Escolar Documentos

Profissional Documentos

Cultura Documentos

Associated Bank v. CA (1996) Gist: Where Thirty Checks

Enviado por

Hansel Jake B. PampiloTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Associated Bank v. CA (1996) Gist: Where Thirty Checks

Enviado por

Hansel Jake B. PampiloDireitos autorais:

Formatos disponíveis

Associated Bank v.

CA

[1996]

Gist: Where thirty checks

bearing

forged

endorsements are paid, who

bears the loss, the drawer,

the drawee bank or the

collecting bank?

Facts:

-The province of Tarlac has

an account with the PNB,

where the provincial funds

are deposited. A portion of

the funds of the province is

allocated

to

Concepcion

Emergency

Hospital

and

drawn to the order of

Concepcion

Emergency

Hospital, Tarlac or The Chief.

Later on, upon auditing, it

was found out that 30 checks

which are issued to the

hospital amounting to 203,

300 pesos were enchashed

by Fausto Pangilinan, the

former administrative officer

and cashier of Concepcion

Emergency Hospital. He had

forged the signature of the

Chief of the Hospital and

encashed the checks after it

was cleared and was paid by

the drawee bank, PNB. All

the checks bore the stamp

All

prior

endorsements

guaranteed

Associated

Bank.

The

Provincial

Treasurer

then

sought

restoration of the amounts

from PNB, which in turn

impleaded Associated Bank.

The latter also impleaded

Adena Canlas [Chief of the

Hospital, whose signature

was forged], and Pangilinan

[Forger].

Issue: WON the drawer shall

bear the loss of the forged

checks.

Held:

-The court in this case held

that the Province of Tarlac

[drawer] is equally liable with

PNB for its negligence in

releasing the checks to an

unauthorized

person,

Pangilinan, being a retired

cashier. [50-50 basis] So, The

province could only demand

50% reimbursement from

PNB. In turn, the collecting

bank [where the check was

deposited and the endorser]

is also liable to PNB for the

50% because of its breach of

its warranty as endorser. It

warranted the genuineness

of all prior endorsements

-The general rule is that the

drawee [PNB] has no right to

pay a forged check and debit

the account of the drawer

because as to the drawer, his

forged

signature

is

inoperative, and he was

never

a

party

to

the

instrument. [Sec. 23, NIL]

However, if the drawee can

prove a failure by the drawer

[Tarlac] to exercise ordinary

care

that

substantially

contributed to the forgery,

the drawer is precluded from

asserting the forgery.

Sec. 23. FORGED SIGNATURE,

EFFECT OF. - When a signature

is forged or made without

authority of the person whose

signature it purports to be, it is

wholly inoperative, and no

right to retain the instrument,

or to give a discharge therefor,

or to enforce payment thereof

against any party thereto, can

be acquired through or under

such signature unless the party

against whom it is sought to

enforce such right is precluded

from setting up the forgery or

want of authority.

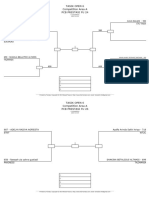

*Discussion:

I.

The effect of a

forged signature

of a drawer is

different from the

effect of a forged

signature of an

endorser/payee:

Nota Bene: These rules

only applies to an order

instrument

A. Drawers signature is

forged.

General Rule:

a. If

the

drawers

signature is forged, it

means that he was

never a party to the

instrument and it is

wholly inoperative as

to him. Hence, the

drawee cannot debit

from

his

account

using the instrument

where

the

his

[drawer]

signature

was

forged.

All

liability falls on the

drawee because it

violates its duty to

charge its customers

(the drawer) account

only

for

properly

payable items and its

obligation to know its

clients

signature.

Therefore, the drawer

can recover from the

drawee. The chain of

liability ends with the

drawee.

Exception:

a. If the drawee bank

can prove a failure by

the customer/drawer

to exercise ordinary

care

that

substantially

contributed to the

making of the forged

signature, the drawer

is precluded from

asserting the forgery.

If at the same time

the drawee bank was

also negligent to the

point of substantially

contributing to the

loss, then such loss

from the forgery can

be

apportioned

between

the

negligent drawer and

the negligent bank.

the drawee bank. The

former

must

necessarily return the

money paid by the

latter because it was

paid wrongfully.

Exception:

a.

B. Payee/Endorsers

signature is forged.

