Escolar Documentos

Profissional Documentos

Cultura Documentos

Market Value Per Share

Enviado por

Nurul Kabir0 notas0% acharam este documento útil (0 voto)

10 visualizações1 páginaTHE aSZ

Direitos autorais

© © All Rights Reserved

Formatos disponíveis

PDF, TXT ou leia online no Scribd

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoTHE aSZ

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

0 notas0% acharam este documento útil (0 voto)

10 visualizações1 páginaMarket Value Per Share

Enviado por

Nurul KabirTHE aSZ

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

Você está na página 1de 1

Additional Information

Shareholder Information

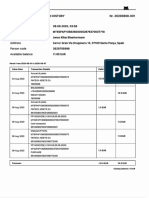

AstraZeneca PLC share listings and prices

2011

2012

2013

2014

2015

Ordinary Shares in issue millions

At year end

1,292

1,247

1,257

1,263

1,264

Weighted average for year

1,361

1,261

1,252

1,262

1,264

Stock market price per Ordinary Share

Highest (pence)

3194.0

3111.5

3612.0

4823.5

4863.0

Lowest (pence)

2543.5

2591.0

2909.5

3549.5

3903.5

At year end (pence)

2975.0

2909.5

3574.5

4555.5

4616.5

2011

%

2012

%

2013

%

2014

%

2015

%

1 250

0.6

0.6

0.5

0.5

0.5

251 500

0.7

0.7

0.6

0.6

0.6

501 1,000

0.8

0.8

0.8

0.7

0.7

1,001 5,000

1.2

1.1

1.1

1.0

0.9

5,001 10,000

0.2

0.2

0.2

0.2

0.2

10,001 50,000

1.0

1.0

1.0

1.0

0.9

50,001 1,000,000

13.8

12.6

12.3

13.3

13.0

Over 1,000,0001

81.7

83.0

83.5

82.7

83.2

Percentage analysis of issued share capital at 31 December

By size of account

Number of Ordinary Shares

Includes Euroclear and ADR holdings.

At 31 December 2015, the Company had

97,260 registered holders of 1,264,122,670

Ordinary Shares. There were 104,150

holders of Ordinary Shares held under

the Euroclear Services Agreement,

representing 10.8% of the issued share

capital of the Company and approximately

172,000 holders of ADSs, representing

10.8% of the issued share capital of the

Company. With effect from 27 July 2015,

the Companys ADS ratio changed to two

ADSs per one Ordinary Share. The former

ratio was one ADS per one Ordinary Share.

With effect from 6 February 2015, Citibank,

N.A. (Citibank) succeeded JPMorgan

Chase Bank (JPMorgan) as depositary

of the ADSs.

In 1999, in connection with the merger

between Astra and Zeneca through which

the Company was formed, the Companys

share capital was redenominated in US

dollars. On 6 April 1999, Zeneca shares

were cancelled and US dollar shares issued,

credited as fully paid on the basis of one

dollar share for each Zeneca share then

held. This was achieved by a reduction of

240

capital under section 135 of the Companies

Act 1985. Upon the reduction of capital

becoming effective, all issued and unissued

Zeneca shares were cancelled and the sum

arising as a result of the share cancellation

credited to a special reserve, which was

converted into US dollars at the rate of

exchange prevailing on the record date. This

US dollar reserve was then applied in paying

up, at par, newly created US dollar shares.

At the same time as the US dollar shares

were issued, the Company issued 50,000

Redeemable Preference Shares for cash,

at par. The Redeemable Preference Shares

carry limited class voting rights, no dividend

rights and are capable of redemption, at par,

at the option of the Company on the giving

of seven days written notice to the

registered holder of the Redeemable

Preference Shares.

A total of 826 million Ordinary Shares were

issued to Astra shareholders who accepted

the merger offer before the final closing

date, 21 May 1999. The Company received

acceptances from Astra shareholders

AstraZeneca Annual Report and Form 20-F Information 2015

representing 99.6% of Astras shares and

the remaining 0.4% was acquired in 2000,

for cash.

Since April 1999, following the merger of

Astra and Zeneca, the principal markets for

trading in the shares of the Company are

the LSE, the SSE and the NYSE. The table

overleaf sets out, for 2014 and 2015, the

reported high and low share prices of the

Company, on the following bases:

>> For shares listed on the LSE, the reported

high and low middle market closing

quotations are derived from the Daily

Official List.

>> For shares listed on the SSE, the high and

low closing sales prices are as stated in

the Official List.

>> For ADSs listed on the NYSE, the

reported high and low sales prices are as

reported by Dow Jones (ADR quotations).

