Escolar Documentos

Profissional Documentos

Cultura Documentos

FAt

Enviado por

Cassandra AnneDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

FAt

Enviado por

Cassandra AnneDireitos autorais:

Formatos disponíveis

BBFA1023 FINANCIAL ACCOUNTING

Tutorial 11 Statement of Cash Flows : IAS7 (Continued)

Question 1

The directors of Greenland Bhd. employ a book-keeper who prepares draft

accounts for them using accounting software. They are pleased that they

have made a profit for the year ended 30 June year 2, but do not

understand why the cash balances have decreased. They have asked you,

as an independent accountant, to prepare a statement of cash flows.

The draft financial statements for Greenland Bhd. for internal use are set

out below:

Statement of comprehensive income for the year ended 30 June year 2

RM000

Revenue

1,702

Cost of sales

(870)

Gross profit

832

Operating expenses

(435)

Depreciation

(250)

Loss on sale of property, plant and equipment

(5)

Interest income

20

Interest expense

(15)

Profit before tax

147

Tax expense

(32)

Profit for the year

115

2015-TL

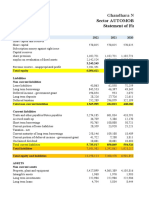

Statement of financial position as at 30 June

Year 2

RM000

Year 1

RM000

Non-current assets

Property, plant and equipment

Current assets

Inventory

Receivables

Prepaid salaries

Fixed deposits

Cash on hand and in bank

Current liabilities

Payables

Interest payable

Bank overdraft

Dividend payable

Tax liability

Net current assets

Equity & liabilities

Share capital

Share premium

Retained earnings

Non-current liability

Loan

1,030

800

70

150

25

30

20

295

65

197

18

35

30

345

90

5

10

65

20

190

105

1,135

180

10

60

5

255

90

890

700

50

85

835

600

40

640

300

1,135

250

890

BBFA1023 FINANCIAL ACCOUNTING

Additional information:

1. Greenland Bhd. purchased property, plant and equipment for

RM550,000 during the year ended 30 June year 1.

2. Included in the operating expenses are salaries expense of

RM200,000.

Required:

Prepare for Greenland Bhd.:

(a) Statement of cash flows for the year ended 30 June year 2 in

accordance with IAS 7 Statement of Cash Flows using the direct

method;

(b) Disclosure notes to the statement of cash flows in respect of the on

cash and cash equivalents;

(c) Reconciliation of net income to cash flows from operating activities;

2015-TL

BBFA1023 FINANCIAL ACCOUNTING

2015-TL

Question 2

Retained earnings

The following are the financial statements extracted from the books of

MWE Sdn. Bhd.:

Non-current liabilities

Bank loan

Statement of profit and loss for the year ended 30 June 2015

RM

Revenue

344,000

Cost of sales

(151,000)

Gross profit

193,000

Distribution cost

(31,100)

Administrative expenses

(58,900)

Interest expenses

(49,500)

Profit before tax

53,500

Taxation

(13,000)

Profit for the year

40,500

Statement of financial position as at 30 June

2015

RM

RM

Assets

Non-current assets

Property, plant and

360,000

equipment

Current assets

Inventories

Trade receivables

26,500

21,000

Current liabilities

Trade payables

Bank overdraft

Tax payable

Dividend payable

Total equity and liabilities

RM

340,000

24,500

18,000

68,110

193,110

51,600

79,600

53,000

28,450

38,900

11,250

65,000

7,900

38,000

17,700

131,600

451,810

128,600

401,310

Additional information:

2014

RM

108,610

268,610

1. The following information relates to the property, plant and equipment

of MWE Sdn. Bhd.:

30 June

30 June

2015

2014

RM

RM

Cost

700,000

595,000

Accumulated depreciation

(340,000)

(255,000)

Net book value

360,000

340,000

2. Fixtures and fittings with an original cost of RM85,000 and net book

value of RM45,000, were sold for RM40,000 during the year ended 30

June 2015.

BBFA1023 FINANCIAL ACCOUNTING

Fixed deposits

Cash at bank

Equities and liabilities

Equity

Ordinary shares of RM1.00 each

Share premium

Question 1 (Answers)

b) Cash and Cash Equivalents:

Balance b/d

Sales (Revenue)

5,500

13,310

61,310

401,310

150,000

10,000

125,000

-

(a)

Prepare the statement of cash flows of MWE Sdn. Bhd. for the year

ended 30 June 2015 in accordance with IAS 7 Statement of Cash

Flows, using the indirect method.

