Escolar Documentos

Profissional Documentos

Cultura Documentos

U 6200 - Accounting For International and Public Affairs Session 4: Pre-Class Assignment Accrual Accounting

Enviado por

sachin_sacTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

U 6200 - Accounting For International and Public Affairs Session 4: Pre-Class Assignment Accrual Accounting

Enviado por

sachin_sacDireitos autorais:

Formatos disponíveis

U 6200 Accounting for International and Public Affairs

Session 4: Pre-Class Assignment

Accrual Accounting

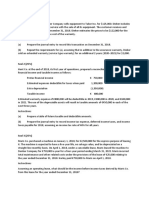

(a) When Company A purchases inventory, it records the transaction as follows:

(Asset) Inventory

(Liability) Accounts payable

xxx

xxx

At the beginning of the year, the balance in the inventory account was $250,000. Sales

during the year totaled $6,000,000. Purchases of inventory during the year totaled

$3,800,000. At the end of the year, the company takes a physical inventory and

determines that the cost of the inventory on hand totals $295,000. (Note: company uses

the periodic inventory method vs. the perpetual inventory method). What adjusting entry

will the company make in order to prepare its year-end financial statements?

How much gross profit will the company report in its year-end income statement?

(b) Company B rents office space on an annual lease which runs from November 1, 2015

to October 31, 2016. Lease payments are made semi-annually, with the first payment

due at the inception of the lease period. For the period November 1, 2015 October 31,

2016, the annual lease cost is $50,000. As of November 1, 2016, the company renews the

lease at an annual cost of $60,000.

(i) How much rent expense will the company report in its 12/31/15 income statement and

how much prepaid rent will it report on its 12/31/15 balance sheet?

(b) Company B contd.

(ii) How much rent expense will the company report in its 12/31/16 income statement

and how much prepaid rent will it report on its 12/31/16 balance sheet?

(c) Company C has a loan outstanding (long-term) of $1,000,000 with interest @ 10%

per annum, payable semi-annually on February 1 and August 1. Note: Unlike rent or

insurance, which is generally paid in advance, interest is generally paid in arrears.

(i)

How much interest expense will the company report in its income statement for

the year ending December 31, 2015?

(ii)

How much will the company report as liabilities on its December 31, 2015

balance sheet related to the borrowings?

(d) Company D reports retained earnings as of December 31, 2014 of $2,500,000.

During 2015, the company has revenues (sales) of $5,000,000, expenses of $4,200,000

and pays dividends to shareholders of $300,000.

(i)

What amount will the company report as net income in its income statement for

the year ending December 31, 2015?

(ii)

What amount will the company report as retained earnings on its December 31,

2015 balance sheet?

(e) Company E operates health clubs, which offer discounted membership for those who

pay 12 months of membership up-front. On March 1 a member pays $1,200 for a 12month membership. How will the transaction impact the year-end December 31 balance

sheet? The year-end December 31 income statement?

Você também pode gostar

- Kuis 2 AK 2 GNP 1314 - Leasing Tax - RegulerDocumento4 páginasKuis 2 AK 2 GNP 1314 - Leasing Tax - RegulerBastian Nugraha SiraitAinda não há avaliações

- Section 1: Accrued Revenue: Mastering Adjusting EntriesDocumento4 páginasSection 1: Accrued Revenue: Mastering Adjusting EntriesMarc Eric Redondo50% (2)

- Mock Test Paper 2Documento7 páginasMock Test Paper 2FarrukhsgAinda não há avaliações

- Answers R41920 Acctg Varsity Basic Acctg Level 1Documento6 páginasAnswers R41920 Acctg Varsity Basic Acctg Level 1John AceAinda não há avaliações

- Lecture Notes Chapters 1-4Documento28 páginasLecture Notes Chapters 1-4BlueFireOblivionAinda não há avaliações

- Qualifying Round QuestionsDocumento9 páginasQualifying Round QuestionsShenne MinglanaAinda não há avaliações

- Intermediate Accounting Kieso 14th ch8, 9, 10, 11Documento8 páginasIntermediate Accounting Kieso 14th ch8, 9, 10, 11Alessandro BattellinoAinda não há avaliações

- Afar QuestionsDocumento16 páginasAfar Questionspopsie tulalianAinda não há avaliações

- Midterms Part 1Documento3 páginasMidterms Part 1Chris CastleAinda não há avaliações

- Financial Accounting Mock Test PaperDocumento7 páginasFinancial Accounting Mock Test PaperBharathFrnzbookAinda não há avaliações

- Reen LawnsDocumento8 páginasReen LawnsAshish BhallaAinda não há avaliações

- Chapter 3 Quick StudyDocumento10 páginasChapter 3 Quick StudyPhạm Hồng Trang Alice -Ainda não há avaliações

