Escolar Documentos

Profissional Documentos

Cultura Documentos

Far 1

Enviado por

syid4hTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Far 1

Enviado por

syid4hDireitos autorais:

Formatos disponíveis

COURSE OUTLINE

Department & Faculty: Dept. of Accounting and

Finance, Faculty of Management

Course Code: SHAC 1103 Financial Accounting

and Reporting 1

Total Lecture Hours: 42 hours

Lecturer

Room No.

Telephone No.

Synopsis

2.

3.

4.

5.

6.

7.

Semester: I

Academic Session: 2016/2017

: KAMARUZZAMAN ABDUL RAHIM

: T08,03-13,04

: +607-55610143, +6011-22054058

: In this first level course, students are exposed to the financial reporting

regulatory framework (introduce key players in the financial reporting

environment in Malaysia; MASB, MIA, SC, CCM, Bursa Malaysia etc.) and

their role in capital market, SME sector, public sector and non-profit sector

(NGOs, charitable organisation etc). Students will also be introduced to the

financial reporting conceptual framework, elements such as assets, liabilities,

equity, income and expenses, components of financial statements (including

the relationship between statement of financial position, statement of

comprehensive income, statement of cash flow and statement of changes in

equity). Basic financial statement analysis, component of equity and financial

reporting standards such presentation of financial statements, fair value

measurement, inventories, PPE, non-current assets held for sales, government

grants and intangible are also introduced.

LEARNING OUTCOMES

By the end of the course, students should be able to:

No Course Learning Outcome

.

1.

Page : 1 of 4

Distinguish different forms of business and

its reporting environment

Discuss issues in the conceptual framework

for financial accounting and reporting

Discuss the requirement for preparation of

and prepare the financial statement.

Discuss

and

estimate

fair

value

measurement

Apply approved accounting standards to

account for cash, receivables and

inventories,

Apply approved accounting standards to

account for property, plant and equipment,

non-current assets held for sales and

intangible assets.

Distinguish different types of share capital

and reserves and prepare Statement of

Changes in Equity.

Prepared by:

Name: KAMARUZZAMAN ABDUL RAHIM

Signature: Kamaruzzaman

Date: 1 SEPTEMBER

Programme

Learning

Outcome(s)

Addressed

PO1

Taxonomy

Assessment

Methods

C2

T,Q

PO1

C2

PO1

C2

T, F

PO1

C3

PO1

C3

PO1

C3

PO1

C3

F,Q

Certified by:

Name: DR ANIZA BINTI OTHMAN

Signature:

Date: 1 SEPTEMBER 2016

Department & Faculty: Dept. of Accounting

and Finance, Faculty of Management

Course Code: SHAC1103 Financial Accounting

and Reporting 1

Total Lecture Hours: 42 hours

8.

9.

10.

11.

Carry out basic financial statement analysis

and interpret the financial ratios

Evaluate the financial performance and

financial position to make business

decisions.

Communicate effectively project findings

through oral presentation and written report

Work collaboratively and assume different

roles in a team to solve a problem through a

project paper.

Page : 2 of 4

Semester: I

Academic Session: 2016/2017

PO2

C4

GP

PO12

KK 1

GP

PO9

CS4

GP, P

PO8

TS3

GP

(T - Test ; Q Quiz; F Final

Exam; GP-Group

Project, P Presentation

STUDENT LEARNING TIME

Teaching and Learning Activities

Student Learning Time (hours)

1. Lecture

2. Independent Study

- self learning

- information search

- library search

- reading

- peer discussion

- exercises

3. Tutorial

4. Test

5. Exam (1x)

Total

42

59

14

2

3

120

TEACHING METHODOLOGY

Lecture and Discussion, Co-operative Learning, Independent Study

WEEKLY SCHEDULE

Week

Week 1

:

