Escolar Documentos

Profissional Documentos

Cultura Documentos

UIIC AO 2016 - Descriptive E-Magazine - Part 2

Enviado por

Praveen TripathiTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

UIIC AO 2016 - Descriptive E-Magazine - Part 2

Enviado por

Praveen TripathiDireitos autorais:

Formatos disponíveis

Part 2

UIIC AO 2016 Descriptive e-Magazine Part 2

Essay: Western Rating Firms are Sometimes Biased Against Emerging Nations Yogita

Credit rating Agency (CRA) are specialist commercial firms that assesses the liabilities of companies,

institutions and government to service their debts. CRAs are not absolute predictor but give subjective

view regarding credit worthiness of companies.

International rating agency is mainly dominated by Moody, Standard & Poor and Finch. Of lately, rating

agencies have seen duopoly or oligopoly by these rating players. As these rating agencies are based and

controlled by western world and governments, we have seen them being partial towards developing

nations. CRAs have time and again come under scanner for their biased and erroneous ratings. They had

rated Lehman and Brothers an 'A' rating, a month before its collapse. In past, collapse of several other

corporate giants triggered a series of questions on role & credibility of CRAs. It is believed that their

revenues are predominantly driven by rating fees earned from issuers.

It is quite apparent that as emerging nations are in the process of development they cannot earmark funds

to up their rating. This results in developing nations not getting ratings as per their performance and

growth. It has been seen that CRAs denote disproportionate resources in rating western countries, rather

than improving their analysis of emerging nations. Rating agencies have also been blamed for contributing

to economic turbulence by underestimating the risk attached with the bigger economies of the worlds.

The reasons for such performance of rating agencies are due to several factors. First of all they are not

independent bodies and have sufficient influence on their decision makings from the government and big

companies who also have been suspected of paying to maintain/increase their rankings. Second, they

have not been held accountable for their faulty predictions in the past.

CRAs wield enormous power as gatekeeper to financial markets for companies due to increase regulatory

use of ratings. There is a need to strengthen the accuracy of credit rating agencies and make them more

unbiased towards emerging economies. There should be a regulatory authority to rank on the basis of

their accuracy to rate. Lastly, they should also be held accountable for their faults and inaccurate ratings,

making sure there is less government interference in their decision making.

Letter: Letter to editor about children's health and education issues in India Arya Stark

Arya Stark,

26, Phulchand Niwas,

NDA Road, Mumbai-400006.

31st May, 2016

6/6/16

Visit us at www.exampundit.in

Part 2

To,

The Editor,

The Indian Express,

Mumbai-400001

Subject- Childrens health & education problems in India.

Dear Sir/Maam,

As a child right activist, I am greatly concerned about the childrens development issues. Though the

standard of living of our countrys citizens is improving day by day, but we used to see many children

begging on the streets daily. It shows that governments schemes and awareness camps are not yet reach

everywhere. Still, many children are facing problems like malnutrition, hunger, etc. and fighting many

diseases without getting any medical help. Lack of sanity and lack of clean drinking water are the main

sources to affect the childrens health.

Along with the health issues, education to every child is another major concern. Today also, there are

many children out of the school. In the rural areas, people are not still so concerned about the education

and especially girl childs education. Free basic education programmes have been launched few years ago,

but the lack of awareness of the importance of education left the children out of school. In the cities, the

rising cost of education is the biggest worry of the parents. If the child is not healthy, naturally it is going

to affect its other developmental activities. The lack of education later leads to poverty and poverty

ultimately goes to degrade the health. And the cycle continues.

Children are citizens of tomorrow. The healthy and active children are going to become development

force to the nation. Only providing food is not the solution, proper food diet containing nutrition, vitamins,

proteins, fibre is required. Also, better education is the key to progress of children. Through this letter I

want to draw your attention to these issues, so that through this medium we can spread the awareness

among the people.

