Escolar Documentos

Profissional Documentos

Cultura Documentos

Wealth Management For The Asian Super-Rich: View Reprint Options Order A Reprint Article Now Print

Enviado por

oliverTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Wealth Management For The Asian Super-Rich: View Reprint Options Order A Reprint Article Now Print

Enviado por

oliverDireitos autorais:

Formatos disponíveis

10/6/16, 5(37 PM

This copy is for your personal, non-commercial use only. Reproductions and

distribution of this news story are strictly prohibited.

View reprint options Order a reprint article now Print

Wealth Management For The Asian Super-Rich

SEPTEMBER 12, 2016 RUSS ALAN PRINCE , BRETT VAN BORTEL

In recent years, the numbers and wealth of the super-rich (those with a net worth of $500

million or more) have grown most prominently in Asia. This region has thus given wealth

managersrunning the spectrum from private bankers to multifamily ocestremendous

opportunities to build substantial advisory practices.

But even if the possibilities are astounding, there are also numerous obstacles to success.

Wealth managers seeking to do business with individuals in this region need to recognize a

number of key client characteristics and preferences. Lets consider three segments of the

Asian super-rich:

Business Owners

Irrespective of geography, most extreme wealth creation is tightly tied to very successful

businesses. This is certainly true of great personal fortunes in Asia. Moreover, most of these

Asian tycoons are presently managing their businesses with the intent of growing them.

This will lead them to rms that can provide structured nance. While that expertise is not a

necessity, it can be an important rst step in connecting a wealth manager to a rich family.

Once a relationship has been established, such wealth managers are well positioned to

provide additional services and products. This need is transforming some of the traditional

private banks operating in the region into private/investment banks.

Discretionary investment managementthe cornerstone oering for many wealth

managers elsewhereis often only a small part of the relationship with wealthy Asian

clients, since much of their wealth is already wrapped up in their businesses. Instead,

advanced planning that strongly focuses on tax mitigation is much more meaningful to

them.

The most appealing tax services will address their present day business dealings and crossborder activity, such as jurisdictional arbitrage strategies. In addition, wealthy Asian clients

often have extensive international holdings, and some of them are concerned about political

http://www.fa-mag.com/news/wealth-management-for-the-asian-super-rich-28892.html?print

Page 1 of 4

10/6/16, 5(37 PM

and economic stability. So an array of wealth protection services is also very appealing.

Many ultra-wealthy Asian clients are digital natives, so wealth managers must be adept at

communicating with them that way. They want immediate access to information, including

the status of their holdings. But though technology plays a big role, they still need personal

interactions with skilled, high-touch, knowledgeable relationship managers. The careful

blending of high-tech and high-touch is critical.

Women

While men dominate the ranks of the super-rich, women are joining this cohort at a greater

pace, and the percentage of new female billionaires exceeds those of male billionaires as

female entrepreneurs emerge in Asia. These women, like all the ultra-wealthy, exhibit a

number of core characteristics: They all have high levels of self-ecacya strong

conviction in their own ability to achieve their goals. They understand and are quite adept at

strategic networking. They are quite accomplished negotiators.

They often have to work harder and many times smarter than men to amass extreme

wealth. Having gone down this track, they are usually motivated to continue enlarging their

personal fortunes.

But women also tend to think about the purposes of their wealth, and think about how they

can use it to positively impact society.

Whats interesting is a trend in which these women have moved away from the traditional

wealth management rms and opted instead for creating their own single-family oces.

Their primary motivation, the same as mens, is to ensure they are in control. And its

common for these single-family oces to strategically outsource expertise, with keen

attention to cost/value trade-osso they will often rely heavily on external wealth

management rms.

http://www.fa-mag.com/news/wealth-management-for-the-asian-super-rich-28892.html?print

Page 2 of 4

10/6/16, 5(37 PM

When it comes to their single-family oces, self-made Asian super-rich women will regularly

do their homework and will be very tough negotiators. They will bring the same mind set,

talents and capabilities that have made their business endeavors so successful to the

establishment and oversight of their single-family oces.