Overview of accounting

Financial reporting environment in Malaysia

Forms of business and different reporting

requirements

Functions or role of accounting

References

Department & Faculty: Dept. of Accounting

and Finance, Faculty of Management

Course Code: SHAC1103 Financial Accounting

and Reporting 1

Total Lecture Hours: 42 hours

Week 2

Week 3

Semester: I

Academic Session: 2016/2017

Accounting principles and concepts

Regulatory and conceptual framework for

corporate reporting

Qualitative characteristics of financial reporting

o Fundamental

o Enhancing

o Pervasive constraint

Going concern assumption

Elements of financial statement

Recognition of elements of

financial statement

Measurement of elements of

financial statement

Misunderstandings about the

conceptual framework

Presentation of Financial Statements

MFRS101 Presentation of financial statements

o Statement of Financial Position

o Statement of Comprehensive Income

o Statement of Changes in Equity

o Cash flow statement

o Notes to the financial statements

Week 4

Fair Value Measurement

Week 5 - 6

Accounting for Current Assets

Cash

Receivables

Inventories

Definition

Initial recognition

Initial measurement

Subsequent measurement

De-recognition, disposal

Disclosure

Week 7 - 10

Page : 3 of 4

Non-Current Tangible Assets

Property, plant and equipment

Definition

Initial recognition

Initial measurement

Subsequent measurement

De-recognition, disposal

Conceptual Framework

for Financial Reporting

MFRS 101

MFRS 13

MFRS 9

MFRS 102

MFRS 116

MFRS 120

MFRS 5

MFRS 136

MFRS 137

MFRS 123

MFRS 13

Department & Faculty: Dept. of Accounting

and Finance, Faculty of Management

Course Code: SHAC1103 Financial Accounting

and Reporting 1

Total Lecture Hours: 42 hours

Week 11 - 12

Page : 4 of 4

Semester: I

Academic Session: 2016/2017

Disclosure

Non-current assets held for sales

Government grants

Intangible Assets

Definition

Initial Recognition by Way of Acquisition

Initial Measurement

Subsequent measurement

De-recognition

Disclosure

Week 13

Basic Financial Statements Analysis

Week 14

Equity

Definition

Statement of Changes in Equity

o ShareCapital

o Reserves

Distributable

Non-distributable

:

REFERENCE

S

GRADING

IFRIC 1

IFRIC 18

MFRS 138

MFRS 136

MFRS 13

MFRS 120

MFRS 101

Conceptual Framework

for Financial Reporting

Main Text:

Ahmad, A., Mohd Saat, N.A., Mahmud, R., Mohd Aripin, R., Ngalim, S.M., Abd

Talib, M. and Abdullah, A.A. (2015). Financial Accounting and Reporting 1.

Oxfor University Press. Malaysia.

Other References:

1. Lazar, J. and Choo, H.C. (2014). Malaysian Financial Reporting Standards.

4th Edition. McGrawHill Education. Malaysia.

2. Lazar, J. and Leng, T.L. (2013). Company and Group Financial Reporting.

Revised 7th Edition. Pearson. Malaysia.

3. Juan, N.E. (2012). A Practical Guide to Financial Reporting Standards

(Malaysia). 3rd Edition. CCH. Asia.

4. Tong, T.L. (2011). Financial Accounting and Reporting in Malaysia (Volume1).

4th Edition. CCH. Asia.

5. Tong, T.L. (2011). Financial Accounting and Reporting in Malaysia (Volume

2). 4th Edition. CCH Asia.

6. Thomas, A. and Ward, A .M. (2012). Introduction to Financial Accounting. 7th

Edition. McGraw-Hill. UK.

7. Harrison, W., Horngren, C.T., Thomas, B. and Suwardy, T. (2010). Financial

Accounting Plus MyAccountingLab. 8th Edition. Pearson. UK.

8. Relevant Malaysia Financial Reporting Standards (MFRS).

9. Relevant International Financial Reporting Standards (IFRS).

Department & Faculty: Dept. of Accounting

and Finance, Faculty of Management

Course Code: SHAC1103 Financial Accounting

and Reporting 1

Total Lecture Hours: 42 hours

No.

Semester: I

Academic Session: 2016/2017

Number

% each

% total

20

20

15

15

Mid-term exam

Group Project &

Presentation

Quizzes

2.5

Final Exam

60

60

1

2

Assessment

Page : 5 of 4

Overall Total

100

Dates

Você também pode gostar

- ELEMENTS OF BOOK-KEEPING II EditedDocumento150 páginasELEMENTS OF BOOK-KEEPING II EditedGifty Asuquo100% (1)

- C11 Principles and Practice of InsuranceDocumento9 páginasC11 Principles and Practice of InsuranceAnonymous y3E7ia100% (2)

- Exclusive Investment Cheat Sheet: The Ultimate Wealth Creation SummitDocumento14 páginasExclusive Investment Cheat Sheet: The Ultimate Wealth Creation SummitMohammad Samiullah100% (1)

- Preqin Latin America Report 2021Documento35 páginasPreqin Latin America Report 2021Carlos ArangoAinda não há avaliações

