Escolar Documentos

Profissional Documentos

Cultura Documentos

BG Speech SF1963

Enviado por

guruekDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

BG Speech SF1963

Enviado por

guruekDireitos autorais:

Formatos disponíveis

A

. November 15-1963

504 per COpy

c

SECURITY _Itf A:N :fNSECUP.E WORLD A LECTURE BY

BENJAMIN GRAHAM

Dc!ctor Rappaport has eaosen a very intriguing title for tslk~ t!SECUlU'l'Y IN AN IIQ"SECURE WORLD. II I hope that, :not many of you came Ullder the mistaken 1m .. press ron ths·t I am going to tal.k about security in generaL I am going to ta]~ only about financial ~ect~ity, not about phy~ical ~ecurity, mental ~ecurity,

matrimonial all 0:: CUl'"it;y s or other typell., Even ail'i far as finar.i.cial llIelcurity con ..

cerned, I am going to sddres~ mysel~ only to investment policy in stock~and

~Jhe title of thillll talk m:l.ght bfrtter have beell!. SECURITIES IN INSECUREWORLDjl

because securities are my field.. I am not going to about iUl.vinglil1 and budget

polic;y» life insurance 1 hOIUii$ O'lIfnel"'ship, pension plans and other m~:tters kind. The :r'tHjl,~On il!ll that I don ~t contilider mylJelf an in would rather talk to you about things I hope I know more about

This remuds me of the fact that when thE! New York el;lltabli~hed a journal :in 19Lj.6 we gave :it the ~imple title !'The ..... s: •• _.,'ff!!J)

B'U.JI", the:n we got so many ~ eB"lIen subscriptio:nll! from

we ~rere forced in ~~lt-deten~e change the name to the pl~e!ifil1:Jnt

Financhal Journa.L, {~

"

In the field of financial security; alii limited to the problemil ot inve~tm~nt policy J! I would say there are thl~ile kinds of or dangers !fl\hould recognize a!lii possibly exilit1i.1.n,gat p:reIII ent "Oll.iII;l -the; threl3.t from atomic war; the~eeond wOUd be the thr~at

third lmuld be the thr~at from i1iH!!Yl'Jre market up down,

primarily down. I have no p:r~8criptioll'Jl. tor fill'Jl.l3.ncial g]lee~ity or torportfol10

that coukd de.al with th~ posa;ibility of' atomic v.far.1I don 'tthillkar..yiQn~

el~1!:i b,al>\J) we preter swe~p that problem ~er rt18 and tOrWud th~ng&;l

that Wflll can deal with more effectively. The~eeond danger mentioned wa$ inf'latlon.

Inflation has been a big factor in tinecial exp*rh1\!ce going back all

al'i\ 1900. Not many people realize that we had more inflstion:1nthef1rilt thirty years of' this century then in the 8eC()nd thirty years, a2\ meslBW'."ad by the indices •

. , I

The continuation of some degree of inflation i~ certainly probable in the future, and that il the chief' re.Non yhy mOllit intelligent 1ilv~storiJ now recognize that soae common stocks must be i:ncluded in their portf'olio* However, thst 18 only .. part of the question of the effect of inflation IOn investmGntpolicy. The fact is . that both thel extent of iIlf'lation and the investor's reaction to it have varied greatly over the years. It iii by no means Ill. straight-line matter. A good example

i~ the most recent one. We have had a small inflation in recent year~ accompanied

by a very large increlll.lllllll in I\tock-~ket pricee;J which IIfJeI.U to be geared not to

'the illflation experienced but rather to the~xpectation ot greater inflation in

the futuI'<I!!. You probably know there hail been no increase in the wholeeisle-price aveI"ag~ ali.nee 1958. There he.s indelrld been a rise of ~ per cent in the cost of Ihrin.g in th~ lMt five years, which of COUI'8el ill not negligiblej but it could ~carcely in itself be $ sound basis tor a 100 per cent rise in Itock prices. 00:0.ver~ely~ during the years 1945-1949 we did have Ill. rather explosive kind of inflation~-"the consumer price index, (that is, the "COilt of living") !!I.dvanced over

per cent--but during that period stock prices actually had a small decline.

,~"y,,,,c,..!',,",,,,,ion h~l"e i~ that investol"~ i, feelingliand r~actionll l"egl'll.rding more thel re§lltUt of the :stock-mllrket ac:i;;ion that they have recently

.J.,,,,.,,~c.;""Vi, than th~ ~9f it~ Con!il@quently the;re i~~ greatdang~r il'C,l@I!i!!ltor~

glyixtg inf'lation too tBluch vfJight when the market M.van©es end ignoring it ent1relYJl

a~ th~y dlid in 1945~9, when the J'Mrket d~clin®&lo Thi~ hll/B Il1ctually th~ hiatory

inflation and Itock market behavior ~ver ~ince 1900~

~:rhe pl'oblem of price tlu<ctuation~» or flllJ.ctuationsp b a very rel!!l.l one

for inveltorill'. it~ wlfelll :;!tit! ~p~o1liJ.lator";> iiUthough there has been a t~flaency in Wall

Street to deny that for a numb~r of y@~~ in th® pa~t curr~ntlyo

J~.h~ b not wl:ullth@r pric@ :f'lu(c:tuationlill ar(!; to thil!! inv~:;toI' $

it b r@rthe;r th~ oppod t~» that ill to find soae good work&ble dilStinction

th~ and thl'fj !!lpec1.ll.lator in eommon $tockl!. Af/; will be pqinti!d out later that

d1~tin©tion ha~ almo8t VMi~h@d from Wall Street; a whichhai C1AUIlIeda g,rellt

r61.~al q;;Jf in_thilZl pa!l'Jt and will cause a gJI:"(Utt d@ltl troubli(1l Ln future.

y~t l~ty~ar? altho~, it ~@e~ a long tim@ . fluctU&tion~p

allll evid<tlnc~d a d@cline in th~ Dow "Jon~~ Average from 735 -to 535$ loom ai'$

lmporta:nt in:v~lI'i3tor~ and ~p~culator~ al:tk<1!!i @ ifhilil taU Of about 27~

in the Do\lf'Jml@1il A\o/'~ragl! W$l.1\il by d4I!Jcl~ Gf betw""tlD 50 ~, pElr

or mor® of the n®ll' lI@Mcuri~tie~ thilt hil.d ~n i~&nl@Md th.e pl"~ceding two

y4I!JIlt·~ IlUld hmd played !ll\u.oh il :!lJpectffil.e1l1l1$)t'ptrt in the &itock m&rketactlv1ty of that

periodo Ji:t ti.i1l(iBl in Mlfly 1962., tbe concept a on~~wtJPl.y mllrk~t" 'tfhich

go upward~ ~with very ~mall reactions~ lee~d to be for goodo Howev~r$

Wall Str~e·t h&~ a very ~hort ill@Millory, ~d now the majority tin~c1lll &uthoritie~

~e~m to be ~lipp1ng back to the conc*pt~ 1960 and 1961.

They ilre to the idea that tor the IIlmaI't the l:!_'Iuultion of

!i!ltock market tluotuation~ dO<!i!&il not haV4I!J to b<l'il conmidered to any great extent.

There il1l. ill two-told. empha~1!!1l here J! which !l1llwrl!!l OV@I' the real:i:ty 01;£' Ijtock market fluctuation~. The fir~t ~the general conviction that the market can be count~d on to advllno~ ~o @mphatically through th® y@llr~ that what~ver d@eline~ t&k~ plac~ ~e comparati v®ly '!m:l.m.portil!l.nt.9 nenee it you have the tru~ invefJtor I~ attitude you

don! t have to concern yo·v.l!:Jt'I<!iIlf' with themo T.h~ l1Jeeond ~lllim illl a denial thlAt the ~ill$tock IDJU'ket" eJXiiltll at all" m~aning thereby that what th~ m.ark~t av~rages do ill

of no real importance to the 1ntelllgentj well~&dvi~@d·inve8tQr Qr ~peculatorG It lleelU to be a r1.ll.ling tene't of Wall Street that it you practice the proper kind of ilelectivity in inv@l!!ltm.ent3ll you donUt have to worry about what the stockrmllrket dOEll!l1 a~ a whol®~ a~ IIIhown by the average~)tor at all times the good stocks will going up and the bad one~ will be going dow:o and all you need to do iI!I pick the good IIItock!ll

and forget about the filltook .. market averllges Q .