NextGen

Despite the preponderance of rst-generation new money, there are quite a number of

multigenerational families that have created incredible personal fortunes. In established

families, the children or grandchildren of the wealth creators (depending on when the family

fortunes were initially founded) are commonly not very happy or enthralled with the way

their predecessors managed the family fortunes.

Thus, they are disinclined to see old, well-worn relationships with their parents or

grandparents advisors as particularly worthwhile, unless those professionals are

demonstrating that their services and products are exceptional. But often, the previous

generations advisors will be discarded in favor of more sophisticated and responsive

professionals. Thats also a motivation behind these families creation of single-family oces.

The increased mobility of the Asian super-rich, especially of younger generations, coupled

with the fact that they are interacting with one another more and more, allows them to do a

lot of sharing. Many of them do lunch together, often with the assistance of a facilitator

and selected experts, informally, perhaps while attending events such as the World

Economic Forum.

As a result, the next generation wealthy are again turning to the idea of a well-run family

oce as a way of maintaining the preferred levels of control, strategically outsourcing tasks

and maximizing their relationships with external experts, just as super-rich women are.

Thus, talented wealth managers who are able to connect with these single-family oces can

become extremely successful.

Conclusions

Given the opportunities, the competition is intense. More and more wealth managers and

other professionals are trying to build highly protable businesses by working with this

cohort. And as single-family oces emerge, the level of competition is only going to

increase.

As with all the super-rich the world over, one of the biggest problems is gaining access to the

decision makers. The optimal way to connect with them is through referrals from other

highly regarded professionals. If you are recognized as one of the best of the best for a

particular expertise, product or service, it can contribute greatly to your gaining access and

winning them over. This stature regularly goes to wealth managers who are recognized

http://www.fa-mag.com/news/wealth-management-for-the-asian-super-rich-28892.html?print

Page 3 of 4

10/6/16, 5(37 PM

industry thought leaders.

This copy is for your personal, non-commercial use only. Reproductions and distribution of this news story are strictly prohibited.

View reprint options Order a reprint article now Print

http://www.fa-mag.com/news/wealth-management-for-the-asian-super-rich-28892.html?print

Page 4 of 4

Você também pode gostar

- MENA Family Businesses Report 17-Apr-11Documento30 páginasMENA Family Businesses Report 17-Apr-11ramdams100% (1)

- Winning Women in Men A Report 2023Documento24 páginasWinning Women in Men A Report 2023masha.brarAinda não há avaliações

- Cii-Fbn India Chapter Journal - Nov 2012 (Print Ready) Kanishka Arumugam, Deccan Pumps, Forbes Marshall .Documento8 páginasCii-Fbn India Chapter Journal - Nov 2012 (Print Ready) Kanishka Arumugam, Deccan Pumps, Forbes Marshall .Betty JoAinda não há avaliações

- Tcs GCP Whitepaper Technology and Wealth Management Best PracticeDocumento19 páginasTcs GCP Whitepaper Technology and Wealth Management Best PracticeSoma DewanganAinda não há avaliações

- "Women" As Entrepreneurs in India:: BusinessDocumento4 páginas"Women" As Entrepreneurs in India:: BusinessGayatri DhawanAinda não há avaliações

- Thesis On Female EntrepreneurshipDocumento6 páginasThesis On Female Entrepreneurshipkatieharrisannarbor100% (2)

- Women Entrepreneur FinalDocumento16 páginasWomen Entrepreneur FinalprakashkumarasamyAinda não há avaliações

- Economics Power Runs in The FamilyDocumento8 páginasEconomics Power Runs in The FamilyIoana Nistor-IanacheAinda não há avaliações

- Women in Business - A Roller Coaster RideDocumento1 páginaWomen in Business - A Roller Coaster RideRumanaSinhaSehgalAinda não há avaliações