- Multiple Choice Questions On Financial Accounting V2Documento6 páginasMultiple Choice Questions On Financial Accounting V2Kate FernandezAinda não há avaliações

- Afa 1 Icmab QuestionsDocumento65 páginasAfa 1 Icmab QuestionsKamrul HassanAinda não há avaliações

- CMA MCQ Self Entrance-1Documento2 páginasCMA MCQ Self Entrance-1Ava DasAinda não há avaliações

- TradesDocumento3 páginasTradesAlber Howell MagadiaAinda não há avaliações

- Accounts TestDocumento6 páginasAccounts Testwaqas malikAinda não há avaliações

- Online Quiz Questions on Accounting AdjustmentsDocumento5 páginasOnline Quiz Questions on Accounting AdjustmentsVincent Larrie Moldez100% (1)

- Coordinated Assignment 2 Spring 2021Documento4 páginasCoordinated Assignment 2 Spring 2021Affan AhmedAinda não há avaliações

- F3 Final Mock 2Documento8 páginasF3 Final Mock 2Nicat IsmayıloffAinda não há avaliações

- The Accounting ProcessDocumento5 páginasThe Accounting ProcessXienaAinda não há avaliações

- Tutorial 8Documento6 páginasTutorial 8Waruna PrabhaswaraAinda não há avaliações

- Chapter 13 In-Class Exercise Set SolutionsDocumento10 páginasChapter 13 In-Class Exercise Set SolutionsJudith Garcia0% (1)

- Cash BasisDocumento4 páginasCash BasisMark DiezAinda não há avaliações

- Ia 2 Compilation of Quiz and ExercisesDocumento16 páginasIa 2 Compilation of Quiz and ExercisesclairedennprztananAinda não há avaliações

- REVIEW-MATERIALS-THE-ACCOUNTING-PROCESS-TO-ACCOUNTS-RECEIVABLEDocumento7 páginasREVIEW-MATERIALS-THE-ACCOUNTING-PROCESS-TO-ACCOUNTS-RECEIVABLEMarin, Nicole DondoyanoAinda não há avaliações

- Calculating Consolidated Net IncomeDocumento18 páginasCalculating Consolidated Net IncomeFleo GardivoAinda não há avaliações

- Correction of Error ALDocumento6 páginasCorrection of Error ALKwan Yin HoAinda não há avaliações

- Accounting Cycle of A Service Business-Step 5-Adjusting EntriesDocumento18 páginasAccounting Cycle of A Service Business-Step 5-Adjusting EntriesdelgadojudithAinda não há avaliações

- SOAL Kuis Materi UAS Inter 2Documento2 páginasSOAL Kuis Materi UAS Inter 2vania 322019087Ainda não há avaliações

- SOAL Kuis Materi UAS Inter 2Documento2 páginasSOAL Kuis Materi UAS Inter 2vania 322019087Ainda não há avaliações

- Accounting Solve AssignmentDocumento8 páginasAccounting Solve AssignmentDanyal ChaudharyAinda não há avaliações

- Assignment 1Documento3 páginasAssignment 1Sheikh AnasAinda não há avaliações

- Mle02 Far 1 Answer KeyDocumento9 páginasMle02 Far 1 Answer KeyCarAinda não há avaliações

- ACT 2100 Worksheet IIIDocumento4 páginasACT 2100 Worksheet IIIAshmini PershadAinda não há avaliações

- Bram Wear CaseDocumento2 páginasBram Wear CaseHabtamu Ye Asnaku Lij89% (9)

- Prelim Lecture 1 Assignment: Multiple ChoiceDocumento4 páginasPrelim Lecture 1 Assignment: Multiple Choicelinkin soyAinda não há avaliações

- All IntermediateDocumento495 páginasAll IntermediateTokis SabaAinda não há avaliações

- ACCT 557 Final ExamDocumento18 páginasACCT 557 Final Examlynnturner123Ainda não há avaliações

- AFAR - Revenue Recognition, JointDocumento3 páginasAFAR - Revenue Recognition, JointJoanna Rose DeciarAinda não há avaliações

- đề kiểm tra nguyên lý kế toán 1 2Documento5 páginasđề kiểm tra nguyên lý kế toán 1 2Lê Thanh HuyềnAinda não há avaliações

- MBA 503 - Exam 1Documento6 páginasMBA 503 - Exam 1Harshitha AnudeepAinda não há avaliações

- Answers R41920 Acctg Varsity Basic Acctg Level 2Documento12 páginasAnswers R41920 Acctg Varsity Basic Acctg Level 2John AceAinda não há avaliações

- DHS Accountancy 2021Documento30 páginasDHS Accountancy 2021Kuenga Geltshen100% (2)

- Ecomprehensiveexam eDocumento12 páginasEcomprehensiveexam eDominic SociaAinda não há avaliações

- PA1 Mock ExamDocumento18 páginasPA1 Mock Examyciamyr67% (3)

