Escolar Documentos

Profissional Documentos

Cultura Documentos

Malayan Banking BHD V Ching Suit Fee - (2012

Enviado por

Norlia Md DesaTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Malayan Banking BHD V Ching Suit Fee - (2012

Enviado por

Norlia Md DesaDireitos autorais:

Formatos disponíveis

Page 1

Page 2

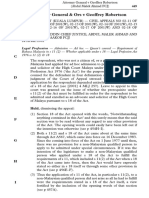

Malayan Law Journal Reports/2012/Volume 2/Malayan Banking Bhd v Ching Suit Fee - [2012] 2 MLJ 289 11 January 2012

10 pages

[2012] 2 MLJ 289

Malayan Banking Bhd v Ching Suit Fee

FEDERAL COURT (PUTRAJAYA)

ZULKEFLI CJ (MALAYA), MOHD GHAZALIAND HASAN LAH FCJJ

CIVIL APPEAL NO 02 FFL-2 OF 2011(W)

11 January 2012

Banking -- Banks and banking business -- Letter of credit -- Issuing bank paid monies on sight of irrevocable

letter of credit without reservation -- Discrepancies later found in documents concerning letter of credit -Whether monies paid under mistake -- Whether issuing bank estopped from claiming for refund

A Taiwanese company ('the company') which purchased goods from the respondent instructed its issuing

bank, TBB, to open a letter of credit for RM194,800 in the respondent's favour. The respondent requested the

appellant bank to negotiate the transaction for the letter of credit and handed it various relevant documents

for that purpose. The appellant later confirmed to the reimbursing bank, Hong Kong and Shanghai Banking

Corp ('HSBC'), that the documents were complete and the terms and conditions of the letter of credit had

been complied with and claimed payment of the RM194,800 from TBB through HSBC. TBB instructed HSBC

to release the sum to the appellant which credited the respondent's account with RM194,605. Two days later,

TBB informed the appellant there were discrepancies in the documents it had forwarded. The appellant

thereupon demanded from the respondent a refund of the credited sum plus interest. The respondent

objected, saying goods had been shipped and that all conditions of the letter of credit had been fulfilled. The

respondent submitted rectified documents as requested by the appellant but made it clear that the appellant

should not refund the monies received. The appellant, nevertheless, debited the respondent's account and

refunded RM196,528 to HSBC. The respondent sued the appellant for wrongfully debiting her account. The

High Court allowed her claim. The decision was upheld by the Court of Appeal on appeal. The appellant then

appealed to the Federal Court.

Held, dismissing the appeal with RM25,000 costs:

1)

1)

1)

1)

1)

The issuing bank had no right to seek the return of the monies it had paid to the appellant as

payment was mandatory upon sight of the irrevocable letter of credit (see paras 8-9).

Having accepted the documents submitted and made payments without reservations, the

issuing bank was estopped from demanding the return of the payment on the grounds of

alleged defects or discrepancies. There

2 MLJ 289 at 290

had to be certainty, promptness and finality of payment which a letter of credit served to provide

to the transacting parties (see para 11).

There was no evidence the respondent had requested for the return of the documents. At any

rate, the alleged return of the documents for rectification did not give an automatic right to the

appellant to demand a refund or debit the respondent's account unilaterally (see para 12).

The appellant had requested for the documents for rectification by the respondent and to have

them re-submitted. Hence the alleged discrepancies, if any, had been resolved and there was

no basis for the return of the money (see para 12).

There was no payment by mistake to the respondent because the payment was in fact due to

her under the letter of credit. There was no equitable ground to hold the money that had been

Page 3

paid by mistake and there was no fraud on the respondent's part in receiving the payment. The

appellant had, in fact, represented to the respondent that she was entitled to the payment and

by doing so, the appellant was estopped from seeking a refund (see para 17).

Sebuah syarikat Taiwan ('syarikat') yang membeli barangan daripada responden mengarahkan bank

pengeluarnya, TBB, untuk mengeluarkan surat kredit bagi sejumlah RM194,800 memihak kepada

responden. Responden meminta bank perayu untuk merundingkan transaksi untuk surat kredit dan

memberikan kepadanya pelbagai dokumen relevan bagi tujuan tersebut. Perayu kemudiannya mengesahkan

kepada bank reimbursing, Hong Kong and Shanghai Banking Corp ('HSBC'), bahawa dokumen-dokumen

adalah lengkap dan terma-terma dan syarat-syarat surat kredit telah dipenuhi dan pembayaran tuntutan

sebanyak RM194,800 daripada TBB melalui HSBC. TBB mengarahkan HSBC untuk membayar jumlah

tersebut kepada perayu yang mengkreditkan akaun responden dengan jumlah RM194,605. Dua hari

kemudian, TBB memberitahu perayu terdapat percanggahan dalam dokumen-dokumen yang telah dihantar.

