Escolar Documentos

Profissional Documentos

Cultura Documentos

2312100150128200000

Enviado por

sachinkulsh_1Descrição original:

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

2312100150128200000

Enviado por

sachinkulsh_1Direitos autorais:

Formatos disponíveis

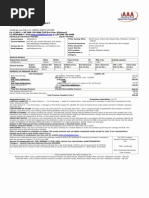

HDFC ERGO General Insurance Company Limited

2312100150128200000

Certificate of Insurance cum Policy Schedule

Policy No. 2312 1001 5012 8200 000

Two Wheeler Package Policy

Insured Name

Man mohan

Correspondence

Hno12 a, lane 6 b, Molarbandh Badarpur, New Delhi

Address

SOUTH DELHI DELHI 110044

Mobile

9911963521

Phone

E Mail

Period of Insurance

From Date & Time

RTO

Registration

Address

sachinkulsh@gmail.com

24/10/2016 00:01 hrs

To Date & Time

DELHI

Hno12 a, lane 6 b, Molarbandh Badarpur, New Delhi

SOUTH DELHI DELHI 110044

Registration No.

DL-03-SBJ-0246

23/10/2017 Midnight

Policy Issuance Date

Make

Model - Variant

Engine No

Chassis No

Mfg Yr

HERO HONDA

HUNK-KICK START

KC13EA7GM05488

MBLKC13EA7GM05670

2007

Vehicle (`)

Insured's Declared

Value (IDV)

14,105

Side Car (`)

Non Electrical Acc. (`)

Electrical Acc. (`)

Named Persons & Nominee (IMT-15)

Nominee (Owner Driver)

21/10/2016

Seats(Incl.

of side car)

2

Body Type

CC

OPEN

150

CNG/LPG Kit (`)

Total IDV (`)

14,105

Appointee

Premium Details (`)

Own Damage Premium (a)

Basic Own Damage:

152

Liability Premium (b)

Basic Third Party Liability:

619

PA Cover for Owner Driver of `100000

Total Basic Premium

Less: Others

11

Total - Less

Net Own Damage Premium (a)

Geographical Area India

Payment Details: Fund Transfer No. TW1610043379

50

152

11

141

Sub Total Addition

669

Net Liability Premium (b)

669

Total Package Premium (a+b)

810

Service Tax 15% (Including Swachh Bharat Cess 0.50%, Krishi Kalyan Cess 0.50% as applicable)

122

Total Premium

932

Compulsory Deductible (IMT-22)

Dated :

` 100

21/10/2016

Drawn on

Voluntary Deductible (IMT-22A)

` 0

BizDirect

List of Endorsements

Endt No Description

Effective Date

End Date

Premium (In ` )

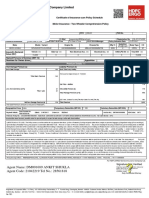

LIMITATIONS AS TO USE: The Policy covers use of the vehicle for any purpose other than: a) Hire or Reward b) Carriage of goods (other than samples or personal luggage) c) Organized racing d) Pace making e)

Speed testing f) Reliability Trials g) Any purpose in connection with Motor Trade. Persons or Class of Persons entitled to drive: Any person including the insured, provided that a person driving holds an effective

driving license at the time of the accident and is not disqualified from holding or obtaining such a license. Provided also that the person holding an effective learner`s license may also drive the vehicle when not used

for the transport of passengers at the time of the accident and that such a person satisfies the requirements of Rule 3 of the Central Motor Vehicles Rules, 1989. Limits of Liability 1. Under Section II-1 (i) of the

policy - Death of or bodily injury - Such amount as is necessary to meet the requirements of the Motor Vehicles Act, 1988. 2. Under Section II - 1(ii) of the policy -Damage to Third Party Property` 100000 3.P.A.

Cover under Section III for Owner - Driver(CSI): ` 100000 Terms, Conditions & Exclusions: As per the Indian Motor Tariff. A personal copy of the same is available free of cost on request & the same is also

available at our website.

I / We hereby certify that the policy to which the certificate relates as well as the certificate of insurance are issued in accordance with the provision of chapter X, XI of M. V.Act 1988. "The stamp duty of

` 0.50

paid by Demand Draft, vide Receipt/Challan no 1922235201617 dated 05/08/2016 as prescribed in Government Notification Revenue and Forest Department No Mudrank 2004/4125/CR 690/M-1, dated 31/12/2004."

