Escolar Documentos

Profissional Documentos

Cultura Documentos

Gold Futures and Forward Prices

Enviado por

sonalzDescrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Gold Futures and Forward Prices

Enviado por

sonalzDireitos autorais:

Formatos disponíveis

www.lecturerlive.

com

186

GOLD FUTURES

COMMODITY FORWARDS AND FUTURES

is constructed using more expiration dates than are in Figure 6.2.) What is interesting

about the gold forward curve is how relatively uninteresting it is, with the forward price

steadily increasing with time to maturity.

From our previous discussion, the forward price implies a lease rate. Short-sales

and loans of gold are common in the gold market, and gold borrowers in fact have to pay

the lease rate. On the lending side, large gold holders (including some central banks) put

gold on deposit with brokers, in order that it may be loaned to short-sellers. The gold

lenders earn the lease rate.

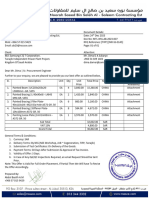

The lease rate for gold, silver, and other commodities is computed in practice using

equation (6.12) and is reported routinely by financial reporting services. Table 6.9 shows

the 6-month and I-year lease rates for the four gold forward curves depicted in Figure

6.3, computed using equation (6.12);

Example 6.2 Here are the details of computing the 6-month lease rate for June

6, 2001. Gold futures prices are in Table 6.9. The June and September

futures prices on this date were 96.09 and 96.13. Thus, 3-month LIBOR from June

to September was (100 - 96.09)/400 x 91/90 = 0.988%, and from September to

December was (100 - 94.56)/400 x 91/90 = 0.978%. The June to December interest

rate was therefore (1.00988) x (1.00978) - 1 = 1.9763%, or 1.0197362 annualized.

Using equation (6.12), the annualized 6-month lease rate is therefore

1.0197632

)

6-month lease rate = ( (269/265.7)(1/0.5) - 1 = 1.456%

Six-month and 12-month gold lease rates for four

dates, computed using equation (6.12). Interest rates

are computed from Eurodollar futures prices.

187

Gold Investments

If you wish to hold gold as part of an investment portfolio, you can do so by holding

physical gold or synthetic gold-i.e., holding T-bills and going long gold futures. Which

should you do? If you hold physical gold without lending it, and if the lease rate is

positive, you forgo the lease rate. You also bear storage costs. With synthetic gold,

on the other hand, you have a counterparty who may fail to pay so there is credit risk.

Ignoring credit risk, however, synthetic gold is generally the preferable way to obtain

gold price exposure.

Table 6.9 shows that the 6-month annualized gold lease rate is 1.46% in June

2001. Thus, by

physical gold instead of synthetic gold, an investor would lose

this 1.46% return. In June 2003 and 2004, however, the lease rate was about -0.10%. If

storage costs are about 0.10%, an investor would be indifferent between holding physical

and synthetic gold. The futures market on those dates was compensating investors for

storing physical gold.

Some nonfinancial holders of gold will obtain a convenience yield from gold.

Consider an electronics manufacturer who uses gold in producing components. Suppose

that running out of gold would halt production. It would be natural in this case to hold

a buffer stock of gold in order to avoid a stock-out of gold, i.e., running out of gold.

For this manufacturer, there is a return to holding gold-namely, a lower probability of

stocking out and halting production. Stocking out would have a real financial cost, and

the manufacturer is willing to pay a price-the lease rate-to avoid that cost.

Evaluation of Gold Production

Suppose we have an operating gold mine and we wish to compute the present value

of future production. As discussed in Section 6.2, the present value of the commodity

received in the future is simply the present value-eomputed at the risk-free rate-of

the forward price. We can use the forward curve for gold to compute the value of an

operating gold mine.

