Escolar Documentos

Profissional Documentos

Cultura Documentos

Saturnino Vs Philamlife

Enviado por

Annabelle Bustamante0 notas0% acharam este documento útil (0 voto)

578 visualizações1 páginaINSURANCE LAW

Título original

Saturnino vs Philamlife

Direitos autorais

© © All Rights Reserved

Formatos disponíveis

DOCX, PDF, TXT ou leia online no Scribd

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoINSURANCE LAW

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato DOCX, PDF, TXT ou leia online no Scribd

0 notas0% acharam este documento útil (0 voto)

578 visualizações1 páginaSaturnino Vs Philamlife

Enviado por

Annabelle BustamanteINSURANCE LAW

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato DOCX, PDF, TXT ou leia online no Scribd

Você está na página 1de 1

IGNACIO SATURNINO in his own behalf and as the JUDICIAL GUARDIAN OF CARLOS SATURNINO,

minor, vs. THE PHILIPPINE AMERICAN LIFE INSURANCE COMPANY

G.R. No. L-16163, 28 February 1963

FACTS:

Estefania Saturnino obtained a 20-year endowment non-medical insurance. This kind of policy dispenses

with the medical examination of the applicant usually required in ordinary life policies.

It appears that two months prior to the issuance of the policy, Saturnino was operated on for cancer,

involving complete removal of the right breast, including the pectoral muscles and the glands found in the

right armpit. She stayed in the hospital for a period of eight days, after which she was discharged,

although according to the surgeon who operated on her she could not be considered definitely cured, her

ailment being of the malignant type.

Notwithstanding the fact of her operation Estefania A. Saturnino did not make a disclosure thereof in her

application for insurance. On the contrary, she stated therein that she did not have, nor had she ever had,

among other ailments listed in the application, cancer or other tumors; that she had not consulted any

physician, undergone any operation or suffered any injury within the preceding five years; and that she

had never been treated for nor did she ever have any illness or disease peculiar to her sex, particularly of

the breast, ovaries, uterus, and menstrual disorders. The application also recites that the foregoing

declarations constituted "a further basis for the issuance of the policy."

Sometime after, Saturnino died of pneumonia, secondary to influenza. Appellants here, who are her

surviving husband and minor child, respectively, demanded payment of the face value of the policy. The

claim was rejected and hence an action was subsequently instituted.

ISSUE:

Whether or not the insured made such false representations of material facts as to avoid the policy.

HELD:

YES. The Insurance Law (Section 30) provides that "materiality is to be determined not by the event, but

solely by the probable and reasonable influence of the facts upon the party to whom the communication is

due, in forming his estimate of the proposed contract, or in making his inquiries."

A concealment, whether intentional or unintentional, entitles the insurer to rescind the contract of

insurance, concealment being defined as negligence to communicate that which a party knows and ought

to communicate. The basis of the rule vitiating the contract in cases of concealment is that it misleads or

deceives the insurer into accepting the risk, or accepting it at the rate of premium agreed upon. The

insurer, relying upon the belief that the assured will disclose every material facts within his actual or

presumed knowledge, is misled into a belief that the circumstance withheld does not exist, and he is

thereby induced to estimate the risk upon a false basis that it does not exist.

In the application for insurance signed by the insured in this case, she agreed to submit to a medical

examination by a duly appointed examiner of Philamlife if in the latter's opinion such examination was

necessary as further evidence of insurability. In not asking her to submit to a medical examination,

appellants maintain, Philamlife was guilty of negligence, which precluded it from finding about her actual

state of health. No such negligence can be imputed to Philamlife. It was precisely because the insured had

given herself a clean bill of health that appellee no longer considered an actual medical checkup

necessary. It is logical to assume that if Philamlife had been properly apprised of the insured's medical

history she would at least have been made to undergo medical examination in order to determine her

insurability.

The judgment appealed from, dismissing the complaint and awarding the return to appellants of the

premium already, paid, with interest at 6% up to January 29, 1959, affirmed, with costs against

appellants.ATU

Você também pode gostar

- Vda de Canilang Vs Court of AppealsDocumento3 páginasVda de Canilang Vs Court of AppealsMan2x SalomonAinda não há avaliações

- Florendo v. Philam PlansDocumento1 páginaFlorendo v. Philam PlansJohney Doe50% (2)

- 4 FORTUNE MEDICARE, INC. Vs AmorinDocumento2 páginas4 FORTUNE MEDICARE, INC. Vs AmorinWV Gamiz Jr.50% (2)

