Escolar Documentos

Profissional Documentos

Cultura Documentos

How To File - IT

Enviado por

Ashok Paskalraj0 notas0% acharam este documento útil (0 voto)

10 visualizações1 páginaIncome tax filing basic for indian citizens.

Título original

How to file - IT

Direitos autorais

© © All Rights Reserved

Formatos disponíveis

DOCX, PDF, TXT ou leia online no Scribd

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoIncome tax filing basic for indian citizens.

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato DOCX, PDF, TXT ou leia online no Scribd

0 notas0% acharam este documento útil (0 voto)

10 visualizações1 páginaHow To File - IT

Enviado por

Ashok PaskalrajIncome tax filing basic for indian citizens.

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato DOCX, PDF, TXT ou leia online no Scribd

Você está na página 1de 1

Go to https://incometaxindiaefiling.gov.

in/

1) Login

Username: (Pan number)

Password:

DOB: Select

Login:

2)

3)

4)

5)

6)

7)

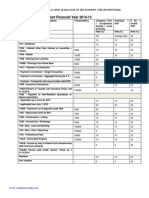

EFile -> Prepare and submit online ITR

ITR Form name ITR 1

Assessment Year (Select AY 2015-2016) for financial year 2014-15

Prefill address - from Previous Return Filed

Save Draft every now and then.

Top Tab- Personal Information

a. Change address to current address with pincode and mobile number.

b. Employer Category Others

c. Residential Status - RES Resident

d. Tax Status Nil Balance

e. Return filed - 11 Before Due date 139(1) or After due date 139 (4)

f. Original or revised Original

g. Portuguese No

h. Aadhaar Yes and enter Aaadhar number ( if prefilled then check and

leave it )

i. Click Next

8) Move to Income Details - top tab

a. B1 - Income from Salary (see your form 1 part b item number 6)

b. B4 C1 80C (see your form 16 item 9. A )

9) Rest all will autopopulate and tax will show as same in form 16. Click Next

10)

Move to tax details next tab dont change anything. Your TDs paid

by company will be there. Click Next

11)

Move to Tax Details and Verification Next tab

a. D19 Refund will be 0. If not check. Go check in Personal Information

tab if Nil tax balance is selected.

b. D21 A - Add Bank accounts both accounts and IFSC code (first

account is where if there is a refund it will be credited. For you no

refund. So anything can be first account).

c. Verification I (name) and son of (name)

d. Place - Chennai

Você também pode gostar

- 2016 Itr4 PR3Documento165 páginas2016 Itr4 PR3TejasAinda não há avaliações

- Steps For Filing Returns OnlineDocumento4 páginasSteps For Filing Returns OnlineSumit BhatAinda não há avaliações

- V. N. Hari,: Sudhakar & Kumar AssociatesDocumento28 páginasV. N. Hari,: Sudhakar & Kumar AssociatesvnharicaAinda não há avaliações

- IRS Reporting Requirements Under The Affordable Care Act Is Your Business Ready?Documento8 páginasIRS Reporting Requirements Under The Affordable Care Act Is Your Business Ready?api-284589375Ainda não há avaliações

- Return ChallanDocumento20 páginasReturn Challansyedfaisal_sAinda não há avaliações

- ITR-3 Indian Income Tax Return: Part A-GENDocumento7 páginasITR-3 Indian Income Tax Return: Part A-GENmohitsharma1996Ainda não há avaliações

- ITR-3 Indian Income Tax Return: Part A-GENDocumento7 páginasITR-3 Indian Income Tax Return: Part A-GENAvani GadaAinda não há avaliações

- ITR-2 Indian Income Tax Return: Part A-GENDocumento12 páginasITR-2 Indian Income Tax Return: Part A-GENMankamesachinAinda não há avaliações

- ITR-3 Indian Income Tax Return: Part A-GENDocumento7 páginasITR-3 Indian Income Tax Return: Part A-GENSudeha ShirkeAinda não há avaliações

- Direct Taxation 1523516 HarishBojja CIA3Documento11 páginasDirect Taxation 1523516 HarishBojja CIA3Madhav LuthraAinda não há avaliações

- Itr 2Documento9 páginasItr 2Arvind PaulAinda não há avaliações

- e-Filing website services for income tax returns and formsDocumento1 páginae-Filing website services for income tax returns and formsfouziataranumAinda não há avaliações

- Assessment Year Sahaj Indian Income Tax ReturnDocumento1 páginaAssessment Year Sahaj Indian Income Tax ReturnAnit SharmaAinda não há avaliações

- ITR-3 Indian Income Tax Return: Part A-GENDocumento8 páginasITR-3 Indian Income Tax Return: Part A-GENRahul SharmaAinda não há avaliações

- ISO 9001:2015 ITR GuideDocumento3 páginasISO 9001:2015 ITR GuideKennedy MbuviAinda não há avaliações

- 2011 Itr4 SpecificeDocumento54 páginas2011 Itr4 SpecificeAnand ThackerAinda não há avaliações

