Escolar Documentos

Profissional Documentos

Cultura Documentos

Formato para Rendicion de Cuentas

Enviado por

MarijoMchMchTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Formato para Rendicion de Cuentas

Enviado por

MarijoMchMchDireitos autorais:

Formatos disponíveis

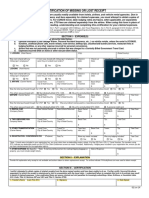

CONSORCIO NIPPON KOEI - NIPPON KOEI LAC - ADERCONSULT

TA #

Empl. No.

Client / Project:

Name (Print)

J3D109

Airline Ticket #

Ref.

1

2

3

4

5

6

7

8

9

10

11

12

Auto Rental #

GASTOS

Pasaje Aereo

Trasporte pblico/ taxi

Alojamiento

City

Comidas/propi (a) Desayuno

(b) Almuerzo

(c) Cena

Viticos

Telfono

Internet Service

Trasporte terrestre

Otros

Fecha

Job Number:

WBS Number:

Cost Type:

Reference

(A)

Daily Total

Week Ending

(B)

S/0.00

(C)

S/0.00

S/0.00

(D)

(E)

S/0.00

S/0.00

(F)

S/0.00

Total Gastos incurridos

Menos Adelanto

Less Balance Outstanding

Less Company Paid

Balance Due Employee

Balance Due Company

Date:

Employee Signature

Reporte

gastos

de viaje

Dept./Ofc.

Purpose of Travel

Approver's Name

Audited by

Approver's Signature

Date

(G)

S/0.00

(H)

Pagado por

Empleado

S/0.00

S/0.00

S/

S/

S/

S/

S/

S/

Check No.

Pagado por

Empresa

S/0.00

S/0.00

S/0.00

S/0.00

S/0.00

S/0.00

S/0.00

Business Meals/Conference Expenses

No.

Date

Amount

Guest(s)

Business Affiliation

Business/Conference Purpose

Other Expenses

No.

Date

Description

Amount

Instructions

General:

Attach a copy of the approved Travel Authorization Form to the Travel Expense Report to indicate the job number, the purpose of the trip, the client visited, and the approving authority for the trip.

1.

Submit the expense report weekly in black or blue ink.

2.

Attach receipts for lodging, employee or company paid travel expenses, and any other items as per company policy.

3.

Expenses must be explained (above) when reporting business meals, conference expenses, and other expenses.

Completion Procedure:

This form is to be completed in accordance with the instructions provided below.

1.

Employee Information. Enter the TA number, employee name, employee number, assigned department, and purpose of travel in the space provided at the top of the form. Also enter the

airline ticket number and the auto rental agreement number in the spaces at the top of the form if these costs were paid for the company.

2.

Job Project Reference. Record your expense daily in the appropriate categories printed on the form. Blanks have been left at the bottom of the daily columns for expenses which you may

have incurred but were not covered by a specific cost category. Describe the expense incurred in the description column.

3.

Job-WBS-Cost Type. Enter the job number/numbers for the trip and reference the job number to the day of travel. The ODC cost types to be used for travel expenses are as belows:

Home Office Expense

Field Expense

Foreign Expense

Contract Non-Billable Expense

Overhead Unallowable Expense

41

42

43

46

47

4.

Total your expenses for the day as well as for each category. Indicate whether the expense was company paid or employee paid.

5.

Total the form and indicate any advance you received. Determine the amount due/owed.

6.

Submit your Travel Expense Form to the Finance Department after receiving a Supervisor's approval.

Você também pode gostar

- Netflix VRIODocumento1 páginaNetflix VRIOHardik Jadav100% (1)

- Qatar - Civil Material RatesDocumento20 páginasQatar - Civil Material Ratespraveenraj murugadass100% (1)

- Sure Repair LectureDocumento10 páginasSure Repair LectureKaye Villaflor80% (5)

- FPG Insurance Proposal - 2023Documento3 páginasFPG Insurance Proposal - 2023Marylyn Joy PamatigaAinda não há avaliações

- Spare Parts Manual M1T - 298 File-IsharatDocumento97 páginasSpare Parts Manual M1T - 298 File-IsharatSharat ChutiaAinda não há avaliações

