Escolar Documentos

Profissional Documentos

Cultura Documentos

Clinton Family Foundation 2015 Form 990

Enviado por

Joe Schoffstall100%(1)100% acharam este documento útil (1 voto)

1K visualizações38 páginasClinton Family Foundation 2015 Form 990

Direitos autorais

© © All Rights Reserved

Formatos disponíveis

PDF ou leia online no Scribd

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoClinton Family Foundation 2015 Form 990

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PDF ou leia online no Scribd

100%(1)100% acharam este documento útil (1 voto)

1K visualizações38 páginasClinton Family Foundation 2015 Form 990

Enviado por

Joe SchoffstallClinton Family Foundation 2015 Form 990

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PDF ou leia online no Scribd

Você está na página 1de 38

IRS efile Signature Authorization

rom 8879-EO for an Exempt Organization

eee eer eee ee

‘THE CLINTON FAMILY FOUNDATION 30-0048436)

WILLIRY J. CLINTON, PRESDENT

ERED Type oF Retrn and Return intonation Gale Dales

Check fo

Chest he ont nS ou onan aout ona er bo

ising ty oo oO wee tain oh etr"9) Vox ona tee eon

te appeso te ion Bo Comps mere an tra mPa

1a Form voocheck mre (| 8 Total revenua, fan (Form 860, Pat i coun (A) Ine 12)... 10

24 Fou a00Ez cinch mee Lp Tot reve ay (Pn 89082 8) 2

3a For 120-OL ehwck are ||. Totlta Form 1120-0, ne 22) ae

442 Form $907F chuck roe ® LK] b Tax based on investment income (Farm Oc.PF Par ina). 4 35

4 Form 4268 chock ara [Balance De (Form 8895, Pat ne Seor Pa nee)...

‘Declaration and Signature Authorization of Oe

‘Unorperaites oper. dele ta am anole of he sbove eigen ard il have eamined copy ob

‘ignitor 2014 scare return or sezamparyrg Schedles and sates td ote est omy krona a ley

Siete, cect and complee | futher Socare hat tn amount in Part | aoove the amour hewn ons Sy of

‘ganar eesrone return | consent te alow my itrmedets sence prover, veromte, a sacronc ten aieater (ERO)

{eSans the organators vt fo eS ara eva fom te (a an ecknowledgemert lca of eason br rjcion ot

tho tensrcsi() teresa fr any Seay It processing he flu aun, a) aaa fay ound. apa

Ethoras be US easury era devignaiee Poaei! Agel te an lcvons fond winraw ac a6) ryt De

il tution account late nthe tax preparaton software for payne of organzaten overage ved ons

‘elu ardine ancl instant Jeb nosy tos acount To rvoeo 8 poymont must orate US eau Fach

‘ort st 188-388-4637 ro ater hen 2 busines days por toe payment seamen) datas sthorze the Sanction

Introd inbeprocassng ofthe @ecven payment a ows fo rasa conical Poa nesesaaytoenewer mre a

‘Reohe sues rales otha payment rave Selected spores! erteaton namon (Nes my arate fhe ogenestons

‘Sastonle eum ard appieabe the oganzoton’s coment elocrone hrds witb

Cftice’s PO: check one Box oly

[] sevtoise HOGAN LOVELLS US LLP voonermyem [6]2]2]218] as my sna

conta organiaton's tx your 2015 laconic fea rtien have ent wth this eum ata copy fhe etn

bong flag wih state agora) regulating chars a pt of he IS Fessat progam, no aurorse re aoremertenad

ERO to ertar my PIM onthe outs aos cont seven

1 Aen omer ottne ergsnzaton, wil ertr my PIN 38:y slonatire on ne organza’ a

‘inav nieatea win ts retun tat scoy of he retn being es wea a

"DaIRS FeasSatesog'am, Iwi eer my PI onthe Toure dese comer sree

cnaipees y (WS TE our Sif

eee ne ee __

RO’ EFHUP. Erie you suc election ng Gantcaton

ruber (EIN folowed by your fect se eeecteg PN, isis PTs Tolols

ory tne above runare etre my IN hn is my slau on ne 2018 alone Wea en fe te oganzten

Informstr for Auhoraed IRS otis Powder or Business Rama. '™ “wren ei ruks e189, Mataneal ek Quer)

wormmar Hoede Daan oar __slehe

ERO Must Retain This Form Soo inetrocions

(Do Not Submit This Form To the IRS Unless Requested To Do So

For Papersork Reduction at Note, se back of form. Fen BOTREO He

reyes} requlng ears es part

73086™ S716 Vv 15-4.5F o2pa6ionoo01 PAGE 2

2015

Return of Private Foundation

or Section 484(a() Trust Trete as Private Foundation

> ont enr et ancy rumour ano may may pe

rom 990-PF

For ealndar your 206 or tx yer begining 2016, and ending 20

"THE CLINTON FAMILY FOUNDATION 30-0040438

POST OFFICE BOX 937

(212) 919-9297

oO

cunpengua, wy 10514

Gre anaemia eum af oer ae Sty a)

[rrareven [Jamon tan

ates cura Oo

WLGhea ope of orpmantor [X Sec

i Far mart vale of all ets at [ Accouning mates |X] cash

rd of ear (hem Pati ca. tne |[_]ome (spac

sym $1,827,425. es oat a aa

aval of Revere ang Exper

* Lestreae aes >)

ce sesonamenim anne)

ageanezt | yrneimes | ciageane | “erowine

fon abo) toe | aly

soso asta tmp ch ai Soa saz RCE

1 Capt oa ne eae ra Patna)

Gres proto (ach ease)

2 Toul Aatinee age TOOT TE}

Soom E

Sancho

esas

aap oer

(Scarce | —

Secteur

23. Ome expenses atch sehen ARE as

Sate | ae!

femora tnsl erase

[ee sa

Pe ees aS

Operating and Administrative Expenses

om $07 215 ‘THE CLINTON FAMILY FOUNDATION 30-0066438 rap?

rm eee es Sa a | Badr

Balance Shoots cree tac ates" — meets —| ove ae | 1 Fara

2 Senge andenprny enh © 551g, 500] —T 02S | 3 wa

4 Pao

trecenet os wt eeai sons

17 Sheroane einen ne ea

Cin sorte cocoa ies

Mmaeenane sates gL

Sarno copes a cee

‘roan, ep ten a,

sear».

