Escolar Documentos

Profissional Documentos

Cultura Documentos

GST Examples

Enviado por

ThivanDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

GST Examples

Enviado por

ThivanDireitos autorais:

Formatos disponíveis

GST - A detailed explanation with examples!

1 of 29

http://www.caclubindia.com/articles/gst-a-detailed-explanation-with-exa...

Home (/) / Articles (/articles/) / GST (article_display_list_by_category.asp?cat_id=54)

Enrol & Get 50% discount on your CPT CS CMA sub for Dec16 Exam attempt Code EXAM50

(/coaching/)

GST - A detailed explanation with

examples!

Brief Intro: Introduction of Goods and Services

Tax

(GST)

will

indeed

be

an

important

perfection and the next logical step towards a

widespread indirect tax reforms in India. As per,

First

Discussion

Empowered

Paper

Committee

released

of

the

by

the

State

Finance Ministers on 10.11.2009, it has been

made clear that there would be a Dual GST in

India, i.e. taxation power lies with both by the

Centre and the State to levy the taxes on the Goods and Services.

The scheme was supposed to be implemented in India from 1st April 2016, however it may

get delayed since the NDA government does not have majority in Rajya sabha (The upper

house of parliament or the house of states).

Further, Punjab and Haryana were reluctant to give up purchase tax, Maharashtra was

unwilling to give up octroi, and all states wanted to keep petroleum and alcohol out of the

ambit of GST. Gujarat and Maharashtra want the additional one per cent levy extended

beyond the proposed two years, and raised to two per cent. Punjab wants purchase tax

outside GST.

11-11-2016 03:24 PM

GST - A detailed explanation with examples!

http://www.caclubindia.com/articles/gst-a-detailed-explanation-with-exa...

Constitutional Amendment: While the Centre is empowered to tax services and goods upto

the production stage, the States have the power to tax sale of goods. The States do not have

the powers to levy a tax on supply of services while the Centre does not have power to levy

tax on the sale of goods. Thus, the Constitution does not vest express power either in the

Central or State Government to levy a tax on the supply of goods and services. Moreover,

the Constitution also does not empower the States to impose tax on imports. Therefore, it is

essential to have Constitutional Amendments for empowering the Centre to levy tax on sale of

goods and States for levy of service tax and tax on imports and other consequential issue.

https://www.facebook.com

/sharer

/sharer.php?u=http

What is GST?

https://twitter.com

%3A%2F

/intent

%2Fwww%2Ecaclubindia%2Ecom%2Farticles%2Fgst%2Da%2Ddetailed%2Dexplanation%2Dwith%2Dexamples

/tweet?url=http

https://plus.google.com

G Goods

%2D%2D23835%2Easp%3Futm%5Fsource%3Darticles%26utm%5Fmedium%3Dsharebar%26utm%5Fcampaign%3Dsoci

%3A%2F

/share?url=http

%2Fwww%2Ecaclubindia%2Ecom%2Farticles%2Fgst%2Da%2Ddetailed%2Dexplanation%2Dwith%2Dexamples

%3A%2F

https://www.linkedin.com

%2D%2D23835%2Easp%3Futm%5Fsource%3Darticles%26utm%5Fmedium%3Dsharebar%26utm%5Fcampaign%3Dsoci

%2Fwww%2Ecaclubindia%2Ecom%2Farticles%2Fgst%2Da%2Ddetailed%2Dexplanation%2Dwith%2Dexamples

S Services

/shareArticle?url=http

text=GST

%2D%2D23835%2Easp%3Futm%5Fsource%3Darticles%26utm%5Fmedium%3Dsharebar%26utm%5Fcampaign%3Dsoci

%3A%2F

-/includes

A

%2Fwww%2Ecaclubindia%2Ecom%2Farticles%2Fgst%2Da%2Ddetailed%2Dexplanation%2Dwith%2Dexamples

detailed

/share_inc_more.asp?mod_id=23835&

T Tax

%2D%2D23835%2Easp%3Futm%5Fsource%3Darticles%26utm%5Fmedium%3Dsharebar%26utm%5Fcampaign%3Dsoci

module_name=articles&

explanation

with

share_title2=GST

and Service Tax (GST) is a comprehensive tax levy on manufacture, sale and

-examples!

A Goods

)

detailed

consumption of goods and service at a national level under which no distinction is made

explanation

with between goods and services for levying of tax. It will mostly substitute all indirect

examples!&share_url2=http

taxes levied on goods and services by the Central and State governments in India.

%3A%2F

%2Fwww%2Ecaclubindia%2Ecom%2Farticles%2Fgst%2Da%2Ddetailed%2Dexplanation%2Dwith%2Dexamples

GST is a tax on goods and services under which every person is liable to pay tax on his

%2D%2D23835%2Easp%3Futm%5Fsource%3Darticles%26utm%5Fmedium%3Dsharebar%26utm%5Fcampaign%3Dsoci

2 of 29

output and is entitled to get input tax credit (ITC) on the tax paid on its inputs(therefore a tax

on value addition only) and ultimately the final consumer shall bear the tax.

OBJECTIVES OF GST: One of the main objective of Goods & Service Tax(GST) would be to

eliminate the doubly taxation i.e. cascading effects of taxes on production and distribution cost

of goods and services. The exclusion of cascading effects i.e. tax on tax till the level of final

consumers will significantly improve the competitiveness of original goods and services in

market which leads to beneficial impact to the GDP growth of the country. Introduction of a

GST to replace the existing multiple tax structures of Centre and State taxes is not only

11-11-2016 03:24 PM

GST - A detailed explanation with examples!

http://www.caclubindia.com/articles/gst-a-detailed-explanation-with-exa...

desirable but imperative. Integration of various taxes into a GST system would make it

possible to give full credit for inputs taxes collected. GST, being a destination-based

consumption tax based on VAT principle.

Worldwide GST:

France was the first country to introduce GST in 1954. Worldwide, Almost 150 countries

have introduced GST in one or the other form since now. Most of the countries have a unified

https://www.facebook.com

GST system. Brazil and Canada follow a dual system vis--vis India is going to introduce. In

/sharer

China, GST applies only to goods and the provision of repairs, replacement and processing

/sharer.php?u=http

https://twitter.com

%3A%2F

/intentservices. GST rates of some countries are given below:%2Fwww%2Ecaclubindia%2Ecom%2Farticles%2Fgst%2Da%2Ddetailed%2Dexplanation%2Dwith%2Dexamples

/tweet?url=http

https://plus.google.com

%2D%2D23835%2Easp%3Futm%5Fsource%3Darticles%26utm%5Fmedium%3Dsharebar%26utm%5Fcampaign%3Dsoci

%3A%2F

/share?url=http

Country

Rate of GST

%2Fwww%2Ecaclubindia%2Ecom%2Farticles%2Fgst%2Da%2Ddetailed%2Dexplanation%2Dwith%2Dexamples

%3A%2F

https://www.linkedin.com

%2D%2D23835%2Easp%3Futm%5Fsource%3Darticles%26utm%5Fmedium%3Dsharebar%26utm%5Fcampaign%3Dsoci

%2Fwww%2Ecaclubindia%2Ecom%2Farticles%2Fgst%2Da%2Ddetailed%2Dexplanation%2Dwith%2Dexamples

/shareArticle?url=http

text=GST

%2D%2D23835%2Easp%3Futm%5Fsource%3Darticles%26utm%5Fmedium%3Dsharebar%26utm%5Fcampaign%3Dsoci

%3A%2F

-/includes

A

Australia

10%

%2Fwww%2Ecaclubindia%2Ecom%2Farticles%2Fgst%2Da%2Ddetailed%2Dexplanation%2Dwith%2Dexamples

detailed

/share_inc_more.asp?mod_id=23835&

%2D%2D23835%2Easp%3Futm%5Fsource%3Darticles%26utm%5Fmedium%3Dsharebar%26utm%5Fcampaign%3Dsoci

module_name=articles&

explanation

with France

share_title2=GST

19.6%

-examples!

A

)

detailed

explanation

Canada

5%

with

examples!&share_url2=http

%3A%2F

Germany

19%

%2Fwww%2Ecaclubindia%2Ecom%2Farticles%2Fgst%2Da%2Ddetailed%2Dexplanation%2Dwith%2Dexamples

%2D%2D23835%2Easp%3Futm%5Fsource%3Darticles%26utm%5Fmedium%3Dsharebar%26utm%5Fcampaign%3Dsoci

3 of 29

Japan

5%

Singapore

7%

New Zealand

15%

Rate of GST:

11-11-2016 03:24 PM

GST - A detailed explanation with examples!

http://www.caclubindia.com/articles/gst-a-detailed-explanation-with-exa...

There would be two-rate structure a lower rate for necessary items and items of basic

importance and a standard rate for goods in general. There will also be a special rate for

precious metals and a list of exempted items. For goods in general, government is considering

pegging the rate of GST from 20% to 23% that is well above the global average rate of

16.4% for similar taxes, however below the revenue neutral rate of 27%.

Model of GST with example:

https://www.facebook.com

a. The GST shall have two components: one levied by the Centre (referred to as Central

/sharer

GST or CGST), and the other levied by the States (referred to as State GST

/sharer.php?u=http

https://twitter.com

%3A%2F

/intentorSGST). Rates for Central GST and State GST would be approved appropriately, reflecting

%2Fwww%2Ecaclubindia%2Ecom%2Farticles%2Fgst%2Da%2Ddetailed%2Dexplanation%2Dwith%2Dexamples

/tweet?url=http

https://plus.google.com

revenue considerations and acceptability.

%2D%2D23835%2Easp%3Futm%5Fsource%3Darticles%26utm%5Fmedium%3Dsharebar%26utm%5Fcampaign%3Dsoci

%3A%2F

/share?url=http

%2Fwww%2Ecaclubindia%2Ecom%2Farticles%2Fgst%2Da%2Ddetailed%2Dexplanation%2Dwith%2Dexamples

%3A%2F

https://www.linkedin.com

%2D%2D23835%2Easp%3Futm%5Fsource%3Darticles%26utm%5Fmedium%3Dsharebar%26utm%5Fcampaign%3Dsoci

b. The CGST and the SGST would be applicable to all transactions of goods and

%2Fwww%2Ecaclubindia%2Ecom%2Farticles%2Fgst%2Da%2Ddetailed%2Dexplanation%2Dwith%2Dexamples

/shareArticle?url=http

text=GST

%2D%2D23835%2Easp%3Futm%5Fsource%3Darticles%26utm%5Fmedium%3Dsharebar%26utm%5Fcampaign%3Dsoci

services made for a consideration except the exempted goods and services.

%3A%2F

-/includes

A

%2Fwww%2Ecaclubindia%2Ecom%2Farticles%2Fgst%2Da%2Ddetailed%2Dexplanation%2Dwith%2Dexamples

detailed

/share_inc_more.asp?mod_id=23835&

%2D%2D23835%2Easp%3Futm%5Fsource%3Darticles%26utm%5Fmedium%3Dsharebar%26utm%5Fcampaign%3Dsoci

module_name=articles&

explanation

c. Cross utilization of ITC both in case of Inputs and capital goods between the CGST

with

share_title2=GST

and )the SGST would not be permitted except in the case of inter-State supply of goods

-examples!

