Escolar Documentos

Profissional Documentos

Cultura Documentos

BBA203 Financial Accounting

Enviado por

Rajdeep KumarDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

BBA203 Financial Accounting

Enviado por

Rajdeep KumarDireitos autorais:

Formatos disponíveis

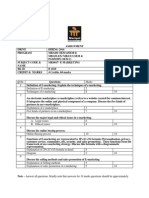

DRIVE

PROGRAM

SEMESTER

SUBJECT CODE &

NAME

BK ID

CREDIT

MARKS

ASSIGNMENT

SPRING 2016

BBA

II

BBA 203

FINANCIAL ACCOUNTING

B1520

4

60

Note: Answer all questions. Kindly note that answers for 10 marks questions should be

approximately of 400 words. Each question is followed by evaluation scheme.

Q.No

Question

Marks

Total Marks

1

P, Q & R are partners sharing profits and losses as 3 : 2 : 1. Their Balance Sheet as on

31.12.2015 is as under :

Liabilities

Rs.

Assets

Rs.

Capital:

1,00,000 Freehold Premises

50,000

P 50,000

Building

40,000

Q 30,000

Machinery

40,000

R 20,000

Reserves

50,000 Investments

10,000

Overdraft

20,000 Inventories

20,000

Creditors

20,000 Receivables

30,000

Bills Payable

10,000 Cash

10,000

2,00,000

2,00,000

R expired on 1st January 2016. So, the assets are revalued and liabilities re-assessed as follows :

i)

ii)

iii)

iv)

Create a provision for doubtful debt Rs. 500.

Building and investment are to be appreciated by 10 %.

Machinery is to be depreciated by 5 %.

Goodwill of the firm is to be valued at Rs. 20,000.

The balance due to R will be transferred to her executors loan account which will carry

an interest of 10 % p.a. Prepare Revaluation Account, Capital Accounts and the Balance

Sheet of new firm after adjustments.

Based on above, prepare :

a) Revaluation Account

b) Capital Accounts and

c) Balance Sheet as on 1st April 2015

3

3

4

10

Classify the accounts under Modern Approach Method.

Differentiate between Trade discount and Cash discount.

Classification of Accounts under Modern Approach

Method

Differentiate between Trade discount & cash discount

5

10

5

Explain the Depreciation Accounting procedure and concept taking AS-6 into consideration.

Explain the Depreciation Accounting procedure and

concept taking AS-6 into consideration.

10

10

Explain Bill of exchange and the procedure for recording bills in the books of drawer and

accepter when the bill is : Accepted and discharged.

i)

ii)

iii)

Explain bill of exchange

Journal entries in the books of drawer

Journal entries in the books of acceptor

Write notes on :

i)

Issue of shares at Premium and Discount

ii)

Buy back of shares and Treasury Stock

Write notes on :

i)

Issue of shares at Premium and Discount

ii)

Buy back of shares and Treasury Stock

4

3

3

5

5

10

10

From the ledger balances as on 31st March 2015 show treatments in Profit and Loss Account

and in Balance Sheet.

Debtors : 50,000; Bad Debts : 3,000; Discount Allowed : 2,000; Creditors: 30,000; Provision

for Discount on Creditors : 400; Discount Received 300.

Adjustments :

i)

Create a provision for Bad Debts @ 10 % on Debtors

ii)

Create a provision for Discount on Debtors @ 5 %

iii)

Additional discount given to Debtors Rs. 1,000

iv)

Create a provision for discount on Creditors @ 2 %.

From the ledger balances and adjustments as above, 5

show treatments in :

Profit and Loss Account and

5

Balance Sheet.

10

Você também pode gostar

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionAinda não há avaliações

- IMT 57 Financial Accounting M1Documento4 páginasIMT 57 Financial Accounting M1solvedcareAinda não há avaliações

- ECO-2 - ENG-J18 - CompressedDocumento6 páginasECO-2 - ENG-J18 - CompressedAmit AdhikariAinda não há avaliações

- Unsolved Paper Part IDocumento107 páginasUnsolved Paper Part IAdnan KazmiAinda não há avaliações

- Final Accounts - That's It BatchDocumento16 páginasFinal Accounts - That's It BatchKunika PimparkarAinda não há avaliações

- 19696ipcc Acc Vol2 Chapter14Documento41 páginas19696ipcc Acc Vol2 Chapter14Shivam TripathiAinda não há avaliações