- IFRS 15 Revenue Recognition ExamplesDocumento4 páginasIFRS 15 Revenue Recognition ExamplesFeruz Sha RakinAinda não há avaliações

- DL PT1Q F3 201301Documento14 páginasDL PT1Q F3 201301MpuTitasAinda não há avaliações

- Receivables ProblemsDocumento13 páginasReceivables ProblemsIris Mnemosyne0% (1)

- Econ 3a Midterm 1 WorksheetDocumento21 páginasEcon 3a Midterm 1 WorksheetZyania LizarragaAinda não há avaliações

- IF2 - Project 1 PDFDocumento6 páginasIF2 - Project 1 PDFBillAinda não há avaliações

- Adjusting EntriesDocumento7 páginasAdjusting EntriesMichael MagdaogAinda não há avaliações

- AdditionalDocumento18 páginasAdditionaldarlene floresAinda não há avaliações

- Exercise LiabilitiesDocumento2 páginasExercise LiabilitiesAlaine Milka GosycoAinda não há avaliações

- SW ErrorsDocumento5 páginasSW ErrorsArlea AsenciAinda não há avaliações

- Chapter 7Documento19 páginasChapter 7nimnim85% (13)

- Answer Key Chapter 4Documento2 páginasAnswer Key Chapter 4Emily TanAinda não há avaliações

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionAinda não há avaliações

- Berman and Bui - Environmental Regulation and ProductivityDocumento13 páginasBerman and Bui - Environmental Regulation and Productivitysachin_sacAinda não há avaliações

- BBPS - FREQUENTLY ASKED QUESTIONS - April 16 2020 - SeenDocumento7 páginasBBPS - FREQUENTLY ASKED QUESTIONS - April 16 2020 - Seensachin_sacAinda não há avaliações

- Service Fellow PD - Volunteer Development CoordinatorDocumento2 páginasService Fellow PD - Volunteer Development Coordinatorsachin_sacAinda não há avaliações

- Clinton Foundation FSDocumento117 páginasClinton Foundation FSsachin_sacAinda não há avaliações

- Abbott 2012 Global Sustainability GovernanceDocumento22 páginasAbbott 2012 Global Sustainability Governancesachin_sacAinda não há avaliações

- 2016-2017 NYC Service Fellowship FAQsDocumento2 páginas2016-2017 NYC Service Fellowship FAQssachin_sacAinda não há avaliações

- 2016-2017 NYC Service Fellowship Eligibility RequirementsDocumento1 página2016-2017 NYC Service Fellowship Eligibility Requirementssachin_sacAinda não há avaliações

- BBPS - FREQUENTLY ASKED QUESTIONS - April 16 2020 - SeenDocumento7 páginasBBPS - FREQUENTLY ASKED QUESTIONS - April 16 2020 - Seensachin_sacAinda não há avaliações

- Clinton Foundation FSDocumento117 páginasClinton Foundation FSsachin_sacAinda não há avaliações

- Caiib Financialmgt A MCQDocumento15 páginasCaiib Financialmgt A MCQsilyyjay121Ainda não há avaliações

- Banking On BlockchainDocumento28 páginasBanking On Blockchainldhutch100% (2)

- Public Econmy Assistant PDFDocumento25 páginasPublic Econmy Assistant PDFsachin_sacAinda não há avaliações

- Event Update Demonetization and Its ImpactDocumento3 páginasEvent Update Demonetization and Its ImpactMinuAinda não há avaliações

- Profiles in Innovation May 24 2016 1 PDFDocumento88 páginasProfiles in Innovation May 24 2016 1 PDFsachin_sacAinda não há avaliações

- IEA 2015 Energy Technology Perspectives PDFDocumento14 páginasIEA 2015 Energy Technology Perspectives PDFsachin_sacAinda não há avaliações

- USAID Fragile States StrategyDocumento28 páginasUSAID Fragile States Strategysachin_sacAinda não há avaliações

- DFID Guidance For Political Economy AnalysisDocumento29 páginasDFID Guidance For Political Economy Analysissachin_sacAinda não há avaliações

- Grindle and Thomas - Public Choices and Policy Change ConclusionDocumento7 páginasGrindle and Thomas - Public Choices and Policy Change Conclusionsachin_sacAinda não há avaliações

- Profiles in Innovation May 24 2016 1 PDFDocumento88 páginasProfiles in Innovation May 24 2016 1 PDFsachin_sacAinda não há avaliações

- Invest in Emerging Companies of TomorrowDocumento4 páginasInvest in Emerging Companies of Tomorrowsachin_sac100% (1)

- Banking On BlockchainDocumento28 páginasBanking On Blockchainldhutch100% (2)

- C01 Garrison FurnitureDocumento10 páginasC01 Garrison Furnituresachin_sacAinda não há avaliações