Escolar Documentos

Profissional Documentos

Cultura Documentos

FINAL REPORT Lower Hudson Valley PDF

Enviado por

jspectorTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

FINAL REPORT Lower Hudson Valley PDF

Enviado por

jspectorDireitos autorais:

Formatos disponíveis

RECLAIM NEW YORK

NEW YORK AFFORDABILITY CRISIS REPORT

NEW YORK

AFFORDABILITY CRISIS

REPORT

Lower Hudson Valley Edition

3

= +

6

RECLAIM

NEW YORK

1

RECLAIM NEW YORK

NEW YORK AFFORDABILITY CRISIS REPORT

ACKNOWLEDGEMENTS

Reclaim New York would like to thank J. Scott Moody, Brandon Muir, Doug Kellogg, Tom

Basile, John Lange, Nickolaus Anzalone, Angelica Irizarry, Rios Lopez, Candice DiLavore,

Sarah Jones, and scholars at the US Census Bureau, the Tax Foundation, the Heritage

Foundation, the Manhattan Institute, the Empire Center, the Office of the New York State

Comptroller, and the Institute of Economic Affairs for their contributions and feedback on

this report.

Additionally, the following resources were helpful in the drafting of this report: quickfacts.

census.gov, factfinder.census.gov, calculator.net, experian.com, myFICO.com, osc.

state.ny.us, seethroughny.net, bls.gov, nyserda.ny.gov, nyc.gov, ehealthinsurance.com,

verizonwiresless.com, digitaltrends.com, optimum.com, gasbuddy.com, eia.gov, ttb.gov, tax.

ny.gov, discus.org, ticas.org, and the Kaiser Foundation.

RECLAIM NEW YORK

NEW YORK AFFORDABILITY CRISIS REPORT

INTRODUCTION

New York: the words once rang with promise. Come here to

make your fortune, start a business, and build a family and a life.

That promise has disintegrated under

the weight of layers of government and

bureaucracy and their impact on every aspect

of daily life. New Yorkers are struggling every

day to keep their heads above the economic

waterline. Theyre dragged down by high taxes,

poor job climate, and politicians that feed a

government mired in failed policy and too

often corruption.

to amass just the down payment on a home.

Also, when the state hits homeowners with the

highest effective property tax rate in the nation,

at a total of $26 billion. With this innovative

and comprehensive report, Reclaim New York

shines a light on what the Affordability Crisis

means for all New Yorkers.

Reclaim New York has calculated the WakeUp Costs for various localities and income

levels by combining the total tax burden with

essential living costs to examine how much

or how little of your income remains after

taxes and basic expenses. In short, how much

do you pay just to wake-up here? For many

New Yorkers, their leftover income can be as

low as two-percent. Some are underwater.

Most are struggling to save for the future.

Put simply, all this drag has New Yorkers

caught in an Affordability Crisis. It affects

people upstate and down, in settings urban,

suburban, and rural. Its the product of a

punishing personal tax regime, and the bad

regulatory policies that drive up the cost of

basic necessities from groceries to gas to

electricity and its driving New Yorkers away

in droves.

The purpose of this report is twofold: to

inform, and to arm citizens with the information

necessary to improve the states conditions.

Reclaims breakthrough modeling techniques

provide clear, easy-to-understand data points.

The results presented should outrage anyone

concerned about the future of New York and

its citizens.

At least 1.8 million people

have left since 2000 for

states with friendlier

economic climates and

clearer visions for the future

more than any other state

in the nation.

We deserve better.

We have to demand better.

Lets Reclaim New York.

This crisis hits nearly every income level,

making it extraordinarily difficult to save.

When the high cost of living means you

struggle to save for your future, theres no

reason to stay, especially when it takes more

than a decade for an average-earning family

RECLAIM NEW YORK

NEW YORK AFFORDABILITY CRISIS REPORT

WHATS YOUR WAKE-UP COST?

Total Tax Burden (TTB) + Basic Living Expenses = Wake-Up Costs

Total Tax Burden = Income Tax + Property Tax + Sales Tax + Excise Tax

Basic Living Expenses. The following

sections explain each of these in greater detail,

including which portions consume the greatest

chunks of income.

To analyze how affordability challenges affect

the daily lives of New Yorkers, we asked a

simple question: What does it cost to wake up

each morning? After paying your taxes and

paying for basic living expenses, how much

money do you actually have left to save for your

future?

The chart below itemizes Wake-Up Costs for

a family of four earning the Median Household

Income of $78,227 in the Village of Tarrytown,

The stark Whats Left figure speaks volumes.

This family has too little savings to tackle

additional expenses from childcare, or debt, let

alone reliably save for college or retirement. We

examine the tax and expense burdens that

create these challenges in the following chart.