Yours faithfully

Arya Stark

6/6/16

Visit us at www.exampundit.in

Part 2

Essay: Future of Insurance in India Arya Stark

To become a developed nation, India must financially empower its large population. A key element of this

empowerment is a base risk cover that covers the elements of life, disability, health, moreover, vehicles,

crops, property, high value products, etc. This empowerment can only be achieved through efforts of

government, private entities and regulators, who must be able to build commercially viable and scalable

models for financial inclusion.

The key issues and challenges resisting the growth of insurance sector in India are product design, market

conduct, distribution intermediary and complaints of management. Also in the rural area, lower access to

information, lack of awareness of insurance products makes the people uninsured class of population.

Insuring people in the informal sector is a challenge, as there is a vast population working in the informal

sector accessing them is not easy.

It is time to use some innovative techniques for the expansion of the insurance industry. For that, it is

need to create new innovative models. There are successive models in other financial and non-financial

service business that can be adopted to distribute the insurance products. Such as adopting social

insurance or peer to peer insurance model. A Berlin based start-up is essentially allowing individuals to

develop their own risk pools. Users of service invite their friends to cover a small portion of any claims

that are made and the rest of the claims are paid by a conventional insurance policy. This service, claimed

by company, prevents insurance fraud and misconduct via means of social control and reduces sales cost,

discourages small claims and cuts administrative overhead.

Implementation of direct delivery model inspired by Amway success of multilevel marketing can be

beneficial to insurance sector too. Then mobile based insurance model, extending the business

capabilities to mobile devices has quickly become a fundamental requirement for companies. As mobile

users are already KYC compliant and with Aadhar enabled bank accounts. Mobile banking platform to

offer insurance solutions is a cost effective method to tap a large market. In areas like information

aggregation and management, communications and human machine interfaces, technology has enabled

new paradigms. Use of technology benefitted to the growth of industry and coupling the insurance

products with technology from time to time will assure growth in future also.

In future, there will be always need to find out new measures which will increase the penetration of

insurance products in our country which can be achieved through focused efforts and suitable

partnerships across the industry and government bodies. The insurance industry still struggles to move

out of the shadow cast by the challenges posed by the economic uncertainties. The strong fundamentals

of the industry can make a way for sustainable long term growth.

Letter: Write a letter to your friend expressing your views on rise of gadget insurance in India Priyanka

Prateeksha

IRC Village

Bhubaneswar-756381

6/6/16

Visit us at www.exampundit.in

Part 2

2nd June 2016

Dear Supreeya,

Sorry to hear about loss as the phone was close to your heart, but anyways, now you can take

some smart steps and then you dont need to worry about your gadget loss. Have you heard about gadget

insurance? I want to share something about that with you.

As you know insurance is very important for all of us. Gone are the days , when people used

to get insurance policies of life and death only, but todays scenario has totally changed. Nowadays people

get insurance policies of every single thing they possess.

So, one of them is gadget insurance. It is a specially designed policy to protect against loss,

damage or theft of all of your gadgets. It isnt until something happens that we realize the value of

protecting these valuable devices. With the help of gadget insurance, you can get complete security and

protection against the accidental damage, damage due to fluid or water, damage due to fire or theft. They

also provide antivirus solution for your gadgets, here the insurance claims are based on the number of

days and usage of the gadget. In gadget insurance you can easily get maximum benefits and get your

precious money back from the insurance companies simply by enrolling for gadget insurance.

So, I hope this awareness will help you to have better protection of all your gadgets. Give my

regard to all.

Yours faithfully,

Prateeksha

Essay: Role of Insurance Aggregators in Insurance Sectors Ghost

Those of us who spend much of our time browsing the internet, would have noticed the advertisements

from Insurance Aggregators now-a-days. As per the definition of the Insurance Regulatory and

Development Authority of India (IRDAI), Insurance Web Aggregators compile and provide information

about insurance policies of various companies on a website. They collect data from various sources and

databases, such as insurance company websites, and compile them to make presentable to potential

insurance policy buyers. Since these web aggregators have gained prominence in India, the Insurance

Regulatory and Development Authority has brought about a set of regulations for these aggregators.