- 3 - Unit 1 Problems of Women EntrepreneurDocumento3 páginas3 - Unit 1 Problems of Women EntrepreneurShikhil MunjalAinda não há avaliações

- VirginDocumento16 páginasVirginTender TenderAinda não há avaliações

- Family Office Recruitment Report 2013 PDFDocumento54 páginasFamily Office Recruitment Report 2013 PDFromanchubey100% (1)

- Culpability: Who Is to Blame for the African Nation's Small Business Owners' Insolvency: Certainly Not of God Almighty, but the Owners, Government, and SocietyNo EverandCulpability: Who Is to Blame for the African Nation's Small Business Owners' Insolvency: Certainly Not of God Almighty, but the Owners, Government, and SocietyAinda não há avaliações

- How Fintechs Can Profit From The Female Economy - FINAL PDFDocumento42 páginasHow Fintechs Can Profit From The Female Economy - FINAL PDFZainab HashmiAinda não há avaliações

- Moyo (2019) Are Businesses Ready For DeglobalizationDocumento6 páginasMoyo (2019) Are Businesses Ready For DeglobalizationJorge RestrepoAinda não há avaliações

- Is Increasing The Entrepreneurial Orientation of A Firm Always A Good Thing. or Are There Circumstances or Environments in Which The Further Pursuit of Opportunities Can Diminish Firm Performance?Documento9 páginasIs Increasing The Entrepreneurial Orientation of A Firm Always A Good Thing. or Are There Circumstances or Environments in Which The Further Pursuit of Opportunities Can Diminish Firm Performance?anjuAinda não há avaliações

- Trust: Creating the Foundation for Entrepreneurship in Developing CountriesNo EverandTrust: Creating the Foundation for Entrepreneurship in Developing CountriesAinda não há avaliações

- Careers in BankingDocumento27 páginasCareers in BankingMonirul IslamAinda não há avaliações

- How Wealth Managers Are Winning Business With The Ultra WealthyDocumento11 páginasHow Wealth Managers Are Winning Business With The Ultra Wealthywestelm12Ainda não há avaliações

- Enterprenuer WomanDocumento85 páginasEnterprenuer WomansuryakantshrotriyaAinda não há avaliações

- Entrepreneurship On Raise in ChinaDocumento3 páginasEntrepreneurship On Raise in ChinasyamskhtAinda não há avaliações

- Accenture Outlook How To Manage A Global WorkforceDocumento9 páginasAccenture Outlook How To Manage A Global WorkforceJonathan LeeAinda não há avaliações

- The OpportunityDocumento46 páginasThe Opportunitygileraz90100% (1)

- AssignmentDocumento6 páginasAssignmentBarakaAinda não há avaliações

- Lib AsigDocumento5 páginasLib AsigARJUN VAinda não há avaliações

- A1a Spinelli JR and Adams-2Documento28 páginasA1a Spinelli JR and Adams-2heinstencardozaAinda não há avaliações

- ThresholdDocumento17 páginasThresholdishita sabooAinda não há avaliações

- Point72 ApplicationDocumento2 páginasPoint72 ApplicationNima AttarAinda não há avaliações

- Intrapreneurship Vs EntrepreneurshipDocumento6 páginasIntrapreneurship Vs EntrepreneurshipankhisekhAinda não há avaliações

- The Small-Cap Advantage: How Top Endowments and Foundations Turn Small Stocks into Big ReturnsNo EverandThe Small-Cap Advantage: How Top Endowments and Foundations Turn Small Stocks into Big ReturnsNota: 4 de 5 estrelas4/5 (1)

- Joshua Yindenaba Abor (Auth.) - Entrepreneurial Finance For MSMEs - A Managerial Approach For Developing Markets-Palgrave Macmillan (2017)Documento443 páginasJoshua Yindenaba Abor (Auth.) - Entrepreneurial Finance For MSMEs - A Managerial Approach For Developing Markets-Palgrave Macmillan (2017)LukhanyoAinda não há avaliações