Before reviewing each countys samples, it is

important to understand the major components

of Wake-Up Costs. That means understanding

Total Tax Burden (TTB), which is the total

amount paid in income, property, sales, and

excise taxes, as well as the breakdown of

Monthly

$6,519

Annually

$78,227

INCOME TAX

$1,050

$12,597

PROPERTY TAX

$661

$7,928

SALES TAX

$212

$2,538

EXCISE TAX

$48

$573

MORTGAGE

$1,493

$17,912

FOOD

$624

$7,494

TRANSPORTATION

$1,206

$14,475

ENERGY

$173

$2,079

WATER

$86

$1,038

HEALTH INSURANCE

$361

$4,329

RENTERS INSURANCE

$0

$0

CELL PHONE

$154

$1,850

TELEPHONE/INTERNET/CABLE

$92

$1,100

$6,159

$73,913

$360

$4,314

MEDIAN INCOME IN TARRYTOWN

Wake-Up Cost Annual Expenditures

Married, Two Dependents (Under 17), Homeowner

TOTAL EXPENDITURES:

WHATS LEFT:

4

RECLAIM NEW YORK

NEW YORK AFFORDABILITY CRISIS REPORT

Whats Left After All Wake-Up Costs in Tarrytown

Median Income - $78,227/Year, Married, Two Dependents

Income Taxes

$12,597 | 16%

Property Taxes

$7,928 | 10%

Sales Taxes

$2,538 | 3%

Excise Taxes

$573 | 1%

Basic Expenses

$50,276 | 64%

Whats Left

$4,314 | 6%

INCOME TAX

PROPERTY TAX

Income taxes account for the largest

share of ones TTB, between 50 to

75-percent of any total tax bill and 20 to

40-percent of all income earned. Not only

do New Yorkers pay federal income tax, but

they also pay state income tax. Residents of

New York City and Yonkers are hit again by

municipal income taxes. These rates translate

to the second-highest income tax burden in

the United States. The Tax Foundation cites

California as the only state in the country

with a higher total income tax burden. Its not

progressive. Its oppressive, and squeezes all

income levels, impacting residents ability to

achieve financial stability. It especially affects

low-income earners.

Property taxes are the second-largest

slice of your TTB. In New York, these are

local taxes levied by the county, city, town,

village, school district, and other special

districts (fire, library, police, etc). The revenue

funds essential functions like public schools,

local police, and municipal offices. But they

also support unfunded mandated spending

levied by the State on local municipalities,

like New Yorks bloated Medicaid program, or

sky-rocketing legacy costs for former state

employees.

Whether youre single and just starting out

or you have a family and a more established

career, the federal and state government can

combine to take one-quarter or more of your

income.

RECLAIM NEW YORK

NEW YORK AFFORDABILITY CRISIS REPORT

SALES TAX

As government becomes increasingly

inefficient, opaque, and less accountable to

voters, we have to ask: are we getting good

value for our money? Reclaims study shows

that the answer to a large extent depends on

where you live. Property taxes, according to the

models, can represent 4 to 25-percent of your

tax bill. If this amount isnt scary enough, most

home owners in the Lower Hudson Valley, who

eventually pay off their home, will essentially

pay for it three times. Over the life of a thirtyyear mortgage, a home owner will pay

for the house once in principal, a second

time in property taxes, and a third time in

interest on the home loan.

The third-largest component of Total Tax

Burden comes from sales taxes. These

hit New Yorkers on a daily basis a few extra

cents on bottled water, a few extra bucks to

park in Manhattan, a bigger-ticket charge on a

tablet bought through Amazon. In New York, a

four-percent state sales tax is combined with a

county tax and in some cases with a special

district tax on goods.

This means roughly half of these dollars go

back to New York State, with the other half

heading to the county. In the Lower Hudson

Valley, all five counties in the region are within

the Metropolitan Commuter Transportation

District. This means residents are taxed an

additional 0.375% for every purchase, whether

or not they use Metro-North, and already pay

hundreds for a monthly rail pass. Sales taxes

in Westchester county are further increased in

the cities of Mount Vernon, New Rochelle, and

White Plains by a 0.375% local sales tax, and

in Yonkers by 0.875%.

Foreclosures and for-sale signs are among the

most visible effects of these steep property

tax rates. These bills hit taxpayers hard, but

the real damage they inflict is much harder to

see. They depress home values. They deter

first-time buyers otherwise capable of affording

a home. Many counties, like Westchester, are

sadly overrun with examples of fixed-income

retirees who have paid for their houses but

cannot afford the property taxes still being

levied on them.

COUNTY SALES TAX RATE

Given that the Lower Hudson Valley has

property taxes that are well above the national

median, some homeowners may feel the

sting even more. Based on a data released

by the Empire Center in 2014 , Westchester

and Rockland counties rank, nationally, in

the top five counties with the highest median

property tax burden. Putnam comes in at a

close eleventh, Orange at twenty-second, and

Dutchess at thirty-sixth. These rankings are out

of nearly 3,000 counties across the nation.