HS Sintec Saunt 2

1s Shoraace Ger

fs tom savew (be copied by a

Iara ana wep hen siaue,seo,| 1,829,428, 1,827,428

Grispmie.

‘Setenee ancora probe acct) [PE

One imu ate 5

Tots ans 17 04.20

Foundations that folow SFAS 117, checkhare, PT]

Foundations tat do not follow seas 177, > LE)

Check bre and compet nes 27 tough 3.

‘Coot sec bt pint ore hres

ent en nue rh 53505 | 5 wT eas

Touro tow ate omen reo) 5,314, 540:[ 1,627,428

Toon" ao nt senna (et 1

inincton) 5,314,540] 1,827,425

‘AnalysT of Changes in Net Asots or Fund Gaiancoa

1 Total el steer urd bates ef Beginning of yer -Pat column a) te 30 (mut ore wit

nd-otyear foe reported on por years en), + ‘

2 Ener aroun tam Pat ine : ma z

5 Other increases ot ned ne 2 ria) A

4 kediows 30rd tetas.

6

5,314,540.

See ei5

Decreases vot ncuced inna 2 (amin) ARGH 3“ = 1832, 500,

Petre a5.

Fos B80-PF a0)

“olan asta ound balances ot eng of yer fine 4 ming i 3) Pa oN ns

PS y3096H 5726 Vv As4.oF 026461/000001, Paee 3

{THE CLINTON FAIZLY FOUNDATION

30-0008838

Copial or Tax on Tavestment REM

9s cee el ape ao. te

uy waves o conan Pa Mees)

ry Tapeaoes aia oe wenn

a Meregeeee eaten

ia as in RD a TH aL

OF My mat 0 angen memes (aon Bn

‘

2 Capita gain natincome or (net captal loss) toonhene-oePatlie? }

‘i os), ener 0 neat ea

13 Net short-term capital gin of (8s) 8 dated in socbons 12220) a4 (8)

Wg, eter in Pa |, 8, colar (oe ratte) fxs enter in}

Par ina

‘ual

jon Under

ion 4) for Reduced Tax on Nat investment inom:

(For optonal se by domes pivete furaatens suber fo the eacton 4840) axon nt vestnet =e)

itsecion 4640(842) apps, eave hs pat bia

Was the foundation Inte forthe section 4942 taxon the dtbtable amount fay yearn eb

Itoves th foundation doe nt quay under eecion ab4O) 9 rat compass ar

scapes? [vee

Tare aopope soaat so scans anh yo sb ni Be ao

sang >. = pc

EET Each atta | asaeaneoaac tome [PEEP

3 18a, 0 3,575,038 2 Sbas08

Sana 563 35358 690 rane

sore 3s0 ager S10 Tassie

Fea 489: aoans 148: ooeea83t

am0y a8 ERIE $4058

2 Toot tn 1 coun) 2 3.652303

3. irrope ton ato oi Sa So pe vie tal ns 8 rb bo

‘nou clyers he ueston ma bon hentece ee fan ee 2 o.ra08t7

4 enna eta of orcas abe fr 2018 fon Pan re ‘ 2,451,828.

5 Multiply ine 4 byfine 3... . 5 f s preliit if

6 Enter 1% of net investment income (1% of Part, ine 27b) s ts

1 nasines Sand 8 oe ; 795,422

4 mar qui dros ron Pa Xn . 2,690,500,

Ing soot tor ost Dan Ine 7. hace th Goin Pati,’ ana complete

Pet Wingvostons

Bree ticneu sme Vv 18-4.5F e461,

{fat pat ag 8 toe Soo FS

Tan BOOP

so0eco PAGE @

THE CLINTON FAMILY FOUNDATION 0-0040438

fo sri 2 raed

BERRI Excise Tax Based'oninvosimont Income (Section 4840] S940E] ABAD), oF 440 - eo loirocons)

rectns dctnmcn u, kbae [_]aei NA en

oan thar es i ei BUS aaron a an Vee ‘

35.

Al atber cones launsatone nt 24 oie 276 Emmet Ten egenzrons nr eh

Panne 2,00

“ox andet eaten 1! (mest econ 4647) bu antacids el COs en).

ss

3:

35

4 Satta (nema te seen 401) Hut an ttt ay Ci 2)

Crete 7 a

‘arpa wh phon rena fe a Pan ae

Sectupwitcang eerste se

1 Tal erate aa payments. ines 6a ic c :

{Ener ey pear verge fetta ie oeccree [—] ¥ Ferm 220% wacad || .

4 Tarde neon Se ere an ne? et amount ered

‘Statements Regarding Activites

fate er narare nan ste! carpus. ite a

id sped. nre thar 8100 dung the yes (har drecty or aro) er pes” perme “Gao

neces en eine? ‘

(Wome snore "ero 10 0” 7, eh deed ans of the actntes and copas a wy mates

putanadr Sede urd in comacon win he aches

fete wreat a acn es (nn i ngb

Eerie rember an) pa Th Toowoton einng the yen ‘ar paca epee Tox impoud en

2 Har eunaon evgapeain ay aces Wl Dre Fa Pov. been gosto eS? s

(Pye abnna eae esron te ces

2a he feunaton rode any changes. ot peel pote to the. ns gonering inane ro

Dare oon av nstebuien gfe ner of 1.006 mare 9 Ye?

Irn nan lt etre on Form 504 fort yon?