Insurance Regulatory and Development Authority (Web Aggregators) Regulations, 2013 define the role

and duties of such aggregators.

This set of regulations define the process of attaining a license to act as a web aggregator, norms and

regulations, penalties for aggregators working without a license and other related matters. As per the final

regulations of IRDA which have been finalized in 2016, the insurance web aggregator can be reimbursed

by charging a fee of Rs.50,000 from the insurer for each insurance policy or product. While performing its

duties, an insurance web aggregator has to ensure that no inconvenience is caused to the customer. It

can act as an insurance broker or solicitor.

6/6/16

Visit us at www.exampundit.in

Part 2

Insurance is a large growing market. Various estimates say that there would be 450 million internet users

by 2020. Using this internet the insurance web aggregators have made life so much more convenient for

busy buyers today and have helped raise the insurance industry of the country to an all-new high. The

insurance industry has increased multiple-fold post the introduction of insurance web aggregators in the

market.

Essay: Indian Government should be smarter, not strict on KYC norms Priyanka

KYC is a major tool used to verify the identity of the clients of an organization, be it banks, corporate

houses or insurance companies. This is a process to ensure that the proposed customers, clients or

distributers are reliable and truthful.

Know Your Customer is becoming very important globally to combat terror financing, money laundering,

financial fraud and identity theft. The objective of KYC procedure is to detain banks and companies from

involving in unlawful and illegal activities intentionally or unintentionally.

In India, RBI introduced the KYC guidelines for all banks in 2002. However, in 2004, RBI made it mandatory

for all banks to be fully equipped with KYC norms by Dec 31st 2005. Some key features of KYC guidelines is

proper verification of the identity provided by the customer, monitoring the customer transaction,

ensuring that he is not involved in any fraudulent activities.

However, in some cases, despite using all these rules and regulations, some banks and companies are

being cheated. What lack are proper coordination among banks or companies, using modern technologies

to track customers, unavailability of quality and acute information and easy acceptance of customers.

So, the process needs to be relevant, effective and measurable. One effective way to strengthen KYC and

to make the process more transparent is to follow digital route and implement e-KYC. e-KYC means that

KYC exercise is conducted entirely through internet using an Aadhar interface provided by UIDAI and Pan

card interface provided by Income tax department. Banks and companies before accepting customers

should evolve a Customer Acceptance Policy i.e. application of Customer Due Diligence (CDD). No account

should be opened in anonymous names or when the identity of the customer matches with the person

involved in illegal activities, new customers should be accepted only after CDD.

So, by adopting all these features banks and insurance companies can have safe transactions and can help

them build good image in market. Moreover, with the help of the improved KYC norms, we can have a

society free of fraudulence.

Essay: INDIAN AGRICULTURE NEEDS ORGANIC REVOLUTION Domino

Agriculture is the backbone of civilization. The entire nation depends on the agriculture of the country for

a proper sustenance and one of the major sectors in India is agriculture. Hence, looking for a sustainable

source of agriculture is mandatory as far as our country is concerned. Organic farming serves the purpose

best as it involves farming techniques which excludes use of manmade fertilizers or pesticides and rather

uses animal or plant manure, biological pest control, etc.

6/6/16

Visit us at www.exampundit.in

Part 2

The conventional farming methods apply the use of fertilizers and pesticides which have harmful effect

on the crop produced. The chemicals harm the activity of the nitrogen-fixing bacteria in the soil which

have adverse effect on the crop yield. The chemicals bought requires quite a huge sum of money for which

the farmers applies for loans and if the crop yield is less it becomes difficult for the farmers to repay the

debt. In addition to the grievances, climatic disputes like drought are always prevailing in our country

elevating the need for organic farming.

The organic farming methods help in enriching the soil. The agricultural by-products are reused and the

waste is minimized. Biological pest control and bio- pest repellents works more than fine in combating the

pests. Another main feature of organic farming is the use of pure breed seeds rather than hybrid ones.

The genetically modified seeds, which are avoided in organic farming, carry health risk. So, a safer food

product is obtained through organic farming.