WESTCHESTER

7.375 - 8.875%

ORANGE

8.125%

PUTNAM

8.375%

DUTCHESS

8.375%

ROCKLAND

8.375%

RECLAIM NEW YORK

NEW YORK AFFORDABILITY CRISIS REPORT

BASIC LIVING EXPENSES

New Yorkers, unfortunately, have come to view

this tax as simply the cost of buying lunch

and more broadly of doing business. This study

examines that cost and shows just how much

a few percentage points can mean to your

bottom line.

The Total Tax Burden costs citizens between

30 and 50-percent of their annual income, but

it gets compounded by the high cost of living

New Yorkers face as a result of their high-tax

climate. For instance, your grocery store needs

to comply with an endless maze of New Yorkspecific taxes and regulations. These costs are

eventually passed onto families. Thats why

basic living expenses consume between 40 to

95-percent of your income, and sometimes all

of it. No matter what state you happen to live

in, youll need to pay for transportation,

housing, and 21st century necessities like cell

phone service. But in New York, all these

things cost far more because of overreaching

government.

Reclaims innovative model is powered by

data from the US Census Bureaus annual

nationwide Consumer Expenditure Survey. We

use those numbers to project the consumption

habits of New Yorkers at multiple income levels

across multiple locations. We incorporated this

data into our model and then cross-referenced

it with goods deemed taxable by New York

State government. Butter, cheese, bread, and

other staples are exempt, most others are

taxed.

EXCISE TAXES

Taxes, regulations, and bad policy have driven

up the cost of everything in New York.

New Yorkers and business owners pay

two-hundred different types of taxes and

are subject to more than two-thousand

regulations that drive up the cost of living

and business. Government may try to justify

these policies as protecting consumers,

workers, or the environment. Yet, many turn

out to protect the financial interests of

government first and foremost.

Excise Taxes have a unique and

disproportionately burdensome effect

on its citizens. Excise taxes are a hidden

cost, passed on to the consumer. They dont

appear on any receipt; most consumers dont

even know they exist. Unfortunately, both the

federal and state government make sure they

do more than just exist.

Their reach is broad: in New York, they add to

the cost of everything from fishing equipment

to airline flights to gasoline. Going to the ball

game? Be prepared to pay the Stadium Tax,

the Soda Tax, a Beer Tax and parking taxes

to name a few. The list goes on all in the

name of feeding New Yorks already bloated

government.

This far weve used a family in Tarrytown as an

example of the impact of the Affordability

Crisis. In the following sections we will show

how New Yorks high-tax climate affects

families across the Lower Hudson Valley.

Take gasoline: on average, excise tax

accounts for 17-percent of your total fuel

bill, helping make New York the secondmost expensive state in the nation to fill

up your car.

RECLAIM NEW YORK

NEW YORK AFFORDABILITY CRISIS REPORT

LOWER HUDSON VALLEY

Whats Left After All Wake-Up Costs in Mount Vernon

Income Taxes

$2,631

The Lower Hudson Valley consists of

Dutchess, Orange, Putnam, Rockland, and

Westchester counties. In the following sections,

we have outlined two localities per county

to emphasize how New Yorks tax structure

and cost of living affects all income levels

and communities, regardless of size. For each

community, we calculated the Wake-Up Costs

for the Median Household Income (MHI) of

a family of four. For some localities, there is an

additional sample demonstrating what a single

college graduate earning the national average

starting salary is projected to pay.

82%

Property Taxes

$3,434

1%

4%

8%

Sales Taxes

$1,710

6%

Excise Taxes

$292

-2%

Median Family Income

$40,492 annually

Basic Expenses

$33,400

Married, 2 Dependents, Renter

Whats Left

$-975

Whats Left After All Wake-Up Costs in Mount Vernon

Income Taxes

$11,555

WESTCHESTER COUNTY

Property Taxes

$4,131

Westchester County is home to an estimated

976,396 people, and has a county-wide

MHI of $93,422. Despite having some of the

wealthiest zip codes in the nation, Reclaims

findings show that New Yorks Affordability

Crisis affects households across the incomespectrum. Although prices are generally high

across all categories, property taxes and

transportation costs are particularly crushing.

To exemplify this, we studied the City of Mount

Vernon and the Hamlet of Pound Ridge.

Sales Taxes

$1,147

Excise Taxes

$228

Basic Expenses

$27,021

2%

1%

8%

24%

54%

9%

Recent Graduate Income

$48,707 annually

Single, No Dependents, Renter

Whats Left

$4,626

A recent college graduate earning $48,707

and renting an apartment in Mount Vernon

will pay $44,081 in Wake-Up Costs. That

leaves them with a total of $4,626 which

is 9-percent of their income for personal

savings, retirement, and student loans. This

puts them at a significant disadvantage,

especially when considering that in other

similarly populated states, like Texas, the takehome pay is nearly double.