A

detailed

and services (i.e. IGST).

explanation

with

d. The Centre and the States would have concurrent jurisdiction for the entire value chain

examples!&share_url2=http

%3A%2F

and for all taxpayers on the basis of thresholds for goods and services prescribed for the

%2Fwww%2Ecaclubindia%2Ecom%2Farticles%2Fgst%2Da%2Ddetailed%2Dexplanation%2Dwith%2Dexamples

States and the Centre.

%2D%2D23835%2Easp%3Futm%5Fsource%3Darticles%26utm%5Fmedium%3Dsharebar%26utm%5Fcampaign%3Dsoci

4 of 29

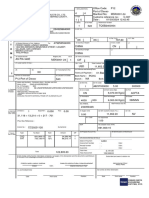

Example: 1(Comprehensive Comparison)

Comparison between Multiple Indirect tax laws and proposed one law

Particulars

Without GST

With GST

11-11-2016 03:24 PM

GST - A detailed explanation with examples!

http://www.caclubindia.com/articles/gst-a-detailed-explanation-with-exa...

(Rs.)

Manufacture to Wholesaler

Cost of Production

5,000.00

5,000.00

Add: Profit Margin

2,000.00

2,000.00

Invoice Value

8,820.00

8,680.00

7,840.00

7,000.00

https://www.facebook.com

/sharer

/sharer.php?u=http

Manufacturer Price

7,000.00

7,000.00

https://twitter.com

%3A%2F

/intent

%2Fwww%2Ecaclubindia%2Ecom%2Farticles%2Fgst%2Da%2Ddetailed%2Dexplanation%2Dwith%2Dexamples

/tweet?url=http

https://plus.google.com

%2D%2D23835%2Easp%3Futm%5Fsource%3Darticles%26utm%5Fmedium%3Dsharebar%26utm%5Fcampaign%3Dsoci

Add: Excise Duty @ 12%

840.00

%3A%2F

/share?url=http

%2Fwww%2Ecaclubindia%2Ecom%2Farticles%2Fgst%2Da%2Ddetailed%2Dexplanation%2Dwith%2Dexamples

%3A%2F

https://www.linkedin.com

%2D%2D23835%2Easp%3Futm%5Fsource%3Darticles%26utm%5Fmedium%3Dsharebar%26utm%5Fcampaign%3Dsoci

%2Fwww%2Ecaclubindia%2Ecom%2Farticles%2Fgst%2Da%2Ddetailed%2Dexplanation%2Dwith%2Dexamples

/shareArticle?url=http

text=GST

Total Value(a)

7,840.00

7,000.00

%2D%2D23835%2Easp%3Futm%5Fsource%3Darticles%26utm%5Fmedium%3Dsharebar%26utm%5Fcampaign%3Dsoci

%3A%2F

-/includes

A

%2Fwww%2Ecaclubindia%2Ecom%2Farticles%2Fgst%2Da%2Ddetailed%2Dexplanation%2Dwith%2Dexamples

detailed

/share_inc_more.asp?mod_id=23835&

%2D%2D23835%2Easp%3Futm%5Fsource%3Darticles%26utm%5Fmedium%3Dsharebar%26utm%5Fcampaign%3Dsoci

module_name=articles&

explanation

Add: VAT @ 12.5%

980.00

with

share_title2=GST

-examples!

A

)

detailedAdd: CGST @ 12%

840.00

explanation

with

examples!&share_url2=http

Add: SGST @ 12%

840.00

%3A%2F

%2Fwww%2Ecaclubindia%2Ecom%2Farticles%2Fgst%2Da%2Ddetailed%2Dexplanation%2Dwith%2Dexamples

%2D%2D23835%2Easp%3Futm%5Fsource%3Darticles%26utm%5Fmedium%3Dsharebar%26utm%5Fcampaign%3Dsoci

5 of 29

Wholesaler to Retailer

COG to Wholesaler(a)

11-11-2016 03:24 PM

GST - A detailed explanation with examples!

http://www.caclubindia.com/articles/gst-a-detailed-explanation-with-exa...

Add: Profit Margin@10%

784.00

700.00

Total Value(b)

8,624.00

7,700.00

Add: VAT @ 12.5%

1,078.00

Add: CGST @ 12%

924.00

Add: VAT @ 12.5%

1,185.80

Add: CGST @ 12%

1,016.40

Add: SGST @ 12%

1,016.40

https://www.facebook.com

/sharer

/sharer.php?u=http

Add: SGST @ 12%

924.00

https://twitter.com

%3A%2F

/intent

%2Fwww%2Ecaclubindia%2Ecom%2Farticles%2Fgst%2Da%2Ddetailed%2Dexplanation%2Dwith%2Dexamples

/tweet?url=http

https://plus.google.com

%2D%2D23835%2Easp%3Futm%5Fsource%3Darticles%26utm%5Fmedium%3Dsharebar%26utm%5Fcampaign%3Dsoci

Invoice Value

9,702.00

9,548.00

%3A%2F

/share?url=http

%2Fwww%2Ecaclubindia%2Ecom%2Farticles%2Fgst%2Da%2Ddetailed%2Dexplanation%2Dwith%2Dexamples

%3A%2F

https://www.linkedin.com

%2D%2D23835%2Easp%3Futm%5Fsource%3Darticles%26utm%5Fmedium%3Dsharebar%26utm%5Fcampaign%3Dsoci

%2Fwww%2Ecaclubindia%2Ecom%2Farticles%2Fgst%2Da%2Ddetailed%2Dexplanation%2Dwith%2Dexamples

/shareArticle?url=http

text=GST

%2D%2D23835%2Easp%3Futm%5Fsource%3Darticles%26utm%5Fmedium%3Dsharebar%26utm%5Fcampaign%3Dsoci

%3A%2F

-/includes

A

%2Fwww%2Ecaclubindia%2Ecom%2Farticles%2Fgst%2Da%2Ddetailed%2Dexplanation%2Dwith%2Dexamples

detailedRetailer to Consumer:

/share_inc_more.asp?mod_id=23835&

%2D%2D23835%2Easp%3Futm%5Fsource%3Darticles%26utm%5Fmedium%3Dsharebar%26utm%5Fcampaign%3Dsoci

module_name=articles&

explanation

with

share_title2=GST

-examples!

A

) to Retailer (b)

COG

8,624.00

7,700.00

detailed

explanation

with Add: Profit Margin

862.40

770.00

examples!&share_url2=http

%3A%2F

%2Fwww%2Ecaclubindia%2Ecom%2Farticles%2Fgst%2Da%2Ddetailed%2Dexplanation%2Dwith%2Dexamples

Total Value(c)

9,486.40

8,470.00

%2D%2D23835%2Easp%3Futm%5Fsource%3Darticles%26utm%5Fmedium%3Dsharebar%26utm%5Fcampaign%3Dsoci

6 of 29

11-11-2016 03:24 PM

GST - A detailed explanation with examples!

http://www.caclubindia.com/articles/gst-a-detailed-explanation-with-exa...

Total Price to the Final

consumer

10,672.20

10,502.80

Cost saving to consumer

169.40

% Cost Saving

1.59

https://www.facebook.com

/sharer

Notes:

/sharer.php?u=http

https://twitter.com

%3A%2F

/intent

%2Fwww%2Ecaclubindia%2Ecom%2Farticles%2Fgst%2Da%2Ddetailed%2Dexplanation%2Dwith%2Dexamples

Input tax credit available to wholesaler is Rs.980 and Rs.1,680 in case of

/tweet?url=http

https://plus.google.com

%2D%2D23835%2Easp%3Futm%5Fsource%3Darticles%26utm%5Fmedium%3Dsharebar%26utm%5Fcampaign%3Dsoci

without GST and with GST respectively.

%3A%2F

/share?url=http

%2Fwww%2Ecaclubindia%2Ecom%2Farticles%2Fgst%2Da%2Ddetailed%2Dexplanation%2Dwith%2Dexamples

%3A%2F

https://www.linkedin.com

%2D%2D23835%2Easp%3Futm%5Fsource%3Darticles%26utm%5Fmedium%3Dsharebar%26utm%5Fcampaign%3Dsoci

%2Fwww%2Ecaclubindia%2Ecom%2Farticles%2Fgst%2Da%2Ddetailed%2Dexplanation%2Dwith%2Dexamples

/shareArticle?url=http

Likewise Input tax credit available to Retailer is Rs.1,078 and Rs.1,848 in

text=GST

%2D%2D23835%2Easp%3Futm%5Fsource%3Darticles%26utm%5Fmedium%3Dsharebar%26utm%5Fcampaign%3Dsoci

%3A%2F

case of without GST and with GST respectively.

-/includes

A

%2Fwww%2Ecaclubindia%2Ecom%2Farticles%2Fgst%2Da%2Ddetailed%2Dexplanation%2Dwith%2Dexamples

detailed

/share_inc_more.asp?mod_id=23835&

%2D%2D23835%2Easp%3Futm%5Fsource%3Darticles%26utm%5Fmedium%3Dsharebar%26utm%5Fcampaign%3Dsoci

module_name=articles&

explanation

with In case, VAT rate is also considered to be 12%, the saving to consumer

share_title2=GST

would

be 1.15%.

-examples!

A

)

detailed

explanation

with IGST Model (Inter-State Transactions of Goods & Services) and Input tax credit (ITC)

examples!&share_url2=http

with example:

%3A%2F

%2Fwww%2Ecaclubindia%2Ecom%2Farticles%2Fgst%2Da%2Ddetailed%2Dexplanation%2Dwith%2Dexamples

a. Existing CST (Central state tax, tax on interstate movement of goods) shall

%2D%2D23835%2Easp%3Futm%5Fsource%3Darticles%26utm%5Fmedium%3Dsharebar%26utm%5Fcampaign%3Dsoci

7 of 29

be discontinued.

b. Center would levy IGST (cumulative rate for CGST and SGST) on all inter-State

transactions of taxable goods and services with appropriate provision for consignment or

stock transfer of goods and services.

c. The ITC of SGST, CGST shall be allowed as applicable.

d. Since ITC of SGST shall be allowed, the Exporting State will transfer to the Centre the

11-11-2016 03:24 PM

GST - A detailed explanation with examples!

http://www.caclubindia.com/articles/gst-a-detailed-explanation-with-exa...

credit of SGST used in payment of IGST. The Importing dealer will claim credit of IGST while

discharging his SGST liability (while selling the goods in state itself). Thereafter, the Centre

will transfer to the importing State the credit of IGST used in payment of SGST.(Please see

example 4 & 5)

e. The relevant information shall be submitted to the Central Agency which will act as a

clearing house mechanism, verify the claims and inform the respective state governments or

central government to transfer the funds.

https://www.facebook.com

/sharer

Advantage of IGST:

/sharer.php?u=http

https://twitter.com

%3A%2F

/intent

%2Fwww%2Ecaclubindia%2Ecom%2Farticles%2Fgst%2Da%2Ddetailed%2Dexplanation%2Dwith%2Dexamples

/tweet?url=http

o No refund claim in exporting State, as ITC is used up while paying the tax.

https://plus.google.com

%2D%2D23835%2Easp%3Futm%5Fsource%3Darticles%26utm%5Fmedium%3Dsharebar%26utm%5Fcampaign%3Dsoci

%3A%2F

/share?url=http

%2Fwww%2Ecaclubindia%2Ecom%2Farticles%2Fgst%2Da%2Ddetailed%2Dexplanation%2Dwith%2Dexamples

%3A%2F

https://www.linkedin.com

o Maintenance of uninterrupted ITC chain on inter-State transactions.

