Escolar Documentos

Profissional Documentos

Cultura Documentos

Weekly Statistics: The Indonesia Stock Exchange Composite Stock Price Index and Equity Trading Value

Enviado por

miiekoTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Weekly Statistics: The Indonesia Stock Exchange Composite Stock Price Index and Equity Trading Value

Enviado por

miiekoDireitos autorais:

Formatos disponíveis

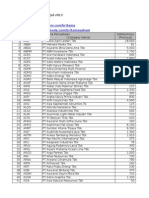

Weekly Statistics

No. 35 Volume XXV, September 5 - 9, 2016

The Indonesia Stock Exchange

Composite Stock Price Index and Equity Trading Value

Billion Rp

24,500

Index

5,600

21,000

5,400

17,500

5,200

14,000

5,000

10,500

4,800

7,000

4,600

3,500

4,400

4,200

14-Mar

28-Mar

11-Apr

9-May

23-May

6-Jun

20-Jun

11-Jul

Hi

Low

Close

Change

Index

5,381.354

927.891

500.517

750.223

1,544.793

767.217

1,158.511

477.840

417.628

323.932

178.371

361.055

388.466

5,281.917

906.475

488.991

730.487

1,513.530

761.065

1,133.250

466.073

405.620

316.103

174.874

347.702

379.224

5,281.917

906.475

488.991

730.487

1,513.530

763.652

1,133.250

466.073

405.620

316.103

174.874

347.702

379.224

(1.34%)

(1.40%)

(1.52%)

(1.56%)

(1.54%)

0.45%

(1.59%)

(1.27%)

(2.89%)

(1.41%)

(1.50%)

(3.29%)

(1.32%)

infobank15

MNC36

Agriculture

Mining

Basic Industry

Miscellanous Industry

Consumer Goods

Property & Real Estate

Infrastructure

Finance

Trade & Service

Manufacturing

Index

Composite Index

LQ45

IDX30

Jakarta Islamic Index

Main Board Index

Dev. Board Index

Kompas100

BISNIS-27

PEFINDO25

SRI-KEHATI

ISSI

SMinfra18

Investor33

25-Apr

Average

PER

Weighted Average

13.78

PER (X)

10.10

25-Jul

22-Aug

5-Sep

Hi

Low

Close

Change

607.375

307.142

1,867.835

1,201.171

510.939

1,376.481

2,490.832

572.604

1,121.061

799.862

867.066

1,416.994

594.151

300.013

1,850.802

1,184.669

504.709

1,363.442

2,431.242

558.537

1,084.415

782.936

849.035

1,390.983

594.151

300.013

1,850.802

1,184.669

506.990

1,363.442

2,431.242

558.537

1,084.415

782.936

849.035

1,390.983

(0.99%)

(1.36%)

0.29%

2.51%

0.50%

0.93%

(2.22%)

(1.27%)

(3.34%)

(1.11%)

(1.78%)

(1.18%)

Weighted Average

Average

PBV

3.55

2.06

PBV (X)

Daily Equity Trading Frequency*

Daily Equity Trading Value*

Daily Equity Trading Volume*

Mill. Shares

12,000

8-Aug

Thousand (Times)

Rp. Billion

9,000

300

10,000

8,000

6,000

200

3,000

100

6,000

4,000

2,000

05

Sell - Buy

06

07

Stocks

Rights

Warrant

ETF

REIT

Total Transaction

08

FI - FI

05

09

DI - FI

06

FI - DI

07

Volume

Value (Rp)

Freq. (X)

34,985,084,328,077

1,247,799

68,577,394

1,119,000

114,800

14,249,290,128

726,146,400

10,473,100

1,522

72

15

35,953,866,464

35,000,070,237,705

1,249,408

Volume

Value (Rp)

Freq. (X)

8,177,838,312

9,441,727,469

12,981,602,562,030

13,795,202,708,832

353,206

401,055

Contract

Value (Rp)

Freq. (X)

Foreign Transaction

Option

08

09

DI - DI

35,884,055,270

Instrumens

Buy

Sel

05

06

07

08

09

Note : DI = Domestic Investor, FI = Foreign Investor

Market Capitalization September 9, 2016 (Rp)