- 52 - Andres v. Crown Life InsuranceDocumento1 página52 - Andres v. Crown Life InsuranceperlitainocencioAinda não há avaliações

- White Gold Marine Services, Inc Vs Pioneer Insurance and Surety Corporation and The Steamship Mutual Underwriting Association (Bermuda) LTD DigestDocumento2 páginasWhite Gold Marine Services, Inc Vs Pioneer Insurance and Surety Corporation and The Steamship Mutual Underwriting Association (Bermuda) LTD DigestAbilene Joy Dela CruzAinda não há avaliações

- JAIME T. GAISANO, Petitioner, vs. DEVELOPMENT INSURANCE AND SURETY CORPORATION, RespondentDocumento3 páginasJAIME T. GAISANO, Petitioner, vs. DEVELOPMENT INSURANCE AND SURETY CORPORATION, RespondentWilliam Azucena100% (1)

- Makati Tuscany Condominium Corporation Vs Court of AppealsDocumento1 páginaMakati Tuscany Condominium Corporation Vs Court of AppealssappAinda não há avaliações

- Malayan Insurance vs. Pap Co. LTDDocumento2 páginasMalayan Insurance vs. Pap Co. LTDKelsey Olivar MendozaAinda não há avaliações

- UCPB General Insurance V Masagana TelemartDocumento3 páginasUCPB General Insurance V Masagana TelemartArtemisTzy100% (1)

- 07 United Merchants v. Country BankersDocumento3 páginas07 United Merchants v. Country BankershungryhippoAinda não há avaliações

- Development Insurance Corporation vs. Intermediate Appellate CourtDocumento2 páginasDevelopment Insurance Corporation vs. Intermediate Appellate CourtbrendamanganaanAinda não há avaliações

- Malayan Insurance Co., Inc. vs. Cruz Arnaldo DigestDocumento3 páginasMalayan Insurance Co., Inc. vs. Cruz Arnaldo DigestMan2x SalomonAinda não há avaliações

- Filipino Merchants Insurance v. CA DigestDocumento2 páginasFilipino Merchants Insurance v. CA DigestMan2x Salomon100% (2)

- Sps. Cha v. CA (Digest)Documento1 páginaSps. Cha v. CA (Digest)Tini GuanioAinda não há avaliações

- Firemans Fund Insurance vs. Jamila CoDocumento2 páginasFiremans Fund Insurance vs. Jamila CoKeangela Louise100% (1)

- Pan Malayan vs. CA Digest (Insurance)Documento2 páginasPan Malayan vs. CA Digest (Insurance)Elerlenne Lim100% (2)

- Violeta Lalican VS Insular Life DigestDocumento2 páginasVioleta Lalican VS Insular Life DigestAlex Villahermosa100% (2)

- Sun Life of Canada Vs SibyaDocumento2 páginasSun Life of Canada Vs SibyaParis Valencia0% (1)

- Philippine Phoenix Surety Vs WoodworkDocumento4 páginasPhilippine Phoenix Surety Vs WoodworkSamael MorningstarAinda não há avaliações

- American Home Assurance V ChuaDocumento1 páginaAmerican Home Assurance V ChuaRoxanne AvilaAinda não há avaliações

- United Merchants Corporation Vs Country Bankers Insurance Corporation DigestDocumento3 páginasUnited Merchants Corporation Vs Country Bankers Insurance Corporation DigestAbilene Joy Dela CruzAinda não há avaliações

- Philamcare Health Systems V CADocumento3 páginasPhilamcare Health Systems V CAsmtm06100% (1)

- Young vs. Midland Textile Insurance CompanyDocumento2 páginasYoung vs. Midland Textile Insurance CompanyMan2x Salomon100% (2)

- Argente v. West Coast Life InsuranceDocumento2 páginasArgente v. West Coast Life InsuranceMan2x Salomon100% (1)

- ACCFA v. Alpha Insurance DigestDocumento2 páginasACCFA v. Alpha Insurance Digestviva_33Ainda não há avaliações

- Thelma Vda. de Canilang v. CADocumento1 páginaThelma Vda. de Canilang v. CAlealdeosaAinda não há avaliações

- Malayan Insurance Corp v. CA - DIGESTDocumento3 páginasMalayan Insurance Corp v. CA - DIGESTAaron Ariston100% (1)

- Sunlife Canada v. CA Case DigestDocumento2 páginasSunlife Canada v. CA Case DigestYodh Jamin Ong100% (1)

- Philamcare Health Systems, Inc. vs. Court of Appeals (DIGEST)Documento2 páginasPhilamcare Health Systems, Inc. vs. Court of Appeals (DIGEST)Ann Catalan100% (1)