City of Mount Vernon

In the City of Mount Vernon, a family of four

earning the median household income of

$40,492, will lose almost all of their income

to taxation and basic living expenses, or what

we call Wake-Up Costs. Thats $8,067 (thats

nearly 20-percent) in taxes and $33,400 in

basic living expenses. Assuming they make no

significant cuts, this family is projected to be

underwater by $975 each year. Essentially they

are living hand to mouth and will likely resort to

debt, public assistance programs (if eligible), or

drastic cuts to their standard of living.

Given that the average student debt for

graduates of four-year colleges in New York

State is approximately $27,822, according to

data from the Institute of College Achievement

and Success, this is particularly concerning.

Its no wonder why many millennials are

cohabitating, moving to other states, or

returning to their parents' house.

RECLAIM NEW YORK

NEW YORK AFFORDABILITY CRISIS REPORT

Pound Ridge also exemplifies one of

Westchesters greatest burdens: astonishingly

high property tax rates. Over the course of the

year, this family pays $52,295 on a mortgage

for a home valued at $622,539. On top of this,

they pay an additional $12,532 in property

taxes. In total, thats $64,827 per year, and

$5,402 per month just to put a roof over their

head in Pound Ridge.

Its also important to note, that Mount Vernon

is one of four cities in Westchester that has

an additional local sales tax. Whereas most of

Westchesters residents are taxed 4.00% by

the state, 3.00% by the county, and 0.375%

by the Metropolitan Commuter Transportation

District at a total of 7.375%, Mount Vernon is

taxed at a total 8.375%. This is remarkable

when considering that Mount Vernon has one

of the lowest MHI in the entire Lower Hudson

Valley. Meaning, one of the countys lowest

income communities has one of the highest

sales tax rates. The family of four, therefore,

pays $1,710 in sales tax. That may not seem

like much, but for this sample family it is the

difference between staying afloat and being

underwater.

If this couple ever hoped to retire

and stay in their home, they will need

significant reserves for property taxes

alone. Assuming they retire at 65, and

expect to live in the house for the next

twenty years or so, they will need to save

approximately $329,991. Thats roughly

$15,656 each year, assuming property

taxes increase at 1.7-percent each year.

After decades of paying income taxes,

sales taxes, and other property taxes,

retirees are still forced to pay what

amounts to another mortgage. Are retirees

getting value for what they put into the

system?

Hamlet of Pound Ridge

In the Hamlet of Pound Ridge, the effect of

New Yorks tax environment is just as striking.

For a family of four who own their home in the

Bedford School District and earn the MHI of

$170,278, Wake-Up Costs amount to

$157,365 per year, 33-percent of which are

taxes. This leaves the family with only $12,913

per year (which is 8-percent of their income),

or $1,067 per month, including saving for

retirement, paying credit card debt, and all

other expenses.

Why are Westchesters Wake-Up Costs

So High? Like other counties in the

region, Westchester has unusually high

property taxes. Nationally, Westchester

County has some of the highest average,

and effective, property tax rates in the

United States. Although Westchester has

high-income communities, these rates still

strain families, and especially retirees and

low-income communities.

Whats Left After All Wake-Up Costs in Pound Ridge

Income Taxes

$39,503

Property Taxes

$12,532

Sales Taxes

$4,111

Excise Taxes

$1,036

Basic Expenses

$100,182

7%

2%

1%

Unlike some counties in the region,

Westchesters basic living expenses

are higher than most. For example,

many people commute to New York

City. Not only do they bear the expense

of owning a car, but they also may be

footing the bill for a monthly rail pass.

For example, the sample family in

Tarrytown pays roughly $14,475 per

year in transportation costs, which is

18.5-percent of their income.

23%

59%

8%

Median Family Income

$170,278 annually

Married, 2 Dependents, Owner

Whats Left

$12,913

RECLAIM NEW YORK

NEW YORK AFFORDABILITY CRISIS REPORT

ROCKLAND COUNTY

11-percent of their income. This amount is

quite steep when compare national median

property tax bill of $1,805.

Rockland County is home to an estimated

326,037 residents, and has a MHI of

$85,808. Like Westchester County,

Rocklands transportation costs are particularly

high. A family with one parent that commutes

to New York City will pay $302 per month for

a rail pass on top of car expenses.

Village of Spring Valley

Whats Left After All Wake-Up Costs in Spring Valley

Income Taxes

$8,166

If they decide to commute by car, the financial

burden would be even worse. Crossing the

George Washington Bridge will cost them $15

per day ($375 monthly), and parking will cost

them an average $40 per day ($538 monthly).