Stocks

5,683

Trillion

Gov. Bonds & Sukuk (Outstanding) **

Corp. Bonds, Sukuk & ABS (Outstanding) **

1,700

278

Trillion

Trillion

1

New Issue (Relisting)

Shares offered

Fund rised (Rp)

Weekly Total Additional Listed Share

Listed Shares

1,445,570,965

3,798,485,669,254

Listed Companies

532

Active Stocks

461

Active Brokerage Houses

106

*) This statistic is calculated based on type of investor provided by IDX members on each buying or selling order inputed into IDX trading system, not based on actual

registered shareholders figures from listed companies

** IDR and USD Denomination

Indonesia Stock Exchange Building, 6th Floor

Jln. Jend. Sudirman Kav. 52-53 Jakarta 12190, Indonesia

Tel: (62-21) 515 0515 ext. 4302, 4320, 4322 Fax: (62-21) 515 0330, 515 0118

Indonesia Stock Exchange, Weekly Statistics, September 5 - 9, 2016

Top Ten Equity Trading Volume (In Million)

Day

5

5

5

5

5

5

3

5

5

5

No.

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

Listed Stocks

Hanson International Tbk.

Bakrieland Development Tbk. [S]

Bank Pundi Indonesia Tbk.

PP Properti Tbk. [S]

Kresna Graha Sekurindo Tbk.

Sri Rejeki Isman Tbk.

Capitalinc Investment Tbk.

Trans Power Marine Tbk.

Sentul City Tbk. [S]

Semen Baturaja (Persero) Tbk. [S]

No.

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

Listed Stocks

Indo Komoditi Korpora Tbk.

Sumber Energi Andalan Tbk. [S]

Island Concepts Indonesia Tbk. [S]

Trans Power Marine Tbk.

Pudjiadi & Sons Tbk. [S]

Danasupra Erapacific Tbk.

PP Properti Tbk. [S]

Tira Austenite Tbk. [S]

Langgeng Makmur Industri Tbk. [S]

Eka Sari Lorena Transport Tbk. [S]

No.

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

Brokerage Firms

Daewoo Securities Indonesia (YP)

Mandiri Sekuritas (CC)

Indo Premier Securities (PD)

UBS Securities Indonesia (AK)

Deutsche Securities Indonesia (DB)

CIMB Securities Indonesia (YU)

Credit Suisse Securities Indonesia (CS)

Merrill Lynch Indonesia (ML)

Phillip Securities Indonesia (KK)

BNI Securities (NI)

Top Ten Equity Trading Value (In Million)

Volume

Value

757,141

5,063

4,553

13,417

1,747

87,064

1,318 1,240,326

1,017

477,264

784

201,168

781

38,736

747

76,986

726

73,910

672 1,078,243

Freq.

15,261

18

15,716

35,478

6,959

13,551

4

56

5,530

5,117

No.

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

Day

5

Telekomunikasi Indonesia (Persero) Tbk. [S] 5

5

Bank Central Asia Tbk.

Bank Rakyat Indonesia (Persero) Tbk. 5

5

Astra International Tbk. [S]

PP Properti Tbk. [S]

5

Inti Agri Resources Tbk. [S]

5

Semen Baturaja (Persero) Tbk. [S]

5

Indofood Sukses Makmur Tbk. [S]

5

Perusahaan Gas Negara (Persero) Tbk. [S] 5

Change

148.78%

100.63%

50.56%

43.64%

42.73%

42.05%

26.25%

21.85%

21.13%

19.83%

No.

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

Listed Stocks

Blue Bird Tbk. [S]

Toba Pulp Lestari Tbk. [S]

Century Textile Industry (PS) Tbk.

Equity Development Investment Tbk.

Panasia Indo Resources Tbk.

Radana Bhaskara Finance Tbk.

Bank CIMB Niaga Tbk.

Bank OCBC NISP Tbk.

Prima Alloy Steel Universal Tbk. [S]

Golden Eagle Energy Tbk.

No.

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

Brokerage Firms

UBS Securities Indonesia (AK)

Trimegah Securities Tbk. (LG)

Mandiri Sekuritas (CC)

CIMB Securities Indonesia (YU)

Morgan Stanley Asia Indonesia (MS)

Daewoo Securities Indonesia (YP)

Indo Premier Securities (PD)

Citigroup Securities Indonesia (CG)

Credit Suisse Securities Indonesia (CS)

CLSA Indonesia (KZ)

Top Ten Gainers

Value

3,123,605

1,763,962

1,739,125

1,415,986

1,329,200

1,240,326

1,137,523

1,078,243

1,063,468

932,661

Freq.