Perayu dengan itu mendesak responden membayar semula jumlah yang dikreditkan dan faedah. Responden

membantah, dengan menyatakan barangan telah dihantar dan bahawa kesemua syarat surat kredit telah

dipenuhi. Responden menyerahkan dokumen-dokumen yang telah dipinda seperti yang dikehendaki oleh

perayu tetapi menjelaskan bahawa perayu tidak patut membayar balik wang yang telah diterima. Perayu

walau bagaimanapun mendebitkan akaun responden dan membayar balik RM196,528 kepada HSBC.

Responden menyaman perayu kerana telah secara salah mendebitkan akaunnya. Mahkamah Tinggi

membenarkan tuntutannya. Mahkamah Tinggi membenarkan tuntutannya.

2 MLJ 289 at 291

Keputusan disahkan oleh Mahkamah Rayuan atas rayuan. Perayu kemudiannya merayu ke Mahkamah

Persekutuan.

Diputuskan, menolak rayuan dengan kos RM25,000:

2)

2)

2)

2)

2)

Bank pengeluar tidak mempunyai hak untuk mendapatkan bayaran semula wang yang

dibayarnya kepada perayu memandangkan bayaran adalah mandatori atas prospek surat

kredit yang tidak boleh ditarik balik (lihat perenggan 8-9).

Setelah menerima dokumen-dokumen yang diserahkan dan membuat bayaran tanpa

kesangsian, bank pengeluar diestop daripada mendesak bayaran semula pembayaran atas

alasan kecacatan atau percanggahan yang didakwa. Mesti terdapat ketentuan, kesegeraan

dan penamatan bayaran yang mana surat kredit diserahkan untuk memperuntukkan kepada

pihak-pihak yang membuat transaksi (lihat perenggan 11).

Tidak terdapat keterangan bahawa responden telah memohon untuk pemulangan semula

dokumen-dokumen tersebut. Walau bagaimanapun, pemulangan dokumen-dokumen yang

didakwa untuk pembetulan tidak memberikan hak automatik kepada perayu untuk mendesak

bayaran semula atau debit akaun responden secara sebelah pihak (lihat perenggan 12).

Perayu telah memohon untuk pembetulan dokumen-dokumen oleh responden dan untuk ianya

diserahkan semula. Maka percanggahan yang didakwa, jika ada, telah diselesaikan dan tidak

terdapat asas untuk pemulangan wang tersebut (lihat perenggan 12).

Tidak terdapat bayaran tersilap kepada responden kerana pembayaran sebenarnya perlu

dibayar kepadanya di bawah surat kredit. Tidak terdapat alasan yang berekuiti untuk

memutuskan wang tersebut dibayar atas kesilapan dan tiada fraud di pihak responden dalam

menerima pembayaran tersebut. Perayu telah sebenarnya merepresentasikan kepada

responden bahawa dia berhak kepada pembayaran dan dengan berbuat demikian perayu

diestop daripada memohon bayaran semula (lihat perenggan 17).

Notes

For cases on letter of credit, see 1(2) Mallal's Digest (4th Ed 2010 Reissue) paras 2292-2319.

Cases referred to

Page 4

FC Seck Trading as Oversea Structural Company v Wong & Lee [1940] MLJ 182 (refd)

Hamzeh Malas & Sons v British Imex Industries Ltd [1958] 1 All ER 262 (refd)

Holt v Markham [1922] All ER 134, HL (refd)

2 MLJ 289 at 292

Kelly v Solari [1835-1842] All ER Rep 320 (folld)

Shiba Prasad Singh v Chandra Nandi (1949) 76 IA 244, PC (refd)

Legislation referred to

Contracts Act 1950 s 73

Indian Contract Act 1950 [IND] s 72

Appeal from: Civil Appeal No W-02-719 of 2005 (Court of Appeal, Putrajaya)

GK Ganeson (KN Geetha and SP Tan with him) (Abd Aziz Chen & Co) for the appellant.

K Ganesan (Indira Ghadi & Co) for the respondent.

Zulkefli CJ (Malaya):

INTRODUCTION

[1] This is an appeal by the appellant against the decision of the Court of Appeal in dismissing the appellant's

appeal against the decision of the High Court in allowing the respondent's claim against the appellant. Leave

to appeal was granted by this court on the following three questions:

1a)

1b)

1c)

whether under the Uniform Customs and Practice for Documentary Credit International

Chamber of Commerce (UCP 400) and international banking procedure, a negotiating bank

had a right of recourse against a beneficiary of a letter of credit;

whether the negotiating bank is obliged to return the monies paid by the issuing bank upon the

return of the documents to the beneficiary; and

whether under s 73 of the Contracts Act 1950, the negotiating bank was entitled to deduct its

customers account for the purpose of returning monies equivalent to the issuing bank's

demand?