Therefore, a commute from Rockland County

to Mid-town Manhattan could cost more than

$10,000 annually.

Property Taxes

$4,306

1% 4%

69%

13%

Sales Taxes

$2,332

Excise Taxes

$450

Basic Expenses

$42,038

7%

6%

Median Family Income

$60,941 annually

Married, 2 Dependents, Renter

Whats Left

$3,649

Hamlet of Stony Point

Whats Left After All Wake-Up Costs in Stony Point

Income Taxes

$17,063

Property Taxes

$10,450

Sales Taxes

$3,913

Excise Taxes

$952

Basic Expenses

$54,525

In the Village of Spring Valley, in the Town of

Ramapo, the MHI is well under the county

average, at $60,941. A family of four, living on

this income, will end the year with just $3,649

after paying $57,292 in Wake-Up Costs.

10%

5%

1%

18%

56%

10%

ORANGE COUNTY

Orange County is home to approximately

377,647 residents, and has a MHI of $70,794.

To demonstrate how the Affordability Crisis

affects all income levels, we have chosen one

locality far above the county MHI and one

below. Both localities are left with less than

ten-percent of their income after Wake-Up

Costs.

Median Family Income

$96,168 annually

Married, 2 Dependents, Owner

Whats Left

$9,266

In the Haverstraw-Stony Point School District,

a family of four earning the MHI of $96,168

spends $32,378 on taxes, and 83-percent of

their annual income in total Wake-Up Costs.

They end the year with $9,266 and only

$772 each month. Stony Points property tax

rate is 4.177-percent. At the MHI, the familys

home value is estimated to be $250,173. In

property taxes alone, theyll pay $10,450, or

Hamlet of Campbell Hall

The MHI in Campbell Hall is about $30,000

higher than the county average. At an income

of $103,750, they spend approximately

$94,562 in Wake-Up Costs. Thats 91-percent

of their income, one-third of which goes to the

government.

10

RECLAIM NEW YORK

NEW YORK AFFORDABILITY CRISIS REPORT

The story isnt much different in the lowerincome area of Middletown. The median

income here is $58,803, and at this income,

the family likely rents. In taxes, they would spend

$13,953 in taxes and $38,811 in basic

expenses at a total of $52,912. That means

a quarter of their income is going to the

government, and 66-percent goes to basic living

expenses. That leaves them with $6,039 per

year, which is $503 per month. At these rates, it

will take them years before theyve saved

enough to purchase a house or achieve other life

goals.

Whats Left After All Wake-Up Costs in Campbell Hall

Income Taxes

$19,213

Property Taxes

$9,445

Sales Taxes

$3,680

Excise Taxes

$808

Basic Expenses

$61,417

9%

19%

1% 4%

9%

59%

Median Family Income

$103,750 annually

Married, 2 Dependents, Owner

Whats Left

$9,188

PUTNAM COUNTY

With approximately $9,000 left to cover all

other expenses, save, and prepare, this family

is financially unstable. Saving for retirement or

a childs college tuition? Paying off student

loan debt? Trying to put together the down

payment for a first home? In this tax climate,

these milestones are likely outside of their

financial reach.

Putnam is the least populated county in the

Lower Hudson Valley at 99,042, and also has

one of the highest county MHIs of $96,262.

Despite this, the amount leftover does not

improve.

Village of Cold Spring

Whats Left After All Wake-Up Costs in Cold Spring

City of Middletown

Income Taxes

$14,450

Property Taxes

$7,336

Whats Left After All Wake-Up Costs in Middletown

Income Taxes

$7,547

Property Taxes

$3,403

Sales Taxes

$2,472

Excise Taxes

$531

Basic Expenses

$38,811

1% 4%

66%

Sales Taxes

$2,741

6%

Excise Taxes

$579

13%

Basic Expenses

$50,872

10%

9%

1% 3%

60%

17%

11%

Median Family Income

$84,966 annually

Married, 2 Dependents, Owner

Whats Left

$8,990

Median Family Income

$58,803 annually

Married, 2 Dependents, Renter

Whats Left

$6,039

In the Village of Cold Spring, in the Town of

Philipstown, the MHI is $84,966. With this

income a family of four who owns their home,

pays $75,976 in Wake-Up Costs which is

89-percent of their income annually. This

leaves them with just $8,990 leftover, or only

$749 per month.

11

RECLAIM NEW YORK

NEW YORK AFFORDABILITY CRISIS REPORT

Hamlet of Mahopac

Whats Left After All Wake-Up Costs in Poughkeepsie

A family of four who owns their home and

earns the MHI of $108,082 in the Mahopac

School District, in the Hamlet of Mahopac, in

the Town of Carmel, has a Wake-Up Cost of

$95,455 each year. Thats $35,062 just in

taxes. With $12,627 left annually, this family

seems to be better off than most sample

families. However, one might ask whether or

not residents are getting value for nearly onethird of their income they send to the state and

county government.