34,469

36,402

15,259

18,387

16,685

35,478

33

5,117

18,776

19,640

Top Ten Losers

Last Week This Week

123

306

16,000

32,100

178

268

110

158

550

785

440

625

800

1,010

290

238

142

172

121

145

Top 10 Brokerage Firms, by Total Frequency (in million)

Volume

3,908

2,711

2,137

919

609

2,545

631

309

997

1,085

Volume

168

424

115

120

161

1,318

307

672

127

324

Listed Stocks

Matahari Department Store Tbk. [S]

Value

2,516,058

4,428,065

2,483,050

5,756,339

2,038,372

3,917,811

2,283,223

1,275,499

699,042

956,912

Change

(22.92%)

(19.60%)

(18.18%)

(17.46%)

(17.28%)

(17.22%)

(17.18%)

(16.84%)

(16.15%)

(15.79%)

Last Week This Week

3,490

2,690

398

320

990

810

104

126

515

426

151

125

815

675

1,630

1,960

260

218

133

112

Top 10 Brokerage Firms, by Trading Value (in million)

Freq.

215,755

161,972

155,808

151,467

100,537

95,984

83,778

74,448

73,126

71,217

Volume

919

5,279

2,711

2,545

805

3,908

2,137

532

631

641

Value

5,756,339

5,408,961

4,428,065

3,917,811

3,058,457

2,516,058

2,483,050

2,289,744

2,283,223

2,101,499

Freq.

151,467

49,576

161,972

95,984

48,233

215,755

155,808

48,775

83,778

37,981

Total Daily Trading for Equity ( volume in million shares, value in million Rp )

Date

05-Sep-16

06-Sep-16

07-Sep-16

08-Sep-16

09-Sep-16

Volume

Reguler

Value

Freq.

Volume

Others

Value

Freq.

Volume

Total

Value

Freq.

Composite

Index

5,015.94

4,186.25

3,813.46

4,196.72

4,392.07

4,648,460

4,453,985

5,164,643

4,501,376

5,067,009

229,632

244,788

272,399

265,661

232,464

2,764.99

1,989.50

6,740.39

924.74

1,859.99

2,033,637

3,591,892

1,819,238

1,071,886

2,632,958

486

520

680

486

683

7,780.93

6,175.76

10,553.85

5,121.46

6,252.06

6,682,097

8,045,877

6,983,881

5,573,262

7,699,967

230,118

245,308

273,079

266,147

233,147

5,356.954

5,372.096

5,381.354

5,371.078

5,281.917

New Issues (Relisting)

Company Name

Code

Indo Komoditi Korpora Tbk.

INCF

Listed Shares

1,438,370,465

Offering Price

123

Par Value

100

Listing Date

6-Sep-16

Sector

Basic Industry and Chemicals

The facts and opinions stated or expressed in this publication are for information purposes only and are not necessarily and must not be relied upon as being those of the publisher or of the institutions for which the

contributing authors work. Although every care has been taken to ensure the accuracy of the information contained within the publication, it should not be by any person relied upon as the basis for taking any action or

making any decision. The Indonesia Stock Exchange cannot be held liable or otherwise responsible in anyway for any advice, action taken or decision made on the basis of the facts and opinions stated or expressed or

stated within this publication.

Você também pode gostar

- Beyond Smart Beta: Index Investment Strategies for Active Portfolio ManagementNo EverandBeyond Smart Beta: Index Investment Strategies for Active Portfolio ManagementAinda não há avaliações

- Weekly Statistics from Indonesia Stock ExchangeDocumento2 páginasWeekly Statistics from Indonesia Stock ExchangemiiekoAinda não há avaliações

- Hero Supermarket Tbk. (S) : Company Report: July 2016 As of 29 July 2016Documento3 páginasHero Supermarket Tbk. (S) : Company Report: July 2016 As of 29 July 2016FiqriAinda não há avaliações

