Escolar Documentos

Profissional Documentos

Cultura Documentos

Ch04 Financial Markets

Enviado por

Honey VashishthaDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Ch04 Financial Markets

Enviado por

Honey VashishthaDireitos autorais:

Formatos disponíveis

11/29/16

4-1 The Demand for Money

Financial

Financial Markets

Markets

CHAPTER 4

Money, which you can use for transactions, pays no

interest. There are two types of money: currency, coins

and bills, and checkable deposits, the bank deposits

on which you can write checks.

Bonds pay a positive interest rate, i, but they cannot be

used for transactions.

Markets

The proportions of money and bonds you wish to hold depend

mainly on two variables:

Fer nand o Quijano

Chapter 4: Financial

Pr ep ar ed b y:

and Y vonn Quijano

Copyright 2009 Pearson Education, Inc. Publishing as Prentice Hall Macroeconomics, 5/e Olivier Blanchard

Your level of transactions

The interest rate on bonds

Money market funds pool together the funds of many

people. The funds are then used to buy bondstypical ly

government bonds.

Copyright 2009 Pearson Education, Inc. Publishing as Prentice Hall Macroeconomics, 5/e Olivier Blanchard

2 of 32

4-1 The Demand for Money

Deriving the Demand for Money

Semantic Traps: Money, Income, and Wealth

Income is what you earn from working plus what you receive in

interest and dividends. It is a flowthat is, it is expressed per unit of

time.

Lets go from this discussion to an equation describing the

demand for money.

M d = $Y L(i)

( )

Saving is that part of after-tax income that is not spent. It is also a

flow. Savings is sometimes used as a synonym for wealth (a term

we will not use in this book).

Investment is a term economists reserve for the purchase of new

capital goods, from machines to plants to office buildings. When you

want to talk about the purchase of shares or other financial assets,

you should refer them as a financial investment.

Copyright 2009 Pearson Education, Inc. Publishing as Prentice Hall Macroeconomics, 5/e Olivier Blanchard

3 of 32

Markets

Chapter 4: Financial

Chapter 4: Financial

Markets

Your financial wealth, or simply wealth, is the value of all your

financial assets minus all your financial liabilities. In contrast to

income or saving, which are flow variables, financial wealth is a stock

variable.

Read this equation in the following way: The demand for

d

money, M , is equal to nominal income, $Y, times a function

of the interest rate, i, with the function denoted by L(i ).

The demand for money:

increases in proportion to nominal income ($Y), and

depends negatively on the interest rate (L(i) and the

negative sign underneath).

Copyright 2009 Pearson Education, Inc. Publishing as Prentice Hall Macroeconomics, 5/e Olivier Blanchard

4 of 32

4-1 The Demand for Money

Deriving the Demand for Money

Who Holds U.S. Currency?

According to household surveys, in 2006, the average U.S. household

held $1,600 in currency. If multiplied by the number of households in the

U.S. the total would come to around $170 billion. However, the Federal

Reserve Board knows the amount of currency in circulation was much

higher, $750 billion.

M = $YL(i )

d

( )

Figure 4 - 1

Clearly some currency was held by firms rather than by households. And

some was held by those involved in the underground economy or in illegal

activities. However, this leaves 66% of the total unaccounted for. The

balance of which is abroad and held by foreigners.

Copyright 2009 Pearson Education, Inc. Publishing as Prentice Hall Macroeconomics, 5/e Olivier Blanchard

Markets

For a given level of nominal

income, a lower interest rate

increases the demand for

money. At a given interest rate,

an increase in nominal income

shifts the demand for money to

the right.

5 of 32

Chapter 4: Financial

Chapter 4: Financial

Markets

The Demand for Money

The fact that foreigners hold such a high proportion of the dollar bills in

circulation has two main macroeconomic implications.

First, the rest of the world, by being willing to hold U.S. currency, is making

in effect an interest-free loan to the United States of $500 billion.

Second, while we shall think of money demand as being determined by

the interest rate and the level of transactions in the country, it is clear that

U.S. money demand also depends on other factors.

