Escolar Documentos

Profissional Documentos

Cultura Documentos

Revenue recognition for installment sales and long-term contracts

Enviado por

naserTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Revenue recognition for installment sales and long-term contracts

Enviado por

naserDireitos autorais:

Formatos disponíveis

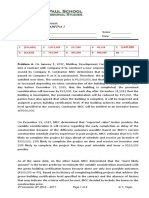

SPECIAL REVENUE RECOGNITION

#0008

INSTALLMENT SALES

PROBLEM 1

The following selected accounts were taken from the trial balance of Survival

Company as of December 31, 2013:

Accounts Receivable

Installment Receivable 2011

Installment Receivable 2012

Installment Receivable 2013

Merchandise Inventory

Purchases

Freight-in

Repossessed Merchandise

Repossession Loss

Cash Sales

Charge Sales

Installment Sales

Deferred Gross Profit 2011

Deferred Gross Profit 2012

Operating Expenses

Shipment on Installment Sales

P750,000

150,000

450,000

2,700,000

525,000

3,900,000

30,000

150,000

240,000

900,000

1,800,000

4,460,000

222,000

393,600

150,000

2,787,500

Additional information:

Gross Profit rates for 2011 and 2012 installment sales were 30% and 32%,

respectively.

The entry for repossessed goods was:

Repossessed Merchandise

150,000

Repossession Loss

240,000

Installment Receivable 2011

180,000

Installment Receivable 2012

210,000

Merchandise on hand at the end of 2013 (new & repossessed) was P282,000

Required: Compute for the following

1. Total Realized Gross Profit in 2013

A. P965,400

B. P2,129,900

C. P2,011,100

D. P2,251,100

2. Balance of Deferred Gross Profit as of December 31, 2013

A. P1,201,500

B. P1,080,300

C. P2,366,000

D. P1,628,100

3. Net income in 2013

A. P1,979,900

B. P1,739,900

C. P1,982,300

D. P1,861,100

PROBLEM 2

Achievement Company which began operations on January 1, 2013 appropriately

uses the instalment method of accounting. The following data pertain to

Achievements operations for year 2013:

Installment sales (before over/under-allowance)

SPECIAL REVENUE RECOGNITION

P3,150,000

#0008

SPECIAL REVENUE RECOGNITION

#0008

Operating expenses

Regular Sales

Total collections for the year (excluding interest of

P84,000)

Cost of regular sales

Cost of instalment sales

Accounts receivable 12/31/2013

Installment receivable written-off (no provision was

made)

Estimated resale value of repossessed merchandise

Profit usual on the sale of repossessed merchandise

Repossessed accounts

Actual value of trade-in Merchandise

Trade-in allowance

Reconditioning cost of the repossessed merchandise

367,500

1,312,500

2,088,000

752,500

2,205,000

512,500

154,000

290,000

15%

350,000

280,000

490,000

57,500

How much is the deferred gross profit at December 31, 2013? What is the net

income for the year ended December 31, 2013?

A.

B.

C.

D.

P353,500;

P353,500;

P287,000;

P287,000;

P455,000

P640,500

P441,000

P525,000

PROBLEM 3

The following account balances appear on the books of Fulfilment Company as of

December 31, 2013:

Cash

Receivables

Merchandise Inventory

Accounts Payable

Deferred Gross Profit 2011

Sales

Purchases

Expenses

P 150,000

800,000

75,000

30,000

261,250

1,250,000

640,000

425,000

The Receivables account is a controlling account for three subsidiary ledgers

which show the following totals:

2012 installment contracts

150,000

2013 installment contracts

600,000

Charge accounts (terms, 30 days, net) 50,000

The Gross profit on sales on installment contract for 2012 was 55%, on

installment contracts for 2013, 50%.

Collections on installment contracts for 2012 total P300,000 for the year just

closed; on installment contracts for 2013, P400,000; on charge accounts,

P200,000.

Account balances from installment sales made prior to 2012 were also collected.

Repossession for the year was on installment contracts for 2012 on which the

uncollected balance at the time of repossession amounted to P50,000.

Merchandise repossessed was erroneously debited as a newly acquired

merchandise equal to the amount defaulted by the customer.

Appraisal reports show that this repossessed merchandise has a true worth of

P20,000 at the time of repossession and remain unsold at year end.

The final inventory of the merchandise (new) valued at cost amounted to

P45,000.