- 2011 - ITR2 - r6Documento33 páginas2011 - ITR2 - r6Bathina Srinivasa RaoAinda não há avaliações

- Soft Skill: ObjectiveDocumento5 páginasSoft Skill: Objectivealka darangeAinda não há avaliações

- E Filing PresentationDocumento14 páginasE Filing PresentationKeshav AroteAinda não há avaliações

- 2015 Itr1 PR3Documento18 páginas2015 Itr1 PR3shubham sharmaAinda não há avaliações

- ITR-3 Indian Income Tax Return: Part A-GENDocumento12 páginasITR-3 Indian Income Tax Return: Part A-GENmehtakvijayAinda não há avaliações

- Value Added Tax in TallyDocumento14 páginasValue Added Tax in TallyAkash AgarwalAinda não há avaliações

- How To File Income Tax Return F.Y. 2015-16Documento12 páginasHow To File Income Tax Return F.Y. 2015-16Dev puniaAinda não há avaliações

- Itr-2 Indian Income Tax Return: (For Individuals and Hufs Not Having Income From Business or Profession) Assessment YearDocumento7 páginasItr-2 Indian Income Tax Return: (For Individuals and Hufs Not Having Income From Business or Profession) Assessment YearVarun ChhabraAinda não há avaliações

- Income Tax Proof Submission FAQs (FY 2014-15)Documento15 páginasIncome Tax Proof Submission FAQs (FY 2014-15)Seetha ChimakurthiAinda não há avaliações

- SUGAM ITR-4S Presumptive Business Income Tax ReturnDocumento11 páginasSUGAM ITR-4S Presumptive Business Income Tax ReturncachandhiranAinda não há avaliações

- BIR Citizens Charter 2020 2nd Edition RR RDODocumento228 páginasBIR Citizens Charter 2020 2nd Edition RR RDOJessa TadeoAinda não há avaliações

- RajVAT-QuickGuide To E-Filing of Returns-UpdatedDocumento2 páginasRajVAT-QuickGuide To E-Filing of Returns-Updatedddemo17demoAinda não há avaliações

- File ITR-1 Form for Individuals with Income from Salary and InterestDocumento6 páginasFile ITR-1 Form for Individuals with Income from Salary and InterestManjunath YvAinda não há avaliações

- Have You Filed Your Income Tax Return Electronically?: Services Available On E-Filing WebsiteDocumento1 páginaHave You Filed Your Income Tax Return Electronically?: Services Available On E-Filing WebsitefouziataranumAinda não há avaliações

- RecoverdDocumento55 páginasRecoverdcmtssikarAinda não há avaliações

- How Toe FileDocumento4 páginasHow Toe Fileirfanahmed.dba@gmail.comAinda não há avaliações

- SAHAJ ITR-1 FORM FOR INDIVIDUALS WITH INCOME FROM SALARY/PENSION, HOUSE PROPERTY, OTHER SOURCESDocumento7 páginasSAHAJ ITR-1 FORM FOR INDIVIDUALS WITH INCOME FROM SALARY/PENSION, HOUSE PROPERTY, OTHER SOURCESrajshri58Ainda não há avaliações

- Tds TcsDocumento20 páginasTds TcsnaysarAinda não há avaliações

- Form ITR2 2012-2013Documento9 páginasForm ITR2 2012-2013N.PalaniappanAinda não há avaliações

- Fate Outreach 17oct2011 (Islamabad)Documento8 páginasFate Outreach 17oct2011 (Islamabad)Farhan JanAinda não há avaliações

- Lesson-4Documento11 páginasLesson-4devravidhan382Ainda não há avaliações

- E-Filling of ReturnDocumento6 páginasE-Filling of ReturnNeelanjan MitraAinda não há avaliações

- Income Slabs Income Tax RateDocumento4 páginasIncome Slabs Income Tax RateSavoir PenAinda não há avaliações

- Input Data For Incometax Fillling FY 2014-15 AY 2015-16Documento3 páginasInput Data For Incometax Fillling FY 2014-15 AY 2015-16satishktAinda não há avaliações

- RMC 19-2015Documento9 páginasRMC 19-2015reseljanAinda não há avaliações

- Tax computation and deductionsDocumento9 páginasTax computation and deductionsAkshay Kumar SahooAinda não há avaliações

- TDS RATE CHART FY 2014-15Documento26 páginasTDS RATE CHART FY 2014-15shivashankari86Ainda não há avaliações

- Form ITR-1Documento3 páginasForm ITR-1Rajeev PuthuparambilAinda não há avaliações

- File and Pay Electronically: Electronic Filing and Payment System (EFPS)Documento26 páginasFile and Pay Electronically: Electronic Filing and Payment System (EFPS)mmeeeowwAinda não há avaliações

- Form_pdf_177155750160424 (1)Documento11 páginasForm_pdf_177155750160424 (1)dkassociate609Ainda não há avaliações