- Advanced AccountingDocumento13 páginasAdvanced AccountingprateekfreezerAinda não há avaliações

- RTP Nov 14Documento127 páginasRTP Nov 14sathish_61288@yahooAinda não há avaliações

- Corporate Accounting - IIDocumento5 páginasCorporate Accounting - IIjeganrajrajAinda não há avaliações

- S4 Aceiteka 2017 AccountsDocumento7 páginasS4 Aceiteka 2017 AccountsEremu ThomasAinda não há avaliações

- Retierment of PartnerDocumento4 páginasRetierment of PartnerSaransh GhoshAinda não há avaliações

- Sample PaperDocumento28 páginasSample PaperSantanu KararAinda não há avaliações

- II PUC Accountancy Paper Model PaperDocumento6 páginasII PUC Accountancy Paper Model PaperCommunity Institute of Management Studies100% (1)

- Chapter - Partnership Accounts If There Is No Partnership DeedDocumento8 páginasChapter - Partnership Accounts If There Is No Partnership DeedVijayasri KumaravelAinda não há avaliações

- Important Questions KMBN103Documento8 páginasImportant Questions KMBN103Shivam ChandraAinda não há avaliações

- Bba 208Documento3 páginasBba 208armaanAinda não há avaliações

- P6 June 2023 SY23Documento5 páginasP6 June 2023 SY23Shivam GuptaAinda não há avaliações

- Corporate Accounting II (T)Documento6 páginasCorporate Accounting II (T)BISLY MARIAM BINSONAinda não há avaliações

- Accounting For Managers MB003 QuestionDocumento34 páginasAccounting For Managers MB003 QuestionAiDLo0% (1)

- F AccountDocumento39 páginasF AccountChandra Prakash SoniAinda não há avaliações

- UZ LB 301 - July 2020Documento4 páginasUZ LB 301 - July 2020Clayton MutsenekiAinda não há avaliações

- CBSE Class 11 Accountancy Sample Paper 2013 PDFDocumento12 páginasCBSE Class 11 Accountancy Sample Paper 2013 PDFsivsyadav100% (1)

- SAMPLE PAPER - (Solved) : For Examination March 2017Documento13 páginasSAMPLE PAPER - (Solved) : For Examination March 2017ankush yadavAinda não há avaliações

- Accountancy EngDocumento8 páginasAccountancy EngBettappa Patil100% (1)

- FINANCIAL ACCOUNTING I 2019 MinDocumento6 páginasFINANCIAL ACCOUNTING I 2019 MinKedarAinda não há avaliações

- Capinew Account June13Documento7 páginasCapinew Account June13ashwinAinda não há avaliações

- 4 CO4CRT11 - Corporate Accounting II (T)Documento5 páginas4 CO4CRT11 - Corporate Accounting II (T)emildaraisonAinda não há avaliações

- Corporate Accounting QUESTIONSDocumento4 páginasCorporate Accounting QUESTIONSsubba1995333333100% (1)

- CBSE Class 11 Accountancy Sample Paper 2013 (4) - 0 PDFDocumento12 páginasCBSE Class 11 Accountancy Sample Paper 2013 (4) - 0 PDFsivsyadavAinda não há avaliações

- AccountDocumento3 páginasAccountSk SinghAinda não há avaliações

- Accountancy March 2008 EngDocumento8 páginasAccountancy March 2008 EngPrasad C M100% (2)

- Cma Advanced AccountingDocumento127 páginasCma Advanced AccountingAli RizwanAinda não há avaliações

- Cash and Cash Equivalents (IA)Documento9 páginasCash and Cash Equivalents (IA)rufamaegarcia07Ainda não há avaliações

- Financial Accounting Mock Test PaperDocumento7 páginasFinancial Accounting Mock Test PaperBharathFrnzbookAinda não há avaliações

- Faculty of Management: Financial Accounting and AnalysisDocumento11 páginasFaculty of Management: Financial Accounting and AnalysisHari KrishnaAinda não há avaliações

- MCA (Revised) Term-End Examination December, 2018: Note: 1 Compulsory ThreeDocumento3 páginasMCA (Revised) Term-End Examination December, 2018: Note: 1 Compulsory ThreepayalAinda não há avaliações

