Escolar Documentos

Profissional Documentos

Cultura Documentos

Indias Real Fiscal Policy

Enviado por

AmitabhDashDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Indias Real Fiscal Policy

Enviado por

AmitabhDashDireitos autorais:

Formatos disponíveis

Indias real fiscal policy for FY16

In the second part of a series, Syed Zubair Naqvi, Kapil Patidar and Arvind Subramanian say it seems likely

the debt situation of the states will exhibit an improvement greater than that of the Centre

n the aftermath of Budget season,

what is the verdict on Indian fiscal

policy for the coming fiscal year

(FY2016)? The finance ministers Budget

speech suggested, and one of us argued

(Moving towards the fiscal target,

March 1), that the answer was unambiguous on three counts. Correctly

measured, India was consolidating its

fiscal position; the quality of fiscal consolidation was improving; and growthpromoting capital expenditures were

being enhanced. Invoking some of the

same assessments, the Reserve Bank of

India eased monetary policy in early

March. Some private sector commentators have disagreed with this characterisation, arguing that fiscal policy was

becoming expansionary.

We have since compiled new data

for the states to complement the data

for the Centre to arrive at a clearer and

more accurate position of Indian public

finances. And the result is to re-inforce

even more strongly our three core conclusions. Consider why.

It is absolutely imperative to recognise that in the aftermath of the adoption

of the recommendations of the

Fourteenth Finance Commission (FFC)

Indias public finances must be assessed

at a consolidated level by combining the

finances of the Centre and the states.

The reason is simple and captured in

the chart States share in national taxes.

Courtesy of the FFC, the states are

expected to have and spend 62 per cent

of all tax revenues collected, a jump from

55 per cent estimated for the last year

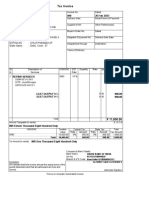

STATES SHARE IN

NATIONAL TAXES

(%)

FISCAL INDICATORS

Level of

government

States

Centre

General

General#

Source: Authors calculations; RE: Revised estimates,

BE: Budget estimates

(FY2015). To focus on the Centre is, therefore, to miss more than half of all the fiscal action.

Therefore, we consolidate the fiscal

estimates of the Centre and all the states

for FY2015 based on the revised estimates

(RE) that are likely to be closer to actual

outcomes, and compare them

with the Budget estimates (BE)

for

FY2016

recently

announced by the states. We

have compiled data for 17

states (which together account

for more than 80 per cent of

expenditure by all the states).1

There is one technicality

that we must contend with. Of

the 17 states for which we have

data, seven of them have presented Budgets for FY2016 without taking account of the increased transfers

they will receive consequent upon the

FFC.2 For these states, we make plausible

assumptions about how the increased

transfers will be used. Specifically, we

assume, partly based on the expenditure

(as per cent of GDP)

Fiscal deficit

FY15 RE

FY16 BE

2.8

4.1

6.9

7.1

Revenue deficit

FY15 RE

FY16 BE

2.5

3.9

6.5

7.0

0.0

2.9

2.9

-

-0.4

2.8

2.4

-

Capital expenditure

FY15 RE

FY16 BE

3.1

1.5

4.6

-

3.4

1.7

5.1

-

# General government with disinvestment receipts as a below-the-line item

Source: Authors calculations based on Budget documents; GDP: gross domestic product

pattern of 10 states who have internalised

the FFCs recommendations, that a part

of the surplus resources (increased tax

revenue net of reduction in plan transfers) would be used for saving and the

remaining for capital expenditure in the

ratio of 1/3 and 2/3, respectively

The results are presented

in the table Fiscal indicators

for our three measures of fiscal policy: the fiscal deficit

(measuring aggregate consolidation); the revenue deficit

(reflecting the quality of fiscal consolidation); and capital spending (reflecting the

augmentation of the economys supply potential).

Fiscal deficit: For the Centre,

the deficit is budgeted to decline from 4.1

per cent of gross domestic product (GDP)

in 2014-15 RE to 3.9 per cent in 2015-16

BE. For the states as a whole, the corresponding estimated change will be from

2.8 to 2.5 per cent of GDP. Combining

the two, the fiscal deficit for India as a

whole will decline by nearly 0.4 percentage points of GDP. Note that even if

disinvestment proceeds are treated as

financing (below-the-line) items, the

consolidated overall deficit will decline

by 0.14 percentage points of GDP.