%2D%2D23835%2Easp%3Futm%5Fsource%3Darticles%26utm%5Fmedium%3Dsharebar%26utm%5Fcampaign%3Dsoci

%2Fwww%2Ecaclubindia%2Ecom%2Farticles%2Fgst%2Da%2Ddetailed%2Dexplanation%2Dwith%2Dexamples

/shareArticle?url=http

text=GST

%2D%2D23835%2Easp%3Futm%5Fsource%3Darticles%26utm%5Fmedium%3Dsharebar%26utm%5Fcampaign%3Dsoci

%3A%2F

-/includes

A

o No upfront payment of tax or substantial blockage of funds for the inter-State seller or buyer.

%2Fwww%2Ecaclubindia%2Ecom%2Farticles%2Fgst%2Da%2Ddetailed%2Dexplanation%2Dwith%2Dexamples

detailed

/share_inc_more.asp?mod_id=23835&

%2D%2D23835%2Easp%3Futm%5Fsource%3Darticles%26utm%5Fmedium%3Dsharebar%26utm%5Fcampaign%3Dsoci

module_name=articles&

explanation

with Example 2 (Input Tax Credit)

share_title2=GST

-examples!

A

)

detailed

Shiva, a registered dealer had input tax credit for CGST and SGST Rs.750/- and Rs.1,050/explanation

with respectively in respect of purchase of inputs and capital goods. He manufactured 1800 liters

examples!&share_url2=http

of finished products. 200 liters was normal loss in the process. The final product was sold at

%3A%2F

%2Fwww%2Ecaclubindia%2Ecom%2Farticles%2Fgst%2Da%2Ddetailed%2Dexplanation%2Dwith%2Dexamples

uniform price of Rs.10 per liter as follows:%2D%2D23835%2Easp%3Futm%5Fsource%3Darticles%26utm%5Fmedium%3Dsharebar%26utm%5Fcampaign%3Dsoci

8 of 29

Goods sold within State 800 liter.

Finished product sold in inter-State sale 650 liter.

Goods sent on stock transfer to consignment agents outside the State 350 liter.

Further, CGST and SGST rate on the finished product of dealer is 5% and 7% respectively.

Further IGST rate is 12%. Calculate tax liability of SGST and CGST to be paid after tax

credit.

11-11-2016 03:24 PM

GST - A detailed explanation with examples!

http://www.caclubindia.com/articles/gst-a-detailed-explanation-with-exa...

Solution:

Output Tax Calculation

Particulars

Sales Within State

Stock Transfer Outside State

Inter State Sales

Qty. Sold

800

350

650

https://www.facebook.com

/sharer Price per

10

10

10

/sharer.php?u=http

unit

https://twitter.com

%3A%2F

/intent

%2Fwww%2Ecaclubindia%2Ecom%2Farticles%2Fgst%2Da%2Ddetailed%2Dexplanation%2Dwith%2Dexamples

/tweet?url=http

https://plus.google.com

%2D%2D23835%2Easp%3Futm%5Fsource%3Darticles%26utm%5Fmedium%3Dsharebar%26utm%5Fcampaign%3Dsoci

Value of

%3A%2F

/share?url=http

Goods

8,000

3,500

6,500

%2Fwww%2Ecaclubindia%2Ecom%2Farticles%2Fgst%2Da%2Ddetailed%2Dexplanation%2Dwith%2Dexamples

%3A%2F

https://www.linkedin.com

Sold

%2D%2D23835%2Easp%3Futm%5Fsource%3Darticles%26utm%5Fmedium%3Dsharebar%26utm%5Fcampaign%3Dsoci

%2Fwww%2Ecaclubindia%2Ecom%2Farticles%2Fgst%2Da%2Ddetailed%2Dexplanation%2Dwith%2Dexamples

/shareArticle?url=http

text=GST

%2D%2D23835%2Easp%3Futm%5Fsource%3Darticles%26utm%5Fmedium%3Dsharebar%26utm%5Fcampaign%3Dsoci

%3A%2F

-/includes

A

%2Fwww%2Ecaclubindia%2Ecom%2Farticles%2Fgst%2Da%2Ddetailed%2Dexplanation%2Dwith%2Dexamples

detailedTax

/share_inc_more.asp?mod_id=23835&

%2D%2D23835%2Easp%3Futm%5Fsource%3Darticles%26utm%5Fmedium%3Dsharebar%26utm%5Fcampaign%3Dsoci

Amount:

module_name=articles&

explanation

with

share_title2=GST

-examples!

A

)

detailedTax

Amount400

explanation

with CGST(5%)

examples!&share_url2=http

%3A%2F

%2Fwww%2Ecaclubindia%2Ecom%2Farticles%2Fgst%2Da%2Ddetailed%2Dexplanation%2Dwith%2Dexamples

Tax

%2D%2D23835%2Easp%3Futm%5Fsource%3Darticles%26utm%5Fmedium%3Dsharebar%26utm%5Fcampaign%3Dsoci

Amount560

9 of 29

SGST(7%)

Tax

AmountIGST(12%)

420

780

Calculation of Tax Payable

11-11-2016 03:24 PM

GST - A detailed explanation with examples!

http://www.caclubindia.com/articles/gst-a-detailed-explanation-with-exa...

Calculation of Tax Payable

Particulars

CGST

SGST

IGST

Tax

Payable

Amount

400

560

1200

Total

https://www.facebook.com

/sharer Less:

Input Tax

/sharer.php?u=http

https://twitter.com

Credit

%3A%2F

/intent

%2Fwww%2Ecaclubindia%2Ecom%2Farticles%2Fgst%2Da%2Ddetailed%2Dexplanation%2Dwith%2Dexamples

/tweet?url=http

https://plus.google.com

%2D%2D23835%2Easp%3Futm%5Fsource%3Darticles%26utm%5Fmedium%3Dsharebar%26utm%5Fcampaign%3Dsoci

%3A%2F

/share?url=http

%2Fwww%2Ecaclubindia%2Ecom%2Farticles%2Fgst%2Da%2Ddetailed%2Dexplanation%2Dwith%2Dexamples

CGST

400

350

750

%3A%2F

https://www.linkedin.com

%2D%2D23835%2Easp%3Futm%5Fsource%3Darticles%26utm%5Fmedium%3Dsharebar%26utm%5Fcampaign%3Dsoci

%2Fwww%2Ecaclubindia%2Ecom%2Farticles%2Fgst%2Da%2Ddetailed%2Dexplanation%2Dwith%2Dexamples

/shareArticle?url=http

text=GST

%2D%2D23835%2Easp%3Futm%5Fsource%3Darticles%26utm%5Fmedium%3Dsharebar%26utm%5Fcampaign%3Dsoci

%3A%2F

-/includes

A

%2Fwww%2Ecaclubindia%2Ecom%2Farticles%2Fgst%2Da%2Ddetailed%2Dexplanation%2Dwith%2Dexamples

detailedSGST

/share_inc_more.asp?mod_id=23835&

560

490

1050

%2D%2D23835%2Easp%3Futm%5Fsource%3Darticles%26utm%5Fmedium%3Dsharebar%26utm%5Fcampaign%3Dsoci

module_name=articles&

explanation

with

share_title2=GST

-examples!

A

)

Balance

detailed

360

360

Payable

explanation

with

examples!&share_url2=http

%3A%2F

%2Fwww%2Ecaclubindia%2Ecom%2Farticles%2Fgst%2Da%2Ddetailed%2Dexplanation%2Dwith%2Dexamples

Notes:

%2D%2D23835%2Easp%3Futm%5Fsource%3Darticles%26utm%5Fmedium%3Dsharebar%26utm%5Fcampaign%3Dsoci

10 of 29

a. There would be no treatment for normal loss.

b. Input tax credit of CGST and SGST of Rs. 750 and Rs. 1050 are paid on inputs. This input

tax credit should first be utilized for payment of CGST and SGST, respectively, and balance is

to be used for payment of IGST. Thus, balance available for payment of IGST is Rs. 350 of

CGST and Rs. 490 of SGST and he is liable to pay balance amount of IGST of Rs. 360 by

cash (1200-350-490 = 360). Since credit of SGST of Rs.490 has been utilized for payment of

IGST, the State Government will get debit of Rs. 490 from the Central Government.

11-11-2016 03:24 PM

GST - A detailed explanation with examples!

http://www.caclubindia.com/articles/gst-a-detailed-explanation-with-exa...

Example 3 (Input Tax Credit)

Now, continuing with the above example 2, suppose the dealer purchases goods interstate

and have input tax credit of IGST available is Rs.2,000/-. Compute the tax payable.

Solution:

Calculation of Tax Payable

https://www.facebook.com

/sharer

Particulars

CGST

SGST

IGST

/sharer.php?u=http

https://twitter.com

%3A%2F

/intent

%2Fwww%2Ecaclubindia%2Ecom%2Farticles%2Fgst%2Da%2Ddetailed%2Dexplanation%2Dwith%2Dexamples

/tweet?url=http

https://plus.google.com

%2D%2D23835%2Easp%3Futm%5Fsource%3Darticles%26utm%5Fmedium%3Dsharebar%26utm%5Fcampaign%3Dsoci

%3A%2F

/share?url=http

%2Fwww%2Ecaclubindia%2Ecom%2Farticles%2Fgst%2Da%2Ddetailed%2Dexplanation%2Dwith%2Dexamples

%3A%2F

Tax

Payable

https://www.linkedin.com

400

560

1,200

%2D%2D23835%2Easp%3Futm%5Fsource%3Darticles%26utm%5Fmedium%3Dsharebar%26utm%5Fcampaign%3Dsoci

Amount

%2Fwww%2Ecaclubindia%2Ecom%2Farticles%2Fgst%2Da%2Ddetailed%2Dexplanation%2Dwith%2Dexamples

/shareArticle?url=http

text=GST

%2D%2D23835%2Easp%3Futm%5Fsource%3Darticles%26utm%5Fmedium%3Dsharebar%26utm%5Fcampaign%3Dsoci

%3A%2F

-/includes

A

%2Fwww%2Ecaclubindia%2Ecom%2Farticles%2Fgst%2Da%2Ddetailed%2Dexplanation%2Dwith%2Dexamples

detailed

/share_inc_more.asp?mod_id=23835&

Less: Input Tax

%2D%2D23835%2Easp%3Futm%5Fsource%3Darticles%26utm%5Fmedium%3Dsharebar%26utm%5Fcampaign%3Dsoci

module_name=articles&

explanation

Credit

with

share_title2=GST

-examples!