General Rule:

a. Although the drawee

bank may not debit

the account of the

drawer,

it

may

generally

pass

liability back to the

party who took from

the forger and, of

course, to the forger

himself, if available.

Therefore,

the

drawee [who paid,

technically

the

acceptor] may seek

reimbursement from

the collecting bank or

to the endorsers who

warrant

the

genuineness of the

instrument. The loss

falls on the party who

took the check from

the forger, or on the

forger himself. Since

a forged indorsement

is inoperative, the

collecting bank had

no right to be paid by

The drawee bank can

recover the amount

paid on the check

bearing

a

forged

indorsement from the

collecting

bank.

However, a drawee

bank has the duty to

promptly inform the

presentor

of

the

forgery

upon

discovery.

If

the

drawee bank delays

in

informing

the

presentor

of

the

forgery,

thereby

depriving

said

presentor of the right

to recover from the

forger, the former is

deemed

negligent

and can no longer

recover

from

the

presentor.

II.

Forgery

Instruments

in

Bearer

Rule:

In bearer instruments, the

signature of the payee or

holder is unnecessary to

pass title to the instrument.

Hence,

when

the

indorsement is a forgery,

only the person whose

signature is forged can raise

the

defense

of

against a holder

course.

forgery

in due

Você também pode gostar

- Actual Notice and Trespass WarningDocumento2 páginasActual Notice and Trespass Warninghearmi83% (6)

- The 5 Elements of the Highly Effective Debt Collector: How to Become a Top Performing Debt Collector in Less Than 30 Days!!! the Powerful Training System for Developing Efficient, Effective & Top Performing Debt CollectorsNo EverandThe 5 Elements of the Highly Effective Debt Collector: How to Become a Top Performing Debt Collector in Less Than 30 Days!!! the Powerful Training System for Developing Efficient, Effective & Top Performing Debt CollectorsNota: 5 de 5 estrelas5/5 (1)

- Bouncing Checks LawDocumento11 páginasBouncing Checks Lawzyphora grace trillanes100% (1)

- Jai-Alai Corporation of The Philippines, Petitioner, vs. Bank of The Philippine Island, RespondentDocumento126 páginasJai-Alai Corporation of The Philippines, Petitioner, vs. Bank of The Philippine Island, RespondentisangpantasAinda não há avaliações

- Graphical Vs Numerical Land Survey and Use of SurnameDocumento5 páginasGraphical Vs Numerical Land Survey and Use of SurnameMichael Jhon ChanAinda não há avaliações

- Business Law Unit-4 NotesDocumento16 páginasBusiness Law Unit-4 NotesTushar GaurAinda não há avaliações

- Westmont Bank V OngDocumento4 páginasWestmont Bank V Ongmodernelizabennet100% (4)

- Philippine Constitution QuizDocumento8 páginasPhilippine Constitution QuizKurt Patrick VillanuevaAinda não há avaliações

- Dishonour of Cheques in India: A Guide along with Model Drafts of Notices and ComplaintNo EverandDishonour of Cheques in India: A Guide along with Model Drafts of Notices and ComplaintNota: 4 de 5 estrelas4/5 (1)

- Associated Bank v. CaDocumento2 páginasAssociated Bank v. CaDNAAAinda não há avaliações

- Jai-Alai Corp. of The Phils. v. BPI (1975)Documento3 páginasJai-Alai Corp. of The Phils. v. BPI (1975)xxxaaxxxAinda não há avaliações

- Gempesaw v. CA Case DigestDocumento4 páginasGempesaw v. CA Case DigestKian FajardoAinda não há avaliações

- Gempesaw V CADocumento2 páginasGempesaw V CARubyAinda não há avaliações

- Digest Republic Bank V CA G.R. No. 42725 April 22, 1991 Relevant FactsDocumento2 páginasDigest Republic Bank V CA G.R. No. 42725 April 22, 1991 Relevant FactsMarj CenAinda não há avaliações

- Admin Notes 01Documento7 páginasAdmin Notes 01Dales BatoctoyAinda não há avaliações

- BP 22 Nego NotesDocumento5 páginasBP 22 Nego NotesAnna Lesava100% (2)

- ANPQP Category 11 Environmental RequirementDocumento5 páginasANPQP Category 11 Environmental Requirementjefry sitorusAinda não há avaliações

- Jai-Alai Corp. of The Phils. v. BPI (1975)Documento3 páginasJai-Alai Corp. of The Phils. v. BPI (1975)xxxaaxxxAinda não há avaliações

