Escolar Documentos

Profissional Documentos

Cultura Documentos

1300 (4 11) F

Enviado por

Carl PerezTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

1300 (4 11) F

Enviado por

Carl PerezDireitos autorais:

Formatos disponíveis

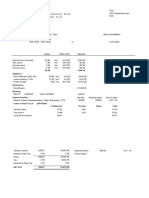

R-1300 (4/11)

Employee Withholding Exemption Certificate (L-4)

Louisiana Department of Revenue

Purpose: Complete form L-4 so that your employer can withhold the correct amount of state income tax from your salary.

Instructions: Employees who are subject to state withholding should complete the personal allowances worksheet indicating the number of withholding

personal exemptions in Block A and the number of dependency credits in Block B.

Employees must file a new withholding exemption certificate within 10 days if the number of their exemptions decreases, except if the change is the result

of the death of a spouse or a dependent.

Employees may file a new certificate any time the number of their exemptions increases.

Line 8 should be used to increase or decrease the tax withheld for each pay period. Decreases should be indicated as a negative amount.

Penalties will be imposed for willfully supplying false information or willful failure to supply information that would reduce the withholding exemption.

This form must be filed with your employer. If an employee fails to complete this withholding exemption certificate, the employer must withhold Louisiana

income tax from the employees wages without exemption.

Note to Employer: Keep this certificate with your records. If you believe that an employee has improperly claimed too many exemptions or dependency credits, please

forward a copy of the employees signed L-4 form with an explanation as to why you believe that the employee improperly completed this form and any other supporting documentation. The information should be sent to the Louisiana Department of Revenue, Criminal Investigations Division, PO Box 2389, Baton Rouge, LA 70821-2389.

Block A

Enter 0 to claim neither yourself nor your spouse, and check No exemptions or dependents claimed under number 3 below.

You may enter 0 if you are married, and have a working spouse or more than one job to avoid having too little tax withheld.

A.

Enter 1 to claim yourself, and check Single under number 3 below. if you did not claim this exemption in connection with other

employment, or if your spouse has not claimed your exemption. Enter 1 to claim one personal exemption if you will file as head

of household, and check Single under number 3 below.

Enter 2 to claim yourself and your spouse, and check Married under number 3 below.

Block B

Enter the number of dependents, not including yourself or your spouse, whom you will claim on your tax return. If no dependents

are claimed, enter 0.

B.

Cut here and give the bottom portion of certificate to your employer. Keep the top portion for your records.

Form

L-4

Louisiana

Department of

Revenue

Employees Withholding Allowance Certificate

1. Type or print first name and middle initial

Last name

2. Social Security Number

3. Select one

No exemptions or dependents claimed Single Married

4. Home address (number and street or rural route)

5. City

State

ZIP

6. Total number of exemptions claimed in Block A

6.

7. Total number of dependents claimed in Block B

7.

8. Increase or decrease in the amount to be withheld each pay period. Decreases should be indicated as a negative amount. 8.

I declare under the penalties imposed for filing false reports that the number of exemptions and dependency credits claimed on this certificate do not exceed

the number to which I am entitled.

Employees signature

Date

The following is to be completed by employer.

9. Employers name and address

10. Employers state withholding account number

Você também pode gostar

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5795)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- Concept of Income TaxDocumento28 páginasConcept of Income TaxLau AngelAinda não há avaliações

- Activity 1 T Accounts Allyssa Marie Gascon GA 2ADocumento2 páginasActivity 1 T Accounts Allyssa Marie Gascon GA 2AAlyssum MarieAinda não há avaliações

- AEC - 12 - Q1 - 0402 - PS - Minimum Wages and Taxes Concerns of Filipino EntrepreneursDocumento88 páginasAEC - 12 - Q1 - 0402 - PS - Minimum Wages and Taxes Concerns of Filipino EntrepreneursJust TinAinda não há avaliações

- Net Infotech System NIS/G/21-22/0340 31-Jul-21: Tax InvoiceDocumento1 páginaNet Infotech System NIS/G/21-22/0340 31-Jul-21: Tax InvoicehhAinda não há avaliações

- ChallanDocumento1 páginaChallanShilesh GargAinda não há avaliações

- ITR Acknowledgement T Durga PrasadDocumento1 páginaITR Acknowledgement T Durga PrasadEdu KondaluAinda não há avaliações