A

)

detailed

CGST

explanation

with

examples!&share_url2=http

SGST

%3A%2F

%2Fwww%2Ecaclubindia%2Ecom%2Farticles%2Fgst%2Da%2Ddetailed%2Dexplanation%2Dwith%2Dexamples

%2D%2D23835%2Easp%3Futm%5Fsource%3Darticles%26utm%5Fmedium%3Dsharebar%26utm%5Fcampaign%3Dsoci

11 of 29

IGST

400

400

1,200

2000

Balance

Payable

160.00

160

Note: Input tax credit of Rs.2000, IGST is available. This input tax credit should first be

utilized for payment of IGST and balance is to be used first for payment of CGST and

remaining for SGST. Likewise in this case Rs.400 and balance Rs.400 are utilized for CGST

and SGST respectively. He is liable to pay balance amount of SGST of Rs.160 by

11-11-2016 03:24 PM

GST - A detailed explanation with examples!

http://www.caclubindia.com/articles/gst-a-detailed-explanation-with-exa...

cash.(2000-1200-400-560 = 160).

Some Specific points for specific products (being high revenue generating products)

This tax does not apply to alcohol and petroleum products. They will be continued

Tax on Tobacco products will be subject to GST. But government can levy the extra

to be taxed as per the existing practices.

https://www.facebook.com

tax percent over and above GST rate.

/sharer

/sharer.php?u=http

https://twitter.com

Other key points:

%3A%2F

/intent

%2Fwww%2Ecaclubindia%2Ecom%2Farticles%2Fgst%2Da%2Ddetailed%2Dexplanation%2Dwith%2Dexamples

/tweet?url=http

https://plus.google.com

%2D%2D23835%2Easp%3Futm%5Fsource%3Darticles%26utm%5Fmedium%3Dsharebar%26utm%5Fcampaign%3Dsoci

%3A%2F

a. Manufacturing state (the state in India in which the goods are manufactured) will be

/share?url=http

%2Fwww%2Ecaclubindia%2Ecom%2Farticles%2Fgst%2Da%2Ddetailed%2Dexplanation%2Dwith%2Dexamples

%3A%2F

allowed to levy an additional tax percent (say 1%) on supply of goods.

https://www.linkedin.com

%2D%2D23835%2Easp%3Futm%5Fsource%3Darticles%26utm%5Fmedium%3Dsharebar%26utm%5Fcampaign%3Dsoci

%2Fwww%2Ecaclubindia%2Ecom%2Farticles%2Fgst%2Da%2Ddetailed%2Dexplanation%2Dwith%2Dexamples

/shareArticle?url=http

text=GST

%2D%2D23835%2Easp%3Futm%5Fsource%3Darticles%26utm%5Fmedium%3Dsharebar%26utm%5Fcampaign%3Dsoci

%3A%2F

-/includes

A b. PAN based identification number will be allowed to each taxpayer to have integration of

%2Fwww%2Ecaclubindia%2Ecom%2Farticles%2Fgst%2Da%2Ddetailed%2Dexplanation%2Dwith%2Dexamples

detailed

/share_inc_more.asp?mod_id=23835&

GST with Direct Tax.

%2D%2D23835%2Easp%3Futm%5Fsource%3Darticles%26utm%5Fmedium%3Dsharebar%26utm%5Fcampaign%3Dsoci

module_name=articles&

explanation

with

share_title2=GST

-examples!

A c. The

) taxpayer would need to submit periodical returns, in common format as far as

detailed

possible, to both the CGST authority and to the concerned SGST authorities.

explanation

with

examples!&share_url2=http

Exemption/Composition Scheme under GST:

%3A%2F

%2Fwww%2Ecaclubindia%2Ecom%2Farticles%2Fgst%2Da%2Ddetailed%2Dexplanation%2Dwith%2Dexamples

a. The Small Taxpayer: The small taxpayers whose gross annual turnover is less than 1.5

%2D%2D23835%2Easp%3Futm%5Fsource%3Darticles%26utm%5Fmedium%3Dsharebar%26utm%5Fcampaign%3Dsoci

12 of 29

Crore will not be covered by GST law and no need to pay tax.

b. Scope of composition and compounding scheme under GST to be provided for this

purpose, an upper ceiling on gross annual turnover (say Rs.50 Lacs) and a floor tax rate (say

0.5%) with respect to gross annual turnover should be provided.

c. Treatment for goods exempt under one state and taxable under the other to be

provided.

11-11-2016 03:24 PM

GST - A detailed explanation with examples!

http://www.caclubindia.com/articles/gst-a-detailed-explanation-with-exa...

d. List of exempt items which shall be outside the purview of GST shall be provided.

GST on Export & Import with example:

a. GST on export would be zero rated

b. Both CGST and SGST will be levied on import of goods and services into India. The

incidence of tax will follow the destination principle i.e. SGST goes to the state where it is

https://www.facebook.com

consumed. Complete set-off will be available on the GST paid on import on goods and

/sharer

services.

/sharer.php?u=http

https://twitter.com

%3A%2F

/intent

%2Fwww%2Ecaclubindia%2Ecom%2Farticles%2Fgst%2Da%2Ddetailed%2Dexplanation%2Dwith%2Dexamples

Example-4 (Import)

/tweet?url=http

https://plus.google.com

%2D%2D23835%2Easp%3Futm%5Fsource%3Darticles%26utm%5Fmedium%3Dsharebar%26utm%5Fcampaign%3Dsoci

%3A%2F

/share?url=http

%2Fwww%2Ecaclubindia%2Ecom%2Farticles%2Fgst%2Da%2Ddetailed%2Dexplanation%2Dwith%2Dexamples

%3A%2F

Shri Shiva imported goods for Rs. 10,000/- and incurred expenses to produce final saleable

https://www.linkedin.com

%2D%2D23835%2Easp%3Futm%5Fsource%3Darticles%26utm%5Fmedium%3Dsharebar%26utm%5Fcampaign%3Dsoci

%2Fwww%2Ecaclubindia%2Ecom%2Farticles%2Fgst%2Da%2Ddetailed%2Dexplanation%2Dwith%2Dexamples

/shareArticle?url=http

goods. BCD @ 10 % was chargeable on imported goods. These manufactured goods were

text=GST

%2D%2D23835%2Easp%3Futm%5Fsource%3Darticles%26utm%5Fmedium%3Dsharebar%26utm%5Fcampaign%3Dsoci

%3A%2F

-/includes

A

sold within the state at Rs. 45,000 plus applicable GST. Rate of CGST and SGST is 5% and

%2Fwww%2Ecaclubindia%2Ecom%2Farticles%2Fgst%2Da%2Ddetailed%2Dexplanation%2Dwith%2Dexamples

detailed

/share_inc_more.asp?mod_id=23835&

%2D%2D23835%2Easp%3Futm%5Fsource%3Darticles%26utm%5Fmedium%3Dsharebar%26utm%5Fcampaign%3Dsoci

7% respectively. Compute Cost, Sale value and tax payable for the transaction.

module_name=articles&

explanation

with

share_title2=GST

-examples!

A

)

Solution: Calculation of Net cost of imported goods

detailed

explanation

with

Amount

examples!&share_url2=http

Particulars

%3A%2F

%2Fwww%2Ecaclubindia%2Ecom%2Farticles%2Fgst%2Da%2Ddetailed%2Dexplanation%2Dwith%2Dexamples

(Rs)

%2D%2D23835%2Easp%3Futm%5Fsource%3Darticles%26utm%5Fmedium%3Dsharebar%26utm%5Fcampaign%3Dsoci

13 of 29

Cost of Goods imported

10,000

Add: Basic

Duty @ 10%

1,000

Customs

Cost of imported goods

(including BCD)

11,000

11-11-2016 03:24 PM

GST - A detailed explanation with examples!

http://www.caclubindia.com/articles/gst-a-detailed-explanation-with-exa...

Add: CGST on Import

@ 5%

550

Add: SGST on Import

@ 7%

770

Cost

of

imported

goods (including BCD

& GST) (Note below)

https://www.facebook.com

12,320

/sharer

/sharer.php?u=http

https://twitter.com

Calculation of Sale value after import

%3A%2F

/intent

%2Fwww%2Ecaclubindia%2Ecom%2Farticles%2Fgst%2Da%2Ddetailed%2Dexplanation%2Dwith%2Dexamples

/tweet?url=http

https://plus.google.com

%2D%2D23835%2Easp%3Futm%5Fsource%3Darticles%26utm%5Fmedium%3Dsharebar%26utm%5Fcampaign%3Dsoci

%3A%2F

Particulars

Amount(Rs)

/share?url=http

%2Fwww%2Ecaclubindia%2Ecom%2Farticles%2Fgst%2Da%2Ddetailed%2Dexplanation%2Dwith%2Dexamples

%3A%2F

https://www.linkedin.com

%2D%2D23835%2Easp%3Futm%5Fsource%3Darticles%26utm%5Fmedium%3Dsharebar%26utm%5Fcampaign%3Dsoci

%2Fwww%2Ecaclubindia%2Ecom%2Farticles%2Fgst%2Da%2Ddetailed%2Dexplanation%2Dwith%2Dexamples

/shareArticle?url=http

text=GST

Sale Value (before tax)

45,000

%2D%2D23835%2Easp%3Futm%5Fsource%3Darticles%26utm%5Fmedium%3Dsharebar%26utm%5Fcampaign%3Dsoci

%3A%2F

-/includes

A

%2Fwww%2Ecaclubindia%2Ecom%2Farticles%2Fgst%2Da%2Ddetailed%2Dexplanation%2Dwith%2Dexamples

detailed

/share_inc_more.asp?mod_id=23835&

%2D%2D23835%2Easp%3Futm%5Fsource%3Darticles%26utm%5Fmedium%3Dsharebar%26utm%5Fcampaign%3Dsoci

module_name=articles&

explanation

Add: CGST on Import

2,250

with

share_title2=GST

@ 5%

-examples!

A

)

detailed

explanation

Add: SGST on Import

3,150

with

@ 7%

examples!&share_url2=http

%3A%2F

%2Fwww%2Ecaclubindia%2Ecom%2Farticles%2Fgst%2Da%2Ddetailed%2Dexplanation%2Dwith%2Dexamples

Sales Value

50,400

%2D%2D23835%2Easp%3Futm%5Fsource%3Darticles%26utm%5Fmedium%3Dsharebar%26utm%5Fcampaign%3Dsoci

14 of 29

Tax Payable Calculation

Particulars

CGST

SGST

(Rs.)

(Rs.)

11-11-2016 03:24 PM

GST - A detailed explanation with examples!

http://www.caclubindia.com/articles/gst-a-detailed-explanation-with-exa...

Output tax

2,250

3,150

Less: Input tax credit

CGST

550

SGST

770

https://www.facebook.com

/sharer

/sharer.php?u=http

Net tax payable

1,700

2,380

https://twitter.com

%3A%2F

/intent

%2Fwww%2Ecaclubindia%2Ecom%2Farticles%2Fgst%2Da%2Ddetailed%2Dexplanation%2Dwith%2Dexamples

/tweet?url=http

https://plus.google.com

%2D%2D23835%2Easp%3Futm%5Fsource%3Darticles%26utm%5Fmedium%3Dsharebar%26utm%5Fcampaign%3Dsoci

Note: Please note that GST shall be levied including Basic Customs Duty considering.