Service Tax Registration No: AABCH0738EST004. IMPORTANT NOTICE: The Insured is not indemnified if the vehicle is used or driven otherwise than in accordance with this Schedule. Any payment made by the

Company by reason of wider terms appearing in the Certificate in order to comply with the Motor Vehicle Act, 1988 is recoverable from the Insured. See the clause headed "AVOIDANCE OF CERTAIN TERMS AND

RIGHT OF RECOVERY." Disclaimer: The Policy shall be void from inception if the premium cheque is not realized. In the event of misrepresentation, fraud or non-disclosure of material fact, the Company reserves

the right to cancel the Policy. Please note that the insured vehicle was pre-inspected and a report was prepared accordingly. The existing damages to the vehicle as mentioned in the report shall not be paid by the

Company. The policy is issued basis the information provided by you, which is available with the company. In case of discrepancy or non recording of relevant information in the policy, the insured is requested to bring

the same to the notice of the company within 15 days.

Policy Issuing Office : LEELA BUSINESS PARK, 6TH FLR, ANDHERI - KURLA RD, MUMBAI, 400059.

Policy Issuing Office: Mumbai

Phone No. : +91-22-66383600

For HDFC ERGO General Insurance Company Ltd.

Agent Name: POLICYBAZAAR INSURANCE WEB AGGREGATORS

PVT. LTD

Agent Code: 201714906552 Tel No.: 91-11-27561382

Duly Constituted Attorney

Registered & Corporate Office: 1st Floor, 165-166 Backbay Reclamation, H. T . Parekh Marg, Churchgate, Mumbai - 400020. Customer Service Address: 6th Floor, Leela Business Park, Andheri Kurla Road,

Andheri (E), Mumbai - 400 059. Toll Free : 1800-2-700-700 (Accessible from India only) | Fax : 91 22 6638 3699 | care@hdfcergo.com | www.hdfcergo.com

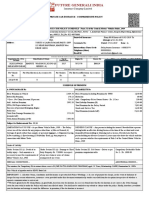

HDFC ERGO General Insurance Company Limited

Frequently Asked Questions (FAQs) - Motor Insurance

WHAT ARE THE MAJOR COVERS UNDER THE POLICY?

HOW DO I FILE A CLAIM?

Loss or Damage to the Insured Vehicle caused due to:

a. Fire, explosion, self ignition or lightning.

b Burglary, housebreaking or theft

c All act of God perils like earthquake, flood, cyclone etc

d Accidental external means, terrorism, riot and strike

Liability to Third Parties:

Provides cover for any legal liability arising out of the use of the vehicle for

a Accidental death / injury to any third party

b Any damage to property owned by third party

Personal Accident Cover:

The policy provides for a mandatory Personal Accident cover for owner driver and optional cover for

passengers covering accidental death and permanent total disability

For Accidental Damage to Insured Vehicle (Own Damage Claims):

Call our customer care Toll-free 1800-2-700-700 (Accessible from India only) if the vehicle meets

with an accident and provide your policy number for reference and register the claim

Alternatively, you can visit and register on IPO (available on website/Download IPO app on your

smart phone) by providing personal details, link your policy and register your claim under "Claims"

tab

Please keep the following details handy while intimating a claim

a. Policy No.

b. Registration details/ RC copy

c. Drivers details at the time of accident including driving license number

d. FIR on a case to case basis

e. Repair estimate

WHAT ARE THE MAJOR EXCLUSIONS OF THE POLICY?

