Escolar Documentos

Profissional Documentos

Cultura Documentos

Engineering Economics Revision

Enviado por

Danial IzzatDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Engineering Economics Revision

Enviado por

Danial IzzatDireitos autorais:

Formatos disponíveis

COEB442 Engineering Economics

Revision

Sem 1, 2016/2017

Dear students,

Majority of the questions here are taken from previous examinations. Plus

few from textbook and past tests.

Page | 1

All the best ya.

Chapter 2

(Q3.a) Final Examination Semester 1, 2015/2016

(a)

Below is information gathered from the Financial Statements of Akookeye Sdn

Bhd for financial year end July 2015.

ITEM

Building

Cash

Inventories

Revenues from sales

Computer equipment

Salary expenses

Vehicles

Prepaid rental expenses

Account receivables/ Debtors

Revenues from investments (other than sales)

Account payables/ Creditors

Administration expenses

Marketing and selling expenses

Long-term Payables

Cost of goods sold

Accrued insurance expense

RM

1,200,000

86,000

34,000

2,435,000

34,000

795,500

250,000

12,000

52,000

350,000

78,500

187,600

235,000

580,000

1,080,000

21,000

To assess Akookeyes financial performance, the accountant wants few analysis using the

data provided.

Required:

i.

Is the company utilizing its assets efficiently in generating its sales, given that the

industrys average is 3? Support your answer with calculation.

[6 marks]

A: assets turnover= RM1.46 sales per RM1 asset. Not efficient compared to

industry which is 3.

ii.

Prepare the Profit or Loss/Income Statement for Akookeye Sdn Bhd. with company tax

1

COEB442 Engineering Economics

Revision

Sem 1, 2016/2017

rate at 25%.

[8 marks]

A: Income Statement with Gross profit=RM1,355,000, operating profit =RM486,900,

profit after tax of RM365,175

Page | 2

Final Examination Semester 1, 2014/2015

(a)

(b)

Give a short definition for the following terms:

i.

Income Statement

[1 mark]

ii.

Net Cash Flow

iii.

Give ONE example of financing activities in a company.

[1 mark]

[1 mark]

The data below were based on the financial statements of Top Manufacturing

Corporation for year 2013 (in RM thousands).

Items

Inventories

Land, Buildings, Plant and Machinery

Cost of sales

Long term liabilities

Accounts payable and Short Term Borrowings

Distribution, selling and marketing expenses

Interest Expenses

Taxation

Dividends

RM

25,500

57,000

85,000

33,000

45,000

20,000

1,000

1,000

2,000

The acid test ratio and the asset turnover ratio is 0.5 and 1.1 respectively.

Calculate the following:

i.

the total assets

= RM105,000

[5 marks]

ii.

the sales

= RM115,500

[2 marks]

iii.

the operating profits = RM 10,500

[3 marks]

iv.

the retained earnings = RM6,500

[2 marks]

Final Examination Semester 2, 2013/2014

(a)

i.

A corporation net income is derived by subtracting income taxes from the

taxable income during the accounting period. Briefly explain what the corporation will

decide to do with this net income.

[2 marks]

ii.

What is a cash flow statement and why it is important to a company?

COEB442 Engineering Economics

Revision

Sem 1, 2016/2017

[2 marks]

(b)

The data below were based on the financial statements of Megah Manufacturing

Corporation for year 2012 (in RM thousands).

Items

RM

235

350

85

940

1,910

2,480

5,560

1,150

2,370

Inventory

Accounts receivable

Prepaid taxes and insurance

Cash and cash equivalents

Land, Buildings and Machines

Cost of sales

Net Revenue

Working capital

Total equity

Page | 3

Calculate the following:

i.

the current liabilities

= RM460k

[2 marks]

ii.

the long-term liabilities = RM690k

[2 marks]

iii.

the gross margin

[2 marks]

iv.

the quick ratio and interpret your answer

= RM3080k

=RM2.99

[2 marks]

(12 marks, Q1, FE Sem 1 13/14)

(a) i.

The income statement is one of the most common financial statements in a

companys annual report. Describe the following items in the income statement:

ii.

1.

Cost of sales

2.

Earnings per share

Briefly explain the difference between preferred stock and common stockof

a corporation. How do they relate to a corporations retained earnings?

iii.

The data below are taken from the financial statements of Beranang Hardware

Manufacturing Corporation. (in RM1,000s)

Cash

Sales revenue

Accounts receivable

Accounts Payable

Notes Payable

Prepaid taxes and insurance

Income taxes payable

RM

880

30,000

470

940

510

60

700

COEB442 Engineering Economics

Revision

Sem 1, 2016/2017

Selling expenses

Long term debt

Cost of goods sold

Inventory

Land

Plant and Equipment

2,000

2300

20,000

1,400

1,640

2,850

Calculate :

1. the current assets

= 2,810

2. the current liabilities

= 2,150

3. the shareholders equity

= 2,850

4. the working capital

= 660

5.

the debt ratio and interpret your answer

= 60.95%

- High proportion of financing through borrowing from creditors

6.

the acid test ratio and interpret your answer

= 0.656 times

- The company depends heavily on inventories to meet its obligation

Page | 4

COEB442 Engineering Economics

Revision

Sem 1, 2016/2017

Chapter 8

Q.4 (a-c) Final Examination Semester 1, 2015/2016

Rinching Furniture Sdn Bhd operates a factory at the Beranang Industrial Zone that

manufacture ergonomic rattan chair. The data given below are for costs in year 2014 for

producing 3,000 units of the rattan chairs. Currently, each rattan chair is been sold at RM120.

Units Produced

Costs (RM)

Direct labor

90,000

Direct raw materials

60,000

Manufacturing overhead:

Variable portion

------------Fixed portion

54,000

Selling and administrative costs:

Variable portion

24,000

Fixed portion

30,000

(a) Given that the manufacturing cost per unit is RM80, calculate the variable portion

value of the manufacturing overhead costs in year 2014. [Hint: Fill in the missing value

in the table] A=RM36,000

[4 marks]

(b) Using the answer that you have calculated in part (a), compute the following:

i. Total variable costs

A=RM210,000

[2 marks]

ii. Total variable costs per unit A=RM70

[1 mark]

iii. Total costs

A=RM294,000

[2 marks]

(c) Based on the current selling price set by the company, answer the following:

i. What is the companys profit per unit for the sale of 3,000 units of rattan

chairs?

A=RM22

[3 marks]

ii. Calculate the contribution margin per unit of the rattan chair when sales

are at 3,000 units. Interpret the meaning of your answer. A=RM50 [3 marks]

iii. Prove that the profit per unit plus the average fixed costs is

equal to the contribution margin value as calculated in part c(ii). [2 marks]

A= RM50

iv.

Determine the break-even volume and sales.

A=vol 1680, sales RM201,600

[3 marks]

Final Examination Semester 2, 2014/2015

The following are the data for LightSys Software Corporation per month.

Units Sold

Total Variable Costs

40,000 units of pendrives

RM560, 000

Page | 5

COEB442 Engineering Economics

Revision

Sem 1, 2016/2017

Contribution Margin Per unit

Profit

RM6

RM70, 000

(a) What is the price per unit of the pendrive? = RM20

[4 marks]

Page | 6

(b) How much sales value can the company generate?

(c)

=RM800k

[2 marks]

Do you agree that the average fixed cost per unit is RM1.75?

Calculate to answer. = AFC= RM4.25, NO

(d)

[5 marks]

How many units of pendrive must LightSys sell in order to break even?

(round to the nearest whole unit) = 28,334 units

(e)

[4 marks ]

Given the variable production cost per unit increases by RM 2, but no change in fixed

costs, can the company maintain the same level of profit if it sells 50,000 units of

pendrive per month?

Calculate to answer.

=NO, profit declined by RM40k

[5 marks]

Final Examination Semester 1, 2014/2015

Toys N Fun Company sells transformer toys imported from Taiwan. The toys are sold to

customers in Klang Valley area. Salespersons are paid basic salary plus commission on sales

made by them. Details data concerning sales and expenses made by the company is shown

below.

Selling price per toy

RM

75

Invoice cost (variable manufacturing cost)

RM

33

Sales Commission

RM

12

Total

RM

45

Variable expenses per toy:

Annual fixed expenses:

Rent

RM120,000

Marketing

RM300,000

Salaries

RM180,000

Total

RM600,000

Required:

(a) Calculate the contribution margin per unit. Explain the meaning of your answer

COEB442 Engineering Economics

Revision

Sem 1, 2016/2017

= RM30

[4 marks]

(b) Compute breakeven number in units.