Revenue deficit: For the Centre, the

revenue deficit for FY16 is budgeted to

decline marginally. However, the states

will witness a sharp increase in their

revenue surplus by about 0.4 percentage

points of GDP. Combining the two yields

an improvement in the consolidated

revenue deficit of about 0.44 percentage

points of GDP. It is worth emphasising

that the states on average are much

more prudent (lower overall deficit) and

have a better quality of fiscal adjustment (revenue surplus compared with

revenue deficit) than the Centre.

Capital expenditures: At a time of weak

private investment, the central governments Budget was aimed at raising public investment in order to further revive

the economy and catalyse private investment. Constrained, however, by the FFC

recommendations, the Centres public

investment envelope was increased only

by about ~50,000 crore or 0.2 per cent of

GDP. But it turns out that the states are

going to make up for the possible shortfall of the Centre. Capital expenditures by

the states are budgeted to increase by

nearly 0.3 percentage point of GDP, so

that the economy as a whole can expect

to receive an investment boost of close to

~1,40,000 crore or 0.5 per cent of GDP.

While updated data on public debt

are not yet available, it seems likely that

the debt situation of the states will exhibit an improvement even greater than

that of the Centre, owing to their substantially better balance on the revenue

account. So, the stock position of the

Indian government will also improve.

The fear about furthering fiscal federalism (by adopting the recommendations of the FFC) was that it would

undermine, or not be completely consistent with the direction of, the Centres

fiscal policy. If the Budgets recently presented by the states are any indication

that fear has been allayed because on all

three counts consolidation, quality,

and growth-enhancing potential

Indias states have not just been consistent with the stance of the Centre, they

have actually re-inforced it. On public

finances, the states and the Centre

appear to be partners in sync.

The authors are assistant directors and

chief economic advisor respectively, in the

Ministry of Finance.

Part one of the series appeared on April 10.

1. These 17 states are: Andhra Pradesh, Bihar,

Chhattisgarh, Goa, Gujarat, Haryana,

Jharkhand, Karnataka, Kerala, Madhya

Pradesh, Odisha, Punjab, Rajasthan, Tamil

Nadu, Telangana, Uttar Pradesh and

West Bengal.

2. These seven states are: Gujarat,

Jharkhand, Madhya Pradesh, Odisha,

Punjab, Uttar Pradesh and West Bengal

Você também pode gostar

- State Finances ReportDocumento18 páginasState Finances ReportHarish MudimelaAinda não há avaliações

- Bangladesh Quarterly Economic Update: June 2014No EverandBangladesh Quarterly Economic Update: June 2014Ainda não há avaliações

- The Slowdown DominoDocumento6 páginasThe Slowdown DominoSiddharth PrabhuAinda não há avaliações

- Local Public Finance Management in the People's Republic of China: Challenges and OpportunitiesNo EverandLocal Public Finance Management in the People's Republic of China: Challenges and OpportunitiesAinda não há avaliações

- Rbi Bulletin Mar 2015Documento110 páginasRbi Bulletin Mar 2015yogeshAinda não há avaliações

- Fiscal Decentralization Reform in Cambodia: Progress over the Past Decade and OpportunitiesNo EverandFiscal Decentralization Reform in Cambodia: Progress over the Past Decade and OpportunitiesAinda não há avaliações

- Report On The State Fiscal Year 2014 - 15 Enacted Budget Financial Plan and The Capital Program and Financing PlanDocumento37 páginasReport On The State Fiscal Year 2014 - 15 Enacted Budget Financial Plan and The Capital Program and Financing PlanRick KarlinAinda não há avaliações

- 2014-15 Financial Plan Enacted BudgetDocumento37 páginas2014-15 Financial Plan Enacted BudgetjspectorAinda não há avaliações

- Union Budget (2016-17) : FM Finally Gets It Right!Documento12 páginasUnion Budget (2016-17) : FM Finally Gets It Right!Muralidharan KrishnamoorthyAinda não há avaliações

- A Budget That Reveals The Truth About India's Growth Story - The WireDocumento8 páginasA Budget That Reveals The Truth About India's Growth Story - The WireRaghaAinda não há avaliações