/ How valid are th~~e two argumentlll? The tirillt one-- the argument that common

,/stockiJ are and alway~ will be attractive~ including the present timElJ,_ because of'

/' th(!!jir <!llxc~ll®nt r®ool'd !\1dnce 1949-~ involvet\l in thot\lfJ tfJ~ a verytDdumental and. important fallacy. Thi~ i~ the idea that the better tU4I!J Pll!l.~t record at the 8tock

I mark4I!Jt a~ ~uch the more certain it i~ that common stocks ~e ~ound inve~tment~ for the futur~. Now we all know that it Il!I. corporation hll!l.~ had a very ~oQd record

over the PIl!I.!'l¥t year; that ill a fair iruUoation (but no gI.ll.aran:tee) that its record iilil lik®ly to be good in the tutur~i' beca"W!l@ it hall certain bul!!in@1Ilil lJ.d:vantage", which in mo~rt caaes ou.g..~t to contn.aue 0 But you CIl!I.DX!.ot iill!l.y thll!l.t the fll!l.ct that the ~tock mll!l.r~~t hag rilen oontinuously (or ~lightly irregulsrly) over a long period in the pa~~ b Il!I. gUll!I.rante@ that it will continue to act in the IJIlQle way in th~ futur®. A; I ~l!llt! it!' the I'~al truth i~ exactly the oppo~it$, '~or the hig.h~r the ~tock mll!l.rld~t advances the more rea~on there iii to mhrtr'lllillt i tiil futurE'J Mtion if you ar~ going to conlider only the m~k~t'$ int@rnal behavior. W~ all know that

:r..i~tory of the ~took ma.rket h!!Uil been III lIl.ll.Cc(i!J~sion ;""ollowiIlld. inllvH.ably by ~ub,:rl:;antial fall"," UPI2lWt1lilllPI$ of the pal}t have alwaym ca.."'Tied with th~m censequences to come 0 It doe~ not n~ce'iuutril:y tollow ri@® in 'the pric@ ot III individual ~tock or in the market ~verage~

\, mU13lt b(~ a d(illcline» but the only rea80n to view with confidence the

\ tutll]'re ot a that ha~ al~uy advanc~d jjub~tl!mtially in prelenCIiil

"ot ~,'J\:'t~l£'n~: J('(®a:!IDonll0» othe:J(' than the actual price movement :.ttllelf, wh:tc~ would jUllItify

.'~UCIO, (conf1Dl.~neeo R~!1,ce a l~ge a6l:iTQce in the market iss badcaL11y a !l!Iign

<I:'or Calli,"itioJ1ll ~Ad nOlt ill!, re,a~Oln for conI'idenc®.

I,et us the marlli.et!~ pO~lil:::lil1ti@~ :from prll!!l!llent level~ int'~rm.~ tirilt

theoreti~al re~~Olning and th~n in termll:1$ of some practical condderat1011~o :t

wmud 11k(\':! ,t© tm"ee pOI$&!Iibi1iti~hI; undoubtably theril!'l lire Il great more.

One pO!!s:filibilitYiJ i~ Il ven popular one in prelent thought, tiiat rille

that h@l.1iID '1;;Ueltil f!lIince 1949 .... from ~bout 163 in the Dow Jone$lAverag~, to 750 Ill.t

th~ time== r@:f1@ct~ a n@!;'\111 Md a m~vlllll(')uIl1y impro~j'ed ch~ractei' of

liiitocktl$) fJ al1ld thell"eti(Jl:R"e c~ be expected to contin:ue more or tilt' .&ila:me rat~ in the

futl<.:l"e", 1& V1.fi can mue lienge cril1'l.t of prev.~~nt p:r~etice of

calcul\'ll.'ting gllain:f!J eotud };uItve 1!M4e in mu:t'WlJl,1"'f~r Itb.~$$ orin

lIIilimilar !,;'Wfeha*ll~:i!I ~JY@:r the lut 14 yelilr&il Iliill lill, ba~iilil :for'~~ to~r!i~~ th~1l1

buy i\:;Jb\elr pr~jj!;~nt Mvan@~d pY(i~tIli~., Ail ~ ~, thil!ll of cl.l~

Ctlll!ti01Cl. 1&iJ done bY'f~l~!,\Imeri"tOl inve!!iltor!i. !he

SEC requirell'i it to aecompllmied ap~rf'U.ll(rtoiY sta"tement that milculation

ClJll"ri~U8 no wurantly tiJr th~ :; but··;t· think very mudl ~mph.ai!JIifl ill placed

that, qUaUificIIJ:!;il'"Juo

The pOl~~ i~ that a good the ri!!ilf!J I ~.

justment from an level in 1949 ill!, proper on some n~ of

valuation~ It that i1lJO $ a goOld part the 1949 ... 1963 rill" could not be expected

to be :repeat®d trQ\M Il lev<!'ll which h nOlw a cornctEilld Olne" l!iQlWlijv<er,weJ could have a

8ati@llfacto;or on th® aV(i!1rag®", fM1Y !]o~ ~I' :from whatevl!Ilr level '~atrn!l; out

to be ab«,);1,lt :ri:'iglrxt fcdir trOlday. It 150 il!!l about th8 right pretlien"1;, level then the in-

V/!Ulitor might pOl!j~ibly Il\ more or lell!!il I!ltandard 4", IIIdVI!'W.CIlll from thilillevel, YflJar

by yearp f'JJubj~rc;t tOl mod~:rli.t<1i!l dO'~'i'il/tl.rd f'luctuat·ions"

But the third :pc~~ibility il1J> that th~ natlU"~ thllll market has not ehlltllgl'lld

:from it~ earlie!l\!t timel(1t, 1.1 ~hCNn in our reeori.~ that gob1l.ck!At lealit to the South

Sea~ Bubbl~ in pratically 200 ;rearm. WE h.aviil also very diltailed data on

stock pric~1@) in the llJnited State~ $Jinl!:lillll 1811, Which WilliI'll iaeorporated in the Cowles and the Stmdard md PoOlrf~ ~ rec@:!r'dj" It may well be that we lihall It111 have the all-too-familiar I.l'ii:;er nati:Q)nrl of eXCflJliliivlll optimigm and excllIllillflive pessimism., The mOlt recent example or exrc;e&il~ive ~$laJim:blln ill the TOry period which wag; a starting one for thb m~k~t<> DlUllfing 1949-50 thilj m&l:"ket had the lowest peacl!1J",time price= earningOli l"i11'ti{? in it:1E hi~ton" Stock@) ~old at only about 7 times their earnings, in the m&rk~rt aVer&g<!lliil 1 am tltlking :abOlu.t, &11 compared with about 20 time. at the presen'!; time~ Th~ imp1icatiolG. her~ i~ that ju.st u IItockill wl!llr\t evid~ntly UDdervalued at ~ev~n tim~~ th~ir earning~ th~y might ~ery well be ov~rvi11lued at twenty timl\,uiil earnings or at some higher muJJ;ipl'1er that willb~ estabITihed later in this mark~t and will lh'iljjp:re~ent :a l\ty@l of \txc-e'!i\\$ive optimism.

My osm Ol:pinion the3!l@ three choicell that thetirilt pOii!fillbili ty is

really out the que~tion. It:lh~ :r:toir in. ,the nature of economic reality to permit

net gainlil i!lt th~ ililho'#'n rate1E :from ~'to~53-... l!olM)t~inglike 14%. per am:mm Lneluding th~ di'1Yid<1!nd r@tWl."J1llIlli-- to continu@ ind~itily ""4.thefutlil.rf~ JUlt

don it have a tinancb.! and econonde ~Ylltem that ~.all op€ira:te on that baliilil. If that wer!!l tn!J.e nobody wow.d havl!'!! to work for a living" I remember Vlfl,ry well the

'i>

number' of people in the late 1920'm; who got ~ COrI'(l@llpondingviw of UI/Il a&tcek !U.rkl!lt,

gave '~::lp~h®irMd plung~d into Wul Str®®t takl1 MVlIllltqO of it&!! yond4llrful

tllt1iJ!!"®. T,h~ po~~ibility-=vh1~h :1,s that thE!! market will MVallCI!.'! pretty IItead-

11y fromapJllr'oxim:llt,®ly the pr~~~nt l®vel, but nll not hav® tho advantage of "tarting

from a very l®~fel~= 11 adm1~f!Jlibl® i,n thl!!lory. But the great problem, .on!!t that I

will talk l~teJ1' s ~f!Jl hw can you d®t®rmine the proper new bujJJ ~orcommon

1<o\~kf!Jl and therefore how can you detlirmiBe the ~~,ar ll!!Nsi9 propli:iF~l~'Vel

for now?" !di!@~~It)(f!Jl®l®d thil qU~iltion in a paper to the Fi>nano411Asgj in"

in December' 1961$ and &!laid then that th~ JlU1.lrk~t YlIJi nally !iii~f(;tled Iiiitand,$I,rOl,~ e Th<e (lld $ItiJJld~!i of value $ which h~ 'beilHn decades and pl!!lrhap~ g@n~r'ationil" no long~r 1lil1818in to 'be tlllina'ble, ISGerv:Iltive]5 but "1\i,he prop<!llr nft ~lrtaudardl of v:lll'U~ could certainly

either i~ inner~eon~eioUf!Jln~~~ or by mathematical

shall hav~ to w~it$ probably for a eon~ider:llbl~ length of ti~ li~term.inel d~p~rl,61ab1® new !llitandari,!'i§ e In the meq, time it llBeemlid

litock maJ1"ket ~lill have ,t© cU'l'Y on 1 tllj cuc'Thdatiou a proeelll\i

which le~ larg~ tluctuilll.ti©n~ ~ound what in the end Will

n~w c~:r.l:trilll.l V~J..ill~ e I think hapll)®ned ~ineo 1961 b®v.

prlllltat1©n ~omo d®gr~@J. C@Jrillinly th€fl in 1962 ~:W~~sl!~nt!.4

of one and the 1mpr<!ll1111 i "If@ l·ecOVQIl;ry

a flu.etu,Slti©lll i())f th~ ©th~r kind~

No doubt you <b~ illltl1J!r~~t;ld to know what I ml1J!&tl1

new llita:nda::rdl;ID v:Illu.e Ii a3J appl1~d to th~ ~toek l'Iil1iil.lf'kti!'t

vllUueJ-~wn1ch w~r@ PI'IWtty w~ll I1iiI.ccept<llld up to j)ay 1955 differ~nt I1iiI.pproachif:lJ6\ll bilU!l@d on relli.!lton1ng or ~.xpll!Srienc4i~

cour-se '1fliS m;y llhiiC:ll hq been oao IiI2lJ tlGruM® ,~

CiIilntral Vl1iiI.lu~ a'11~r:lli@J ~iJ.,rIJdngl of 'thifll iIlltocu the DQfir JQn~,