India needs Organic Revolution as the main aspect of a nations prosperity is health. Organic farming

produces food materials which are less hazardous and more sustainable. The export market is also facing

issues as the food materials produced in India is found to be having pesticides in larger quantities by the

importers of other countries, especially the European countries. A lot of work has to done in the grassroots

level to bring in the Organic Revolution. First of all, awareness campaigns have to be held. The farmers

need to know the benefits of organic farming which can be taught to be them by skilled trainers. Secondly,

methods like rain water harvesting have to be promoted as India is facing major problems regarding

drought and other calamities which reduce the crop yield. It is the impeccable effort that has brought

change in the farming scenario in states like Sikkim. So, with efforts the entire country can bring about

the change too. A plant is a producer not a consumer. So, enriching the soil will enrich the plant and can

produce a nutritious hazardless yield.

Essay: INDIAN AGRICULTURE NEEDS ORGANIC REVOLUTION Ghost

Nowadays, pollution, use of chemical fertilisers and many uncertainties are accentuating the climate

change. Use of chemical fertilisers and pesticide in the farms not only affecting health but also it is causing

threat to the environment. That is why, there is rising concern over the world for shifting chemical farming

to the organic farming.

In India there is slow shift to the organic farming. Firstly, because of the lack of awareness about the

overuse of chemicals, intensive fertilisers and secondly, because of the perception that chemical farming

gives more produce than the organic farming. The organic farming produce less but only for the initial 3

years, but farmers are not aware of this.

The economy of any nation rests on the industry and agriculture. So it is required to focus on eco-friendly,

less chemo intensive farming which will produce healthy organic food and also it will not affect the

environment. With the farmers perception, more fertiliser will give more produce. But it is actually

affecting land, soil fertility and such chemically raised food become sources of health issues.

Even scientists, those are working in various science institutes and related to agricultural research agreed

to curb chemical farming and to promote organic farming. Indian farmers have some reasons to shift to

6/6/16

Visit us at www.exampundit.in

Part 2

organic farming. First, they cannot sustain longer through uneconomical chemical farming. Second, as use

of chemicals decaying the lands efficiency, so they will not have enough produce and that will not be

sufficient to pay back their loans. And third, as there is a big concern for organic food in the European and

other foreign markets, they say that our food contains too much pesticide. They insist for organic food.

This is affecting our exports, resulting in to losses.

Therefore, India needs to motivate organic farming among the farmers. Thats why, in 2016-17 budget,

government announced package of Rs.412 crore to focus on organic farming. It is also required to spread

awareness about organic food among consumers. The market link should be proper to sell the organic

food. Farmers must get reasonable price for the organic food, so that they will get encourage for organic

farming.

Letter: Write a letter to the newspaper editor on how Insurance companies need to raise awareness to

curb down rejection of claims Domino

Domino,

27, Russell Street

Delhi -400032

3-05-2016

To

The Editor,

The Hindu,

Delhi-400045

Subject: Insurance companies need to raise awareness to curb down rejection of claims .

Dear Sir/Maam,

I am a reader of your esteemed national daily and recently I have come across the various

predicament faced by several while claiming for the insurance they bought. It is rather sad to see

people suffer due to some negligence and loose trust over the Insurance companies, who have

little mistake in this situation.

Insurance is an essentiality which is bought by almost everyone to curb the sudden losses one

can face monetarily. There are several reasons on why an insurance claim gets rejected. One of

6/6/16

Visit us at www.exampundit.in

Part 2

the primary reasons is the fact that most consumers dont read the form and allows their

insurance agents to fill it up for them. This practice which can be termed as a malpractice has led

to forms being not filled properly. Places in forms are kept vacant which an insurance company

can easily term as non-disclosure of information. On the basis of this ground the claim can be

rejected. In fact the claims are mostly rejected as the person is not aware of the importance of

the process. Another prevailing mistake is lapsing of the policy. The claim has to be active in order

to settle it. The premium needs to be paid on time.