[2 marks]

=20,000 units

Page | 7

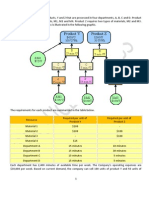

(c) Based on your answer in (b), draw a cost-volume-profit graph (break-even chart).

Show the break-even point; profit and loss area; fixed cost, variable cost; and

revenues.

The graph below is a cost-volume-profit graph.

Revenue line

RM

Profit

Break-even point

Variable cost

Loss

Fixed cost

Volume

20,000 units

[4 marks]

(d) If the company target to achieve RM150,000 profit this year, how many toys should

the company sells?

[3 marks]

= 25,000 units

(e) The company is thinking to pay RM7 commission to manager on each toy sold in

excess of break-even point. What will be the effect of these changes on the net

operating income or loss for the company if 23,500 toys were sold in year.

[5 marks]

Net income= RM80,500

(f) Refer to the original data. The Sales Manager is recommending for sales

commission is eliminated entirely and salaries are increased by RM214,000?

i.

Calculate the new contribution margin per unit.

= RM42

[1

COEB442 Engineering Economics

Revision

Sem 1, 2016/2017

mark]

ii.

Calculate the new total fixed costs.

= RM814,000

[1

mark]

iii.

What will be the new breakeven point (in units)? = 19,381 units

[2

marks]

iv.

Should the company accepts this recommendation? Compare with

your answer in (b)

With the new system, the company will starts making profit after selling 19,381 units

compare to the old system 20,000 units . Should implement the suggestion given by

[3 marks]

the manager

Final Examination Semester 2, 2013/2014

IT Excel Sdn. Bhd., a manufacturing company that produces a computer component leases a

building for RM250,000 per year for its manufacturing facilities. In addition, the machinery in

this building is being paid for in installments of RM50,000 per year. Each unit of the product

produced costs RM40 in labor and RM20 in materials. The variable costs are estimated at 60

percent of total revenue.

(a)

Determine the price per unit of the product. = RM100

[2 marks]

(b)

Calculate the quantity at which the manufacturer will cover the fixed costs.

= 3,000 units

(c)

i.

[2 marks]

How many units per year must be sold for the company to breakeven?

= 7,500 units

ii.

[2 marks]

Show that at breakeven point contribution margin is equal to average fixed

costs.

= CM=RM40; AFC at BE = RM40; therefore MC=AFC=RM40

iii.

[2 marks]

Can an increase in the overtime rate paid to staff lower down the breakeven

point? Briefly explain.

[2 marks]

= No, it would increase fixed costs, more should be produced and sold to breakeven.

Page | 8

COEB442 Engineering Economics

Revision

Sem 1, 2016/2017

(d)

i.

Assuming demand is high and there is an increase in production and

sales by 16,500 units above the breakeven quantity. Calculate the annual profit

per unit. = RM27.50

ii.

[4 marks]

To increase profit further, the sales manager is recommending a 10% reduction

in selling price which he believes will produce a 25% increase in the number

sold each year.

(1) What is the change in average fixed costs? = decrease by RM2.50 [2 marks]

(2) Calculate the percentage change in labor costs. = 25%

[2 marks]

(3) Should this suggestion be implemented? Calculate to explain.

= Decision: Should not reduce price, because profit will decline by RM60,000.

[7 marks]

[Q1, FE Sem 1 12/13]

Eponvessemson Sdn Bhd. sells toys handphones. Below is information for the first 6-month sales in

2012.

Fixed Expenses

Variable Expenses

Sales revenue

Rent

RM26,000

Salaries

RM90,000

Depreciation

Cost of Goods manufactured

RM12,000

and sold

RM252,000

Sales Commissions

Units sold 50,000

RM21,000

RM420,000

i.

What is the company's contribution margin per unit?

ii.

What is the break-even point in RM?

[5 marks]

[5 marks]

CM = RM2.94

BEQ = 43, 537 units

in RM x RM8.40 = RM365,710.8

iii.

If the company wants to earn a profit of RM80,000 instead of breaking even, what

would be the new selling price be is the units sold is still 50,000 units? SP = RM9.62

[5 marks]

Page | 9

COEB442 Engineering Economics

Revision

Sem 1, 2016/2017

Chapter 3

QUESTION 1 [25 marks] Final Examination Semester 1, 2015/2016

The Q is a combination of Ch 3 & Ch 5

(a)

(b)

Upin and Ipin are twins. Upin is planning for his retirement 19 years from now. He plans

to invest RM5,800 per year for the first 8 years and RM8,300 per year for the following

11 years (assume all cash flows occur at the end of each year). If both Upin and Ipin can

invest in saving account with 9% interest rate, how much Ipin has to deposit each year in

equal amount into his account so that after 19 years, the total amount in his account is the

same as his brother Upin? (Note: all cash flows occur at the end of the year).

A:RM6,752.34

[7 marks]

Ali just purchased a brand new machine worth RM40,000. He estimates that the

maintenance cost for the machine during the first year will be RM2,800. The

maintenance cost is expected to increase by RM800 per year throughout its seven years

useful life. Ali wants to set up an account and all future maintenance expenses will be

paid out of this account. Assuming the maintenance cost occur at the end of year, how

much does Ali has to deposit in the account now at 10% interest rate?

[4 marks]

A: RM23,842

(c)

The management of Titans Electronics Company is considering to purchase an

equipment to be attached with the main machine use to manufacture a product. The

company has two options, A and B. Information on both equipment is given below.

Initial outlay (RM)

Annual Cash flow (RM)

Salvage value at end year 4 (RM)

Option A

6,000

Year 1 - 2,300

Year 2 - 2,300

Year 3 - 2,300

Year 4 - 2,300

0

Option B

8,000

Year 1 - 1,700

Year 2 - 1,900

Year 3 - 2,500

Year 4 - 2,900

1,500

The management of Titans Electronics Company wants a 12% return on all investments.

Using Present Worth method, which equipment should the company purchase?

(Note: Except for initial outlay, all cash flows occur at the end of the year).

A: Option A PW= +985.79; Option B PW= -391.70. thus Choose Option A [14 marks]

10

Page | 10

COEB442 Engineering Economics

Revision

Sem 1, 2016/2017

Final Examination Semester 2, 2014/2015

(a)

Hoojane wants to invest portions of her yearly bonuses in Amanah Saham Wawasan

2020 (ASW 2020) that has an annual return of 4%. Her investment plan is to invest

RM4,500 now, RM6,000 two years from now, and RM8,000 four years from now.

Page | 11

What will be the total amount in her ASW2020 account after 8 years?

[5 marks]

ANSWER:

(b)

= 23,109.7

Amintoo has been working for Ti-En-Bi for 5 years. On Ti-En-Bi Annual Dinner Night,

Amintoo won cash prize of RM20,000. Amintoo, such a good man he is, wants to

expedite his payment back to PTPTN using the cash he won.

He plans to put the whole RM20,000 now in an investment scheme with 8% return that

allow him to withdraw equal amount annually for 5 years, starting from first year.

How much is Amintoos annual payment to PTPTN?

[5 marks]

ANSWER:= 5,010 per year

Final Examination Semester 1, 2014/2015

(a) i.

Compare the interest earned from an investment of RM1,000 for 15 years at

8% per annum of simple interest, with the amount of interest that could be earned if

these funds were invested for 15 years at 8% per year, compounded annually.

Explain why the interest amounts that you have calculated are not the same.

[5 marks]

(a) i.

Simple Interest:

= $1,200

ii.

Compound Interest:

= $2172.17

Miss Anita, a talented singer won the recent Akademi Fantasia singing competition

and was awarded the first cash prize of RM500,000. She decided to save the amount

in a fixed deposit account that give returns of 10% interest compounded yearly. How

long would it take for Anita to have one million (RM1,000,000) from her savings?

[3marks]

N =7.27 years

(b)

Mr James, Mr Messi and Mr Neymar are three good friends whom are about to retire

soon. Answer the following questions based on different scenarios of retirement planning

given for each person. Assume that the savings account for all of them earn 6% annual

interest.

11

COEB442 Engineering Economics

Revision

Sem 1, 2016/2017

i.

Suppose Mr James has accumulated RM400,000 in his savings account upon his

retirement. He wishes to withdraw a fixed sum of money at the end of each year for

15 years. What is the maximum amount that can be withdrawn for each year?

[2 marks]

ii.

Page | 12

Mr Messi expects to withdraw RM76,500 from his savings account at the end of each

retirement year to maintain his normal lifestyle. How much money must Mr Messi

have in the bank at the start of his retirement considering that he is planning a 12year retirement period?

iii.