- Chapter 1 MCQs On Income Tax Rates and Basic Concept of Income TaxDocumento28 páginasChapter 1 MCQs On Income Tax Rates and Basic Concept of Income TaxMeenal Luther100% (1)

- TBLTAX Chapter 4 VAT Integrative ProblemsDocumento4 páginasTBLTAX Chapter 4 VAT Integrative ProblemsBeny MiraflorAinda não há avaliações

- 104-B, STREET 4, EDEN CITY, LAHORE, Lahore Cantonement Muhammad Salman EjazDocumento3 páginas104-B, STREET 4, EDEN CITY, LAHORE, Lahore Cantonement Muhammad Salman EjazFaizi93Ainda não há avaliações

- Sep 15-Pay StatementDocumento1 páginaSep 15-Pay Statementmahak.gupta1902Ainda não há avaliações

- 2008 Sro 947Documento3 páginas2008 Sro 947Faheem ShaukatAinda não há avaliações

- MCom CBCS Syllabus and Course Structure 2015 16 1Documento50 páginasMCom CBCS Syllabus and Course Structure 2015 16 1Ganesh KotteAinda não há avaliações

- Theory and Basis of TaxationDocumento8 páginasTheory and Basis of TaxationGreggy BoyAinda não há avaliações

- Pay SlipDocumento1 páginaPay SliptashijingaAinda não há avaliações

- Rex B. Banggawan, CPA, MBA: Business & Trasfer Tax Solutions Manual True or False: Part 1Documento5 páginasRex B. Banggawan, CPA, MBA: Business & Trasfer Tax Solutions Manual True or False: Part 1ela alan100% (2)

- DR Trust Oxymeter InvoiceDocumento1 páginaDR Trust Oxymeter InvoicejvnraoAinda não há avaliações

- Current Affair Questions On Lagos StateDocumento43 páginasCurrent Affair Questions On Lagos Statealphatrade500Ainda não há avaliações

- CFC, FSC and Tax HavensDocumento14 páginasCFC, FSC and Tax Havensdigvijay bansalAinda não há avaliações

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocumento1 páginaIndian Income Tax Return Acknowledgement 2021-22: Assessment YearRaveendra MoodithayaAinda não há avaliações

- CTC Offer - Akash MokashiDocumento1 páginaCTC Offer - Akash Mokashiakashmokashi03Ainda não há avaliações

- Effect of Public Expenditure and National Income Accounting On Macroeconomic Performance in NigeriaDocumento274 páginasEffect of Public Expenditure and National Income Accounting On Macroeconomic Performance in NigeriaEmmanuel KingsAinda não há avaliações

- Group 2 Exclusion From Gross IncomeDocumento27 páginasGroup 2 Exclusion From Gross IncomeMaryrose MalaluanAinda não há avaliações

- Tax Invoice: Main Road, Athagarh, Cuttack 754029 Gstin/Uin: 21DGZPM0370M1ZX State Name: Odisha, Code: 21Documento1 páginaTax Invoice: Main Road, Athagarh, Cuttack 754029 Gstin/Uin: 21DGZPM0370M1ZX State Name: Odisha, Code: 21Ashish BhagatAinda não há avaliações

- Solved Interpret Each of The Following Citations A 54 T C 1514 1970 BDocumento1 páginaSolved Interpret Each of The Following Citations A 54 T C 1514 1970 BAnbu jaromiaAinda não há avaliações

- Chapter 13C Optional Standard DeductionsDocumento3 páginasChapter 13C Optional Standard DeductionsJason Mables100% (1)

- 0 BZ C5 NQ Luwu IBb Ut GTS05 A 1 U0 D TADocumento50 páginas0 BZ C5 NQ Luwu IBb Ut GTS05 A 1 U0 D TAyohannes johnAinda não há avaliações

- Annual Income Tax ReturnDocumento2 páginasAnnual Income Tax ReturnRAS ConsultancyAinda não há avaliações

- Taxation and Fiscal Policy: First Semester 2020/2021Documento33 páginasTaxation and Fiscal Policy: First Semester 2020/2021emeraldAinda não há avaliações

- Return To VendorDocumento1 páginaReturn To VendorPavan Kumar PAinda não há avaliações

- Test 3Documento1 páginaTest 3shreyas kotiAinda não há avaliações