1 os ares iden tema, easton er tbat eoabon en ye? i

17902" ater ne stoned rgoed 67 Gover enn

16 feet equrens 2 sect 8s (lng econ 404 OU 4948) sates ter

‘=o rquoge ne geri anne

5) soe legnon tht eleciay aren the gowring nein! tha ra. manctoy Satons that

1 bist fundton nove teat $,00I ae y ring te yr °¥ cmp Pa a an Pa 7

1 ernst hc i ann ara orn reps tact)

(song of eon sate reutesy Gene! hacen G7 Nate? expan

4 inte fandson chiming sous ae a pote cprsing fundaon within te mening of scien S84}9) ot

‘osaye) er calc yw 2018 or fe tla your Doping Im 2016 fue buco for Pat XV? Yas"

comatle Rot, :

1 ergo coon tinh Ya? : sats

‘Bosen s716 V 15-457 928461/000002

o| |x

sik

Fon SBOP eT

PAGE 5

fom a 35 ‘THe CLINTON EANTLY eOUNDATZON 30-0048438 roe

Statements Regarding Activites (continued)

1 A ay ie core a gor, be tanisin scl «icy om © Sriael Sny ww we | [VOTE

invert cen SEENON th weal on ac ole

povenhat even pga? teste eee ato) al |x

1 Ghote oman ee be epeion eons HS iin i exh pte CAST

vree we Bn TR irvazzneveseenaniicess

4 nevoon wen crop HOARD Wi FOPRE Teaprne b BTS BTRTOS

cota P ATTACHMENT 7 “ap OOzE

16 Sedo (0a) pane ete Ra fry Faw Bh Ter Fam TO > Get me

tea tenor oieveet me ce est Be elie l

‘4 hey tne sr coun ur 2018 aw tases ne oye ein oh snery TVR] RS

crt aban ete ener cl acen soca wl’

Soe" to ace inrerone te FGDN init "fxs tee a

vepaene

(BEDI Statornoris Regarding Reiiis for Which Form 4720 May Be Required

Fle Form 720 aye is hehe in th “Ys" col, vee an exepion la. se

Detgthe yr onan eter ty ora

(3) enor erchange ora et ony Seated prt Cv Bene

{2 oven mony ton ind wy foc eee ean et fo HHH ba 8

‘dps ae aa a

(2) orn goon. eres ahi alr at a is degnitespnan A The

(i) Porenserien ao wy minae Reco sean pro. to

(5) now oy neon ements 8 cred peer ane oie la

te beet cr ue of cages prs? » Cvs [Ene

(0) zea iy ovey ope 8 goon ca? Expo" Whe

(Sour opeed we nate"e yom fo ely eect ode

tenet goa nen fcminaig io 9 aoa) re ne

ou oo mower ceo MC) yo te ft uly neers nee Repos

Tedin sti Sonscaretctes gun deat eet etiarnc? == he

be be tvnnln epee bor yor ty fw oh seed 1. sone He, at

oer corse rt yg 2? o «| |e

2 Toor on Toay fate ane cn C00) (Yt si 1 ae tunton wae re

Spring tenon nei acan eb 201 or

{e, Par Xi fr tyr bagrrira DW" 21ST. ee vee ee Dre

ta noe soy oe bed oT Wieh be Tain 6 Ge HOM of sc 4042040

Guin te mevedwoten et na) ow yore dees rome? ap wan sa) Te

‘eI ihe provions of secon 4842(a2) are Being apps Io any ofthe years Used 2a, st Ue yors here.

Auyinesstgtene? rovreeocerescere Ove Ese

wee ne cas sous hgh in 0i8 os fn oY Sy pote by Be don

Greve yer her hy 26198, B) the ge oe Sop po lange pet poet by te

$Eimmne ince en fue) 1 toe w hchar sre by ott (ee

fetes s" cyan tn pe todty poet far Sema G fom eo. ceemee fe

tantra mats os hate 201) x

ba ne tomo me yeni 8 p(w aD 9” 10H Bo ope te

‘tet no ma al tn ert a egy els heb ny fee Sogneng neo? | ae |X

ox 990:PF Gora

He sogeH $725 vasasr 26e61/000003, Pace 5

wan zt [THE CLINTON FAMILY FOUNDATION 30-0045439 _ rue

MERETEN SierantoRogarang Activin for Which Form 4720 ay Be Requied SSaiie

12) Influence Om Bw

i Re teecwonscuriany sii Eke Bis

: Pn ot nein eter amn Re a Gn

Se letenteansniese es cascnoncomep asec

‘roentgen cent etc ger dene sane cece noo

ifthe anwar "Yer fo cinton Ss, aber tne fesaston cam exon tom te ton

‘because it mantnined expense responstiy forme gan. . AICH 8 vee []mo

Ieuan ester eqs y Repu eta 54945 50)

a nity er nt Se of ay, 1 frome

1» Due fovnan, rng he ab py pom, eyo ay. pers eet it?

196 a 8970.

1a Asay tne dong axes, wat ne oud pay a pentose asa’. . [ee

sul Offcars Directors, Trustees, Foundation Managers, ighiy Pad Emp

sit “oe ae een ae

7 Saeenian aT Tre HGRSTTRG SaRGaeE (SUNT Th Tate ead oh Ue oe Was W ne, el

r em Ease) wo meer

‘[jalnunber of ater empbyos paid over 69500. >

Fon OFF GH

“Posey su16 Vv A5-4SF 926461/000001

pace 7

‘THE CLENTON FAMILY FOUNDATION 30-0048438

a snc is 27

Information About Oficers, Directors, Trustees, Foundation Managers, Ng Pald Employee

‘and Contractors (continued)

Fit Right -pid independent contractors Yor profesional serves (ee itt) Wrne, ie "WONE™

(aan an ae ec poe pr pm Eee

TOE

‘opanunbr of irs rosiing over $50,000 fr protessonal sora ot

Summary of Direct Chaable Activites

7a

(ERNNDEE] — Summary of Program-Revated investments (oes natosins)