%3A%2F

/share?url=http

%2Fwww%2Ecaclubindia%2Ecom%2Farticles%2Fgst%2Da%2Ddetailed%2Dexplanation%2Dwith%2Dexamples

%3A%2F

https://www.linkedin.com

%2D%2D23835%2Easp%3Futm%5Fsource%3Darticles%26utm%5Fmedium%3Dsharebar%26utm%5Fcampaign%3Dsoci

Example-5 (Export)

%2Fwww%2Ecaclubindia%2Ecom%2Farticles%2Fgst%2Da%2Ddetailed%2Dexplanation%2Dwith%2Dexamples

/shareArticle?url=http

text=GST

%2D%2D23835%2Easp%3Futm%5Fsource%3Darticles%26utm%5Fmedium%3Dsharebar%26utm%5Fcampaign%3Dsoci

%3A%2F

-/includes

A

%2Fwww%2Ecaclubindia%2Ecom%2Farticles%2Fgst%2Da%2Ddetailed%2Dexplanation%2Dwith%2Dexamples

Now continuing with the above example 4, suppose the same good is exported after 1 year of

detailed

/share_inc_more.asp?mod_id=23835&

%2D%2D23835%2Easp%3Futm%5Fsource%3Darticles%26utm%5Fmedium%3Dsharebar%26utm%5Fcampaign%3Dsoci

module_name=articles&

explanation

use after adding margin and modification amounting Rs.10,000/- and use factor of 1 year for

with

share_title2=GST

-examples!

A refund

) calculation is 0.20. Therefore the refund will be 0.80 of Duty amount. Compute Export

detailed

Value and Refund Value.

explanation

with

Solution: Export Value calculation

examples!&share_url2=http

%3A%2F

%2Fwww%2Ecaclubindia%2Ecom%2Farticles%2Fgst%2Da%2Ddetailed%2Dexplanation%2Dwith%2Dexamples

Amount

%2D%2D23835%2Easp%3Futm%5Fsource%3Darticles%26utm%5Fmedium%3Dsharebar%26utm%5Fcampaign%3Dsoci

15 of 29

Particulars

Cost

of

Goods(from

example)

(Rs)

Imported

above

50,400

11-11-2016 03:24 PM

GST - A detailed explanation with examples!

Add:

Margin

Modification Amt.

and

http://www.caclubindia.com/articles/gst-a-detailed-explanation-with-exa...

10,000

Sale Value

60,400

Add: CGST on Export

@ 5%

https://www.facebook.com

/sharer Add: SGST on Export

@ 7%

/sharer.php?u=http

https://twitter.com

%3A%2F

/intent

%2Fwww%2Ecaclubindia%2Ecom%2Farticles%2Fgst%2Da%2Ddetailed%2Dexplanation%2Dwith%2Dexamples

/tweet?url=http

https://plus.google.com

%2D%2D23835%2Easp%3Futm%5Fsource%3Darticles%26utm%5Fmedium%3Dsharebar%26utm%5Fcampaign%3Dsoci

Export Value

60,400

%3A%2F

/share?url=http

%2Fwww%2Ecaclubindia%2Ecom%2Farticles%2Fgst%2Da%2Ddetailed%2Dexplanation%2Dwith%2Dexamples

%3A%2F

https://www.linkedin.com

%2D%2D23835%2Easp%3Futm%5Fsource%3Darticles%26utm%5Fmedium%3Dsharebar%26utm%5Fcampaign%3Dsoci

%2Fwww%2Ecaclubindia%2Ecom%2Farticles%2Fgst%2Da%2Ddetailed%2Dexplanation%2Dwith%2Dexamples

Refund Calculation

/shareArticle?url=http

text=GST

%2D%2D23835%2Easp%3Futm%5Fsource%3Darticles%26utm%5Fmedium%3Dsharebar%26utm%5Fcampaign%3Dsoci

%3A%2F

-/includes

A

%2Fwww%2Ecaclubindia%2Ecom%2Farticles%2Fgst%2Da%2Ddetailed%2Dexplanation%2Dwith%2Dexamples

detailed

/share_inc_more.asp?mod_id=23835&

Amount

%2D%2D23835%2Easp%3Futm%5Fsource%3Darticles%26utm%5Fmedium%3Dsharebar%26utm%5Fcampaign%3Dsoci

module_name=articles&

explanation

with Particulars

share_title2=GST

-examples!

A

)

(Rs)

detailed

explanation

with

Basic

Customs

examples!&share_url2=http

Duty(BCD, from above 1,000.00

%3A%2F

example)

%2Fwww%2Ecaclubindia%2Ecom%2Farticles%2Fgst%2Da%2Ddetailed%2Dexplanation%2Dwith%2Dexamples

%2D%2D23835%2Easp%3Futm%5Fsource%3Darticles%26utm%5Fmedium%3Dsharebar%26utm%5Fcampaign%3Dsoci

16 of 29

Refund Factor

0.80

Refund amount of BDC

800.00

Add:

CGST(from

above example)

550.00

11-11-2016 03:24 PM

GST - A detailed explanation with examples!

http://www.caclubindia.com/articles/gst-a-detailed-explanation-with-exa...

Add: SGST(from above

example)

770.00

Total Refund amount

2,120.00

The above example withstand two basic principles of Taxation Laws i.e. Exports are

zero rated and the incidence of tax will follow the destination principle (The taxes will

remain with the state where the goods are used, however use factor can be prescribed by the

https://www.facebook.com

law)

/sharer

/sharer.php?u=http

https://twitter.com

%3A%2F

/intentIndirect taxes that will be included under GST:%2Fwww%2Ecaclubindia%2Ecom%2Farticles%2Fgst%2Da%2Ddetailed%2Dexplanation%2Dwith%2Dexamples

/tweet?url=http

https://plus.google.com

%2D%2D23835%2Easp%3Futm%5Fsource%3Darticles%26utm%5Fmedium%3Dsharebar%26utm%5Fcampaign%3Dsoci

%3A%2F

/share?url=http

State taxes which will be subsumed in SGST

%2Fwww%2Ecaclubindia%2Ecom%2Farticles%2Fgst%2Da%2Ddetailed%2Dexplanation%2Dwith%2Dexamples

%3A%2F

https://www.linkedin.com

%2D%2D23835%2Easp%3Futm%5Fsource%3Darticles%26utm%5Fmedium%3Dsharebar%26utm%5Fcampaign%3Dsoci

%2Fwww%2Ecaclubindia%2Ecom%2Farticles%2Fgst%2Da%2Ddetailed%2Dexplanation%2Dwith%2Dexamples

/shareArticle?url=http

text=GST

%2D%2D23835%2Easp%3Futm%5Fsource%3Darticles%26utm%5Fmedium%3Dsharebar%26utm%5Fcampaign%3Dsoci

VAT/Sales Tax

%3A%2F

-/includes

A

%2Fwww%2Ecaclubindia%2Ecom%2Farticles%2Fgst%2Da%2Ddetailed%2Dexplanation%2Dwith%2Dexamples

detailed

/share_inc_more.asp?mod_id=23835&

%2D%2D23835%2Easp%3Futm%5Fsource%3Darticles%26utm%5Fmedium%3Dsharebar%26utm%5Fcampaign%3Dsoci

module_name=articles&

explanation

Entertainment Tax (unless it is levied by local bodies)

with

share_title2=GST

-examples!

A

)

Luxury

Tax

detailed

explanation

with Taxes on lottery, betting and gambling.

examples!&share_url2=http

%3A%2F

State cess and surcharges to the extent related to supply of goods and services.

%2Fwww%2Ecaclubindia%2Ecom%2Farticles%2Fgst%2Da%2Ddetailed%2Dexplanation%2Dwith%2Dexamples

%2D%2D23835%2Easp%3Futm%5Fsource%3Darticles%26utm%5Fmedium%3Dsharebar%26utm%5Fcampaign%3Dsoci

17 of 29

Entry tax not on in lieu of octroi.

Central Taxes which will be subsumed in CGST

Central Excise Duty.

Additional Excise Duty.

The Excise Duty levied under the medical and Toiletries Preparation Act

11-11-2016 03:24 PM

GST - A detailed explanation with examples!

http://www.caclubindia.com/articles/gst-a-detailed-explanation-with-exa...

Service Tax.

Additional Customs Duty, commonly known as countervailing Duty (CVD)

Special Additional duty of customs(SAD)

Education Cess

Surcharges

https://www.facebook.com

/sharer

/sharer.php?u=http

https://twitter.com

Taxes that may or may not be subsumed due to no consensus between the Central and

%3A%2F

/intent

State Governments:

%2Fwww%2Ecaclubindia%2Ecom%2Farticles%2Fgst%2Da%2Ddetailed%2Dexplanation%2Dwith%2Dexamples

/tweet?url=http

https://plus.google.com

%2D%2D23835%2Easp%3Futm%5Fsource%3Darticles%26utm%5Fmedium%3Dsharebar%26utm%5Fcampaign%3Dsoci

%3A%2F

/share?url=http

%2Fwww%2Ecaclubindia%2Ecom%2Farticles%2Fgst%2Da%2Ddetailed%2Dexplanation%2Dwith%2Dexamples

Stamp Duty

%3A%2F

https://www.linkedin.com

%2D%2D23835%2Easp%3Futm%5Fsource%3Darticles%26utm%5Fmedium%3Dsharebar%26utm%5Fcampaign%3Dsoci

%2Fwww%2Ecaclubindia%2Ecom%2Farticles%2Fgst%2Da%2Ddetailed%2Dexplanation%2Dwith%2Dexamples

/shareArticle?url=http

text=GST

%2D%2D23835%2Easp%3Futm%5Fsource%3Darticles%26utm%5Fmedium%3Dsharebar%26utm%5Fcampaign%3Dsoci

%3A%2F

-/includes

A Vehicle Tax

%2Fwww%2Ecaclubindia%2Ecom%2Farticles%2Fgst%2Da%2Ddetailed%2Dexplanation%2Dwith%2Dexamples

detailed

/share_inc_more.asp?mod_id=23835&

%2D%2D23835%2Easp%3Futm%5Fsource%3Darticles%26utm%5Fmedium%3Dsharebar%26utm%5Fcampaign%3Dsoci

module_name=articles&

explanation

Electricity Duty

with

share_title2=GST

-examples!

A

)

detailed

Other Entry taxes and Octroi

explanation

with

Entertainment Tax (levied by local bodies)

examples!&share_url2=http

%3A%2F

%2Fwww%2Ecaclubindia%2Ecom%2Farticles%2Fgst%2Da%2Ddetailed%2Dexplanation%2Dwith%2Dexamples

Basic customs duty and safeguard duties on import of goods into India

%2D%2D23835%2Easp%3Futm%5Fsource%3Darticles%26utm%5Fmedium%3Dsharebar%26utm%5Fcampaign%3Dsoci

18 of 29

Other Benefits of GST apart from discussed in first 2-3 paragraph of this article:

Reduces transaction costs and unnecessary wastages: A single registration and a

single compliance will suffice for both SGST and CGST provided government produces

effective IT infrastructure and integration of states level with the union.

Eliminates the multiplicity of taxation: The reduction in the number of taxation applicable

in a chain of transaction will help to reduce the paper work and clean up the current mess that

11-11-2016 03:24 PM

GST - A detailed explanation with examples!

http://www.caclubindia.com/articles/gst-a-detailed-explanation-with-exa...

is brought by existing indirect taxation laws.

