Escolar Documentos

Profissional Documentos

Cultura Documentos

Romania Investment MarketView H1 2016

Enviado por

EvaluareDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Romania Investment MarketView H1 2016

Enviado por

EvaluareDireitos autorais:

Formatos disponíveis

MARKETVIEW

Romania Investment, H1 2016

Retail and office sectors have

regained market share

compared to industrial sector

Investment volume

Prime office yield

Prime shopping centre yield

Prime industrial yield

+107% HoH

7.5% QoQ

7.25 % QoQ

8.75 % QoQ

Chart 1: Investment volume per sector H1 2011 - H1 2016

800

700

600

500

400

300

200

100

EUR mln.

H1 2011

H2 2011

Retail

H1 2012

Office

H2 2012

H1 2013

Residential

H2 2013

H1 2014

Industrial

H2 2014

Hotels

H1 2015

H2 2015

H1 2016

Mixed-Use

Source: CBRE Research, Q2 2016

Key Topics

The total investment volume for H1 2016 was of over

EUR 359 million, compared to EUR 107 million

registered in the same period of 2015.

Top five investment transactions recorded during H1

2016 account for over 80% of the total investment

volume, the assets being located both in Bucharest and

in the province.

The retail and office assets properties were the most

transacted, meaning 88% of the total amount.

One of the largest single asset transactions in the last

years outside Bucharest was recorded in June Shopping City Sibiu - worth of EUR 100 million.

Foreign investors continue to dominate the local

market (NEPI, GTC), with local capital accounting for

less than 1% of the total investment volume.

No significant yield compression was recorded in the

last six months as prime properties were transacted at

similar parameters.

H1 2016 CBRE Research

2016 CBRE Real Estate Consultancy |

MARKETVIEW

ROMANIA INVESTMENT

Macroeconomic indicators

Chart 2 : Investment volume per sector H1 2013 - H1 2016

100%

90%

80%

70%

60%

During Q1 2016 Romania registered the highest

GDP growth within the EU28 area with 4.2%,

while the EU 28 average was of 1.8%, compared

to the same quarter of the previous year. The

European Commission is estimating that

Romanias GDP gwowth by the end of 2016 will

be at 4.2%, while for 2017 a decrease to 3.7% is

expected.

The National Bank of Romania has recently

revised the inflation rate estimation for 2016 at

-0.4%, while the previos estimation was at -0.6%.

As for 2017 the revised figure is at 2%, compared

to the previous forecast (2.7%).

The National Bank of Romanias key interest rate

remains at 1.75%.

The local unemployment rate was of 6.4% in

June 2016, while the figures for EU 28 and Euro

area were 8.6% respectively 10.1% according to

Eurostat.

As far as the exchange rate is concerned the local

currency during the first six months of 2016 was

rather stable comprising of 4.5 RON for 1 EUR, 4

RON for 1 USD and 5.4 RON for 1 GBP.

50%

40%

30%

20%

10%

0%

H1 2013

Retail

H1 2014

Office

H1 2015

Industrial

H1 2016

Hotel

Source: CBRE Research, Q2 2016

Chart 3: Investment volume by country of origin in H1 2016

Investment activity

Investment volumes in Romania in H1 2016

increased by 107% compared to H2 2015,

totalling EUR 359 million. Foreign investors

continued to dominate with groups already

present increasing their RO holdings (GTC, NEPI)

joined by new entrants (Partners Group,

Adamamerica).

During the first half of 2016 the highest volumes

were registered for the retail sector with a figure

of over EUR 170m, followed by office (EUR 143m)

and industrial sectors (EUR 43m).

Retail transactions continue to evidence an

upward pricing trend as increased demand and

improving finance drive yield compression.

Industrial transactions were noticeably muted

compared with 2015 due to a paucity of available

product, while investor appetite for the sector

remains high due to strong occupational

fundamentals.

Office transactions evidenced a variety of asset

profiles, mainly smaller lot-sizes in Bucharest.