- 2015-2016 Rotman Fact SheetDocumento114 páginas2015-2016 Rotman Fact SheetRichmond LauAinda não há avaliações

- FINN 100-Principles of Finance-Mohammad Basharullah-Arslan Shahid Butt-Humza GhaffarDocumento7 páginasFINN 100-Principles of Finance-Mohammad Basharullah-Arslan Shahid Butt-Humza GhaffarHaris AliAinda não há avaliações

- Financial Acccounting MBA KUKDocumento125 páginasFinancial Acccounting MBA KUKlalit_wadhwa_1100% (2)

- Case Delta Beverage Group 7Documento8 páginasCase Delta Beverage Group 7Wouter Hendriksen100% (1)

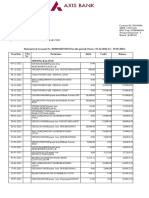

- Garima Axis Bank SDocumento3 páginasGarima Axis Bank SSajan Sharma100% (1)

- Chapter 11 Pfrs For Small and Medium-Sized Entities (Smes)Documento38 páginasChapter 11 Pfrs For Small and Medium-Sized Entities (Smes)Sarah G100% (1)

- Students' Perception of The Causes of Low Performance in Financial AccountingDocumento48 páginasStudents' Perception of The Causes of Low Performance in Financial AccountingJodie Sagdullas100% (2)

- Deed of Conditional Sale House and Lot DraftDocumento3 páginasDeed of Conditional Sale House and Lot DraftJanmari G. FajardoAinda não há avaliações

- Course Book TAKTKTDocumento201 páginasCourse Book TAKTKTHạ MộcAinda não há avaliações

- Financial Accounting TheoryDocumento8 páginasFinancial Accounting TheoryJustAHumanAinda não há avaliações

- Financial Analysis and Control: Financial Awareness for Students and ManagersNo EverandFinancial Analysis and Control: Financial Awareness for Students and ManagersNota: 2 de 5 estrelas2/5 (2)

- Intermediate Accounting 2 Syllabus 2015Documento5 páginasIntermediate Accounting 2 Syllabus 2015Altea ZaimanAinda não há avaliações

- Financial Reporting and AnalysisDocumento5 páginasFinancial Reporting and AnalysisPiyush AgarwalAinda não há avaliações

- Learn Financial Accounting FundamentalsDocumento4 páginasLearn Financial Accounting FundamentalsAnira RosliAinda não há avaliações

- Financial Reporting & AnalysisDocumento6 páginasFinancial Reporting & AnalysisrakeshAinda não há avaliações

- Course Outline Intermediate and Advanced Accounting1 Revised 2Documento5 páginasCourse Outline Intermediate and Advanced Accounting1 Revised 2Amde GetuAinda não há avaliações

- Accreditation Accounting & FinanceDocumento112 páginasAccreditation Accounting & Financeobaly musukwaAinda não há avaliações

- Financial Statement Analysis - Session PlanDocumento2 páginasFinancial Statement Analysis - Session PlanAnkit SaxenaAinda não há avaliações

- ACCT201 Corporate Reporting & Financial Analysis: Course Outline 2018/2019 Term 1Documento4 páginasACCT201 Corporate Reporting & Financial Analysis: Course Outline 2018/2019 Term 1Hohoho134Ainda não há avaliações

- Course Outlines of G&NFPEDocumento6 páginasCourse Outlines of G&NFPEHirko DiribaAinda não há avaliações

- Course Plan: Principle of Accounting IIDocumento5 páginasCourse Plan: Principle of Accounting IIYusuf HusseinAinda não há avaliações

- School of Economics, Finance & Banking Uum College of BusinessDocumento9 páginasSchool of Economics, Finance & Banking Uum College of BusinessSeekengAinda não há avaliações

- IILM Graduate School of ManagementDocumento15 páginasIILM Graduate School of ManagementMd. Shad AnwarAinda não há avaliações

- IIM Bangalore Financial Accounting course outlineDocumento4 páginasIIM Bangalore Financial Accounting course outlineShabir AhmedAinda não há avaliações

- Universiti Teknologi Mara: Acc406: Intermediate Financial Accounting and ReportingDocumento3 páginasUniversiti Teknologi Mara: Acc406: Intermediate Financial Accounting and Reportingnur asmaaAinda não há avaliações

- UUM Business Accounting Course OverviewDocumento5 páginasUUM Business Accounting Course OverviewSozia TanAinda não há avaliações