[2 marks]

Mr Neymar though is planning a 16-year retirement. In order to supplement his

pension and offset the expected effects of inflation, he intends to withdraw RM85,300

at the end of the first year, and to increase the withdrawals by RM10,000 at the end of

each successive year. How much money must Mr Neymar have in his savings account

at the start of his retirement?

iv.

[4 marks]

Assuming that Mr Neymar has decided to extend his retirement to another four

more years. Due to this longer retirement period, he intends to withdraw at a lower

amount of RM74,800 at the end of the first year, and decrease it by RM 5,000 at the

end of each successive year. Calculate the amount of savings that he must now have

at the start of his retirement.

(b)

[4 marks]

i. A = $41,200

ii. P = $641,360.70

iii. P = $1,496,625.27

v.

P = $421,796.52

Final Examination Semester 2, 2013/2014

(a)

Aime was born on 31 December 2012. In order to meet her future tertiary educational

expenses, her father intends to invest in an Educational Saving Plan by depositing an

annual equal sum of RM3, 600 at the end of each year starting on her 1 st birthday on 31

December 2013. Given that the saving plan yields a return of 9% per annum, what will

be the total value of the saving plan when Aime celebrates her 18th birthday?

[3 marks]

12

COEB442 Engineering Economics

Revision

Sem 1, 2016/2017

(b)

Suppose there is another new Saving Plan offer by XYZ bank that allows Aimes father

to make the following annual withdrawal.

Date of withdrawal

On 18th Birthday

On 19th Birthday

On 20th Birthday

Amount of Withdrawal (RM)

45,000

50,000

55,000

Require: Calculate the annual saving amount that the father is required to deposit into

the Saving Plan.

[9 Marks]

(a) A=RM3,600,

N=18, i=9%

F =

RM148,685

(b) A =

1089

A =

1085

A =

1072

Total required equal annual contribution is 1089 +1085 + 1072 = RM3, 246

From textbook

3.20

If $3,000 is invested now, $3,500 two years from now, and $4,000 four years from

now at an interest rate of 6% compounded annually, what will be the total amount

in 8 years?

3.24

$14,796.27

You are paying into a mutual fund that earns 6% compound interest. If you are

making an annual contribution of $12,000, how much will be in the funds in 20

years?

3.33

$441,427.09

You have borrowed $50,000 at an interest rate of 12%. Equal payments will be made

over a three-year period. (The first payment will be made at the end of the first

year.) What will the annual payment be, and what will the interest payment be for

the second year?

13

Page | 13

COEB442 Engineering Economics

Revision

Sem 1, 2016/2017

Page | 14

3.36

You are considering buying a piece of industrial equipment to automate a part of

your production process. This automation will save labor costs by as much as

$40,000 per year over 10 years. The equipment costs $250,000. Should you purchase

the equipment if your interest rate is 10%?

Labour cost savings 40,000(P/A,10%,10y) = RM245,782.68

i.e < cost $250,000. Thus DONT BUY the machinery

14

COEB442 Engineering Economics

Revision

Sem 1, 2016/2017

Chapter 4

(Q4.d) Final Examination Semester 1, 2015/2016

Page | 15

(d) Rinching Furniture Sdn Bhd deposited 50% of its profit amount from part (c), at

an interest rate of 8% compounded monthly in the companys savings account.

i.

What will be the additional amount in the savings account after one year?

A= extra RM913

[2 marks]

ii.

Do you agree that the Annual Percentage Yield (APY) is less than 8%?

Calculate the value of APY to support your answer.

[3 marks]

A= NO. APY=8.299% > 8%

Final Examination Semester 2, 2014/2015

(a)

ONEJIMAT Sdn Bhd, a credit card company based in Kajang has offered you a card that

charges interest at 1.15% per month, compounded monthly.

i.

Determine the annual percentage rate (APR) and the annual percentage yield

(APY) that ONEJIMAT Sdn Bhd charges on its credit card. Explain why the APR

and the APY amounts that you have calculated are not the same.

= APR= 13.8%

= APY=14.71%

[4

marks]

ii.

If your current outstanding credit card balance is RM3,000 and you skip

payments for the next three months, what would be the total outstanding

balance three months from now?

= RM3,104.69

(b)

[2 marks]

Miss Aida, a recent university graduate was offered a job and wanted to purchase a new

car to facilitate her travel to work. The price of the car is RM58,000 and she is required to

make a 10% down payment. Miss Aida will borrow the remainder from Maybank

Finance at an interest rate of 3% compounded monthly. The period of the loan is six

years.

i.

What is the amount of monthly loan payment that Miss Aida need to pay to

Maybank Finance?

=RM793.44

[5

marks]

15

COEB442 Engineering Economics

Revision

Sem 1, 2016/2017

ii. Miss Aida has made 36 payments and wants to know the balance remaining

immediately after the 36th payment. What is that balance?

= RM27,283.62

[2 marks]

Page | 16

Final Examination Semester 1, 2014/2015

i.

Mr Johari wanted to purchase a RM800,000 semi-detached house by making a 12.5%

down payment to the developer. He borrowed the remaining amount from Maybank

Finance, which he will repay on a monthly basis over the next 10 years. If the bank

charges an interest rate of 9% per year compounded monthly, how much monthly

installment must Mr Johari pay to Maybank Finance?

= RM8890

[5 marks]

Final Examination Semester 2, 2013/2014

Upon graduation, Mr. Rajin and Ms. Lawa decide to venture into business by setting up a small

bakery store. Both are considering the following three ways of financing the oven.

Option A (Debt financing):

Purchase the new Oven at the normal price of RM12, 500

and pay for it over 36 months with equal payment at 6% APR financing. A

down payment of RM1, 875 is required. There is a resale value of RM6, 875 at

the end of 36 months.

Option B (Cash purchase):

Purchase the new Oven at a discount price of RM10, 000 to

be paid immediately. Again, it has a resale value of RM 6,875 at the end of 36

months.

Option C (Leasing):

Lease the new Oven for 36 months with an equal monthly leasing

sum of RM226. Down payment of RM1, 250 is required. At the end of the

lease, the Oven simply returns to the leaser.

Required:

Given that the funds that used in the leasing and purchasing are presently earning 6%

annual interest compounded monthly. Find the most economical financing option for

the new Oven.

[13 Marks]

Effective loan interest payment is 6% /12

16

COEB442 Engineering Economics

Revision

Sem 1, 2016/2017

Monthly loan payment is

P Option A=

6,747

P Option B=

4,255

P Option C=

8,678.85

323

Page | 17

Option B is the most economical since it has the lowest (RM4, 255) equivalent present value.

1. [Q2, FE Sem 1 12/13]

a) A design-build-operate engineering company borrowed RM3 million for 3 years so that

it could purchase new equipment. The terms of the loan included compound interest

and repayment of the total amount owed in a single lump-sum payment at the end of

the 3-year period. Interest at the end of the first year amounted to RM450,000.

(i) What was the interest rate on the loan? [2 marks]

= 15% per year

(ii) How much interest was charged for year 2? [3 marks]

= RM517,500

Federal facilities associated with an international port of entry at Southern Region are expected

to cost RM60 million. A six-lane, 1274 foot long bridge is expected to cost RM24 million. Land

and inspection facilities, offices, and parking will add another RM15million to the cost.

Construction is expected to take three years. Assuming that all of the funds are allocated at

time 0, what is the future worth of the project in year 3 at an interest rate of 6% per year

compounded quarterly?

[5 marks]

17

= RM118,364,400

COEB442 Engineering Economics

Revision

Sem 1, 2016/2017

Chapter 5

MODIFIED Final Examination Semester 2, 2014/2015

Ujeependu Kaboom Sdn Bhd. has just finished a 4-year R&D and pilot testing for stressrelieving bag pack targeted for university students. The bag pack is expected to have a 6 year

product life. The R&D expenditures for the past 3 years and the current year, together with the

anticipated net cash flows that the company can generate over the next 6 years are summarized

in the table below.

Period (n)

-3

-2

-1

0

1

2

3-5

6

Cash Flow (Unit: RM

million)

-0.5

-2

-1.6

-1

0.8

2.4

4 each year

3.5

Begje Ade Sdn Bhd, a large bag retailer company is interested in purchasing the stress-relieving

bag pack project and the right to commercialise the product from Ujeependu Kaboom Sdn Bhd;

planning to purchase it now (n=0). Begje Ade Sdn Bhd has offered a purchase price of RM16.5

million.

Assume Ujeependu Kaboom Sdn Bhds MARR= 15%.

i.