WHAT IS THE CLAIM PROCESS?

a. General aging, wear & tear, mechanical or electrical breakdown, failure, depreciation, any

consequential loss

b. Damage by a person driving without a valid license

c. Damage by a person driving under the influence of liquor or drugs

d. Loss/damage attributable to war, mutiny, nuclear risks

e. Damage to tyres and tubes, unless damaged during an accident

f. Usage on hire & reward (applicable for all classes except public commercial vehicles)

g. Loss or damage to bonnet side parts, mudguard, bumpers, lamps, tyres, tubes, headlights, paint

work (applicable for all commercial vehicles; unless opted additionally)

h. Loss or damage resulting from overturning arising out of operation as a tool (applicable for mobile

cranes, drilling rigs, mobile plants, navvies, shovels, grabs, rippers unless opted for additionally)

i. Loss of or damage to accessories by burglary housebreaking or theft unless the vehicle is stolen at

the same time (applicable to all commercial vehicles & two wheelers)

1. If your vehicle can be driven, take it to the nearest dealer / garage.

2. Get a repair estimate, fill up the claim form and attach a copy of the registration certificate and

driving license of the person driving at the time of the accident.

3. If the garage is within our network, you could avail of cashless claim facility. Pay for non accident

related repairs, depreciation and deductible. We would settle the rest.

4. If the garage is outside our network, you would have to get the claim reimbursed subsequently.

TRANSFER OF INSURANCE (INCASE VEHICLE IS SOLD)

a. No objection letter from the previous insured

b. Form 29/30, Sale Deed OR transferred RC copy. In case of smart card, RTO transfer fee paid

receipt.

c. Differential Premium if any (NCB recovery, PA to Owner - Driver etc)

d. NOC from Financier, if applicable.

e. Pre-inspection is must if transfer request date is >14 days from the endorsed RC copy date

f. Break-in loading >45 days ( if applicable)

Additional Documents

a. Incase of death of Insured - a. Death Certificate b. Legal heir certificate

b. Incase of Employer to Employee transfer - a. Letter from Employer

WHAT CHANGES CAN BE DONE IN MY POLICY ENDORSEMENT

For Changes related to registration of vehicle or vehicle details like

a. Correction in registration number/ location / address

b. Correction in vehicle make & model/ cubic capacity/ seating capacity/ engine & chassis

number/manufacture year

To make above changes, you need following documents:

a. Request letter for the change

b. Policy copy

c. Registration Certificate copy /Invoice Copy for change in vehicle details

d. Cheque for additional premium if applicable

CLAIMS DOCUMENTS For ACCIDENTAL DAMAGE TO INSURED VEHICLE

a.

b.

c.

d.

e.

f.

g.

h.

i.

Duly filled and signed claim form & satisfaction voucher

Registration Certificate (RC)

Driving license of the person driving at the time of the accident

Policy copy , original repair estimate, repair invoice

Payment receipt for non-cashless claims

Original repair invoice for cashless claims

AML documents for amount more than 1 lac (PAN card, 2 passport size photo, residence proof)

Form 35 & original NOC from financer incase of total loss where payment is made to insured

A copy of police FIR/panchnama is required for TP injury / death / property damage

Additional documents required for commercial vehicles:

a. Spot survey

b. Load challan

c. Fitness certificate

Route permit

CLAIMS DOCUMENTS: IN CASE OF LOSS DUE TO THEFT

a.

b.

c.

d.

e.

f.

g.

h.

i.

j.

k.

l.

Duly filled and signed claim form & discharge voucher ( after loss settlement )

Original Registration Certificate (RC)

Original policy copy

Copy of FIR lodged at the nearest police station

All original keys & vehicle invoice copy

No trace report confirming that the stolen vehicle is not traceable

Original NOC from financer incase of hypothecation / HPA

Intimation to RTO for theft of vehicle

Duly signed RTO transfer papers (Form 26, 28,29,30,35)

RC extract with stolen remark from the concerned RTO after the loss

AML documents for amount more than 1 lac (PAN card, 2 passport size photo, residence proof)

Deed of subrogation cum indemnity on judicial stamp paper

WHAT IS NCB?

NO CLAIM BONUS (NCB):

NCB is provided for every claim free year basis the slab as provided by Tariff.

For addition of electrical and non electrical accessories, CNG & LPG Kit:

a. Request letter for the change

b. Policy copy

c. Invoice copy (mandatory where value of accessory exceeds ` 20,000/-)

d. Endorsed Registration Certificate Copy (For CNG/LPG kit)

e. Cheque for additional premium

E mail or Call us for additional premium details & send relevant documents copy to our customer service

office

For Change of financier details (Hypothecation/Lease/Hire-Purchase)

a. Request letter for the change

b. Policy copy

c. Endorsed Registration Certificate copy

d. NOC from financier (not mandatory for deletion if RC is endorsed)

How can I get No Claim Bonus Reserving Letter?