- Ram Mohan T T (ET) (03!03!2011) Pranab Deserves 9 On 10Documento2 páginasRam Mohan T T (ET) (03!03!2011) Pranab Deserves 9 On 10AshutoshAinda não há avaliações

- Fiscal ConsolidationDocumento3 páginasFiscal Consolidationadarshbahetwar411Ainda não há avaliações

- Consistent Measurement of Fiscal Deficit and Debt of States in IndiaDocumento21 páginasConsistent Measurement of Fiscal Deficit and Debt of States in Indiaprism1702Ainda não há avaliações

- ICAI JournalDocumento121 páginasICAI Journalamitkhera786Ainda não há avaliações

- Fiscal Deficit InfoDocumento12 páginasFiscal Deficit InfoSanket AiyaAinda não há avaliações

- Budget Overvie1Documento10 páginasBudget Overvie1farahnaz889Ainda não há avaliações

- State Finances in Haryana - Manju DalalDocumento26 páginasState Finances in Haryana - Manju Dalalvoldemort1989Ainda não há avaliações

- Economics ProjectDocumento10 páginasEconomics ProjectbhavikAinda não há avaliações

- GDP Growth Sustained: Total Expenditure Has Increased by Rs. 192669 Crore in 2016-17 (BE) From 2015-16 (RE)Documento4 páginasGDP Growth Sustained: Total Expenditure Has Increased by Rs. 192669 Crore in 2016-17 (BE) From 2015-16 (RE)Aryan DeepAinda não há avaliações

- Federation, Japan, and Canada. These Data Include CODocumento16 páginasFederation, Japan, and Canada. These Data Include COSaif EqbalAinda não há avaliações

- Revenue Deficit & Fiscal DeficitDocumento3 páginasRevenue Deficit & Fiscal DeficitMahesh T MadhavanAinda não há avaliações

- 2016 17 Enacted Budget FinplanDocumento47 páginas2016 17 Enacted Budget FinplanMatthew HamiltonAinda não há avaliações

- Fiscal DevoDocumento59 páginasFiscal DevovineethinscribdAinda não há avaliações

- F F y Y: Ear Uls MmetrDocumento4 páginasF F y Y: Ear Uls MmetrChrisBeckerAinda não há avaliações

- Acct 260 Cafr 3-15Documento6 páginasAcct 260 Cafr 3-15StephanieAinda não há avaliações

- Revenue Deficit, Primary Deficit, Effective Revenue Deficit: Fiscal PolicyDocumento4 páginasRevenue Deficit, Primary Deficit, Effective Revenue Deficit: Fiscal PolicyPrince AroraAinda não há avaliações

- Fiscal DeficitDocumento7 páginasFiscal DeficitpoisonboxAinda não há avaliações

- Budget Analysis 2011 12Documento7 páginasBudget Analysis 2011 12s lalithaAinda não há avaliações

- Feb 2014 ForecastDocumento79 páginasFeb 2014 ForecastRachel E. Stassen-BergerAinda não há avaliações

- 2012 Midyear RevenueDocumento8 páginas2012 Midyear RevenueNick ReismanAinda não há avaliações

- Analysis of Fiscal Indicators of Kerala: Prepared For The 15th Finance CommissionDocumento67 páginasAnalysis of Fiscal Indicators of Kerala: Prepared For The 15th Finance CommissionM CharlesAinda não há avaliações

- B e AssingementDocumento25 páginasB e AssingementAhmed AlyaniAinda não há avaliações

- Budget 2011-12 - Analysis: Tax ProjectDocumento19 páginasBudget 2011-12 - Analysis: Tax ProjectSaurabh SadaniAinda não há avaliações

- Union Budget Report 2019 20 PDFDocumento19 páginasUnion Budget Report 2019 20 PDFok2Ainda não há avaliações

- Union Budget 2019-20: July 5, 2019Documento19 páginasUnion Budget 2019-20: July 5, 2019majhiajitAinda não há avaliações

- Ghana - Total Debt Service (% of Exports of Goods, Services and Primary Income)Documento4 páginasGhana - Total Debt Service (% of Exports of Goods, Services and Primary Income)ravi bodhaneAinda não há avaliações

- ICRA Union Budget 2012-13Documento7 páginasICRA Union Budget 2012-13NIKUNJ_SARAF11Ainda não há avaliações

- Macro Term1Documento15 páginasMacro Term1Mahfuzur RahmanAinda não há avaliações