In addition, to the mistakes I have pointed out there is another icing on the cake. The consumer

generally forgets to update about the nominee. If a single man buys insurance and has his parents

as nominees; he should add his wifes name after his marriage. This is of utmost importance as it

is generally regarded after any misfortunate event it s upon his wife to look after his family.

The joe public faces issues only because of lack of awareness. If they are made more aware of

the processes and the importance of each step; the chances of a rejection of a claim will be

minimized. The thought of the entire process being cumbersome has to be eradicated by the

insurance agents or claim officers. The consumers have to accept buying insurance is essential

and hence, having patience to correctly go through the process is more important. There is no

substitute for the happiness of our loved ones. If the focus is shifted to rural areas where teaching

them about the importance of insurance and along with it the method to buy it will be of great

help as the impoverished are the ones who need insurance the most.

Yours faithfully,

Domino

Scan the below QR Code for the Part 1 of the Descriptive PDF

6/6/16

Visit us at www.exampundit.in

Você também pode gostar

- Topic Role of Private Players in Insurance SectorDocumento13 páginasTopic Role of Private Players in Insurance SectorNandini JaganAinda não há avaliações

- The Prosperity Revolution: An exploration of how WealthTech is changing the face of wealth managementNo EverandThe Prosperity Revolution: An exploration of how WealthTech is changing the face of wealth managementAinda não há avaliações

- FIN 405 RezaulDocumento9 páginasFIN 405 RezaulAl MamunAinda não há avaliações

- The Role of Data Analytics in Insurance SectorDocumento4 páginasThe Role of Data Analytics in Insurance SectorIIM Indore Management Canvas100% (2)

- Thesis On Life Insurance Corporation of IndiaDocumento8 páginasThesis On Life Insurance Corporation of Indiamaritzapetersonpaterson100% (2)

- Banking 2020: Transform yourself in the new era of financial servicesNo EverandBanking 2020: Transform yourself in the new era of financial servicesAinda não há avaliações

- 2013 Consumer Action Handbook: Be a Smarter ConsumerNo Everand2013 Consumer Action Handbook: Be a Smarter ConsumerAinda não há avaliações

- The Effects of Brand Equity On Purchase Intention On Car InsuranceDocumento54 páginasThe Effects of Brand Equity On Purchase Intention On Car InsuranceKlein SantosAinda não há avaliações

- Why Insurance Company Has Low PenetrationDocumento2 páginasWhy Insurance Company Has Low PenetrationTamim RahmanAinda não há avaliações

- The Effects of Brand Equity On Purchase Intention On Car InsuranceDocumento54 páginasThe Effects of Brand Equity On Purchase Intention On Car InsuranceKlein SantosAinda não há avaliações

- CHAPTER 1 IntroductionDocumento6 páginasCHAPTER 1 IntroductionPrerana AroraAinda não há avaliações

- Kastur I J Bao Spring 2006Documento16 páginasKastur I J Bao Spring 2006Ħøşęħ ÖżįlAinda não há avaliações

- More Than a Balance Sheet: Business's Need to Help SocietyNo EverandMore Than a Balance Sheet: Business's Need to Help SocietyAinda não há avaliações

- Microfinance CommunityDocumento19 páginasMicrofinance CommunityrahulskullAinda não há avaliações

- Insurance Analysis ReportDocumento12 páginasInsurance Analysis ReportMazharul KarimAinda não há avaliações

- Problem Statement 2017Documento5 páginasProblem Statement 2017PG93Ainda não há avaliações

- Political factors impacting the Indian insurance industryDocumento7 páginasPolitical factors impacting the Indian insurance industryruchibagal1993Ainda não há avaliações

- Literature Review On Microinsurance in IndiaDocumento5 páginasLiterature Review On Microinsurance in Indiadajemevefaz2100% (1)

- Insurance Marketing StrategiesDocumento44 páginasInsurance Marketing Strategiesshrenik100% (1)

- Insunews: 24 - 30 November 2018 Issue No. 2018/47Documento27 páginasInsunews: 24 - 30 November 2018 Issue No. 2018/47Himanshu PantAinda não há avaliações