BACKGROUND FACTS

[2] The relevant background facts and the chronology of events leading to the present appeal are as follows:

2a)

2b)

2c)

on 6 July 1993, McMillan Enterprises Co Ltd, a Taiwanese company ('the company') instructed

Taipei Business Bank ('TBB'), the issuing bank to open a letter of credit for a sum of

RM194,800 in favour of the respondent in respect of purchase of goods by the company from

the respondent. After receiving the letter of credit, the respondent requested the appellant, the

negotiating bank to assist in the letter of credit's

2 MLJ 289 at 293

transaction. The respondent handed various relevant documents to the appellant for it to

'negotiate' the letter of credit;

on 6 July 1993, Standard Chartered Bank, the advising bank, advised the appellant that the

letter of credit for the benefit of the respondent had been issued by TBB for the sum of

RM194,800;

on 10 July 1993, the respondent submitted the draft and documents for negotiations to the

appellant which included:

Page 5

1.

1.

1.

1.

1.

an original letter of credit No BAGAIM000937;

an original Airway Bill No 695 0094 5103;

original signed packing list in three copies;

two copies of signed bill of exchange; and

two copies of signed documentary collecting/negotiation forms.

1d)

1e)

1f)

1g)

1h)

1i)

1j)

1k)

1l)

1m)

1n)

on 12 July 1993 the appellant confirmed to the Hong Kong and Shanghai Banking Corp

('HSBC') the reimbursing bank that the said documents were complete and the terms and

conditions of the said letter of credit had been complied with and hence the appellant claimed

payment of RM194,800 from the issuing bank through the said reimbursement bank;

on 20 July 1993 TBB gave confirmation to HSBC to pay the appellant the sum claimed by the

appellant under the letter of credit;

on 22 July 1993 the appellant credited the respondent's account with the sum of RM194,605;

on 24 July 1993 TBB informed the appellant that there were discrepancies in the documents

forwarded to them by the appellant;

on 20 August 1993 the appellant demanded from the respondent for the refund of the sum

credited together with interest;

on 20 August 1993 the respondent refuted the appellant's demands, inter alia, stated that the

goods had been shipped and that all conditions of the letter of credit had been fulfilled. Any

refund made shall be at the appellant's own peril;

on 21 August 1993 the respondent submitted documents duly rectified as per appellant's

request and clearly stated that the appellant should withhold any refund;

on 24 August 1993 despite the objection by the respondent, the appellant unilaterally

proceeded to debit the respondent's account and refunded to HSBC the sum of RM196,528;

on 28 August 1993 the appellant informed TBB that it was unable to

2 MLJ 289 at 294

refund since TBB as the issuing bank had authorised payment and payment had in fact been

received by the appellant;

on 9 September 1993 the respondent sued the appellant claiming that the appellant had

wrongly deducted the customer's account of the respondent for the purpose of returning

monies equivalent to the issuing bank's demand; and

the High Court allowed the respondent's claim against the appellant. The Court of Appeal on

appeal affirmed the decision of the High Court. The appellant now appeals to this court against

the decision of the Court of Appeal.

CONTENTION OF THE APPELLANT

[3] It is the contention of the appellant that in a letter of credit's transaction, documents travel in 'opposite

direction' to the funds. It is based on documents which are negotiated instead of goods. Documentary

requirements are of utmost priority. Discrepancies in documents would mark the end of the transaction, and

time is of essence. When an issuing bank rejects the documents due to discrepancies, the beneficiary is

entitled to demand for the return of the documents and the issuing bank must receive the credit it sent to the

reimbursing bank.

[4] In the present case it is also contended on behalf of the appellant that there is a clear case of mistake

when the respondent as the beneficiary was paid before the confirmation of the documents. The respondent

was paid through the account held with the appellant. The appellant had a duty to return monies paid by

mistake and the moment the respondent requested for return of its documents, the letter of credit's

transaction no longer existed. The appellant further contended the fact that the respondent made a second

attempt to commence a new letter of credit's transaction for the same item showed that there was a clear

variation of the transaction. The respondent therefore does not have a valid claim after resorting to an

alternative mechanism.

Page 6

DECISION

The law relating to letter of credit

[5] At the outset it is necessary that we examine what is a letter of credit and its legal effect when it is issued.

A letter of credit or documentary credit means any arrangement, however named or described whereby a

bank (the issuing bank) acting at the request and on instructions of a customer (the applicant for the credit) is

to make a payment to or to the order of a third party (the beneficiary), or is to pay or accept bills of exchange

drawn by the beneficiary, or

2 MLJ 289 at 295

authorises another bank to effect such payment, or to pay, accept or negotiate such bills of exchange against

stipulated documents provided that the terms and conditions of the credit are complied with (see Law of

Banking (2nd Ed), Poh Chu Chai).