Tas nes oS ns =

Fon OPE ae

‘oven s7i6 Vv ASAP 026461/020002 rast 0

‘THe CLINTON FAMILY FOUNDATION 30-00

oy sn 21) 8

es venen Ratun(ATaost ondtans Hut conDae Wi a Fs Toa

See natuctons

[Foi mart value of esta ot used (er Pad Yor ws) aveaky i caring Out chara,

[arage month frmartet vate of secs, . *

‘average of month ean baloces. TB 255,757,

Far mareet aun of aloe eae eee natu 7 of

Total (addins a, ane) 2 pet TAS ST

Fesicton claagior blockage ote actos reprint

te (atach dtaed expansion). | i

2 Aeauistoninsattesness apaabe ia asses 7 2

3 Subract Ine 2 fom neo 3 ZS EST

{1 Cash deemed held for charabia tines’ Ear + 1250 ct'ng 3G ial? ards. se

lnsructre), “ 37,428

15 Net vv of nonchartatline at, Sub! i 4 rom in 3 Er bre aon Pav ino # [5] Basie28.

pin investment return. Ener of ire 5 zu é THz 83T

EME Distributable amount (coe nstrctons) (Secion #84243) end Q() srvate opera oncatans

nd eta frelgrerganratone check tare [| and go rot comple the at)

7 Winerum imveriment tun fom Part X, no 8 7 z TET

2a Taxon vasiment income for 2015 fom Pat VI aS. a as

' Income tax” 2075 (Ths does nat neue the tax tom Part). | CB

© Ad nes 29 and 20 ee ee eee

3° Djstrmuaoie smut beara ajisimens’Sbirae ine 2 rote | “Et Tee BSE.

4 Recovers of nouns rested ne qualiingseubuiows 7 «

5 Aad noe 3 ane s FEAL

{6 Dacuston om darusbie amit (ss rsructor) s

7 Diwbutele tmount a2 adjused Subtract line 6 om ines. Ena hero and on Patil

Ine Bee 2 122,886.

Qualifying Distributions (S00 instructions)

"Amora aid induding Sarina expanses] to aecomplah Gabe, 6, pUpEEe

2 Exoonses contig, it, ee = ft fom Part cour (ch. 28. 2,630,500.

1 Progreso mnormerts tla tom Pane

2° Amounts pid to agora atta sed (2 hid fr Cc} Soc Wh bavng Ot chatbl’

pupos 2

23 rvoune sal sof speiie cartle pees ha ates

1 Sutabiy teste IR sopra aur) A 3

Cash dtnution tet (tach he rege se) 3

4 Qeetising nto. Ads Toes te thegh 3 Ear how sn be Bot ime, Ga Yow & C4 7,530,500:

1 Foundatone tat quality under recon «B40 or the reduced ate of axon ret vesmertincome.

Enter 1% of Pat pe 270 (se sts) 5

5 Aajsted qualityngstrotons. Sutac ne Yn he 4 é Zam

Note, Toe amount on Ine 6 wil be used in Par V, colin), insiseueit years when caeulating whether Pe Toundeon

{Gusto orth sation 46406) retin of avin hose 03,

FoR BOP Fe

ea o66H 5726 VASA. 29461000002, PAGE 9

{THE CLINTON FAMILY FOUNDATION

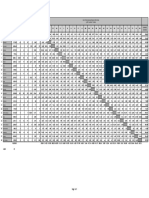

United es TATISTT)

© = @ @,

+ oeveusne anoint fr 2015 fom Pat x,|_ coms | Yoweptrnanne | _ 2bte as

wet 5 THOSE:

see oven te ;

S renner 20-3 70 12 35 34

arent renee fe defeh, B38

renzo 1,656,103

Create 1) 520,276]

om 2013 7701, 696

Sem apie 2 3,588,098;

nwa “830,300

fone 02010 banana

9,117,688,

Appies to unarttes eae of rye

(Coston meres sera).

foie os aura os. TEASE

Beeeraey es

toe en‘ on wren te seston WEA

eapsenet

(oti ogre geese

Treen 4429) (En way be

reimcueninaten sree ecreee

Sete onne rie boron)

lee tam eh 1,656,203,

{eae ton ao13 T;TOTE86'

Even am 014 3,388, 098:

fs Gscas am gots | [2 507, 6

1,252,538,

20, 373, 761,

Fon OFFS

"*y3086H 5716 vase 026¢61/000002, pace 10

THE CLINTON FRNZLY FOUNDATION so-0048438

rating Foundation (see nstusions and Pan VPA, qussion ) NOT APPLTCRBLE

eunsten, end tne ung elec fr 016, wth el he ng |

eng feindton descines in sone | Taaapae | | aane

wre

(2) tet rao a.

wy seaman I

ERGERG Soppomaviay irormaton (Complete Wm par ony Whe foundation had $5000 or more Tr escis wi

Shy line cute tho Joar-rovnsrutons}

+ Tarmation Regarding Foundation Manager:

a Lt any morapes of fe foundation whe have contbuted more than 2% of the taal convo recoled by the foundation

‘stot ho 8 ay yea bt ony fney hav conecs mare than $8,000) (See ston 071)