- CA-Foundation Accounts Full Syllabus Test For Dec 2023 StudentsDocumento4 páginasCA-Foundation Accounts Full Syllabus Test For Dec 2023 Studentsbabu.bhiwadiAinda não há avaliações

- Advanced Accounting RTP N21Documento39 páginasAdvanced Accounting RTP N21Harshwardhan PatilAinda não há avaliações

- Module-2 Sample Question PaperDocumento18 páginasModule-2 Sample Question PaperRay Ch100% (1)

- Reviewer (Cash-Accounts Receivable)Documento5 páginasReviewer (Cash-Accounts Receivable)Camila Mae AlduezaAinda não há avaliações

- Parcor QuizbowlDocumento38 páginasParcor QuizbowlKrestyl Ann GabaldaAinda não há avaliações

- Corporate Accounting Ii-1Documento4 páginasCorporate Accounting Ii-1ARAVIND V KAinda não há avaliações

- Contents of Balance SheetDocumento8 páginasContents of Balance SheetJainBhupendraAinda não há avaliações

- Intermediate Accounting QuizDocumento5 páginasIntermediate Accounting Quizchingchong100% (1)

- Financial Accounting and Reporting: ConceptualDocumento9 páginasFinancial Accounting and Reporting: Conceptualben yiAinda não há avaliações

- 438Documento6 páginas438Rehan AshrafAinda não há avaliações

- RTP Nov 15Documento46 páginasRTP Nov 15Aaquib ShahiAinda não há avaliações

- FAR Final Preboards (May 2023)Documento19 páginasFAR Final Preboards (May 2023)John DoeAinda não há avaliações

- 29240rtp - May13 - Ipcc Atc 5Documento49 páginas29240rtp - May13 - Ipcc Atc 5adityatiwari122006Ainda não há avaliações

- MBA-I Semester MB0025 - Financial & Management Accounting - 3 Credits Book ID - (B0907) Assignment Set 1 - (60 Marks)Documento2 páginasMBA-I Semester MB0025 - Financial & Management Accounting - 3 Credits Book ID - (B0907) Assignment Set 1 - (60 Marks)Nigist WoldeselassieAinda não há avaliações

- Corporate Accounting Ii 2020Documento4 páginasCorporate Accounting Ii 2020joe josephAinda não há avaliações

- Book-Keeping and Accounts/Series-3-2004 (Code2006)Documento16 páginasBook-Keeping and Accounts/Series-3-2004 (Code2006)Hein Linn Kyaw100% (1)

- (Semester Sdteqte) Commerce FLN Tneial Accottnfibg-Il ,,'Documento16 páginas(Semester Sdteqte) Commerce FLN Tneial Accottnfibg-Il ,,'zingcemAinda não há avaliações

- CH18601 FM - II Model PaperDocumento5 páginasCH18601 FM - II Model PaperKarthikAinda não há avaliações

- MB0041 - Summer 2014Documento3 páginasMB0041 - Summer 2014Rajesh SinghAinda não há avaliações

- MOJAKOE AK1 UTS 2010 GasalDocumento10 páginasMOJAKOE AK1 UTS 2010 GasalVincenttio le CloudAinda não há avaliações

- Blue Print: Accounting: Class XI Weightage Difficulty Level of QuestionsDocumento12 páginasBlue Print: Accounting: Class XI Weightage Difficulty Level of Questionssirsa11Ainda não há avaliações

- Sample SMU MBA Sem3 Fall 2015Documento4 páginasSample SMU MBA Sem3 Fall 2015Rajdeep KumarAinda não há avaliações

- Project Guidelines For BBA - SMUDocumento9 páginasProject Guidelines For BBA - SMURahul DewanAinda não há avaliações

- BBA201 Research MethodsDocumento1 páginaBBA201 Research MethodsRajdeep KumarAinda não há avaliações

- 597183Documento1 página597183Smu DocAinda não há avaliações

- Sample SMU MBA Sem4 Fall 2015Documento4 páginasSample SMU MBA Sem4 Fall 2015Rajdeep KumarAinda não há avaliações

- 597183Documento2 páginas597183Smu DocAinda não há avaliações

- Solved Assignments of SMU MBA Semester 2 Spring 2015Documento4 páginasSolved Assignments of SMU MBA Semester 2 Spring 2015Rajdeep KumarAinda não há avaliações