Suppose that at times t;, i = 1, ... ,11, we expect to extract

ounces of gold

by paying an extraction cost x(t;). We have a set of 11 forward prices, Fo I.' If the

value of

continuously compounded annual risk-free rate from time 0 to t; is reO, t;),

the gold mine is

II

PV gold production

[Fo,li -

x(t;)] e-r(O,li)li

(6.16)

;=1

June 6, 2001

265.7

269.0

271.7

1.46%

1.90%

June 5, 2002

321.2

323.9

326.9

0.44%

0.88%

June 4,2003

362.6

364.9

366.4

-0.14%

0.09%

June 2,2004

391.6

395.2

400.2

-0.10%

0.07%

Source: Futures data from Datastream.

www.articlestudy.com

This equation assumes that the gold mine is certain to operate the entire time and that

the quantity of production is known. Only price is uncertain. (We will see in Chapter 17

8The cost of I ounce of physical gold is So. However, from equation (6.10), the cost of I ounce of gold

bought as a prepaid forward is Soe- oIT Synthetic gold is proportionally cheaper by the lease rate,

Você também pode gostar

- Hedging at Its Most Basic: Ian LevyDocumento3 páginasHedging at Its Most Basic: Ian Levyivanuska90100% (1)

- MEE Innovative FinanceDocumento9 páginasMEE Innovative FinanceRudianto SitanggangAinda não há avaliações

- Hedging at Its Most BasicDocumento4 páginasHedging at Its Most BasicHenry NCAinda não há avaliações

- Gold As CollateralDocumento0 páginaGold As Collateralkoib789Ainda não há avaliações

- Gold Prices, Exchange Rates, Gold Stocks and The Gold PremiumDocumento18 páginasGold Prices, Exchange Rates, Gold Stocks and The Gold PremiumRavichandra KsAinda não há avaliações

- Wrap Sheet - Oct 26, 2011Documento2 páginasWrap Sheet - Oct 26, 2011jpkoningAinda não há avaliações

- Gold Investment AnalysisDocumento14 páginasGold Investment AnalysisMkingAinda não há avaliações

- Gold in The Investment Portfolio: Frankfurt School - Working PaperDocumento50 páginasGold in The Investment Portfolio: Frankfurt School - Working PaperSharvani ChadalawadaAinda não há avaliações

- A Study On Role of Gold Portfolio AllocationDocumento6 páginasA Study On Role of Gold Portfolio AllocationNITINAinda não há avaliações

- MILESTONE BULLION SERIES - I: Gold and Silver Investment OutlookDocumento2 páginasMILESTONE BULLION SERIES - I: Gold and Silver Investment Outlookprateek0284Ainda não há avaliações

- Gold As A Source of CollateralDocumento12 páginasGold As A Source of CollateralThiti VanichAinda não há avaliações

- How Gold Price Is Determined?Documento3 páginasHow Gold Price Is Determined?MOHAK AGARWALAinda não há avaliações

- Wrap Sheet - Jun 17, 2011Documento2 páginasWrap Sheet - Jun 17, 2011jpkoningAinda não há avaliações

- Gold-Physical Vs MF DemystifiedDocumento4 páginasGold-Physical Vs MF Demystifiedmcube4uAinda não há avaliações

- Gold Sector Initiation: Don't Miss This Golden OpportunityDocumento44 páginasGold Sector Initiation: Don't Miss This Golden OpportunityDavid QuahAinda não há avaliações

- Future PricingDocumento14 páginasFuture PricingashutoshAinda não há avaliações

- Is Gold A Zero-Beta Asset? Investment Potential of Precious MetalsDocumento23 páginasIs Gold A Zero-Beta Asset? Investment Potential of Precious MetalsCervino InstituteAinda não há avaliações

- Gold EconomicsDocumento7 páginasGold EconomicsRezwan UllahAinda não há avaliações

- Sovereign Gold Bond - by AdarshDocumento21 páginasSovereign Gold Bond - by AdarshAadarsh ChaudharyAinda não há avaliações