NCB Reserving letter can be provided only on Sale of vehicle evidenced by transferred RC copy OR

Sale Deed and Form 29 & 30. The OD section of the policy needs to be transferred to the new owner or

cancelled.

HOW DO I RENEW MY POLICY?

a. Visit www.hdfcergo.com to renew instantly

online

b. SMS "RENEW <POLICY NO> " to 9999

700700

c. Visit our nearest branch / your agent

d. Send a copy of the renewal notice along with

premium cheque to our branch office

/Corporate office

e. Call our toll free number 1800 2 700 700

(Accessible from India only)

HOW TO CONTACT US?

Call Toll-free

Fax

Write to us at

(Customer service office)

IPO

Link multiple policies

View/Email your policy

Register Motor claims

Track your claim status

* supports smart phone based on Blackberry, iPhone, Windows 8 & Android platform.

:1800 2 700 700 (Accessible from India only)

:022 6638 3669

:care@hdfcergo.com

:HDFC ERGO General Insurance Company Limited

6th Floor, Leela Business Park, Andheri Kurla Road, Andheri (East),

Mumbai - 400 059

:Raise a service request on Insurance Portfolio Organiser (IPO)

View/Edit your contact details

Set Renewal Reminders

Create and track your interactions

Locate our network garages/ branches

Download IPO mobile application from IPO website post log in

This document is a summary of the benefits offered. The information mentioned above is illustrative and not exhaustive. Information must be read in conjunction with the policy wordings.

In case of any conflict between this document and the policy wordings, the terms and conditions mentioned in the policy wordings shall prevail.

Ver.Aug14

For any endorsments on your policy you can contact us through any of the below mentioned modes:

E mail us at : care@hdfcergo.com OR Call Toll-free: 1800 2 700 700 (Accessible from India only)

OR Fax your request at: 022 6638 3669 OR Raise a service request on Insurance Portfolio

Organizer (IPO) from www.hdfcergo.com

Manage Your Portfolio

@ hdfcergo.com /

Smartphones*

d.

Você também pode gostar

- 3 Hold Harmless Indemnity Agreement NEW 1st para 511Documento4 páginas3 Hold Harmless Indemnity Agreement NEW 1st para 511Angelus Watson91% (11)

- Iffco TokioDocumento2 páginasIffco Tokioneel55% (11)

- Two Wheeler Insurance Package PolicyDocumento2 páginasTwo Wheeler Insurance Package Policy332233% (3)

- Two Wheeler Insurance Package PolicyDocumento2 páginasTwo Wheeler Insurance Package PolicyJai Deep43% (21)

- Future Generali India: IND-0208352-01-R-1Documento2 páginasFuture Generali India: IND-0208352-01-R-1SamaAinda não há avaliações

- Shri Mata Vaishno Devi Shrine Board - Yatra Parchi ServicesDocumento1 páginaShri Mata Vaishno Devi Shrine Board - Yatra Parchi Servicessachinkulsh_1100% (1)

- Sunrise Logisticks - 1Documento2 páginasSunrise Logisticks - 1niren4u1567100% (2)

- Basic Own DamageDocumento3 páginasBasic Own DamageHarsh PriyaAinda não há avaliações

- Harpriti PolicyDocumento1 páginaHarpriti PolicyIASkanhaAinda não há avaliações

- InsuranceDocumento3 páginasInsurancePinakin Puranik0% (2)

- TW Niapolicyschedulecirtificatetw 26204148Documento3 páginasTW Niapolicyschedulecirtificatetw 26204148harinadh birudukota0% (2)

- 9202532312008516Documento2 páginas9202532312008516Roopesh KumarAinda não há avaliações

- Reliance Private Car Vehicle Certificate Cum Policy ScheduleDocumento1 páginaReliance Private Car Vehicle Certificate Cum Policy ScheduleBarry Peterson100% (4)

- Bike Insurance PolicyDocumento2 páginasBike Insurance PolicyAnaruzzaman Sheikh0% (1)

- 2312100095928100000Documento2 páginas2312100095928100000Kavin Prakash100% (2)