One Point Single Tax: They would be focus on business rather than worrying about their

taxation that may crop at later stages. This will help the business community to decide their

supply chain, pricing modalities and in the long run helps the consumers being goods

competitive as price will no longer be the function of tax components but function of sheer

business intelligence and innovation.

https://www.facebook.com

Reduces average tax burdens:- The cost of tax that consumers have to bear will be certain

/sharer

and it is expected that GST would reduce the average tax burdens on the consumers.

/sharer.php?u=http

https://twitter.com

%3A%2F

/intent

%2Fwww%2Ecaclubindia%2Ecom%2Farticles%2Fgst%2Da%2Ddetailed%2Dexplanation%2Dwith%2Dexamples

/tweet?url=http

Reduces the corruption:- As the no. of taxes reduces so does the no of visits to multiple

https://plus.google.com

%2D%2D23835%2Easp%3Futm%5Fsource%3Darticles%26utm%5Fmedium%3Dsharebar%26utm%5Fcampaign%3Dsoci

%3A%2F

/share?url=http

department reduces and hence the reduction in corruption.

%2Fwww%2Ecaclubindia%2Ecom%2Farticles%2Fgst%2Da%2Ddetailed%2Dexplanation%2Dwith%2Dexamples

%3A%2F

https://www.linkedin.com

%2D%2D23835%2Easp%3Futm%5Fsource%3Darticles%26utm%5Fmedium%3Dsharebar%26utm%5Fcampaign%3Dsoci

%2Fwww%2Ecaclubindia%2Ecom%2Farticles%2Fgst%2Da%2Ddetailed%2Dexplanation%2Dwith%2Dexamples

/shareArticle?url=http

text=GST

In all cases except a few products and states, there would be uniformity of tax rates

%2D%2D23835%2Easp%3Futm%5Fsource%3Darticles%26utm%5Fmedium%3Dsharebar%26utm%5Fcampaign%3Dsoci

%3A%2F

-/includes

A

%2Fwww%2Ecaclubindia%2Ecom%2Farticles%2Fgst%2Da%2Ddetailed%2Dexplanation%2Dwith%2Dexamples

across the states.

detailed

/share_inc_more.asp?mod_id=23835&

%2D%2D23835%2Easp%3Futm%5Fsource%3Darticles%26utm%5Fmedium%3Dsharebar%26utm%5Fcampaign%3Dsoci

module_name=articles&

explanation

with General points on Various Business Sectors that arise after GST implementation:share_title2=GST

-examples!

A

)

detailed

Real Estate Industry: Construction and Housing sector need to be included in the GST tax

explanation

with

base being high tax revenue generating sector and for reduction in no. of tax legislations

examples!&share_url2=http

involved.

%3A%2F

%2Fwww%2Ecaclubindia%2Ecom%2Farticles%2Fgst%2Da%2Ddetailed%2Dexplanation%2Dwith%2Dexamples

%2D%2D23835%2Easp%3Futm%5Fsource%3Darticles%26utm%5Fmedium%3Dsharebar%26utm%5Fcampaign%3Dsoci

19 of 29

FMCG Sector: .Implementation of proposed GST and opening of Foreign Direct Investment

(F.D.I.) are expected to fuel the growth and raise industrys size.

Rail Sector: There have been suggestions for including the rail sector under the GST

umbrella to bring about significant tax gains and widen the tax net so as to keep overall GST

rate low. This will have the added benefit of ensuring that all interstate transportation of

goods can be tracked through the proposed Information technology (IT) network.

Information Technology enabled services: At present, if the software is transferred through

11-11-2016 03:24 PM

GST - A detailed explanation with examples!

http://www.caclubindia.com/articles/gst-a-detailed-explanation-with-exa...

electronic form, it should be considered as Intellectual Property and regarded as a service and

if the software is transmitted on media or any other tangible property, then it should be treated

as goods and this classification is full of litigation. As GST will have uniform rate for Goods

and Services and no concept of state revenue being VAT or central revenue being service tax

and hence, the reduction in litigation.

Transport Sector: Truck drivers spend more than half of their time while negotitating

check post and tolls. At present there are more than 600 check points and more than ton

https://www.facebook.com

types of taxes in road sector.

/sharer

/sharer.php?u=http

https://twitter.com

%3A%2F

/intentAfter the introduction of GST, the time spend by the road transport industry in complaining

%2Fwww%2Ecaclubindia%2Ecom%2Farticles%2Fgst%2Da%2Ddetailed%2Dexplanation%2Dwith%2Dexamples

/tweet?url=http

https://plus.google.com

with laws will reduce and service is going to be better which will boost the goods industry

%2D%2D23835%2Easp%3Futm%5Fsource%3Darticles%26utm%5Fmedium%3Dsharebar%26utm%5Fcampaign%3Dsoci

%3A%2F

/share?url=http

and thus the taxes also.

%2Fwww%2Ecaclubindia%2Ecom%2Farticles%2Fgst%2Da%2Ddetailed%2Dexplanation%2Dwith%2Dexamples

%3A%2F

https://www.linkedin.com

%2D%2D23835%2Easp%3Futm%5Fsource%3Darticles%26utm%5Fmedium%3Dsharebar%26utm%5Fcampaign%3Dsoci

%2Fwww%2Ecaclubindia%2Ecom%2Farticles%2Fgst%2Da%2Ddetailed%2Dexplanation%2Dwith%2Dexamples

/shareArticle?url=http

text=GST

%2D%2D23835%2Easp%3Futm%5Fsource%3Darticles%26utm%5Fmedium%3Dsharebar%26utm%5Fcampaign%3Dsoci

Impact on Small Enterprises: There will be three categories of Small Enterprises in the GST

%3A%2F

-/includes

A

%2Fwww%2Ecaclubindia%2Ecom%2Farticles%2Fgst%2Da%2Ddetailed%2Dexplanation%2Dwith%2Dexamples

detailed

/share_inc_more.asp?mod_id=23835&

regime.

%2D%2D23835%2Easp%3Futm%5Fsource%3Darticles%26utm%5Fmedium%3Dsharebar%26utm%5Fcampaign%3Dsoci

module_name=articles&

explanation

with

share_title2=GST

a. Those

below threshold limit of Rs.1.5 Crores would not be covered.

-examples!

A

)

detailed

explanation

b. Those between the threshold and composition turnovers will have the option to pay a

with

turnover based tax i.e. composite tax or opt to join the GST regime.

examples!&share_url2=http

%3A%2F

%2Fwww%2Ecaclubindia%2Ecom%2Farticles%2Fgst%2Da%2Ddetailed%2Dexplanation%2Dwith%2Dexamples

c. Those above threshold limit will need to be within framework of GST. Possible

%2D%2D23835%2Easp%3Futm%5Fsource%3Darticles%26utm%5Fmedium%3Dsharebar%26utm%5Fcampaign%3Dsoci

20 of 29

downward changes in the threshold in some States consequent to the introduction of GST

may result in obligation being created for some dealers.

Questions, please ask?

At what point of time, the tax will be levied?

What will be the nature of Taxable Event?

GST is proposed to be levied by both the CG and SGs. How will it be defined under CGST

11-11-2016 03:24 PM

GST - A detailed explanation with examples!

http://www.caclubindia.com/articles/gst-a-detailed-explanation-with-exa...

and SGST?

Printable in Hard form for easy reference, Tried and Tested

Hope you got the sound understanding of the provisions of GST.

For any kind of professional Assistance, please reach out to me freely and preferably by mail

or mobile.

https://www.facebook.com

/sharer

Regards,

/sharer.php?u=http

https://twitter.com

%3A%2F

/intent

%2Fwww%2Ecaclubindia%2Ecom%2Farticles%2Fgst%2Da%2Ddetailed%2Dexplanation%2Dwith%2Dexamples

CA. Shivashish Kumar

/tweet?url=http

https://plus.google.com

%2D%2D23835%2Easp%3Futm%5Fsource%3Darticles%26utm%5Fmedium%3Dsharebar%26utm%5Fcampaign%3Dsoci

%3A%2F

/share?url=http

%2Fwww%2Ecaclubindia%2Ecom%2Farticles%2Fgst%2Da%2Ddetailed%2Dexplanation%2Dwith%2Dexamples

%3A%2F

https://www.linkedin.com

Practicing Chartered Accountant

%2D%2D23835%2Easp%3Futm%5Fsource%3Darticles%26utm%5Fmedium%3Dsharebar%26utm%5Fcampaign%3Dsoci

%2Fwww%2Ecaclubindia%2Ecom%2Farticles%2Fgst%2Da%2Ddetailed%2Dexplanation%2Dwith%2Dexamples

/shareArticle?url=http

text=GST

%2D%2D23835%2Easp%3Futm%5Fsource%3Darticles%26utm%5Fmedium%3Dsharebar%26utm%5Fcampaign%3Dsoci

%3A%2F

-/includes

A

%2Fwww%2Ecaclubindia%2Ecom%2Farticles%2Fgst%2Da%2Ddetailed%2Dexplanation%2Dwith%2Dexamples

B.Com(H), ACA (Former Tax Consultant-Ernst & Young)

detailed

/share_inc_more.asp?mod_id=23835&

%2D%2D23835%2Easp%3Futm%5Fsource%3Darticles%26utm%5Fmedium%3Dsharebar%26utm%5Fcampaign%3Dsoci

module_name=articles&

explanation

with

share_title2=GST

ca.shivashish@gmail.com

(mailto:ca.shivashish@gmail.com)

-examples!

A

)

detailed

explanation

Add: F-50, Near Gurudwara, Madhu Vihar, I.P. Extension, Patparganj, Delhi-92

with

examples!&share_url2=http

Network Offices in Kashmere Gate & Laxmi Nagar

%3A%2F

%2Fwww%2Ecaclubindia%2Ecom%2Farticles%2Fgst%2Da%2Ddetailed%2Dexplanation%2Dwith%2Dexamples

%2D%2D23835%2Easp%3Futm%5Fsource%3Darticles%26utm%5Fmedium%3Dsharebar%26utm%5Fcampaign%3Dsoci

21 of 29

Link to Previous Article on MAT provisions (IT Act, 1961) of Author:

http://www.caclubindia.com/articles/provisions-of-mat-amt-22594.asp#.VVgjybmqqko

(http://www.caclubindia.com/articles/provisions-of-mat-amt-22594.asp#.VVgjybmqqko)

No part of this article shall be reproduced, copied in any material form (including e-medium)

without written permission of CA. Shivashish.

The information provided is not a substitute for legal and other professional advice where the

facts and circumstances warrant. If any person requires legal advice or other professional

11-11-2016 03:24 PM

GST - A detailed explanation with examples!

http://www.caclubindia.com/articles/gst-a-detailed-explanation-with-exa...

assistance, please contact at above contact details.