Você também pode gostar

- Case 1 New (Signal Cable Company)Documento6 páginasCase 1 New (Signal Cable Company)nicole100% (2)

- AFSA Certification Test - FinShiksha - SolutionDocumento20 páginasAFSA Certification Test - FinShiksha - SolutionAnil Kumar SharmaAinda não há avaliações

- EOI On Excess Bank ChargesDocumento22 páginasEOI On Excess Bank ChargesOlufemi Moyegun100% (4)

- AdaniDocumento95 páginasAdanirajput_chetan2904Ainda não há avaliações

- XLS092-XLS-EnG Tire City - RaghuDocumento49 páginasXLS092-XLS-EnG Tire City - RaghuSohini Mo BanerjeeAinda não há avaliações

- BlackDocumento2 páginasBlacksaxvdx100% (1)

- BALANCE SHEET AS AT JUNE 2006,2007,2008.: Liabilities & EquityDocumento20 páginasBALANCE SHEET AS AT JUNE 2006,2007,2008.: Liabilities & EquityAitzaz AliAinda não há avaliações

- Annexure - 2Documento18 páginasAnnexure - 2satyamehtaAinda não há avaliações

- ETF Landscape: STOXX Europe 600 Sector ETF Net FlowsDocumento10 páginasETF Landscape: STOXX Europe 600 Sector ETF Net FlowsRichard GregorAinda não há avaliações

- Capitec Interim2004Documento1 páginaCapitec Interim2004naeemrencapAinda não há avaliações

- Asics CorporationDocumento6 páginasAsics Corporationasadguy2000Ainda não há avaliações

- Aberdeen Australia Equity Fund (IAF)Documento20 páginasAberdeen Australia Equity Fund (IAF)ArvinLedesmaChiongAinda não há avaliações

- Powerspeed H1 2014Documento2 páginasPowerspeed H1 2014Kristi DuranAinda não há avaliações

- Daily Technical Report: Sensex (16213) / NIFTY (4867)Documento5 páginasDaily Technical Report: Sensex (16213) / NIFTY (4867)Angel BrokingAinda não há avaliações

- NESTLE Financial Report (218KB)Documento64 páginasNESTLE Financial Report (218KB)Sivakumar NadarajaAinda não há avaliações

- Revenue: Revenue & Net Profit/ (Loss) - 9 Months Ended 31st DecemberDocumento2 páginasRevenue: Revenue & Net Profit/ (Loss) - 9 Months Ended 31st DecemberMihiri de SilvaAinda não há avaliações

- Technical Report 2nd December 2011Documento5 páginasTechnical Report 2nd December 2011Angel BrokingAinda não há avaliações

- Daily Technical Report: Sensex (16973) / NIFTY (5146)Documento4 páginasDaily Technical Report: Sensex (16973) / NIFTY (5146)Angel BrokingAinda não há avaliações

- Financial Statement AnalysisDocumento18 páginasFinancial Statement AnalysisSaema JessyAinda não há avaliações

- Flattish Earnings Performance Broadly in Line: Result HighlightsDocumento3 páginasFlattish Earnings Performance Broadly in Line: Result HighlightssanjeevpandaAinda não há avaliações

- Ioof Holdings LTD: Ibisworld Company ReportDocumento12 páginasIoof Holdings LTD: Ibisworld Company ReportNicholas AngAinda não há avaliações

- Technical Report 13th January 2012Documento5 páginasTechnical Report 13th January 2012Angel BrokingAinda não há avaliações

- Yeat Valves and Control Inc For ScribdDocumento9 páginasYeat Valves and Control Inc For ScribdRizky Yoga Pratama100% (1)

- Market Outlook 5th January 2012Documento3 páginasMarket Outlook 5th January 2012Angel BrokingAinda não há avaliações

- Trend Analysis of Ultratech Cement - Aditya Birla Group.Documento9 páginasTrend Analysis of Ultratech Cement - Aditya Birla Group.Kanhay VishariaAinda não há avaliações

- Technical Report 10th October 2011Documento4 páginasTechnical Report 10th October 2011Angel BrokingAinda não há avaliações

- Proiect Audit - RapoarteDocumento28 páginasProiect Audit - RapoarteLorena TudorascuAinda não há avaliações

- University of Wales and Mdis: Introduction To Accounting (Hk004)Documento11 páginasUniversity of Wales and Mdis: Introduction To Accounting (Hk004)Muhd RizdwanAinda não há avaliações

- Accounting For and Presentation of Owners' EquityDocumento26 páginasAccounting For and Presentation of Owners' EquitydanterozaAinda não há avaliações

- Platinum 2004 ASX Release FFH Short PositionDocumento36 páginasPlatinum 2004 ASX Release FFH Short PositionGeronimo BobAinda não há avaliações