ABTACHMENT 10

TT oe Ss Tanaton wha Go TOR SSA WES Ta SORRON aH COW BP PION TE

‘SuruThparchetieano eae) oarch he unten tos ee rear nwre

wn

2 aforation Repaaing COnIbAIGR, ra, OM, Lan, SATAN we, ProaTaT

Check rere ® Lit the foundation only makes canrbuiors to posslcad chartable organons end does not accent

ihastcted reauows fr funds be foundation maces gn, grams, cs (eee nseuclon) fo novels of ergnaions Under

a The re, soaree an eons rumba or TAT BESET a i pHADH Ww WT aI TOUS ba aTESE

Ts Tor WH ESTES STOUR Bo RTRSY BS TOPTRUS B MTaShay SOU TeU

© Fay SUBTRRGT cB

aEE asi 7

wow Fan OOF aT

‘20864 5716 Vv ase4.5F 26461/000001, PAGE 12

‘THE CLINTON FAMILY FOUNDATION 30-0048438

a

Total . ee oe 2,630, 500~

a

i

‘730864 5726 Vv 1504.58 26461/000c0r pace 12

‘WE CLINTON FAMILY FOUNDATION ao-o0eat38,

ca 42

“Analy of income Producing Activities

Eo on arcs wn obvinindenes | Ue ua rae ena bysosen i Sea],

@ co * a ‘moses,

Seapeaeoea re cecal

1 Neral come os) en ex

vetted ey

1 net setenance prpwiy 22

4 neincone Fs) ton seit ee tT

18 Grose tires) tom sos eimeny:-

12 Subia Aadcaes GGL BT) Taz

43 Tot Aoi 12 cure (9.2 7 Bz

{Sex waronectn ie ucts vy sa

ERWERIEL__Rolationship of Aciviios tothe Accomplahment of Bxempt Purposes

lune | Espian Below pow each acy for which income is rporag in column () of Pan VLA conrad importa to the

‘y | sccompiehert a te foundetor's eamp!puposes (ota than by roving funds freuen pubes) Sob rstutons)

a Fon OFF TT

73086" S716 v 15-4.5F 028461/000002, pace 13

Faso 9 THE CLINTON FAMILY FOUNDATION 30-0048438 _nge 43

[EEERII —trvormation Regarding Transfors To and Transactions and Relationships With Nonchariable”

Exempt Organizations

1 Did the aianzaonstecty or ndvecty gage many ofthe olwng wit any cher erpanuatondessrbed | — [vee] a

in secon 1(c of he Code (car han secon $01()) epariztons) ri ecton 627, reling to police

genase?

4 Transers om te repring foudation to «norchartatle exempt erganzaon ot

(can

(2) Ot arcis,

(1) Sols of eet to a nonchatabe exp organi,

(2) Purchases of asels tom a noncartae mmpt ogenaton |

(3) Rental of tactes, equpmert of abe asses

(a) Reinturseret srangerent.

(6) Loaneorlom quararnes,

{a} Partmancs st andens i etnias a kai ent

« Stanng of aces, queer, malig isi, oer asst, oad ompoyecs

4 Ite answer te any of te above “Yeu” complete the flowing Senecio Glunn() shoul aways sh

Valve othe gods ier ass, or sores gen by the fepingfeuncton. I the Touran recaved lee han fi ma

fetal 1X

‘alu i ey Warsecion ar shang srangemare. showin com (2) he vakn off goose. sar arse, © serves essa,

WR wr

725 isthe foundation dealy © ively anid wih, o rele fo, ore or rte conan orpansatore

escrtedn secion S0() ofthe Coe (oer tansecton £01(3}) ra secton 5277 ve Ei no

ined open (ee Soman baie seen

_

fore Paci 2 cups __|_____ aos _ [Fn

Rec sea ne ondy =

as mn some Te ae ile [Sao [raresen

itil Famsnane, ROGAN TOVELIS UB LLP [remo p 53-0084704

eee or YORK, NY 10022 Jpnonena 222 918-3000

‘Foseu s725 V 15-4.5F 026461/000003,

Pace 15

Schedule 8 ‘Schedule of Contributors

ele > tach o Form 0, Frm HOLE, o For #07 2015

seein aa ae

aon00t0438

Sram pe oo

Form 0080082 (covey cenernenten opaston

TF asarieyr nonexemot cnartable rust net tested

227 potteat ganization

501123) exempt pete fourdaton

TE avanyay) sonexempt chartable ust treated es 2 privetefourdeton

TE s011¢13) taxable private foundation

‘Shock your organization cowred bythe General Rus ora Special Rue

Note, Oniy 2 seston 601()7), (9° (10} eranaaton can ene bowser bot ha Gener Rule an. Spec Rue, Soe

LB Foran xgaizaton ting Form 990, 9902, oF 990.PF thst reeled ducing ha yor, contibutions ttn $5,000,

cor more (money prope) fom anyone conroor Complete Pars I and See xo fr tem 9

onto oa oma.

SpacialRlos

F7 Fer an orgaization dese in section £01(<)(3} fing Form 99¢ or 900-E2 that met the 33 1/3 % support test of he

regulations unr sectors £09(a) and ATO] AKU, hat chokes Sched A (Fom 0900: $902), Pa ne

12182, or 1b, and tha raced tem anyone contbuto rig the yea, etal eanrbutons ofthe gear)

{55,000 or (2) 2% othe amount on 6) Form 90D, Pat Vl. ine tho) Fem S002, rm Compt Pa ana

Oo

Foran erganaaten doscites in seston 5167), (8), or (10) fg Fors 990 or 890-£2 tat recsvd Hom any ore

conto, ring the yea, otal contmutons of mre than $1,000 archer egos, chara, sore,

Tera, 7 educational purposes, ofr he praventon of rly ohidren or ana Comps Par I aril

Foran crganization deserved in secton 501(0K7), (8). oF (10) fing Form 990 or 990-E2 tht received fom anyone

condor ourng th yer, conttons ecustay fo relitve chain ete,pupoees, it ra such

fonirbutons fotled moe then $000, th boxe cracked, ena here the toll cannons al were receied

‘urna the yar for an exclusiva ois, cacti, sc, pose. Do nol complete ay ofte pas esse

‘General Rue apps otis organization because ocened nner religious, chartabe et, conbutions

totaling $5600 8 more cringe year 7 we BS:

Caution. An egerization iat not covered by tne General Rue andor he Special Rules dss ot a Schad (Farm BE

280-22, or 0.7F) out must answer No" on Pa WV, Ina 2, oft Form #9; or check be boron ne Hof Form 90-62 oon ts

Form SG0-PF, Prt, ine 2, carly tet ous nt meet he ng equrement ef Schesule 8 (For O50, D2, or BOPF)