Averag<l'i tor t~n y~l1iiI.rot PI1iil.~tj) el1iil.pitalizliilld at twicif:lJ tb,(j int~l"4fj~t bonds , For t1ll:1l',:a!ll\pl~ a', t,ne pl";[!l8ilent time the aViI'lrag~ earnin.glill tor

mre ab©ut $33 on, the Dow Jone§! {mit and th~

per cent , It yo~JJ. el1iil.pitl1iil.l1z;~ $33 atBo6%-- which a

would a C@ntral VUU.1iill on th~ old bl1iil.$i~ of about

present p.ric~ of

early 1955 when I te~titied b~tore the ~tock m~k®t

was about; 400.)1 my cl!1lntral value wal alliO arOu.n4!lt1dthe vllU"W1tionll'l ot other

If ~xpert~ t, u:d:ng oth~r met.hod;~. 11:11 ~~*med to come to about that lEnrel. The action of th~ stock mark~t liii~.~;.:then -WOuld appear to d<!llmon.tratetha;t theae .methodlJ ofval=

uationlii ar~ ultr:l.=conl<li!rvative and m1Illch ,too lw, aitbough they did work out extremely well throUg.h the Iltock market tbtotuation.trom 1871 to about 1954, which 18 an exceptionally long period of tim.e for a te!1lt. U'Mo:rtrwlately in this! kind of workp where you are trying to det<!1lrmine relatioIlshipill base(! upon pal5t behavior, the

almoliit inv:Ilriabl~ exp~r1~nce i. that by the time you have had a long enough period

to giv~ you ~uf'fici<!lnt confidence yout' form of meas'lXt"EHlI.ent ju.t then n~w con';'

ditionlii !l!lup~rllll®de ~d th~ m~ai'filll"ement 1&1 no lO:l!1gel' dependablCl'l :for the future.

We had to deu with thifil problem in the fourth edition fJf, ... f!S~curity AnalYlIIiIll" publimhed lagJt y~ar» and to recogn1zQIl "the probability that Zltooks ~hould be valued more lib@rlAlly nov than in the plAilt iJ our chhf'· reason that t incidentalj.;Y"l.~not

beeause gOV@ll'nm~nt I iJ commitment to pre',entlarge !Jcal.1IIJ depresBionll has changed

the climat~ of corpo:Jf:llt<8 earning, :trom lllhat it n,1l prior to the Employment Act

of 19460 I{e think thillBnew 1nsit,u,ce againllt a v~lZ'Y .1JJ* .. viIll.r. e ... falling Qtt in the

earnings of corporations genera wot~d Justify a higher valuation of these

earnmgs th"u in former yearl.. J:l:iI!Il1ee Vii ha:lfe added an arbitrary 50 per cent to thilll yaluation blJ1i@J~d upon oUJ:' old milthOO,* That wow.dgivil ~ now til. valu.e of about

5

th.~ .Dow Jones Average, and a cOl'r~Bponding vlltlue of' about tor thli:J Sta.ndard

averag~ 0 Liflt me point out that t,hl!ll two av"''''agiI!J~ IiIO clo~~' te-

on a ten-to-onl!? bads in their price 1I!v~1~ dividends and earningii~that you can. u~l!!lth~ two figureli almollilt :1rrl.;erchang~ably for purposee of de~cription or an-

You mu~t recognize that this level of 570J which i!l derived from q ~b:ltrary

mark '011) of 50% from the old l~v'llll.l' hall no ~pecial authority behind It was

merelytlue belillt judgment th!ll.~' ve could give on a situation which does not admit

of l!ii.:Jay r~lltlly dependable calcmJ.atiQn~. A!!l a matter of fillet if on~iI iltlff:1eillllntly

C)l?t~imi!ilrtic and wU;'oit it b quit~ pO&!li~ib1~ ~'o d~v¢!llop it m~thod va1uationwhieh.

10'IUk'1d.:Iil plillu$ttb1~ enough and would J'WIitify the pr~fjJent level of 750 for the Dow

Jon~~ AV!lllI'ag",. m~ ~how you hQW that could be done, You fj,ay firl'lrt that 1n-

V~SltOJl."1 likG to get ~ ov@r~al1 returJl of 7~ on their mon~y in f\ll.tUl"~ yemrl.

T.hatU~ what commQn ~tock~ hav~ on th~ i\lv~rage- in divid~nd~ aad

appr~c1t'l:ti.on=ever ~ince 1871"" ~9B BJhO'Wn by the CO'lfl~&j ~d MolQdorflllky ~tudi~~~ Now

we c&n expecf a rat~ growth of @!Jarn:tnglfl and di vid@nd~ of l~# a then ill1l we

need it'rll :I! d:i.vidend ret1.l!.I'n of to mM~ up de~1r~d 7t% total. Dow

JOl!1@!Ji;,\ ~;nd Sta:nd~d POQr i!li\ div1d~nd r@.rt1lllll:"n :iii! a littll'll mor~ thU, right now

market priee; we could the~e at th~ present level with eonfldenc~, a~

th~n get a 3~ return in d1vid~nd~ ~d ~ 4~ ann~al r~tUl~n in growth0

might:!;; think that even l~IIH,l than an oVlillrall 7~ a All th~t

~ound~ fine but if you th~t by $om~th~ future growth r~t~ would be

j 3-!$ inSlltt!ad of 4~- (l1M 3~ WlI.lli! about th~ actu~l annual growth in dividends in the

litlilt ten yliJj~'iI=- th~m you get quit~ III diff~rliJj~c~" if now expec'Ung a

3t% growth ratlill J1 yQU 11111 nelld l:1 4~ di vid~nd r\i$turn to mUll up required 7~.

On that basili th<tll Dow Jon~1I iI abou.t the which '!if~ II.l'bitrarily

gavl'!l to it.

Th~re illl a lot Qf .1uggling with figurelJl that can 01$ done now a~ uway~ $ but non~ of the~e nethod~ in it~elf giv~~ a dependable re~ult~ To a great extent th~

f'1gwJ."~1Ei ~lfIlected .. are determined the generLl. .. Iltti t·aa..® of the man who is (lflleeting

them, and that general attitude iii very often determined intuxn by what the ~tock market ha~ been doing. Wnen th~ ~tock market i~ at 750 you t~e an optimi~tic attitud~ and use soae favorable tigu.:re~» but if:!.t IiIhoUd:d h_11ft; at se"ll~ere decline

mOllt peQple would jump back to the and more conservative evllluation methodil.

Let me now PQint out at 8triking ar~a in which the uncertainty of the proper valuation of common ~tocks 18 brought to the fore@ That i~ this Vtlry question of the relation~hip between div14~nd return on stock~ and th~: interelt rate on bQnds~ For .. :nf'ty year; or more it was a t<lnet in Wall street that stocks should yield co~iderably more than bondse In Ipeculative market; ~tocks might rise until their yield became less than that of oond~. But th1. very development wa~ a sure sign that you were in a dangerous marke·t-= one heading for a bad fall. A friend of' mine, head of an important brokerage hOUAU~;p wail so enamored of that idea he lilJiled it constantly in his market letter~$ More than that he actually had the relation=

ship between ~tQck yield~ and bond yields printed in a nice chart-d~sign on neck tie8 imported from Pari~, vhich he di~tribut~d hi~ friends including me. For awhile I wore th1~ tie at ~ome of my l~cture~, and ~a1d that this wa~ the tir~t

time that anybody hlLd analyized the technical pOi!lt1on of the IBtock ll'Wrkflt from

hil1ll necktime. Well, liince 1958 stockil have b~en yielding cO:l2..liderably lesal than. bonds 'With no dgn of IJ.. return to .010. relationllhip,,@ Hence uzy broker friend"

fQund ,ta.~ this; concept 1ncrealJing';ihard. to Slti.ck tOio About two years ago $ actually not very long before the big market break, in a huge newspaper advertisement

he abandoned thi~ concept completely, ~a1d it vaa all bosh to talk abQut ~tock yield~ li~ the baii~ ot evaluation, claimed the main thing wa" the psychology and attitude of the public; and a"se~ed thi!!i factor was strongly buJ.li~h and justified

-,

6

confid~nt buying of ~tock~. My chief re~ion for mentioning thi~ incident 12 that I

had ~p~nt ~ lot t1m~ ~tudying the w~~kly &nalysei of ~tock market

one our olde~t fin~cial ~ervic~~ which ~tarted in 1909 ~d I found the identic~l

experience took place jUlt 30 year~ before in thi~ ~ervice (whol~ name I al~o won't m~ntion. ) For many years they tllllked about, the mli"i;;edard. relationlJhip betweenlitock yie!ldilll and bond yieldl, and they used it to determin~ the probable top l~vel~ for '. the Ililtock m(!rk~t adv~nci5~. In the great bull mit.rket of the late 1920'~ thi~ rela~ tionship proved to be unreliable a~ ~ ~hort=term market forecastero So they tOO;l in it spectacular i\Jt&tement using <lI!.lmoililt th~ same Language , turned thdr back complfltely on -th~ comparbon of stoel", yields land bond yields and 8aid thi1l.t th~ marketi~ p~ychology was th~ best basi~ tor foreci1l.~ting. That happened ~om~time

in 1928" and they iiltiek ·to thb vi~wpoint to -the grell"c Clrai\'lh of 1929~

The pre~~nt r~lationship g~ve~ con$iderably low~r yield~ on ~tock~ th~

on bonds , High grade bonds yi~ld about, 400 per cent while IlItockilil averlil.gel!!

yield a little bit more 'I:;hm 3%. Because that r@lation&1lhip haa exilited the

past fiv~ y~lIlr~ doe~' itm permanent; I'elmtion~hip for th!l.!1 ft:~t'U'l:'e)l or b

it an indication thmt thilll !lltock mllrki!!j'1; hal) been clellI'ly overvalued fiYe yllllil'Sy in th~ lI1lam~ '!:fay that it wa~ clearly underva'lued during ·tht) period 1949-19541

Thb iilth(jl mlll.ny=billioll-dollar quel$tion. You won~t be abl® get th~ answer

to thillt by math~matic~; you won it be iJ..bl® to gElt it from an expez-t sueh ali mlfll

or %!JJlybody el~~; so you III have to an!!llw~r th:llt for youxsl!l1.;lf'.