- AF101 Course Outline s1 2024Documento11 páginasAF101 Course Outline s1 2024Maciu TuilevukaAinda não há avaliações

- Course Code: Course Name: Course Description:: UC-VPAA-COA-SYL-53 September 17, 2012.rev.1Documento8 páginasCourse Code: Course Name: Course Description:: UC-VPAA-COA-SYL-53 September 17, 2012.rev.1Annie EinnaAinda não há avaliações

- FAR 635 - Lesson PlanDocumento11 páginasFAR 635 - Lesson PlanAmirah HananiAinda não há avaliações

- Name: Mrs Felicia AnsahDocumento6 páginasName: Mrs Felicia Ansahsalifu yahayaAinda não há avaliações

- FA MBA Quarter I SNU Course Outline 2020Documento7 páginasFA MBA Quarter I SNU Course Outline 2020Kartikey BharadwajAinda não há avaliações

- ICMAP Syllabus 2012Documento33 páginasICMAP Syllabus 2012FaisalAinda não há avaliações

- Finaman Graduate Syllabus Rev 1 PDFDocumento3 páginasFinaman Graduate Syllabus Rev 1 PDFCaryl DominguezAinda não há avaliações

- AF102 Course OutlineDocumento18 páginasAF102 Course OutlineIsfundiyerTaungaAinda não há avaliações

- Advanced Financial Reporting Module OutlineDocumento4 páginasAdvanced Financial Reporting Module Outlineevans muteeraAinda não há avaliações

- BSC Accounting and Finance - Intermediate Financial AccountingDocumento4 páginasBSC Accounting and Finance - Intermediate Financial AccountingEverjoice ChatoraAinda não há avaliações

- BFN715Documento244 páginasBFN715Misbah MirzaAinda não há avaliações

- PGDM I Semester I Management Accounting - 1 (Ma-1) : 1. Course ObjectiveDocumento4 páginasPGDM I Semester I Management Accounting - 1 (Ma-1) : 1. Course Objectivecooldude690Ainda não há avaliações

- De cuong Tai chính doanh nghiệp 1 (tiếng Anh)Documento12 páginasDe cuong Tai chính doanh nghiệp 1 (tiếng Anh)Faith Le100% (1)

- MFRD GuidelinesDocumento5 páginasMFRD GuidelinesNguyen Dac ThichAinda não há avaliações

- GM5101: Accounting and Finance CourseDocumento2 páginasGM5101: Accounting and Finance Courserakeshsharmarv3577Ainda não há avaliações

- Lesson Plan - Fin430 Semester March 2023Documento3 páginasLesson Plan - Fin430 Semester March 2023Nur Nadirah HamidiAinda não há avaliações

- FINS1612 Capital Markets Course OutlineDocumento17 páginasFINS1612 Capital Markets Course OutlinenooguAinda não há avaliações

- Advanced Financial Accounting: FTMS College Malaysia (2011)Documento6 páginasAdvanced Financial Accounting: FTMS College Malaysia (2011)891511Ainda não há avaliações

- Financial Management 1st Sem 15-16 HODocumento3 páginasFinancial Management 1st Sem 15-16 HOGopi SatyaAinda não há avaliações

- Course Objectives & Competences To Be AcquiredDocumento2 páginasCourse Objectives & Competences To Be AcquiredHussen AbdulkadirAinda não há avaliações

- UCFS SyllabusDocumento2 páginasUCFS Syllabusbhargav.bhut112007Ainda não há avaliações

- Agw610 Course Outline Sem 1 2013-14 PDFDocumento12 páginasAgw610 Course Outline Sem 1 2013-14 PDFsamhensemAinda não há avaliações

- Syllabus Commercial Banking 2Documento9 páginasSyllabus Commercial Banking 2Ảo Tung ChảoAinda não há avaliações

- SUCC102Documento264 páginasSUCC102joy100% (1)

- Financial ReportingDocumento3 páginasFinancial Reportinggembel mlithiAinda não há avaliações

- ACCT2542 Corporate Financial Reporting and Analysis S22012 PartADocumento16 páginasACCT2542 Corporate Financial Reporting and Analysis S22012 PartAAngela AuAinda não há avaliações

- ACCT335 PT Public VersionDocumento6 páginasACCT335 PT Public VersionNurhanifah SoedarsAinda não há avaliações

- Fina2330 Outline Fmi 2021Documento4 páginasFina2330 Outline Fmi 2021LUI RogerAinda não há avaliações

