Escolar Documentos

Profissional Documentos

Cultura Documentos

Session 3a Handout PDF

Enviado por

Chin Hung YauTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Session 3a Handout PDF

Enviado por

Chin Hung YauDireitos autorais:

Formatos disponíveis

06/01/2014

Accounting Principles

Retailing operations

Learning objectives

Describe retailing operations, perpetual and periodic inventory

systems and understand how to account for GST

Account for the purchase of inventory using a perpetual system

Account for the sale of inventory using a perpetual system

Adjust and close the accounts of a retailing business

Prepare a retailers financial statements

Use gross profit percentage, inventory turnover and days in

inventory to evaluate a business

What are retailing operations?

Retailing consists of buying and selling goods rather than

services

Retailers have some new balance sheet and income statement

items, for example Inventory, Sales revenue, and Cost of sales

The operating cycle of a retailing business begins when the

business purchases inventory from a vendor. It then sells the

inventory to a customer. Finally, the business collects cash from

customers

06/01/2014

What are retailing operations?

Goods and services tax (GST)

GST is a tax levied on the supply of goods and services

The tax is a flat percentage charge

Each firm registered for GST collects tax on the goods and

services it supplies and pays tax on the goods and services it

buys

The firm then deducts the tax it pays on purchases from the tax

it charges on sales and pays the balance to the Australian

Taxation Office

Inventory systems: Perpetual and periodic

The periodic inventory system is normally used for relatively

inexpensive goods

Goods are counted periodically to determine quantity

The perpetual inventory system keeps a running

computerised record of inventory

The number of inventory units and the dollar amounts are

perpetually (constantly) updated

It records units purchased and cost amount, units sold and sales

and cost amounts, and the quantity of inventory on hand and its

cost

06/01/2014

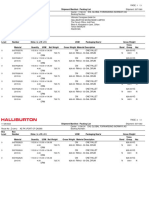

Accounting for inventory in the perpetual system

Accounting for inventory in the perpetual system

The inventory account is increased with each purchase

The vendor submits an invoice for payment

The inventory account is used for goods purchased

The method of payment is credited

Date

Account title

Dr

Jul 3

Inventory (770/1.1) (A+)

700

GST clearing (770/11) (A+)

70

Accounts payable (L+)

Cr

770

Purchased inventory on credit.

Accounting for inventory in the perpetual system

Many businesses offer customers a settlement discount for

early payment

RCAs credit terms of 3/15, NET 30 DAYS mean that Smart

Touch can deduct 3% from the total bill (excluding freight

charges, if any) if the business pays within 15 days of the

invoice date

Date

Account title

Dr

Jul 15

Accounts payable (L)

770

Cr

Cash ($770 0.97) (A)

746.90

Inventory ($7700.0310/11)

(A)

21

GST clearing ($7700.031/11)

(A/L+)

2.10

Paid within discount period.

06/01/2014

Accounting for inventory in the perpetual system

Businesses allow customers to return goods that are defective,

damaged or otherwise unsuitable purchase returns

The seller may also deduct an allowance from the amount the

buyer owes purchase allowances

Date

Account title

Dr

Jul 4

Accounts payable (L)

110

Cr

Inventory (110/1.1) (A+)

100

GST clearing (110/11) (A/L+)

10

Returned inventory to seller.

Accounting for inventory in the perpetual system

The purchase agreement specifies FOB (free on board) terms

to determine when title to the good transfers to the purchaser

and who pays the freight

FOB delivery point means the buyer takes ownership (title) to

the goods at the delivery point

FOB destination means the buyer takes ownership (title) to

the goods at the delivery destination point

Freight in is the transportation cost to ship goods into the

purchasers warehouse

Freight out is the transportation cost to ship goods out of the

warehouse and to the customer

Sale of inventory

After a business buys inventory, the next step is to sell the

goods

The amount a business earns from selling inventory is called

Sales revenue (Sales)

At the time of the sale, two entries must be recorded in the

perpetual system: one entry records the sale and the cash (or

receivable) at the time of the sale; the second entry records

Cost of sales (debit the expense) and reduces the Inventory

(credit the asset)

Cost of sales (COS) is the cost of inventory that has been sold

to customers

06/01/2014

Sale of inventory

Sale of inventory: Cash sale

Date

Account title

Dr

Jul 9

Cash (A+)

3300

Cr

Sales revenue (3 300/1.1) (R+)

3000

GST clearing (3 300/11) (A/L+)

300

Cash sale.

