Escolar Documentos

Profissional Documentos

Cultura Documentos

0602PM

Enviado por

ZerohedgeDescrição original:

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

0602PM

Enviado por

ZerohedgeDireitos autorais:

Formatos disponíveis

[DAILY PETROSPECTIVE] June 2, 2010

Early Evening Market Review for Wednesday

Oil prices advanced on Wednesday as traders boosted

cvommodities quotes on positive data reports on US homes and

autos, generally considered the two “biggest-ticket” items

purchased by consumers.

The National Association of Realtors reported a 6% jump in its

April index of pending hom,e sales. This was more than the 5%

generally expected by analysts and realtors. And, American auto

sales recorded strong year-on-year sales figures, with Ford

reporting a 22% increase in sales in May, while General Motors

reported an increase of 32% in May sales.

Page | 1 Research: 203.801.0771

Sales: 203.504.2786

www.cameronhanover.com Powered by FMX | Connect

[DAILY PETROSPECTIVE] June 2, 2010

These specifically American numbers helped US oil prices, although traders were quick to remind

themselves that oil is a global commodity and weakness in one place needs to be made up or compensated for

by strength somewhere else. And Europe, or the “euro-zone” as it is being called these days, is seen as being

an anchor on the economic recovery as well as on oil prices.

At the end of yesterday’s trading, the positive economic factors had been seen as being positive enough to

generate a rally of more than a dollar in crude oil prices (we apologize, but the PM report plucks “closing”

prices early, rather than the “settlement” prices released later in the day and used in the morning Daily

Hedger). The DJIA was up a very strong 225.52 points, to 10,249.54, by its final bell, but the gains were posted

in a fairly steady strem throughout

Wednesday’s session, and then DOE Expectations

enjoyed another burst at the end. Category Dow Jones Bloomberg Reuters

The buying we have seen recently Crude Oil up 0.200 unchanged dn 0.100 mln bbls

in the oil markets is different from Distillate dn 0.100 up 0.200 up 0.100

the buying we had throughout March Gasoline dn 0.700 dn 0.500 dn 0.500

and April. That early second-quarter Utilization up 0.1% up 0.3% up 0.2%

buying came from index funds, we

believe, from large investors who allowed money managers to place their money into oil futures as a long-term

investment. These investors typically bought and held for a long time. The investor buying we are seeing now

is much shorter-term, and it tends to view oil futures more as a composite animal that has economic inputs –

rather than as an investment that one can buy and hold in a “knee-jerk” response to higher equities or a

weaker US dollar. The fundamentals also seem to be getting more play here, and investors seem to be slightly

more aware of their existence. Of course, all of this is in flux right now.

Tonight’s API report showed a draw of 1.418 million

barrels in crude oil stocks, a build of 0.852 million bbls in

API Report

Crude Stocks dn 1.418 mln bbls distillate stocks and a drawdown of 0.962 million barrels in

Distillate up 0.852 gasoline inventories. Refineries increased utilization to

Gasoline dn 0.962 86.6%, while they cut imports by 719,000 bpd to 8.702

Utilization up 0.7% to 86.6% million bpd, which is very low for this time of year.

Crude Imports dn 0.719 mln to 8.702 mln Im[plied distillate demand was very good for late May at

bpd 4.422 million bpd, while implied gasoline demand was

unexceptional at 9.376 million bpd.

Tomorrow’s DOE report could be the next big source of movement in this market.

Crude Oil Daily Technical Chart

Page | 2 Research: 203.801.0771

Sales: 203.504.2786

www.cameronhanover.com Powered by FMX | Connect

Você também pode gostar

- 0608PMDocumento2 páginas0608PMZerohedgeAinda não há avaliações

- 0616PMDocumento2 páginas0616PMZerohedgeAinda não há avaliações

- Early Evening Market Review For Wednesday: (Daily Petrospective)Documento3 páginasEarly Evening Market Review For Wednesday: (Daily Petrospective)ZerohedgeAinda não há avaliações

- Early Evening Market Review For Tuesday: (Daily Petrospective)Documento3 páginasEarly Evening Market Review For Tuesday: (Daily Petrospective)ZerohedgeAinda não há avaliações