H1 2016 CBRE Research

Source: CBRE Research, Q2 2016

Table 1: CEE prime yields Q2 2016

Retail SC

Office

Industrial

Bucharest

7.25%

7.50%

8.75%

Budapest

6.75%

6.75%

8.5%

Bratislava

6%

6.9%

7.75%

Prague

5.25%

5.50%

6.5%

Warsaw

5.50%

5.50%

6%

Source: CBRE Research, Q2 2016

2016 CBRE Real Estate Consultancy |

MARKETVIEW

ROMANIA INVESTMENT

Table 2: Top five investment transactions in H1 2016

Asset

Domain

Purchaser

Shopping City Sibiu

Retail

NEPI

Mega Mall

Retail

NEPI

City Gate

Office

GTC

Premium Point & Premium Plaza

Office

GTC

Industrial

Partners Group

A1 Business Park & Domnesti Business Park

Price (EUR mln)

100

over 72

(estimation)

over 60

(estimation)

over 35

(estimation)

over 30

(estimation)

Source: CBRE Research, companies

Yields

Outlook

Prime yields have compressed during the past 12

months from 8% to 7.25% for shopping centers,

from 7.75% to 7.5% for offices and from 9.5% to

8.75% for industrial. Significantly improved

finance terms in combination with an increased

yield delta to locations further west indicate

potential for further compression.

Several sizable on-going transactions entail that

2016 has the potential to exceed 2015 volumes

while the pipeline of anticipated disposal

processes indicates a continued rise in

investment volumes over the coming 18 months.

An increase in potential market entrants is being

registered across asset classes; however, its

relevance will ultimately be measured by process

participation. While wider-market movements

indicate increasing value in Romanian real

estate, potential investors will first be cautious

to satisfy themselves of property fundamentals

and of real estate advisory partners.

Chart 4: Bucharest prime yields Q2 2007 - Q2 2016

Source: CBRE Research, Q2 2016

H1 2016 CBRE Research

2016 CBRE Real Estate Consultancy |

MARKETVIEW

ROMANIA INVESTMENT

CONTACTS

Robert Paulson

Head of Investment Properties CBRE

Romania

+40 21 313 10 20

robert.paulson@cbre.com

Razvan Iorgu

Managing Director

+40 21 313 10 20

razvan.iorgu@cbre.com

Laura Dumea-Bencze

Head of Research Romania & CEE

Research Analyst

+40 21 313 10 20

laura.bencze@cbre.com

Marius Ene

Senior Analyst

+40 21 313 10 20

marius.ene@cbre.com

Definitions

Central and Eastern Europe (CEE) includes the

following countries: Bulgaria, Croatia, the Czech

Republic, Hungary, Poland, Romania, Russia, Serbia,

Slovakia and Ukraine.

Prime Rent Represents the top open-market tier of

rent that could be expected for a unit of standard size

(commensurate with demand in each location), of the

highest quality and specification and in the best

location in a market at the survey date. The Prime Rent

should reflect the level at which relevant transactions

are being completed in the market at the time, but

need not be exactly identical to any of them,

particularly if deal flow is very limited or made up of

unusual one-off deals. If there are no relevant

transactions during the survey period, the quoted

figure will be more hypothetical, based on an expert

opinion of market conditions.

Prime Yield - represents the yield that an investor

would receive when acquiring a grade/class A building

in a prime location (for offices in the CBD, for

example), which is fully let at current market value

rents. Prime Yield should reflect the level at which

relevant transactions are being completed in the

market at the time but need not be exactly identical to

any of them, particularly if deal flow is very limited or

made up of unusual one-off deals. If there are no

relevant transactions during the survey period, a

hypothetical yield should be quoted, and is not a

calculation based on particular transactions, but it is

an expert opinion formed in the light of market

conditions, but the same criteria on building location

and specification still apply.

FOLLOW US

To learn more about CBRE Research, or to access additional research reports, please visit the Global

Research Gateway at: www.cbre.com/researchgateway.com

Disclaimer: Information contained herein, including projections, has been obtained from sources believed to be reliable. While we do not doubt its accuracy,

we have not verified it and make no guarantee, warranty or representation about it. It is your responsibility to confirm independently its accuracy and

completeness. This information is presented exclusively for use by CBRE clients and professionals and all rights to the material are reserved and cannot be

reproduced without prior written permission of CBRE.