(/forum/display.asp?cat_id=54&utm_source=articles&utm_medium=banner_strip&

utm_campaign=forum_post_clicks)

https://www.facebook.com

/sharer

CA. Shivashish (../profile.asp?member_id=692523)

/sharer.php?u=http

on 18 May 2015

https://twitter.com

%3A%2F

/intent(../profile.asp?member_id=692523)

%2Fwww%2Ecaclubindia%2Ecom%2Farticles%2Fgst%2Da%2Ddetailed%2Dexplanation%2Dwith%2Dexamples

/tweet?url=http

https://plus.google.com

%2D%2D23835%2Easp%3Futm%5Fsource%3Darticles%26utm%5Fmedium%3Dsharebar%26utm%5Fcampaign%3Dsoci

%3A%2F

www.facebook.com/sharer/sharer.php?u=http%3A%2F

/share?url=http

%2Fwww%2Ecaclubindia%2Ecom%2Farticles%2Fgst%2Da%2Ddetailed%2Dexplanation%2Dwith%2Dexamples

%3A%2F

caclubindia%2Ecom%2Farticles%2Fgst%2Da%2Ddetailed%2Dexplanation%2Dwith%2Dexamples

https://www.linkedin.com

%2D%2D23835%2Easp%3Futm%5Fsource%3Darticles%26utm%5Fmedium%3Dsharebar%26utm%5Fcampaign%3Dsoci

%2Fwww%2Ecaclubindia%2Ecom%2Farticles%2Fgst%2Da%2Ddetailed%2Dexplanation%2Dwith%2Dexamples

35%2Easp%3Futm%5Fsource%3Darticles%26utm%5Fmedium%3Dsharestrip%26utm%5Fcampaign%3Dsocialshare

/shareArticle?url=http

text=GST

%2D%2D23835%2Easp%3Futm%5Fsource%3Darticles%26utm%5Fmedium%3Dsharebar%26utm%5Fcampaign%3Dsoci

witter.com/intent/tweet?url=http%3A%2F

%3A%2F

-/includes

A

caclubindia%2Ecom%2Farticles%2Fgst%2Da%2Ddetailed%2Dexplanation%2Dwith%2Dexamples

%2Fwww%2Ecaclubindia%2Ecom%2Farticles%2Fgst%2Da%2Ddetailed%2Dexplanation%2Dwith%2Dexamples

detailed

/share_inc_more.asp?mod_id=23835&

35%2Easp%3Futm%5Fsource%3Darticles%26utm%5Fmedium%3Dsharestrip%26utm%5Fcampaign%3Dsocialshare&

%2D%2D23835%2Easp%3Futm%5Fsource%3Darticles%26utm%5Fmedium%3Dsharebar%26utm%5Fcampaign%3Dsoci

module_name=articles&

explanation

detailed explanation with examples!)

(https://www.linkedin.com/shareArticle?url=http%3A%2F

with

share_title2=GST

caclubindia%2Ecom%2Farticles%2Fgst%2Da%2Ddetailed%2Dexplanation%2Dwith%2Dexamples

-examples!

A

)

35%2Easp%3Futm%5Fsource%3Darticles%26utm%5Fmedium%3Dsharestrip%26utm%5Fcampaign%3Dsocialshare

detailed

?to=&subject=GST

explanation - A detailed explanation with examples!&body=http%3A%2F

caclubindia%2Ecom%2Farticles%2Fgst%2Da%2Ddetailed%2Dexplanation%2Dwith%2Dexamples

with

35%2Easp%3Futm%5Fsource%3Darticles%26utm%5Fmedium%3Dsharebar%26utm%5Fcampaign%3Dsocialshare)

examples!&share_url2=http

es/share_inc_more.asp?share_title2=GST

- A detailed explanation with examples!&share_url2=http%3A%2F

%3A%2F

%2Fwww%2Ecaclubindia%2Ecom%2Farticles%2Fgst%2Da%2Ddetailed%2Dexplanation%2Dwith%2Dexamples

caclubindia%2Ecom%2Farticles%2Fgst%2Da%2Ddetailed%2Dexplanation%2Dwith%2Dexamples

%2D%2D23835%2Easp%3Futm%5Fsource%3Darticles%26utm%5Fmedium%3Dsharebar%26utm%5Fcampaign%3Dsoci

35%2Easp%3Futm%5Fsource%3Darticles%26utm%5Fmedium%3Dsharestrip%26utm%5Fcampaign%3Dsocialshare

22 of 29

Published in GST

(article_display_list_by_category.asp?cat_id=54)

Views : 15418

Other Articles by - CA. Shivashish

(article_display_list_by_member.asp?member_id=692523)

Report Abuse

(../report_abuse.asp?module=articles)

Previous (check_next.asp?article_id=23835&mode=0)

Next (check_next.asp?article_id=23835&mode=1)

11-11-2016 03:24 PM

GST - A detailed explanation with examples!

http://www.caclubindia.com/articles/gst-a-detailed-explanation-with-exa...

https://www.facebook.com

/sharer

/sharer.php?u=http

https://twitter.com

%3A%2F

/intent

%2Fwww%2Ecaclubindia%2Ecom%2Farticles%2Fgst%2Da%2Ddetailed%2Dexplanation%2Dwith%2Dexamples

/tweet?url=http

https://plus.google.com

%2D%2D23835%2Easp%3Futm%5Fsource%3Darticles%26utm%5Fmedium%3Dsharebar%26utm%5Fcampaign%3Dsoci

%3A%2F

/share?url=http

%2Fwww%2Ecaclubindia%2Ecom%2Farticles%2Fgst%2Da%2Ddetailed%2Dexplanation%2Dwith%2Dexamples

%3A%2F

https://www.linkedin.com

%2D%2D23835%2Easp%3Futm%5Fsource%3Darticles%26utm%5Fmedium%3Dsharebar%26utm%5Fcampaign%3Dsoci

%2Fwww%2Ecaclubindia%2Ecom%2Farticles%2Fgst%2Da%2Ddetailed%2Dexplanation%2Dwith%2Dexamples

/shareArticle?url=http

text=GST

%2D%2D23835%2Easp%3Futm%5Fsource%3Darticles%26utm%5Fmedium%3Dsharebar%26utm%5Fcampaign%3Dsoci

%3A%2F

-/includes

A

%2Fwww%2Ecaclubindia%2Ecom%2Farticles%2Fgst%2Da%2Ddetailed%2Dexplanation%2Dwith%2Dexamples

detailed

/share_inc_more.asp?mod_id=23835&

%2D%2D23835%2Easp%3Futm%5Fsource%3Darticles%26utm%5Fmedium%3Dsharebar%26utm%5Fcampaign%3Dsoci

module_name=articles&

explanation

with

share_title2=GST

-examples!

A

detailed

explanation

with

examples!&share_url2=http

%3A%2F

%2Fwww%2Ecaclubindia%2Ecom%2Farticles%2Fgst%2Da%2Ddetailed%2Dexplanation%2Dwith%2Dexamples

%2D%2D23835%2Easp%3Futm%5Fsource%3Darticles%26utm%5Fmedium%3Dsharebar%26utm%5Fcampaign%3Dsoci

23 of 29

11-11-2016 03:24 PM

GST - A detailed explanation with examples!

http://www.caclubindia.com/articles/gst-a-detailed-explanation-with-exa...

Invest in Top SIP Fund

Frequently asked questions

on GST

Retirement Planning

Calculator

IGST model in Goods

Service Tax (GST)

Ad ABM MyUniverse

caclubindia.com

Ad Big Decisions

caclubindia.com

https://www.facebook.com

/sharer

/sharer.php?u=http

https://twitter.com

%3A%2F

/intent

%2Fwww%2Ecaclubindia%2Ecom%2Farticles%2Fgst%2Da%2Ddetailed%2Dexplanation%2Dwith%2Dexamples

/tweet?url=http

https://plus.google.com

%2D%2D23835%2Easp%3Futm%5Fsource%3Darticles%26utm%5Fmedium%3Dsharebar%26utm%5Fcampaign%3Dsoci

%3A%2F

/share?url=http

%2Fwww%2Ecaclubindia%2Ecom%2Farticles%2Fgst%2Da%2Ddetailed%2Dexplanation%2Dwith%2Dexamples

Service tax filing procedure Personal loan in 2 Min

All About GST Regime

An overview of GST

%3A%2F

https://www.linkedin.com

Others - Service...

%2D%2D23835%2Easp%3Futm%5Fsource%3Darticles%26utm%5Fmedium%3Dsharebar%26utm%5Fcampaign%3Dsoci

%2Fwww%2Ecaclubindia%2Ecom%2Farticles%2Fgst%2Da%2Ddetailed%2Dexplanation%2Dwith%2Dexamples

/shareArticle?url=http

text=GST

%2D%2D23835%2Easp%3Futm%5Fsource%3Darticles%26utm%5Fmedium%3Dsharebar%26utm%5Fcampaign%3Dsoci

caclubindia.com

caclubindia.com

caclubindia.com

Ad indialends.com

%3A%2F

-/includes

A

%2Fwww%2Ecaclubindia%2Ecom%2Farticles%2Fgst%2Da%2Ddetailed%2Dexplanation%2Dwith%2Dexamples

detailed

/share_inc_more.asp?mod_id=23835&

%2D%2D23835%2Easp%3Futm%5Fsource%3Darticles%26utm%5Fmedium%3Dsharebar%26utm%5Fcampaign%3Dsoci

module_name=articles&

explanation

with

share_title2=GST

-examples!

A

)

detailed

explanation

Export Promotion Capital Goods (EPCG) Scheme (http://www.caclubindia.com/articles/export-promotionwith

examples!&share_url2=http

capital-goods-epcg-scheme-20531.asp)

%3A%2F Cenvat credit on defective Goods return back to the factory (http://www.caclubindia.com/articles/cenvat-credit%2Fwww%2Ecaclubindia%2Ecom%2Farticles%2Fgst%2Da%2Ddetailed%2Dexplanation%2Dwith%2Dexamples

on-defective-goods-return-back-to-the-factory-21644.asp)

%2D%2D23835%2Easp%3Futm%5Fsource%3Darticles%26utm%5Fmedium%3Dsharebar%26utm%5Fcampaign%3Dsoci

24 of 29

A Brief explanation of standard on auditing (SA 550 related) (http://www.caclubindia.com/articles/a-briefexplanation-of-standard-on-auditing-sa-550-related--22034.asp)

Service Tax on Transfer of Development Rights of Land - A Detailed Legal Analysis

(http://www.caclubindia.com/articles/service-tax-on-transfer-of-development-rights-of-land-a-detailed-legalanalysis--22080.asp)

Assessee is eligible for remission of duty in respect of goods cleared for export (http://www.caclubindia.com

/articles/assessee-is-eligible-for-remission-of-duty-in-respect-of-goods-cleared-for-export-22286.asp)

Goods & Service Tax Will Be A Reality By April 2016 (http://www.caclubindia.com/articles/-goods-servicetax-will-be-a-reality-by-april-2016-22428.asp)

CENVAT on Capital Goods - Part I (http://www.caclubindia.com/articles/cenvat-on-capital-goods-part-i22438.asp)

11-11-2016 03:24 PM

GST - A detailed explanation with examples!

http://www.caclubindia.com/articles/gst-a-detailed-explanation-with-exa...