SPECIAL REVENUE RECOGNITION

#0008

SPECIAL REVENUE RECOGNITION

#0008

Required: Compute for the following

1. Total Realized Gross Profit in 2013

A. P626,250

B. P756,250

C. P495,000

D. P365,000

2. Net Income in 2013

A. P331,250

B. P301,250

C. P328,750

D. P382,500

PROBLEM 4

Confidence Corporation sells goods on the installment basis. For the year just

ended, the following were reported: Cost of installment sales, P8,400,000; Loss on

repossession, P202,500; Wholesale value of repossessed merchandise, P1,687,500;

Repossessed account, P2,700,000; Deferred gross profit after adjustment,

P1,620,000.

How much was the collections for the year?

A.

B.

C.

D.

P5,850,000

P6,600,000

P3,900,000

P3,150,000

LONG-TERM CONSTRUCTION CONTRACTS

PROBLEM 1

On July 1, 2012, GB Construction Corp. contracted to build an office building for RX,

Inc. for a total contract price of P1,825,000.

Contract cost incurred

Estimated costs to complete the

contract

Billings to RX, Inc

2012

P 350,000

1,050,000

2013

P 930,000

685,000

2014

P670,000

0

192,500

1,420,000

212,500

Which of the following statements is true?

A. The inventory account, net at December 31, 2013, assuming no dependable

estimates are available amount to P386,250 due to customer.

B. The inventory account balance at December 31, 2013, using cost to cost

method is P1,140,000

C. The recognized loss in 2013 using zero profit method is P246,250

D. The realized gross profit in 2014 using percentage of completion method is

P15,000 and the recognized loss in 2014 using zero profit method is

P125,000.

PROBLEM 2

DM, Inc. works on a P10,500,000 contract in 2013 to construct an office building.

During 2013, DM, Inc. uses the cost to cost method. At December 31, 2013, the

balances in certain accounts were: Construction in progress P3,780,000; Accounts

receivable P360,000; and Billings on construction in progress P1,800,000;

Contract retention P180,000; Mobilization fee P140,000. At December 31, 2013,

the estimated cost at completion is P7,350,000.

The realized gross profit in 2013.

A. P1,102,500

SPECIAL REVENUE RECOGNITION

#0008

SPECIAL REVENUE RECOGNITION

#0008

B. P1,062,500

C. P1,242,500

D. P1,134,000

PROBLEM 3

On January 1, 2012, Brave Construction Corp. began constructing a P2,100,000

contract. The following are relevant information provided by the corporation: Brave

uses percentage of completion method. For the year ended December 31, 2013,

Brave Construction billed its client an additional 55% of the contract price.

Construction in Progress

Estimated cost to complete

Costs incurred

Excess of CIP over Billings

2012

P 441,000

?

425,250

P84,000

current liability

2013

?

?

969,000

P330,750

current

liability

2014

?

675,750

-

Required: Compute for the following:

1. How much is the estimated remaining cost in 2012?

A. P1,599,750

B. P1,155,000

C. P1,680,000

D. P1,584,000

2. How much is the realized gross profit (loss) in 2013?

A. P(45,000)

B. P15,750

C. P(60,750)

D. P30,000

3. How much is the balance of construction in progress in 2013?

A. P1,680,000

B. P2,010,750

C. P1,349,250

D. P1,365,000

PROBLEM 4

On July 1, 2012, Great Corp. obtained a contract to construct a building. The

building was estimated to be built at a total cost of P5,250,000 and is scheduled for

completion on October 2014. The contract contains a penalty clause to the effect

that the other party was to deduct P17,500 from the contract price each week of

delay. Completion was delayed for three weeks. Below are data pertaining to the

construction period. In 2013, there was an increase in the contract price in the

amount of P200,000 per cost escalation clause. Great Corp. uses percentage of

completion method.

Required: Compute for the following

1. How much is the excess of construction in progress over progress billings or

progress billings over construction in progress in 2012? (current asset or

current liability)

A. P840,000 current asset

B. P840,000 current liability

C. P800,000 current liability

D. P800,000 current asset

2. How much is the excess of construction in progress over progress billings or

progress billings over construction in progress in 2013? (current asset or

current liability)

A. P682,500 current liability

B. P682,500 current asset

SPECIAL REVENUE RECOGNITION

#0008

SPECIAL REVENUE RECOGNITION

#0008

C. P635,250 current liability

D. P635,250 current asset

FRANCHISE

PROBLEM 1

On April 30, 2013, Date and Dine entered into a franchise agreement with Food Trip

Inc. to sell their products. The agreement provides for an initial franchise fee of

P1,200,000 which is payable as follows: P400,000 cash to be paid upon signing the

contract, and the balance in five equal annual instalments every December 1,

starting in 2013. Date and Dine signs a non-interest bearing note for the balance.