Copyright 2009 Pearson Education, Inc. Publishing as Prentice Hall Macroeconomics, 5/e Olivier Blanchard

6 of 32

11/29/16

4-2 The Determination of the Interest Rate, I

4-2 The Determination of the Interest Rate, I

Money Demand, Money Supply, and the Equilibrium

Interest Rate

Money Demand, Money Supply, and the Equilibrium

Interest Rate

Figure 4 - 2

Equilibrium in financial markets requires that money supply

be equal to money demand, or that Ms = Md. Then using

this equation, the equilibrium condition is:

The Determination of the

Interest Rate

The interest rate must be such

that the supply of money

(which is independent of the

interest rate) is equal to the

demand for money (which does

depend on the interest rate).

Money Supply = Money demand

Markets

This equilibrium

relation is called the LM relation.

Copyright 2009 Pearson Education, Inc. Publishing as Prentice Hall Macroeconomics, 5/e Olivier Blanchard

7 of 32

Chapter 4: Financial

Chapter 4: Financial

Markets

M = $Y L(i)

4-2 The Determination of the Interest Rate, I

Money Demand, Money Supply, and the Equilibrium

Interest Rate

Money Demand, Money Supply, and the Equilibrium

Interest Rate

Figure 4 - 4

An increase in nominal income

leads to an increase in the

interest rate.

An increase in the supply of

money leads to a decrease in

the interest rate.

Copyright 2009 Pearson Education, Inc. Publishing as Prentice Hall Macroeconomics, 5/e Olivier Blanchard

9 of 32

Chapter 4: Financial

Chapter 4: Financial

Markets

The Effects of an

Increase in the Money

Supply on the Interest

Rate

Markets

The Effects of an

Increase in Nominal

Income on the Interest

Rate

Copyright 2009 Pearson Education, Inc. Publishing as Prentice Hall Macroeconomics, 5/e Olivier Blanchard

10 of 32

4-2 The Determination of the Interest Rate, I

4-2 The Determination of the Interest Rate, I

Monetary Policy and Open Market Operations

Monetary Policy and Open Market Operations

Open market operations

Open market operations

Figure 4 - 5

Open-market operations, which take place in the

open market for bonds, are the standard method

central banks use to change the money stock in modern

economies.

The Balance Sheet of

the Central Bank and the

Effects of an

Expansionary Open

Market Operation

If the central bank sells bonds, this operation is called a

contractionary open market operation because the

central bank decreases (contracts) the supply of money.

Copyright 2009 Pearson Education, Inc. Publishing as Prentice Hall Macroeconomics, 5/e Olivier Blanchard

11 of 32

Chapter 4: Financial

Markets

If the central bank buys bonds, this operation is called

an expansionary open market operation because the

central bank increases (expands) the supply of money.

Markets

8 of 32

4-2 The Determination of the Interest Rate, I

Figure 4 - 3

Chapter 4: Financial

Copyright 2009 Pearson Education, Inc. Publishing as Prentice Hall Macroeconomics, 5/e Olivier Blanchard

The assets of the central bank

are the bonds it holds. The

liabilities are the stock of

money in the economy. An

open market operation in which

the central bank buys bonds

and issues money increases

both assets and liabilities by

the same amount.

Copyright 2009 Pearson Education, Inc. Publishing as Prentice Hall Macroeconomics, 5/e Olivier Blanchard

12 of 32

11/29/16

4-2 The Determination of the Interest Rate, I

4-2 The Determination of the Interest Rate, I

Monetary Policy and Open Market Operations

Monetary Policy and Open Market Operations

Bond Prices and Bond Yields

Bond Prices and Bond Yields

Treasury bills, or T-bills are issued by the U.S. government

promising payment in a year or less. If you buy the bond

today and hold it for a year, the rate of return (or interest) on

holding a $100 bond for a year is ($100 - $PB )/$PB .

If we are given the interest rate, we can figure out the price

of the bond using the same formula.

i=

$100 $ PB

$ PB

$ PB =

Markets

Lets summarize what we have learned so far in this chapter:

The interest rate is determined by the equality of the supply

of money and the demand for money.

By changing the supply of money, the central bank can

affect the interest rate.

The central bank changes the supply of money through open

market operations, which are purchases or sales of bonds

for money.

$100

1+ i

Copyright 2009 Pearson Education, Inc. Publishing as Prentice Hall Macroeconomics, 5/e Olivier Blanchard

13 of 32

Chapter 4: Financial

Chapter 4: Financial

Markets

Understandin g the relation between the interest rate and bond

prices will prove useful both here and later in this book:

Copyright 2009 Pearson Education, Inc. Publishing as Prentice Hall Macroeconomics, 5/e Olivier Blanchard

14 of 32

4-2 The Determination of the Interest Rate, I

Choosing Money or Choosing the Interest Rate?