- Perjalanan d2p SurabayaDocumento9 páginasPerjalanan d2p SurabayaxumpitAinda não há avaliações

- Summary Sheet Petty ExpDocumento6 páginasSummary Sheet Petty Expzahidahmed42Ainda não há avaliações

- Cash Expense Report or Company Credit Card RPTDocumento4 páginasCash Expense Report or Company Credit Card RPTTyler Beth VandeWaterAinda não há avaliações

- Travel UserManualDocumento20 páginasTravel UserManualanielemc4Ainda não há avaliações

- New TAS SystemDocumento20 páginasNew TAS Systemanielemc4Ainda não há avaliações

- Domestic Revised InstructionsDocumento1 páginaDomestic Revised Instructionshotpig13Ainda não há avaliações

- Angelique International Limited New Delhi: Procurement ExpensesDocumento18 páginasAngelique International Limited New Delhi: Procurement ExpensesVijayakumar KoppattaAinda não há avaliações

- Travel Order FormDocumento1 páginaTravel Order FormJack SprwAinda não há avaliações

- General Reimbursement FormDocumento7 páginasGeneral Reimbursement FormakashguptambaAinda não há avaliações

- Expense ReportDocumento8 páginasExpense ReportAshvinkumar H Chaudhari100% (1)

- In-Lieu of TravelDocumento5 páginasIn-Lieu of TravelLydia ChiuAinda não há avaliações

- DTS User Training SLidesDocumento107 páginasDTS User Training SLidesChris BennettAinda não há avaliações

- Travel Services ManualDocumento106 páginasTravel Services ManualsolaabAinda não há avaliações

- Format FaresDocumento46 páginasFormat Farestedi hartadiAinda não há avaliações

- Candidate Expense FormDocumento2 páginasCandidate Expense Formsrinivas jagathaAinda não há avaliações

- Travel Approval Form: (Including Leave / Business Travel)Documento1 páginaTravel Approval Form: (Including Leave / Business Travel)vishvesh9595Ainda não há avaliações

- Form Travel RequestDocumento3 páginasForm Travel RequestedumacerenAinda não há avaliações

- Self-Employment Ledger Form-PDF Reader ProDocumento4 páginasSelf-Employment Ledger Form-PDF Reader ProNicola NenciAinda não há avaliações

- Alt Airport W Car RentalDocumento4 páginasAlt Airport W Car Rentalmohd_shaarAinda não há avaliações

- Bill For Travelling Expenses: Grand TotalDocumento2 páginasBill For Travelling Expenses: Grand Totalavant5Ainda não há avaliações

- Expense Claim FormDocumento1 páginaExpense Claim FormbluefangtjAinda não há avaliações

- Expense Claim Form (Ecf) : Allocation Basis: PercentageDocumento1 páginaExpense Claim Form (Ecf) : Allocation Basis: Percentagediptendrasarkar9062Ainda não há avaliações

- Galileo Lesson PlansDocumento23 páginasGalileo Lesson Plansblackbutterfly69Ainda não há avaliações

- Instructions - Itinerary of TravelDocumento1 páginaInstructions - Itinerary of TravelRainnie McBeeAinda não há avaliações

- Expense Claim: Personal Information Contact Number PIN Cost CentreDocumento3 páginasExpense Claim: Personal Information Contact Number PIN Cost CentreMansiAroraAinda não há avaliações

- New Travel Authorization FormDocumento1 páginaNew Travel Authorization Formangela_tomlinso5392Ainda não há avaliações

- Travel Agency Unit 7Documento12 páginasTravel Agency Unit 7Diana Patricia Soto OsorioAinda não há avaliações

- LTA - FormDocumento3 páginasLTA - FormpowermuruganAinda não há avaliações

- Airport Entry Pass (Aep) Application Form (Aepaf) : Government of India Bureau of Civil Aviation SecurityDocumento3 páginasAirport Entry Pass (Aep) Application Form (Aepaf) : Government of India Bureau of Civil Aviation SecurityPramod MauryaAinda não há avaliações

- The Detail Sheet of Claim: 1 28-Sep-15 IDR 200,000Documento2 páginasThe Detail Sheet of Claim: 1 28-Sep-15 IDR 200,000Khairul AyØunk AkbarAinda não há avaliações