But the thought that thl~ mark~t may have been oV<!llr-1talued in the lm!llt yearl, ju~t am it Will.I undervalu~d fiftilll®ll y~arl ago, brings us to th~ third whioh I enumerat~dJ1 namely that w~ ar~ ~till going to have wid~ fluctua-

the :future,. I cOll~id\l!)r mOlJt probable one , though 1 t far from

cllrtmin. rlS a&i on' for thinking W ilthall hltviIZl theiiJe wide fluctuation~- of whioh

we had a taste in 1962, in May pit.rticruliilJr'ly= 11.1l t.hat I don it ~~1il?J any char.ag@ in human naturemll viii-a",vitz the i1tock mark~t which i~ ~'I..l!t'ficiem,t t,o e!llltabliilh more restraintlJl in th~ public behavior thrul it ;;howe,d over so ma:t!Y d~cadellil in the Pi!!.~to The actions

ot ·the public w1"l;h !'t1l~p~ot to nev i&i!,"nl~~ d!.l1.1"'~~g :th~ 1960=61 extravaganza in

"'chat field arl! an indication of: it9Jl inherent of r~~traint. You ought. to

r!I!Jmember alillO, that many of the highe!ii\t grad~ common 5ltock,~li'ialues were forced up

to exce~l!liv" level~ a market enthU!Illial£!m produced large subsequent declines.

Let me give you ~ome exampl~i~ The mowt impre~~ive to ~y mind wm~ that of Inter=

\ national Bu~inei!J1i1l Machines which ilil undoubtably th@il l~&ding commcn ~tock in the (

\ entire m$.l'ket. Speculative enthyial~ll!! pushed it up to 607 in December 1961Jl from

\ which it declined to 300 in Jun!!il 1962-- a t"'all of' more than 5~ in the ~ho:rt period \ of 6 months" General Electric, which ill! the oldest high grade investment common

\ stock, d@clin~d from a high of 100 in 1960 to 54 in 1962" Dow Ch~mical, one of our

\ best chemical companiell, fell from it. high of 101 to a low of 40, and UoS. Steel which lis an old leader, shrank trom 109 in 1959 to a low of 38 in 1962. Th~se very

\wide swings underline the t'ac·t th.,t the i$ltock max>ket i~ b&l1ically the !\lllllmt;! now aBJ it

\

alwaYI) wu, in the sense it is liltill 1\llubj\!ilct to 1/"1!~ry otubstantial over-ev~,jhuation at

\somettmes and"undoubtably subililtantial under evalUa!.tion~ at other~0

My basic conclusion is tha-'e invl!!storlill ail well a~ ~peclJ.llltorj!j mUlt be prepared in their thinking and in their policy for wide price movem~nt~ in either direction. They shoukd not be taken in by soothing li!ltllt~m@mt!lll that a rf.!al invei!rtor doe lin It have to ~il'orry about the fluctuation!! of' the ~rtoclt mtlIl.rketo

It b timtl now to way what lit't;le I can '!jay about; th~ probable c our iUI of :the stock m&rk~t from the pre~ent level. No doubt thmt i~ th~ point which would int~rest the audf.ence mOlt and on which I can be the le215il't ~n1ight~ni.ng. In my view th<!!re

is an import&nt difference b~tween th~ pl'~~ent !!Itock m<arket and the m!lJlJ:'ket at more or lest!)! the same level in Dec®mbilf!l' 1961c At that ti.lIl'lll I had no hesiti!!.tion about predicting that then there would have to be Q fairly n~ar=t~rm collap~e of the newiuue mllU'k@t, which. had paSlIIIl!ld all bound!!! in lilpeculative exct'lli!!lelt. And if thit.t

co.Ll.apsed it li!lll"~lyflft~ct in ~ome ~firio~ ny th~ gelneral l~vel or stock

s it m:tgh:t pO!lilt!!ibly u~b.~I' in the be~ mJl.rket vhich inwardly I have been expecting for ~am~ tim~ pa$to The new i~~ue coll~p~e came per ~chedul@ and it did have a major mdver~e ~ft~ct on the relt at the II1$l.I"k~!rt.o But a reco"lfery begq in

a compar$:tivlI!Jly I!lhort till1fJ!l artd it hal clJJ."I'i~d tht; rMlJ:"ket I!!.v~rage~ to new he 19.htll ,

which wer~ contr&ry to inward expilllctatimuli but not to I!!.ny IlJpflcific predictionllJ

v;fhich I made 0 I '\\1ould like to point out that the laiJt tim~ I made aIIY ~toClk market dictionl wa~ in the year wh~n my firm judged, me qualified to

writ~ their y mark~t letter9 ba~~d on the fact th~t I had one month'~ ex~

pe;l:"'ience in Wall StrfJ@!lt. Since then I hav~ up Wlking predictionli@

The important point now i~ 'that m)J.I'T'~nt high l~y~lli of th~ mark~t ar~

not accom:pl!!.ni!ll!d ~XC~~:Illeil in thllll n@!lw=iliilue markilt iIlnd in lome oth~r direc=

tionli whi~h mad~ it app~ar ~o ~~lnerable in 1961. It i~ the general view in Wall Street that such characteri~tic abus~~ mu~t d~velop again befor@ the stock market

can have anoth~r collap~efl==or b~for@!l a tru® bear m&rket can b~gin (if it i~n~t againllt the law to use th@!l dirty word~ i'~ mark@!lt12) 0 Thl2l~@l a1:l'!l~el would large public ~mul peoplitllwho ,don't know what th@!lY ar@!l dOing, high bor::rowing!ill on margin, th!!;\) r~neW:lll.l of th@ n!!lw",i~!litUeifl i!!l_pre@ ,mil 110 on. Now thb coatention Ilou.~dtl¥l pb:u~iblr@ ~rnJ:m,gh. ba~t!!l(l on exp®ri~nc~p and so one might gueI!Jsthat

·thlll! lUtrk®t well con3t;inu(I!i g~nleriiltlly ~,l!,pwll'lXd, for quite iiIt wh:ile~ But l<lilt me point'

out nf'or -th@ that it net impol!l\~1bl®1 in th~ory that the market!ii high l~vill

alone aooeer or l,¥Il,t@r pr<lllcipit:lll.t~ :/1i, ©oll:lll.pll@il!!l without for thtUll1llP

technic:IIl.l w~$kn~~~e~ to ~how the~elv~~. The ©ollapme might b@ triggered by ~om@ untoward ~conomil~~ or politic!ll d~v~lopment. But if thing~ do happen that way H;;

will be th~ tim!!! in mark~t hi~torY!i I believe JJ that we would have the IifInd

a bull m&rket without the @!:l!:ce:~~~£!l and l\,'l:nMII~1I!i ot: the I have mentionlltdw But

there il alway~ a fir~t tim~ ~v~rythingo

opinion then rll&gard:1ng th~ prl@iiiilnt market l~r1.fti!))l mlullt be rllth~r incon=

clu~iveJ ~ld I ~h~ll my l~t~r prelcriptlon of policy on the Il~~umption that

inve~tor~ c~ot hav~ a d~pendabl~ vi~w on 'the mQI'ketq~ future action in th~ next year or ~o, but that a large and di~turbing d~clin® i~ likely totak~ place ~ain iliomCfttime':in thil'l futUl"'~!J and that '\\1@!l lihould btl! prepartlld in thought and action for it, i~ II. nec~s~ary a~~umption for inve~tor~ to make, and for ~~n~ibl$ ~p~cuIators too if there ar~i;'l.ny such,

Thll'l !ilecond claim 'which b that iii no real IIltock market" but only, u the

Wall Str~e't peopl.e liki!!! to ~ay, only II a market of I2ltockil.! I~ -= dell!lerveo; a moment or

two of dilcu~iono What they mea;n by !l!aying thill is that inveiitment ruultlldepend only on what happen~to individual ~~curit1ell» somll'l of which will go up and otherfj dOWll, and that it iii illusory to talk about what happens to the market q a whole

as having a mllJor bearing on how the inve~tor fare~o I di~agreewith that point ot view on thr~e groundso