- Energy Information Administration Latest Release: SourceDocumento6 páginasEnergy Information Administration Latest Release: SourceSunil DarakAinda não há avaliações

- 0707PMDocumento2 páginas0707PMZerohedgeAinda não há avaliações

- 0623PMDocumento2 páginas0623PMZerohedgeAinda não há avaliações

- Early Evening Market Review For Tuesday: (Daily Petrospective)Documento3 páginasEarly Evening Market Review For Tuesday: (Daily Petrospective)ZerohedgeAinda não há avaliações

- 0504PMDocumento2 páginas0504PMZerohedgeAinda não há avaliações

- 0609PMDocumento2 páginas0609PMZerohedgeAinda não há avaliações

- 0521PMDocumento2 páginas0521PMZerohedgeAinda não há avaliações

- 0603PMDocumento2 páginas0603PMZerohedgeAinda não há avaliações

- Early Evening Market Review For Wednesday: (Daily Petrospective)Documento3 páginasEarly Evening Market Review For Wednesday: (Daily Petrospective)ZerohedgeAinda não há avaliações

- 0428PMDocumento2 páginas0428PMZerohedgeAinda não há avaliações

- 0726PMDocumento2 páginas0726PMZerohedgeAinda não há avaliações

- Early Evening Market Review For Monday: (Daily Petrospective)Documento3 páginasEarly Evening Market Review For Monday: (Daily Petrospective)ZerohedgeAinda não há avaliações

- CH0421PMDocumento2 páginasCH0421PMZerohedgeAinda não há avaliações

- 0712PMDocumento2 páginas0712PMZerohedgeAinda não há avaliações

- Early Evening Market Review For Thursday: (Daily Petrospective)Documento3 páginasEarly Evening Market Review For Thursday: (Daily Petrospective)ZerohedgeAinda não há avaliações

- 0420PMDocumento2 páginas0420PMZerohedgeAinda não há avaliações

- Crude Oil CommentaryDocumento5 páginasCrude Oil CommentaryMphatso ManyambaAinda não há avaliações

- Report 29-2006Documento7 páginasReport 29-2006Kien LeAinda não há avaliações

- Crude Oil A Commodity That Moves The MarketDocumento4 páginasCrude Oil A Commodity That Moves The MarketChetan PanchamiaAinda não há avaliações

- Artikel Bahasa Inggris Tentang Ekonomi Rising Oil Price A Boon For The US EconomyDocumento2 páginasArtikel Bahasa Inggris Tentang Ekonomi Rising Oil Price A Boon For The US EconomyCiendt CienthaAinda não há avaliações

- 0629PMDocumento2 páginas0629PMZerohedgeAinda não há avaliações

- OPEC MOMR February 2021Documento93 páginasOPEC MOMR February 2021OmarAinda não há avaliações

- 0510PMDocumento2 páginas0510PMZerohedgeAinda não há avaliações

- Research Paper Oil PricesDocumento5 páginasResearch Paper Oil Pricesfvfr9cg8100% (1)

- Shamik Bhose September Crude Oil ReportDocumento8 páginasShamik Bhose September Crude Oil ReportshamikbhoseAinda não há avaliações

- Demanda de Crudo Se Reducirá en 9,1 Millones de Barriles Diarios Según La OPEPDocumento93 páginasDemanda de Crudo Se Reducirá en 9,1 Millones de Barriles Diarios Según La OPEPEn BrevesAinda não há avaliações

- OPEC MOMR August 2020 PDFDocumento93 páginasOPEC MOMR August 2020 PDFjunges99Ainda não há avaliações

- 0607PMDocumento2 páginas0607PMZerohedgeAinda não há avaliações

- 0416PMDocumento2 páginas0416PMZerohedgeAinda não há avaliações

- Oil Refineries in the Northeast Face ChallengesDocumento2 páginasOil Refineries in the Northeast Face ChallengesGaryAinda não há avaliações

- Musings: Energy Stocks Have Mostly Trailed The Market This YearDocumento10 páginasMusings: Energy Stocks Have Mostly Trailed The Market This YearMurugiah RamilaAinda não há avaliações

- Oil Demand Uncertainties Linger: Economic and Financial AnalysisDocumento6 páginasOil Demand Uncertainties Linger: Economic and Financial AnalysisOwm Close CorporationAinda não há avaliações