[6] The law governing letter of credit in the present case is the uniform customs and practice for documentary

credit international chamber of commerce ('UCP 400'). Articles 3 and 4 of the UCP 400 provides as follows:

1)

Credits, by their nature, are separate transactions from the sales or other contract(s) on which they

may be based and banks are in no way concerned with or bound by such contract(s), even if any

reference whatsoever to such contracts(s) is included in the credit.

1)

In credit operations all parties concerned deal in documents, and not in goods, services and/or other

performances to which the documents may relate.

[7] It is to be noted the type of letter of credit issued in this case is an irrevocable letter of credit. As regards

this irrevocable letter of credit article 10(a)(iv) of the UCP 400 provided that:

(a) An irrevocable credit constitutes a definite undertaking of the Issuing Bank, provided that the stipulated documents

are presented and that the terms and conditions of the credit are complied with: (iv) If the credit provides for negotiation

-- to pay without recourse to drawers and/or bona fide holders, draft(s) drawn by the beneficiary, at sight or at a tenor,

on the applicant for the credit or on any other drawee stipulated in the credit other than the issuing bank itself, or to

provide for negotiation by another bank and to pay, as above, if such negotiation is not effected.

[8] Based on the provision of article 10(a)(iv) of the UCP 400, we are of the view that upon the presentation

of an irrevocable letter of credit to the issuing bank (TBB), it is a mandatory requirement that payment is to

be effected upon sight of the said document by the issuing bank. The contract pursuant to the said letter of

credit is considered by then to have been fully realised.

Right of recourse

[9] In relation to the appellant's rights of recourse it is our judgment that the issuing bank had no right to seek

the return of the monies it had paid to the appellant as payment was upon sight of the documents. The

issuing bank is estopped from seeking the return of the monies that it had lawfully remitted to the respondent

through the appellant as the negotiating bank.

[10] The right of recourse does not arise in the present case because TBB as the issuing bank did honour

the letter of credit at the first instance. Telegraphic

2 MLJ 289 at 296

transfer and the remittance of the payment RM194,605 into the respondent's account was made on 22 July

1993 upon deduction of bank commission and charges. It was only on 24 July 1993 that the TBB, citing

discrepancies in the letter of credit sought a refund from the appellant. The legitimacy of the TBB's request

for a refund at that point of time was never questioned by the appellant at all. On 24 August 1993 the

appellant provided TBB with a refund. It is to be noted however, that in a letter dated 28 August 1993 the

appellant had informed TBB that it was unable to carry out TBB's instruction regarding the refund because

the reimbursing bank had made the payment upon the authorisation of the issuing bank (TBB). The appellant

therefore on its own had later admitted that the refund was not possible.

[11] We are of the view having accepted the documents submitted and made payments without reservations,

Page 7

the issuing bank is estopped from demanding the return of the payment made on the grounds of alleged

defects or discrepancies. There must be certainty, promptness and finality of payment which a letter of credit

serve to provide to the transacting parties. The court would also not lightly interfere with the bank's obligation

to make payments under a letter of credit. On this point in Hamzeh Malas & Sons v British Imex Industries

Ltd [1958] 1 All ER 262, Jenkins LJ referred to the practice of the courts as follows:

We were referred to several authorities, and it seems to be plain that the opening of a confirmed letter of credit

constitutes a bargain between the banker and the vendor of the goods, which imposes on the banker an absolute

obligation to pay, irrespective of any dispute there may be between the parties on the question whether the goods are

up to contract or not. An elaborate commercial system has been built up on the footing that bankers' confirmed credits

are of that character, and, in my judgment, it would be wrong for this court in the present case to interfere with that

established practice.

[12] It is further noted in this case there is no evidence that the respondent had in fact requested for the

return of the documents. The alleged return of the documents at any rate in our view does not give an

automatic right for the appellant to demand a refund or debit the respondent's account unilaterally. The

appellant had requested the documents for rectification by the respondent and to have them resubmitted.

Hence the alleged discrepancies, if any, had been resolved and therefore there is no basis for the return of

the money.

Indemnity

[13] A letter of indemnity was relied upon by the appellant to support the argument that the transaction was

carried out under the UCP 400 which provides for a right of recourse. On this point we are in agreement with

the finding of the Court of Appeal that the argument made by the appellant is

2 MLJ 289 at 297

unnecessary for if there is an indemnity, the appellant's recourse to the respondent is upon the indemnity and

not the UCP 400.

[14] Even assuming the appellant can rely on the letter of indemnity it is our judgment that the indemnity was

suspect as to its authenticity and applicability to the said letter of credit's transaction. The respondent had

lodged a police report in which she admitted that she had given the documents relating to the letter of credit

as well as a letter of indemnity to the appellant. However, the respondent contended that she only signed a

blank general indemnity and maintained that it was for other purposes. The learned trial judge of the High

Court accepted the evidence of the respondent and held that the letter of indemnity was suspicious because

the date had been blanked over and it was executed for other purposes. That is a finding of fact made by the

trial judge and it is trite that this court as an appellate court should not disturb such a finding unless the trial

judge had made an error of law or made a finding contrary to the evidence before him.