The credit rating of the franchisee indicates that the money can be borrowed at

10%. The present value factor of an ordinary annuity at 10% for 5 periods is 3.7908.

The agreement further provides that the franchisee must pay a continuing franchise

fee equal to 5% of its monthly gross sales. Food Trip Inc. incurred direct cost of

P540,000, of which P170,000 is related to continuing services and indirect costs of

P72,000, of which 18,000 is related to continuing services. The franchisee started

business operations on September 2, 2013 and was able to generate sales of

P950,000 for 2013. The first installment payment was made in due date.

Assuming that the collectability of the note is not reasonably assured, how much is

the net income of the franchisor for the fiscal year ended December 1, 2013?

A.

B.

C.

D.

P252,206

P174,508

P172,650

P254,935

PROBLEM 2

Spiral Restaurant sold a fine dining restaurant franchise to Circles Hotel. The sale

agreement signed on January 1, 2013 called for a P875,000 down payment plus

three P437,500 annual payments (covered by a non-interest bearing note)

representing the value of initial franchise services rendered by Spiral restaurant. In

addition, the agreement required the franchisee to pay 6% of its gross sales to the

franchisor. The restaurant operated in July and its sales for the year amounted to

P6,562,500. Assuming a 15% interest rate is appropriate, PV of annuity of P1 at 15%

for three periods is 2.28.

How much is the franchisors total revenue for the year ended 2013 income

statement?

A.

B.

C.

D.

P2,266,250

P2,415,875

P2,022,125

P2,403,405

PROBLEM 3

On August 1, 2013, Holiday Inc. entered into a franchise agreement with intense

franchisee. The initial franchise fees agreed upon is P246,900, of which P46,900 is

payable upon signing and the balance to be covered by a non-interest bearing note

payable in four equal annual installments. The down payment is refundable within

75 days. Intense Inc. has a high credit rating, thus, collection of the note is

reasonably assured. Out-of-pocket costs of P125,331 and P12,345 were incurred for

direct expenses and indirect expenses respectively. Prevailing market rate is 9%. PV

factor is 3.2397.

SPECIAL REVENUE RECOGNITION

#0008

SPECIAL REVENUE RECOGNITION

#0008

On the fiscal year ended September 30, 2013, how much revenue from franchise

fee will the franchisor recognize?

A.

B.

C.

D.

P208,885

P246,900

P0

P83,554

PROBLEM 4

On December 1, 2013, Zach, Inc. authorized Movers Company to operate as a

franchisee for an initial franchise fee of P600,000. Of this amount, P240,000 was

received upon signing the agreement and the balance, represented by a note, is

due in three annual payments of P120,000 each beginning December 31, 2014. The

present value on December 1, 2013, for three annual payment appropriately

discounted at P288,000. According to the agreement, the non-refundable down

payment represents a fair measure of the services already performed by Zach and

substantial future services are still to be rendered. However, collectability of the

note is reasonably certain.

On December 31, 2013 Statement of Financial Position how much should Zach

report as unearned franchise fee from Movers Company?

A.

B.

C.

D.

P528,000

P360,000

P400,000

P288,000

*** END ***

SPECIAL REVENUE RECOGNITION

#0008

Você também pode gostar

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNo EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryAinda não há avaliações

- Installment Sales & Long-Term ConsDocumento6 páginasInstallment Sales & Long-Term ConsSirr JeyAinda não há avaliações

- Consumer Lending Revenues World Summary: Market Values & Financials by CountryNo EverandConsumer Lending Revenues World Summary: Market Values & Financials by CountryAinda não há avaliações

- Installment Sales RecognitionDocumento12 páginasInstallment Sales RecognitionAGNES CASTILLOAinda não há avaliações

- Financial Accounting - Want to Become Financial Accountant in 30 Days?No EverandFinancial Accounting - Want to Become Financial Accountant in 30 Days?Nota: 5 de 5 estrelas5/5 (1)

- Auditing Problems With AnswersDocumento12 páginasAuditing Problems With Answersaerwinde79% (34)

- Sales Financing Revenues World Summary: Market Values & Financials by CountryNo EverandSales Financing Revenues World Summary: Market Values & Financials by CountryAinda não há avaliações