- A Primer at The PumpDocumento8 páginasA Primer at The PumpKumar Gaurab JhaAinda não há avaliações

- Petro Journal Dec 2018Documento19 páginasPetro Journal Dec 2018kihilAinda não há avaliações

- OPEC MOMR May 2020 PDFDocumento89 páginasOPEC MOMR May 2020 PDFOscar GonzálezAinda não há avaliações

- Understanding Shocks of Oil Prices: IJASCSE Vol 1 Issue 1 2012Documento7 páginasUnderstanding Shocks of Oil Prices: IJASCSE Vol 1 Issue 1 2012IJASCSEAinda não há avaliações

- Focus List Q 318Documento7 páginasFocus List Q 318calpikAinda não há avaliações

- Olefins E-Ethy 2 - 15 - 2013Documento3 páginasOlefins E-Ethy 2 - 15 - 2013Amin Soleimani MehrAinda não há avaliações

- 0503PMDocumento2 páginas0503PMZerohedgeAinda não há avaliações

- Demand fears return from trade war threatsDocumento7 páginasDemand fears return from trade war threatsകൂട്ടുകാരിയെ സ്നേഹിച്ച കൂട്ടുകാരൻAinda não há avaliações

- Oil Refineries in 2013: ST NDDocumento2 páginasOil Refineries in 2013: ST NDxjyang01Ainda não há avaliações

- Philip VerlegerDocumento5 páginasPhilip VerlegerAlfredo Jalife RahmeAinda não há avaliações

- Opec Momr May 2021Documento94 páginasOpec Momr May 2021DanielAinda não há avaliações

- 0610PMDocumento2 páginas0610PMZerohedgeAinda não há avaliações

- Energy Data Highlights: Sakhalin Energy Partners Could Decide On Train 3 in 2012Documento9 páginasEnergy Data Highlights: Sakhalin Energy Partners Could Decide On Train 3 in 2012choiceenergyAinda não há avaliações

- RBS Round Up: 01 September 2010Documento11 páginasRBS Round Up: 01 September 2010egolistocksAinda não há avaliações

- Ass 3Documento6 páginasAss 3Sneha BasnetAinda não há avaliações

- Cause and Effect - US Gasoline Prices 2013Documento7 páginasCause and Effect - US Gasoline Prices 2013The American Security ProjectAinda não há avaliações

- 0622PMDocumento2 páginas0622PMZerohedgeAinda não há avaliações

- Aily Arket Pdate: BCD C M I - VMI 'Ejummo W HQN RU UMM NNNN ) K K KDocumento3 páginasAily Arket Pdate: BCD C M I - VMI 'Ejummo W HQN RU UMM NNNN ) K K Kapi-25889552Ainda não há avaliações

- Wall Street Rally Continues As All Sectors Post GainsDocumento2 páginasWall Street Rally Continues As All Sectors Post GainsRalph FogelAinda não há avaliações

- LINC Week 10Documento8 páginasLINC Week 10Anonymous pgsgpgwvxiAinda não há avaliações

- Financial Performance of The Major Oil Companies, 2007-2011: Robert PirogDocumento12 páginasFinancial Performance of The Major Oil Companies, 2007-2011: Robert PirogFederovici Adrian GabrielAinda não há avaliações

- OPEC Monthly Oil Market Report highlights global oil market developments in October 2021Documento94 páginasOPEC Monthly Oil Market Report highlights global oil market developments in October 2021MARCO ANTONIO ARANDA PINTOAinda não há avaliações

- OPEC MOMR July 2020Documento90 páginasOPEC MOMR July 2020Thorreg GamingAinda não há avaliações

- Oil's Endless Bid: Taming the Unreliable Price of Oil to Secure Our EconomyNo EverandOil's Endless Bid: Taming the Unreliable Price of Oil to Secure Our EconomyAinda não há avaliações

- JPM Q1 2024 PresentationDocumento14 páginasJPM Q1 2024 PresentationZerohedgeAinda não há avaliações

- BOJ Monetary Policy Statemetn - March 2024 Rate HikeDocumento5 páginasBOJ Monetary Policy Statemetn - March 2024 Rate HikeZerohedge0% (1)