Section 73 of the Contracts Act 1950

[15] The appellant also relied on the provision of s 73 of the Contracts Act 1950 to support its contention that

the appellant as the negotiating bank was entitled to deduct the customer's account of the respondent for the

purpose of returning the monies equivalent to the issuing bank's demand. Section 73 of the Contracts Act

1950 reads:

A person to whom the money has been paid, or anything delivered by mistake or under coercion, must repay or return

it.

[16] Section 73 of the Contract Act 1950 applies both to mistake of fact as well as mistake of law. The Privy

Council in the case of Shiba Prasad Singh v Chandra Nandi (1949) 76 IA 244 when construing payment by

mistake under s 72 of the Indian Contracts Act which is in pari materia with our s 73 stated that it must refer

to a payment which was not due and which could not have been enforced. The mistake is in thinking that the

money paid was due when in fact it was not due. In the Singapore case of FC Seck Trading as Oversea

Structural Company v Wong & Lee [1940] MLJ 182 it was held on appeal by the High Court that the court

has the power to relieve against mistake of law as well as against mistake of fact if there is any equitable

Page 8

ground for doing so. Still, on the issue of payment by mistake in Kelly v Solari [1835-1842] All ER Rep 320

Lord Abinger CB, inter alia, held:

The safest rule, however, is that if the party makes the payment with full knowledge of facts, although under ignorance

of the law, there being no fraud on the other side, he cannot recover it back again.

2 MLJ 289 at 298

[17] Based on the principles of law as laid down in the above cited case authorities it is our considered view

for the present case there was no payment by mistake to the respondent because the payment made was in

fact due to the respondent under the letter of credit. There is no equitable ground to hold that the money has

been paid by mistake. There was also no fraud on the part of the respondent during her receipt of the

payment. The appellant had in fact represented to the respondent that the respondent was entitled to the

payment. By doing so the appellant is estopped from seeking a refund. On this point we would refer to the

case of Holt v Markham [1922] All ER134 wherein Scrutton LJ at p 141 held:

I think this is a simple case of estoppel. In this case the plaintiffs have, in my view, represented to the defendant that he

is entitled to a sum of money as a gratuity and have paid it, and after a lapse of time sufficient to enable mistake to be

detected and rectified, the defendant has acted on the representation and has spent the money before any claim on

him for return has been made.

CONCLUSION

[18] For the reasons abovestated we would answer the three questions posed in this appeal in the negative.

In the result the appeal is dismissed with costs. We award a sum of RM25,000 as costs to the respondent.

Deposit to the respondent towards costs.

Appeal dismissed with RM25,000 costs.

Reported by Ashok Kumar

Você também pode gostar

- Case Mahadevan V ManilalDocumento11 páginasCase Mahadevan V ManilalIqram Meon100% (1)

- Assignment - Commercial LawDocumento15 páginasAssignment - Commercial LawNURKHAIRUNNISAAinda não há avaliações

- Deed of Receipt & ReassignmentDocumento3 páginasDeed of Receipt & ReassignmentJessica KongAinda não há avaliações

- Damansara Realty BHD V Bungsar Hill HoldingsDocumento17 páginasDamansara Realty BHD V Bungsar Hill HoldingsLim Siew YingAinda não há avaliações

- Summary of Kamarudin Merican Noordin v. Kaka Singh DhaliwalDocumento2 páginasSummary of Kamarudin Merican Noordin v. Kaka Singh Dhaliwaldalia1979100% (1)

- Ong Koh Hou at Wan Kok Fond V Da Land SDN BHD (2018) MYCA 207Documento15 páginasOng Koh Hou at Wan Kok Fond V Da Land SDN BHD (2018) MYCA 207Marco Isidor TanAinda não há avaliações

- CASE NO.8 Kurdamai Construction and Engineering SDN BHD V Innoseven SDN BHD - HSKDocumento24 páginasCASE NO.8 Kurdamai Construction and Engineering SDN BHD V Innoseven SDN BHD - HSKSKGAinda não há avaliações

- Topic: Third Party Proceeding (PG 267green)Documento22 páginasTopic: Third Party Proceeding (PG 267green)Yi YingAinda não há avaliações

- Fatal Accident ClaimsDocumento17 páginasFatal Accident ClaimsAttyynHazwaniAinda não há avaliações

- Importance of Domestic InquiryDocumento4 páginasImportance of Domestic InquiryizyanAinda não há avaliações

- Rangka Kursus Uuuk4083Documento16 páginasRangka Kursus Uuuk4083Syaz SenoritasAinda não há avaliações

- Separate Legal EntityDocumento18 páginasSeparate Legal EntityJagdesh SinghAinda não há avaliações

- 299 CertaintyDocumento29 páginas299 CertaintyShahrizatSmailKassimAinda não há avaliações