- Cathay Vs Ca - DIGESTDocumento1 páginaCathay Vs Ca - DIGESTermorsAinda não há avaliações

- DIGEST - The Insular Life Assurance Company, Ltd. vs. KhuDocumento3 páginasDIGEST - The Insular Life Assurance Company, Ltd. vs. KhuJass ElardoAinda não há avaliações

- FIRST QUEZON CITY INSURANCE CO V CADocumento1 páginaFIRST QUEZON CITY INSURANCE CO V CAPraisah Marjorey PicotAinda não há avaliações

- The Insular Life vs. Khu, GR 195176, April 18, 2016Documento2 páginasThe Insular Life vs. Khu, GR 195176, April 18, 2016Julie Anne GarciaAinda não há avaliações

- General Insurance V. NG Hua: GR No. L-14373, Jan 30, 1960Documento8 páginasGeneral Insurance V. NG Hua: GR No. L-14373, Jan 30, 1960Reynaldo YuAinda não há avaliações

- Insular Life Assurance Company Vs FelicianoDocumento1 páginaInsular Life Assurance Company Vs FelicianoKayzer SabaAinda não há avaliações

- Arce Vs Capital InsuranceDocumento2 páginasArce Vs Capital Insurancethornapple25Ainda não há avaliações

- Gulf Resorts Inc. v. Philippine Charter Insurance Corporation DigestDocumento2 páginasGulf Resorts Inc. v. Philippine Charter Insurance Corporation DigestCaroline A. Legaspino100% (1)

- Digest of Sun Insurance Office, Ltd. v. CA (G.R. No. 89741)Documento2 páginasDigest of Sun Insurance Office, Ltd. v. CA (G.R. No. 89741)Rafael Pangilinan100% (1)

- New Life Enterprises v. CADocumento4 páginasNew Life Enterprises v. CACourtney TirolAinda não há avaliações

- 02 - Qua Chee Gan v. Law UnionDocumento1 página02 - Qua Chee Gan v. Law UnionperlitainocencioAinda não há avaliações

- Eagle Star V Chia YuDocumento2 páginasEagle Star V Chia YuArrha De Leon100% (2)

- Pan Malayan Ins. Corp. v. Court of AppealsDocumento1 páginaPan Malayan Ins. Corp. v. Court of AppealsHaryet SupeAinda não há avaliações

- Soliman v. U.S. LifeDocumento1 páginaSoliman v. U.S. Lifeperlitainocencio100% (1)

- Insurance: Verendia V. Ca G.R. No. 75605 January 22, 1993Documento2 páginasInsurance: Verendia V. Ca G.R. No. 75605 January 22, 1993LaraAinda não há avaliações

- Gulf Resorts Inc Vs Philippine Charter Insurance CorpDocumento2 páginasGulf Resorts Inc Vs Philippine Charter Insurance CorpJ. LapidAinda não há avaliações

- Malayan vs. Arnaldo - DigestDocumento2 páginasMalayan vs. Arnaldo - Digestdamp_pradg100% (1)

- Calanoc v. Court of AppealsDocumento1 páginaCalanoc v. Court of AppealsRebecca ChanAinda não há avaliações

- Insurance Case #048 Malayan Insurance Co. Inc. vs. PAP Ltd. Co (Phil. BR)Documento2 páginasInsurance Case #048 Malayan Insurance Co. Inc. vs. PAP Ltd. Co (Phil. BR)Ma. Cielito Carmela Gabrielle G. Mateo100% (1)

- 05 Calanoc v. CADocumento1 página05 Calanoc v. CAkmand_lustregAinda não há avaliações

- Insurance Country Bankers Vs LiangaDocumento2 páginasInsurance Country Bankers Vs LiangaKaye de Leon0% (1)

- CD - 11. Edillon vs. Manila Bankers Life InsuranceDocumento2 páginasCD - 11. Edillon vs. Manila Bankers Life InsuranceAlyssa Alee Angeles JacintoAinda não há avaliações

- Biagtan v. Insular LifeDocumento2 páginasBiagtan v. Insular LifeIldefonso Hernaez100% (2)

- Geagonia vs. Court of Appeals DigestDocumento2 páginasGeagonia vs. Court of Appeals DigestKaren Jane Palmiano100% (2)

- Digest of Fortune Insurance and Surety Co. v. CA (G.R. No. 115278)Documento2 páginasDigest of Fortune Insurance and Surety Co. v. CA (G.R. No. 115278)Rafael Pangilinan100% (1)