- Fomc Minutes 20240320Documento11 páginasFomc Minutes 20240320ZerohedgeAinda não há avaliações

- TBAC Basis Trade PresentationDocumento34 páginasTBAC Basis Trade PresentationZerohedgeAinda não há avaliações

- Fomc Minutes 20240131Documento11 páginasFomc Minutes 20240131ZerohedgeAinda não há avaliações

- NSF Staff ReportDocumento79 páginasNSF Staff ReportZerohedge Janitor100% (1)

- Warren Buffett's Annual Letter To ShareholdersDocumento16 páginasWarren Buffett's Annual Letter To ShareholdersFOX Business100% (2)

- TSLA Q4 2023 UpdateDocumento32 páginasTSLA Q4 2023 UpdateSimon AlvarezAinda não há avaliações

- Earnings Presentation Q3 2023Documento21 páginasEarnings Presentation Q3 2023ZerohedgeAinda não há avaliações

- Fomc Minutes 20231213Documento10 páginasFomc Minutes 20231213ZerohedgeAinda não há avaliações

- Rising US Government Debt: What To Watch? Treasury Auctions, Rating Agencies, and The Term PremiumDocumento51 páginasRising US Government Debt: What To Watch? Treasury Auctions, Rating Agencies, and The Term PremiumZerohedge100% (1)

- AMD Q3'23 Earnings SlidesDocumento33 páginasAMD Q3'23 Earnings SlidesZerohedgeAinda não há avaliações

- Hunter Biden Indictment 120723Documento56 páginasHunter Biden Indictment 120723New York PostAinda não há avaliações

- BTCETFDocumento22 páginasBTCETFZerohedge JanitorAinda não há avaliações

- Fomc Minutes 20231101Documento10 páginasFomc Minutes 20231101ZerohedgeAinda não há avaliações

- SCA Transit FeesDocumento2 páginasSCA Transit FeesZerohedgeAinda não há avaliações

- X V Media Matters ComplaintDocumento15 páginasX V Media Matters ComplaintZerohedge Janitor100% (1)

- 3Q23 PresentationDocumento12 páginas3Q23 PresentationZerohedgeAinda não há avaliações

- Hunter Biden ReportDocumento64 páginasHunter Biden ReportZerohedge50% (2)

- Jerome Powell SpeechDocumento6 páginasJerome Powell SpeechTim MooreAinda não há avaliações

- Tesla Inc Earnings CallDocumento20 páginasTesla Inc Earnings CallZerohedge100% (1)

- TBAC Presentation Aug 2Documento44 páginasTBAC Presentation Aug 2ZerohedgeAinda não há avaliações

- Fomc Minutes 20230726Documento10 páginasFomc Minutes 20230726ZerohedgeAinda não há avaliações

- BofA The Presentation Materials - 3Q23Documento43 páginasBofA The Presentation Materials - 3Q23Zerohedge100% (1)

- 2023-09-14 OpinionDocumento42 páginas2023-09-14 OpinionZerohedgeAinda não há avaliações

- Powell 20230825 ADocumento16 páginasPowell 20230825 AJuliana AméricoAinda não há avaliações

- Yellow Corporation Files Voluntary Chapter 11 PetitionsDocumento2 páginasYellow Corporation Files Voluntary Chapter 11 PetitionsZerohedgeAinda não há avaliações

- Earnings Presentation Q4 2022Documento21 páginasEarnings Presentation Q4 2022ZerohedgeAinda não há avaliações

- November 2021 Secretary Schedule RedactedDocumento62 páginasNovember 2021 Secretary Schedule RedactedNew York PostAinda não há avaliações

- 2Q23 PresentationDocumento12 páginas2Q23 PresentationZerohedgeAinda não há avaliações

- Iskandar Malaysia's Vision, Growth and Promotional PoliciesDocumento29 páginasIskandar Malaysia's Vision, Growth and Promotional PoliciesJiaChyi PungAinda não há avaliações

- Hostile Takeover of Mindtree: An Analysis of Benefits and ChallengesDocumento4 páginasHostile Takeover of Mindtree: An Analysis of Benefits and Challengesanuj rakheja100% (1)

- Price DispersionDocumento4 páginasPrice DispersionAbel VasquezAinda não há avaliações