- ITR 1 Sahaj in Excel Format For A.Y 2011 12 Financial Year 2010 11Documento8 páginasITR 1 Sahaj in Excel Format For A.Y 2011 12 Financial Year 2010 11Modin HorakeriAinda não há avaliações

- Applying for a TIN Number: Instructions for Completing Form DT-1002Documento41 páginasApplying for a TIN Number: Instructions for Completing Form DT-1002enyonyoziAinda não há avaliações

- Computerised Payroll Practice Set Using MYOB AccountRight: Australian EditionNo EverandComputerised Payroll Practice Set Using MYOB AccountRight: Australian EditionAinda não há avaliações

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionAinda não há avaliações

- Goods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesNo EverandGoods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesAinda não há avaliações

- Round 2 Allotment List (Broad Sheet) - Uttarakhand - 1-100 PDFDocumento100 páginasRound 2 Allotment List (Broad Sheet) - Uttarakhand - 1-100 PDFAshok PaskalrajAinda não há avaliações

- Round 2 Allotment List (Broad Sheet) - Uttarakhand - 101-200Documento100 páginasRound 2 Allotment List (Broad Sheet) - Uttarakhand - 101-200Ashok PaskalrajAinda não há avaliações

- AI State and DNB Links Updated Info - 03 July 2020Documento3 páginasAI State and DNB Links Updated Info - 03 July 2020Ashok PaskalrajAinda não há avaliações

- SelList With Previous Selection-140619Documento2 páginasSelList With Previous Selection-140619Ashok PaskalrajAinda não há avaliações

- Round 2 Allotment List (Broad Sheet) - Uttarakhand - 1-100 PDFDocumento100 páginasRound 2 Allotment List (Broad Sheet) - Uttarakhand - 1-100 PDFAshok PaskalrajAinda não há avaliações

- Neet PG 2019 - All IndiaDocumento2 páginasNeet PG 2019 - All IndiaAshok PaskalrajAinda não há avaliações

- 1 DNB PDCET January 2018 Admission Session - Centralized Merit Based Counseling - RegDocumento3 páginas1 DNB PDCET January 2018 Admission Session - Centralized Merit Based Counseling - RegAshok PaskalrajAinda não há avaliações

- Round 2 Allotment List (Broad Sheet) - Uttarakhand - 101-200Documento100 páginasRound 2 Allotment List (Broad Sheet) - Uttarakhand - 101-200Ashok PaskalrajAinda não há avaliações

- NEET PG 2020 - FAQs List 1Documento9 páginasNEET PG 2020 - FAQs List 1Ashok PaskalrajAinda não há avaliações

- INICET PG Jul 2021 Results - Sorted by Rank With Category RankDocumento679 páginasINICET PG Jul 2021 Results - Sorted by Rank With Category RankAshok PaskalrajAinda não há avaliações

- TN Rank List With NEET Rank - Final PDFDocumento169 páginasTN Rank List With NEET Rank - Final PDFAshok PaskalrajAinda não há avaliações

- Revised Guidelines For Poster Presentation Tanpaps 2020Documento2 páginasRevised Guidelines For Poster Presentation Tanpaps 2020Ashok PaskalrajAinda não há avaliações

- Solitary ReaperDocumento1 páginaSolitary ReaperAyisha RashidAinda não há avaliações

- NEET PG 2020 Counseling GuideDocumento13 páginasNEET PG 2020 Counseling GuideAshok PaskalrajAinda não há avaliações

- Casagrand Aqua Brochure 1Documento72 páginasCasagrand Aqua Brochure 1Ashok PaskalrajAinda não há avaliações

- ASG 2018 CV Schedule 17122018Documento50 páginasASG 2018 CV Schedule 17122018Ashok PaskalrajAinda não há avaliações

- TNPG 2016 Complete Medical Allotment ListDocumento35 páginasTNPG 2016 Complete Medical Allotment ListAshok PaskalrajAinda não há avaliações

- For Rank 4700Documento195 páginasFor Rank 4700Ashok PaskalrajAinda não há avaliações

- 08 Chapter 1Documento35 páginas08 Chapter 1Ashok PaskalrajAinda não há avaliações

- Print Expected Seat Matrix TamilnaduDocumento2 páginasPrint Expected Seat Matrix TamilnaduAshok PaskalrajAinda não há avaliações

- LearningsDocumento1 páginaLearningsAshok PaskalrajAinda não há avaliações

- TN - Increase in Seats Based On LOP and Expected Total Seats in TNDocumento3 páginasTN - Increase in Seats Based On LOP and Expected Total Seats in TNAshok PaskalrajAinda não há avaliações

- Kanyakumari District Statistical Handbook 2010-11Documento157 páginasKanyakumari District Statistical Handbook 2010-11Ashok PaskalrajAinda não há avaliações

- March 2016 Data Bank of MaheshkaushikDocumento18 páginasMarch 2016 Data Bank of MaheshkaushikAshok PaskalrajAinda não há avaliações

- LearningsDocumento1 páginaLearningsAshok PaskalrajAinda não há avaliações