- Technical Report 9th November 2011Documento5 páginasTechnical Report 9th November 2011Angel BrokingAinda não há avaliações

- Daily Technical Report: Sensex (16546) / NIFTY (5000)Documento4 páginasDaily Technical Report: Sensex (16546) / NIFTY (5000)Angel BrokingAinda não há avaliações

- FTSE/JSE All-Share IndexDocumento3 páginasFTSE/JSE All-Share IndexAmmi JulianAinda não há avaliações

- Intercorporate InvestmentsDocumento30 páginasIntercorporate InvestmentsMia ramosAinda não há avaliações

- Technical Report 12th January 2012Documento5 páginasTechnical Report 12th January 2012Angel BrokingAinda não há avaliações

- Daily Technical Report: Sensex (16668) / NIFTY (5054)Documento4 páginasDaily Technical Report: Sensex (16668) / NIFTY (5054)Angel BrokingAinda não há avaliações

- Supplement q4 2012Documento14 páginasSupplement q4 2012EnergiemediaAinda não há avaliações

- Technical Report 18th October 2011Documento5 páginasTechnical Report 18th October 2011Angel BrokingAinda não há avaliações

- Daewoo Securities Co., LTD: KoreaDocumento7 páginasDaewoo Securities Co., LTD: Koreasasaki16Ainda não há avaliações

- SP Setia Annual Report 2005Documento13 páginasSP Setia Annual Report 2005Xavier YeohAinda não há avaliações

- Technical Report 17th January 2012Documento5 páginasTechnical Report 17th January 2012Angel BrokingAinda não há avaliações

- Technical Report 14th February 2012Documento5 páginasTechnical Report 14th February 2012Angel BrokingAinda não há avaliações

- Technical Report 24th October 2011Documento5 páginasTechnical Report 24th October 2011Angel BrokingAinda não há avaliações

- Daily Technical Report: Sensex (17430) / NIFTY (5279)Documento4 páginasDaily Technical Report: Sensex (17430) / NIFTY (5279)Angel BrokingAinda não há avaliações

- Key RatiosDocumento2 páginasKey RatiosKhalid MahmoodAinda não há avaliações

- Consolidated First Page To 11.2 Property and EquipmentDocumento18 páginasConsolidated First Page To 11.2 Property and EquipmentAsif_Ali_1564Ainda não há avaliações

- Market Outlook 26th August 2011Documento3 páginasMarket Outlook 26th August 2011Angel BrokingAinda não há avaliações

- Market Outlook 20th September 2011Documento4 páginasMarket Outlook 20th September 2011Angel BrokingAinda não há avaliações

- 494.Hk 2011 AnnReportDocumento29 páginas494.Hk 2011 AnnReportHenry KwongAinda não há avaliações

- Enron Case Study - So What Is It WorthDocumento20 páginasEnron Case Study - So What Is It WorthJohn Aldridge ChewAinda não há avaliações

- Technical Report 9th December 2011Documento5 páginasTechnical Report 9th December 2011Angel BrokingAinda não há avaliações

- Market Outlook 11th October 2011Documento5 páginasMarket Outlook 11th October 2011Angel BrokingAinda não há avaliações

- Technical Report 19th October 2011Documento5 páginasTechnical Report 19th October 2011Angel BrokingAinda não há avaliações

- Ishares Barclays 20+ Year Treasury Bond Fund (TLT) FS 13-10-10Documento3 páginasIshares Barclays 20+ Year Treasury Bond Fund (TLT) FS 13-10-10João Silva TavaresAinda não há avaliações

- Ezra Holdings 3QFY13 Results 20130715Documento10 páginasEzra Holdings 3QFY13 Results 20130715tansillyAinda não há avaliações

- Technical Report 4th November 2011Documento5 páginasTechnical Report 4th November 2011Angel BrokingAinda não há avaliações

- Kajaria Ceramics: Upgrade in Price TargetDocumento4 páginasKajaria Ceramics: Upgrade in Price TargetSudipta BoseAinda não há avaliações

- Rupees 000: Unconsolidated Statement of Financial Position As at December 31, 2011Documento17 páginasRupees 000: Unconsolidated Statement of Financial Position As at December 31, 2011Jamal GillAinda não há avaliações

- Technical Report 6th January 2012Documento5 páginasTechnical Report 6th January 2012Angel BrokingAinda não há avaliações

- Elpl 2009 10Documento43 páginasElpl 2009 10kareem_nAinda não há avaliações

- Eaton Vance Tax-Mgd Div Eq Inc Fund (ETY)Documento32 páginasEaton Vance Tax-Mgd Div Eq Inc Fund (ETY)ArvinLedesmaChiongAinda não há avaliações