- Overall Insurance Company in BangladeshDocumento10 páginasOverall Insurance Company in BangladeshAsif Abdullah HemonAinda não há avaliações

- I. Challenge: (Source: US Census)Documento9 páginasI. Challenge: (Source: US Census)Runveer SurwadeAinda não há avaliações

- AI Era: Financial and Economic Baseline and Landscape: 1A, #1No EverandAI Era: Financial and Economic Baseline and Landscape: 1A, #1Ainda não há avaliações

- Research Paper On General InsuranceDocumento8 páginasResearch Paper On General Insurancegzzjhsv9100% (1)

- Thesis On Insurance Sector in IndiaDocumento6 páginasThesis On Insurance Sector in Indiaaprilchesserspringfield100% (2)

- Sariga.s - Insurance PresentationDocumento13 páginasSariga.s - Insurance PresentationSasi KumarAinda não há avaliações

- CSR Project On InsuranceDocumento69 páginasCSR Project On Insurancedhwani0% (1)

- Bii Insurtech 2016Documento19 páginasBii Insurtech 2016Jake Seip100% (1)

- Study of Frauds in Insurance SectorDocumento51 páginasStudy of Frauds in Insurance SectorLaxshmi Pasi100% (2)

- Literature Review On Life Insurance Corporation of IndiaDocumento5 páginasLiterature Review On Life Insurance Corporation of IndiaafmzkbuvlmmhqqAinda não há avaliações

- Summer InternDocumento36 páginasSummer InternnehaAinda não há avaliações

- Customer Relationship Management - Ankit Pandey - XIMBDocumento48 páginasCustomer Relationship Management - Ankit Pandey - XIMBAnirban BiswasAinda não há avaliações

- Market Research and Customer Satisfaction at Kotak Mahindra Life Insurance Co. LTD by RJ - MarketingDocumento58 páginasMarket Research and Customer Satisfaction at Kotak Mahindra Life Insurance Co. LTD by RJ - MarketingGaurav ChhabraAinda não há avaliações

- Problems and Prospects of Insurance Business in BangladeshDocumento5 páginasProblems and Prospects of Insurance Business in BangladeshKawsar Ahmed BadhonAinda não há avaliações

- Challenges and Opportunities of Insurance Sector in emerging marketDocumento3 páginasChallenges and Opportunities of Insurance Sector in emerging marketAlisha ThapaliyaAinda não há avaliações

- 1.1) Explain The Various Elements of The Marketing ProcessDocumento14 páginas1.1) Explain The Various Elements of The Marketing ProcessKasim MalikAinda não há avaliações

- Current LIC ProjDocumento4 páginasCurrent LIC ProjAmit VinerkarAinda não há avaliações

- Escape the Rat Race: Mastering Money and Investing for the FutureNo EverandEscape the Rat Race: Mastering Money and Investing for the FutureAinda não há avaliações

- Mini ProjectDocumento89 páginasMini Projectnisha singhAinda não há avaliações

- Thesis On Insurance SectorDocumento4 páginasThesis On Insurance Sectordeborahquintanaalbuquerque100% (2)

- Lic Final ReportDocumento109 páginasLic Final ReportAbhisek BanerjeeAinda não há avaliações

- Influencers On Non-Life Insurance Purchase Among Car OwnersDocumento53 páginasInfluencers On Non-Life Insurance Purchase Among Car Ownerschristy1mae1accion1sAinda não há avaliações

- ICICI Lombard Project ReportDocumento92 páginasICICI Lombard Project ReportShweta SawantAinda não há avaliações

- Mis selling of life insurance policiesDocumento5 páginasMis selling of life insurance policiesSrivastavaAinda não há avaliações

- The Major Products Offered by The Early Salary Are:: Unsecured Loans Are Surging in Popularity and May Other TopicsDocumento3 páginasThe Major Products Offered by The Early Salary Are:: Unsecured Loans Are Surging in Popularity and May Other Topicsalak coolAinda não há avaliações