- Revocation of GuaranteeDocumento34 páginasRevocation of GuaranteeHardik SharmaAinda não há avaliações

- Gentral Rate Contragt 144 (CL: For Supply of Drugs DressingsDocumento64 páginasGentral Rate Contragt 144 (CL: For Supply of Drugs Dressingschetan_nirmaAinda não há avaliações

- Vehicle Insurance 2nd YearDocumento2 páginasVehicle Insurance 2nd YearVivek KuppusamyAinda não há avaliações

- Iffco-Tokio General Insurance Co - LTD: Regd. Office: IFFCO Sadan C1 Distt. Centre, Saket, New Delhi - 110017Documento3 páginasIffco-Tokio General Insurance Co - LTD: Regd. Office: IFFCO Sadan C1 Distt. Centre, Saket, New Delhi - 110017SureshAinda não há avaliações

- InsuranceDocumento1 páginaInsuranceOmkar TrivediAinda não há avaliações

- Shashi Kant Policy PDFDocumento1 páginaShashi Kant Policy PDFJamie Jordan100% (1)

- XCD InsuranceDocumento3 páginasXCD Insuranceabhiin4Ainda não há avaliações

- Iffco-Tokio General Insurance Co - LTD: Servicing OfficeDocumento2 páginasIffco-Tokio General Insurance Co - LTD: Servicing OfficeRANGITHAinda não há avaliações

- Bike PolicyDocumento2 páginasBike PolicyAdhwareshBharadwaj100% (2)

- New Bajaj Policies PDFDocumento11 páginasNew Bajaj Policies PDFexcel.syed0% (1)

- Innova Ranbir PDFDocumento2 páginasInnova Ranbir PDFNarinder KaurAinda não há avaliações

- INSURANCEDocumento3 páginasINSURANCEmurali9026100% (1)

- ManeDocumento2 páginasManeMukesh Manwani100% (2)

- Bike Insurance 06 July '11 To '12Documento1 páginaBike Insurance 06 July '11 To '12Ankit Bansal0% (2)

- Document in Return For DownloadDocumento2 páginasDocument in Return For DownloadSamaAinda não há avaliações

- Bike InsuranceDocumento1 páginaBike Insurancejitendra asdeoAinda não há avaliações

- Motor Insurance - Two Wheeler Comprehensi PDFDocumento2 páginasMotor Insurance - Two Wheeler Comprehensi PDFVijay MaskarAinda não há avaliações

- PolicySchedule SR039719 134623191Documento1 páginaPolicySchedule SR039719 134623191Sridhar RamanAinda não há avaliações

- Passion Insurance PDFDocumento1 páginaPassion Insurance PDFHungamaSurat SuratAinda não há avaliações

- United India Insurance Company Limited: WWW - Uiic.co - inDocumento2 páginasUnited India Insurance Company Limited: WWW - Uiic.co - inpmukundaAinda não há avaliações

- Smart Drive Two Wheeler Insurance PolicyDocumento2 páginasSmart Drive Two Wheeler Insurance PolicyUma Mahesh100% (1)

- 2320100231958600000Documento2 páginas2320100231958600000vikasAinda não há avaliações

- Reliance General Insurance Company Limited: AKEPN2524LDocumento6 páginasReliance General Insurance Company Limited: AKEPN2524LvidyahemAinda não há avaliações

- Wego InsuranceDocumento1 páginaWego Insuranceuttam patraAinda não há avaliações

- InsuranceDocumento3 páginasInsurancevel AAinda não há avaliações

- Document in Return For DownloadDocumento2 páginasDocument in Return For DownloadSamaAinda não há avaliações

- Star CityDocumento1 páginaStar CityAjai K0% (1)

- 15C26792 / Reliance Money Solutions PVT LTD: Reliance Private Car Vehicle Certificate Cum Policy ScheduleDocumento2 páginas15C26792 / Reliance Money Solutions PVT LTD: Reliance Private Car Vehicle Certificate Cum Policy Scheduleswami rAinda não há avaliações

- Sub: Risk Assumption Letter: Insured & Vehicle DetailsDocumento2 páginasSub: Risk Assumption Letter: Insured & Vehicle DetailsUTTAL RAYAinda não há avaliações

