaliações

- Marketbeats Indonesia Jakarta Landed Residential H2 2022Documento4 páginasMarketbeats Indonesia Jakarta Landed Residential H2 2022SteveAinda não há avaliações

- Angola AFRICA P151224 Second Water Sector Institutional Development Project Procurement PlanDocumento14 páginasAngola AFRICA P151224 Second Water Sector Institutional Development Project Procurement PlanWallace ChitambaAinda não há avaliações

- The Champion Legal Ads 10-01-20Documento39 páginasThe Champion Legal Ads 10-01-20Donna S. SeayAinda não há avaliações

- 5224 Ethiopian State Support To Insurgency in SudanDocumento25 páginas5224 Ethiopian State Support To Insurgency in SudanGech DebAinda não há avaliações

- Supreme Transportation Liner vs Antonio San AndresDocumento2 páginasSupreme Transportation Liner vs Antonio San AndresMiaka UrginoAinda não há avaliações

- Deed of CompromiseDocumento4 páginasDeed of Compromisechithra ja100% (1)

- University Summer Courses Offered in Germany For Foreign Students and Graduates - DAADDocumento4 páginasUniversity Summer Courses Offered in Germany For Foreign Students and Graduates - DAADmaría del pilar león riveraAinda não há avaliações

- p158.01 LTR SPML Simi L-s1Documento2 páginasp158.01 LTR SPML Simi L-s1Kadi MagdiAinda não há avaliações

- Module 4.2 - RegionalizationDocumento6 páginasModule 4.2 - RegionalizationDan Sherwin Mulato LazoAinda não há avaliações

- Unpacking Zimbabwe's CrisisDocumento21 páginasUnpacking Zimbabwe's CrisisMukus MharaparaAinda não há avaliações

- Special Power of Attorney For TitlingDocumento3 páginasSpecial Power of Attorney For TitlingGladys Ann A. Donato100% (1)

- Economic Globalization PDFDocumento27 páginasEconomic Globalization PDFericacadagoAinda não há avaliações

- Rare Book CategoryDocumento2 páginasRare Book CategoryAri SudrajatAinda não há avaliações

- The Rundown 11/25/13Documento3 páginasThe Rundown 11/25/13American Enterprise InstituteAinda não há avaliações

- MistakeDocumento11 páginasMistakejiajie chenAinda não há avaliações

- Business Ethics in Action Lecture & Seminar 2Documento29 páginasBusiness Ethics in Action Lecture & Seminar 2Shanuka SapugodaAinda não há avaliações

- DirectoryDocumento6 páginasDirectoryabbas dastiAinda não há avaliações