Money, Bonds, and Other Assets

We have been looking at an economy with only two assets:

money and bonds. This is obviously a much simplified

version of actual economies, with their many financial

assets and many financial markets.

Copyright 2009 Pearson Education, Inc. Publishing as Prentice Hall Macroeconomics, 5/e Olivier Blanchard

Markets

Figure 4 - 4

15 of 32

Chapter 4: Financial

Markets

Chapter 4: Financial

Open market operations in which the central bank increases

the money supply by buying bonds lead to an increase in the

price of bonds and a decrease in the interest rate.

Open market operations in which the central bank decreases

the money supply by selling bonds lead to a decrease in the

price of bonds and an increase in the interest rate.

4-2 The Determination of the Interest Rate, I

A decision by the central

bank to lower the interest

rate from i to i is equivalent

to increasing the money

supply.

There is one dimension, however, to which our model must

be extended. We have assumed that all money in the

economy consists of currency supplied by the central bank.

In the real world, money includes not only currency but also

checkable deposits.

Copyright 2009 Pearson Education, Inc. Publishing as Prentice Hall Macroeconomics, 5/e Olivier Blanchard

16 of 32

4-3 The Determination of Interest Rate, II*

4-3 The Determination of Interest Rate, II*

What Banks Do

What Banks Do

Financial intermediaries are institutions that receive

funds from people and firms, and use these funds to

buy bonds or stocks, or to make loans to other people

and firms.

Banks hold reserves for three reasons:

1. On any given day, some depositors withdraw cash from their

checking accounts, while others deposit cash into their

accounts.

Markets

Banks receive funds from people and firms who

either deposit funds directly or have funds sent to

their checking accounts. The liabilities of the banks

are therefore equal to the value of these checkable

deposits.

Banks keep as reserves some of the funds they

receive.

Copyright 2009 Pearson Education, Inc. Publishing as Prentice Hall Macroeconomics, 5/e Olivier Blanchard

17 of 32

Chapter 4: Financial

Markets

Chapter 4: Financial

2. In the same way, on any given day, people with accounts at

the bank write checks to people with accounts at other banks,

and people with accounts at other banks write checks to

people with accounts at the bank.

3. Banks are subject to reserve requirements. The actual

reserve ratio the ratio of bank reserves to bank checkable

deposits is about 10% in the United States today.

Copyright 2009 Pearson Education, Inc. Publishing as Prentice Hall Macroeconomics, 5/e Olivier Blanchard

18 of 32

11/29/16

4-3 The Determination of Interest Rate, II*

4-3 The Determination of Interest Rate, II*

What Banks Do

What Banks Do

Loans represent roughly 70% of banks non-reserve assets.

Bonds count for the rest, 30%.

Figure 4 - 6

The Balance Sheet of

Banks and the Balance

Sheet of the Central

Bank, Revisited

Markets

Copyright 2009 Pearson Education, Inc. Publishing as Prentice Hall Macroeconomics, 5/e Olivier Blanchard

19 of 32

Chapter 4: Financial

Chapter 4: Financial

Markets

The assets of the central bank are the bonds it holds. The

liabilities of the central bank are the money it has issued,

central bank money. The new feature is that not all of central

bank money is held as currency by the public. Some of it is

held as reserves by banks.

4-3 The Determination of Interest Rate, II*

The Supply and the Demand for Central Bank Money

The Supply and the Demand for Central Bank Money

Figure 4 - 7

The demand for central bank money is equal to the

demand for currency by people plus the demand for

reserves by banks.

The supply of central bank money is under the direct

control of the central bank.

The equilibrium interest rate is such that the demand and

the supply for central bank money are equal.

Copyright 2009 Pearson Education, Inc. Publishing as Prentice Hall Macroeconomics, 5/e Olivier Blanchard

Markets

Determinants of the

Demand and the Supply

of Central Bank Money

21 of 32

Chapter 4: Financial

Markets

20 of 32

4-3 The Determination of Interest Rate, II*

Lets think in terms of the supply and the demand for central

bank money.