Th~ f'ir~t ltii that I doubt that 'th~ mark~t i~ r~ally so much diff4!!rent in this resp4!!ct from what it al\.fay~ was in the pa~to I have some recollection of' the market in 1928 and 1929, and I am ,ur~ that the disparity and diver~ity of stock~ betwfAfln thol(j that acbed 't~~ll and thoiie thatllcted poorly wall almost a~ great then Ilt$ we see nov. .But d~@pi te that fact it wall el!llllent:hl.l f'or invelitorllil to be guided by a vi~w alii to the g~n~rlil~ levl'llll of 'th~ ~tl)ck mark~to It 1m lIuprbing to me that 'it/all Street peopllfl haven ta.k~n the time to make a study of the spreM in price movements b~twe~n individual stocks in rec~nt years 11$ compared with what happened in former yt!ar!!ilo (I haVil!! a ~t'wient at UClA who h going to mUe thiil! study

and it may prove quit~ illluuinatory}o

The second rl!!laiiSon 11 that there j,1m actultlly a cons Lder-ab.Le underlying consi~tency in the ~toCk m~k~t if you mea~l~e it~ movem~nt~ by comparing two ~v~rages which seem to be quite dif'f~rento One of th@m i~ the Dow Jone~ Indu~trial Averag@, which conlllbt~ of only 30 !litock~" Itnd the other is the Standi!U"d & Poor'!J CompOlite Averag@ which con8i~t~ of 500 ~toc~. You might well al~ume that if there

L'llll!.:t:, of pric~ mov~m~ntlll thlfm an &~r~rag~ including only 30 litock~

ditf~r~nt from on~ embracing 500@ ~ut if you obmerv~ the I>!.yermge!ij now giv~n by mOBt new!'llpaper~ you g~t virtually a

o,;;u,llJ,U/,;>,,",» 'which m~!lfliil a parity change, almoat day by day and c@rtainJ.;y month year. In the pa~t ten yldla;r~ the DeN Jones Averag~ ro~e from

to 750» while the Standard Poor I s index rose fr~m ,tq., ,

.5. 11;) that the apparentl;y misce1lan~o'Wi! group .iss~s .

actually had a bett~r advance than th~ ",'Llt ... edge or blue-chip in the

Dow Joneid Avez-age , Thia indicateiS that you cannot tell a priorft,;'1~~a:tl.nwnEr~pr6f

stock!! :is gof.ng to do oyer the futul."'e years in comparison with '~the1f,,' \ ". '.'

r third and moat important r~aaon why the inVtlstor be

Iled to emphas Lse hi!W f~election of individlli.al stocks, and to neglect the gen .. e.ra .. 1 level

of the is thee fact that ther~ La no indication that the i:mrestoX'·t

bett~)Jr than t.he marklsrt averages by making o'Wn aeleetions or by taking expert '

/ ~~r pessimistic: atatem.ent is found' th~

,/ imrestment 'whi(:h repxiIJIsent a combination of about the beet

the country!) and a tremendo'l.l.ii 'expendi tuxe." of money I' timilJ,

dix'ected ef'forto 'rhe record that the have had great d:tf'-

whole in "I:;h<ill per.rOl~ma:nce of: the 30 iltocks in Dow Jones

as I:ndex* an investq:;r. .. had been able II by some

",,,,,,·"'J.VU -to make up a portf~tQ;.'approXimat:~ipg these reason to expect about as! 'good results! a;s'; were the very in"t~lliglliint and l::ar~ful stock sel~ction$ by the

mal18g~rflll. But the jv-s'tif1cat1on for the mutual fundilli ia that

actually do follow ~uch a ~ound ~~d ~1mple policy_

I mtu;t soae sl!:epticism the geneJ;·al efficacy ro;

economic forecasting» of market. foreca!rllting, and expert selection com-

mon sbocka, in their relation to the inve~tm~,mt and speculatiye profitll 'which can

be made th~refrom. Let me give you my rea~onSf I say fir~t that to the extent that

an econonrlc forilllcast lappear:s dl/!lI=H!llflJlable-",and it is g~mera11y so only for short

tsrm--it~ aff~ct is likely 'be already reflected in the .~ket lev~l, and there

ia no "ray to make from ito Ji'or ~ iii'S cannot ~ay because the foreca!lEt for

1964, is: favorable that 'CO!l!l.mO:n atock~ i\\'I!houJ.d. b~ bot1ght today. Th~ :price of common stock!!l alS1) ~v<1ilrybody !llhO'iud ~know ref'lll1'Jcts thl\1lJ g@lJneral expil!)jctation of a good 1964. On thEl othter hand, longer term busfness forecal!!lts have proY~n'll:rareH.a:mle on the whole.

Siml1ar1y~ take the ca~e where an individual 8tock is favored by one of my own fraternity of security analysi~ i~ because he i~ optimistic about its future earnings and general ~o~pect"'~;;, 'I'o th«l e~tent that investor~ generally agree that this! company has good future proO"iipect!i!l tQ~;that extent its prospects are a1$0 likely to be fully reflected and perhap!lI over=ref'lectil\ld in the market price. Sometimes you find the contrary tjase where a Wall Street man may say "Nobody likes this stock~ nobody ha~ confidence in 1t$ but I have confidence in it and I know its results are going to be bett(~r in the future~" That I s an interesting and valuabl:~ conclusion if tru~. The trouble is that in mO!i!t cases you can't r<l!Jly on itli!l d~= p~ndabili ty. '1lh~ man may be :right or he may be wrong in saying' that some unpopular stock ig;g going have a very good futtU'e e That 18 the dil<$j~,a1l ·inves'tors 'f'ace in trying ,to make money out of forecast~ es to the future prospects

of any individual security.

Now~ with r~spect; to il1ltod~ mark~t forecatlllting as! such, as a 1Z1lep@..rate oc~ cupation or amusementjl I don't think thElre iii any good I1!lvid~nce that a r~cognized and publicly used m~thod of stock market f'orecastir.g can be r~li~d upon to be pro=

"

Let me illu~tratlill what I mean by rllf~rt!lnce the famoWi nDOIi Th~oryn known of th~ m~thod~ used tel" tor~cMting the ~tock market. I

macte some £'>Itlt).dietSl of the r~~ult~ applying the mechanical concepbs

of the Dmif Theor'J s in which have well .. d~t"ined !2\ignalli to buy and iiI~ll stock~

by t;he m(fir~l!Mmt of the averag~ t~ough resistan<!~ points upward or downva.rd~ I

fefund that when I l3~iGudied record from 1898 to' 1933 p a period about 35

yeal"'8=-tM" from folloWing this mecha,ni,da;l method:were~'i'~marltably 0 good.

~ the time when Dow Theory hrul. a 1\..weful method

with th~ mark<et action in the ~s and ifelarly 1930!s., public's

in,tere~t enormously ~ P:li:"evioT;!sly it had been a kind of:

esonez-ac (nuy 13. few dililvot~d adhErents fj and which

iIiIl~~ had b~~n prililtty ~kililpticalo ~~~ Dow Th~ory bililcame extremely popular

af't~r 1933. thilil con~ililquililnc@~ exactly the ~ame method in

thilil mSJ1'ket 1933» and I ±~o'lmd pecu.liarly enough tha.t in no case in the

next a,in onilil benililtit through following thI!!J Dow $igna.l~ mechanically®

By thi.!.il ! m~an that one wa$l\ Xl!Jl'nrer to "bti;J( Ij·tock~ back at a lWeI'

than he th~m :tor,

AiBJ yo'l1 Dow Theory b i!llt1ll p<l!lri!llued a. of practit:1.on~rl!

and ser"ic®~o I think all of t1:MUll vill t®ll yOll that it i~ not a ml!lJcllanical

tlMflory that a ladt'gilil ®l@mililnt of judgment hM tlO in thl!!J intililrpretat10n

of thilil But once you that eleml!!Jnt you don't hav~ a theory

anymor@ » have a c®rtain i!lxpertiill!!$ "!Afhich mayor may be depilijndabl~ and

usefu.l.

Ll&t ml& now make a g~n~ral For obvious l'~a~on!fj it is 1mpos~:l.b10

J!o1". . as a s and :t~or "th€l av~rag~ in.VfHl'Jltor 91" I5lpll'lcrua"torl1

/ todo ~ett~~ thRtl,th: g~~~ral mark~'''te Thill r~a~on i~ you ~:A~h~ g1l!neral marki!lt

and you can. t d.o rJ@lti]:;~r bhan I do beli~v~ i~~ il'£l possible a

/ mil".l,ori'((;y of ,to g@t !"®:1:!l'ulta thrul the aVl!erag~. '1iio

a'l'l!ii J()J.(~c~i!ll~ary :tor must, tollow some sound prin~

which are th~ valu~ of th~ ~~c~Jriti~~ and not to

th~il" market actiOllo The oth~r i~ that their m~thod of op~l'ation must be ba8llieally d.itfei.!:"~nt than that of thlfll: majority ~ecurity buy~r11iio They have to

cue t,h@mf@~l"lJ"t~~ off f:rom ·th~ g®n®:ral public and put into a cataF!' _

gory. ! will mor® briefly on that later.

Now» let me $lummari2:e up thiilil ~tag~ 0 Th~ inVi!!lstolo needs common stock~ in hb portfolio» but thes~ introduc~ ha2:a.rds of wide fluctuations which he cannot

~xp~ct to a,'10id mor-e @uc'c~~ll!lfully than obhez-s unlil!lsfj perhaps he thinks independ~ntly from the crowdJ that i~ unlell!l~ he is conmtltutlonally different from the avterage.