Income Taxes

$2,823

81%

Property Taxes

$1,545

1%

5%

4%

Sales Taxes

$2,258

Excise Taxes

$464

Basic Expenses

$33,424

7%

2%

Median Family Income

$41,331 annually

Married, 2 Dependents, Renter

Whats Left

$818

Whats Left After All Wake-Up Costs in Mahopac

Income Taxes

$20,016

Property Taxes

$10,964

Sales Taxes

$3,343

Excise Taxes

$738

Basic Expenses

$60,393

Hamlet of LaGrangeville

10%

3%

1%

56%

The states poor tax climate doesnt just affect

low-income communities. A family of four who

owns their home in the Arlington School

District, in the Hamlet of LaGrangeville, in the

Town La Grange will pay $31,775 in taxes

at a median income of $100,285. Their total

Wake-Up Costs will amount to $93,183, which

is 93-percent of their income. This leaves them

with $7,102 per year, or $592 per month. With

7-percent leftover, even a family in a higherincome community struggles to save, invest,

or come up with the funds for leisure activities,

like a vacation.

19%

12%

Median Family Income

$108,082 annually

Married, 2 Dependents, Owner

Whats Left

$12,627

DUTCHESS COUNTY

Whats Left After All Wake-Up Costs in La Grangeville

Dutchess County has 292,754 residents and

a MHI of $72,471. Although its property tax

rates are not as infamous as the rest of the

region, Dutchess families still struggle to meet

their financial goals. In the following sections,

we explore Wake-Up Costs between two

different income levels and communities.

Income Taxes

$18,167

Property Taxes

$9,391

Sales Taxes

$3,431

Excise Taxes

$786

City of Poughkeepsie

Basic Expenses

$61,407

Poughkeepsie is a small city with one of

the Lower Hudson Valleys lowest MHIs of

$41,331. A family of four on this income will

spend $40,513 in Wake-Up Costs. This leaves

the family with $818, or 2-percent of income

left for all other expenses. Imagine how much

even a small tax decrease would help them.

Whats Left

$7,102

12

3%

1%

61%

9%

18%

7%

Median Family Income

$100,285 annually

Married, 2 Dependents, Owner

RECLAIM NEW YORK

NEW YORK AFFORDABILITY CRISIS REPORT

CONCLUSION

It does not matter whether you rent or own your home; what income bracket you fall in;

whether you live in an urban, suburban, or rural area; are single or married; a Baby Boomer or

Millennial, there is an Affordability Crisis in New York State that impacts the financial stability

of virtually everyone. The snapshot Reclaim New York has provided here illustrates how New

Yorkers struggle to save due to the crushing cost of government and its impact on the cost of

living.

Since most New Yorkers pay anywhere from eighty to ninety-percent of their income

in Wake-Up Costs its important for citizens to ask if theyre getting sufficient value for what

they pay into the government. If New Yorkers actually breakdown the amount they pay in

Wake-Up Costs and begin looking at their relationship with government as a consumer

transaction, chances are theyd feel theyre getting a bad deal.

All states require revenue to function. Lively, balanced debate can and must take place about

how much revenue they need, and how they should spend your money. In order for that

debate to produce substantive results, citizens must participate and need to be well-informed.

Given the energy our state and local governments expend on erecting barriers to

transparency, and protecting the status quo of high taxes, it is often hard for consumers to get

a clear picture of the fiscal forces that impact their future.

We created this Affordability Crisis Report to help all New Yorkers who want, and

deserve, a better future to participate in the conversation. Reclaim New York has synthesized

hundreds of studies and data points using a new model to isolate interactions with

government that hinder New Yorkers ability to save.

When we learn how our government crushes our families, keeps youth running in place,

leaves seniors with an uncertain financial future, and stops even those earning double their

local median income from building up real savings; we begin to realize that the game is rigged

against all New Yorkers. We also realize serious change is necessary.

This report is the first step to building a stronger New York for millions who struggle

to live here. We encourage each of you to engage us in a deeper conversation. Reclaim New

York can help you define what the next step is for you and your community. Activation could

be as simple as reaching out to friends and neighbors or attending a town board meeting. The

key is that we understand the issues and work together to move New York forward.