- BMRI Bank Mandiri (Persero) Tbk. Company Report HighlightsDocumento3 páginasBMRI Bank Mandiri (Persero) Tbk. Company Report Highlightsdavidwijaya1986Ainda não há avaliações

- PT Multi Bintang Indonesia TBK.: Summary of Financial StatementDocumento2 páginasPT Multi Bintang Indonesia TBK.: Summary of Financial StatementIshidaUryuuAinda não há avaliações

- IDX STATISTICS Indonesia Stock Exchange Quarterly StatisticsDocumento1 páginaIDX STATISTICS Indonesia Stock Exchange Quarterly StatisticsDefinite NineluckAinda não há avaliações

- Equity Futures & Options SegmentDocumento20 páginasEquity Futures & Options SegmentsuralkarAinda não há avaliações

- PT Indoexchange TBK.: Financial Performance: The Company Still Suffered Net Loss atDocumento2 páginasPT Indoexchange TBK.: Financial Performance: The Company Still Suffered Net Loss atIsni AmeliaAinda não há avaliações

- Daily Trade Journal - 16.05.2013Documento6 páginasDaily Trade Journal - 16.05.2013Randora LkAinda não há avaliações

- Ringkasan Kinerja Perusahaan TercatatDocumento3 páginasRingkasan Kinerja Perusahaan TercatatDian PrasetyoAinda não há avaliações

- Bumi Resources Tbk. Company Report and Financial OverviewDocumento3 páginasBumi Resources Tbk. Company Report and Financial OverviewDevina DAJAinda não há avaliações

- Top 20 JSX member firms and top 45 stocks by market capDocumento2 páginasTop 20 JSX member firms and top 45 stocks by market capBurhanuddin BurAinda não há avaliações

- Daily Trade Journal - 13.05.2013Documento6 páginasDaily Trade Journal - 13.05.2013Randora LkAinda não há avaliações

- ADHIDocumento3 páginasADHIluvzaelAinda não há avaliações

- Bank Mandiri (Persero) TBK.: Company History SHAREHOLDERS (July 2012)Documento3 páginasBank Mandiri (Persero) TBK.: Company History SHAREHOLDERS (July 2012)Agus Wibowo PurnomoAinda não há avaliações

- Lampiran PDFDocumento3 páginasLampiran PDFFaizzal AffandieAinda não há avaliações

- Daily Trade Journal - 13.06.2013Documento7 páginasDaily Trade Journal - 13.06.2013Randora LkAinda não há avaliações

- BJBRDocumento3 páginasBJBRdavidwijaya1986Ainda não há avaliações

- IDX Fact Book 2006 PDFDocumento57 páginasIDX Fact Book 2006 PDFdavidwijaya1986Ainda não há avaliações

- Daily Trade Journal - 28.01.2014Documento6 páginasDaily Trade Journal - 28.01.2014Randora LkAinda não há avaliações

- ArnaDocumento3 páginasArnaLuhh SukarhyniAinda não há avaliações

- Securities: Ranking by Total Asset (Million RP) Ranking by Net Profit/Loss (Million RP)Documento1 páginaSecurities: Ranking by Total Asset (Million RP) Ranking by Net Profit/Loss (Million RP)IshidaUryuuAinda não há avaliações

- Upward Climb in ASPI Amidst Crossings Adding 54% To TurnoverDocumento6 páginasUpward Climb in ASPI Amidst Crossings Adding 54% To TurnoverRandora LkAinda não há avaliações

- Weekly Market Outlook 11.05.13Documento5 páginasWeekly Market Outlook 11.05.13Mansukh Investment & Trading SolutionsAinda não há avaliações

- Top50 2010Documento2 páginasTop50 2010goldtraderAinda não há avaliações

- MYORDocumento3 páginasMYORTubagusPayungAinda não há avaliações

- Bumi Resources TBK.: Company Report: February 2013 As of 28 February 2013Documento3 páginasBumi Resources TBK.: Company Report: February 2013 As of 28 February 2013Ardi FassaAinda não há avaliações

- AHAP Insurance Financial SummaryDocumento2 páginasAHAP Insurance Financial SummaryluvzaelAinda não há avaliações

- Daily Trade Journal - 12.06.2013Documento7 páginasDaily Trade Journal - 12.06.2013Randora LkAinda não há avaliações