- Tour Claim FormDocumento1 páginaTour Claim FormGeeta VigAinda não há avaliações

- Travel Processing Remedyforce TutorialDocumento22 páginasTravel Processing Remedyforce TutorialDanielAinda não há avaliações

- MULTIPLE CHOICE. Choose The One Alternative That Best Completes The Statement or Answers The QuestionDocumento5 páginasMULTIPLE CHOICE. Choose The One Alternative That Best Completes The Statement or Answers The QuestionMohammad Abu LailAinda não há avaliações

- Interview Expenses Form: For Office Use Only Financial Approval: GL Account: 52130 Tax Code: I0Documento1 páginaInterview Expenses Form: For Office Use Only Financial Approval: GL Account: 52130 Tax Code: I0Musa MohammadAinda não há avaliações

- University of Illinois: Invoice Voucher and Travel/Program Advance FormDocumento1 páginaUniversity of Illinois: Invoice Voucher and Travel/Program Advance FormmehahdAinda não há avaliações

- Writing Off Travel ExpenseDocumento2 páginasWriting Off Travel ExpenseDivya DhakalAinda não há avaliações

- Reimbursement FormDocumento1 páginaReimbursement FormChrisinius Lawrencor HodakahnAinda não há avaliações

- Travel Services Week2 Q3 1Documento16 páginasTravel Services Week2 Q3 1Irish MacalalagAinda não há avaliações

- Handing Taking Over Form PDFDocumento7 páginasHanding Taking Over Form PDFShahzaib AliAinda não há avaliações

- MyExpenses UsersDocumento63 páginasMyExpenses Usersmandapati100% (1)

- Park (Regular) - EnglishDocumento6 páginasPark (Regular) - EnglishcdefghAinda não há avaliações

- BV 04 Athletes Travel ScheduleDocumento1 páginaBV 04 Athletes Travel ScheduleСергей КазановичAinda não há avaliações

- Travelling Allowance Bill For Tour: Part - ADocumento4 páginasTravelling Allowance Bill For Tour: Part - ANilesh MishraAinda não há avaliações

- World History Step #2Documento2 páginasWorld History Step #2Luv2TrollAinda não há avaliações

- Travel Policies FormsDocumento7 páginasTravel Policies FormsmissaveneAinda não há avaliações

- Ticketing IndexDocumento17 páginasTicketing IndexAbhishek MukhopadhyayAinda não há avaliações

- Expense ReportDocumento2 páginasExpense ReportDave ThompsonAinda não há avaliações

- Claim Form For Interview, Travel & Subsistence Expenses For 2013 Specialty Recruitment ProcessDocumento2 páginasClaim Form For Interview, Travel & Subsistence Expenses For 2013 Specialty Recruitment ProcessblebeacristinaAinda não há avaliações

- Imam Bux DIEMsDocumento18 páginasImam Bux DIEMsIRFAN marfaniAinda não há avaliações

- Format Fares)Documento46 páginasFormat Fares)Abdul HannanAinda não há avaliações

- Unit 3 TravelDocumento24 páginasUnit 3 Traveldianus666Ainda não há avaliações

- Administartion Format Close ChecklistDocumento15 páginasAdministartion Format Close ChecklistYogesh MisraAinda não há avaliações

- Lost Receipt Form (Fillable)Documento1 páginaLost Receipt Form (Fillable)Roch SampagaAinda não há avaliações

- Human Resources Department Employee Clearance FormDocumento1 páginaHuman Resources Department Employee Clearance Formkikomats2003Ainda não há avaliações

- Local Travel Expense / Cell Phone Reimbursement: (A) (B) (E) (F) (G) Here If (D) (C)Documento19 páginasLocal Travel Expense / Cell Phone Reimbursement: (A) (B) (E) (F) (G) Here If (D) (C)ajintimeAinda não há avaliações

- Bcas Aep FormDocumento3 páginasBcas Aep FormtorqaholicAinda não há avaliações

- January TEV 2024editedDocumento11 páginasJanuary TEV 2024editedmarlonplaciojrAinda não há avaliações