Now let m~ come to part two~ what inve$tment policy to follow und~r the condition~ di~cuIl!lB~d? My v1ew~ th~reon ar~ and definit~ and ~trongo In my u@arly fifty year~ of exper tence in Wall Street live found that I know l~81s and les8 about what th~i :!!ltock ma:rket i~ going to do but I know morllll and mor'e about what Lnveator!:i oughf to do $ and that i 8l a pretty vital change in atti tudilll 0 The first point

is that the inve~tor i~ r~qu.irfld by the very insecurity ruling in the world of 'today to maintain at all 'tim~il some divi~ion of hh fun.dEJ b~twe~n bonds and stocklll (ca~h &11.0. variou~ 'type~ of intl!1!r~lSt=bearing depoili ts may \e viewed ai!ll bondequh'aleJ:lt~ 0) Jl..1y &iugge~tion iii that th~ mininnlm pold tionof thii'lli ;portfolio

held in common mtock~ shoukd be 25~ and th,~ llla.:i'::imum ~horud be 75%.. consequen-

tly the !lUi!Ximum holding o:t bonds 'tfOrut't be 75ap and. th.e miromu.m 25'%= the figurelil

being r~'V'erliJ)edo yariationil mad~ in hi&. portfolio mi:il: ahoukd be he Ld within

th~iHli!l) 25% and tig~ll'It1!~o Any such variations llilhCftud b@ clearly ba8~d em vakus

cOllsidera.tion~ ~ '!Which would lead him to own more \~0lD.t1l0l1 sbocks wh~n th~ market

se~ll1i!il low in to val1J.~ and l~s5l common srtock:!1ll Wh€il1 the ma.rk~t ~e~ms high

· .

10

in relation to value.

Now while this is the classic language of investment authorities, it is amazing how many people thiru{ in exactly opposite terms, That was brought home to me shortly after the May 1962 break when a savings=and~loan company

representati'le came to me questions. The first question he asked me

was "Don't you think that common stocks now are less safe than before because of the decline in the market?" That hit me between the eyese Her~ were financial peop.Le..who could consider that ertockB Leas safe because they have dec.Lf.ne .. d' in price than they wer!!!l after they had advanced in price. The policy I propose to have more common !il"Gockf!! when the mar-ket seems to be low and len vhen it seems to be high value iitandard~ is to th!l!! p!i4ychology

of invesi;oI'1lJ geni!lJfally and 'GO that of !\\1peculatoI"s alwaYio It is particularly true now because of t";he great conrus ron between investment and specul.atdon '-'hich I shall refer to later. I euppoSle thl1!l idea of having more common ~tockl!ll at low levels than at high Leve l,s b a "counsel, of perfection" for mo~t invutor~. But it could be follow~d by many inve!l'ltO!'81 to the ,extent of an inflexible z-ul.e that

th~y should not increa~~ th~ of common stockiJ in the portfolio ailil

the market advance 1$ s except of cour-se through Jl;,h<!l'l ri:€le in the market itself. However , a more sophifilticat'liid app.Lf.ca't Lon , which '~wuld take advanbage of a rin in the

market level f'or wa11jl1!l J be sometihf.ng lik~ t;hi~ 0 Use a 50-50 di vis ion

betw~en bonds and ~tock~. When the market l~v~l of th~ ~tocks ris~s to a point

whC!ilr~ of the total or maybe 60% p you voul.d then se.LL o;;'t enough

to bring your proport1op back to 50%1 back into bonds or irito

saving8 banks. And conver~ely wh~n th~ went down so that your common Itock

proportion had 45~ or 40%) you som~ of your bond mon~y to buy

common ~tockl!ll and j:t back to ·thl! 50,%. That; was th'l';) famoui!Il Yale University

~y~tem, which wasot: the ~arlie!!lt f'o:1emula me thods knovn, They used a ba£iillll

for common stocks!J a per-centage which at that time wa!!'l regarded alit pretty rash

for an instltut,ion of • When a market rise brought it up to 40% they sold

out one eighth of the i:I.~ ho.Ld.Lnga p to get back to 35% ~~ when it went down "1;;0 30% they

99ughtone sixt,h <co bring the' ratio up again to 35%. It was 2, good until

the marki'fran away on the 1 and then had too little in

common ~tockii. Now they are tiO like the ot,her untver-s Lt Les ,

I think, and they don It, follml the formula anymore.

Another approach that i~ practicable, but from Ii!. different of View, i~

the "Dollar Averaging" method, in which you the same amount of money in common stOcks year after year, or quarter after quarter. In that way you buy more ~hares .9:f IIItocks when the market level illZ low and t:l~!'~rer 13iharel!! "Mhen i tlSl high. That

.~l!'Ithod has worked out extremely well for who have had (a) the money, (b) the

time, and (c) the character neceasary to per'sue a c:onalli~tent poli.cy over the yearIJ regardless of whether th~ market ha~ been going up or down. If you can do that you are guaranteed satisfactory suoc~~~ in your inve~tment~o

Let me add that there are count.Less variam~~ of thill 'type $I which are called "formula plans. Ii The main need here ia: for thre irnrestor to Mlect some rule which seems to be suitable for hi~ point of view~ one which will keep him out of misli" chhf, and one, I insi~t~ which will always maintain Eloml!!l intereSlt in common ~tQcks regardlelu of' how high the ma:rcket Leve L goe s , For if you 'had f\:)llOWed one of

t;he~e older formulaiJ whioh took you out of common gtock51 entirely at some level of the markililt, your di~appointm~nt would have b~en ~o great because of the ensui!!ing advance all probably to ruin you from the of intelligent investing for the re~t of your life.

Now let me oome to the problemlll of security gelectiono We have talked about a bond component (and/or a ca~h=equivalent component) and a oommon stock com~ ponerrt , Th~r~ Iii Ii wide cho i.ce Ln the bond componerrt , but the decf.s Lon b not of

,~ 'FAGE

too much tmpor-tance in most C1ll.6~S 0 In the taxable li"t, you can put your money

in U.S. Saving~ Bond~ at 3~; which can redeem at will; you can buy long

term U.S. Gov~rnment Bond~ at about .10% taxable; you can buy high grade, longterm corporate bonds at 4.30~$ or 4~ it you do a littl~ selecting~ you can

have ~avinglJ in commer-c LaL banks which gin you up to 4~ if he Id for

one year, you can buy lavings=and loan $har~~ (b~ar in mind that th~y are not deipo!'!!it~ but ~hare~) which now yield up to 5% in California. Another choice of

great importance are tax=free and municipal bonds , wrhich yield up to about

3~ for good quality and long maturity~ For mo~t investors who are in a tax bracket of more than 30~, tax=f'r~~ bonds have been th~ most att;ractable for

year-s , actually 'iMert') in a gift to the in,r~8tor of ~Hhich didn It

take advarrcage up to the clrtent, he should have as againit taxabl~ bonds. That advantage ha~ diminished, b~cau8~ t~ free bonds have advanc~d relative to others, but it is gtill p~r~ua~iv~ for p~ople of sub~tantial means. I would like to point

out that in municipal bonds yielded 2.93% and U.S. Government taxable bonds

3.0810 2 the same return the full tax on the governments. In October

63 the nnmf.cf.pal, average was 3. and that of U.S. Government bonds 4.06,%» so

you see the advantiage that has ~'lf't'l;!f1a to the past holder of tax-frelJJbonds as compared with U. S. government.,

One que~tion for th<!\! inYE)",tor which I won~t go into, and I am glad I haYn't

got thO!l time to do it, is wh~th@lr hll!l IlIlhould tak~ advantage of thl'!l 5~ offered

by some of' the aav:1tngs and loan aSk'llociation!ll. California. Leo/; m~ that I am

not an ~xp~rt on ~a.ving~~ and loan a~sociation~, and I don't want to get drawn into the controverlilY that has now begun as to whether their methods are complet~ly sound and their prospect s are compl®tely depsndab.Le , I just want to ~ay in general terl:!'l8 that nobody can as:i!!ume that he can get exactly th~ $am~ deg:rrSfI of maf'iffity and

dependabf.Li.by in a !:lltandard of investrn,~,:tat yielding 5% M in one yidding 4%$

\'Ii'ith rewpect to pr~fl!!r~d ~tockfj! the import point ill that thl!'!ydo not belong

in the individual inve~tor!s portfolio. The reason i~ th~y have a great tax advantage for corporate owner~ which th~y don't hav~ for individual OWI1!!!lI'S. Corporate ovnez-s I&l'f'l.ve 85% of the tax on these di viden1Jis J individual ovmerlB save

a very ~mall amoluit, which may disapp~ar pretty ~oon in the n~w law. It ~hould

be obv Lous that preferred stockfl! shou.Ld be bought only by cor'por'atie imreltltor1l\l just a, tax=fr~e bonds should be bought only by peopl.e 'who pay income tax. You may have noticed lalt week that one of the public utility compani~s offered a bond issue and a pr6f~rred~~tock i~~U6 at practically th~ same yield, although hitherto preferred ~tock.; hav~ always yielded quite a bit more than the bonds to which they were junior. The great tax advantage of preferred ~tocks to corporate buyers is now

be atedly showing itl5l effect on relatiYII! yd.elds.