What is the total amount of R&D costs at Y0?

= RM6.245 million

ii.

[4 marks]

Calculate the present value of the net cash flow streams at Y0.

= RM4.684 million

iii.

[8 marks]

Should Ujeependu Kaboom Sdn Bhd accept the offer and sell the project to Begje

Ade Sdn Bhd?

= YES. Offer price > net inflow

[3 marks]

Final Examination Semester 1, 2014/2015

Highland Sediment Brick Sdn Bhd is considering purchasing a new injection-molding machine

for RM100, 000. It will cost an additional RM20, 000 to do the site installation. The machine will

be used for six years with zero salvage value at the end of sixth year. The company is expected

18

Page | 18

COEB442 Engineering Economics

Revision

Sem 1, 2016/2017

to receive annual returns as given below.

Year

1

2

3

4

5

6

Cash Flow (RM)

18,500

25,500

27,980

32,660

40,230

48,500

Page | 19

(a) How long does it take to recover the total investment cost? (Hints: use conventional

[6 marks]

payback method)

=It takes 4.38 year to recover the total investment cost (using conventional payback

method)

(b) What is the discounted payback period at an interest rate of 12%? [10 marks]

=Rm34,637 will be fully paid around 0.71 year into year sixth. As such, the discounted payback

period is 5.17 years

(c) Would the investment of this injection molding machine be justified given that the

interest rate is at 15%

[9 marks]

NPW= -6,591.11

Since NPW is negative, it is not justifiable for the company to proceed with the purchase.

19

COEB442 Engineering Economics

Revision

Sem 1, 2016/2017

From textbook

Camptown Togs. Inc., a children's clothing manufacturer, has always found

payroll processing to be costly because it must be done by a clerk. The number of

piece-goods coupons received by each employee are collected and the types of

tasks per formed by each employee are calculated. Not long ago, an industrial

engineer designed a system that partially automates the process by means of a

scanner that reads the piece-goods coupons. Management is enthusiastic about

this system, because it utilizes some personal computer systems that were

purchased recently. It is expected that this new automated system will save

$45,000 per year in labor.

The new system will cost about $30,000 to build and test prior to operation. It is

expected that operating costs, including income taxes, will be about $5,000 per

year. The system will have a five-year useful life. The expected net salvage value

of the system is estimated to be $3,000.

5.2

5.6

(a) Identify the cash inflows over the life of the project.

(b) Identify the cash outflows over the life of the project.

(c) Determine the net cash flows over the life of the project.

A project cost $120,000 and the expected annual returns are given in table below:

Year

Cash flows

1

$18,500

2

25,500

3

27,980

4

32,660

5

40,230

(a) What is the payback period of the project?

20

Page | 20

COEB442 Engineering Economics

Revision

Sem 1, 2016/2017

(b) What is the discounted payback period at an interest rate of 15%

Larson Manufacturing is considering purchasing a new injection-molding

machine for $300,000 to expand its production capacity. It will cost an additional

$25,000 to do the site preparation. With the new injection-molding machine

5.8

installed, Larson Manufacturing expects to increase its revenue by 5.000. The

machine will be used for five years with an expected salvage value of $80,000. At

an interest rate of 12%, would the purchase of the injection-molding machine be

justified?

PW of 62,847.89 > 0 , the investment is justified

A large food-processing corporation is considering using laser technology to

speed up and eliminate waste in the potato-peeling process. To implement the

system, the company anticipates needing $3.5 million to purchase the industrialstrength lasers. The system will save $1,550,000 per year in labor and materials.

However, it will require an additional operating and maintenance cost of

5.14

$360,000. Annual income taxes will also increase by $160,000. The system is

expected to have a 10-year service life and will have a salvage value of about

$200,000. If the company's MARR is 16%, use the NPW method to justify the

project.

PW(16%) = $3,500,000 +[$1,550,000- $360,000- $160, 000](P /A ,16%,10)

+$200,000(P /F ,16%,10) = $1, 482,730

Since PW is positive, the project is justified

You are considering two investment options.

In option A, you have to invest $5,000 now and $1,000 three years from now, In

option B, you have to invest $3,500 now, $1,500 a year from now, and $1,000

three years from now. In both options, you will receive four annual payments of

5.38

$2,000 each. (You will get the first payment a year from now.) Which of these

options would you choose based on (a) the conventional payback criterion, and

(b) the present worth criterion, assuming 10% interest?

Both give same payback period of 3 years. Thus, cannot select.

Consider two mutually exclusive investment projects, each with MARR = 12%, as

21

Page | 21

COEB442 Engineering Economics

Revision

Sem 1, 2016/2017

shown in the table:

Projects Cash Flow

n

0

1

2

3

5.41

A

-17,500

13,610

14,930

14,300

B

-15,900

13,210

13,720

13,500

(a) On the basis of PW criterion, which alternative would be selected?

(b) On the basis on FW criterion, which alternative would be selected?

a)

PW A = $16,732.35

PW B = $16, 441.18

Select A

b)

FW A= $23,507.74

FW B= $23,098.67

Select A

You are considering two types of machines for a manufacturing process.

Machine A has a first cost of $76,200, and its salvage value at the end of six

years of estimated service life is $21,500. The operating costs of this machine are

estimated to be $7,000 per year. Extra income taxes are estimated at $2,600 per

year.

Machine B has a first cost of $45,000, and its salvage value at the end of six

5.45

years' service is estimated to be negligible. The annual operating costs will be

$11,600.

Compare these two mutually exclusive alternatives by the present-worth method

at i =13%

machine A

(104,249.63

)

machine B

(91,371.58)

Thus, machine B is a better choice

22

Page | 22

COEB442 Engineering Economics

Revision

Sem 1, 2016/2017

Page | 23

23

COEB442 Engineering Economics

Revision

Sem 1, 2016/2017

Chapter 6

(Q2.a & b) Final Examination Semester 1, 2015/2016

The Q is a combination of Ch6 & Ch4

(a)

Page | 24

Ahmad Zaki Enterprise is a taxi service provider. The company is

considering to purchase a new Perodua Alza 1.5 Premium that costs

RM60, 000. The car is assumed to have a five-year useful life. At the

end of five years, it can be sold for RM20, 000. The monthly operating

and maintenance costs are RM650. It is calculated that the company

is able to earn after- tax revenue of RM19, 000 per year with this new

car.

i.

Using capital recovery cost analysis, compute the equivalent

annual cost (AEC) for this new car if the company obtains the

financing for the whole total amount at an interest rate of 4%.

[7 marks]

A: AEC car = RM17,584

ii.

Determine whether it is a wise investment based on AE criterion? [3

marks]

A: AE = AES-AEC AE=1,416 positive. Yes a wise investment

(b)

The managing director of Ahmad Zaki Enterprise, however, decided to choose

Proton Exora 1.6 Premium that costs RM80, 000. The company makes a down

payment in the amount of RM8, 000. It would then borrow the remainder from

CIMB bank at an interest rate of 3% compounded monthly. The company also

agrees to pay off the loan monthly for a period of five years.

i.

ii.

What is the amount of its monthly installment payment?

A= RM1,296

[5 marks]

The company has successfully made 20 payments and wish to figure out

the balance remaining immediately after 20th payment. What is that

balance?

A: RM49,273.79

[5 marks]

24

COEB442 Engineering Economics

Revision

Sem 1, 2016/2017

iii.

Determine the total amount of interest paid over the 20-months period.

A: RM3,193.79

[5 marks]

Page | 25

Final Examination Semester 2, 2014/2015

Syarikat EasyRide Sdn Bhd is considering purchasing a minivan to transport children to a

primary school in Semenyih. The minivan initially cost RM70,000 and the company spend

another RM5,000 to paint it and also refurbish the vans interior. The salvage value of

the

minivan is RM25,000 after eight years of service life at an interest rate of 6%. It is also estimated

that the net cash flows from the transport service will be RM20,000 for the first year and

increases by RM2,500 per year for the next year and each year thereafter.

i.

What is the annual capital cost of owning and operating the minivan?

= CR = RM9,550

ii.

[5 marks]

Determine the annual equivalent cost if the operating and maintenance cost of

the minivan is RM14,400 annually.

= AEC= RM23,950

[2 marks]

iii.

What is the annual equivalent savings (revenues) from operating the minivan?

= AES= RM27,988

[ 3 marks]

iv.

From your above analysis, explain whether this is a good investment for the

company.