- Vehicle Insurance Policy Format - Vehicle Insurance - Liability Insurance PDFDocumento10 páginasVehicle Insurance Policy Format - Vehicle Insurance - Liability Insurance PDFRajasekar GanapathyAinda não há avaliações

- MOTOR INSURANCE - Two Wheeler Liability Only SCHEDULEDocumento1 páginaMOTOR INSURANCE - Two Wheeler Liability Only SCHEDULEIshan BakshiAinda não há avaliações

- Two Wheeler PolicyDocumento2 páginasTwo Wheeler Policykomal bhosaleAinda não há avaliações

- http:// rgiclservices.reliancegeneral.co.in/ PDFDownload/ViewPDF.aspx? PolicyNo=1104262348016357 &| PolicyNo:1104262348016357 | CustName:RAJESH HARISHCHANDRA MHASHELKAR | Prod:2348 | RSD:19-Jul-2016 | RED:18-Jul-2017Documento2 páginashttp:// rgiclservices.reliancegeneral.co.in/ PDFDownload/ViewPDF.aspx? PolicyNo=1104262348016357 &| PolicyNo:1104262348016357 | CustName:RAJESH HARISHCHANDRA MHASHELKAR | Prod:2348 | RSD:19-Jul-2016 | RED:18-Jul-2017RGILAinda não há avaliações

- Bike InsuranceDocumento2 páginasBike InsuranceChinnabbai ChettubathinaAinda não há avaliações

- Own Damage-25-Dec-2020 To 24-Dec-2021: Schedule of Premium (Amount in RS.)Documento4 páginasOwn Damage-25-Dec-2020 To 24-Dec-2021: Schedule of Premium (Amount in RS.)Davinder SharmaAinda não há avaliações

- Reliance General Insurance Company LimitedDocumento7 páginasReliance General Insurance Company LimitedSURESH MEHERKARAinda não há avaliações

- Motor Insurance Certificate Cum Policy Schedule GCCV - Public Carriersother Than Three Wheelers Package Policy - Zone CDocumento2 páginasMotor Insurance Certificate Cum Policy Schedule GCCV - Public Carriersother Than Three Wheelers Package Policy - Zone CcursorkkdAinda não há avaliações

- Reliance General Insurance Company Limited: Reliance Two Wheeler Package Policy-BundledDocumento6 páginasReliance General Insurance Company Limited: Reliance Two Wheeler Package Policy-BundledSaqibAinda não há avaliações

- Final Motor Insurance Claim FormDocumento1 páginaFinal Motor Insurance Claim FormPrateek PatelAinda não há avaliações

- Insurance Au168Documento5 páginasInsurance Au168sebincherianAinda não há avaliações

- United India Insurance Company LimitedDocumento2 páginasUnited India Insurance Company LimitedThoufeeq IbrahimAinda não há avaliações

- HDFC ERGO General Insurance Company LimitedDocumento3 páginasHDFC ERGO General Insurance Company LimitedRaj NAinda não há avaliações

- Prashant (1) CompletedDocumento1 páginaPrashant (1) CompletedAsifshaikh7566Ainda não há avaliações

- United India Insurance Company LimitedDocumento4 páginasUnited India Insurance Company LimitedpoojaAinda não há avaliações

- Oriental Insurance Motor Policy Done On PortalDocumento3 páginasOriental Insurance Motor Policy Done On PortalAnkur Patil50% (2)

- Your Policy DetailsDocumento6 páginasYour Policy DetailsMohit Jangid100% (2)

- Truck Public Old ID 120Documento1 páginaTruck Public Old ID 120anshiAinda não há avaliações

- Private Car Comprehensive Policy: Certificate of Insurance Cum Policy ScheduleDocumento3 páginasPrivate Car Comprehensive Policy: Certificate of Insurance Cum Policy ScheduleShobhit GoelAinda não há avaliações

- Future Generali India: Insurance Company LimitedDocumento2 páginasFuture Generali India: Insurance Company LimitedThe CharlieAinda não há avaliações

- 46 PercdentDocumento1 página46 Percdentsachinkulsh_1Ainda não há avaliações

- 45 PercentDocumento1 página45 Percentsachinkulsh_1Ainda não há avaliações

- Leadership Conclave North Hub 2016 - 17Documento1 páginaLeadership Conclave North Hub 2016 - 17sachinkulsh_1Ainda não há avaliações