- TRB V RPNDocumento1 páginaTRB V RPNeieipayadAinda não há avaliações

- Case DigestsDocumento10 páginasCase DigestsRen Concha100% (1)

- 57 VASAK KAREL The International Dimensions of Human RightsDocumento774 páginas57 VASAK KAREL The International Dimensions of Human RightstaysantlordAinda não há avaliações

- Republic vs. CastellviDocumento2 páginasRepublic vs. CastellviHansel Jake B. PampiloAinda não há avaliações

- Associated Bank VS CaDocumento3 páginasAssociated Bank VS CaaxvxxnAinda não há avaliações

- Associated Bank vs. CADocumento4 páginasAssociated Bank vs. CAMaster GanAinda não há avaliações

- Associated Bank Vs CADocumento4 páginasAssociated Bank Vs CATacoy DolinaAinda não há avaliações

- Nego CasesDocumento46 páginasNego CasesNorhian AlmeronAinda não há avaliações

- ASSOCIATED BANK V HON. COURT OF APPEALSDocumento2 páginasASSOCIATED BANK V HON. COURT OF APPEALSNiajhan PalattaoAinda não há avaliações

- For Nego Today - Full TextDocumento50 páginasFor Nego Today - Full Textadonis.orillaAinda não há avaliações

- Associated Bank vs. CA, Province of Tarlac and PNB: RD THDocumento10 páginasAssociated Bank vs. CA, Province of Tarlac and PNB: RD THJoshua AmancioAinda não há avaliações

- Associated Bank Vs CADocumento10 páginasAssociated Bank Vs CAJessa PuerinAinda não há avaliações

- Associated Bank vs. Court of AppealsDocumento22 páginasAssociated Bank vs. Court of AppealsShien TumalaAinda não há avaliações

- Associated Bank v. CADocumento19 páginasAssociated Bank v. CAGia DimayugaAinda não há avaliações

- AssociatedBank Vs - CA Full Text NegoDocumento22 páginasAssociatedBank Vs - CA Full Text NegoEmelie Marie DiezAinda não há avaliações

- NIL 77-109jhjDocumento39 páginasNIL 77-109jhjBenedict AlvarezAinda não há avaliações

- Petitioner VS: SynopsisDocumento15 páginasPetitioner VS: SynopsisJobelle VillanuevaAinda não há avaliações

- ASSOCIATED BANK v. COURT OF APPEALS - G.R. Nos. 107382 & 107612 January 31, 1996 PDFDocumento10 páginasASSOCIATED BANK v. COURT OF APPEALS - G.R. Nos. 107382 & 107612 January 31, 1996 PDFJulie Rose FajardoAinda não há avaliações

- In Case There Is A Collecting BankDocumento9 páginasIn Case There Is A Collecting BankMikkboy RosetAinda não há avaliações

- Natividad Gempesaw v. CADocumento16 páginasNatividad Gempesaw v. CALouvanne Jessa Orzales BesingaAinda não há avaliações

- Westmont Bank V. OngDocumento3 páginasWestmont Bank V. OngJames WilliamAinda não há avaliações

- Associated Bank V. Ca 252 SCRA 620Documento4 páginasAssociated Bank V. Ca 252 SCRA 620Ralph Allen Mañalac GarciaAinda não há avaliações

- Westmont Bank vs. OngDocumento3 páginasWestmont Bank vs. OngMariaFaithFloresFelisartaAinda não há avaliações

- WESTMONT BANK Vs OngDocumento2 páginasWESTMONT BANK Vs OngHoney BiAinda não há avaliações

- 24.dino VDocumento3 páginas24.dino VMatt EvansAinda não há avaliações

- Forgery Case DigestsDocumento4 páginasForgery Case DigestsKim Arizala100% (1)

- Tarlac Case NIL UVDocumento3 páginasTarlac Case NIL UVMercy LingatingAinda não há avaliações

- Forgery CasesDocumento2 páginasForgery CasesLittle GirlblueAinda não há avaliações

- Petitioner Vs Respondent Villanueva Caña & Associates Law Offices Alberto Salazar & AssociatesDocumento16 páginasPetitioner Vs Respondent Villanueva Caña & Associates Law Offices Alberto Salazar & AssociatesJobelle VillanuevaAinda não há avaliações