= (AES-AEC) =AEW = RM4038. YES. AEW is positive

[2 marks]

A 300 units condominium building project by Tegap Construction Sdn Bhd. requires an

investment of RM12 million. The expected maintenance cost for the building is RM300,000 in

year 1, RM350,000 in year 2, and will increase by RM50,000 per year from year 3 to year 4. The

cost to hire a manager for the building is RM5,000 per month. After 4 years of operation the

building can be sold for RM8 million.

b) If the building remains fully occupied during the four years, calculate the annual

rent per unit that will provide a return on investment of 12%.

[17 marks]

= find PW AW divide by 300 units = RM9,015.49

c) Assume Tegap Construction Sdn Bhd. decided to sell the units for RM500,000 each.

Mr Danial is interested to buy one unit and make a RM100,000 down payment. He

25

COEB442 Engineering Economics

Revision

Sem 1, 2016/2017

obtained a 30-year loan for the remaining amount. Payments will be made monthly

at an amount of RM3,220. The nominal interest rate is 9%. If he planned to pay the

remaining balance on the loan after 20 years (240 payments), how much should he

pay the bank?

[8 marks]

= RM254,192.25

Page | 26

(Q3, FE Sem 2 12/13)

From textbook

Consider the accompanying cash flow diagram. Compute the equivalent annual

worth at i = 12%

6.5

What is the annual equivalent cost of purchasing a lift truck that has an initial cost of

$70,000, an annual operating cost of $14,000, and an estimated salvage value of

$25,000 after six years of use at an annual interest rate of 6%?

6.14

AEC(6%)

= R-E-CR

=0 14,000 CR

= - 25,670

6.16

CR

= (70,000 -25,000)(A/P,6%,6) + (0.06)(25,000)

The Emerson Electronics Company just purchased a soldering machine to be used in

its assembly cell for flexible disk drives. The soldering machine cost $350,000. Because

of the specialized function it performs, its useful life is estimated to be five years.

26

COEB442 Engineering Economics

Revision

Sem 1, 2016/2017

It is also estimated that at that time its salvage value will be $60,000. What is the

capital recovery cost for this investment if the firm's interest rate is 15%?

Page | 27

27

COEB442 Engineering Economics

Revision

Sem 1, 2016/2017

Chapter 7

Q5 [25 marks] Final Examination Semester 1, 2015/2016

Page | 28

(this question is a combination of Ch7 + Ch 6 & Ch14)

(a)

Your team are involved with an equipment selection task in your company to replace an

aging asset that the company owns. Vital statistics for the new equipment with three

different models are as in the table below. The minimum attractive rate of return being

used by your company for economic decision is 10% per year. Which model would your

team recommend using the Internal Rate of Return method?

[12 marks]

(Use 10% and 40% in your calculation using trial and error method)

Purchase Price

Net Cash Flow

Salvage Value

Useful life, years

Individual IRR

Model A

RM8,500

RM2,500

RM500

5

15.39%

Model B

RM9,500

RM2,300

RM400

5

7.83%

Model C

RM10,000

RM3,200

RM400

5

18.79%

A: Interpolated IRR(model C- model A) = 37.63%

(Note that Model B is not considered as its IRR < MARR of 10%)

(b)

To justify the purchase of the acceptable model (challenger) in part (a), your team has

agreed to conduct a replacement analysis. Pertinent data of the aging asset (defender)

are as follows:

Purchase Price(5 years ago)

Current Market Value

Upgrade Cost

Net Cash Flow

Salvage Value

Useful life, years

Defender

RM13,000

RM4,000

RM1,600

RM1,800

RM500

5

Is the purchase of the new model to improve efficiency still remain economically

attractive? (Use annual equivalent method)

[13 marks]

A= AE defender: 404.62; AE challenger: 627.52 replace the defender

Final Examination Semester 2, 2014/2015

(this question is a combination of Ch6 & Ch7 & Ch14)

Mr. Tim, a construction contractor is considering to replace his old machine with a new

machine. The old machine has another 5 years useful life. The cash flow details for the old and

new machines are as follows:

28

COEB442 Engineering Economics

Revision

Sem 1, 2016/2017

Old Machine Purchased 3 years ago at RM 1,500,000. At present the annual operating cost is

RM 440,000 per year at end of first year and increasing by 10% per year in the subsequent years

till the end of year 5. Expected annual income is RM 980,000 per annum and decreasing by 15%

each year. After five years, the market value of the machine 5 is expected to be

RM 500,000. If Page | 29

Mr. Tim decided to replace the old machine with a new machine now, the old machine can be

sold immediately in the market for RM 800,000.

New Machine The cost price is RM 2,000,000. The annual operating cost RM 580,000 at end of

first year and increasing by RM 30,000 in the subsequent years till the end of its 5 years useful

life. Expected annual income RM 1,650,000 per annum. At the end of its useful life, the machine

is expected to be sold for RM 450,000.

Mr. Tim uses 12% MARR to evaluate his investment.

Required:

(a)

Based on the MARR given, calculate the annual equivalent worth (AEW) of each

option. Should Mr. Tim replace the old machine?

= AEW OLD = RM84,372

AEW NEW = RM532,763

(b)

[18 marks]

Calculate the IRR of the project you suggested. (Hint: you can try 40% and 50%

interest rate in your calculations).

= IRR chosen (NEW) = RM 43.14%

[7 marks]

Final Examination Semester 2, 2013/2014

FastBits Electronic Company Sdn. Bhd. is evaluating new precision inspection devices to help

verify package quality. The manager has obtained the following bids from four companies. All

devices have a life of five years and a minimum attractive rate of return of 6%. The alternatives

are mutually exclusive.

Initial Cost (RM)

Annual Costs (RM)

Net Cash Flows (RM)

IRR

(a)

Company A

Company B

Company C

Company D

400,000

100,000

500,000

200,000

900

12,000

23,000

9,000

100,900

27,700

125,200

46,200

8.3%

12%

8%

5%

Determine the annual benefits of the devices from all four companies. Device from

29

COEB442 Engineering Economics

Revision

Sem 1, 2016/2017

which company has the highest annual benefit?

(b)

FastBits should reject the bid from which company based on the given individual IRR?

Why?

(c)

[5 marks]

[2 marks]

Using incremental internal rate of return analysis, from which company, if any, should

the manager purchase the new precision inspection device? Use trial and error method

with 6% and 10% interest rates.

[14 marks]

30

Page | 30

COEB442 Engineering Economics

Revision

Sem 1, 2016/2017

(d)

Show that the same company selection would be made with proper application of the

Present Worth (PW) method.

(a)

(a)

RM101,800

(b)

RM39,700

(c)

RM148,200

(d)

RM55,200

[4 marks]

Page | 31

Company C (10= 5 marks)

(b)

Project D; IRR<MARR (4=2 marks)

(c)

A-B Increment:

= 7.02%

Since IRR on increment > MARR, select company A.

C-A Increment:

= 6.82%

Since IRR on increment > MARR, select company C.

The manager should purchase from company C.

(d)

NPW A = RM25,031

NPW B = RM16,683

NPW C = RM27,392

Device from company C has highest NPW, therefore buy from company C.

From textbook

Suppose that you invest $1,500 in stock, which is called your financial asset.

One year later, your investment yields $1,745. What is the rate of return of your

investment?

7.1

1,745 = 1500 (1+i)1

i = 16.33%

7.2

You are going to buy a new car worth $24,500. The dealer computes your

monthly payment to be $514.55 for 60 months of financing. What is the dealer's

effective rate of return on this loan transaction?

=9.93% per year

7.29

Consider an investment project with the cash flows given in the table:

31

COEB442 Engineering Economics

Revision

Sem 1, 2016/2017

n

Cash flow

0

-15,000

1

0

2

14,520

3

3,993

Compute the IRR for this investment. Is the project acceptable at MARR =

10%?

7.30

Consider the cash flows of a certain project given in the table:

n

Cash flow

0

-3,000

1

800

2

900

3

X

If the projects IRR is 10%,

(a) Find the value of X.

(b) Is this project acceptable at MARR = 8%?

Answer:

7.37

Consider two investments A & B with the sequences of cash lfows given in the

table:

Projects Cash Flow

n

0

1

2

3

A

-$125,000

30,000

30,000

120,000

B

-$110,000

20,000

20,000

130,000

(a) Compute the IRR of each investment.

(b) At MARR = 15%, determine the acceptability of each project

(c) If A and B are mutually exclusive projects, which project would you

select based on the IRR incremental investment?

Answers:

32

Page | 32

COEB442 Engineering Economics

Revision

Sem 1, 2016/2017

Page | 33

Consider the two mutually exclusive investment alternatives given in table

below:

Projects Cash Flow

n

0

1

2

3

IRR

7.41

A

-$15,000

7,500

7,500

7,500

23.5%

B

-$20,000

8,000

15,000

5,000

20%

(a) Determine the incremental investments IRR.