(b) Prepare the notes to the statement of cash flows in respect of the cash

and cash equivalents.

Dividend Payable

Balance c/d

Year 2

RM

30

20

(10)

40

Trade Receivables (Note 1)

197 Bank

1,702 Balance c/d

1,899

Bank

Balance c/d

Trade Payables (Note 2)

965 Balance b/d

90 Purchases

1,055

Bank

Balance c/d

Interest payable (Note 3)

20 Balance b/d

5 Interest Expenses

25

Bank

Balance c/d

2015-TL

Required:

91,810

451,810

Total assets

Fixed Deposits

Cash at Bank

Bank Overdraft

18,500

25,810

Tax payable (Note 4)

17 Balance b/d

20 Tax expenses

37

Retained Earnings (Note 5)

Year 1

RM

35

30

Balance b/d

Bank

65

1,749

150

1,899

PPE (NBV)

70

85

155

Balance b/d

Tax expenses

40

115

155

PPE (NVB) (Note 6)

800 Disposal

Depreciation

550 Balance c/d

1,350

Disposal (Note 7)

70 Bank

Loss

70

20

250

1,030

1,350

65

5

70

a) Statement of Cash Flows for the Year ended 30 June (Direct Method)

180

875

1,055

10

15

25

5

32

37

Cash Flows from Operating Activities

Cash received from customers (Note 1)

Cash paid to suppliers (Note 2)

Cash paid to employees

Cash paid for operating expenses

(435-200)

Cash generated from operations

Tax paid (Note 4)

Finance Cost (Note 3)

Net Cash Generated from Operations

Cash flows from Investing Activities

Additions to PPE (Note 6)

Proceeds from disposal of PPE (Note 7)

Interest Received

Net Cash used in Investing Activities

RM000

RM000

1,749

(965)

(207)

(235)

342

(17)

(20)

305

(550)

65

20

(465)

BBFA1023 FINANCIAL ACCOUNTING

Cash flows from Financing Activities

Issuance of Shares (700 600) + 50

Dividend Paid (Note 5)

Issuance of Loan notes (300-250)

Net Cash used in Financial Activities

150

(65)

50

135

Net Decrease in Cash and Cash Equivalents

Cash and Cash equivalents at beginning of year

Cash and Cash equivalents at end of year

(25)

65

40

c) Reconciliation of net income to cash flows from operating activities

Cash Flows from Operating Activities

Profit before tax

Adjustments for:

Depreciation

Gain on Disposal of PPE

Interest Income

Finance Cost

Operating Profit before W.C changes

Increase in Inventories (70-65)

Decrease in trade receivables (150-197)

Increase in prepayments (25-18)

Decrease in trade payables (90-180)

Cash generated from operations

RM000

250

5

(20)

15

(5)

47

(7)

(90)

RM000

147

250

397

(55)

342

2015-TL

BBFA1023 FINANCIAL ACCOUNTING

2015-TL

Question 2

b) Cash and Cash Equivalents

Fixed Deposits

Cash at Bank

Bank Overdraft

Year 2

RM

18,500

25,810

(28,450)

15,860

Bank

Balance c/d

Tax Payable (Note 1)

12,100 Balance b/d

38,900 Tax expense

51,000

Balance b/d

Bank

PPE (Cost) (Note 2)

595,000 Disposal

190,000 Balance c/d

785,000

Disposal

Balance c/d

PPE (Cost)

Bank

Balance c/d

Year 1

RM

5,500

13,310

(7,900)

10,910

38,000

13,000

51,000

85,000

700,000

785,000

Accumulated Depreciation (Note 3)

40,000 Balance b/d

340,000 Depreciation

380,000

255,000

125,000

380,000

Disposal- PPE (Note 4)

85,000 Bank

Acc. Dep

Loss

85,000

40,000

40,000

5,000

85,000

Dividend Payable (Note 5)

6,450 Balance b/d

11,250

17,700

17,700

17,700

a) Statement of Cash Flows for the Year ended 30 June (Indirect Method)

Cash Flows from Operating Activities

Profit before tax

Adjustments for:

Depreciation

Loss on Disposal of PPE

Finance Cost

Operating Profit before W.C changes

Increase in Inventories (26,500-24,500)

Increase in trade receivables (21,000-18,000)

Decrease in trade payables (53,000-65,000)

Cash generated from operations

Tax paid (Note 1)

Finance Cost

Net Cash Generated from Operations

Cash flows from Investing Activities

Additions to PPE (Note 2)