- Fiscal Defecit and Its Trends in India: IntroductionDocumento7 páginasFiscal Defecit and Its Trends in India: IntroductionAyushi PatelAinda não há avaliações

- India: Highlights of The 2012/2013 Budget: The Indian Government Has Announced Its Proposals For The 2012/13 BudgetDocumento4 páginasIndia: Highlights of The 2012/2013 Budget: The Indian Government Has Announced Its Proposals For The 2012/13 BudgetVishal PranavAinda não há avaliações

- India ExecbriefingDocumento2 páginasIndia ExecbriefinggauravroongtaAinda não há avaliações

- Economics AssignmentDocumento28 páginasEconomics AssignmentJoydeep NaskarAinda não há avaliações

- Fiscal DeficitDocumento7 páginasFiscal DeficitpoisonboxAinda não há avaliações

- Analysing Budgetary RisksDocumento2 páginasAnalysing Budgetary RisksmuhammadasifrashidAinda não há avaliações

- Need For Credible Fiscal PlanDocumento3 páginasNeed For Credible Fiscal Planviswaprakash_vAinda não há avaliações

- Revenue Mobilization in NepalDocumento12 páginasRevenue Mobilization in NepalAlisha ThapaliyaAinda não há avaliações

- Project Report: Trends in State FinancesDocumento16 páginasProject Report: Trends in State FinancesvishalpahariyaAinda não há avaliações

- Icici Subsidiaries Ar 2015 16Documento492 páginasIcici Subsidiaries Ar 2015 16RAHIM KHANAinda não há avaliações

- Fiscal Policy Strategy StatementDocumento10 páginasFiscal Policy Strategy StatementparasAinda não há avaliações

- Indian Economy IDocumento10 páginasIndian Economy IVirendra SinghAinda não há avaliações

- Remarks by Henri Lorie, Senior Resident RepresentativeDocumento11 páginasRemarks by Henri Lorie, Senior Resident Representativesaad aliAinda não há avaliações

- FRBM ExamDocumento40 páginasFRBM ExamNaman MishraAinda não há avaliações

- Macro AssignmentDocumento4 páginasMacro AssignmentShahxaib KhanAinda não há avaliações

- Who Is The Spin Doctor - 13-6-2016Documento3 páginasWho Is The Spin Doctor - 13-6-2016klatifdgAinda não há avaliações

- Budget Analysis Report June 07Documento27 páginasBudget Analysis Report June 07Sajid BalochAinda não há avaliações

- Fiscal FederalismDocumento3 páginasFiscal Federalismanushkajaiswal2002Ainda não há avaliações

- Budget 2014-15 Analysis - Vedantam GuptaDocumento3 páginasBudget 2014-15 Analysis - Vedantam GuptaVedantam GuptaAinda não há avaliações

- Analysing Budget 2009-10Documento3 páginasAnalysing Budget 2009-10muhammadasifrashidAinda não há avaliações

- Macro Economics Assignment-1 Fiscal Performance of Andhra PradeshDocumento5 páginasMacro Economics Assignment-1 Fiscal Performance of Andhra Pradeshjrntr7799Ainda não há avaliações

- ND NDDocumento1 páginaND NDAmitabhDashAinda não há avaliações

- Full and Variable CostingDocumento20 páginasFull and Variable CostingAmitabhDashAinda não há avaliações

- Marketing Project PaperBoatDocumento20 páginasMarketing Project PaperBoatAmitabhDash67% (3)

- World PumpsDocumento18 páginasWorld PumpsAmitabhDashAinda não há avaliações

- Riverbridge Live Project: Industry OverviewDocumento1 páginaRiverbridge Live Project: Industry OverviewAmitabhDashAinda não há avaliações

- 100 Baggers PDFDocumento202 páginas100 Baggers PDFAmitabhDash97% (58)

- Dr. Daisy Chauhan Associate Professor: Management Development Institute, Gurgaon Daisy@mdi - Ac.inDocumento31 páginasDr. Daisy Chauhan Associate Professor: Management Development Institute, Gurgaon Daisy@mdi - Ac.inAmitabhDashAinda não há avaliações

- Financial Reporting MechanicsDocumento17 páginasFinancial Reporting MechanicsAmitabhDashAinda não há avaliações

- Kenya Ports Authority: Tax InvoiceDocumento1 páginaKenya Ports Authority: Tax InvoiceGeofrey NzomoAinda não há avaliações