(b) If the firms MARR is 10%, which alternative is the better choice?

Answers:

(a) IRR (A2-A1) = 7.36%, which is smaller than MARR, so we select

A1.

7.51

The following information on four mutually exclusive projects is given here.

All four projects have the same service life and require investment in year 0

only one. Suppose that you are provided with the following additional

information about between projects.

IRR (B - A) = 85%

IRR (B - C) = 30%

IRR (D - C) = 25%

IRR (A D) = 50%

33

COEB442 Engineering Economics

Revision

Sem 1, 2016/2017

Which project would you choose based on the rate of return criterion at a

MARR of 29%?

Answer:

Project B

Page | 34

34

COEB442 Engineering Economics

Revision

Sem 1, 2016/2017

Chapter 14

Final Examination Semester 2, 2014/2015

Refer to question above (Mr Tim)

Page | 35

Bombastic Manufacturing Company is considering replacing a stamping machine that has

been used in its factory. The new machine will cost RM45,000 delivered and installed, with

an estimated economic life of 8 years and a salvage value of RM3,000 at the end of its life.

The new machine is expected to perform with so much efficiency and Mr. Tan, the

Production Engineer estimates that over its 8-year life, labor, material and other direct costs

can be reduced from RM15,000 to RM12,000 annually.

The old machine that is still in used was purchased 5 years ago at RM30,000. At the time of

purchased, its economic life was estimated to be eight years with a salvage value of zero. If

the company decides not to purchase the new machine, it will then retain its old machine

and the estimated market value, book value and operating costs for the old machine for the

next three years is shown in the table below.

Market Value (RM)

10,600

7,400

4,100

1,500

Book Value (RM)

12,400

7,850

4,660

1,880

3,540

4,130

4,810

5,680

Year-end

Operating Costs

(RM)

If the MARR is 10% before taxes,

35

COEB442 Engineering Economics

Revision

Sem 1, 2016/2017

a) Determine the remaining useful life of the old machine (Hint: Refer to the

estimated figures of market values and operating costs given in the table).

Page | 36

b) Determine whether it is economical to make the replacement now.

Answers

a) Determine the remaining useful life of the old machine (Hint: Refer to the estimated

figures of market values and operating costs given in the table).

Year-end

0

1

2

3

4

AE (10%)

-7,799.96

-7,976.34

-7,928.63

-7,800.56

The old machines MOST ECONOMICAL useful economic life is 1 more year with an

AEC value of RM7,799.96.

b)

Determine whether it is economical to make the replacement now.

AEC c =RM- 5,171

Since AECc < AECD , the defender should be replaced now

For this q, you could do similar exercise from Ch 14 14.8 on page 794

From textbook

14.2. The Columbus Electronics Company is considering replacing a 1,000-pound-capacity

forklift truck that was purchased three years ago at a cost of $15,000. The diesel-operated

forklift was originally expected to have a useful life of eight years and a zero estimated

salvage value at the end of that period. The truck has not been dependable and is

frequently out of service while awaiting repairs. The maintenance expenses of the truck

have been rising steadily and currently amount to about $3,000 per year. The truck could

be sold for $6,000. If retained, the truck will require an immediate $1,500 overhaul to keep

it in operating condition. This overhaul will neither extend the originally estimated service

life nor increase the value of the truck. The updated annual operating costs, engine

36

COEB442 Engineering Economics

Revision

Sem 1, 2016/2017

overhaul cost, and market values over the next five years are estimated as given in the

table.

n

-3

-2

-1

0

1

2

3

4

5

O&M

-

Depreciation

$3,000

4,800

2,880

1,728

1,728

864

0

0

Engine

overhaul

1,500

5,000

Market value

6,000

4,000

3,000

1,500

1,000

0

A drastic increase in operating costs during the fifth year is expected due to another

overhaul, which will again be required to keep the truck in operating condition. The firm's

MARR is 15%

(a) If the truck is to be sold now, what will be its sunk cost?

(b) What is the opportunity cost of not replacing the truck now?

(c) What is the equivalent annual cost of owning and operating the truck for five years?

Answer:

(a) Purchase cost = $15,000, market value $6,000

sunk cost = $15,000 - $6,000 = $9,000

(b) Opportunity cost = $6,000

(c) PW (15%)= -$7,500-$3,000 P/F, 15%, 1)-$3,500(P/F,15%, 2) -$3,800(P F, 15%, 3)

-$4,500 (P/F, 15%, 4) - $9,800(P/F, 15%,5)

= -$22,698.98

AEC (15%) = $6,771.46 (written as +ve because AEC, C is cost)

14.4. Air Links, a commuter airline company, is considering replacing one of its baggagehandling machines with a newer and more efficient one. The current book value of the old

machine is $50,000, and it has a remaining useful life of five years. The salvage value

expected from scrapping the old machine at the end of five years is zero, but the company

can sell the machine now to another firm in the industry for $10,000. The new baggagehandling machine has a purchase price of $120,000 and an estimated useful life of seven

years. It has an estimated salvage value of $30,000 and is expected to realize economic

37

Page | 37

COEB442 Engineering Economics

Revision

Sem 1, 2016/2017

savings on electric power usage, labor, repair costs and also to reduce the amount of

damaged luggage. In total, an annual savings of $50,000 will be realized if the new

machine is installed. The firm uses a 15% MARR. Using the opportunity cost approach,

(a) What is the initial cash outlay required for the new machine?

(b) What are the cash flows for the defender in years zero through five?

(c) Should the airline purchase the new machine?

Answer:

(a) Initial cash outlay for the new machine = $120,000

(b) Cash flows for the defender: Year 0: -$10,000 Years 1-5: 0

(c) AEW(15%)Defender = -$2,983

AEW(15%)Challenger = $23,868

The company should purchase the new machine because it has a higher annual equivalent

cash flow

38

Page | 38

COEB442 Engineering Economics

Revision

Sem 1, 2016/2017

Chapter 9

(Q3.b) Final Examination Semester 1, 2015/2016

(b)

i. A rice cleaning equipment was purchased in December 2009 for RM8,500 and

is yearly depreciated by the double declining balance (DDB) method for an

expected life of 10 years. What is the book value of the equipment at the end

of 2014? Original salvage value was estimated to be RM1,500 at the end of 10

years. (hints: only do full year depreciation).

[9 marks]

A:

Prepare the table

ii. Give ONE out of three conditions must an asset satisfy to be considered depreciable.

[2 marks]

Final Examination Semester 2, 2013/2014

(c)

i.

Assuming that you own a car. Describe how you calculate the economic

depreciation accumulated for your car with each passing year. [2marks]

ii.

InnoCom Sdn Bhd buys a new telecommunication machine that costs $160,000.

It has a useful life of 6 years and can be sold for $50,000 at the end of this period.

It is expected that $10,000

will be spent by the company to dismantle and

remove the machine at the end of its

useful life. Compute the annual

depreciation allowances and the resulting book values and put them in a table

form by using the following methods:

(c)

i.

(1)

Straight- line depreciation

(2)

150% declining balance

[4 marks]

[7 marks]

Subtracting the current market value of the car from the original

price paid for the car.

Economic depreciation = Purchase price market value

[2 marks]

ii.

SL Dep = (I S) /N

Salvage value (S) = $50,000 - $10,000 = $40,000

SL Dep = ($160,000 - $ 40,000)/6 =$ 20,000

39

[1mark]

Page | 39

COEB442 Engineering Economics

Revision

Sem 1, 2016/2017

For 150%DB,

= (1/N) x Multiplier

=1.5/6 = 0.25

Year

0

1

2

3

4

5

6

[1 mark]

SL

Book

depreciation

using

[1 mark]

method

balance

declining

[2 marks]

[4 marks]

balance

$40,000

$30,000

$22,500

$16,875

$12,656.25

$9492.19

[2 marks]

$160,000

$120,000

$90,000

$67,500

$50,625

$37,968.75

$28,476.56

$20,000

$20,000

$20,000

$20,000

$20,000

$20,000

value 150%

SL declining

$160,000

$140,000

$120,000

$100,000

$80,000

$60,000

$40,000

Book

value

using

150%

2. Quality Plastics Inc. makes plastic bowls. It recently bought a new machine, on January 1,

that molds plastic pellets into the desired shapes. The price of that machine was RM480,000.