Proceeds from disposal of PPE (Note 4)

Net Cash used in Investing Activities

RM

125,000

5,000

49,500

(2,000)

(3,000)

(12,000)

RM

53,500

179,500

233,000

(17,000)

216,000

(12,100)

(49,500)

154,400

(190,000

)

40,000

(150,000

)

Cash flows from Financing Activities

Issuance of Shares (150,000-125,000)+10,000

Dividend Paid (Note 5)

Repayment of Loan Notes (51,600-79,600)

Net Cash used in Financial Activites

35,000

(6,450)

(28,000)

550

Net Decrease in Cash and Cash Equivalents

Cash and Cash equivalents at beginning of year

Cash and Cash equivalents at end of year

4,950

10,910

15,860

Você também pode gostar

- Hertz A + BDocumento11 páginasHertz A + BLinus Vallman Johansson100% (1)

- Record The Following Transactions On Page 2 of The Journal:: InstructionsDocumento3 páginasRecord The Following Transactions On Page 2 of The Journal:: InstructionsItsF2bleAP 37100% (1)

- Exercise (Chapter 3: MFRS 123 Borrowing Cost)Documento6 páginasExercise (Chapter 3: MFRS 123 Borrowing Cost)just jumperAinda não há avaliações

- Drafting Financial Statements (International Stream) : Monday 1 December 2008Documento9 páginasDrafting Financial Statements (International Stream) : Monday 1 December 2008salaam7860Ainda não há avaliações

- Megan MediaDocumento8 páginasMegan Mediarose0% (1)

- Fair Value Adjustment 44,305: Unrealized Gain (Or Cummulative Amount of OCI) 8,730Documento2 páginasFair Value Adjustment 44,305: Unrealized Gain (Or Cummulative Amount of OCI) 8,730Gray Javier100% (1)

- ACC 4041 Tutorial - Corporate Tax 2Documento3 páginasACC 4041 Tutorial - Corporate Tax 2Atiqah DalikAinda não há avaliações

- Tutorial 3 MFRS111 Construction ContractDocumento9 páginasTutorial 3 MFRS111 Construction Contractnatasha thaiAinda não há avaliações

- Tax ComputationDocumento13 páginasTax ComputationEcha Sya0% (1)

- Suggested Solution Far 660 Final Exam JUNE 2019Documento6 páginasSuggested Solution Far 660 Final Exam JUNE 2019Nur ShahiraAinda não há avaliações

- Assignment 2 Bkaf 3083Documento5 páginasAssignment 2 Bkaf 3083Nur Adilah Dila100% (1)

- Taxation AnswerDocumento13 páginasTaxation AnswerkannadhassAinda não há avaliações

- Finacial Management Project Restore Incorporated 14-4Documento9 páginasFinacial Management Project Restore Incorporated 14-4Muhammad Talha60% (10)

- Chapter 31 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Documento44 páginasChapter 31 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Falah Ud Din SheryarAinda não há avaliações

- Balance Sheet AuditDocumento10 páginasBalance Sheet AuditFathiah HamidAinda não há avaliações

- MFRS 101 - Ig - 042015Documento24 páginasMFRS 101 - Ig - 042015Prasen RajAinda não há avaliações

- ABMF 3174 Financial ManagementDocumento23 páginasABMF 3174 Financial ManagementRayAinda não há avaliações

- Tutorial 3Documento6 páginasTutorial 3Mastura Abd Hamid100% (1)

- Topic 1: Cost-Volume-Profit (CVP) Analysis Exercise 1: BKAM3023 Management Accounting IIDocumento4 páginasTopic 1: Cost-Volume-Profit (CVP) Analysis Exercise 1: BKAM3023 Management Accounting IINur WahidaAinda não há avaliações

- WCM Optimum Credit PolicyDocumento21 páginasWCM Optimum Credit PolicyLekha V P NairAinda não há avaliações

- Aud589 Dec2019Documento6 páginasAud589 Dec2019LANGITBIRU0% (1)

- Kumpulan 2 - Kancil Group ProjectDocumento58 páginasKumpulan 2 - Kancil Group ProjectYamunasri Mari100% (1)

- Partnership - ExercicesDocumento7 páginasPartnership - ExercicesNurul SharizaAinda não há avaliações

- Capital Allowance 2220Documento58 páginasCapital Allowance 2220YanPing AngAinda não há avaliações

- Appeal Tax Procedure (Malaysia)Documento2 páginasAppeal Tax Procedure (Malaysia)Zati TyAinda não há avaliações