- Daily Trade Journal - 04.03Documento7 páginasDaily Trade Journal - 04.03ran2013Ainda não há avaliações

- Manila Standard Today - Business Weekly Stock Review (March 11 - 15, 2013)Documento1 páginaManila Standard Today - Business Weekly Stock Review (March 11 - 15, 2013)Manila Standard TodayAinda não há avaliações

- Daily Trade Journal - 29.04.2013Documento8 páginasDaily Trade Journal - 29.04.2013Randora LkAinda não há avaliações

- Index Dipped Amidst Profit Taking : Tuesday, April 30, 2013Documento7 páginasIndex Dipped Amidst Profit Taking : Tuesday, April 30, 2013Randora LkAinda não há avaliações

- 03 September 2015 PDFDocumento9 páginas03 September 2015 PDFRandora LkAinda não há avaliações

- Manufacturing Company Financial Data 2018-2019Documento44 páginasManufacturing Company Financial Data 2018-2019Novi YantiAinda não há avaliações

- Weekly Market Outlook 25.03.13Documento5 páginasWeekly Market Outlook 25.03.13Mansukh Investment & Trading SolutionsAinda não há avaliações

- Bank Rakyat Indonesia (Persero) TBK.: Company Report: July 2014 As of 25 July 2014Documento3 páginasBank Rakyat Indonesia (Persero) TBK.: Company Report: July 2014 As of 25 July 2014Itie WirataAinda não há avaliações

- ZBRA - PDF Indonesian Capital Market DirectoryDocumento3 páginasZBRA - PDF Indonesian Capital Market DirectorysientamiAinda não há avaliações

- FKS Multi Agro Tbk. (S) : Company Report: July 2014 As of 25 July 2014Documento3 páginasFKS Multi Agro Tbk. (S) : Company Report: July 2014 As of 25 July 2014Rochmatul UmmahAinda não há avaliações

- Weekly Market Outlook 11.03.13Documento5 páginasWeekly Market Outlook 11.03.13Mansukh Investment & Trading SolutionsAinda não há avaliações

- Excel Google Filter LQ45Documento1 páginaExcel Google Filter LQ45Irfan sidik PrabowoAinda não há avaliações

- PT Betonjaya Manunggal TBK.: Summary of Financial StatementDocumento2 páginasPT Betonjaya Manunggal TBK.: Summary of Financial StatementIshidaUryuuAinda não há avaliações

- Tabel Angsuran Kredit PumkDocumento1 páginaTabel Angsuran Kredit PumkAsyifa AzrahaAinda não há avaliações

- Reliance Balance SheetDocumento5 páginasReliance Balance SheetRicha JulkaAinda não há avaliações

- Daily Trade Journal - 27.03.2014Documento6 páginasDaily Trade Journal - 27.03.2014Randora LkAinda não há avaliações

- Daily Trade Journal - 06.05.2013Documento6 páginasDaily Trade Journal - 06.05.2013ishara-gamage-1523Ainda não há avaliações

- Daily Trade Journal - 31.10.2013Documento6 páginasDaily Trade Journal - 31.10.2013Randora LkAinda não há avaliações

- Index Flat Deals in JKH Boost Turnover : Tuesday, July 30, 2013Documento6 páginasIndex Flat Deals in JKH Boost Turnover : Tuesday, July 30, 2013Randora LkAinda não há avaliações

- Tourism in Singapore: Orchids at The Singapore Botanic GardensDocumento8 páginasTourism in Singapore: Orchids at The Singapore Botanic GardensMohamedou Matar SeckAinda não há avaliações

- Daily Trade Journal - 15.10.2013Documento6 páginasDaily Trade Journal - 15.10.2013Randora LkAinda não há avaliações

- Ipo-PzzaDocumento17 páginasIpo-PzzaTri AstutiAinda não há avaliações

- Daily Trade Journal - 18.09.2013Documento6 páginasDaily Trade Journal - 18.09.2013Randora LkAinda não há avaliações

- Asuransi Bina Dana Arta TBK.: Company Report: January 2016 As of 29 January 2016Documento3 páginasAsuransi Bina Dana Arta TBK.: Company Report: January 2016 As of 29 January 2016AdjieSenoAinda não há avaliações

- Harga Penutupan Saham 12 Jul 2013Documento55 páginasHarga Penutupan Saham 12 Jul 2013flikrainAinda não há avaliações