- Overthrowing The New FeudalismDocumento66 páginasOverthrowing The New FeudalismEugeneAinda não há avaliações

- ™ WorkspanDocumento4 páginas™ WorkspanGhansham PanwarAinda não há avaliações

- Ummati White PaperDocumento13 páginasUmmati White PaperIbrahim Abu SammyAinda não há avaliações

- SopDocumento2 páginasSopAhmad FarazAinda não há avaliações

- The New Fundraising Reality for Entrepreneurs: Why You Must Throw Out the Old Rules of Fundraising to Get Capital TodayNo EverandThe New Fundraising Reality for Entrepreneurs: Why You Must Throw Out the Old Rules of Fundraising to Get Capital TodayAinda não há avaliações

- The Characteristics of Successful Investment Firms - Dr. Charles D. Ellis, CFADocumento7 páginasThe Characteristics of Successful Investment Firms - Dr. Charles D. Ellis, CFAIgor Chalhub100% (1)

- Background of The StudyDocumento17 páginasBackground of The Studybibek dhakalAinda não há avaliações

- The Global Company's Challenge: Martin Dewhurst, Jonathan Harris, and Suzanne HeywoodDocumento5 páginasThe Global Company's Challenge: Martin Dewhurst, Jonathan Harris, and Suzanne Heywoodjamesjames13Ainda não há avaliações

- Growing Role of Women Entrepreneur in IndiaDocumento7 páginasGrowing Role of Women Entrepreneur in IndiaGaurav Singh RajpootAinda não há avaliações

- Why the Best Man for the Job Is a Woman: The Unique Female Qualities of LeadershipNo EverandWhy the Best Man for the Job Is a Woman: The Unique Female Qualities of LeadershipNota: 2.5 de 5 estrelas2.5/5 (2)

- Outsizing: Strategies to Grow Your Business, Profits, and PotentialNo EverandOutsizing: Strategies to Grow Your Business, Profits, and PotentialAinda não há avaliações

- Family Business Succession Literature ReviewDocumento8 páginasFamily Business Succession Literature Reviewlbiscyrif100% (1)

- Rich Vs Poor Research PaperDocumento4 páginasRich Vs Poor Research Paperkquqbcikf100% (1)

- Concept Paper: Business Development & Planning DeptDocumento13 páginasConcept Paper: Business Development & Planning DeptArefayne WodajoAinda não há avaliações

- Investing for Better: Harnessing the Four Driving Forces of Asset Management to Build a Wealthier and More Equitable WorldNo EverandInvesting for Better: Harnessing the Four Driving Forces of Asset Management to Build a Wealthier and More Equitable WorldAinda não há avaliações

- Entrepreneurship Development and New BusinessDocumento21 páginasEntrepreneurship Development and New BusinessIvan TaylorAinda não há avaliações

- Innovation Finance WIF Digital Booklet of BiographiesDocumento35 páginasInnovation Finance WIF Digital Booklet of BiographiesCrowdfundInsiderAinda não há avaliações

- Entrepreneurs Create New BusinessesDocumento13 páginasEntrepreneurs Create New Businessesmabvuto phiriAinda não há avaliações

- Entrepreneurship Assignment 1Documento5 páginasEntrepreneurship Assignment 1Noppawan SrikhirinAinda não há avaliações

- Literature Review On Entrepreneurship in South AfricaDocumento6 páginasLiterature Review On Entrepreneurship in South AfricabsdavcvkgAinda não há avaliações

- WVC Report - The Untapped Potential of Women-Led FundsDocumento25 páginasWVC Report - The Untapped Potential of Women-Led FundsDara BlonsteinAinda não há avaliações

- Leading Clever PeopleDocumento14 páginasLeading Clever PeopleKSHITIJ CHANDRACHOORAinda não há avaliações

- Lessons from the Poor: Triumph of the Entrepreneurial SpiritNo EverandLessons from the Poor: Triumph of the Entrepreneurial SpiritNota: 4 de 5 estrelas4/5 (1)