- Masura 2Documento2.156 páginasMasura 2ClaudiuAinda não há avaliações

- Contemporary World PPT IntroDocumento13 páginasContemporary World PPT IntroSindac, Maria Celiamel Gabrielle C.Ainda não há avaliações

- Low Fouling, High Temperature Air Preheaters For The Carbon Black IndustryDocumento3 páginasLow Fouling, High Temperature Air Preheaters For The Carbon Black IndustryffownAinda não há avaliações

- Pt. Bank Rakyat Indonesia (Persero) Tbk. Banjar Branch (F.0162)Documento2 páginasPt. Bank Rakyat Indonesia (Persero) Tbk. Banjar Branch (F.0162)LaiLi ImnidaAinda não há avaliações

- US Internal Revenue Service: p1438Documento518 páginasUS Internal Revenue Service: p1438IRSAinda não há avaliações

- Survey highlights deficits facing India's minority districtsDocumento75 páginasSurvey highlights deficits facing India's minority districtsAnonymous yCpjZF1rFAinda não há avaliações

- Torrent Power Signs Distribution Franchisee Agreement For Kanpur and AgraDocumento2 páginasTorrent Power Signs Distribution Franchisee Agreement For Kanpur and AgraTanmay Meera Mishra0% (1)

- A Synopsis Submitted in Partial Fulfilment: Road NetworksDocumento7 páginasA Synopsis Submitted in Partial Fulfilment: Road Networksmunish747Ainda não há avaliações

- Ceiling heating system guideDocumento4 páginasCeiling heating system guideUday Kiran100% (1)

- Deed of Sale 2Documento6 páginasDeed of Sale 2Edgar Frances VillamorAinda não há avaliações

- Solar Crimp ToolsDocumento4 páginasSolar Crimp ToolsCase SalemiAinda não há avaliações

- Status Report Example 021606110036 Status Report-ExampleDocumento5 páginasStatus Report Example 021606110036 Status Report-ExampleAhmed Mohamed Khattab100% (2)

- Hybrid Electric AircraftDocumento123 páginasHybrid Electric AircraftSoma Varga100% (1)

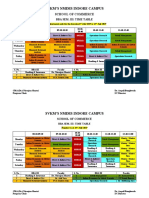

- Time-Table - BBA 3rd SemesterDocumento2 páginasTime-Table - BBA 3rd SemesterSunny GoyalAinda não há avaliações

- Analisa Investasi AlatDocumento15 páginasAnalisa Investasi AlatPaula Olivia SaiyaAinda não há avaliações

- TLE Budgeting Roleplay ScriptDocumento2 páginasTLE Budgeting Roleplay Scriptfelixterence5Ainda não há avaliações

- Decentralization challenges and solutionsDocumento10 páginasDecentralization challenges and solutionsAvinash VenkatAinda não há avaliações

- Strategic Management in Tourism 3rd Edition Chapter 3Documento9 páginasStrategic Management in Tourism 3rd Edition Chapter 3Ringle JobAinda não há avaliações

- Measuring Efficiency of Islamic Banks: Evidence From IndonesiaDocumento9 páginasMeasuring Efficiency of Islamic Banks: Evidence From IndonesiaJEKIAinda não há avaliações

- Places and Landscapes in a Changing WorldDocumento9 páginasPlaces and Landscapes in a Changing WorldRazel G. Taquiso80% (10)

- Projected Balance SheetDocumento1 páginaProjected Balance Sheetr.jeyashankar9550100% (1)

- Talent Corp - Final Report (Abridged) PDFDocumento211 páginasTalent Corp - Final Report (Abridged) PDFpersadanusantaraAinda não há avaliações

- House Share Agreement Resident OwnerDocumento2 páginasHouse Share Agreement Resident Ownerburn dont freeze0% (1)

- Accounting-ABM WorksheetDocumento5 páginasAccounting-ABM WorksheetPrincess AlontoAinda não há avaliações

- STP DoneDocumento3 páginasSTP DoneD Attitude KidAinda não há avaliações

- Tag Question - Practice - StudentsDocumento10 páginasTag Question - Practice - Studentsvan anh phanthiAinda não há avaliações

- Edp Imp QuestionsDocumento3 páginasEdp Imp QuestionsAshutosh SinghAinda não há avaliações