- Introduction of Gold Monetization SchemesDocumento81 páginasIntroduction of Gold Monetization Schemesnamita patharkar0% (1)

- How Lease Rates Impact Precious Metals MarketsDocumento3 páginasHow Lease Rates Impact Precious Metals MarketsAmol KulkarniAinda não há avaliações

- Precious Metals FinalDocumento54 páginasPrecious Metals FinalsmritakachruAinda não há avaliações

- Article Summary On Gold or Gold EtfDocumento6 páginasArticle Summary On Gold or Gold EtfarushpratyushAinda não há avaliações

- India's Sovereign Gold Bond and Gold Monetisation Schemes ExplainedDocumento4 páginasIndia's Sovereign Gold Bond and Gold Monetisation Schemes ExplainedPavitraAinda não há avaliações

- Investment Insights Gold Does Not Equal Gold MinersDocumento3 páginasInvestment Insights Gold Does Not Equal Gold MinersAnonymous Ht0MIJAinda não há avaliações

- The Impact of Inflation and Deflation On The Case For GoldDocumento48 páginasThe Impact of Inflation and Deflation On The Case For GoldSuchit HowaleAinda não há avaliações

- American BarrickDocumento8 páginasAmerican BarrickPramod kAinda não há avaliações

- Physical Gold Is Not Physical Gold - Swiss GoldplanDocumento2 páginasPhysical Gold Is Not Physical Gold - Swiss GoldplantigerkillerAinda não há avaliações

- Historical Pullbacks in Gold Prices Have Been Long and SevereDocumento5 páginasHistorical Pullbacks in Gold Prices Have Been Long and SevereAsad HashmiAinda não há avaliações

- Precious Metals Streaming Companies: Competitive Advantages of Wheaton Precious MetalsDocumento5 páginasPrecious Metals Streaming Companies: Competitive Advantages of Wheaton Precious MetalsShacindAinda não há avaliações

- Gold A Commodity Like No OtherDocumento20 páginasGold A Commodity Like No OtherRaman Kumar SrivastavaAinda não há avaliações

- IAMGold - The Cote Gold Project Is A Waste of Money - IAMGOLD Corporation (NYSE:IAG) - Seeking AlphaDocumento7 páginasIAMGold - The Cote Gold Project Is A Waste of Money - IAMGOLD Corporation (NYSE:IAG) - Seeking AlphaBisto MasiloAinda não há avaliações

- RGSF Product Note Oct 2012 PDFDocumento10 páginasRGSF Product Note Oct 2012 PDFinfosipriAinda não há avaliações

- Is Gold Still A Good Investment OptionDocumento3 páginasIs Gold Still A Good Investment OptionSwati ShahAinda não há avaliações

- Agricultural, Energy and Metallurgical Futures ContractsDocumento68 páginasAgricultural, Energy and Metallurgical Futures ContractsCan BayirAinda não há avaliações

- In GOLD We TRUST 2013 - Incrementum Extended VersionDocumento54 páginasIn GOLD We TRUST 2013 - Incrementum Extended VersionZerohedgeAinda não há avaliações

- Guide To Investing in Gold & SilverDocumento12 páginasGuide To Investing in Gold & Silveravoman123100% (1)

- Gold Investment-1Documento2 páginasGold Investment-1Ahmad GunawanAinda não há avaliações

- There's No Gold - COMEX Report Exposes Conditions Behind Physical Crunch - Zero HedgeDocumento7 páginasThere's No Gold - COMEX Report Exposes Conditions Behind Physical Crunch - Zero HedgeRobert GatesAinda não há avaliações

- Why Is Gold Different From Other Assets? An Empirical InvestigationDocumento45 páginasWhy Is Gold Different From Other Assets? An Empirical InvestigationAnonymous XR7iq7Ainda não há avaliações

- Derivatives Lecture Futures ForwardsDocumento32 páginasDerivatives Lecture Futures ForwardsavirgAinda não há avaliações