- Nego Cases Part 2Documento7 páginasNego Cases Part 2cute_treeena5326Ainda não há avaliações

- For ReportingDocumento3 páginasFor Reportingcarl fuerzasAinda não há avaliações

- Case Digest 2Documento5 páginasCase Digest 2TsuuundereeAinda não há avaliações

- Nego Finals DoctrinesDocumento4 páginasNego Finals DoctrinesejAinda não há avaliações

- Cheque Dishonor Court Cases Sec 14Documento33 páginasCheque Dishonor Court Cases Sec 14Sulav DulalAinda não há avaliações

- Negotiable Instruments Law - Chapter 6: By: Atty. Richard M. Fulleros, CPA, MBADocumento33 páginasNegotiable Instruments Law - Chapter 6: By: Atty. Richard M. Fulleros, CPA, MBACarol EvangelistaAinda não há avaliações

- Jai Alai vs. CaDocumento2 páginasJai Alai vs. CaaxvxxnAinda não há avaliações

- Digest 2Documento6 páginasDigest 2Van CazAinda não há avaliações

- Libertas (Jurisprudence On Nego)Documento106 páginasLibertas (Jurisprudence On Nego)Vince AbucejoAinda não há avaliações

- 252 Scra 620Documento5 páginas252 Scra 620Jan MadejaAinda não há avaliações

- Jai-Alai Corp v. BPIDocumento10 páginasJai-Alai Corp v. BPIGia DimayugaAinda não há avaliações

- Republic Bank Vs CADocumento2 páginasRepublic Bank Vs CAboomonyouAinda não há avaliações

- Nil 5Documento2 páginasNil 5celineAinda não há avaliações

- Chapter 2-ForgeryDocumento14 páginasChapter 2-ForgerySteffany RoqueAinda não há avaliações

- Legal Remedies For Dishonour of Cheque - Law Times JournalDocumento5 páginasLegal Remedies For Dishonour of Cheque - Law Times JournalSajal SahaAinda não há avaliações

- Dela Victoria V. Burgos 245 SCRA 374Documento4 páginasDela Victoria V. Burgos 245 SCRA 374Sangguniang BayanAinda não há avaliações

- Petitioner Respondents L.B. Camins Angara, Abello, Concepcion, Regala & CruzDocumento13 páginasPetitioner Respondents L.B. Camins Angara, Abello, Concepcion, Regala & CruzJiro AcuñaAinda não há avaliações

- Jai-Alai, V. Bpi 66 Scra 29 August 6, 1975Documento3 páginasJai-Alai, V. Bpi 66 Scra 29 August 6, 1975Fritzie G. PuctiyaoAinda não há avaliações

- 01 July AM Remedial LawDocumento2 páginas01 July AM Remedial LawGAinda não há avaliações

- Associated Bank vs. Court of Appeals FactsDocumento4 páginasAssociated Bank vs. Court of Appeals FactsMegan PacientoAinda não há avaliações

- Collection and Payment of Cheques and BillsDocumento27 páginasCollection and Payment of Cheques and BillsPRATICK RANJAN GAYEN83% (6)

- REVENUE MEMORANDUM CIRCULAR NO. 21-2018 Issued On April 5, 2018Documento1 páginaREVENUE MEMORANDUM CIRCULAR NO. 21-2018 Issued On April 5, 2018Hansel Jake B. PampiloAinda não há avaliações

- Be It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledDocumento4 páginasBe It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledHansel Jake B. PampiloAinda não há avaliações

- P.D. No. 1613Documento2 páginasP.D. No. 1613Hansel Jake B. PampiloAinda não há avaliações

- 11th Negative ListDocumento8 páginas11th Negative ListHansel Jake B. PampiloAinda não há avaliações

- CarpioDocumento9 páginasCarpioHansel Jake B. PampiloAinda não há avaliações

- 12.saguitan Vs City of MandaluyongDocumento7 páginas12.saguitan Vs City of MandaluyongHansel Jake B. PampiloAinda não há avaliações

- Abello v. CIRDocumento6 páginasAbello v. CIRHansel Jake B. PampiloAinda não há avaliações

- 16.GSIS v. City Treasurer of ManilaDocumento15 páginas16.GSIS v. City Treasurer of ManilaHansel Jake B. PampiloAinda não há avaliações

- 19.NPC v. Province of QuezonDocumento15 páginas19.NPC v. Province of QuezonHansel Jake B. PampiloAinda não há avaliações