- Surety SummaryDocumento4 páginasSurety SummaryLouis Lim Chun WengAinda não há avaliações

- Contract Case Review (Privity)Documento31 páginasContract Case Review (Privity)khairiah tsamAinda não há avaliações

- Torts Past YearDocumento7 páginasTorts Past YearKhairun Nisaazwani100% (1)

- Esso Standard Malaya BHD V Southern Cross AirwaysDocumento8 páginasEsso Standard Malaya BHD V Southern Cross AirwaysKitQian TanAinda não há avaliações

- TOPIC 15. Disciplinary ProceedingsDocumento23 páginasTOPIC 15. Disciplinary ProceedingsFatin NabilaAinda não há avaliações

- ATTORNEY GENERAL & ORS V GEOFFREY ROBERTSONDocumento9 páginasATTORNEY GENERAL & ORS V GEOFFREY ROBERTSONmerAinda não há avaliações

- ArticleonLetterofCredit Part-IIDocumento3 páginasArticleonLetterofCredit Part-IIessakiAinda não há avaliações

- Uis4612-Law of Insolvency Tri 2, 2020/2021 Tutorial 3 QUESTION 1 (Adopted From CLP 2009)Documento2 páginasUis4612-Law of Insolvency Tri 2, 2020/2021 Tutorial 3 QUESTION 1 (Adopted From CLP 2009)Azreen AzlanAinda não há avaliações

- Award 32322Documento26 páginasAward 32322averroes7Ainda não há avaliações

- TROS Part III-A Technical Specification Final and Clean Copy2072010 (5.1 ADocumento26 páginasTROS Part III-A Technical Specification Final and Clean Copy2072010 (5.1 AFaIz SafWanAinda não há avaliações

- Q&A PartnershipDocumento24 páginasQ&A PartnershipLoveLyzaAinda não há avaliações

- Topic 6 - Winding Up CA 2016Documento25 páginasTopic 6 - Winding Up CA 2016Umar Razak100% (1)

- Assignment Law503.2003Documento8 páginasAssignment Law503.2003lyana47Ainda não há avaliações

- Kevin Peter Schmider V Nadja Geb Schmider Poignee & AnorDocumento29 páginasKevin Peter Schmider V Nadja Geb Schmider Poignee & AnorJoanne LauAinda não há avaliações

- Topic: Disclosure in A Criminal ProceedingDocumento15 páginasTopic: Disclosure in A Criminal ProceedingLee Jun ZheAinda não há avaliações

- Kathiravelu Ganesan & Anor v. Kojasa Holdings BHDDocumento9 páginasKathiravelu Ganesan & Anor v. Kojasa Holdings BHDNuna ZachAinda não há avaliações

- List of Cases and Headnotes For Conspiracy To InjureDocumento75 páginasList of Cases and Headnotes For Conspiracy To InjureMalini SubramaniamAinda não há avaliações

- Kasus Pasar Modal Di MalaysiaDocumento12 páginasKasus Pasar Modal Di MalaysiaArsip KerjaAinda não há avaliações

- Lawof Agency (Iii) PDFDocumento63 páginasLawof Agency (Iii) PDFIffah FirzanahAinda não há avaliações

- Contract - Consent of PartiesDocumento78 páginasContract - Consent of Partiesfadzliza_83Ainda não há avaliações

- Case-Section 3 (1) Partnership Act 1961 Malayan Law Journal UnreportedDocumento16 páginasCase-Section 3 (1) Partnership Act 1961 Malayan Law Journal UnreportedAZLINAAinda não há avaliações

- A - LIM - KIAT - BOON - & - ORS - V LIM - SEU - KONG - & - ANORDocumento7 páginasA - LIM - KIAT - BOON - & - ORS - V LIM - SEU - KONG - & - ANORf.dnAinda não há avaliações

- Ucl3612 Company Law I Tri 1, 2020/2021 Tutorial Topic 2: Promoters and Pre-Incorporation ContractsDocumento7 páginasUcl3612 Company Law I Tri 1, 2020/2021 Tutorial Topic 2: Promoters and Pre-Incorporation ContractsClara SusaieAinda não há avaliações

- Case Law Related To AssignmentsDocumento14 páginasCase Law Related To AssignmentsSuraj Jung ChhetriAinda não há avaliações

- Kuen at Au Yong Wai Kuen V Majlis Bandaraya Shah Alam (2004) MLJU 147, The CourtDocumento3 páginasKuen at Au Yong Wai Kuen V Majlis Bandaraya Shah Alam (2004) MLJU 147, The CourtEugenie GilbertAinda não há avaliações

- Mirra SDN BHD Summary of CaseDocumento2 páginasMirra SDN BHD Summary of CaseEdisonTeoAinda não há avaliações

- Chan Kok Suan-InjunctionDocumento6 páginasChan Kok Suan-InjunctionUmmi IsmailAinda não há avaliações