Date

Account title

Dr

Jul 9

Cost of sales (E+)

1900

Inventory (A)

Cr

1900

Recorded the cost of goods sold.

Sale of inventory: Credit sale

Date

Account title

Dr

Jul 11

Accounts receivable (A+)

5500

Cr

Sales revenue (5 500/1.1) (R+)

5000

GST clearing (5 500/11) (A/L+)

500

Sale on credit.

Jul 11

Cost of sales (E+)

2900

Inventory (A) 2 900

2900

Recorded the cost of sales.

Date

Account title

Dr

Jul 19

Cash (A+)

5500

Accounts receivable (A)

Cr

5500

Collection on account.

06/01/2014

Sale of inventory

Sales returns and allowances and sales settlement discounts

decrease the net amount of revenue earned on sales

Sales returns and allowances and Sales discounts are contra

accounts to Sales revenue

Net sales

revenue

Sales

revenue

Sales

returns

and

allowances

Sales

discounts

Sale of inventory: Sales returns

Date

Account title

Dr

Jul 12

Sales returns and allowances

(660/1.1) (CR+)

600

GST clearing (660/11) (A+/L)

60

Accounts receivable (A)

Cr

660

Received returned goods.

Date

Account title

Dr

Jul 12

Inventory (A+)

400

Cost of sales (E)

Cr

400

Placed goods back in inventory.

Sale of inventory: Sales allowances

Date

Account title

Dr

Jul 15

Sales returns and allowances

(110/1.1) (CR+)

100

GST clearing (110/11) (A+/L)

10

Accounts receivable (A)

Cr

110

Granted a sales allowance for

damaged goods.

06/01/2014

Sale of inventory: Sales discounts

Date

Account title

Dr

Jul 17

Cash ($4 400 0.98) (A+)

4312

Sales discounts ($4 400 0.02

10/11) (CR+)

80

GST clearing ($4 400 0.02

1/11) (A+/L)

Accounts receivable (A) 4 400

Cr

4400

Cash collection within the

discount period.

Date

Account title

Dr

Jul 28

Cash ($7 150 $4 400) (A+)

2750

Accounts receivable (A)

Cr

2750

Cash collection after the discount

period.

Sales revenue, cost of sales and gross profit

Net sales

revenue

(abbreviated

as Sales)

Gross profit

Cost of sales

(same as

Gross

margin)

Adjusting inventory based on a physical count

The Inventory account should stay current at all times in a

perpetual inventory system

The actual amount of inventory on hand may differ from what

the books show

For this reason, businesses take a physical count of inventory at

least once a year

The business then adjusts the Inventory account based on the

physical count

06/01/2014

Closing the accounts of a retailer

Step 1: Make the revenue and contra revenue accounts equal

zero via the Income summary

Step 2: Make expense accounts equal zero via the Income

summary account

Step 3: Make the Income summary account equal zero via the

Capital account

Step 4: Make the Drawings account equal zero via the Capital

account

Preparing a retailers financial statements

AASB 101, Presentation of Financial Statements, refers to two

different income statement formats based upon the method

used for analysing expenses

The by nature of expenses method begins by showing sales

and other revenues and then deducts expenses analysed into

categories such as employee benefits (for example, wages), the

cost of depreciation and advertising

The alternative function of expenses method begins with sales

but then deducts cost of sales to show the gross profit, adds

other revenues and classifies the remaining operating expenses

into categories such as distribution, administration, marketing

and finance

Under both alternatives, revenues and finance costs must be

shown separately on the face of the income statement

Three ratios for decision making

The gross profit percentage is one of the most carefully

watched measures of profitability.