We come finally to common=stock investment. My recommendation is that the inve~tor choome either hil own li~t of, say, 20 or 30 representative and leading compani~~, or el~6 put hil money in ~~veral of the well-establi$hed mutual fund~. (There i~ u~ually an advantage for the shrewd invemtor in buying ghar~s ot the clo~ed=end inve~tm~nt companies on the New York Stock Exch~ge, when obtainable

at dillcount;!II from net allltl!et val.ue , rath~r than paying thfJ premium added on to thEli price of mo~t open~end ~hares.)

Many :tnv{ll~torlil would think m:y prescription too ~imple. If they can get r(!l<? ~ultl!J equal to the 1l:tyerages in thil!i es,IIJlY wily why shouldn't they try to get a ~ubstantially highElr return by caref'ul and competently-adYillled ;;election? My

.. shor-t anSiwer has 1l:tlready been ghren: If the inveli!!tmemt funds M a whole can't

\ beat the av~rageljl even pretty clever innll!tors as a whole can it do it either.

\\ Thiii! underlying problem of selection is J,hat the "good stock~==chiefly the

\growth li!tockllll with bett<!!lr than average prospectf!!==tend to be fully priced and \ .

'L-

\

\ \

." PAGE 12

, , ,,' I

oft~n ov~rpriced." At th~ oth®r extr~m@ n~w Itock off~ring~p when th~ craz@ i. one, ar~ lik~ly to combin® fourth=r~t~ quality with ab~urdly high pric~-earning~ rAtio •• Therll ar~ bett'iill" opport'W'l1 tllUI in b!itv~lIln tUtU'll! extreme!J $ but mOllt inv~ii!ltorl don it, look for them th@r~.

As r le@ it, th~ fundamental problem in common stockm ill the market'~ 1n~ J~ction of a larg~ ~pecu1ativ~ element into the strong~st and be~t compan1'1 by

eltablilhing an unt~nably high pric~ them. (Th~ ri$e of, IBM or 607, loon

follow~d by a tall to 300, 11 th~ b~st 11lu~tration of my point®) Thil h~ add~ ~dgrlatly to th~ confu~lon b®tw,en 1nveetment and §peculatioll, becaus~ it 11 ea~y -to tell onl'lllj~lf that thi IIha;r@1lI of a good company al"4!l alwaYIi a 1lI0und 1nV8!1iaullnt, regardl~fnl ot pric(I. From th:ll it Wa.1i an Iil.iillY ~tep to calling @v@ryon!!l an ln~ v~~tor who bought hi~ ~h~r®1 outright» and finally to calling ~v.ry Wall Str.~t customlr an lnv6~tor--p~riod.

My r4!lCellnt crullad® hi!ltlJ oil'!n ~'O per-luau" Wall strlllJ<Iilt that it hl!l,~!IlI\l,diii& mbtuOi$ and harmed :l.t8<tlt ~ in luppr~!I!I~ing the 1iford "lp~Clllat:!.on" from itlJ vocabulary", Speoulation i~ not bad in it~~lt$ ov@r~peculation 1~. It i~ important that th, publl~ mhould ltt$!.v~ a. :f;,\llrly good idea of th~ elx:t~nt to which it I>~Qulat1ng"

not only wh~n 'l::rUIY $l.\"hot hllUllli &1..t I, complllt@ly 8illy p;rio~$l but ~v~n w~ it

'l::myli'! into a wond~rtul concern euch ~!!I IBM at "70 time!!! it!! h1ghellBrt:record@d .~ .. ingll. To!lfY mind th~ mOlip valuablecontribut10n that l!J~cur1ty l.llalYlltl eould mUljI to th~ ~;rt ot :invl'£!il'ltins would. be thll !3l.ilt.rminllotion of thilll! 1:o;veil"tment ~ Iplculam

,:!:~Te compOlllllntl'J in th@ curr@ut prioe of WlY g1vifln common IJtockp 110 that thlil in",

. ":t~nd1ng 1:)\.1.y~r might haVIjI lIomi notion of tha1 :fiSIko h~ tUil'lg all w~ll a~ what profit hI might mak~~ I hav~ pointed out that my own con~erv~tlve apprat~al

put th® inv~ltm~nt component in rBM!~ 1961 pric® ~t not more than $200 p~r~h~~ -~about $6 billion for th~ ~nt1re ent'rpri~~~~the r@mainderot th, quotation :r@prliuj~nting a Il!p@ctillJ:t1ve v8.luatt,pn of the company ill undoubtldly brilliant futtU:'l. Conv¢i.lr~@Jlyp I IItat~d,thl:t at lilaa;t 80~ of the high~lt pr1c~q(5.5) of International Ha::rvil-It~r in 191;)1 could b~ I.IJcrio4!ld to 1t~ invel!tm~nt value~

Th1; did not prove that Rarve~t~r w~s a b@tt~r buy than IBM--it wasp alit

tlU'IlfHi out",,,,but :it did d!ljUl.onlBtrate that the rilk taotor involved was much small!!r.

/ LfJt m~ ra:tflll a final qUISllt1on~ D~lp1\, l'ath,:!, dbcouraging r~sultl! from,

"ndfUtvorlil to prfld:ict urk~t moV1I1II or to ~~l~ct tll, mOilt attractiv~ compan1~ull$ :. can the 1nt~11igent 1nv~lto:r toll ow any po11ci~1 ~ common=stock Isloction that prom1,~e betto%' than ~v.rlil.g, rlll!!rults'l I thil1k it 11 pOllible for lome strons.;, mind.! 1nv~gtorl to do thil~ by buying value rathlr than prolp~ctg Qr pop~ ularity. $om~ example. ot th1g approaoh: (1) S~l,ct Itockl.ot important oom~ pan!.1 which I~ll on I. no ... glamour .be.lliI .... e.g. ~ Intlrnational Ha:rvelter. Soml extraordinary r'lultl oould have be/fn obtained linee 1933 by buying il.oh year the .hare, of the lix oampanill in the Dow Jonel Ind. Average whioh lold at the

lowest multiplier of their reoent earn:l.ngtil& (2) Buy definitely "bargain illuu.'"' Typioally thell would be Iharel th~t sold for lell thlir value in working~capital &lo~el with nothing paid tor f1xld al8etl and goodwill. Thele veri quite n~roul ~ to 81 late &1 1957, and wer, conliltently profitabl. when div'rI1~ t1cat1on val obl,rvGd. F~ ~uoh opportun1t1e~ remainJ perhaps they hay, be.n ~upplAnt'd by Iharel of Imall~r oompaniel selling on a rGl&tively d~prell;d

balil ~ lik~ly to ba1 takln over by a l~ger oonc~rn at a sood advanol in priol. (.3) Finally there il the wid, field of n1peoial I1tuat1onl" .... r@orgMizat1c)llllll mers,r~, tak,~overl, 11quidat1on~1 eto. ~h1e is a prot'.lional ~I&, but it

11 not 1mpoliible for intelligent inv~ltorl to profit handsomely from it if

\t~IY approa.oh I~curity operatlon~ $,1 they would I. commeroial bUllinlll.

\ CONCLUSION.

\ Th. 1nvlltor mUlt reoognize that thero al"l uncertain and h'no~ Ip~culativ~

\ \

· .

in &ny policy h@ follc;iWIl--<lIIVIIUl an tul-GoV'flr:nm<l!lnt""bond program" E1t irU1!it,; de.aL 1W'i th ·thl!llllUB uncertm1nti~!I by ill. policy of continuouil compromimle be"';;\tt\'J'JJ'i'fll bonds and common I!jtock~.'I and by adequate d:lverlllJificationQ (Exc(lJption:

He ma;,/ and k@leJP mOlllt of hil funda in Iharll'U! of ill. promi81ng bUlllin<l!lI!Ui'l with

:tle i@: elo~ely connec'sedv ) He m:ulIJt make ill. ~trong ~ffort to hav~ more money ",;:PJ'i:1'.t~d, in common I'!;ocks at lOller mark<l!lt l<l!lvell (at least on thO! bi!l.!lJis of co~t) CJ;;h,I:L~, at "lI'l'hB;t h((', r<l!lcognizl'll~ to b(\1'l potentially high lillvel~. M08t important~ h<l!l mc;,cii~'t ffij1!,intain a philoliophical mttitlll.de towardll the ineflcapabl@ variationlJ in pOllition and th~ in~vltil,blifj Umbtuifjl§l" lii8:.IJocilated vU;,h thifil!Sfb

to 1l'U old Wall :str®~t wtory" wh~n a c~rta~ln broker ?!I@.[i ii.~k,d by

recomm~nd i~~u~~ buy~ h~ alway~ aske~ in ~$turn$ WWhat your

Do you ,{ant to "at "\\l"ell or to Il,.e~p well? tI I am opti:millt ~nough

'\t;o b~liifjY<l'J that t~ollo~!J'ing sound polici~~ almost ~ inv~stor", .. l)lvifjn in this

world==&1!hould be ablifi to <$at lrl!!ill ~nough withou.t having t.o lOllllllJ any

Você também pode gostar

- Business Startup Guides-Preparing Yourself Ver 2Documento4 páginasBusiness Startup Guides-Preparing Yourself Ver 2Minh Huỳnh100% (1)

- 101 Problems in AlgebraDocumento160 páginas101 Problems in AlgebraTrishaii Cuaresma96% (28)

- Huge Book of Puzzles (2007)Documento386 páginasHuge Book of Puzzles (2007)Hazlina Siwok100% (1)