- IIGC conference opening address highlights gold investment prospectsDocumento4 páginasIIGC conference opening address highlights gold investment prospectsOlivia JacksonAinda não há avaliações

- Gold Price Prediction PublicationDocumento8 páginasGold Price Prediction Publicationbp8k.mobile.legendAinda não há avaliações

- GoldDocumento10 páginasGoldShikha TiwaryAinda não há avaliações

- 1gold Report PDFDocumento86 páginas1gold Report PDFrahul84803Ainda não há avaliações

- Retail Research: Sovereign Gold Bond 2016-17 - Series IDocumento4 páginasRetail Research: Sovereign Gold Bond 2016-17 - Series IumaganAinda não há avaliações

- A Comparative Study On Investing in Gold Related AssetsDocumento5 páginasA Comparative Study On Investing in Gold Related AssetsLakskmi Priya M CAinda não há avaliações

- Ruling the Roost in Precious MetalsDocumento6 páginasRuling the Roost in Precious MetalsPrashant UjjawalAinda não há avaliações

- Imf Committee On Balance of Payments Statistics Reserve Assets Technical Expert Group (Resteg)Documento6 páginasImf Committee On Balance of Payments Statistics Reserve Assets Technical Expert Group (Resteg)richardck50Ainda não há avaliações

- Relationship Between Gold Price & Inflation, Interest & Exchange RatesDocumento42 páginasRelationship Between Gold Price & Inflation, Interest & Exchange Rateshaikal hafizAinda não há avaliações

- Draft Outline of The Sovereign Gold Bond Scheme (For Discussion Purposes Only)Documento3 páginasDraft Outline of The Sovereign Gold Bond Scheme (For Discussion Purposes Only)Anonymous nQtCpIqooAinda não há avaliações

- Problem SetDocumento105 páginasProblem SetYodaking Matt100% (1)

- GoldDocumento7 páginasGoldsraman60Ainda não há avaliações

- Arif HabibDocumento2 páginasArif HabibUpdesh ThakwaniAinda não há avaliações

- Example Exam SolutionDocumento21 páginasExample Exam SolutionTatiana RotaruAinda não há avaliações

- How to Trade Gold: Gold Trading Strategies That WorkNo EverandHow to Trade Gold: Gold Trading Strategies That WorkNota: 1 de 5 estrelas1/5 (1)

- Gold Value and Gold Prices from 1971 - 2021: An Empirical ModelNo EverandGold Value and Gold Prices from 1971 - 2021: An Empirical ModelAinda não há avaliações

- The Investor's Dilemma Decoded: Recognize Misinformation, Filter the Noise, and Reach Your GoalsNo EverandThe Investor's Dilemma Decoded: Recognize Misinformation, Filter the Noise, and Reach Your GoalsAinda não há avaliações

- Sms SpamDocumento1.596 páginasSms Spamsonalz0% (2)

- InputdataDocumento1 páginaInputdatasonalzAinda não há avaliações

- File 1Documento22 páginasFile 1sonalzAinda não há avaliações

- Assignment 1Documento2 páginasAssignment 1sonalzAinda não há avaliações

- PSMDocumento21 páginasPSMsonalzAinda não há avaliações

- File 1Documento22 páginasFile 1sonalzAinda não há avaliações

- File 1Documento1 páginaFile 1sonalzAinda não há avaliações

- Customer Analytics Exam InsightsDocumento10 páginasCustomer Analytics Exam InsightssonalzAinda não há avaliações

- Arindam Banerjee Arindam Banerjee SecB 71310058 346Documento6 páginasArindam Banerjee Arindam Banerjee SecB 71310058 346sonalzAinda não há avaliações

- Praveen Kumar Praveen 297Documento8 páginasPraveen Kumar Praveen 297sonalzAinda não há avaliações