- 7 2006 Dec QDocumento6 páginas7 2006 Dec Qapi-19836745Ainda não há avaliações

- Assignment Question BAC2634 2110Documento11 páginasAssignment Question BAC2634 2110Syamala 29Ainda não há avaliações

- Bank Reconciliation Solution - Uhuru Sacco LTD V1Documento9 páginasBank Reconciliation Solution - Uhuru Sacco LTD V1Daniel Dayan SabilaAinda não há avaliações

- 9-Trialtest (Sage UBS Payroll SSG 2011 Edition)Documento154 páginas9-Trialtest (Sage UBS Payroll SSG 2011 Edition)bezeeAinda não há avaliações

- BBFA2303 Take Home Exam - Eng & BM - Jan20Documento10 páginasBBFA2303 Take Home Exam - Eng & BM - Jan20AnnieAinda não há avaliações

- CHPT 19 Answer MFRS 118 Revenue-180214 - 050144Documento3 páginasCHPT 19 Answer MFRS 118 Revenue-180214 - 050144Navin El Nino50% (2)

- ACC2054 Tutorial 4Documento3 páginasACC2054 Tutorial 4Euvan KumarAinda não há avaliações

- Chapter 2 Corporate TaxDocumento50 páginasChapter 2 Corporate TaxNgAinda não há avaliações

- Module 7 - UpdatesDocumento2 páginasModule 7 - Updatesbilly930% (1)

- Aud 679 - Internal Auditing TUTORIAL-Chapter 2Documento1 páginaAud 679 - Internal Auditing TUTORIAL-Chapter 2auni fildzahAinda não há avaliações

- ABE Dip 1 - Financial Accounting JUNE 2005Documento19 páginasABE Dip 1 - Financial Accounting JUNE 2005spinster40% (1)

- Basis PeriodDocumento3 páginasBasis Periodafraahmed0Ainda não há avaliações

- Financial Statements 2, ModuleDocumento4 páginasFinancial Statements 2, ModuleSUHARTO USMANAinda não há avaliações

- Test Aud 689 - Apr 2018Documento3 páginasTest Aud 689 - Apr 2018Nur Dina AbsbAinda não há avaliações

- Solutions Chapter 21Documento17 páginasSolutions Chapter 21mashko1100% (1)

- Section A - QuestionsDocumento27 páginasSection A - Questionsnek_akhtar87250% (1)

- Solution Far450 UITM - Jan 2013Documento8 páginasSolution Far450 UITM - Jan 2013Rosaidy SudinAinda não há avaliações

- Benefits of Accounting StandardsDocumento2 páginasBenefits of Accounting Standardsmanikkin bagasAinda não há avaliações

- Accounting Theory & PracticesDocumento6 páginasAccounting Theory & PracticesNur AbidinAinda não há avaliações

- MFRS 108 Changes in Accounting PoliciesDocumento21 páginasMFRS 108 Changes in Accounting Policiesnatasha thaiAinda não há avaliações

- Tutorial Pengekosan KeluaranDocumento13 páginasTutorial Pengekosan KeluaranatehanaAinda não há avaliações

- MFRS108 & MFRS110 - in Class ExerciseDocumento2 páginasMFRS108 & MFRS110 - in Class ExerciseRubiatul AdawiyahAinda não há avaliações

- Chapter 3 - Agriculture AllowancesDocumento3 páginasChapter 3 - Agriculture AllowancesNURKHAIRUNNISA100% (2)

- Far410 Chapter 2 Conceptual Framework EditedDocumento60 páginasFar410 Chapter 2 Conceptual Framework EditedWAN AMIRUL MUHAIMIN WAN ZUKAMALAinda não há avaliações

- 9706 s16 QP 32 PDFDocumento12 páginas9706 s16 QP 32 PDFFarrukhsgAinda não há avaliações

- Exam Docs Dipifr 2012Documento2 páginasExam Docs Dipifr 2012aqmal16Ainda não há avaliações

- Indoco Annual Report FY16Documento160 páginasIndoco Annual Report FY16Ishaan MittalAinda não há avaliações

- Earnings ManagementDocumento16 páginasEarnings ManagementakfajarAinda não há avaliações

- E-14 AfrDocumento5 páginasE-14 AfrInternational Iqbal ForumAinda não há avaliações

- Far410 Chapter 1 Fin Regulatory FrameworkDocumento19 páginasFar410 Chapter 1 Fin Regulatory Frameworkafdhal50% (4)

- Report Law346Documento7 páginasReport Law346qhoirun nissaAinda não há avaliações

