Escolar Documentos

Profissional Documentos

Cultura Documentos

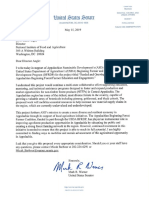

Reinsurance Tax Bill - Warner

Enviado por

MarkWarnerDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Reinsurance Tax Bill - Warner

Enviado por

MarkWarnerDireitos autorais:

Formatos disponíveis

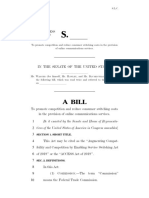

MCG16127

S.L.C.

114TH CONGRESS

2D SESSION

S. ll

To amend the Internal Revenue Code of 1986 to prevent the avoidance

of tax by insurance companies through reinsurance with non-taxed affiliates.

IN THE SENATE OF THE UNITED STATES

Mr. WARNER

llllllllll

introduced the following bill; which was read twice and referred

to the Committee on llllllllll

A BILL

To amend the Internal Revenue Code of 1986 to prevent

the avoidance of tax by insurance companies through

reinsurance with non-taxed affiliates.

1

Be it enacted by the Senate and House of Representa-

2 tives of the United States of America in Congress assembled,

3

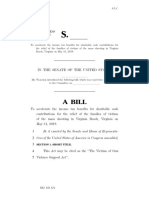

SECTION 1. PREVENTION OF AVOIDANCE OF TAX THROUGH

REINSURANCE WITH NON-TAXED AFFILIATES.

(a) IN GENERAL.Part III of subchapter L of chap-

6 ter 1 of the Internal Revenue Code of 1986 is amended

7 by adding at the end the following new section:

MCG16127

S.L.C.

2

1

SEC. 849. SPECIAL RULES FOR REINSURANCE OF NON-

LIFE CONTRACTS WITH NON-TAXED AFFILI-

ATES.

(a) IN GENERAL.The taxable income under sec-

5 tion 831(a) or the life insurance company taxable income

6 under section 801(b) (as the case may be) of an insurance

7 company shall be determined by not taking into account

8

(1) any non-taxed reinsurance premium,

(2) any additional amount paid by such insur-

10

ance company with respect to the reinsurance for

11

which such non-taxed reinsurance premium is paid,

12

to the extent such additional amount is properly al-

13

locable to such non-taxed reinsurance premium, and

14

(3) any return premium, ceding commission,

15

reinsurance recovered, or other amount received by

16

such insurance company with respect to the reinsur-

17

ance for which such non-taxed reinsurance premium

18

is paid, to the extent such return premium, ceding

19

commission, reinsurance recovered, or other amount

20

is properly allocable to such non-taxed reinsurance

21

premium.

22

(b) NON-TAXED REINSURANCE PREMIUMS.For

23 purposes of this section

24

(1) IN

GENERAL.The

term non-taxed rein-

25

surance premium means any reinsurance premium

26

paid directly or indirectly to an affiliated corporation

MCG16127

S.L.C.

3

1

with respect to reinsurance of risks (other than ex-

cepted risks), to the extent that the income attrib-

utable to the premium is not subject to tax under

this subtitle (either as the income of the affiliated

corporation or as amounts included in gross income

by a United States shareholder under section 951).

(2) EXCEPTED

RISKS.The

term excepted

risks means any risk with respect to which reserves

described in section 816(b)(1) are established.

10

(c) AFFILIATED CORPORATIONS.For purposes of

11 this section, a corporation shall be treated as affiliated

12 with an insurance company if both corporations would be

13 members of the same controlled group of corporations (as

14 defined in section 1563(a)) if section 1563 were applied

15

(1) by substituting at least 50 percent for at

16

least 80 percent each place it appears in subsection

17

(a)(1), and

18

(2) without regard to subsections (a)(4),

19

(b)(2)(C), (b)(2)(D), and (e)(3)(C).

20

(d) ELECTION TO TREAT REINSURANCE INCOME AS

21 EFFECTIVELY CONNECTED.

22

(1) IN

GENERAL.A

specified affiliated cor-

23

poration may elect for any taxable year to treat

24

specified reinsurance income as

MCG16127

S.L.C.

4

1

(A) income effectively connected with the

conduct of a trade or business in the United

States, and

(B) for purposes of any treaty between

the United States and any foreign country, in-

come attributable to a permanent establishment

in the United States.