- 9.liability Questionnaire QUIZDocumento10 páginas9.liability Questionnaire QUIZMark GaerlanAinda não há avaliações

- Credit Union Revenues World Summary: Market Values & Financials by CountryNo EverandCredit Union Revenues World Summary: Market Values & Financials by CountryAinda não há avaliações

- Assignment Fin AccDocumento4 páginasAssignment Fin AccShaira SalandaAinda não há avaliações

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionAinda não há avaliações

- (Problems) - Audit of LiabilitiessDocumento17 páginas(Problems) - Audit of Liabilitiessapatos0% (2)

- Commercial Banking Revenues World Summary: Market Values & Financials by CountryNo EverandCommercial Banking Revenues World Summary: Market Values & Financials by CountryAinda não há avaliações

- P2 103 Special Revenue Recognition Installment Sales Construction Contracts Franchise 1Documento12 páginasP2 103 Special Revenue Recognition Installment Sales Construction Contracts Franchise 1Kate Alvarez100% (2)

- Pawn Shop Revenues World Summary: Market Values & Financials by CountryNo EverandPawn Shop Revenues World Summary: Market Values & Financials by CountryAinda não há avaliações

- Cel 1 Prac 1 Answer KeyDocumento12 páginasCel 1 Prac 1 Answer KeyLauren ObrienAinda não há avaliações

- Business Credit Institutions Miscellaneous Revenues World Summary: Market Values & Financials by CountryNo EverandBusiness Credit Institutions Miscellaneous Revenues World Summary: Market Values & Financials by CountryAinda não há avaliações

- Audit Liabilities Current NoncurrentDocumento6 páginasAudit Liabilities Current Noncurrentnikkibausa100% (1)

- Wrwftauditing Problems Watitiw: Page 1 of 7Documento7 páginasWrwftauditing Problems Watitiw: Page 1 of 7Ronnel TagalogonAinda não há avaliações

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2016 EditionNo EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2016 EditionAinda não há avaliações

- Local Media3172437425380563588Documento20 páginasLocal Media3172437425380563588Candy SchrendiAinda não há avaliações

- 21St Century Computer Solutions: A Manual Accounting SimulationNo Everand21St Century Computer Solutions: A Manual Accounting SimulationAinda não há avaliações

- NFJPIA Region XII 8th Annual Regional Convention Mock Board ExaminationDocumento49 páginasNFJPIA Region XII 8th Annual Regional Convention Mock Board ExaminationRonnel Tagalogon100% (1)

- Basic Accounting ReviewerDocumento11 páginasBasic Accounting ReviewerandreamrieAinda não há avaliações

- Auditing Problem ReviewerDocumento10 páginasAuditing Problem ReviewerTina Llorca83% (6)

- Advance AccountingDocumento5 páginasAdvance AccountingChristopher PriceAinda não há avaliações

- Qa - Installment SalesDocumento3 páginasQa - Installment SalesSittie Ainna Acmed UnteAinda não há avaliações

- Auditing Problems QaDocumento12 páginasAuditing Problems QaSheena CalderonAinda não há avaliações

- AdvaccDocumento3 páginasAdvaccRarajAinda não há avaliações

- Long Quiz 2Documento8 páginasLong Quiz 2CattleyaAinda não há avaliações

- Ho P2 06Documento2 páginasHo P2 06Kriza Sevilla Matro50% (2)

- AFARicpaDocumento23 páginasAFARicpaRegine YbañezAinda não há avaliações

- Chapter 9Documento13 páginasChapter 9Yenelyn Apistar Cambarijan75% (4)

- Cfas Fs PreparationDocumento3 páginasCfas Fs PreparationEvelina Del RosarioAinda não há avaliações

- p1 ADocumento8 páginasp1 Aincubus_yeahAinda não há avaliações

- Audit Quizzer ProblemDocumento5 páginasAudit Quizzer ProblemJazzy100% (1)

- Accounting for unredeemed coupons and warranty costsDocumento14 páginasAccounting for unredeemed coupons and warranty costsnikkaaaAinda não há avaliações

- Final Exam in Advanced Financial Accounting IDocumento6 páginasFinal Exam in Advanced Financial Accounting IYander Marl BautistaAinda não há avaliações

- Auditing Problems and SolutionsDocumento45 páginasAuditing Problems and SolutionsRonnel TagalogonAinda não há avaliações

- Auditing Problems1Documento45 páginasAuditing Problems1Ronnel TagalogonAinda não há avaliações