- GM Relés y Fusibles Corsa PDFDocumento1 páginaGM Relés y Fusibles Corsa PDFcorylinAinda não há avaliações

- Flow Design Formulas For Calculation - Exported From (HTM - 02 - 01 - Part - A)Documento8 páginasFlow Design Formulas For Calculation - Exported From (HTM - 02 - 01 - Part - A)wesam allabadi50% (2)

- Music To Watch Girls by MJDocumento3 páginasMusic To Watch Girls by MJMarvin JongAinda não há avaliações

- Music Theory BasicLevelDocumento20 páginasMusic Theory BasicLevelHlachingmong Issac Murruy100% (27)

- All The Things You AreDocumento1 páginaAll The Things You ArePeppe LiottaAinda não há avaliações

- Extreme Rhyming Poetry: Over 400 Inspirational Poems of Wit, Wisdom, and Humor (Five Books in One)No EverandExtreme Rhyming Poetry: Over 400 Inspirational Poems of Wit, Wisdom, and Humor (Five Books in One)Ainda não há avaliações

- Calculus Cheat Sheet DerivativesDocumento4 páginasCalculus Cheat Sheet DerivativesRajatAinda não há avaliações

- Aural RitmoDocumento1 páginaAural RitmofabioAinda não há avaliações

- Excercise in FDocumento2 páginasExcercise in FPaz Villahoz100% (2)

- Jim Rogers shares how he made his first million and advice for investorsDocumento3 páginasJim Rogers shares how he made his first million and advice for investorsSEKAi.org100% (3)

- 5Documento2 páginas5Abel Salazar PianoAinda não há avaliações

- Chi Kung - Home HealingDocumento243 páginasChi Kung - Home HealingGarbanzoNegro100% (2)

- Panem Map FinalDocumento1 páginaPanem Map FinalSEKAi.orgAinda não há avaliações

- Renault Inyección Electrónica Kangoo RL-RN 1.6 1999 Siemens Sirius 32b PDFDocumento2 páginasRenault Inyección Electrónica Kangoo RL-RN 1.6 1999 Siemens Sirius 32b PDFOsvaldo LópezAinda não há avaliações

- Taita Salasaca - Conga Drums 2Documento2 páginasTaita Salasaca - Conga Drums 2Carlos XavierAinda não há avaliações

- Renault Inyección Electrónica Clio 1.4 Ac Delco Monopoint P PDFDocumento2 páginasRenault Inyección Electrónica Clio 1.4 Ac Delco Monopoint P PDFGood CarAinda não há avaliações

- Xsara 18 - Berlingo 18 - 18 Xu7jb PDFDocumento2 páginasXsara 18 - Berlingo 18 - 18 Xu7jb PDFJorge Daniel DiazAinda não há avaliações

- PDF Parts Catalog Tvs Rockz - CompressDocumento104 páginasPDF Parts Catalog Tvs Rockz - CompressaspareteAinda não há avaliações

- Strong Enough - DrumsDocumento2 páginasStrong Enough - DrumsКолянсур ИвановAinda não há avaliações

- Cicuta Tibia - TubaDocumento2 páginasCicuta Tibia - TubaYohan Octavio Vera DelgadoAinda não há avaliações

- Tu Me Gustas Trompeta 1Documento2 páginasTu Me Gustas Trompeta 1JonathanAinda não há avaliações

- Como Quien Pierde Una Estrella VozDocumento2 páginasComo Quien Pierde Una Estrella VozGerardo100% (2)

- Paradise Violín IIDocumento2 páginasParadise Violín IIJavier Rubio PérezAinda não há avaliações

- 5756867Documento1.027 páginas5756867Sách Việt Nam50% (2)

- Planes APIDocumento10 páginasPlanes APIManuel FigueroaAinda não há avaliações

- Ruf 1Documento3 páginasRuf 1poofpoofpoof13Ainda não há avaliações

- Ibfc 142 Engenheiro MecanicoDocumento16 páginasIbfc 142 Engenheiro MecanicoJosé Maria junior100% (2)

- Indian Express 19 AugustDocumento20 páginasIndian Express 19 AugustTension Dene kaAinda não há avaliações

- Charles D Ghilani - Paul R Wolf - Elementary Surveying - An Introduction To Geomatics-Pearson Prentice Hall (2012) - ExtractoDocumento19 páginasCharles D Ghilani - Paul R Wolf - Elementary Surveying - An Introduction To Geomatics-Pearson Prentice Hall (2012) - ExtractoRodrigo DelBarrioAinda não há avaliações

- All Art Is Propaganda PDFDocumento2.708 páginasAll Art Is Propaganda PDFPau_Brand_25500% (2)

- Lagenda Violin PDFDocumento2 páginasLagenda Violin PDFMarvin Jong0% (1)

- ElvisDocumento1 páginaElvismaui3Ainda não há avaliações

- Building ActDocumento136 páginasBuilding ActVeronika RaušováAinda não há avaliações

- 113-SEW Brake DetailsDocumento10 páginas113-SEW Brake DetailsTarak Nath RakshitAinda não há avaliações

- 6periostitisDocumento10 páginas6periostitisAntonioAinda não há avaliações

- El Pastor - VihuelaDocumento1 páginaEl Pastor - VihuelaDamian Guardia SalazarAinda não há avaliações

- GM Inyección Electrónica S10 Blazer 2.2 Efi Delphi Multec emDocumento2 páginasGM Inyección Electrónica S10 Blazer 2.2 Efi Delphi Multec emyayixdfuego131Ainda não há avaliações

- Hecho Del PíncipeDocumento11 páginasHecho Del PíncipeEdisson MoralesAinda não há avaliações

- Tema 6. CULTURADocumento7 páginasTema 6. CULTURAMarinaAinda não há avaliações

- Trompeta 2Documento2 páginasTrompeta 2Mauricio TorresAinda não há avaliações

- 388 1006 1 PBDocumento20 páginas388 1006 1 PBGabriel Evangelista dos SantosAinda não há avaliações

- Extracto Destinos-Elementos-para-la-gestión-de-destinos-turisticosDocumento76 páginasExtracto Destinos-Elementos-para-la-gestión-de-destinos-turisticosEnzo Navarrete UlloaAinda não há avaliações

- 09 - Chapter 1Documento20 páginas09 - Chapter 1Dr. POONAM KAUSHALAinda não há avaliações

- 2020Documento14 páginas2020mintrikpalougoudjoAinda não há avaliações

- Mix Trompeta ChilombianoDocumento1 páginaMix Trompeta ChilombianoDenise AlvaradoAinda não há avaliações

- Los Mareados Arreglo Hernan PossettiDocumento2 páginasLos Mareados Arreglo Hernan PossettiteomondejarmusicaAinda não há avaliações

- 01 - Lista de Parametros SimplificadaDocumento8 páginas01 - Lista de Parametros SimplificadaLuis Felipe VidigalAinda não há avaliações

- Elec 4 BlackDocumento1 páginaElec 4 Blackyudo08Ainda não há avaliações

- Enfermeiro Ebsrh 2015Documento10 páginasEnfermeiro Ebsrh 2015Neila Reis da SilvaAinda não há avaliações

- UTS ELT MDE S1 Coursebook Evaluation ChecklistDocumento3 páginasUTS ELT MDE S1 Coursebook Evaluation ChecklistHanin Khalishah WaqqasAinda não há avaliações

- Detail (1-1) To R.C. Strip Footing (Sf1) : A B E F H J KDocumento1 páginaDetail (1-1) To R.C. Strip Footing (Sf1) : A B E F H J KThomas Garcia0% (1)

- Escort 18 16 ZetecDocumento2 páginasEscort 18 16 ZetecOsvaldo LópezAinda não há avaliações

- Trompeta 1Documento2 páginasTrompeta 1Mauricio TorresAinda não há avaliações

- Fiat CoupeDocumento1 páginaFiat CoupeJulio FaninAinda não há avaliações

- Mix Serpiente - BandaDocumento53 páginasMix Serpiente - BandaJohn Carlos Vilca VelizAinda não há avaliações

- What A Wonderful World Eb - Bass Trombone PDFDocumento1 páginaWhat A Wonderful World Eb - Bass Trombone PDFJose HerreroAinda não há avaliações

- Interview-Zan-PerrionDocumento26 páginasInterview-Zan-Perrionm.soloAinda não há avaliações

- Benjamin Graham - Some Calculus Suggestions by A Student (1917)Documento8 páginasBenjamin Graham - Some Calculus Suggestions by A Student (1917)SEKAi.orgAinda não há avaliações

- Wing Chun - 18 Hand TechniqueDocumento2 páginasWing Chun - 18 Hand TechniqueSEKAi.org50% (4)

- Rulers CM in SimpleDocumento1 páginaRulers CM in SimpletupelohuneyAinda não há avaliações

- Ebook - Martial Arts Kung Fu - Bei Shaolin SiDocumento6 páginasEbook - Martial Arts Kung Fu - Bei Shaolin SiDanny_RabinowitzAinda não há avaliações

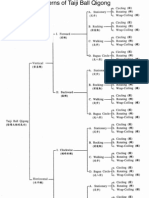

- 48 Patterns of Taiji Ball Qigong - by Dr. Yang Jwing MingDocumento1 página48 Patterns of Taiji Ball Qigong - by Dr. Yang Jwing MingSEKAi.org100% (1)