- Dokumen - Tips Hospital Chart of AccountsDocumento38 páginasDokumen - Tips Hospital Chart of AccountsRizwan HassanAinda não há avaliações

- Scheme of Examination and Course Structure B. Voc. in Banking Financial Services and Insurance (BFSI)Documento3 páginasScheme of Examination and Course Structure B. Voc. in Banking Financial Services and Insurance (BFSI)sainipreetpalAinda não há avaliações

- Business Visa For ItalyDocumento1 páginaBusiness Visa For ItalyAli AmjadAinda não há avaliações

- SKF in India Transfer Expenses Policy: (Version 4 - July 1, 2010)Documento3 páginasSKF in India Transfer Expenses Policy: (Version 4 - July 1, 2010)anks_raAinda não há avaliações

- FDIC Core Deposits White PaperDocumento18 páginasFDIC Core Deposits White PaperDouglas FunkAinda não há avaliações

- PankajKumar - Business ExcellenceDocumento2 páginasPankajKumar - Business ExcellenceRenitaAinda não há avaliações

- Module 10 - Income TaxDocumento6 páginasModule 10 - Income TaxLuiAinda não há avaliações

- p2 Revision PackDocumento233 páginasp2 Revision PackRana Hasan RahmanAinda não há avaliações

- Epsf FormDocumento1 páginaEpsf FormSavio MenezesAinda não há avaliações

- Non-Disparagement Employment AgreementDocumento5 páginasNon-Disparagement Employment AgreementRocketLawyerAinda não há avaliações

- A1. Offer Document (Clean) PDFDocumento565 páginasA1. Offer Document (Clean) PDFInvest StockAinda não há avaliações

- ChartOfAccount YAIN 2012Documento20 páginasChartOfAccount YAIN 2012litu84Ainda não há avaliações

- Investment Declaration Form - FY 2023-24Documento2 páginasInvestment Declaration Form - FY 2023-24kunal singhAinda não há avaliações

- FR FemaDocumento33 páginasFR FemarohanAinda não há avaliações

- Alpha and Risk-Adjusted Correlation For Economic Capital CalculationsDocumento21 páginasAlpha and Risk-Adjusted Correlation For Economic Capital CalculationsNajeeb YarkhanAinda não há avaliações

- Motorway Car Rental QuotationDocumento3 páginasMotorway Car Rental QuotationGina LiemAinda não há avaliações

- DepreciationDocumento4 páginasDepreciationMadhura KhapekarAinda não há avaliações

- Insurance Matters in SportDocumento7 páginasInsurance Matters in SportMvula InnaAinda não há avaliações

- BCOM HONS 5 Income Tax Law PracticeHDocumento36 páginasBCOM HONS 5 Income Tax Law PracticeHPurushottam RathoreAinda não há avaliações

- Case - Nderitu - Core Competencies and Sustainable Competitive Advantage by CIC General Insurance Company Limited in KenyaDocumento63 páginasCase - Nderitu - Core Competencies and Sustainable Competitive Advantage by CIC General Insurance Company Limited in KenyaToto SubagyoAinda não há avaliações

- Rushikesh Black BookDocumento49 páginasRushikesh Black BookRushikesh SonawaneAinda não há avaliações

- Dying To Make A ProfitDocumento14 páginasDying To Make A ProfitChris Ryan100% (1)

- CRSPDocumento17 páginasCRSPMichel KamelAinda não há avaliações

- Business Ethics ActivityDocumento3 páginasBusiness Ethics ActivityEstefi SirenaAinda não há avaliações

- The Chamber in Louth Town Hall: All Future Meetings Will Be Upstairs inDocumento24 páginasThe Chamber in Louth Town Hall: All Future Meetings Will Be Upstairs inapi-110060233Ainda não há avaliações

- Sample Budget Worksheets For A Restaurant 12 Month BudgetDocumento5 páginasSample Budget Worksheets For A Restaurant 12 Month BudgetBabyBabyAngel100% (1)

- Investment Linked ProductsDocumento15 páginasInvestment Linked ProductsMay BucagAinda não há avaliações