- Auditing Problems1Documento45 páginasAuditing Problems1Ronnel TagalogonAinda não há avaliações

- AP.m 1401 Correction of ErrorsDocumento12 páginasAP.m 1401 Correction of ErrorsMark Lord Morales Bumagat75% (4)

- Quiz 14P - Income TaxDocumento5 páginasQuiz 14P - Income TaxDolaypanAinda não há avaliações

- Lecture 5 Events After The Reporting Period Multiple ChoiceDocumento7 páginasLecture 5 Events After The Reporting Period Multiple ChoiceJeane Mae Boo0% (1)

- Naqdown – Elimination Auditing ProblemsDocumento5 páginasNaqdown – Elimination Auditing ProblemsJohn Paulo SamonteAinda não há avaliações

- Advance Accounting 1 Final Exam ReviewDocumento13 páginasAdvance Accounting 1 Final Exam ReviewTina LlorcaAinda não há avaliações

- Auditing Problems1Documento45 páginasAuditing Problems1Ronnel TagalogonAinda não há avaliações

- 8th PICPA National Accounting Quiz ShowdownDocumento28 páginas8th PICPA National Accounting Quiz Showdownrcaa04Ainda não há avaliações

- Level 1 AVERAGEDocumento4 páginasLevel 1 AVERAGEJaime II LustadoAinda não há avaliações

- Audit Problems SolutionsDocumento12 páginasAudit Problems Solutionskim ryan besinanAinda não há avaliações

- MQC - Quiz On Segment, Cash To Accrual, Single and CorrectionDocumento10 páginasMQC - Quiz On Segment, Cash To Accrual, Single and CorrectionLenie Lyn Pasion Torres0% (1)

- Notre Dame Educational Association: Mock Board Examination Financial Accounting and ReportingDocumento17 páginasNotre Dame Educational Association: Mock Board Examination Financial Accounting and Reportingirishjade100% (1)

- Guided Exercises Current Liabilities.pdfDocumento4 páginasGuided Exercises Current Liabilities.pdflexfred55Ainda não há avaliações

- Cash Received From Customers During The YearDocumento5 páginasCash Received From Customers During The Yearelsana philipAinda não há avaliações

- MQ 1 Receivables and InventoryDocumento4 páginasMQ 1 Receivables and Inventorymarygraceomac100% (2)

- Accounting Prodigy BasicAcc1 Instructors Manual PDFDocumento5 páginasAccounting Prodigy BasicAcc1 Instructors Manual PDFPrecious Vercaza Del RosarioAinda não há avaliações

- Ad2 1Documento13 páginasAd2 1MarjorieAinda não há avaliações

- FAR Practice ProblemsDocumento34 páginasFAR Practice ProblemsJhon Eljun Yuto EnopiaAinda não há avaliações

- Wrap-Up Exercise No. 2 Installment Sales: Problem 1Documento3 páginasWrap-Up Exercise No. 2 Installment Sales: Problem 1Samantha Dionisio0% (1)

- Sales Reviewer PDFDocumento25 páginasSales Reviewer PDFShaireen Prisco Rojas100% (2)

- Business Combi - AcquisitionDocumento6 páginasBusiness Combi - Acquisitionnaser20% (5)

- Boa Tos AfarDocumento5 páginasBoa Tos AfarMr. CopernicusAinda não há avaliações

- Ateneo 2007 Commercial LawDocumento124 páginasAteneo 2007 Commercial LawJingJing Romero100% (54)

- Business Combi - SubsequentDocumento5 páginasBusiness Combi - Subsequentnaser100% (2)

- Audit stockholders' equity problemsDocumento7 páginasAudit stockholders' equity problemsLizette Oliva80% (5)

- Week 1 Problem Solving Assignment Solutions PDFDocumento4 páginasWeek 1 Problem Solving Assignment Solutions PDFnaser100% (1)

- Ap 59 PW - 5 06 PDFDocumento18 páginasAp 59 PW - 5 06 PDFJasmin NgAinda não há avaliações

- AP 5902 LiabilitiesDocumento11 páginasAP 5902 LiabilitiesAnonymous Cd5GS3GM100% (1)

- Audit of liabilities quiz problemsDocumento4 páginasAudit of liabilities quiz problemsEarl Donne Cruz100% (4)

- CPA Review School Audit ProblemsDocumento10 páginasCPA Review School Audit Problemsxxxxxxxxx100% (1)