Você também pode gostar

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (119)

- AG-The Modernization of The BRICsDocumento231 páginasAG-The Modernization of The BRICs3301vmAinda não há avaliações

- Grimms Fairy TalesDocumento348 páginasGrimms Fairy TalestaraleighAinda não há avaliações

- Melamchi Water Supply Project - 2011 PDFDocumento150 páginasMelamchi Water Supply Project - 2011 PDFSuman AryalAinda não há avaliações

- SM Chapter 13Documento52 páginasSM Chapter 13Fedro Susantana0% (1)

- Hershey's Strengths in Market Leadership, Social Responsibility & InnovationDocumento2 páginasHershey's Strengths in Market Leadership, Social Responsibility & InnovationSamantha Dianne CalanaoAinda não há avaliações

- ConfirmationDocumento2 páginasConfirmationsunny singhAinda não há avaliações

- Sample Negotiation PlanDocumento3 páginasSample Negotiation PlanNikhil Srivastava100% (1)

- City of Mountain View (CA) Nexus Study For Below-Market Housing Fees (2011)Documento83 páginasCity of Mountain View (CA) Nexus Study For Below-Market Housing Fees (2011)wmartin46Ainda não há avaliações

- NATL Financial ModelDocumento38 páginasNATL Financial ModelKrishna Moorthy0% (1)

- Inside Debt: U.S. Markets Today Chart of The DayDocumento6 páginasInside Debt: U.S. Markets Today Chart of The DayBoris MangalAinda não há avaliações

- Problem I Philippine ViewpointDocumento14 páginasProblem I Philippine ViewpointAnonymous PBLfEOJAinda não há avaliações

- Blackrock Sample Financial ReportingDocumento497 páginasBlackrock Sample Financial Reportingduc anhAinda não há avaliações

- Corporate+Presentation August 2015 Enercom FINALDocumento27 páginasCorporate+Presentation August 2015 Enercom FINALpco123Ainda não há avaliações

- Shared Currencies and Exchange Rates AX2012Documento16 páginasShared Currencies and Exchange Rates AX2012sha3llanAinda não há avaliações

- Small Group Case Studies Fall Assignment 2010Documento4 páginasSmall Group Case Studies Fall Assignment 2010Laurence Ibay Palileo0% (2)

- Actual TestDocumento5 páginasActual TestMehroz KhanAinda não há avaliações

- 1Documento13 páginas1gamalbedAinda não há avaliações

- frm指定教材 risk management & derivativesDocumento1.192 páginasfrm指定教材 risk management & derivativeszeno490Ainda não há avaliações

- Hedging With Foreign Currency Futures at Transcend IncDocumento5 páginasHedging With Foreign Currency Futures at Transcend IncYuyun Purwita SariAinda não há avaliações

- Keith Weiner The Swiss Franc Will CollapseDocumento16 páginasKeith Weiner The Swiss Franc Will CollapseTREND_7425Ainda não há avaliações

- TCodeDocumento12 páginasTCodeSudhakar RaiAinda não há avaliações

- The Little Black Book For Managers by John Cross, Rafael Gomez and Kevin MoneyDocumento35 páginasThe Little Black Book For Managers by John Cross, Rafael Gomez and Kevin MoneyCapstone PublishingAinda não há avaliações

- Ecb Electronification of PaDocumento198 páginasEcb Electronification of PaFlaviub23Ainda não há avaliações

- Ashi StrategyDocumento5 páginasAshi StrategypriyasujathaAinda não há avaliações

- Greqia P Monetare 2Documento14 páginasGreqia P Monetare 2Rozalinda HasanajAinda não há avaliações

- Chap 019Documento36 páginasChap 019skuad_024216Ainda não há avaliações

- 3 6int 2006 Dec QDocumento9 páginas3 6int 2006 Dec QHannan SalimAinda não há avaliações

- Macroeconomics Money Market MCQsDocumento3 páginasMacroeconomics Money Market MCQsTan NguyenAinda não há avaliações

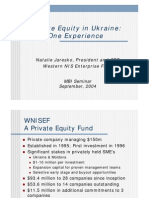

- WNISEF Experience in UkraineDocumento21 páginasWNISEF Experience in UkraineVitaliy HamuhaAinda não há avaliações

- Compensation 9th Edition Chapter 1Documento29 páginasCompensation 9th Edition Chapter 1Sarfaraj OviAinda não há avaliações