Gross profit percentage = Gross profit / Net sales revenue

Inventory turnover measures how rapidly inventory is sold

Inventory turnover = Cost of sales / Average inventory

Days in inventory ratio measures the average number of days

inventory is held by the business

Days in inventory = 365 days / Inventory turnover ratio

06/01/2014

Cost of Sales Periodic Inventory System

In the periodic inventory system, cost of sales(COS or COGS)

must be calculated at the end of the accounting period after a

physical stock take is conducted.

The COS is calculated as follows:

Beginning inventory + Net purchases & freight in = Cost of goods

available for sale

Cost of goods available for sale closing inventory = COGS

Summary:

Retailers have some new balance sheet and income statement

items, for example Inventory, Sales revenue, and Cost of sales

GST is a tax levied on the supply of goods and services

The perpetual inventory system keeps a running computerised

record of inventory

It records units purchased and cost amount, units sold and sales

and cost amounts, and the quantity of inventory on hand and its

cost

The actual amount of inventory on hand may differ from what

the books show. For this reason, businesses take a physical

count of inventory at least once a year

Você também pode gostar

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- Master Data Management (MDM) Sales Assessment For ReSellersDocumento37 páginasMaster Data Management (MDM) Sales Assessment For ReSellersashisAinda não há avaliações

- CRM Strategies of DellDocumento8 páginasCRM Strategies of Dellsunita_sandhu0% (1)

- French CuisineDocumento25 páginasFrench CuisineChin Hung YauAinda não há avaliações

- Written Assignment (Class Presentation)Documento4 páginasWritten Assignment (Class Presentation)Chin Hung YauAinda não há avaliações

- Tute 3b PDFDocumento7 páginasTute 3b PDFChin Hung YauAinda não há avaliações

- Tute 3b PDFDocumento7 páginasTute 3b PDFChin Hung YauAinda não há avaliações

- Session 9 Handout PDFDocumento6 páginasSession 9 Handout PDFChin Hung YauAinda não há avaliações

- Tute 3a PDFDocumento7 páginasTute 3a PDFChin Hung YauAinda não há avaliações

- Session 5b Handout PDFDocumento10 páginasSession 5b Handout PDFChin Hung YauAinda não há avaliações

- Session 2b Handout PDFDocumento6 páginasSession 2b Handout PDFChin Hung YauAinda não há avaliações

- Session 6a Handout PDFDocumento6 páginasSession 6a Handout PDFChin Hung YauAinda não há avaliações

- Session 6b Handout PDFDocumento7 páginasSession 6b Handout PDFChin Hung YauAinda não há avaliações

- Session 4b Handout PDFDocumento8 páginasSession 4b Handout PDFChin Hung YauAinda não há avaliações

- Session 5a Handout PDFDocumento10 páginasSession 5a Handout PDFChin Hung YauAinda não há avaliações

- Session 4a Handout PDFDocumento7 páginasSession 4a Handout PDFChin Hung YauAinda não há avaliações

- Session 3b Handout PDFDocumento7 páginasSession 3b Handout PDFChin Hung YauAinda não há avaliações

- Session 2a Handout PDFDocumento7 páginasSession 2a Handout PDFChin Hung YauAinda não há avaliações

- Session 1b Handout PDFDocumento6 páginasSession 1b Handout PDFChin Hung YauAinda não há avaliações

- Session 1a Handout PDFDocumento8 páginasSession 1a Handout PDFChin Hung YauAinda não há avaliações

- Chapter 5 - Purchase - InventoryDocumento29 páginasChapter 5 - Purchase - Inventoryhasan jabrAinda não há avaliações

- AVTEC Supplier Quality ManualDocumento22 páginasAVTEC Supplier Quality ManualRavi YadavAinda não há avaliações