- Admf PDFDocumento3 páginasAdmf PDFGeorgekastanyaAinda não há avaliações

- Manila Standard Today - Business Daily Stocks Review (March 31, 2014)Documento1 páginaManila Standard Today - Business Daily Stocks Review (March 31, 2014)Manila Standard TodayAinda não há avaliações

- Daftar Saham - 20230615Documento36 páginasDaftar Saham - 20230615Nircholis SadghoviroAinda não há avaliações

- Daily Trade Journal - 30.09.2013Documento6 páginasDaily Trade Journal - 30.09.2013Randora LkAinda não há avaliações

- Bluechips Stepped Center Stage Amidst Rallying of IndicesDocumento6 páginasBluechips Stepped Center Stage Amidst Rallying of IndicesRandora LkAinda não há avaliações

- I.3. Neraca Analitis Bank Umum Dan BPR (Miliar RP)Documento2 páginasI.3. Neraca Analitis Bank Umum Dan BPR (Miliar RP)Izzuddin AbdurrahmanAinda não há avaliações

- IDX Monthly-Des-2017Documento116 páginasIDX Monthly-Des-2017miiekoAinda não há avaliações

- IDX Monthly Aug 2017Documento114 páginasIDX Monthly Aug 2017miiekoAinda não há avaliações

- IDX Monthly June 2016 NewDocumento114 páginasIDX Monthly June 2016 NewmiiekoAinda não há avaliações

- IDX Monthly Mar 2017Documento115 páginasIDX Monthly Mar 2017miiekoAinda não há avaliações

- IDX Monthly Jan 2016Documento107 páginasIDX Monthly Jan 2016miiekoAinda não há avaliações

- IDX Monthly Mar 2016Documento108 páginasIDX Monthly Mar 2016miieko50% (2)

- IDX-Monthly-April 2017Documento114 páginasIDX-Monthly-April 2017miieko100% (1)

- IDX Monthly Sept 2016 UpdateDocumento111 páginasIDX Monthly Sept 2016 UpdatemiiekoAinda não há avaliações

- IDX Monthly Jul 2016Documento112 páginasIDX Monthly Jul 2016miiekoAinda não há avaliações

- IDX Monthly-Nov-2015Documento111 páginasIDX Monthly-Nov-2015miiekoAinda não há avaliações

- IDX Monthly-Nov-2015Documento111 páginasIDX Monthly-Nov-2015miiekoAinda não há avaliações

- IDX Monthly June 2015 PDFDocumento112 páginasIDX Monthly June 2015 PDFmiiekoAinda não há avaliações

- IDX Monthly Oct 2015Documento112 páginasIDX Monthly Oct 2015miieko100% (1)

- Establishment of Company ProceduresDocumento3 páginasEstablishment of Company ProceduresmiiekoAinda não há avaliações

- IDX Monthly Aug 2015Documento104 páginasIDX Monthly Aug 2015miiekoAinda não há avaliações

- IDX Monthly Jul 2015Documento108 páginasIDX Monthly Jul 2015miiekoAinda não há avaliações

- IDX Monthly Feb 2014Documento95 páginasIDX Monthly Feb 2014miiekoAinda não há avaliações

- IDX Monthly Aug 2014Documento105 páginasIDX Monthly Aug 2014miiekoAinda não há avaliações

- Economic Value Added or Cash Value AddedDocumento42 páginasEconomic Value Added or Cash Value AddedmiiekoAinda não há avaliações

- IDX Monthly July 2012Documento87 páginasIDX Monthly July 2012miiekoAinda não há avaliações

- IDX Monthly July 2012Documento87 páginasIDX Monthly July 2012miiekoAinda não há avaliações

- IDX Monthly Statistic June 2012Documento89 páginasIDX Monthly Statistic June 2012miiekoAinda não há avaliações

- SPPT 5 - Competitive Advantage, Firm Performance & Business ModelsDocumento27 páginasSPPT 5 - Competitive Advantage, Firm Performance & Business ModelsBaaba EsselAinda não há avaliações

- Chapter 1-Introduction To Financial Accounting (Acc106)Documento17 páginasChapter 1-Introduction To Financial Accounting (Acc106)Syahirah AzlyzanAinda não há avaliações