- Women Entrepreneurs Think They Need To Act Like Men.: TrunkettesDocumento9 páginasWomen Entrepreneurs Think They Need To Act Like Men.: TrunkettesAnjan BaruaAinda não há avaliações

- Management, Leadership and Entrepreneurship in Latin America.: The New Land of Opportunity - the Real Leaders in the Global Economy.No EverandManagement, Leadership and Entrepreneurship in Latin America.: The New Land of Opportunity - the Real Leaders in the Global Economy.Ainda não há avaliações

- Private Equity Investment CriteriaDocumento14 páginasPrivate Equity Investment CriteriaoliverAinda não há avaliações

- Venture Capital OverviewDocumento12 páginasVenture Capital Overviewoliver100% (2)

- Immigration: Coming To The UKDocumento2 páginasImmigration: Coming To The UKoliverAinda não há avaliações

- Mergers Acquisitions in Franchising:: Strategies For 2011 and BeyondDocumento10 páginasMergers Acquisitions in Franchising:: Strategies For 2011 and BeyondoliverAinda não há avaliações

- When Big Acquisitions Pay OffDocumento7 páginasWhen Big Acquisitions Pay OffoliverAinda não há avaliações

- Wealth Adviser Awards 2015: WWW - Wealthadviser.coDocumento18 páginasWealth Adviser Awards 2015: WWW - Wealthadviser.cooliverAinda não há avaliações

- Have You Outgrown Your Portfolio Management System?: If Your System Is Falling Behind, Your Business May FollowDocumento4 páginasHave You Outgrown Your Portfolio Management System?: If Your System Is Falling Behind, Your Business May FollowoliverAinda não há avaliações

- Family Office AgendaDocumento13 páginasFamily Office Agendaoliver100% (1)

- Satriyo Dharmanto Satriyo DharmantoDocumento154 páginasSatriyo Dharmanto Satriyo DharmantooliverAinda não há avaliações

- August 2017 EditionDocumento11 páginasAugust 2017 EditionoliverAinda não há avaliações

- Single Family Offices Wharton RSRCH Paper 2010Documento51 páginasSingle Family Offices Wharton RSRCH Paper 2010amit.tiwari8619Ainda não há avaliações

- Campden Wealth Global Family Office Report 2014 - Campden WealthDocumento14 páginasCampden Wealth Global Family Office Report 2014 - Campden WealtholiverAinda não há avaliações

- CPA Guide InvestmentDocumento47 páginasCPA Guide InvestmentoliverAinda não há avaliações

- R1 CH5 Encoder Decoder Mux DemuxDocumento44 páginasR1 CH5 Encoder Decoder Mux DemuxChang BillyAinda não há avaliações

- Mentor Graphics Corporation, SystemVerilog-VHDL Assistant Reference Manual, Release v2018.2Documento454 páginasMentor Graphics Corporation, SystemVerilog-VHDL Assistant Reference Manual, Release v2018.2dupipiAinda não há avaliações

- Iteh Standard Preview (Standards - Iteh.ai) : SIST EN 837-1:1997 Slovenski StandardDocumento13 páginasIteh Standard Preview (Standards - Iteh.ai) : SIST EN 837-1:1997 Slovenski StandardJAMSHIL.T JjAinda não há avaliações

- Cheat Sheet - Mathematical Reasoning Truth Tables Laws: Conjunction: Double Negation LawDocumento1 páginaCheat Sheet - Mathematical Reasoning Truth Tables Laws: Conjunction: Double Negation LawVîñît YãdûvãñšhîAinda não há avaliações

- Crop MicrometeorologyDocumento22 páginasCrop Micrometeorologyrajkumarpai100% (1)

- Berna1Documento4 páginasBerna1Kenneth RomanoAinda não há avaliações

- Keshav Mohaneesh Aumeer 16549793 Assignment 2 Case Study Managing Change 3002Documento12 páginasKeshav Mohaneesh Aumeer 16549793 Assignment 2 Case Study Managing Change 3002pri demonAinda não há avaliações