Chapter 4: Financial

Copyright 2009 Pearson Education, Inc. Publishing as Prentice Hall Macroeconomics, 5/e Olivier Blanchard

Copyright 2009 Pearson Education, Inc. Publishing as Prentice Hall Macroeconomics, 5/e Olivier Blanchard

22 of 32

4-3 The Determination of Interest Rate, II*

The Supply and the Demand for Central Bank Money

Bank Runs

The Demand for Money

When people can hold both currency and checkable deposits,

the demand for money involves two decisions.

First, people must decide how much money to hold. Second,

they must decide how much of this money to hold in currency

and how much to hold in checkable deposits.

An alternative solution is narrow banking, which would

restrict banks to holding liquid, safe, government bonds,

such as T-bills.

We can assume that overall money demand is given by the

d

same equation as before: M = $Y L(i )

( )

Copyright 2009 Pearson Education, Inc. Publishing as Prentice Hall Macroeconomics, 5/e Olivier Blanchard

Markets

To avoid bank runs, the U.S. government provides

federal deposit insurance.

23 of 32

Chapter 4: Financial

Chapter 4: Financial

Markets

Rumors that a bank is not doing well and some loans will

not be repaid, will lead people to close their accounts at

that bank. If enough people do so, the bank will run out

of reservesa bank run.

The demands for currency and checkable deposits are given

by:

d

d

CU = c M

D d = (1 c) M d

Copyright 2009 Pearson Education, Inc. Publishing as Prentice Hall Macroeconomics, 5/e Olivier Blanchard

24 of 32

11/29/16

4-3 The Determination of Interest Rate, II*

4-3 The Determination of Interest Rate, II*

The Supply and the Demand for Central Bank Money

The Supply and the Demand for Central Bank Money

The Demand for Reserves

The Demand for Central Bank Money

The larger the amount of checkable deposits, the larger

the amount of reserves the banks must hold, for both

precautionary and regulatory reasons.

The demand for central bank money is equal to the sum of

the demand for currency and the demand for reserves.

H d = CU d + R d

The relation between reserves (R) and deposits (D):

Replace CU d and R d with their expressions from equations

(4.4) and (4.7) to get:

Rd =

(1

c) M d

Copyright 2009 Pearson Education, Inc. Publishing as Prentice Hall Macroeconomics, 5/e Olivier Blanchard

25 of 32

(1 c )

Md

Finally, replace the overall demand for money, M d ,

with its expression from equation (4.3) to get:

Hd = c+

(1 c )

$Y L ( i )

Copyright 2009 Pearson Education, Inc. Publishing as Prentice Hall Macroeconomics, 5/e Olivier Blanchard

26 of 32

The Supply and the Demand for Central Bank Money

The Determination of the Interest Rate

Figure 4 - 8

Equilibrium in the

Market for Central Bank

Money and the

Determination of the

Interest Rate

(1

c ) $Y L ( i )

Copyright 2009 Pearson Education, Inc. Publishing as Prentice Hall Macroeconomics, 5/e Olivier Blanchard

27 of 32

Chapter 4: Financial

Hd = c+

Markets

Or restated as:

Markets

= c+

The Supply and the Demand for Central Bank Money

H = Hd

4-4 Two Alternative Ways of Looking

at the Equilibrium*

The Federal Funds Market and the Federal Funds Rate

The equilibrium interest rate is

such that the supply of central

bank money is equal to the

demand for central bank

money.

Copyright 2009 Pearson Education, Inc. Publishing as Prentice Hall Macroeconomics, 5/e Olivier Blanchard

1

H = $Y L(i)

[c + (1 c)]

H CU d = R d

Supply of money = Demand for money

29 of 32

Chapter 4: Financial

Markets

The federal funds market is a market for bank reserves.

In equilibrium, demand (Rd) must equal supply (H-CUd).

The interest rate determined in the market is called the

federal funds rate.