- Application Design: Amit Dalal Gulu Gulu Tour and Travels Pvt. Ltd. 1/1/2020Documento7 páginasApplication Design: Amit Dalal Gulu Gulu Tour and Travels Pvt. Ltd. 1/1/2020AMITAinda não há avaliações

- DPWH-INFR-45 ConMethDocumento3 páginasDPWH-INFR-45 ConMethRayarch WuAinda não há avaliações

- Busn 5 5th Edition Kelly Solutions ManualDocumento25 páginasBusn 5 5th Edition Kelly Solutions ManualDeniseWadeoecb100% (49)

- Deepak Kumar - Hotel Management: United Arab Emirate 971547215363Documento2 páginasDeepak Kumar - Hotel Management: United Arab Emirate 971547215363Deepak KumarAinda não há avaliações

- Sublimatex Company ProfileDocumento17 páginasSublimatex Company ProfileMohamed MahmoudAinda não há avaliações

- Elspec Case Study Cablecaritaly WebDocumento3 páginasElspec Case Study Cablecaritaly WebSid LicoAinda não há avaliações

- Financial Marekts (Chapter 2)Documento3 páginasFinancial Marekts (Chapter 2)Kyla DayawonAinda não há avaliações

- 2147 Bill OmrDocumento1 página2147 Bill Omrofficer lkoAinda não há avaliações

- Cement and Fuel RequirmentDocumento2 páginasCement and Fuel RequirmentAbel100% (1)

- Riester Stethoscope Set Brochure ENDocumento8 páginasRiester Stethoscope Set Brochure ENAudreyAinda não há avaliações

- Tutorial 6 Week 7 Short Answer SolutionDocumento2 páginasTutorial 6 Week 7 Short Answer SolutionOmisha SinghAinda não há avaliações

- SHS APPLIED ECONOMICS Module 2 Utility and Application of Applied Economics To Solve Economic Issues and ProblemsDocumento17 páginasSHS APPLIED ECONOMICS Module 2 Utility and Application of Applied Economics To Solve Economic Issues and ProblemsJr ParaynoAinda não há avaliações

- Practice Problems Ch. 5 Externalities and Public GoodsDocumento6 páginasPractice Problems Ch. 5 Externalities and Public GoodsAyanleAinda não há avaliações

- Araling Panlipunan: Quarter 2, Wk. 3-4 - Module 8Documento30 páginasAraling Panlipunan: Quarter 2, Wk. 3-4 - Module 8Cora Amor GorgoniaAinda não há avaliações

- Fee Challan FormDocumento1 páginaFee Challan FormMuhammad ZAFAR IQBALAinda não há avaliações

- Deed of SaleDocumento5 páginasDeed of SaleFelipe FamilyAinda não há avaliações

- Interview Transcript: Age: Sex: Name: Joseph Ladion Male 47Documento11 páginasInterview Transcript: Age: Sex: Name: Joseph Ladion Male 47Lavigne EmphasisAinda não há avaliações

- Set 1 QP Business StatisticsDocumento2 páginasSet 1 QP Business StatisticsTitus ClementAinda não há avaliações

- The Basics - 7 Bankroll Management - 1 Poker Bankroll ManagementDocumento5 páginasThe Basics - 7 Bankroll Management - 1 Poker Bankroll ManagementOpawesomeAinda não há avaliações

- Guardex ENG 2023Documento3 páginasGuardex ENG 2023MohamedAinda não há avaliações

- Hyundai Wia - L800LMADocumento3 páginasHyundai Wia - L800LMAarjunkoppalAinda não há avaliações

- Energy Material 101Documento8 páginasEnergy Material 101Dr. Muhammad ImranAinda não há avaliações

- Tax Invoice Gokulakrishnan .: Billing Period Invoice Date Amount Payable Due Date Amount After Due DateDocumento2 páginasTax Invoice Gokulakrishnan .: Billing Period Invoice Date Amount Payable Due Date Amount After Due DateKumaresan SubramanianAinda não há avaliações

- Absorption Coefficient TableDocumento1 páginaAbsorption Coefficient TableMark bellie TeranteAinda não há avaliações

- Design Report of Compound WallDocumento30 páginasDesign Report of Compound WallSivamurugan SivanayagamAinda não há avaliações

- Business WorldDocumento8 páginasBusiness WorldnasrAinda não há avaliações