- Dissertation Report On Microfinance in IndiaDocumento6 páginasDissertation Report On Microfinance in IndiaPaySomeoneToDoMyPaperCorpusChristi100% (1)

- NMIMS 1st Year Solved Assignment Dec 2020 - Call 9025810064Documento23 páginasNMIMS 1st Year Solved Assignment Dec 2020 - Call 9025810064Palaniappan NAinda não há avaliações

- NMIMS Assignment Answer Sheet Dec 2020 Call 9025810064Documento77 páginasNMIMS Assignment Answer Sheet Dec 2020 Call 9025810064Palaniappan NAinda não há avaliações

- Literature Review On Insurance in IndiaDocumento7 páginasLiterature Review On Insurance in Indiakhkmwrbnd100% (1)

- IDM EditedDocumento22 páginasIDM EditedVaishnaviAinda não há avaliações

- Consumer Satisfaction with Tata-AIG Life InsuranceDocumento66 páginasConsumer Satisfaction with Tata-AIG Life Insurancetulasinad123100% (1)

- NMIMS 1 Sem Solved Assignment Dec 2020 - Call 9025810064Documento10 páginasNMIMS 1 Sem Solved Assignment Dec 2020 - Call 9025810064Palaniappan N0% (1)

- Factors Affecting Customer Retention in The Non-Life Insurance Industry in NepalDocumento18 páginasFactors Affecting Customer Retention in The Non-Life Insurance Industry in NepalSarose ThapaAinda não há avaliações

- Swot - Bancassurance Viet NamDocumento6 páginasSwot - Bancassurance Viet NamAnh Vy NguyễnAinda não há avaliações

- 7 P's of Services MarketingDocumento169 páginas7 P's of Services MarketingZulejha IsmihanAinda não há avaliações

- IB1816208- RURAL MARKETING DOCDocumento27 páginasIB1816208- RURAL MARKETING DOCDeepanjali KushwahaAinda não há avaliações

- Innovation in INsurance SectorDocumento7 páginasInnovation in INsurance SectorNisha NairAinda não há avaliações

- Himalayan College of Management Marketing Management MGMT 5212Documento11 páginasHimalayan College of Management Marketing Management MGMT 5212iam arpanAinda não há avaliações

- Ibps Po SpecialDocumento16 páginasIbps Po SpecialPraveen TripathiAinda não há avaliações

- 1559physics Set C 171Documento5 páginas1559physics Set C 171Praveen TripathiAinda não há avaliações

- Chapter 1Documento15 páginasChapter 1ravindhra365Ainda não há avaliações

- PapersscDocumento17 páginasPapersscPraveen TripathiAinda não há avaliações

- NIOS Lesson 10. Insurance ServicesDocumento12 páginasNIOS Lesson 10. Insurance ServicesPraveen TripathiAinda não há avaliações

- SSC CGL 2013 Notification Downloaded FromDocumento39 páginasSSC CGL 2013 Notification Downloaded FromSushant PatilAinda não há avaliações

- 12024cbsesample PaperDocumento4 páginas12024cbsesample PaperPraveen TripathiAinda não há avaliações

- Chapter 1Documento15 páginasChapter 1ravindhra365Ainda não há avaliações

- PapersscDocumento17 páginasPapersscPraveen TripathiAinda não há avaliações

- RHS NCRPO COVID FormDocumento1 páginaRHS NCRPO COVID Formspd pgsAinda não há avaliações

- Journalize The Following Transactions in The Journal Page Below. Add Explanations For The Transactions and Leave A Space Between EachDocumento3 páginasJournalize The Following Transactions in The Journal Page Below. Add Explanations For The Transactions and Leave A Space Between EachTurkan Amirova100% (1)

- Clinical Case Report No 2Documento11 páginasClinical Case Report No 2ملک محمد صابرشہزاد50% (2)

- Right To HealthDocumento9 páginasRight To HealthPriya SharmaAinda não há avaliações

- Genetics ProblemsDocumento50 páginasGenetics ProblemsTasneem SweedanAinda não há avaliações

- Valvula de Leve MasterDocumento20 páginasValvula de Leve Masterguillermo trejosAinda não há avaliações