7acgeH 5736

284617000003 PAGE 15

Fae ot egeniny THE CLINTON PARTLY FOONDRTTON

oS

Contributors (see instructions). Use duplicate copes of Part | adetnal space is needed

@

@ @

snap 04 ‘out contbutions | Type ef contrbuton

a_| wroutam 9. ¢ aruaRy R. cLINTON

POST OFFICE BOX 937 1,000,001

canpeagun, wy 10524

@ @

Totetcontnoutons | Type ef gontrbation

SEES | eee EEE eee person I

Payot

5 Noneass I]

(coraiae anit

ny oi © @

No. Name, sdereet, and 21+ ¢ Totalcontibutone | _Typecf contrition

Payot [|

s_—_______] onesss_ CJ

(ont 1

‘een cota)

@ @

@

fe ‘otal contibutons _| Type ct contrition

Payot [|

s_—___ | noneasn

(conn? utr

2 ame arn, and 2 64 “otal cont “ype ot Son

s_______| nonessn

Scan ssn)

ry @

© @,

est, and 2 +4 ‘otal contributions _| typeof controaton

Payot [|

Ee eee itor

(compen te

‘earn ones)

"12086 9726 visas 028461000002 Pace 16

Kame oogenesis THE CLINTON FARILY FOONOMTTOW

Noneash Property (see instruction), Use dupiate copies of Pat If additonal space is needed

(a).

o

Deseripton of noneeeh property ven

el

Fy (or esate)

toes)

@

Date recon

‘one 2

‘nee o io imate

‘om scription a oath prop ohen retina

‘om ©, Fay (or eens) @

fom Deccipen of nah rope en sev or eatin) | tg aed

‘vor © FMV (or etna) “

fon siotan of onexeh repr oven pik Tani

ome ft mit a

ion Descrinton of acash property han seyret) | oun Sth

one, @

trom oe) FMV (or estimate) a

on Derrnton of ott rv tenia) | ie ated

‘750861 5716 Vv 154.58

028461/000001

pace 17

‘ign of aransalon THE" CLINTON FAUILY FONORTION GFT TN aT

30-0048438

[RMU Sectsvayyrligious, charitable, ot, contributions to organizations described in section B01(c), (8), oF

(10) that otal more than $1,000 forthe year from any one contributor. Compete columns (a) trough (e) and

the folowing line enty. For crgarizatons completing Part Il enter the total of exclusively religous, chartable et,

‘contibutons of $1,000 oF lees forthe year (Enter tis information once. See nsttuctons) ®

Use dupleate copes of Par If adaitonl spaces eedes

a eee oleate SS

= prmeaon ey

Ce) (ese ao (e) ererpon tow ge le

oor

“raatrs name sree, nd 2 4 eave of wanaerort eaaeve

tm (0) Prone ot et (ua (@) esepon ow gia ae

L See

‘720864 5716 Vv 1s-4.5F 026461/000001 PAGE 18

st anu

T axamiowne

T ENRHOWLEW

acbavoo-oF

roonnn/ raver. sgt 8

ae reno.

soe

“tere

SyODe WaT

SESNadxe

ae

avn

tus wes0EL,

(orvogH>) awouonae

NvDUOnae

NOrLaTHOSIT

SINGWLSGANT WW RUWWOGNSL NO ISTUSINT - T Gawd ‘44066 WHOT

NoriwaNno xTTuWs NOINTID SHE

on saws agtpor A

2 anasaowse

—_—— are sTeLOL

sue ‘oz a7 waouwn

-006'9 a1 8 STTEAOT NeOOH

“sgsoawna ‘HOSNT “aHOONT sue waa NorgaTwosea

STGWLTEWHO aN INERLSSANT ‘S3SNSAX3

uausarow TEN ‘any

sONgAgH

‘S8ag ONTINOODOY - I dd ‘adoee WHOA

woravonnor x2rHva woLNITD sHE

2 ENGWHOWEEY

‘THE CLINTON

FORM 990PF, PART T - TAXES

DESCRIPTION,

TOTALS

72086 9725

ERWILY FOUNDATION

REVENUE

‘AND

EXPENSES

PER BOOKS

250.

20.

Vv 1s-4sF 2846/0000. RAGE 21

{THE CLINTON FANILY FOUNDATION 30-004803

ATTACHMENT @

[FORM 390PF, PART

XP

REVENUE

‘AND.

EXPENSES

DESCRIPTION PER BOOKS

EAW JOURNAL AD FEE 145.

TOTALS naa 145.

ya03en 5716 2846i/0coo0,

{THE CLINTON FAMILY FOUNDATION 30-0048433

RPTACHMENT 5

FORM 991

DESCRIPTION Awount

2014 CHARITABLE CHECKS CLEARED IN 2015 41,832,500.

voray To

va0g6m 5716 vy isase 26461/000¢01, pace 23

oe ova

ro0o0a/ta0z0 serbect A

2 aon

eTsot AN ‘wadwaawHO:

Le XO8 #91440 4sud

NOUNITO “MH AUWTITE 3 °C WETTTIM,

‘SSaudgy ONY SAWS

ed

SWOLNGIMINOD TILNWISOS WAN ~ OT SNIT /v-TIA duva “aao66 IOS

seve!

06 NOLAVOKNOS ATENWE NOBNITD 3HE

{THE CLINTON ERMILY FOUNDATION 30-0040838

‘ASTACHMENT 7

LINE_14 = LOCATTON OF _RODKS.

€/0 HOGAN LOVELLS US LLP, 675 THIRD AVE. NEW YORE, NY

ram 9726 v 154.5 929461/000001 HAGE 23

{THE CLINTON FAMILY FOUNDATION 30-0048038

QPF, PART VII-8,

GRANTEE'S NAM BA RUDOLPH FOUNDATION

GRANTEE'S ADDRESS: P.0. BOX 21251

CITY, STATE & ZIP: WASHINGTON, DC 20009

GRANT DATE: 03/30/2015

GRANT ANOUNT 5,000.