- Saura Import & Export Co., Inc. v. Philippine International Surety Co., Inc.Documento2 páginasSaura Import & Export Co., Inc. v. Philippine International Surety Co., Inc.Charmila SiplonAinda não há avaliações

- 2 UNITED MERCHANTS CORPORATION Vs COUNTRY BANKERS INSURANCE CORPORATION DigestDocumento3 páginas2 UNITED MERCHANTS CORPORATION Vs COUNTRY BANKERS INSURANCE CORPORATION DigestAbilene Joy Dela CruzAinda não há avaliações

- 1 Pioneer Insurance V Yap Case DigestDocumento2 páginas1 Pioneer Insurance V Yap Case DigestApril Gan CasabuenaAinda não há avaliações

- Saturnino V PhilamDocumento1 páginaSaturnino V Philammb_estanislaoAinda não há avaliações

- Insurance Case 17 - Saturnino Vs Philam LifeDocumento2 páginasInsurance Case 17 - Saturnino Vs Philam LifeOppa KyuAinda não há avaliações

- Saturnino vs. Phil American LifeDocumento2 páginasSaturnino vs. Phil American LifeKelsey Olivar MendozaAinda não há avaliações

- Case # 88Documento2 páginasCase # 88Annabelle BustamanteAinda não há avaliações

- !court: 3repubhc of Tbe F'btlippinegDocumento15 páginas!court: 3repubhc of Tbe F'btlippinegAnnabelle BustamanteAinda não há avaliações

- Case # 89Documento2 páginasCase # 89Annabelle BustamanteAinda não há avaliações

- !court - .: 31/ - Epubltt of TbeDocumento17 páginas!court - .: 31/ - Epubltt of TbeAnnabelle BustamanteAinda não há avaliações

- (SMA), Dated February 26, 2008, Was Purportedly Executed by Nuvoland and SilvericonDocumento8 páginas(SMA), Dated February 26, 2008, Was Purportedly Executed by Nuvoland and SilvericonAnnabelle BustamanteAinda não há avaliações

- C.A. G.R. SP No. 53806Documento6 páginasC.A. G.R. SP No. 53806Annabelle BustamanteAinda não há avaliações

- F : - MPTT - : $upreme QtourtDocumento8 páginasF : - MPTT - : $upreme QtourtAnnabelle BustamanteAinda não há avaliações

- Supreme CourtDocumento4 páginasSupreme CourtAnnabelle BustamanteAinda não há avaliações

- G.R. Nos. 174941 February 1, 2012 Antonio P. Salenga and National Labor Relations Commission, Petitioners, Court of Appeals and Clark Development Corporation, RespondentsDocumento11 páginasG.R. Nos. 174941 February 1, 2012 Antonio P. Salenga and National Labor Relations Commission, Petitioners, Court of Appeals and Clark Development Corporation, RespondentsAnnabelle BustamanteAinda não há avaliações

- G.R. No. 160827 June 18, 2014 Netlink Computer Incorporated, Petitioner, ERIC DELMO, RespondentDocumento4 páginasG.R. No. 160827 June 18, 2014 Netlink Computer Incorporated, Petitioner, ERIC DELMO, RespondentAnnabelle BustamanteAinda não há avaliações

- G.R. No. 82819 February 8, 1989 LUZ LUMANTA, ET AL., Petitioners, National Labor Relations Commission and Food Terminal, Inc., RespondentsDocumento2 páginasG.R. No. 82819 February 8, 1989 LUZ LUMANTA, ET AL., Petitioners, National Labor Relations Commission and Food Terminal, Inc., RespondentsAnnabelle BustamanteAinda não há avaliações

- Koronado B. Apuzen and Jose C. Espinas For Petitioners. The Solicitor General For Public Respondent. Dominguez & Paderna Law Offices Co. For Private RespondentDocumento3 páginasKoronado B. Apuzen and Jose C. Espinas For Petitioners. The Solicitor General For Public Respondent. Dominguez & Paderna Law Offices Co. For Private RespondentAnnabelle BustamanteAinda não há avaliações

- Lastimoso VS AsayoDocumento1 páginaLastimoso VS AsayoAnnabelle BustamanteAinda não há avaliações

- Procedure For Election ContestsDocumento5 páginasProcedure For Election ContestsAnnabelle BustamanteAinda não há avaliações

- Grepalife Vs CADocumento1 páginaGrepalife Vs CAAnnabelle BustamanteAinda não há avaliações

- B. Special ActionsDocumento2 páginasB. Special ActionsAnnabelle BustamanteAinda não há avaliações