It cost RM8,000 to deliver the machine to the factory. It cost RM12,000 to install and properly

calibrate the machine. It has an expected useful life of 5 years, and is expected to have

RM50,000 salvage value at the end of 5 years.

(a) What is the depreciable cost of the new machine? =RM500,000

[2 marks]

(b) What is the amount of the annual depreciation if straight line method is use?

Determine the book value at the end of year 4.

=annual depreciation: RM90,000

=Book value: RM140,000

[4 marks]

(c) Calculate the depreciation percent of the new machine that will be used to compute the

depreciation amount, the amount of annual depreciation and book value at the end of

each year if the company decides to use double declining balance method. [13 marks]

YEAR

DDB

BOOK VALUE

DEPRECIATION

0

1

2

3

4

5

200,000

120,000

72,000

43,200

14,800

500,000

300,000

180,000

108,000

64,800

50,000

40

Page | 40

COEB442 Engineering Economics

Revision

Sem 1, 2016/2017

(d) Compare the amount of accumulated depreciation of the machine in the books at the

end of the third year comparing straight line method and double declining (Q HAS

BEEN MODIFIED)

[6 marks]

Straight line method: RM90,000 X 3 =RM270,000

Page | 41

Double declining:= RM392,000

[Q4, FE Sem 1 12/13]

3. [FE Sem 1 13/14 Q HAS BEEN MODIFIED]

(a)

What is depreciation?

(b)

[1 mark]

Idea Perfect Sdn Bhd purchased a RM196,000 hole-punching machine with a freight

charge of RM1,000 and an installation cost of RM3,000. The machine has a recovery period of 5

years and the salvage value is expected to be zero. Complete the depreciation below.

Year

Straight Line

Book value

Double declining

Book value

depreciation

using SL

balance (DDB)

using DDB

without

method

depreciation [5

method

switching

[2 marks]

marks]

[5 marks]

[2 marks]

0

1

2

3

4

5

Answers

Year

Straight Line

Book value

Double

Book value using

depreciation

using SL

declining

DDB method

without

method

balance (DDB)

[5 marks]

switching

[2 marks]

depreciation [5

[2 marks]

0

1

5

RM40,000

RM40,000

marks]

RM200,000

RM160,000

0

RM80,000

RM10,368

RM200,000

RM120,000

RM15,552

THE DEPRECIATION VALUE FOR 5TH YEAR USING DDB MUST BE ADJUSTED TO GET 0

SALVAGE VALUE.

41

COEB442 Engineering Economics

Revision

Sem 1, 2016/2017

Depreciation is defined as a gradual decrease in the utility of fixed assets with use and time.

Page | 42

From textbook

The General Service Contractor Company paid $400,000 for a house and lot. The value

of the land was appraised at $155,000 and the value of the house at $245,000. The

house was then torn down at an additional cost of $15,000 so that a warehouse could be

built on the combined lots at a cost of $1,250,000. What is the value of the property

with the warehouse? For depreciation purposes, what is the cost basis for the

warehouse?

Answer:

9.3

9.10

The double-declining-balance method is to be used for an asset with a cost of $88,000,

an estimated salvage value of $13,000, and an estimated useful life of six years.

(a) What is the depreciation for the first three fiscal years, assuming that the asset was

placed in service at the beginning of the year?

(b) If switching to the straight-line method is allowed, when is the optimal time to

switch?

Answer:

42

COEB442 Engineering Economics

Revision

Sem 1, 2016/2017

Page | 43

Compute the DDB depreciation schedule for the following asset:

Cost of the asset, I

Useful life, N

Salvage value, S

$38,000

5 years

$6,000

(a) What is the value of ?

9.12

(b) What is the amount of depreciation for the second full year of use of the asset?

(c) What is the book value of the asset at the end of the fourth year?

Answer:

a)

= (1/5)2 = 0.4

b) D2

= (0.4)(1-0.4)(38,000)=9,120

(the yellow one is portion for the 1st year depreciation)

c) B4

= (38,000)(1-0.4)4= 4924.80

43

Você também pode gostar

- Relevant CostDocumento19 páginasRelevant CostWanIzyanAinda não há avaliações

- Week 5 Lecture Handout - LecturerDocumento5 páginasWeek 5 Lecture Handout - LecturerRavinesh PrasadAinda não há avaliações

- Law Report Ques 41Documento15 páginasLaw Report Ques 41Syahirah AliAinda não há avaliações

- Tax ComputationDocumento13 páginasTax ComputationEcha Sya0% (1)

- PERT/CPM SampleDocumento1 páginaPERT/CPM SampleBianca Jane MaaliwAinda não há avaliações

- PQR Limited Is An Engineering Company Engaged in The ManufactureDocumento2 páginasPQR Limited Is An Engineering Company Engaged in The ManufactureAmit PandeyAinda não há avaliações

- DEPRECIATIONDocumento11 páginasDEPRECIATIONsiddhartha RajAinda não há avaliações

- ACL 9 - Tutorial 1Documento7 páginasACL 9 - Tutorial 1Rantees100% (1)

- Breakeven and EOQ Exercises (With Answers)Documento6 páginasBreakeven and EOQ Exercises (With Answers)Charlene ChorAinda não há avaliações

- PPTDocumento33 páginasPPTanis solihah0% (1)

- UACS ManualDocumento8 páginasUACS Manual099153432843Ainda não há avaliações

- Upload 8Documento3 páginasUpload 8Meghna CmAinda não há avaliações

- Group Assignment Far 1Documento3 páginasGroup Assignment Far 1Farah Farhain100% (1)

- Challenges of Technical AnalysisDocumento3 páginasChallenges of Technical AnalysisNushrat JahanAinda não há avaliações

- Name Shehnila Azam Registration No# 45736 Course Cost and Management Accounting DAY Sunday Timing 3 To 6 Practice#1Documento6 páginasName Shehnila Azam Registration No# 45736 Course Cost and Management Accounting DAY Sunday Timing 3 To 6 Practice#1yousuf AhmedAinda não há avaliações

- Answers Chapter 1Documento43 páginasAnswers Chapter 1Maricel Inoc FallerAinda não há avaliações

- FIN 370 Final Exam Answers Grade - 100Documento9 páginasFIN 370 Final Exam Answers Grade - 100Alegna72100% (4)

- Case Study 26 Finalized 1Documento11 páginasCase Study 26 Finalized 1auni fildzah100% (1)

- ICWAI Dividend Policy-Financial Management & International Finance Study Material DownloadDocumento35 páginasICWAI Dividend Policy-Financial Management & International Finance Study Material DownloadsuccessgurusAinda não há avaliações

- ACCT 2112 2013/2014 Solution For Tutorial 9Documento6 páginasACCT 2112 2013/2014 Solution For Tutorial 9Weiyee WongAinda não há avaliações

- Toyota and Chassis Co - Case StudyDocumento3 páginasToyota and Chassis Co - Case StudyShajara Whave UsonAinda não há avaliações

- Tutorial 1Documento3 páginasTutorial 1Farah AdrizalAinda não há avaliações

- Chapter 1 Hire Purchase Accounts ExercisesDocumento5 páginasChapter 1 Hire Purchase Accounts ExercisesAsminawati IsmailAinda não há avaliações

- ExercisesDocumento9 páginasExercisesArzum EserAinda não há avaliações

- The Perception of Small Business Owners On Canva in Creating Digital Marketing MaterialsDocumento30 páginasThe Perception of Small Business Owners On Canva in Creating Digital Marketing MaterialsGabriel CrisologoAinda não há avaliações

- Tutorial 5 Eco 415Documento7 páginasTutorial 5 Eco 415ZhiXAinda não há avaliações

- Lancaster Engineering IncDocumento2 páginasLancaster Engineering IncMamunoor RashidAinda não há avaliações

- Tutorial Pengekosan KeluaranDocumento13 páginasTutorial Pengekosan KeluaranatehanaAinda não há avaliações

- 4.unit-4 Capital BudgetingDocumento51 páginas4.unit-4 Capital BudgetingGaganGabriel100% (1)

- FFinal JanusDocumento25 páginasFFinal JanusĐặng Thùy HươngAinda não há avaliações

- Kolej Universiti Tunku Abdul Rahman Faculty of Accountancy, Finance and Business SEMESTER 2020/2021 BBMF 3073 Risk Management Tutorial 4 (Week 5)Documento4 páginasKolej Universiti Tunku Abdul Rahman Faculty of Accountancy, Finance and Business SEMESTER 2020/2021 BBMF 3073 Risk Management Tutorial 4 (Week 5)Wong Ji ChingAinda não há avaliações