- Mii 103Documento2 páginasMii 103Khalids MusaAinda não há avaliações

- FM 09-10 Financial Statement AnalysisDocumento4 páginasFM 09-10 Financial Statement AnalysisRohit GuptaAinda não há avaliações

- Indian Institute of Management Kozhikode Executive Post Graduate Programme in ManagementDocumento3 páginasIndian Institute of Management Kozhikode Executive Post Graduate Programme in Managementreva_radhakrish1834Ainda não há avaliações

- IIM Bangalore Financial Accounting course outlineDocumento3 páginasIIM Bangalore Financial Accounting course outlineSmriti AggarwalAinda não há avaliações

- MGT AssignDocumento242 páginasMGT AssignVivian ArigbedeAinda não há avaliações

- Principles of Accounting: Course DescriptionDocumento10 páginasPrinciples of Accounting: Course DescriptionFasil BulaAinda não há avaliações

- Rahimie GE20003 Islamic Financial SystemDocumento5 páginasRahimie GE20003 Islamic Financial SystemMohamad Amirul AminAinda não há avaliações

- Vdocuments - MX - Blackbook Project On Mutual Funds PDFDocumento88 páginasVdocuments - MX - Blackbook Project On Mutual Funds PDFAbu Sufiyan ShaikhAinda não há avaliações

- The Payment of Bonus Act, 1965Documento15 páginasThe Payment of Bonus Act, 1965Raman GhaiAinda não há avaliações

- Bata & AB BankDocumento8 páginasBata & AB BankSaqeef RayhanAinda não há avaliações

- ACCT4010 Group Assignment SolutionsDocumento3 páginasACCT4010 Group Assignment SolutionsSin TungAinda não há avaliações

- Dvorak Mar 23Documento103 páginasDvorak Mar 23glimmertwins100% (1)

- ACC 570 CQ3b Practice Tax QuestionsDocumento2 páginasACC 570 CQ3b Practice Tax QuestionsMohitAinda não há avaliações

- Subramanian Cibil ReportDocumento13 páginasSubramanian Cibil ReportManish KumarAinda não há avaliações

- PROFILE FINTECH MENARA JAMSOSTEK - ContohDocumento18 páginasPROFILE FINTECH MENARA JAMSOSTEK - ContohRioz GonzalezAinda não há avaliações

- Tutorial Letter 102/3/2020: Question BankDocumento303 páginasTutorial Letter 102/3/2020: Question Bankdivyesh mehtaAinda não há avaliações

- Report on Saurashtra Chemicals Ltd: Organization, Departments & FunctionsDocumento85 páginasReport on Saurashtra Chemicals Ltd: Organization, Departments & FunctionsBhavesh RogheliyaAinda não há avaliações

- Case Study Currency SwapsDocumento2 páginasCase Study Currency SwapsSourav Maity100% (2)

- Registration flow and documentsDocumento22 páginasRegistration flow and documentsmdzainiAinda não há avaliações

- Bangladesh's Leading Mobile Banking ServicesDocumento12 páginasBangladesh's Leading Mobile Banking ServicesTaymur Hasan MunnaAinda não há avaliações

- PPE HandoutsDocumento6 páginasPPE Handoutsashish.mathur1Ainda não há avaliações

- Sakthi Fianance Project ReportDocumento61 páginasSakthi Fianance Project ReportraveenkumarAinda não há avaliações

- Internal Audit For Finance SectorDocumento1 páginaInternal Audit For Finance SectorSURYA SAinda não há avaliações

- Passage No 50Documento7 páginasPassage No 50SanchitAinda não há avaliações

- EF2A1 HDT Budget Upto Direct Taxes PCB4 1629376359978Documento30 páginasEF2A1 HDT Budget Upto Direct Taxes PCB4 1629376359978Mamta Patel100% (1)

- Bcoc 136Documento2 páginasBcoc 136Suraj JaiswalAinda não há avaliações

- NpoDocumento30 páginasNpoSaurabh AdakAinda não há avaliações

- t8. Money Growth and InflationDocumento53 páginast8. Money Growth and Inflationmimi96Ainda não há avaliações

- Blue Chip Share in Bangladesh.. (Premier University)Documento65 páginasBlue Chip Share in Bangladesh.. (Premier University)সুদেষ্ণা দাশ0% (2)

- Consumer Mathematics: Gwendolyn TadeoDocumento14 páginasConsumer Mathematics: Gwendolyn TadeoproximusAinda não há avaliações