- Credit Rating AgencyDocumento3 páginasCredit Rating AgencyJaved KhanAinda não há avaliações

- Writing The Business Plan IDG VenturesDocumento9 páginasWriting The Business Plan IDG VentureswindevilAinda não há avaliações

- L&T Restructuring Cement Business Through DemergerDocumento28 páginasL&T Restructuring Cement Business Through Demergerak123umtAinda não há avaliações

- FRIADocumento13 páginasFRIADanice MuñozAinda não há avaliações

- RWJ Chapter 1Documento29 páginasRWJ Chapter 1Umar ZahidAinda não há avaliações

- FAQs of Company TakeoverDocumento18 páginasFAQs of Company TakeoverTeju SagarAinda não há avaliações

- Central University of South Bihar: School of Law & Governance Financial Market RegulationDocumento22 páginasCentral University of South Bihar: School of Law & Governance Financial Market RegulationRajeev RajAinda não há avaliações

- Stanford Case Study PDFDocumento20 páginasStanford Case Study PDFWilliam LouchAinda não há avaliações

- Banker's Customers - Special TypesDocumento28 páginasBanker's Customers - Special TypesShafeer KhanAinda não há avaliações

- Strategic CEO President COO in San Diego CA Resume Michael StraussDocumento3 páginasStrategic CEO President COO in San Diego CA Resume Michael StraussMichaelStraussAinda não há avaliações

- Analyzing McDonald's Financial Ratios and Constructing an IFE MatrixDocumento3 páginasAnalyzing McDonald's Financial Ratios and Constructing an IFE MatrixHella Mae RambunayAinda não há avaliações

- Acca f3 Financial Accounting FormulaDocumento4 páginasAcca f3 Financial Accounting FormulaNadir Muhammad100% (2)

- Buy Back of SharesDocumento10 páginasBuy Back of SharesRajgor ShrushtiAinda não há avaliações

- CPA Review School PhilippinesDocumento9 páginasCPA Review School PhilippinesLisa ManobanAinda não há avaliações

- 5-Year Balance Sheet and Income Statement AnalysisDocumento10 páginas5-Year Balance Sheet and Income Statement AnalysisSumit Kumar AwkashAinda não há avaliações

- Reporting Alternatives Lab Week 1 QuestionsDocumento3 páginasReporting Alternatives Lab Week 1 QuestionsSara ThompsonAinda não há avaliações

- Lanuza v. BF Corp. GR 174938 Case DigestDocumento1 páginaLanuza v. BF Corp. GR 174938 Case DigestPlandito ElizabethAinda não há avaliações

- Presentaion On Inclusiveness Chapter-8Documento35 páginasPresentaion On Inclusiveness Chapter-8Addi100% (2)

- Securities and Exchange Board of India (Share Based Employee Benefits) Regulations, 2014Documento19 páginasSecurities and Exchange Board of India (Share Based Employee Benefits) Regulations, 2014Shyam SunderAinda não há avaliações

- Financial Management (I-Mba V) Important Questions (Module 1&3) (I.e. Asked in GTU Question Papers)Documento2 páginasFinancial Management (I-Mba V) Important Questions (Module 1&3) (I.e. Asked in GTU Question Papers)Sabhaya Chirag100% (2)

- State Grid Corporation of ChinaDocumento6 páginasState Grid Corporation of Chinasalkaz22432Ainda não há avaliações

- Ratio Analysis of HDFC ERGO: A Report OnDocumento8 páginasRatio Analysis of HDFC ERGO: A Report OnchetanAinda não há avaliações

- Unit 14 Dividend Policy BBS Notes eduNEPAL - Info - PDFDocumento3 páginasUnit 14 Dividend Policy BBS Notes eduNEPAL - Info - PDFGirja AutomotiveAinda não há avaliações

- Check Lists For Listing On SME-ITP Platform PDFDocumento4 páginasCheck Lists For Listing On SME-ITP Platform PDFShruti KirveAinda não há avaliações

- DocxDocumento6 páginasDocxMika MolinaAinda não há avaliações

- Analyze stocks with the P/E ratioDocumento2 páginasAnalyze stocks with the P/E ratioMuhammad HassanAinda não há avaliações