- BENIGN OVARIAN DISEASES - Updated January 2018Documento31 páginasBENIGN OVARIAN DISEASES - Updated January 2018daniel100% (1)

- Sports Massage Therapist - Sports Injury ChiropractorDocumento3 páginasSports Massage Therapist - Sports Injury ChiropractorDr. Dale MacdonaldAinda não há avaliações

- Potter & Perry: Fundamentals of Nursing, 7 EditionDocumento11 páginasPotter & Perry: Fundamentals of Nursing, 7 Editionmissy23pap100% (1)

- Practice Test Questions Downloaded From FILIPINO NURSES CENTRALDocumento4 páginasPractice Test Questions Downloaded From FILIPINO NURSES CENTRALFilipino Nurses Central100% (1)

- BIOL 2210 Chapter 6, Integument System-1Documento15 páginasBIOL 2210 Chapter 6, Integument System-1KellyPatrick SpencerAinda não há avaliações

- Obstetrical Nursing NotesDocumento25 páginasObstetrical Nursing NotesFreeNursingNotes81% (16)

- Zentel™ Albendazole: Page 1 of 5Documento5 páginasZentel™ Albendazole: Page 1 of 5zain qadriAinda não há avaliações

- CPG Management of Breast Cancer (2nd Edition) 2010 PDFDocumento100 páginasCPG Management of Breast Cancer (2nd Edition) 2010 PDFNana Nurliana NoorAinda não há avaliações

- Hemothorax - Background, Anatomy, Pathophysiology PDFDocumento6 páginasHemothorax - Background, Anatomy, Pathophysiology PDFHendriawan PutraAinda não há avaliações

- Identifying VariablesDocumento4 páginasIdentifying VariablesAllan CastroAinda não há avaliações

- Normal Menstrual CycleDocumento20 páginasNormal Menstrual CycleTrevor UratelAinda não há avaliações

- Transgenic ValidationDocumento22 páginasTransgenic ValidationSyama J.S33% (6)

- Sabrina's Brochure: Mariana Burca Allstaff Training ConsultantsDocumento4 páginasSabrina's Brochure: Mariana Burca Allstaff Training ConsultantsIrina DumitrescuAinda não há avaliações

- Blumgart PDFDocumento815 páginasBlumgart PDFrensobger87% (15)

- Sujok Therapy and Treatment of DiseasesDocumento11 páginasSujok Therapy and Treatment of DiseasesDoctor A Sethi100% (1)

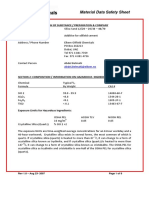

- Silica Sand MSDSDocumento8 páginasSilica Sand MSDSizzybjAinda não há avaliações

- Enzymes of Clinical SignificanceDocumento65 páginasEnzymes of Clinical SignificancepaulaOrialAinda não há avaliações

- Star Super Surplus Floater BrochureDocumento5 páginasStar Super Surplus Floater BrochurepunAinda não há avaliações

- RBC and WBC MorphologyDocumento165 páginasRBC and WBC MorphologyZeeshan Yousuf100% (1)

- Living With Hormone Therapy IfmDocumento68 páginasLiving With Hormone Therapy Ifmapi-675909478Ainda não há avaliações

- Cancer Is DEAD Cancer Cures From A To ZDocumento169 páginasCancer Is DEAD Cancer Cures From A To Zcamjob80% (5)

- Perichondritis - Not Just Simple Cellulitis - REBEL EM - Emergency Medicine BlogDocumento8 páginasPerichondritis - Not Just Simple Cellulitis - REBEL EM - Emergency Medicine BlogMarica SibulovAinda não há avaliações

- Differences Between Monozygotic and Dizygotic Twins: RD RDDocumento11 páginasDifferences Between Monozygotic and Dizygotic Twins: RD RDprism1702Ainda não há avaliações

- Germany CancerDocumento6 páginasGermany CancerDaniel VenablesAinda não há avaliações

- Causes, Risk Factors, and PreventionDocumento19 páginasCauses, Risk Factors, and PreventionvictorAinda não há avaliações

- CPT PCM NHSNDocumento126 páginasCPT PCM NHSNEngDbtAinda não há avaliações

- Rheumatoid ArthritisDocumento14 páginasRheumatoid ArthritisLorebell100% (5)

- S&P Pharma Industry Overview - 11252010Documento49 páginasS&P Pharma Industry Overview - 11252010earajesh100% (1)

- OsteoporosisDocumento11 páginasOsteoporosisNisaar Jogi100% (1)