- A Tale of Two LedgersDocumento3 páginasA Tale of Two LedgersManuel Elijah SarausadAinda não há avaliações

- Pay Slip: Payroll Basic DataDocumento2 páginasPay Slip: Payroll Basic DataAdarsha ChandelAinda não há avaliações

- Statement of MNGT Responsibility For Annual Itr Sideco 2018Documento1 páginaStatement of MNGT Responsibility For Annual Itr Sideco 2018NERALENE DIAZ EBIOAinda não há avaliações

- PAYSLIP - Oppo April 25 May 10 June 25 April 10Documento2 páginasPAYSLIP - Oppo April 25 May 10 June 25 April 10bktsuna0201Ainda não há avaliações

- Taxation & Economics PresentationDocumento21 páginasTaxation & Economics PresentationDanica Mae SerranoAinda não há avaliações

- HW #1 Financial ManagemenrDocumento3 páginasHW #1 Financial ManagemenrHaidie DiazAinda não há avaliações

- Unit 7-Income TaxesDocumento4 páginasUnit 7-Income TaxesJean Pierre IsipAinda não há avaliações

- PayslipDocumento2 páginasPayslipjzeb.gonzales18Ainda não há avaliações

- GST Council: MR Aditya Vikram Advocate Visiting Faculty in Bharti College, DU & IITM College, IP UniversityDocumento9 páginasGST Council: MR Aditya Vikram Advocate Visiting Faculty in Bharti College, DU & IITM College, IP UniversityNavendu ShuklaAinda não há avaliações

- 090 PDFDocumento1 página090 PDFAMIT SYSTEMAinda não há avaliações

- RMC 39-14Documento2 páginasRMC 39-14racheltanuy6557Ainda não há avaliações

- Mccurry Foundation ApplicationDocumento4 páginasMccurry Foundation ApplicationMrs. LibbyAinda não há avaliações

- Tax Information InterviewDocumento2 páginasTax Information InterviewKIPA TV Pringsewu LampungAinda não há avaliações

- GST & Custom Duty - 18233364 - 2024 - 01 - 23 - 08 - 53Documento440 páginasGST & Custom Duty - 18233364 - 2024 - 01 - 23 - 08 - 53Yasu RawteAinda não há avaliações

- Company Tax Return 2023Documento12 páginasCompany Tax Return 2023Carol YaoAinda não há avaliações

- SolutionsManual Ch30Documento16 páginasSolutionsManual Ch30Thiba SathivelAinda não há avaliações

- CTT - Public Finance (Prelim Exam)Documento4 páginasCTT - Public Finance (Prelim Exam)geofrey gepitulanAinda não há avaliações

- General Principles of TaxationDocumento3 páginasGeneral Principles of TaxationAljay LabugaAinda não há avaliações

- Session 6 Exercise DrillDocumento3 páginasSession 6 Exercise DrillAbigail Ann PasiliaoAinda não há avaliações

- Basics of Income TaxDocumento20 páginasBasics of Income Taxsakshi chauhanAinda não há avaliações

- Domestic Corporation Subject To Special Tax: Group 2Documento11 páginasDomestic Corporation Subject To Special Tax: Group 2Hanna Niña MabrasAinda não há avaliações

- Jimma, EthiopiaDocumento51 páginasJimma, EthiopiaRiyaad MandisaAinda não há avaliações

- Income and Business TaxationDocumento45 páginasIncome and Business TaxationKoro SenseiAinda não há avaliações

- Public Economics-Course SyllabusDocumento1 páginaPublic Economics-Course SyllabusshuvamAinda não há avaliações

- Mangalore University Syllabus 123Documento69 páginasMangalore University Syllabus 123jayasheel0% (1)

- Case Study On Operational ManagementDocumento3 páginasCase Study On Operational ManagementCindy Faye CrusanteAinda não há avaliações

- Buy Vs Lease Car CalculatorDocumento1 páginaBuy Vs Lease Car CalculatorLCAinda não há avaliações

- Summative Assessment 01Documento5 páginasSummative Assessment 01cpabirreplyAinda não há avaliações

- This Study Resource Was: Tax QuizzerDocumento5 páginasThis Study Resource Was: Tax QuizzerGee-Anne GonzalesAinda não há avaliações