- Solved Assignments of SMU BBA Semester 2 Spring 2015Documento3 páginasSolved Assignments of SMU BBA Semester 2 Spring 2015Rajdeep KumarAinda não há avaliações

- Sample MBA Sem2 Fall 2015Documento4 páginasSample MBA Sem2 Fall 2015Rajdeep KumarAinda não há avaliações

- Solved Assignments of SMU MBA Semester 4 Spring 2015Documento3 páginasSolved Assignments of SMU MBA Semester 4 Spring 2015Rajdeep KumarAinda não há avaliações

- Solved Assignments of SMU BBA Semester 1 Spring 2015Documento4 páginasSolved Assignments of SMU BBA Semester 1 Spring 2015Rajdeep KumarAinda não há avaliações

- SMU MBA Semester 4 Spring 2014 Solved AassignmentsDocumento3 páginasSMU MBA Semester 4 Spring 2014 Solved AassignmentsRajdeep KumarAinda não há avaliações

- Solved Assignments of SMU BBA Semester 3 Spring 2015Documento3 páginasSolved Assignments of SMU BBA Semester 3 Spring 2015Rajdeep Kumar0% (1)

- Solved Assignments of SMU MBA Semester 3 Spring 2015Documento4 páginasSolved Assignments of SMU MBA Semester 3 Spring 2015Rajdeep KumarAinda não há avaliações

- SMU MBA Semester 1 Spring 2014 Solved AssignmentsDocumento3 páginasSMU MBA Semester 1 Spring 2014 Solved AssignmentsRajdeep KumarAinda não há avaliações

- Solved Assignments of SMU MBA Semester 1 Summer 2014 Are Available.Documento4 páginasSolved Assignments of SMU MBA Semester 1 Summer 2014 Are Available.Rajdeep KumarAinda não há avaliações

- Solved Assignments of SMU MBA Semester 1 Spring 2015Documento3 páginasSolved Assignments of SMU MBA Semester 1 Spring 2015Rajdeep KumarAinda não há avaliações

- Solved Assignments of SMU BBA Semester 1 Summer 2014 Are Available.Documento4 páginasSolved Assignments of SMU BBA Semester 1 Summer 2014 Are Available.Rajdeep KumarAinda não há avaliações

- Solved Assignments of SMU MBA Semester 4 Summer 2014 Are Available.Documento3 páginasSolved Assignments of SMU MBA Semester 4 Summer 2014 Are Available.Rajdeep KumarAinda não há avaliações

- Solved Assignments of SMU MBA Semester 3 Summer 2014 Are Available.Documento4 páginasSolved Assignments of SMU MBA Semester 3 Summer 2014 Are Available.Rajdeep KumarAinda não há avaliações

- SMU MBA Semester 2 Spring 2014 Solved AssignmentsDocumento3 páginasSMU MBA Semester 2 Spring 2014 Solved AssignmentsRajdeep KumarAinda não há avaliações

- SMU MBA Semester 3 Spring 2014 Solved AssignmentsDocumento4 páginasSMU MBA Semester 3 Spring 2014 Solved AssignmentsRajdeep KumarAinda não há avaliações

- SMU BBA Semester 2 Summer 2014 AssignmentDocumento4 páginasSMU BBA Semester 2 Summer 2014 AssignmentRajdeep KumarAinda não há avaliações

- Solved Assignments of SMU MBA Semester 2 Summer 2014 Are Available.Documento4 páginasSolved Assignments of SMU MBA Semester 2 Summer 2014 Are Available.Rajdeep KumarAinda não há avaliações

- SMU BBA Semester 5 Spring 2014 Solved AssignmentsDocumento4 páginasSMU BBA Semester 5 Spring 2014 Solved AssignmentsRajdeep KumarAinda não há avaliações

- SMU BBA Semester 1 Spring 2014 AssignmentsDocumento3 páginasSMU BBA Semester 1 Spring 2014 AssignmentsRajdeep KumarAinda não há avaliações

- MK0017Documento2 páginasMK0017Rajdeep KumarAinda não há avaliações

- SMU MBA Sem1 Summer 2013 Sooved AssignmentDocumento4 páginasSMU MBA Sem1 Summer 2013 Sooved AssignmentRajdeep KumarAinda não há avaliações

- MK0018Documento2 páginasMK0018Rajdeep KumarAinda não há avaliações

- Common Size Statement: A Technique of Financial Analysis: June 2019Documento8 páginasCommon Size Statement: A Technique of Financial Analysis: June 2019safa haddadAinda não há avaliações