GRANT PURPOSE FUND SCHOLARSHIPS FOR UNPAID INTERNSHIPS

AMOUNT. BXPENDEI 5,000.

ANY DIVERSION? no

DATES OF REPORTS: 04/28/16

VERIFICATION DATE:

RESULTS OF VERIFICATION:

N/A

730864 5726 Vv 184.38 028461000002 PAGE 26

ue exe

= rr F

0 “0 0

0 ° °

° “0 °

pene oueT EraaKe

WEHLO GW azKOTAWE OF

ecrav00-16

NOTE VeNGANOD

rooana/tse870

ASS A

craze

serunswaun pvEsNoAs

woHLTS0d OF OBt0AG0 wamH

‘age Sunok SOVESAY ONY STLTL

Stes nosoee

PISOT AN “wnowaawio

Le6 xou 301340 aso

SOINITD “4 VESTED

rigor an “wnowasena

Ug6 Xou 201830 1308

OLN WENOOE ABVIITH

pts0t aN "eobecawiio

16 oa 291420 1503

NoENITD Noguaaaae WerTTIH

SER mY aE

SURAT GY "GVOIORNIS TRUSTING 36 LETT = TTix TOW "Habed wns

NOLSYONDOS RITHM AOANLIO Hu

‘tHE ELINTON FAMILY FOUNDATION 30-0048838

‘ATTACHMENT 10

RUATION REGARDING FOUNDATION MANAGERS

WILLIAM JEFFERSON CLINTON

HILLARY RODHAM CLINTON

vanRen 5736 vas. sF 028461/000003, PACE 28

ee a a TE TS RSH ET

PATER RT RRA WT

roe rue wo La 48

1H ST PRS HWS = WAH ST

eos. sean

IE ST TRE RE = A A aE

Você também pode gostar

- Windward Fund's 2018 Tax FormsDocumento49 páginasWindward Fund's 2018 Tax FormsJoe SchoffstallAinda não há avaliações

- Hopewell Fund's 2018 Tax FormsDocumento72 páginasHopewell Fund's 2018 Tax FormsJoe Schoffstall100% (1)

- Confidential Democracy Alliance Memo Sent To Pelosi Mentioning Now Dem Candidate Scott WallaceDocumento10 páginasConfidential Democracy Alliance Memo Sent To Pelosi Mentioning Now Dem Candidate Scott WallaceJoe Schoffstall100% (1)

- Media Matters at Democracy Alliance Spring Donor ConferenceDocumento1 páginaMedia Matters at Democracy Alliance Spring Donor ConferenceJoe SchoffstallAinda não há avaliações

- Citizens For Responsibility and Ethics in Washington's (CREW) 2017 Tax FormsDocumento37 páginasCitizens For Responsibility and Ethics in Washington's (CREW) 2017 Tax FormsJoe SchoffstallAinda não há avaliações

- Wiscosin Dem Gov Candidate Dana Wachs' Foxconn EmailsDocumento5 páginasWiscosin Dem Gov Candidate Dana Wachs' Foxconn EmailsJoe SchoffstallAinda não há avaliações

- CREW's Financial Filings That Reveal They Share Employees With Media MattersDocumento16 páginasCREW's Financial Filings That Reveal They Share Employees With Media MattersJoe SchoffstallAinda não há avaliações

- New Venture Fund 2018 Tax FormsDocumento146 páginasNew Venture Fund 2018 Tax FormsJoe SchoffstallAinda não há avaliações

- Dem Candidate Katie Porter Questionnaire Showing Support For Reparations, Far-Left AgendaDocumento17 páginasDem Candidate Katie Porter Questionnaire Showing Support For Reparations, Far-Left AgendaJoe SchoffstallAinda não há avaliações

- Scott Wallace Bucks County Voting RecordDocumento1 páginaScott Wallace Bucks County Voting RecordJoe SchoffstallAinda não há avaliações

- PICO Action Fund 2018 Civic Engagement Plan - Congressional TargetsDocumento17 páginasPICO Action Fund 2018 Civic Engagement Plan - Congressional TargetsJoe SchoffstallAinda não há avaliações

- Clinton Family Foundation 2017 Tax FormsDocumento33 páginasClinton Family Foundation 2017 Tax FormsJoe SchoffstallAinda não há avaliações

- CFPB's Richard Cordray Email Offering Campaign HelpDocumento1 páginaCFPB's Richard Cordray Email Offering Campaign HelpJoe SchoffstallAinda não há avaliações

- Emails Show Obama DOJ's 'Slush Fund' Sought To Route Money To Organizations of Their 'Choosing'Documento14 páginasEmails Show Obama DOJ's 'Slush Fund' Sought To Route Money To Organizations of Their 'Choosing'Joe Schoffstall100% (1)

- Clinton Family Foundation 2016 Form 990Documento30 páginasClinton Family Foundation 2016 Form 990Joe Schoffstall0% (1)

- Southern Poverty Law Centers' 2015 Form 990TDocumento5 páginasSouthern Poverty Law Centers' 2015 Form 990TJoe SchoffstallAinda não há avaliações

- Majority Forward Dark Money Nonprofit - Marc EliasDocumento2 páginasMajority Forward Dark Money Nonprofit - Marc EliasJoe Schoffstall100% (1)

- Donors of Anti-Trump Resistance' Group Revealed (Center For Community Change - 2015)Documento64 páginasDonors of Anti-Trump Resistance' Group Revealed (Center For Community Change - 2015)Joe Schoffstall100% (5)

- 2017: Kansas Interstate Voter Registration Crosscheck ProgramDocumento1 página2017: Kansas Interstate Voter Registration Crosscheck ProgramJoe Schoffstall100% (1)

- Full David Brock Confidential Memo On Fighting TrumpDocumento49 páginasFull David Brock Confidential Memo On Fighting TrumpJoe Schoffstall82% (301)