- Raghuram Lanka - Raghuram Lanka - Section B - 71310043 - CBA - Exam - 338Documento7 páginasRaghuram Lanka - Raghuram Lanka - Section B - 71310043 - CBA - Exam - 338sonalzAinda não há avaliações

- Arpit Gupta Arpit Gupta CAII Mid-Term Exam 344Documento6 páginasArpit Gupta Arpit Gupta CAII Mid-Term Exam 344sonalzAinda não há avaliações

- Pranab Singh CBA Exam 71310067 306Documento6 páginasPranab Singh CBA Exam 71310067 306sonalzAinda não há avaliações

- Praveena Sistla CA2 Exam 71310091 362Documento7 páginasPraveena Sistla CA2 Exam 71310091 362sonalzAinda não há avaliações

- Nitin Singh CBA Exam 309Documento12 páginasNitin Singh CBA Exam 309sonalzAinda não há avaliações

- Abhishek Manjrekar CBA Exam Abhishek M 71310002 271Documento8 páginasAbhishek Manjrekar CBA Exam Abhishek M 71310002 271sonalzAinda não há avaliações

- Nikhil Dwarakanath CBA Exam Nikhil 71310012 278Documento7 páginasNikhil Dwarakanath CBA Exam Nikhil 71310012 278sonalzAinda não há avaliações

- Apurva Madiraju CBA Exam Apurva Madiraju 71310044 296Documento8 páginasApurva Madiraju CBA Exam Apurva Madiraju 71310044 296sonalzAinda não há avaliações

- 10 Simulation-Assisted Estimation: 10.1 MotivationDocumento22 páginas10 Simulation-Assisted Estimation: 10.1 MotivationsonalzAinda não há avaliações

- Praveen Kumar Praveen 297Documento8 páginasPraveen Kumar Praveen 297sonalzAinda não há avaliações

- Amit Pradhan CA Exam Amit Pradhan 71310017 282Documento10 páginasAmit Pradhan CA Exam Amit Pradhan 71310017 282sonalzAinda não há avaliações

- Drawing from Densities SimulationDocumento32 páginasDrawing from Densities SimulationsonalzAinda não há avaliações

- Cover LetterDocumento1 páginaCover LettersonalzAinda não há avaliações

- Amandeep Singh CBA Exam (Amandeep-71310011) 277Documento12 páginasAmandeep Singh CBA Exam (Amandeep-71310011) 277sonalzAinda não há avaliações

- Abdul Mohammed CBA Exam Ca2 283Documento9 páginasAbdul Mohammed CBA Exam Ca2 283sonalzAinda não há avaliações

- A Different Path (From Mathematics To Startups) : Daniel KrasnerDocumento4 páginasA Different Path (From Mathematics To Startups) : Daniel KrasnersonalzAinda não há avaliações

- FPM Probabilty Session 1 010914Documento13 páginasFPM Probabilty Session 1 010914sonalzAinda não há avaliações

- Maximizing Likelihood Functions NumericallyDocumento22 páginasMaximizing Likelihood Functions NumericallysonalzAinda não há avaliações

- 10 Simulation-Assisted Estimation: 10.1 MotivationDocumento22 páginas10 Simulation-Assisted Estimation: 10.1 MotivationsonalzAinda não há avaliações

- OWNERISSUE110106IDocumento16 páginasOWNERISSUE110106ISamAinda não há avaliações

- Alternative DevelopmentDocumento13 páginasAlternative Developmentemana710% (1)

- KU Internship Report on Nepal Investment BankDocumento39 páginasKU Internship Report on Nepal Investment Bankitsmrcoolpb100% (1)

- MQ3 Spr08gDocumento10 páginasMQ3 Spr08gjhouvanAinda não há avaliações

- P1-1a 6081901141Documento2 páginasP1-1a 6081901141Mentari AnggariAinda não há avaliações

- Chapter 2 Macro SolutionDocumento12 páginasChapter 2 Macro Solutionsaurabhsaurs100% (1)