(2) EFFECT

9

10

11

OF ELECTION.In

the case of

any specified reinsurance income with respect to

which the election under this subsection applies

(A) DEDUCTION

ALLOWED FOR REINSUR-

12

ANCE PREMIUMS.For

13

section (a), see definition of non-taxed reinsur-

14

ance premiums in subsection (b).

15

(B) EXCEPTION

exemption from sub-

FROM EXCISE TAX.The

16

tax imposed by section 4371 shall not apply

17

with respect to any income treated as effectively

18

connected with the conduct of a trade or busi-

19

ness in the United States under paragraph (1).

20

(C)

TAXATION

UNDER

THIS

SUB-

21

CHAPTER.Such

22

under this subchapter to the same extent and

23

in the same manner as if such income were the

24

income of a domestic insurance company.

income shall be subject to tax

MCG16127

S.L.C.

5

1

(D) COORDINATION

WITH FOREIGN TAX

CREDIT PROVISIONS.For

A of part III of subchapter N and sections 78

and 960

purposes of subpart

(i) such specified reinsurance income

shall be treated as derived from sources

without the United States, and

(ii) subsections (a), (b), and (c) of

section 904 and sections 902, 907, and

10

960 shall be applied separately with re-

11

spect to each item of such income.

12

The Secretary may issue regulations or other

13

guidance which provide that related items of

14

specified reinsurance income may be aggregated

15

for purposes of applying clause (ii).

16

(3) SPECIFIED

AFFILIATED CORPORATION.

17

For purposes of this subsection, the term specified

18

affiliated corporation means any affiliated corpora-

19

tion which is a foreign corporation and which meets

20

such requirements as the Secretary shall prescribe to

21

ensure that tax on the specified reinsurance income

22

of such corporation is properly determined and paid.

23

(4) SPECIFIED

REINSURANCE INCOME.For

24

purposes of this paragraph, the term specified rein-

25

surance income means all income of a specified af-

MCG16127

S.L.C.

6

1

filiated corporation which is attributable to reinsur-

ance with respect to which subsection (a) would (but

for the election under this subsection) apply.

4

5

(5) RULES

RELATED

TO

ELECTION.Any

election under paragraph (1) shall

(A) be made at such time and in such

form and manner as the Secretary may provide,

and

(B) apply for the taxable year for which

10

made and all subsequent taxable years unless

11

revoked with the consent of the Secretary.

12

(e) REGULATIONS.The Secretary shall prescribe

13 such regulations or other guidance as may be appropriate

14 to carry out, or to prevent the avoidance of the purposes

15 of, this section, including regulations or other guidance

16 which provide for the application of this section to alter17 native reinsurance transactions, fronting transactions,

18 conduit and reciprocal transactions, and any economically

19 equivalent transactions..

20

(b) CLERICAL AMENDMENT.The table of sections

21 for part III of subchapter L of chapter 1 of such Code

22 is amended by adding at the end the following new item:

Sec. 849. Special rules for reinsurance of non-life contracts with non-taxed affiliates..

MCG16127

S.L.C.

7

1

(c) EFFECTIVE DATE.The amendment made by

2 this section shall apply to taxable years beginning after

3 December 31, 2016.

Você também pode gostar

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- Save Rural Hospitals Act of 2021 Bill TextDocumento4 páginasSave Rural Hospitals Act of 2021 Bill TextMarkWarnerAinda não há avaliações

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- Save Rural Hospitals Act of 2021 One PagerDocumento1 páginaSave Rural Hospitals Act of 2021 One PagerMarkWarnerAinda não há avaliações

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Resolution Honoring Hispanic Heritage MonthDocumento6 páginasResolution Honoring Hispanic Heritage MonthMarkWarnerAinda não há avaliações

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (894)

- Deepfakes Letter To TwitterDocumento2 páginasDeepfakes Letter To TwitterMarkWarnerAinda não há avaliações

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- 5.15.19 MRW ASD BFRDP Grant Support LetterDocumento1 página5.15.19 MRW ASD BFRDP Grant Support LetterMarkWarnerAinda não há avaliações

- Deepfakes Letter To YouTubeDocumento2 páginasDeepfakes Letter To YouTubeMarkWarnerAinda não há avaliações

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- Syrian Allies Protection ActDocumento6 páginasSyrian Allies Protection ActMarkWarnerAinda não há avaliações

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- ACCESS Act Section by Section FINAL.Documento3 páginasACCESS Act Section by Section FINAL.MarkWarnerAinda não há avaliações