For questions and inquiries regarding this report, please contact:

Info@ReclaimNewYork.org

646-781-7800

13

RECLAIM NEW YORK

NEW YORK AFFORDABILITY CRISIS REPORT

RECLAIM

NEW YORK

14

597 Fifth Avenue, Seventh Floor New York, NY 10017

ReclaimNewYork.org info@ReclaimNewYork.org

Você também pode gostar

- Joseph Ruggiero Employment AgreementDocumento6 páginasJoseph Ruggiero Employment AgreementjspectorAinda não há avaliações

- Pennies For Charity 2018Documento12 páginasPennies For Charity 2018ZacharyEJWilliamsAinda não há avaliações

- Film Tax Credit - Quarterly Report, Calendar Year 2017 2nd Quarter PDFDocumento8 páginasFilm Tax Credit - Quarterly Report, Calendar Year 2017 2nd Quarter PDFjspectorAinda não há avaliações

- Federal Budget Fiscal Year 2017 Web VersionDocumento36 páginasFederal Budget Fiscal Year 2017 Web VersionjspectorAinda não há avaliações

- State Health CoverageDocumento26 páginasState Health CoveragejspectorAinda não há avaliações

- IG LetterDocumento3 páginasIG Letterjspector100% (1)

- Cornell ComplaintDocumento41 páginasCornell Complaintjspector100% (1)

- 2017 08 18 Constitution OrderDocumento27 páginas2017 08 18 Constitution OrderjspectorAinda não há avaliações

- Abo 2017 Annual ReportDocumento65 páginasAbo 2017 Annual ReportrkarlinAinda não há avaliações

- Teacher Shortage Report 05232017 PDFDocumento16 páginasTeacher Shortage Report 05232017 PDFjspectorAinda não há avaliações

- NYSCrimeReport2016 PrelimDocumento14 páginasNYSCrimeReport2016 PrelimjspectorAinda não há avaliações

- SNY0517 Crosstabs 052417Documento4 páginasSNY0517 Crosstabs 052417Nick ReismanAinda não há avaliações

- Inflation AllowablegrowthfactorsDocumento1 páginaInflation AllowablegrowthfactorsjspectorAinda não há avaliações

- Class of 2022Documento1 páginaClass of 2022jspectorAinda não há avaliações

- Oag Sed Letter Ice 2-27-17Documento3 páginasOag Sed Letter Ice 2-27-17BethanyAinda não há avaliações

- Opiods 2017-04-20-By Numbers Brief No8Documento17 páginasOpiods 2017-04-20-By Numbers Brief No8rkarlinAinda não há avaliações

- Hiffa Settlement Agreement ExecutedDocumento5 páginasHiffa Settlement Agreement ExecutedNick Reisman0% (1)

- Youth Cigarette and E-Cigs UseDocumento1 páginaYouth Cigarette and E-Cigs UsejspectorAinda não há avaliações

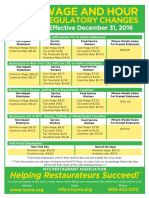

- Wage and Hour Regulatory Changes 2016Documento2 páginasWage and Hour Regulatory Changes 2016jspectorAinda não há avaliações

- Siena Poll March 27, 2017Documento7 páginasSiena Poll March 27, 2017jspectorAinda não há avaliações

- 2017 School Bfast Report Online Version 3-7-17 0Documento29 páginas2017 School Bfast Report Online Version 3-7-17 0jspectorAinda não há avaliações

- Schneiderman Voter Fraud Letter 022217Documento2 páginasSchneiderman Voter Fraud Letter 022217Matthew HamiltonAinda não há avaliações

- 16 273 Amicus Brief of SF NYC and 29 Other JurisdictionsDocumento55 páginas16 273 Amicus Brief of SF NYC and 29 Other JurisdictionsjspectorAinda não há avaliações

- Activity Overview: Key Metrics Historical Sparkbars 1-2016 1-2017 YTD 2016 YTD 2017Documento4 páginasActivity Overview: Key Metrics Historical Sparkbars 1-2016 1-2017 YTD 2016 YTD 2017jspectorAinda não há avaliações

- Review of Executive Budget 2017Documento102 páginasReview of Executive Budget 2017Nick ReismanAinda não há avaliações

- Voting Report CardDocumento1 páginaVoting Report CardjspectorAinda não há avaliações

- p12 Budget Testimony 2-14-17Documento31 páginasp12 Budget Testimony 2-14-17jspectorAinda não há avaliações

- Darweesh Cities AmicusDocumento32 páginasDarweesh Cities AmicusjspectorAinda não há avaliações

- 2016 Local Sales Tax CollectionsDocumento4 páginas2016 Local Sales Tax CollectionsjspectorAinda não há avaliações

- Pub Auth Num 2017Documento54 páginasPub Auth Num 2017jspectorAinda não há avaliações

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- Quezon City v. ABS CBNDocumento4 páginasQuezon City v. ABS CBNJunmer OrtizAinda não há avaliações

- Obre VoucherDocumento33 páginasObre VoucherAnthony DelarosaAinda não há avaliações

- Price THB 1,996: Stay SamedDocumento2 páginasPrice THB 1,996: Stay SamedMuhammad Fazle Rabbi (202054005)Ainda não há avaliações

- AgarwalPackers - in QuotationDocumento2 páginasAgarwalPackers - in Quotation9853318441Ainda não há avaliações