- Anna Jong Yu Hiong V Government of SarawakDocumento6 páginasAnna Jong Yu Hiong V Government of SarawakRijah WeiweiAinda não há avaliações

- Tutorial 5 Company LawDocumento7 páginasTutorial 5 Company LawWei Weng ChanAinda não há avaliações

- Sample Affidavit in Support Messrs. Izat Hazzail & CoDocumento9 páginasSample Affidavit in Support Messrs. Izat Hazzail & CoDiba NajmiAinda não há avaliações

- Topic 2-Proceedings in Company Liquidation - PPTX LatestDocumento72 páginasTopic 2-Proceedings in Company Liquidation - PPTX Latestredz00Ainda não há avaliações

- Arif - Letter of Undertaking Maybank To VendorDocumento3 páginasArif - Letter of Undertaking Maybank To VendorDania IsabellaAinda não há avaliações

- 05 Oral EvidenceDocumento7 páginas05 Oral EvidencegivamathanAinda não há avaliações

- PUBLIC PROSECUTOR V DATUK HAJI HARUN BIN HAJDocumento26 páginasPUBLIC PROSECUTOR V DATUK HAJI HARUN BIN HAJAnis NajwaAinda não há avaliações

- ROSLI KAMARUDDIN v. HOW HOCK SING & ANORDocumento23 páginasROSLI KAMARUDDIN v. HOW HOCK SING & ANORmerAinda não há avaliações

- Menta Construction SDN BHD V Lestari Puchong SDN BHDDocumento55 páginasMenta Construction SDN BHD V Lestari Puchong SDN BHDmerAinda não há avaliações

- Measure of Damages: TortDocumento6 páginasMeasure of Damages: Tort072 Yasmin AkhtarAinda não há avaliações

- Ibiz Muamalat: User Guide Fund TransferDocumento18 páginasIbiz Muamalat: User Guide Fund TransfermohdtakrimiAinda não há avaliações

- Cimb Bank BHD v. Ambank (M) BHDDocumento40 páginasCimb Bank BHD v. Ambank (M) BHDEden YokAinda não há avaliações

- CPC I BailDocumento3 páginasCPC I Bailebby1985Ainda não há avaliações

- Notes On Arthorin Adalat Ain 2003Documento10 páginasNotes On Arthorin Adalat Ain 2003Rabiul AualAinda não há avaliações

- A Kanapathi Pillay V Joseph Chong - (1981) 2Documento6 páginasA Kanapathi Pillay V Joseph Chong - (1981) 2NuraniAinda não há avaliações

- ZAHAREN HJ ZAKARIA v. REDMAX SDN BHD & OTHERDocumento21 páginasZAHAREN HJ ZAKARIA v. REDMAX SDN BHD & OTHERJJAinda não há avaliações

- Wong Hon Leong David v. Noorazman Bin AdnanDocumento7 páginasWong Hon Leong David v. Noorazman Bin AdnandarwiszaidiAinda não há avaliações

- CASE - Expo Holdings V - Saujana TriangleDocumento8 páginasCASE - Expo Holdings V - Saujana TriangleIqram MeonAinda não há avaliações

- Bank Bumiputra (M) BHD V Hashbudin Bin HashiDocumento10 páginasBank Bumiputra (M) BHD V Hashbudin Bin HashiNorlia Md DesaAinda não há avaliações

- (HC) Ung Eng Huat V Arab Malaysia BankDocumento15 páginas(HC) Ung Eng Huat V Arab Malaysia BankAisyah RazakAinda não há avaliações

- KKGDocumento2 páginasKKGNorlia Md DesaAinda não há avaliações

- Resume Kakak/kkgDocumento1 páginaResume Kakak/kkgNorlia Md DesaAinda não há avaliações

- KKGDocumento2 páginasKKGNorlia Md DesaAinda não há avaliações

- Contract - Consent of PartiesDocumento78 páginasContract - Consent of Partiesfadzliza_83Ainda não há avaliações

- Bank Bumiputra (M) BHD V Hashbudin Bin HashiDocumento10 páginasBank Bumiputra (M) BHD V Hashbudin Bin HashiNorlia Md DesaAinda não há avaliações

- Course Outline: International Islamic University MalaysiaDocumento6 páginasCourse Outline: International Islamic University MalaysiaNorlia Md DesaAinda não há avaliações

- Contract - Consent of PartiesDocumento78 páginasContract - Consent of Partiesfadzliza_83Ainda não há avaliações

- Foo Fio Na V DR Soo Fook Mun & Anor - (2007)Documento17 páginasFoo Fio Na V DR Soo Fook Mun & Anor - (2007)Norlia Md DesaAinda não há avaliações

- Halycon CaseDocumento22 páginasHalycon CaseChirag SainiAinda não há avaliações

- Islamic Judiciary SystemDocumento19 páginasIslamic Judiciary SystemM Zeeshan WazirAinda não há avaliações