- GOE19968Documento17 páginasGOE19968MarkWarner100% (1)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (265)

- Insurance Commission Signed LetterDocumento2 páginasInsurance Commission Signed LetterMarkWarnerAinda não há avaliações

- Deepfakes Letter To SnapchatDocumento2 páginasDeepfakes Letter To SnapchatMarkWarnerAinda não há avaliações

- Signed Pre-Ex LetterDocumento4 páginasSigned Pre-Ex LetterMarkWarner100% (1)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- Deepfakes Letter To FacebookDocumento2 páginasDeepfakes Letter To FacebookMarkWarnerAinda não há avaliações

- Deepfakes Letter To TwitchDocumento2 páginasDeepfakes Letter To TwitchMarkWarnerAinda não há avaliações

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- Deepfakes Letter To TikTokDocumento2 páginasDeepfakes Letter To TikTokMarkWarnerAinda não há avaliações

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- Deepfakes Letter To TumblrDocumento2 páginasDeepfakes Letter To TumblrMarkWarnerAinda não há avaliações

- Deepfakes Letter To LinkedInDocumento2 páginasDeepfakes Letter To LinkedInMarkWarnerAinda não há avaliações

- Deepfakes Letter To PinterestDocumento2 páginasDeepfakes Letter To PinterestMarkWarnerAinda não há avaliações

- Deepfakes Letter To ImgurDocumento2 páginasDeepfakes Letter To ImgurMarkWarnerAinda não há avaliações

- Deepfakes Letter To RedditDocumento2 páginasDeepfakes Letter To RedditMarkWarnerAinda não há avaliações

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The Illicit Cash Act One PagerDocumento2 páginasThe Illicit Cash Act One PagerMarkWarner100% (1)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2219)

- MCG 19647 LatestDocumento3 páginasMCG 19647 LatestMarkWarnerAinda não há avaliações

- 9.25.19 Letter To AgriLogic Industrial Hemp Crop InsuranceDocumento2 páginas9.25.19 Letter To AgriLogic Industrial Hemp Crop InsuranceMarkWarnerAinda não há avaliações

- ILLICIT CASH Act, As IntroducedDocumento133 páginasILLICIT CASH Act, As IntroducedMarkWarner100% (1)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- VA Beach Tax Letter 6.13.19Documento1 páginaVA Beach Tax Letter 6.13.19MarkWarnerAinda não há avaliações

- 09.17.2019 MRW To Pompeo Re EDC ProgramDocumento2 páginas09.17.2019 MRW To Pompeo Re EDC ProgramMarkWarnerAinda não há avaliações

- The ILLICIT CASH Act Section by SectionDocumento5 páginasThe ILLICIT CASH Act Section by SectionMarkWarnerAinda não há avaliações

- MCG 19610Documento3 páginasMCG 19610MarkWarnerAinda não há avaliações

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (119)

- 2019.09.23 Warner USIP China SpeechDocumento13 páginas2019.09.23 Warner USIP China SpeechMarkWarnerAinda não há avaliações

- MobileXUSA Letter23Documento2 páginasMobileXUSA Letter23MarkWarnerAinda não há avaliações

- BITS Pilani Course Handout on Fundamentals of Finance & AccountingDocumento2 páginasBITS Pilani Course Handout on Fundamentals of Finance & Accountingbijesh9784Ainda não há avaliações

- Yukitoshi Higashino MftaDocumento29 páginasYukitoshi Higashino MftaSeyyed Mohammad Hossein SherafatAinda não há avaliações

- Chapter 4 Assignment Recording TransactionsDocumento6 páginasChapter 4 Assignment Recording TransactionsjepsyutAinda não há avaliações

- Income From SalaryDocumento60 páginasIncome From SalaryroopamAinda não há avaliações

- IVALIFE - IVApension Policy BookletDocumento12 páginasIVALIFE - IVApension Policy BookletJosef BaldacchinoAinda não há avaliações

- Entrepreneur Management Questions and AnswersDocumento24 páginasEntrepreneur Management Questions and AnswersArun DassiAinda não há avaliações

- Payment Systems Worldwide: Appendix Country-by-Country AnswersDocumento306 páginasPayment Systems Worldwide: Appendix Country-by-Country Answersravinewatia27Ainda não há avaliações

- Syllabus Mls Part 1 2Documento18 páginasSyllabus Mls Part 1 2Fanatic AZAinda não há avaliações