- Average Down StrategyDocumento11 páginasAverage Down StrategyThines KumarAinda não há avaliações

- 007.MTL-NSS-AB-2023-007 - Quotation For SS Fabrication & Coating - MR-SS-0145Documento1 página007.MTL-NSS-AB-2023-007 - Quotation For SS Fabrication & Coating - MR-SS-0145abasithamAinda não há avaliações

- 2021 Unlocking The Next Wave of Digital Growth Beyond Metropolitan IndonesiaDocumento84 páginas2021 Unlocking The Next Wave of Digital Growth Beyond Metropolitan IndonesiacoralAinda não há avaliações

- Branding QuizDocumento5 páginasBranding QuizJagrity SinghAinda não há avaliações

- Hitech Security BrochureDocumento9 páginasHitech Security BrochureKawalprit BhattAinda não há avaliações

- ERP Systems Manage Business OperationsDocumento10 páginasERP Systems Manage Business OperationsGoAinda não há avaliações

- Logistic Industry Employee PersonalityDocumento10 páginasLogistic Industry Employee Personalityjoel herdianAinda não há avaliações

- Customer Satisfaction Towards Honda Two Wheeler: Presented By: Somil Modi (20152002) BBA-MBA 2015Documento9 páginasCustomer Satisfaction Towards Honda Two Wheeler: Presented By: Somil Modi (20152002) BBA-MBA 2015Inayat BaktooAinda não há avaliações

- For A New Coffe 2 6Documento2 páginasFor A New Coffe 2 6Chanyn PajamutanAinda não há avaliações

- ON Dry Fish Business: Submitted byDocumento6 páginasON Dry Fish Business: Submitted byKartik DebnathAinda não há avaliações

- Questions With SolutionsDocumento4 páginasQuestions With SolutionsArshad UllahAinda não há avaliações

- Saudi Arabia Report 2018 PDFDocumento9 páginasSaudi Arabia Report 2018 PDFSandy SiregarAinda não há avaliações

- Project Report On Marketing Environment of Coca ColaDocumento18 páginasProject Report On Marketing Environment of Coca ColaSiddiqui Jamil94% (16)

- Organization and Its EnvironmentDocumento39 páginasOrganization and Its EnvironmentAntawnYo TreyAinda não há avaliações

- Securities and Exchange Board of India Final Order: WTM/AB/IVD/ID4/14459/2021-22Documento91 páginasSecurities and Exchange Board of India Final Order: WTM/AB/IVD/ID4/14459/2021-22Pratim MajumderAinda não há avaliações

- Pre104: Auditing and Assurance: Specialized Industries 1. Overview of Auditing in Specialized IndustriesDocumento2 páginasPre104: Auditing and Assurance: Specialized Industries 1. Overview of Auditing in Specialized IndustriesCristina ElizaldeAinda não há avaliações

- Bluescope Steel 2016Documento48 páginasBluescope Steel 2016Romulo AlvesAinda não há avaliações

- Land Use Patterns in CitiesDocumento46 páginasLand Use Patterns in Citiesarnav saikiaAinda não há avaliações

- Internship Report 2011Documento35 páginasInternship Report 2011Rani BakhtawerAinda não há avaliações

- ch18 ANALYZING FINANCIAL STATEMENTSDocumento67 páginasch18 ANALYZING FINANCIAL STATEMENTSUpal MahmudAinda não há avaliações

- Pia Policy ProjectDocumento118 páginasPia Policy ProjectRude RanaAinda não há avaliações

- Idfc Institute Housing ReportDocumento118 páginasIdfc Institute Housing ReportDhruval Jignesh PatelAinda não há avaliações

- Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocumento11 páginasDate Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceAryan JaiswalAinda não há avaliações

- Hutchison Whampoa Capital Structure DecisionDocumento11 páginasHutchison Whampoa Capital Structure DecisionUtsav DubeyAinda não há avaliações