- Intellectual Property RightsDocumento15 páginasIntellectual Property Rightsshauntri7767% (3)

- Problems in Indonesian Community Management CBFM Policies Examination of Village Forest HD Programs in The Provinces of Jambi and East KalimantanDocumento17 páginasProblems in Indonesian Community Management CBFM Policies Examination of Village Forest HD Programs in The Provinces of Jambi and East KalimantanYuki AlandraAinda não há avaliações

- International Trade LawDocumento22 páginasInternational Trade LawNidhi FaganiyaAinda não há avaliações

- The Philippine Cybercrime Prevention Act of 2012 - To Protect or Destroy? PDFDocumento8 páginasThe Philippine Cybercrime Prevention Act of 2012 - To Protect or Destroy? PDFMa Christian RamosAinda não há avaliações

- Metrobank Vs RosalesDocumento2 páginasMetrobank Vs RosalesmayaAinda não há avaliações

- Kanishk Land LawsDocumento13 páginasKanishk Land LawsDheera KanishkAinda não há avaliações

- @CPC IntroductionDocumento20 páginas@CPC Introductionsheetal rajputAinda não há avaliações

- Is 5256 (1992) - Sealing Expansion Joints in Concrete Lining of Canals - Code of PracticeDocumento8 páginasIs 5256 (1992) - Sealing Expansion Joints in Concrete Lining of Canals - Code of PracticeN.J. Patel100% (1)

- 62 Sunlife Assurance Company of Canada v. CADocumento2 páginas62 Sunlife Assurance Company of Canada v. CAFrances Ricci SalgadoAinda não há avaliações

- Data Privacy Policy and Guidelines: Mystical Rose College of Science and TechnologyDocumento10 páginasData Privacy Policy and Guidelines: Mystical Rose College of Science and TechnologyReiven TolentinoAinda não há avaliações

- Plain English, Please!: A Seminar-Workshop in Plain English (How To Write Readable Documents)Documento29 páginasPlain English, Please!: A Seminar-Workshop in Plain English (How To Write Readable Documents)miam leynesAinda não há avaliações

- 5 Rodil Enterprises, Inc. vs. CADocumento2 páginas5 Rodil Enterprises, Inc. vs. CAVox Populi100% (2)

- Draft Loan AgreementDocumento19 páginasDraft Loan AgreementLin Hg100% (1)

- Far East Bank and Trust Co vs. Court of Appeals 240 Scra 348Documento5 páginasFar East Bank and Trust Co vs. Court of Appeals 240 Scra 348Marianne Shen PetillaAinda não há avaliações

- Rhetoric Reality Men and ViolenceDocumento10 páginasRhetoric Reality Men and ViolencegregcanningAinda não há avaliações

- Property Pre-Mid Notes: Albert Gunda AzuraDocumento4 páginasProperty Pre-Mid Notes: Albert Gunda AzuraBhouwls CanilloAinda não há avaliações

- Unpan016237 PDFDocumento6 páginasUnpan016237 PDFJaneAinda não há avaliações

- Crimlaw CasesDocumento7 páginasCrimlaw Casesxerah0808Ainda não há avaliações

- Class Last Will and TestamentDocumento2 páginasClass Last Will and TestamentJamila TaguiamAinda não há avaliações

- Unit 1 - Understanding Corporate Social ResponsibilityDocumento4 páginasUnit 1 - Understanding Corporate Social ResponsibilityPeppy Gonzales VillaruelAinda não há avaliações

- Dwnload Full Seeing Sociology An Introduction 1st Edition Joan Ferrante Test Bank PDFDocumento17 páginasDwnload Full Seeing Sociology An Introduction 1st Edition Joan Ferrante Test Bank PDFtermitnazova0100% (11)

- Class Action Lawsuit Against Ultra Music FestivalDocumento21 páginasClass Action Lawsuit Against Ultra Music FestivalJoey FlechasAinda não há avaliações

- Renault Without CAN - EmulatorDocumento21 páginasRenault Without CAN - EmulatorLalinhu ElAinda não há avaliações

- CLASS 11-Physics Model Question PaperDocumento11 páginasCLASS 11-Physics Model Question PaperSenthil KumarAinda não há avaliações

- Urc 522Documento6 páginasUrc 522Abhi ShekAinda não há avaliações

- Coa Memorandum-Cem 6,26Documento3 páginasCoa Memorandum-Cem 6,26Allyssa GabaldonAinda não há avaliações

- Code of Professional Responsibility CanonsDocumento7 páginasCode of Professional Responsibility CanonsDivine VelascoAinda não há avaliações

- Submitted in Partial Fulfilment of The Requirements For The DegreeDocumento25 páginasSubmitted in Partial Fulfilment of The Requirements For The DegreeZororai Nkomo100% (1)