Copyright 2009 Pearson Education, Inc. Publishing as Prentice Hall Macroeconomics, 5/e Olivier Blanchard

28 of 32

4-4 Two Alternative Ways of Looking

at the Equilibrium*

The Supply of Money, the Demand for Money, and the

Money Multiplier

The equilibrium condition that the supply and the demand

for bank reserves be equal is given by:

Markets

4-3 The Determination of Interest Rate, II*

In equilibrium, the supply of central bank money (H) is

equal to the demand for central bank money (Hd):

Chapter 4: Financial

(1 c ) M

4-3 The Determination of Interest Rate, II*

The Determination of the Interest Rate

Chapter 4: Financial

H d = cM d +

Markets

The demand for reserves by banks is given by:

Chapter 4: Financial

Chapter 4: Financial

Markets

R= D

The overall supply of money is equal to central bank money

times the money multiplier:

1/ ( c +

(1 c ) )

High-powered money is the term used to reflect the fact

that the overall supply of money depends in the end on the

amount of central bank money (H), or monetary base.

Copyright 2009 Pearson Education, Inc. Publishing as Prentice Hall Macroeconomics, 5/e Olivier Blanchard

30 of 32

11/29/16

4-4 Two Alternative Ways of Looking

at the Equilibrium*

The Supply of Money, the Demand for Money, and the

Money Multiplier

Key Terms

Understanding the Money Multiplier

Markets

Copyright 2009 Pearson Education, Inc. Publishing as Prentice Hall Macroeconomics, 5/e Olivier Blanchard

31 of 32

Chapter 4: Financial

Chapter 4: Financial

Markets

We can think of the ultimate increase in the money

supply as the result of successive rounds of purchases

of bondsthe first started by the Fed in its open market

operation, the following rounds by banks.

Federal Reserve Bank (Fed)

income

flow

saving

savings

financial wealth, wealth

stock

investment

financial investment

money

currency

checkable deposits

bonds

money market funds

LM relation

open market operation

expansionary, and contractionary,

open market operation

Treasury bill, (T-bill)

financial intermediaries

(bank) reserves

reserve ratio

bank run

federal deposit insurance

narrow banking

central bank money

federal funds market

federal funds rate

money multiplier

high-powered money

monetary base

Copyright 2009 Pearson Education, Inc. Publishing as Prentice Hall Macroeconomics, 5/e Olivier Blanchard

32 of 32

Você também pode gostar

- Statisitical TestDocumento190 páginasStatisitical TestHoney VashishthaAinda não há avaliações

- S/No. Attribute Project Manager General Manager Chief Operating Officer 1Documento2 páginasS/No. Attribute Project Manager General Manager Chief Operating Officer 1Honey VashishthaAinda não há avaliações

- Mdi Gurgaon Human Resource Management and Industrial RelationsDocumento12 páginasMdi Gurgaon Human Resource Management and Industrial RelationsHoney VashishthaAinda não há avaliações

- Operatius Case Study CompetitionDocumento5 páginasOperatius Case Study CompetitionHoney VashishthaAinda não há avaliações

- MrsFieldCookies ODC Group03Documento1 páginaMrsFieldCookies ODC Group03Honey VashishthaAinda não há avaliações

- Economic Survey of Delhi 2014-15Documento359 páginasEconomic Survey of Delhi 2014-15Honey VashishthaAinda não há avaliações

- Budget 2016: A Comprehensive Sector Specific Analysis March 2016Documento28 páginasBudget 2016: A Comprehensive Sector Specific Analysis March 2016Honey VashishthaAinda não há avaliações

- IR and Technological ChangeDocumento7 páginasIR and Technological ChangeHoney VashishthaAinda não há avaliações

- Electricity and Clean Cooking Strategy For India: Round) - inDocumento3 páginasElectricity and Clean Cooking Strategy For India: Round) - inHoney VashishthaAinda não há avaliações

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5795)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- Microsoft PowerPoint - ICT December Study Notes - ICT-MENTORSHIP-M4-PDF.11Documento35 páginasMicrosoft PowerPoint - ICT December Study Notes - ICT-MENTORSHIP-M4-PDF.11romaric0% (1)

- What Is The Present Value ofDocumento27 páginasWhat Is The Present Value ofJade Ballado-TanAinda não há avaliações

- Extension ExercisesDocumento10 páginasExtension Exercisesjackie.chanAinda não há avaliações

- The Conduct of Monetary Policy: Strategy and TacticsDocumento26 páginasThe Conduct of Monetary Policy: Strategy and TacticsLazaros KarapouAinda não há avaliações

- Part 2 Working Capital Management Qs PDFDocumento15 páginasPart 2 Working Capital Management Qs PDFAnuar LoboAinda não há avaliações