- Liabilities & Net Worth: AssetsDocumento4 páginasLiabilities & Net Worth: AssetsProfessor XAinda não há avaliações

- Sapm TextDocumento460 páginasSapm TextAkash BAinda não há avaliações

- ACC124 ReviewerDocumento22 páginasACC124 Reviewermarites yuAinda não há avaliações

- Parallel Ledgers in Asset AccountingDocumento26 páginasParallel Ledgers in Asset AccountingHridya PrasadAinda não há avaliações

- T10 - Financial Reporting QualityDocumento30 páginasT10 - Financial Reporting QualityJhonatan Perez VillanuevaAinda não há avaliações

- RM EegDocumento3 páginasRM Eegrohit kumarAinda não há avaliações

- Chapter 03 Im 10th EdDocumento32 páginasChapter 03 Im 10th EdAzman MendaleAinda não há avaliações

- Why Did You Kill The Cambodian Genocide and The Dark Side of Face and HonorDocumento30 páginasWhy Did You Kill The Cambodian Genocide and The Dark Side of Face and HonorVivian LeAinda não há avaliações

- 23 P1 (1) .1y ch22 PDFDocumento20 páginas23 P1 (1) .1y ch22 PDFAdrian NutaAinda não há avaliações

- GCE OL Syllabi GRADE 11Documento12 páginasGCE OL Syllabi GRADE 11Ravindu GamageAinda não há avaliações

- Assignment Help Guide SheetDocumento11 páginasAssignment Help Guide SheetShakil KhanAinda não há avaliações

- MCQSDocumento19 páginasMCQSpankaj singhAinda não há avaliações

- CA CPT WWW - Ca-Gyanguru - inDocumento111 páginasCA CPT WWW - Ca-Gyanguru - inHimanshu PurohitAinda não há avaliações

- Anton Video Tech Sells The Play Station Portable (PSP) 1 2Documento6 páginasAnton Video Tech Sells The Play Station Portable (PSP) 1 2Siti Marian V. OlmillaAinda não há avaliações

- Corporate Finance LectureDocumento124 páginasCorporate Finance LectureMuhammad Kashif ZafarAinda não há avaliações

- SolMan (Advanced Accounting)Documento190 páginasSolMan (Advanced Accounting)Jinx Cyrus RodilloAinda não há avaliações

- Worldwide Accounting Diversity and International Standards: Chapter OutlineDocumento19 páginasWorldwide Accounting Diversity and International Standards: Chapter OutlineJordan YoungAinda não há avaliações

- Saln Gerry MalgapoDocumento2 páginasSaln Gerry MalgapogerrymalgapoAinda não há avaliações

- 2023 Grade 11 Provincial Examination Accounting P1 (English) June 2023 Possible AnswersDocumento8 páginas2023 Grade 11 Provincial Examination Accounting P1 (English) June 2023 Possible AnswersChantelle IsaksAinda não há avaliações

- Financial StatementsDocumento6 páginasFinancial StatementsYasir ABAinda não há avaliações

- Principles of Accounting 5th Edition Smart Solutions ManualDocumento26 páginasPrinciples of Accounting 5th Edition Smart Solutions ManualTiffanyHernandezwako100% (36)

- AnandamDocumento12 páginasAnandamNarinderAinda não há avaliações

- 03 - Handout - Partnership DissolutionDocumento4 páginas03 - Handout - Partnership DissolutionJanysse CalderonAinda não há avaliações

- TEA RulesDocumento820 páginasTEA RulesCBS Austin WebteamAinda não há avaliações

- Strama Research PaperDocumento17 páginasStrama Research PaperKLD C100% (1)

- (Course Outline) ACT 301Documento4 páginas(Course Outline) ACT 301Saiyan IslamAinda não há avaliações

- Financial Accounting AND Reporting: FAR22 Share-Based PaymentsDocumento9 páginasFinancial Accounting AND Reporting: FAR22 Share-Based PaymentsUNKNOWNNAinda não há avaliações

- ALDEN FS-update 2019Documento57 páginasALDEN FS-update 2019cris gerard trinidadAinda não há avaliações

- Partnership Accounting - Part 4Documento2 páginasPartnership Accounting - Part 4Larpii MonameAinda não há avaliações