- Miscellaneous Investment Pools & Funds Revenues World Summary: Market Values & Financials by CountryNo EverandMiscellaneous Investment Pools & Funds Revenues World Summary: Market Values & Financials by CountryAinda não há avaliações

- Deposit Slip For Faculty and Staff - BankDocumento1 páginaDeposit Slip For Faculty and Staff - BankSaurabh ShubhamAinda não há avaliações

- Cert in Maths SAM Collation WEB 9781446932575 Issue3 PDFDocumento84 páginasCert in Maths SAM Collation WEB 9781446932575 Issue3 PDFNazir RashidAinda não há avaliações

- Rating ReckonerDocumento136 páginasRating ReckonerKeya DasAinda não há avaliações

- RGGHDDocumento2 páginasRGGHDbeer mohamedAinda não há avaliações

- Banking Procedures and Control of CashDocumento27 páginasBanking Procedures and Control of CashMohamedAinda não há avaliações

- Fincen 2011 0003 0016Documento5 páginasFincen 2011 0003 0016Carl MullanAinda não há avaliações

- Ezetap Caselet Case Study PDFDocumento12 páginasEzetap Caselet Case Study PDFSaurabh KumarAinda não há avaliações

- Comparative Study On Personal Banking of SBI and HDFCDocumento14 páginasComparative Study On Personal Banking of SBI and HDFCsaurabhm707Ainda não há avaliações

- Cash Handling ManualDocumento88 páginasCash Handling ManualSrishti Vasdev100% (1)

- Peti Kemas/Usaha TerminalDocumento3 páginasPeti Kemas/Usaha Terminalmeidy pratamaAinda não há avaliações

- Module 4 - ED - 14MBA26Documento28 páginasModule 4 - ED - 14MBA26Uday GowdaAinda não há avaliações

- Account Overview: View History For Transaction History PeriodDocumento6 páginasAccount Overview: View History For Transaction History PeriodNara WangsaAinda não há avaliações

- Multiple Deposit CreationDocumento10 páginasMultiple Deposit CreationAsif NawazAinda não há avaliações

- MODAUD1 UNIT 3 - Audit of ReceivablesDocumento11 páginasMODAUD1 UNIT 3 - Audit of ReceivablesJake BundokAinda não há avaliações

- 202d - Skill Based Subject - Banking Law and PracticeDocumento21 páginas202d - Skill Based Subject - Banking Law and PracticeŠ Òű VïķAinda não há avaliações

- NBFC Edelweise Retail FinanceDocumento14 páginasNBFC Edelweise Retail FinancesunitaAinda não há avaliações

- Solved What If The Fa Cts Were Diferent Suppose That TheDocumento1 páginaSolved What If The Fa Cts Were Diferent Suppose That TheAnbu jaromiaAinda não há avaliações

- Industry Status & IDBI Bank's Interface Industry IntroductionDocumento5 páginasIndustry Status & IDBI Bank's Interface Industry IntroductionHoney AliAinda não há avaliações

- Audit of The Inventory and Warehousing Cycle: Chapter 2DDocumento34 páginasAudit of The Inventory and Warehousing Cycle: Chapter 2DCyndi SyifaaAinda não há avaliações

- Bank of America Case SolutionDocumento7 páginasBank of America Case SolutionSAMBIT HALDER PGP 2018-20 BatchAinda não há avaliações

- Cred 2 Piczon YulimDocumento8 páginasCred 2 Piczon YulimIt'sRalph MondayAinda não há avaliações

- Brief History of PayPalDocumento2 páginasBrief History of PayPalMamun Or Rashid RumonAinda não há avaliações

- 700 Most Important Questions Asked in Recent IbpsDocumento20 páginas700 Most Important Questions Asked in Recent Ibpsbshree1011Ainda não há avaliações

- Mutual Find SBIDocumento25 páginasMutual Find SBIMäñåň FãłķëAinda não há avaliações

- Bonds: Formulas & ExamplesDocumento12 páginasBonds: Formulas & ExamplesAayush sunejaAinda não há avaliações

- PBI Distressed Commercial Mortgage Loan Workout June 25 2010Documento217 páginasPBI Distressed Commercial Mortgage Loan Workout June 25 2010mateo165Ainda não há avaliações

- Sathya's Iob ProjectDocumento35 páginasSathya's Iob ProjectVenkatesh ChowdaryAinda não há avaliações

- Financial System of ColombiaDocumento14 páginasFinancial System of ColombiaSantiago Aguirre CastiblancoAinda não há avaliações