- Bloomberg QuickTake Jan-June 20Documento55 páginasBloomberg QuickTake Jan-June 20Ahmed AlHassan100% (1)

- Week 3 Tutorial ProblemsDocumento6 páginasWeek 3 Tutorial ProblemsWOP INVESTAinda não há avaliações

- Thabat Fund Fact Sheet - January 2021Documento4 páginasThabat Fund Fact Sheet - January 2021ResourcesAinda não há avaliações

- Nabil Standard Final ProjectDocumento29 páginasNabil Standard Final ProjectKafle BpnAinda não há avaliações

- Understanding Australian Accounting Standards 1st Edition Loftus Solutions ManualDocumento28 páginasUnderstanding Australian Accounting Standards 1st Edition Loftus Solutions Manualdarkishacerose5jf100% (20)

- Engineering Economics PDFDocumento74 páginasEngineering Economics PDFEng JuajuAinda não há avaliações

- Business and Society Stakeholders Ethics Public Policy 13th Edition Lawrence Test BankDocumento24 páginasBusiness and Society Stakeholders Ethics Public Policy 13th Edition Lawrence Test Bankraymondjohnsonsmjzyntckx100% (25)

- Interest/Maturity Gap and SensitivityDocumento11 páginasInterest/Maturity Gap and SensitivityJamie RossAinda não há avaliações

- Global Weekly Economic Update - Deloitte InsightsDocumento8 páginasGlobal Weekly Economic Update - Deloitte InsightsSaba SiddiquiAinda não há avaliações

- Nigerian Banks: Resilience Built inDocumento52 páginasNigerian Banks: Resilience Built inapanisile14142Ainda não há avaliações

- AEC - 12 - Q1 - 0401 - PS - Investments, Interest Rate, and Rental Concerns of Filipino EntrepreneursDocumento58 páginasAEC - 12 - Q1 - 0401 - PS - Investments, Interest Rate, and Rental Concerns of Filipino EntrepreneursVanessa Fampula FaigaoAinda não há avaliações

- FINS5530 Lecture 1 IntroductionDocumento42 páginasFINS5530 Lecture 1 IntroductionMaiNguyenAinda não há avaliações

- QFR (E-Series) March 2022Documento28 páginasQFR (E-Series) March 2022Napolean DynamiteAinda não há avaliações

- SCDL Solved Papers & Assignments - Security Analysis and Portfolio Management - Set 3Documento13 páginasSCDL Solved Papers & Assignments - Security Analysis and Portfolio Management - Set 3Om PrakashAinda não há avaliações

- Chapter 5Documento31 páginasChapter 5Emi NguyenAinda não há avaliações

- Solution Manual For Macroeconomics 5 e 5th Edition Stephen D WilliamsonDocumento15 páginasSolution Manual For Macroeconomics 5 e 5th Edition Stephen D WilliamsonVanessaMerrittdqes100% (44)

- Project - MBA Prajakat Todkar - 25032023Documento67 páginasProject - MBA Prajakat Todkar - 25032023Divya DhumalAinda não há avaliações

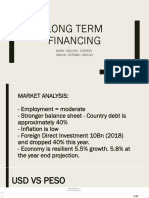

- LONG TERM FINANCING Finma FinalDocumento36 páginasLONG TERM FINANCING Finma FinalJane Baylon100% (2)

- Strategic MGMT - DaldaDocumento22 páginasStrategic MGMT - DaldaSuren Sonawane100% (1)

- Mathematics of Finance 8th Edition Brown Test BankDocumento112 páginasMathematics of Finance 8th Edition Brown Test BankLarryHicksetdrb100% (18)

- Liquidity Management: Corporate Financial Management 3e Emery Finnerty StoweDocumento52 páginasLiquidity Management: Corporate Financial Management 3e Emery Finnerty StoweMichelle GoAinda não há avaliações

- Acctg 320 Risk Management SummaryDocumento14 páginasAcctg 320 Risk Management SummaryMeroz JunditAinda não há avaliações

- Engineering EconomicsDocumento2 páginasEngineering EconomicsGoverdhan ShresthaAinda não há avaliações

- Chapter 1. L1.2 Principles of LendingDocumento5 páginasChapter 1. L1.2 Principles of LendingvibhuAinda não há avaliações

- Case Retirement PlanningDocumento11 páginasCase Retirement PlanningHimanshu Gupta0% (1)