- Final Assessment - Suggested Solution & Marking Scheme Paper 1Documento3 páginasFinal Assessment - Suggested Solution & Marking Scheme Paper 1Deidree Elsa100% (1)

- Far660 - Group Project - October 2020Documento2 páginasFar660 - Group Project - October 2020Nur ImanAinda não há avaliações

- FMAForecasting QDocumento11 páginasFMAForecasting QAnisahMahmoodAinda não há avaliações

- Exercise Topic 4Documento7 páginasExercise Topic 4jr ylvsAinda não há avaliações

- IFRS For SME's Financial Statements TemplateDocumento27 páginasIFRS For SME's Financial Statements TemplatemrlskzAinda não há avaliações

- Financial Results, Limited Review Report For December 31, 2015 (Result)Documento4 páginasFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderAinda não há avaliações

- Consolidated Accounts June-2011Documento17 páginasConsolidated Accounts June-2011Syed Aoun MuhammadAinda não há avaliações

- Tax 1 CorpDocumento16 páginasTax 1 CorpRen A Eleponio0% (1)

- DebentureDocumento34 páginasDebentureSOHEL BANGIAinda não há avaliações

- Ontario Budget 2017Documento330 páginasOntario Budget 2017National PostAinda não há avaliações

- Islamic Finance and Their Financial Growth Verses Their Maqasid Al ShariahDocumento54 páginasIslamic Finance and Their Financial Growth Verses Their Maqasid Al ShariahNader MehdawiAinda não há avaliações

- Asset Management ISO55Documento50 páginasAsset Management ISO55helix2010Ainda não há avaliações

- Research Report 2012-CIMBDocumento272 páginasResearch Report 2012-CIMBTam AbdullahAinda não há avaliações

- Dividends and Other Payouts c19Documento38 páginasDividends and Other Payouts c19Corey WuAinda não há avaliações

- DepricitionDocumento26 páginasDepricitionhagos dargoAinda não há avaliações

- Ghandhara NissanDocumento7 páginasGhandhara NissanShamsuddin SoomroAinda não há avaliações

- Civica Acquires Keystone Asset Management SolutionsDocumento1 páginaCivica Acquires Keystone Asset Management SolutionsCivicaGroupAinda não há avaliações

- Heavy OilDocumento6 páginasHeavy Oilsnikraftar1406Ainda não há avaliações

- ADMU Taxation CasesDocumento370 páginasADMU Taxation CasesAthena Valero0% (1)

- Amazon Case StudyDocumento15 páginasAmazon Case Studyade firmansyah71% (7)

- Ashok LeylandDocumento12 páginasAshok LeylandDwarakesh Rocky YadavAinda não há avaliações

- Kotak Assured Income PlanDocumento9 páginasKotak Assured Income Plandinesh2u85Ainda não há avaliações

- Patrick Morgan: HighlightsDocumento1 páginaPatrick Morgan: HighlightsGhazni ProvinceAinda não há avaliações

- Managing Currency Risk - 1: Duke Ghosh, PH.DDocumento10 páginasManaging Currency Risk - 1: Duke Ghosh, PH.DVishal SinghAinda não há avaliações

- Acct 301 - CH 8 ProbDocumento8 páginasAcct 301 - CH 8 ProbbeethamhomerAinda não há avaliações

- Finance AssignmentDocumento7 páginasFinance AssignmentMeshack MateAinda não há avaliações

- CourseworkDocumento6 páginasCourseworkyonghuiAinda não há avaliações

- Unit 5 - 08 - Financial Ratios FinalDocumento57 páginasUnit 5 - 08 - Financial Ratios Finalbabitjha664Ainda não há avaliações

- FINMAN 104 Module IDocumento34 páginasFINMAN 104 Module IAlma Teresa NipaAinda não há avaliações

- Exxon Mobil Research PaperDocumento16 páginasExxon Mobil Research Paperbmcginnis83Ainda não há avaliações

- BCG Matrix Analysis UnileverDocumento2 páginasBCG Matrix Analysis UnileverAmna NasserAinda não há avaliações

- Overseas Investment Directions, 2022Documento26 páginasOverseas Investment Directions, 2022Arpit AgarwalAinda não há avaliações

- NIDC Vs AquinoDocumento2 páginasNIDC Vs AquinoJennilyn TugelidaAinda não há avaliações

- Urp GFM 01 Global Financial Markets StructureDocumento61 páginasUrp GFM 01 Global Financial Markets StructureWhiny CustodioAinda não há avaliações