- Business Combi - AcquisitionDocumento6 páginasBusiness Combi - Acquisitionnaser20% (5)

- Pnadz936 PDFDocumento122 páginasPnadz936 PDFHoward EnglishAinda não há avaliações

- Product ProfilingDocumento9 páginasProduct Profilingpiyu_43Ainda não há avaliações

- Assignment On Private Company Vs Public Company in eDocumento5 páginasAssignment On Private Company Vs Public Company in eSaravanagsAinda não há avaliações

- Corporate Profile and ServicesDocumento43 páginasCorporate Profile and Servicesnavaid79Ainda não há avaliações

- DRR-CCA Integration in Local Development PlanningDocumento10 páginasDRR-CCA Integration in Local Development PlanningJEnny RojoAinda não há avaliações

- What is a Futures ContractDocumento4 páginasWhat is a Futures Contractareesakhtar100% (1)

- Divis Laboratories Stock Performance Over 3 YearsDocumento19 páginasDivis Laboratories Stock Performance Over 3 YearsAbhishekKumarAinda não há avaliações

- Libroalex145pags PDFDocumento145 páginasLibroalex145pags PDFAlexander Orjuela MárquezAinda não há avaliações

- Stock Market IndexDocumento27 páginasStock Market Indexjubaida khanamAinda não há avaliações

- Intership ReportqerqrDocumento22 páginasIntership ReportqerqrNgo TramAinda não há avaliações

- Booklet-Profiting With Futures Options PDFDocumento44 páginasBooklet-Profiting With Futures Options PDFAng Yu LongAinda não há avaliações

- Limit Pricing, Entry Deterrence and Predatory PricingDocumento16 páginasLimit Pricing, Entry Deterrence and Predatory PricingAnwesha GhoshAinda não há avaliações

- Spot Bitcoin ETFs WhitepaperDocumento20 páginasSpot Bitcoin ETFs WhitepaperT.A.P.ExE.CEOAinda não há avaliações

- Alemayehu Geda: Department of Economics Addis Abeba University EmailDocumento38 páginasAlemayehu Geda: Department of Economics Addis Abeba University Emailassefa mengistuAinda não há avaliações

- Altria Group Inc 5.95% 2049Documento49 páginasAltria Group Inc 5.95% 2049jamesAinda não há avaliações

- UK Railways Rolling Stock Procurement and LeasingDocumento20 páginasUK Railways Rolling Stock Procurement and Leasingsanto_tango100% (1)

- Powerol - Monthly MIS FormatDocumento34 páginasPowerol - Monthly MIS Formatdharmender singhAinda não há avaliações

- Learning OutcomesDocumento48 páginasLearning OutcomesPom Jung0% (1)

- AmalgamationDocumento44 páginasAmalgamationPraveen Kumar DusiAinda não há avaliações

- Quess Corp: India's Leading Integrated Business Services PlatformDocumento18 páginasQuess Corp: India's Leading Integrated Business Services PlatformSnigdha DasAinda não há avaliações

- ANNUAL Report Sardar Chemical 2014Documento44 páginasANNUAL Report Sardar Chemical 2014Shabana KhanAinda não há avaliações

- Microsoft's R&D Expensing Strategy ExplainedDocumento3 páginasMicrosoft's R&D Expensing Strategy Explainedmawiesya100% (1)

- Axelum Resources Corp Preliminary ProspectusDocumento198 páginasAxelum Resources Corp Preliminary ProspectusEmil Victor Medina MasaAinda não há avaliações

- A Major Project Report On A Study of Awareness and Knowledge About Wealth Management Among IndividualsDocumento51 páginasA Major Project Report On A Study of Awareness and Knowledge About Wealth Management Among IndividualsGaurav Solanki50% (2)

- 8 McKinsey On Social Impact BondsDocumento6 páginas8 McKinsey On Social Impact Bondsar15t0tleAinda não há avaliações

- Adv Fa I CH 1Documento30 páginasAdv Fa I CH 1Addi Såïñt GeorgeAinda não há avaliações

- IES OBJ Mechanical Engineering 2007 Paper IIDocumento14 páginasIES OBJ Mechanical Engineering 2007 Paper IIGopal KrishanAinda não há avaliações

- UAE's Management of Global Economic ChallengesDocumento26 páginasUAE's Management of Global Economic ChallengesEssa SmjAinda não há avaliações

- Building The is-LM ModelDocumento46 páginasBuilding The is-LM ModelMicky BozaAinda não há avaliações