- Insurance Principles, Types and Industry in IndiaDocumento10 páginasInsurance Principles, Types and Industry in IndiaAroop PalAinda não há avaliações

- Live Performance Award Ma000081 Pay GuideDocumento48 páginasLive Performance Award Ma000081 Pay GuideDan LijndersAinda não há avaliações

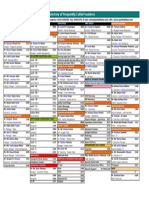

- Directory of Frequently Called Numbers: Maj. Sheikh RahmanDocumento1 páginaDirectory of Frequently Called Numbers: Maj. Sheikh RahmanEdward Ebb BonnoAinda não há avaliações

- Health 6 Q 4 WK 6 Module 6 Version 4Documento16 páginasHealth 6 Q 4 WK 6 Module 6 Version 4Kassandra BayogosAinda não há avaliações

- Request For Review FormDocumento11 páginasRequest For Review FormJoel MillerAinda não há avaliações

- Rockwool 159: 2.2 Insulation ProductsDocumento1 páginaRockwool 159: 2.2 Insulation ProductsZouhair AIT-OMARAinda não há avaliações

- Growing Turmeric: Keys To SuccessDocumento4 páginasGrowing Turmeric: Keys To SuccessAnkit ShahAinda não há avaliações

- Workplace Hazard Analysis ProcedureDocumento12 páginasWorkplace Hazard Analysis ProcedureKent Nabz60% (5)

- Aphasia PDFDocumento4 páginasAphasia PDFRehab Wahsh100% (1)

- Exercise 4 Summary - KEY PDFDocumento3 páginasExercise 4 Summary - KEY PDFFrida Olea100% (1)

- RUKUS March 2010Documento32 páginasRUKUS March 2010RUKUS Magazine29% (14)

- PT6 Training ManualDocumento64 páginasPT6 Training ManualAnderson Guimarães100% (2)

- Life Overseas 7 ThesisDocumento20 páginasLife Overseas 7 ThesisRene Jr MalangAinda não há avaliações

- Week 6 Blood and Tissue FlagellatesDocumento7 páginasWeek 6 Blood and Tissue FlagellatesaemancarpioAinda não há avaliações

- Malaysia's Trade Potential in Colourful AfricaDocumento18 páginasMalaysia's Trade Potential in Colourful AfricaThe MaverickAinda não há avaliações

- Material Safety Data Sheet: WWW - Smartlab.co - IdDocumento8 páginasMaterial Safety Data Sheet: WWW - Smartlab.co - Idlalan suparlanAinda não há avaliações

- HTM 2025 2 (New) Ventilation in HospitalsDocumento123 páginasHTM 2025 2 (New) Ventilation in HospitalsArvish RamseebaluckAinda não há avaliações

- Owners Manual Water Mist PDFDocumento6 páginasOwners Manual Water Mist PDFZeeAinda não há avaliações

- EEDMATH1 - Teaching Mathematics in The Primary Grades Beed 2E Learning Activity PlanDocumento3 páginasEEDMATH1 - Teaching Mathematics in The Primary Grades Beed 2E Learning Activity PlanBELJUNE MARK GALANANAinda não há avaliações

- Q4 Module 8Documento14 páginasQ4 Module 8DerickAinda não há avaliações

- Vturn-NP16 NP20Documento12 páginasVturn-NP16 NP20José Adalberto Caraballo Lorenzo0% (1)

- Practice of Epidemiology Performance of Floating Absolute RisksDocumento4 páginasPractice of Epidemiology Performance of Floating Absolute RisksShreyaswi M KarthikAinda não há avaliações

- PERSONS Finals Reviewer Chi 0809Documento153 páginasPERSONS Finals Reviewer Chi 0809Erika Angela GalceranAinda não há avaliações

- Ensure Even Preload with Proper Tightening Tools and SequenceDocumento2 páginasEnsure Even Preload with Proper Tightening Tools and SequenceMachineryengAinda não há avaliações