- Effective Use of Teaching AidsDocumento25 páginasEffective Use of Teaching AidsAdibah AnuarAinda não há avaliações

- Bcpp6e TB Ch01Documento32 páginasBcpp6e TB Ch01tnguyen194Ainda não há avaliações

- How To OSCPDocumento34 páginasHow To OSCPbudi.hw748100% (3)

- Release Notes: 2288H V5&1288H V5&2288C V5&5288 V5 CPLD V212Documento6 páginasRelease Notes: 2288H V5&1288H V5&2288C V5&5288 V5 CPLD V212LTI MaintenanceAinda não há avaliações

- MOP QuizDocumento2 páginasMOP QuizJude MagbanuaAinda não há avaliações

- CREW: Department of Defense: Department of The Army: Regarding PTSD Diagnosis: 6/30/2011 - Release Pgs 1-241 On 24 May 2011Documento241 páginasCREW: Department of Defense: Department of The Army: Regarding PTSD Diagnosis: 6/30/2011 - Release Pgs 1-241 On 24 May 2011CREWAinda não há avaliações

- Sun Safety PresentationDocumento14 páginasSun Safety Presentationrichard_mikealAinda não há avaliações

- P6 Set Up Performance %Documento10 páginasP6 Set Up Performance %Bryan JacksonAinda não há avaliações

- 2016/2017 Master Timetable (Tentative) : Published: May 2016Documento19 páginas2016/2017 Master Timetable (Tentative) : Published: May 2016Ken StaynerAinda não há avaliações

- FKBI VI - ACED - 03 - Oktaviani Rita P Teti Rahmawati - Universitas KuninganDocumento8 páginasFKBI VI - ACED - 03 - Oktaviani Rita P Teti Rahmawati - Universitas KuninganAndriiAinda não há avaliações

- Amazon Web ServicesDocumento85 páginasAmazon Web ServicesSrinivasa Reddy KarriAinda não há avaliações

- r050210803 Chemical Process CalculationsDocumento8 páginasr050210803 Chemical Process CalculationsSrinivasa Rao GAinda não há avaliações

- Why Slabs Curl - Part1Documento6 páginasWhy Slabs Curl - Part1Tim LinAinda não há avaliações

- 03 Task Performance 1 - ARG - MMW - RelevoDocumento4 páginas03 Task Performance 1 - ARG - MMW - Relevocessarine relevoAinda não há avaliações

- Drawing With EnvelopesDocumento9 páginasDrawing With EnvelopesJulio Garcia Garcia100% (2)

- Chapter-Wise Suggestion Paper: M201 MathematicsDocumento6 páginasChapter-Wise Suggestion Paper: M201 MathematicsSoumodip ChakrabortyAinda não há avaliações

- Science Companion Earth's Changing Surface Virtual Field TripDocumento90 páginasScience Companion Earth's Changing Surface Virtual Field TripScience Companion100% (2)

- TFG Lost in Intercultural Translation (Beta)Documento25 páginasTFG Lost in Intercultural Translation (Beta)Oxo AfedoxoAinda não há avaliações

- E-Cell DSCOE IIT Bombay - 2018 19Documento12 páginasE-Cell DSCOE IIT Bombay - 2018 19abhiAinda não há avaliações

- PSG Marijuana For Medical PurposesDocumento5 páginasPSG Marijuana For Medical PurposesCKNW980Ainda não há avaliações

- Computer ProfessionalDocumento185 páginasComputer ProfessionalSHAHSYADAinda não há avaliações

- Statement of PurposeDocumento3 páginasStatement of PurposeSamarth NegiAinda não há avaliações

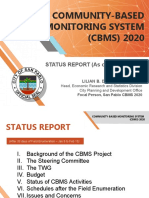

- Status Report Cbms 2020Documento20 páginasStatus Report Cbms 2020Lilian Belen Dela CruzAinda não há avaliações