- Chevron Philippines v. CoC PDFDocumento22 páginasChevron Philippines v. CoC PDFHansel Jake B. PampiloAinda não há avaliações

- Creser Precision System vs. CA 1998Documento5 páginasCreser Precision System vs. CA 1998Hansel Jake B. PampiloAinda não há avaliações

- IS 908 Specification For Fire Hydrant, Stand Post Type (Second Revision) (1975)Documento11 páginasIS 908 Specification For Fire Hydrant, Stand Post Type (Second Revision) (1975)sruhilAinda não há avaliações

- Tasik Open 6 Hari Ke 3Documento70 páginasTasik Open 6 Hari Ke 3Andhika Purnama HerwindoAinda não há avaliações

- Airport Security Breaches Found by The Associated PressDocumento6 páginasAirport Security Breaches Found by The Associated PressPennLiveAinda não há avaliações

- Case Study Domestic ViolenceDocumento5 páginasCase Study Domestic ViolenceAlexandra Monica LovinAinda não há avaliações

- Hindu Law Assignment by Tejaswi BhadwajDocumento17 páginasHindu Law Assignment by Tejaswi BhadwajTejaswi BhardwajAinda não há avaliações

- J.T. Garner v. Carol G. Green, Kansas Appellate Court Clerk, 991 F.2d 805, 10th Cir. (1993)Documento4 páginasJ.T. Garner v. Carol G. Green, Kansas Appellate Court Clerk, 991 F.2d 805, 10th Cir. (1993)Scribd Government DocsAinda não há avaliações

- Himachal Pradesh Excise Act, 2011 PDFDocumento36 páginasHimachal Pradesh Excise Act, 2011 PDFLatest Laws Team100% (1)

- Supreme Court of Appeal On SpyTapesDocumento26 páginasSupreme Court of Appeal On SpyTapesJulie FloresAinda não há avaliações

- En Banc A.C. No. 8494, October 05, 2016 Spouses Emilio and Alicia JACINTO, Complainants, v. ATTY. EMELIE P. BANGOT, JR., Respondent. Decision Bersamin, J.Documento7 páginasEn Banc A.C. No. 8494, October 05, 2016 Spouses Emilio and Alicia JACINTO, Complainants, v. ATTY. EMELIE P. BANGOT, JR., Respondent. Decision Bersamin, J.wedwdwdAinda não há avaliações

- Application Form PDFDocumento1 páginaApplication Form PDFKRPHSAinda não há avaliações

- Letter To The Editor - Stouffville and Environmental LeadershipDocumento3 páginasLetter To The Editor - Stouffville and Environmental LeadershipArnold Neufeldt-FastAinda não há avaliações

- Annex C.1Documento1 páginaAnnex C.1Eric OlayAinda não há avaliações

- Francisco vs. CertezaDocumento3 páginasFrancisco vs. CertezaJhunjie SabacahanAinda não há avaliações

- SOCIAL SCIENCE-Q&A-RationalizationDocumento37 páginasSOCIAL SCIENCE-Q&A-RationalizationCza Mae ArsenalAinda não há avaliações

- MNLU Mumbai LL.M. Professional RegulationsDocumento7 páginasMNLU Mumbai LL.M. Professional RegulationsSheldon DsouzaAinda não há avaliações

- Detail Program IAPDocumento9 páginasDetail Program IAPKing StonAinda não há avaliações

- ScribdDocumento1 páginaScribdVladNeculaAinda não há avaliações

- Airtel CocDocumento20 páginasAirtel CocAsim KhanAinda não há avaliações

- Deal Police Department LetterDocumento1 páginaDeal Police Department LetterAsbury Park PressAinda não há avaliações

- Parliamentary PrivilegesDocumento3 páginasParliamentary PrivilegesPrasun TiwariAinda não há avaliações

- Chapter 17 EcoDocumento37 páginasChapter 17 EcoMubin Ahmed MunirAinda não há avaliações

- TELAN Vs CADocumento3 páginasTELAN Vs CAJohn Ramil RabeAinda não há avaliações

- United States Court of Appeals, Tenth Circuit.: Nos. 89-7005 and 89-7008 To 89-7012Documento55 páginasUnited States Court of Appeals, Tenth Circuit.: Nos. 89-7005 and 89-7008 To 89-7012Scribd Government DocsAinda não há avaliações