- PEP PRACTICE QU-WPS OfficeDocumento26 páginasPEP PRACTICE QU-WPS OfficeCynthia ObiAinda não há avaliações

- Cargo Loading and Unloading EfficiencyDocumento10 páginasCargo Loading and Unloading EfficiencyyoussefAinda não há avaliações

- Chap 9 - IPEDocumento21 páginasChap 9 - IPEsai prasadAinda não há avaliações

- 02 Cost Terms, Concepts and Behavior ANSWER KEYDocumento4 páginas02 Cost Terms, Concepts and Behavior ANSWER KEYJemAinda não há avaliações

- NotesDocumento5 páginasNoteskaran kushwahAinda não há avaliações

- Logistics Collaboration in Supply Chains: Practice vs. TheoryDocumento21 páginasLogistics Collaboration in Supply Chains: Practice vs. Theorylobna_qassem7176Ainda não há avaliações

- Using Supply Chain Financial OrchestrationDocumento18 páginasUsing Supply Chain Financial OrchestrationnahlaAinda não há avaliações

- Additional ProblemDocumento3 páginasAdditional ProblemLabLab ChattoAinda não há avaliações

- Hugos Chap 1Documento15 páginasHugos Chap 1Febra HutamaAinda não há avaliações

- Lec 1 Case 1Documento2 páginasLec 1 Case 1Sanduni jayarathne100% (1)

- Wan - Davi Journal 2015.pdf 856218388Documento33 páginasWan - Davi Journal 2015.pdf 856218388Wan Desti TariniAinda não há avaliações

- Sanjeevani IS08036 Lazeez Foods HospitalityDocumento13 páginasSanjeevani IS08036 Lazeez Foods HospitalityharshmarooAinda não há avaliações

- Chapter 4: Inventory Management BUSI2603U Fall 2015Documento5 páginasChapter 4: Inventory Management BUSI2603U Fall 2015Jharr699Ainda não há avaliações

- Chapter 14-Performance Measurement Along The Supply ChainDocumento21 páginasChapter 14-Performance Measurement Along The Supply ChainHamidaAinda não há avaliações

- RFI Vs RFQ Vs RFPDocumento8 páginasRFI Vs RFQ Vs RFPAayush tyagi100% (1)

- Latihan LATIHAN Soal SAPDocumento31 páginasLatihan LATIHAN Soal SAPahsiamahgoblog100% (1)

- Unlimited Packaging PLCDocumento8 páginasUnlimited Packaging PLCmulatAinda não há avaliações

- Business Model Canvas (BMC) : Key Partners Key Activities Value Propositions Customer Relationships Customer SegmentsDocumento2 páginasBusiness Model Canvas (BMC) : Key Partners Key Activities Value Propositions Customer Relationships Customer SegmentsMirza FaizAinda não há avaliações

- Maintenance Spare Parts Logistics PDFDocumento9 páginasMaintenance Spare Parts Logistics PDFAnonymous ABPUPbKAinda não há avaliações

- Introduction To Business: Managing ProcessesDocumento68 páginasIntroduction To Business: Managing ProcessesTiara RossaAinda não há avaliações

- Shipment Manifest / Packing ListDocumento3 páginasShipment Manifest / Packing ListZahid MahmoodAinda não há avaliações

- IT Project SynopsisDocumento8 páginasIT Project SynopsisVandana Hegde100% (1)

- Construction ProcurementDocumento2 páginasConstruction ProcurementromeoAinda não há avaliações

- Critical Thinking ExecisesDocumento1 páginaCritical Thinking ExecisesUyên PhạmAinda não há avaliações

- HW Chap 10Documento29 páginasHW Chap 10Xuân QuỳnhAinda não há avaliações

- Channel Objectives: Marketing Channels Exist To Create Utility For CustomersDocumento25 páginasChannel Objectives: Marketing Channels Exist To Create Utility For CustomersScarlet100% (2)