- Clinton Status Memo Mentioning Google's Eric SchmidtDocumento3 páginasClinton Status Memo Mentioning Google's Eric SchmidtJoe Schoffstall100% (1)

- David Brock's Share Blue Plan To Delegitimize TrumpDocumento10 páginasDavid Brock's Share Blue Plan To Delegitimize TrumpJoe Schoffstall80% (10)

- Corrine Brown Defense Fund Lobbyist ContributionsDocumento1 páginaCorrine Brown Defense Fund Lobbyist ContributionsJoe SchoffstallAinda não há avaliações

- Confidential David Brock American Bridge MemoDocumento6 páginasConfidential David Brock American Bridge MemoJoe Schoffstall100% (5)

- Denial of Expedited Processing of Russ Feingold State Department CorrespondenceDocumento2 páginasDenial of Expedited Processing of Russ Feingold State Department CorrespondenceJoe SchoffstallAinda não há avaliações

- Corrine Brown Legal Defense Fund EventDocumento1 páginaCorrine Brown Legal Defense Fund EventJoe SchoffstallAinda não há avaliações

- FOIA Appeal For Expedited Processing of Russ Feingold State Department CorrespondenceDocumento1 páginaFOIA Appeal For Expedited Processing of Russ Feingold State Department CorrespondenceJoe SchoffstallAinda não há avaliações

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (119)

- Expected Linear Seating Arrangement With Blood Relation For SbiDocumento24 páginasExpected Linear Seating Arrangement With Blood Relation For SbiADARSH PRIYAAinda não há avaliações

- Bank Gala: Arena CLM 16000N2LDocumento10 páginasBank Gala: Arena CLM 16000N2LIbrahim cañizalezAinda não há avaliações

- Guide To UK State PensionsDocumento87 páginasGuide To UK State PensionsslyxdexicAinda não há avaliações

- Ucsp Q2 LP Sy 2019 2020Documento22 páginasUcsp Q2 LP Sy 2019 2020Bernadette ReyesAinda não há avaliações

- Oedipus & Electra ComplexDocumento12 páginasOedipus & Electra ComplexshahanaAinda não há avaliações

- The Dowry SystemDocumento4 páginasThe Dowry SystemaditiAinda não há avaliações

- Jeremiahs Song PacketDocumento5 páginasJeremiahs Song PacketLorie100% (2)

- Page Not Found Error on Pakistan Law WebsiteDocumento9 páginasPage Not Found Error on Pakistan Law WebsiteAbdul Majeed NisarAinda não há avaliações

- Maternal and Child Health Nursing TestDocumento21 páginasMaternal and Child Health Nursing TestAt Day's Ward50% (2)

- A Psychoanalysis of Edgar Allan Poes Ligeia and The Fall of The House of UsherDocumento3 páginasA Psychoanalysis of Edgar Allan Poes Ligeia and The Fall of The House of UsherMuhammad RafikuddinAinda não há avaliações

- Indexing Obituaries and Death Notices: Last Updated On 27 January 2014Documento51 páginasIndexing Obituaries and Death Notices: Last Updated On 27 January 2014alejandro_fuente_3Ainda não há avaliações

- Professional Teachers: Legal and Ethical MandatesDocumento41 páginasProfessional Teachers: Legal and Ethical MandatesDynne Yrylle Lou SierteAinda não há avaliações

- Wedding ScriptDocumento2 páginasWedding ScriptDavid Jhan CalderonAinda não há avaliações

- Henry Howard Earl of Surrey 2012 4Documento65 páginasHenry Howard Earl of Surrey 2012 4Muhammad Ijaz JanjuaAinda não há avaliações

- Harry Potter 1 Plot SummaryDocumento3 páginasHarry Potter 1 Plot SummaryEthan Zachary100% (1)

- 09 - Chapter 3 PDFDocumento105 páginas09 - Chapter 3 PDFmanikaAinda não há avaliações

- Cause and Effect Divorce RatesDocumento3 páginasCause and Effect Divorce RatesPelin ZehraAinda não há avaliações

- Domestic V MemoDocumento5 páginasDomestic V Memoapi-269272406Ainda não há avaliações

- Theodore Roosevelt History 1302 Video QuizDocumento2 páginasTheodore Roosevelt History 1302 Video QuizJHAinda não há avaliações

- Joanne Fluke's Lake Eden CookbookDocumento6 páginasJoanne Fluke's Lake Eden CookbookKensington Books0% (4)

- Reading Comprehension Family MembersDocumento3 páginasReading Comprehension Family MembersLe Drac50% (2)

- Kimia PPT 2017Documento5 páginasKimia PPT 2017ahmad shanusey sulaimanAinda não há avaliações

- User EraporDocumento10 páginasUser EraporAhmad SolehAinda não há avaliações

- Sociology of Contemporary IndiaDocumento16 páginasSociology of Contemporary IndiaNeeraj Dwivedi100% (1)

- IIM Lucknow's Manjunath Shanmugam: Purpose-Driven Personality and The Value of Values - Interview With Raghavendran ShanmugamDocumento4 páginasIIM Lucknow's Manjunath Shanmugam: Purpose-Driven Personality and The Value of Values - Interview With Raghavendran ShanmugamETCASESAinda não há avaliações

- JOKES40Documento9 páginasJOKES40I.O100% (1)

- World Statesmen Org Russia La-CoDocumento42 páginasWorld Statesmen Org Russia La-Coapi-3707213Ainda não há avaliações

- Let Me Introduce MyselfDocumento11 páginasLet Me Introduce MyselfzulkarnainAinda não há avaliações

- MERK ROKOk Harga GrosirDocumento5 páginasMERK ROKOk Harga Grosirabel HimappkaAinda não há avaliações

- Your English Pal ESL Lesson Plan Family Student v4Documento4 páginasYour English Pal ESL Lesson Plan Family Student v4Youssef FatihiAinda não há avaliações