- Analysis and Correction of Errors WorksheetDocumento3 páginasAnalysis and Correction of Errors WorksheetDaphneAinda não há avaliações

- Chapter 5 MishkinDocumento21 páginasChapter 5 MishkinLejla HodzicAinda não há avaliações

- Default Profile Customer Level Account - FusionDocumento1 páginaDefault Profile Customer Level Account - FusionhuyhnAinda não há avaliações

- Annexure 4 - Pradhan Mantri Suraksha Bima Yojana FormDocumento1 páginaAnnexure 4 - Pradhan Mantri Suraksha Bima Yojana FormRaghav SharmaAinda não há avaliações

- 4th Quarter Entrepreneurship FinalsDocumento3 páginas4th Quarter Entrepreneurship FinalsShen EugenioAinda não há avaliações

- 7 Things About Support and Resistance That Nobody Tells YouDocumento6 páginas7 Things About Support and Resistance That Nobody Tells YouAli Abdelfatah Mahmoud100% (1)

- Admission of A PartnerDocumento21 páginasAdmission of A PartnerHarmohandeep singhAinda não há avaliações

- Assignment PDFDocumento31 páginasAssignment PDFjjAinda não há avaliações

- EAE0516 - 2022 - Slides 15Documento25 páginasEAE0516 - 2022 - Slides 15Nicholas WhittakerAinda não há avaliações

- AccountingDocumento2 páginasAccountingMerielle Medrano100% (2)

- HOME DEPOT - Debt StructureDocumento3 páginasHOME DEPOT - Debt Structureluxi0Ainda não há avaliações

- Forex Trading, Simplified Members Strategy E-BookDocumento77 páginasForex Trading, Simplified Members Strategy E-BookShankar R100% (1)

- ABC7Documento6 páginasABC7Melissa R.100% (3)

- Implementing Your Business PlanDocumento10 páginasImplementing Your Business PlanGian Carlo Devera71% (7)

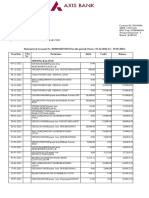

- Garima Axis Bank SDocumento3 páginasGarima Axis Bank SSajan Sharma100% (1)

- Insolvency LawDocumento14 páginasInsolvency LawShailesh KumarAinda não há avaliações

- 2015 Accountancy Question PaperDocumento4 páginas2015 Accountancy Question PaperJoginder SinghAinda não há avaliações

- N26 StatementDocumento4 páginasN26 StatementCris TsauAinda não há avaliações

- Answer All QuestionsDocumento5 páginasAnswer All QuestionsfazmjAinda não há avaliações

- GTI 2011 Chapter 5 Automated ToolsDocumento23 páginasGTI 2011 Chapter 5 Automated ToolsAsad MuhammadAinda não há avaliações

- Caltex v Security Bank: 280 CTDs worth P1.12MDocumento52 páginasCaltex v Security Bank: 280 CTDs worth P1.12MAir Dela CruzAinda não há avaliações

- Bata & AB BankDocumento8 páginasBata & AB BankSaqeef RayhanAinda não há avaliações

- University of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingNo EverandUniversity of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingNota: 4.5 de 5 estrelas4.5/5 (97)

- Getting Through: Cold Calling Techniques To Get Your Foot In The DoorNo EverandGetting Through: Cold Calling Techniques To Get Your Foot In The DoorNota: 4.5 de 5 estrelas4.5/5 (63)

- Mastering Private Equity: Transformation via Venture Capital, Minority Investments and BuyoutsNo EverandMastering Private Equity: Transformation via Venture Capital, Minority Investments and BuyoutsAinda não há avaliações

- Introduction to Negotiable Instruments: As per Indian LawsNo EverandIntroduction to Negotiable Instruments: As per Indian LawsNota: 5 de 5 estrelas5/5 (1)

- Disloyal: A Memoir: The True Story of the Former Personal Attorney to President Donald J. TrumpNo EverandDisloyal: A Memoir: The True Story of the Former Personal Attorney to President Donald J. TrumpNota: 4 de 5 estrelas4/5 (214)

- Deduct Everything!: Save Money with Hundreds of Legal Tax Breaks, Credits, Write-Offs, and LoopholesNo EverandDeduct Everything!: Save Money with Hundreds of Legal Tax Breaks, Credits, Write-Offs, and LoopholesNota: 3 de 5 estrelas3/5 (3)