- C35 - MFRS 138 IntangiblesDocumento28 páginasC35 - MFRS 138 IntangibleskkAinda não há avaliações

- Group Assignment (Problem Based Learning - Set F) : Pma1113 Introducting To Cost & Management AccountingDocumento7 páginasGroup Assignment (Problem Based Learning - Set F) : Pma1113 Introducting To Cost & Management AccountingSyamala 29Ainda não há avaliações

- Salco7 12Documento3 páginasSalco7 12Einstein WilliamsAinda não há avaliações

- Assignement IPMDocumento5 páginasAssignement IPMMihretab Yifter100% (1)

- QMT425.429-T7 Simulation 7Documento20 páginasQMT425.429-T7 Simulation 7namalinazim100% (1)

- CTM Tutorial 2Documento4 páginasCTM Tutorial 2crsAinda não há avaliações

- Cost Accounting - Job Process Costing Flashcards - QuizletDocumento56 páginasCost Accounting - Job Process Costing Flashcards - QuizletReicci Lisette JumalonAinda não há avaliações

- Mfrs116 - Property, Plant and EquipmentDocumento21 páginasMfrs116 - Property, Plant and EquipmentTenglum LowAinda não há avaliações

- Pom Sol 10Documento5 páginasPom Sol 10amritranjan123_34249Ainda não há avaliações

- Taller OPT-SoluciónDocumento14 páginasTaller OPT-SoluciónMauricio Alejandro Buitrago Soto100% (1)

- Engineering EconomyDocumento272 páginasEngineering EconomyKristian TarucAinda não há avaliações

- What Does It Cost? IRR and The Time Value of MoneyDocumento36 páginasWhat Does It Cost? IRR and The Time Value of MoneydanielortizeAinda não há avaliações

- Toyota Case StudyDocumento3 páginasToyota Case StudyauroraincyberspaceAinda não há avaliações

- Case Study - ABC CostingDocumento3 páginasCase Study - ABC CostingDaiannaAinda não há avaliações

- Universiti Teknologi Mara Final Examination: Confidential AC/DEC 2019/TAX517Documento11 páginasUniversiti Teknologi Mara Final Examination: Confidential AC/DEC 2019/TAX517Diyana NabihahAinda não há avaliações

- CH 14 FMDocumento2 páginasCH 14 FMAsep KurniaAinda não há avaliações

- Ecoon PDFDocumento9 páginasEcoon PDFFritz FatigaAinda não há avaliações

- Economic Order Quantity ModelsDocumento7 páginasEconomic Order Quantity ModelsP Singh KarkiAinda não há avaliações

- Case StudyDocumento5 páginasCase StudyAastha MalhotraAinda não há avaliações

- Accounting 1 FinalDocumento2 páginasAccounting 1 FinalchiknaaaAinda não há avaliações

- Strategic ManagementDocumento8 páginasStrategic Managementvij.scribdAinda não há avaliações

- Company Segments Market Share Market Share Largest CompetitorDocumento2 páginasCompany Segments Market Share Market Share Largest CompetitorthivahgaranAinda não há avaliações

- Baf2104 Financial Management CatDocumento4 páginasBaf2104 Financial Management Catcyrus100% (1)

- Chapter 9 Summary Management Information SystemsDocumento6 páginasChapter 9 Summary Management Information SystemsNguyễn Thị Ngọc HânAinda não há avaliações

- AirTran Airways PresentationDocumento54 páginasAirTran Airways PresentationSarah GhummanAinda não há avaliações

- FIN 205 Tutorial Questions Sem 3 2021Documento55 páginasFIN 205 Tutorial Questions Sem 3 2021黄于绮Ainda não há avaliações

- COEB442 - Sem - 2 - 2015-2016 RevisionDocumento37 páginasCOEB442 - Sem - 2 - 2015-2016 RevisionNirmal ChandraAinda não há avaliações

- BMAC5203 Assignment Jan 2015 (Amended)Documento6 páginasBMAC5203 Assignment Jan 2015 (Amended)Robert WilliamsAinda não há avaliações

- Tutorial QuestionsDocumento11 páginasTutorial QuestionsAwnieAzizanAinda não há avaliações

- Julia Dito ResumeDocumento3 páginasJulia Dito Resumeapi-253713289Ainda não há avaliações

- Man and Historical ActionDocumento4 páginasMan and Historical Actionmama.sb415Ainda não há avaliações

- Module 2 MANA ECON PDFDocumento5 páginasModule 2 MANA ECON PDFMeian De JesusAinda não há avaliações

- ML Ass 2Documento6 páginasML Ass 2Santhosh Kumar PAinda não há avaliações

- Anemia in PregnancyDocumento5 páginasAnemia in PregnancycfgrtwifhAinda não há avaliações

- Evs ProjectDocumento19 páginasEvs ProjectSaloni KariyaAinda não há avaliações

- Catify To Satisfy - Simple Solutions For Creating A Cat-Friendly Home (PDFDrive)Documento315 páginasCatify To Satisfy - Simple Solutions For Creating A Cat-Friendly Home (PDFDrive)Paz Libros100% (2)

- Government College of Nursing Jodhpur: Practice Teaching On-Probability Sampling TechniqueDocumento11 páginasGovernment College of Nursing Jodhpur: Practice Teaching On-Probability Sampling TechniquepriyankaAinda não há avaliações

- Scholastica: Mock 1Documento14 páginasScholastica: Mock 1Fatema KhatunAinda não há avaliações

- EqualLogic Release and Support Policy v25Documento7 páginasEqualLogic Release and Support Policy v25du2efsAinda não há avaliações

- IMCI Chart BookletDocumento43 páginasIMCI Chart Bookletmysticeyes_17100% (1)

- Executive Summary-P-5 181.450 To 222Documento14 páginasExecutive Summary-P-5 181.450 To 222sat palAinda não há avaliações

- Baseline Scheduling Basics - Part-1Documento48 páginasBaseline Scheduling Basics - Part-1Perwaiz100% (1)

- Resume: Mr. Shubham Mohan Deokar E-MailDocumento2 páginasResume: Mr. Shubham Mohan Deokar E-MailAdv Ranjit Shedge PatilAinda não há avaliações

- Core ValuesDocumento1 páginaCore ValuesIan Abel AntiverosAinda não há avaliações

- Hidrl1 PDFDocumento7 páginasHidrl1 PDFRajesh Kumar100% (1)

- ECE Companies ListDocumento9 páginasECE Companies ListPolaiah Geriki100% (1)

- Physics Blue Print 1 Class XI Half Yearly 23Documento1 páginaPhysics Blue Print 1 Class XI Half Yearly 23Nilima Aparajita SahuAinda não há avaliações

- Continue Practice Exam Test Questions Part 1 of The SeriesDocumento7 páginasContinue Practice Exam Test Questions Part 1 of The SeriesKenn Earl Bringino VillanuevaAinda não há avaliações

- Building Services Planning Manual-2007Documento122 páginasBuilding Services Planning Manual-2007razanmrm90% (10)

- Oxford EAP B1 Pre-Intermediate Student - S Book 2Documento167 páginasOxford EAP B1 Pre-Intermediate Student - S Book 2Thư Dương Thị AnhAinda não há avaliações

- 1 in 8.5 60KG PSC Sleepers TurnoutDocumento9 páginas1 in 8.5 60KG PSC Sleepers Turnoutrailway maintenanceAinda não há avaliações

- Illustrating An Experiment, Outcome, Sample Space and EventDocumento9 páginasIllustrating An Experiment, Outcome, Sample Space and EventMarielle MunarAinda não há avaliações

- Tool Charts PDFDocumento3 páginasTool Charts PDFtebengz100% (2)

- Sveba Dahlen - SRP240Documento16 páginasSveba Dahlen - SRP240Paola MendozaAinda não há avaliações

- John L. Selzer - Merit and Degree in Webster's - The Duchess of MalfiDocumento12 páginasJohn L. Selzer - Merit and Degree in Webster's - The Duchess of MalfiDivya AggarwalAinda não há avaliações

- My Mother at 66Documento6 páginasMy Mother at 66AnjanaAinda não há avaliações

- B I o G R A P H yDocumento17 páginasB I o G R A P H yRizqia FitriAinda não há avaliações

- Rajiv Gandhi University of Health Sciences, Bengaluru, KarnatakaDocumento9 páginasRajiv Gandhi University of Health Sciences, Bengaluru, KarnatakaNavin ChandarAinda não há avaliações

- 2022 Mable Parker Mclean Scholarship ApplicationDocumento2 páginas2022 Mable Parker Mclean Scholarship Applicationapi-444959661Ainda não há avaliações