- Lakshmi Niwas MittalDocumento34 páginasLakshmi Niwas MittalSneha AgarwalAinda não há avaliações

- PENFinalExam1415 1lAdvancedFinancialAccountingandReportingPart1 COCDocumento20 páginasPENFinalExam1415 1lAdvancedFinancialAccountingandReportingPart1 COCRhedeline LugodAinda não há avaliações

- Value: The Four Cornerstones of Corporate FinanceNo EverandValue: The Four Cornerstones of Corporate FinanceNota: 4.5 de 5 estrelas4.5/5 (18)

- 7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelNo Everand7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelAinda não há avaliações

- Joy of Agility: How to Solve Problems and Succeed SoonerNo EverandJoy of Agility: How to Solve Problems and Succeed SoonerNota: 4 de 5 estrelas4/5 (1)

- Angel: How to Invest in Technology Startups-Timeless Advice from an Angel Investor Who Turned $100,000 into $100,000,000No EverandAngel: How to Invest in Technology Startups-Timeless Advice from an Angel Investor Who Turned $100,000 into $100,000,000Nota: 4.5 de 5 estrelas4.5/5 (86)

- Finance Basics (HBR 20-Minute Manager Series)No EverandFinance Basics (HBR 20-Minute Manager Series)Nota: 4.5 de 5 estrelas4.5/5 (32)

- These are the Plunderers: How Private Equity Runs—and Wrecks—AmericaNo EverandThese are the Plunderers: How Private Equity Runs—and Wrecks—AmericaNota: 4.5 de 5 estrelas4.5/5 (14)

- Venture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistNo EverandVenture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistNota: 4.5 de 5 estrelas4.5/5 (73)

- Product-Led Growth: How to Build a Product That Sells ItselfNo EverandProduct-Led Growth: How to Build a Product That Sells ItselfNota: 5 de 5 estrelas5/5 (1)

- Financial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanNo EverandFinancial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanNota: 4.5 de 5 estrelas4.5/5 (79)

- Mastering Private Equity: Transformation via Venture Capital, Minority Investments and BuyoutsNo EverandMastering Private Equity: Transformation via Venture Capital, Minority Investments and BuyoutsAinda não há avaliações

- Summary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisNo EverandSummary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisNota: 5 de 5 estrelas5/5 (6)

- Startup CEO: A Field Guide to Scaling Up Your Business (Techstars)No EverandStartup CEO: A Field Guide to Scaling Up Your Business (Techstars)Nota: 4.5 de 5 estrelas4.5/5 (4)

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialNo EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialAinda não há avaliações

- Financial Modeling and Valuation: A Practical Guide to Investment Banking and Private EquityNo EverandFinancial Modeling and Valuation: A Practical Guide to Investment Banking and Private EquityNota: 4.5 de 5 estrelas4.5/5 (4)

- Note Brokering for Profit: Your Complete Work At Home Success ManualNo EverandNote Brokering for Profit: Your Complete Work At Home Success ManualAinda não há avaliações

- The Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursNo EverandThe Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursNota: 4.5 de 5 estrelas4.5/5 (34)

- Financial Risk Management: A Simple IntroductionNo EverandFinancial Risk Management: A Simple IntroductionNota: 4.5 de 5 estrelas4.5/5 (7)

- 2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNNo Everand2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNNota: 4.5 de 5 estrelas4.5/5 (3)

- These Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaNo EverandThese Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaNota: 3.5 de 5 estrelas3.5/5 (8)

- Add Then Multiply: How small businesses can think like big businesses and achieve exponential growthNo EverandAdd Then Multiply: How small businesses can think like big businesses and achieve exponential growthAinda não há avaliações

- Warren Buffett Book of Investing Wisdom: 350 Quotes from the World's Most Successful InvestorNo EverandWarren Buffett Book of Investing Wisdom: 350 Quotes from the World's Most Successful InvestorAinda não há avaliações

- The Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingNo EverandThe Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingNota: 4.5 de 5 estrelas4.5/5 (17)

- Investment Valuation: Tools and Techniques for Determining the Value of any Asset, University EditionNo EverandInvestment Valuation: Tools and Techniques for Determining the Value of any Asset, University EditionNota: 5 de 5 estrelas5/5 (1)

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialNo EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialNota: 4.5 de 5 estrelas4.5/5 (32)