- Bank Collection Sales System JuneDocumento44 páginasBank Collection Sales System Juneaktaruzzaman bethuAinda não há avaliações

- International Business Law (DLW1083) : Law of Bill of ExchangeDocumento11 páginasInternational Business Law (DLW1083) : Law of Bill of Exchangewafiq100% (1)

- Tax Planning, Evasion, AvoidanceDocumento16 páginasTax Planning, Evasion, AvoidanceDr. Nathan WafAinda não há avaliações

- BarBill Bezdicek 2022.08.26Documento2 páginasBarBill Bezdicek 2022.08.26Miroslav MathersAinda não há avaliações

- Nam Casestudies PostmatesDocumento2 páginasNam Casestudies PostmatessugandhaAinda não há avaliações

- 42 Implementation of Tds in Tallyerp 9Documento171 páginas42 Implementation of Tds in Tallyerp 9P VenkatesanAinda não há avaliações

- Tanggal No Nama Dept Jam Masuk Jam KeluarDocumento25 páginasTanggal No Nama Dept Jam Masuk Jam KeluarHui AikoAinda não há avaliações

- Affidavit of Exempt Sale StandardDocumento2 páginasAffidavit of Exempt Sale StandardAnna AtienzaAinda não há avaliações

- Invoice OD119939448063285000Documento1 páginaInvoice OD119939448063285000ShivAinda não há avaliações

- MF0012 - Summer 2014Documento2 páginasMF0012 - Summer 2014Rajesh SinghAinda não há avaliações

- Annex A.1 Checklist of Mandatory RequirementsDocumento1 páginaAnnex A.1 Checklist of Mandatory RequirementsJemila Paula DialaAinda não há avaliações

- Gross Sales Declaration Form 2023Documento1 páginaGross Sales Declaration Form 2023Ramon Vinzon67% (9)

- ACFrOgBWnU5pY1 VTEVkoQtR - 0Rkg7FFpY57K2UdGKU7ruDXN8xM4n5pZK92SR172nx70t 8HLnc1K qfD4D1ZRYRxx4qKKjZLotL9JqtUw1n7K2SPRAr3tnJHbVW56URi7mLk5wN6CatILDMwTDocumento2 páginasACFrOgBWnU5pY1 VTEVkoQtR - 0Rkg7FFpY57K2UdGKU7ruDXN8xM4n5pZK92SR172nx70t 8HLnc1K qfD4D1ZRYRxx4qKKjZLotL9JqtUw1n7K2SPRAr3tnJHbVW56URi7mLk5wN6CatILDMwTmercyvienhoAinda não há avaliações

- On January 1 Pulse Recording Studio Prs Had The FollowingDocumento1 páginaOn January 1 Pulse Recording Studio Prs Had The FollowingLet's Talk With HassanAinda não há avaliações

- Graphic Is Ed Cheque - FINALDocumento2 páginasGraphic Is Ed Cheque - FINALdennismyoAinda não há avaliações

- VAT 100 FormDocumento48 páginasVAT 100 FormzulfiAinda não há avaliações

- ACFrOgDrfk9wT 7y1 fbRMiv4xjP7hNTGwqfzNJ1G27r3eTgtVDid9F7RrBmpGFgcOsGtPT0J6IIB0RUl JaXR7YG0rDWVbPsPWL0 - H4w111trlgzjhfck669j7oooo PDFDocumento3 páginasACFrOgDrfk9wT 7y1 fbRMiv4xjP7hNTGwqfzNJ1G27r3eTgtVDid9F7RrBmpGFgcOsGtPT0J6IIB0RUl JaXR7YG0rDWVbPsPWL0 - H4w111trlgzjhfck669j7oooo PDFAmitAinda não há avaliações

- Tutorial 7Documento3 páginasTutorial 7Muntasir AhmmedAinda não há avaliações

- Sep 22Documento1 páginaSep 22austin LevisAinda não há avaliações

- Gocardless Direct Debit GuideDocumento53 páginasGocardless Direct Debit GuideGregory CarterAinda não há avaliações

- RR No. 1-2022Documento3 páginasRR No. 1-2022try saguilotAinda não há avaliações

- Prepaid ServiceDocumento6 páginasPrepaid ServicemmasliniaAinda não há avaliações

- Income Tax On Individuals and Tax RatesDocumento25 páginasIncome Tax On Individuals and Tax RatesmmhAinda não há avaliações

- WEO DataDocumento14 páginasWEO DataPrypiat 0Ainda não há avaliações

- Bain Online Test PDFDocumento21 páginasBain Online Test PDFAvedeoAinda não há avaliações

- Front Office Section - Accounting and CashieringDocumento15 páginasFront Office Section - Accounting and CashieringRishina CabilloAinda não há avaliações