Rebate on Export of Goods (Notification 41/2014) (http://www.caclubindia.com/articles/rebate-on-exportof-goods-notification-41-2014--22553.asp)

Input Credit on Capital Goods under Delhi VAT (http://www.caclubindia.com/articles/input-credit-on-capitalgoods-under-delhi-vat-22595.asp)

IGST model in Goods & Service Tax (GST) (http://www.caclubindia.com/articles/igst-model-in-goods-servicetax-gst--22716.asp)

More (article_display_list_by_category.asp?cat_id=54

https://www.facebook.com

/sharer

/sharer.php?u=http

Suggested answers for CA IPC Taxation - (Indirect Tax Portion) for Nov 16 (/articles/suggested-answershttps://twitter.com

%3A%2F

for-ca-ipc-taxation-indirect-tax-portion-for-nov-16-28197.asp)

/intent

%2Fwww%2Ecaclubindia%2Ecom%2Farticles%2Fgst%2Da%2Ddetailed%2Dexplanation%2Dwith%2Dexamples

/tweet?url=http

5 most important questions to ask before timing the market to achieve huge returns (/articles/5-mosthttps://plus.google.com

%2D%2D23835%2Easp%3Futm%5Fsource%3Darticles%26utm%5Fmedium%3Dsharebar%26utm%5Fcampaign%3Dsoci

%3A%2F

important-questions-to-ask-before-timing-the-market-to-achieve-huge-returns-28196.asp)

/share?url=http

%2Fwww%2Ecaclubindia%2Ecom%2Farticles%2Fgst%2Da%2Ddetailed%2Dexplanation%2Dwith%2Dexamples

%3A%2F

Analysis of SFM (CA Final) Paper for Nov 16 Exams (/articles/analysis-of-sfm-ca-final-paper-for-novhttps://www.linkedin.com

%2D%2D23835%2Easp%3Futm%5Fsource%3Darticles%26utm%5Fmedium%3Dsharebar%26utm%5Fcampaign%3Dsoci

%2Fwww%2Ecaclubindia%2Ecom%2Farticles%2Fgst%2Da%2Ddetailed%2Dexplanation%2Dwith%2Dexamples

16-exams-28199.asp)

/shareArticle?url=http

text=GST

%2D%2D23835%2Easp%3Futm%5Fsource%3Darticles%26utm%5Fmedium%3Dsharebar%26utm%5Fcampaign%3Dsoci

%3A%2F

Review of AMA Paper of CA Final (/articles/review-of-ama-paper-of-ca-final-28195.asp)

-/includes

A

%2Fwww%2Ecaclubindia%2Ecom%2Farticles%2Fgst%2Da%2Ddetailed%2Dexplanation%2Dwith%2Dexamples

detailed

/share_inc_more.asp?mod_id=23835&

Whether and how much money should be deposited in Bank? (/articles/whether-and-how-much-money%2D%2D23835%2Easp%3Futm%5Fsource%3Darticles%26utm%5Fmedium%3Dsharebar%26utm%5Fcampaign%3Dsoci

module_name=articles&

explanationshould-be-deposited-in-bank--28194.asp)

with

share_title2=GST

Your money will be your money! (/articles/-your-money-will-be-your-money--28192.asp)

-examples!

A

)

All about CSR (/articles/-all-about-csr-28191.asp)

detailed

explanationDo's and Dont's to remember when buying a life insurance policy (/articles/do-s-and-dont-s-to-rememberwhen-buying-a-life-insurance-policy-28188.asp)

with

examples!&share_url2=http

Audits under GST Regime: Are we geared enough to face the challenges (/articles/audits-under-gst-regime%3A%2F are-we-geared-enough-to-face-the-challenges-28186.asp)

%2Fwww%2Ecaclubindia%2Ecom%2Farticles%2Fgst%2Da%2Ddetailed%2Dexplanation%2Dwith%2Dexamples

Understand the demonetisation scheme - A Imandaari ka Utsav (/articles/understand-the-demonetisation%2D%2D23835%2Easp%3Futm%5Fsource%3Darticles%26utm%5Fmedium%3Dsharebar%26utm%5Fcampaign%3Dsoci

25 of 29

scheme-a-imandaari-ka-utsav-28181.asp)

More (default.asp

You can also submit your article by sending to

article@caclubindia.com

Submit article (article_list_add.asp)

(http://bit.ly/2evmWCE)

11-11-2016 03:24 PM

GST - A detailed explanation with examples!

http://www.caclubindia.com/articles/gst-a-detailed-explanation-with-exa...

(http://bit.ly/2beKxKU)

(articles_popular.asp)

(http://bit.ly/2ccylpQ)

https://www.facebook.com

/sharer

/sharer.php?u=http

https://twitter.com

%3A%2F

/intent

%2Fwww%2Ecaclubindia%2Ecom%2Farticles%2Fgst%2Da%2Ddetailed%2Dexplanation%2Dwith%2Dexamples

/tweet?url=http

https://plus.google.com

%2D%2D23835%2Easp%3Futm%5Fsource%3Darticles%26utm%5Fmedium%3Dsharebar%26utm%5Fcampaign%3Dsoci

%3A%2F

/share?url=http

%2Fwww%2Ecaclubindia%2Ecom%2Farticles%2Fgst%2Da%2Ddetailed%2Dexplanation%2Dwith%2Dexamples

%3A%2F

https://www.linkedin.com

%2D%2D23835%2Easp%3Futm%5Fsource%3Darticles%26utm%5Fmedium%3Dsharebar%26utm%5Fcampaign%3Dsoci

%2Fwww%2Ecaclubindia%2Ecom%2Farticles%2Fgst%2Da%2Ddetailed%2Dexplanation%2Dwith%2Dexamples

/shareArticle?url=http

text=GST

%2D%2D23835%2Easp%3Futm%5Fsource%3Darticles%26utm%5Fmedium%3Dsharebar%26utm%5Fcampaign%3Dsoci

%3A%2F

-/includes

A

%2Fwww%2Ecaclubindia%2Ecom%2Farticles%2Fgst%2Da%2Ddetailed%2Dexplanation%2Dwith%2Dexamples

detailed

/share_inc_more.asp?mod_id=23835&

%2D%2D23835%2Easp%3Futm%5Fsource%3Darticles%26utm%5Fmedium%3Dsharebar%26utm%5Fcampaign%3Dsoci

module_name=articles&

explanation

with

share_title2=GST

(https://ad.doubleclick.net/ddm/jump

-examples!

A

/N4988.2553118CACLUBCFA

detailed

/B10582147.141286483;sz=300x250;

explanation

ord=[11112016151623]?)

with

examples!&share_url2=http

%3A%2F

%2Fwww%2Ecaclubindia%2Ecom%2Farticles%2Fgst%2Da%2Ddetailed%2Dexplanation%2Dwith%2Dexamples

%2D%2D23835%2Easp%3Futm%5Fsource%3Darticles%26utm%5Fmedium%3Dsharebar%26utm%5Fcampaign%3Dsoci

26 of 29

Residential Investment Goa

Goa Real Estate

11-11-2016 03:24 PM

GST - A detailed explanation with examples!

http://www.caclubindia.com/articles/gst-a-detailed-explanation-with-exa...

Similar Forum Post

Browse by Category

(article_category_stats.asp)

Excise cenvat agst short receipt of matl

(../forum/excise-cenvat-agst-short-receiptof-matl-190098.asp)

Query regarding articleship & final

regstration (../forum/query-regardingarticleship-amp-final-regstration-189511.asp

Reporting chain amongst itos (../forum

https://www.facebook.com

Recent Comments

/reporting-chain-amongst-itos-184473.asp)

/sharer

(recent_comments.asp)

Lovable lines. u feel gud. must read. for

/sharer.php?u=http

https://twitter.com

youngsters only. (../forum/lovable-lines%3A%2F

/intent

Popular Articles

u-feel-gud-must-read-for-youngsters-only-%2Fwww%2Ecaclubindia%2Ecom%2Farticles%2Fgst%2Da%2Ddetailed%2Dexplanation%2Dwith%2Dexamples

/tweet?url=http

https://plus.google.com

183283.asp)

%2D%2D23835%2Easp%3Futm%5Fsource%3Darticles%26utm%5Fmedium%3Dsharebar%26utm%5Fcampaign%3Dsoci

(articles_popular.asp)

%3A%2F

/share?url=http

Gst, direct tax code in 2012 ?? (../forum

%2Fwww%2Ecaclubindia%2Ecom%2Farticles%2Fgst%2Da%2Ddetailed%2Dexplanation%2Dwith%2Dexamples

%3A%2F

https://www.linkedin.com

/gst-direct-tax-code-in-2012--181871.asp)

%2D%2D23835%2Easp%3Futm%5Fsource%3Darticles%26utm%5Fmedium%3Dsharebar%26utm%5Fcampaign%3Dsoci

%2Fwww%2Ecaclubindia%2Ecom%2Farticles%2Fgst%2Da%2Ddetailed%2Dexplanation%2Dwith%2Dexamples

/shareArticle?url=http

text=GST

Dtc, gst, ind as, companies bill (../forum

%2D%2D23835%2Easp%3Futm%5Fsource%3Darticles%26utm%5Fmedium%3Dsharebar%26utm%5Fcampaign%3Dsoci

%3A%2F

-/includes

A

/dtc-gst-ind-as-companies-bill-180960.asp)

%2Fwww%2Ecaclubindia%2Ecom%2Farticles%2Fgst%2Da%2Ddetailed%2Dexplanation%2Dwith%2Dexamples

detailed

/share_inc_more.asp?mod_id=23835&

New rules of vat, cst, service tax & gst 20th

%2D%2D23835%2Easp%3Futm%5Fsource%3Darticles%26utm%5Fmedium%3Dsharebar%26utm%5Fcampaign%3Dsoci

module_name=articles&

explanation

january, 2012. (../forum/new-rules-of-vatwith

share_title2=GST

cst-service-tax-amp-gst-20th-january-examples!

A

)

2012--180742.asp)

detailed

More (/forum/display.asp?cat_id=54

explanation

with

examples!&share_url2=http

%3A%2F

Subscribe to Articles Feed

%2Fwww%2Ecaclubindia%2Ecom%2Farticles%2Fgst%2Da%2Ddetailed%2Dexplanation%2Dwith%2Dexamples

(http://feedproxy.google.com

%2D%2D23835%2Easp%3Futm%5Fsource%3Darticles%26utm%5Fmedium%3Dsharebar%26utm%5Fcampaign%3Dsoci

/CaclubindiacomArticles)

27 of 29

Enter your email address

Submit

Income Tax

(article_display_list_by_category.asp?cat_id=3)

11-11-2016 03:24 PM

GST - A detailed explanation with examples!

http://www.caclubindia.com/articles/gst-a-detailed-explanation-with-exa...

GST

(article_display_list_by_category.asp?cat_id=54)

Audit

(article_display_list_by_category.asp?cat_id=2)

Students

(article_display_list_by_category.asp?cat_id=8)

Accounts

(article_display_list_by_category.asp?cat_id=1)

Custom

About (/about_us.asp)

(article_display_list_by_category.asp?cat_id=4)

Terms of Use

https://www.facebook.com

We are Hiring

(/terms_of_use.asp)

/sharer VAT

(article_display_list_by_category.asp?cat_id=5)

/sharer.php?u=http

(http://www.interactivemedia.co.inDisclaimer

https://twitter.com

%3A%2F

/intent Career

/jobs/)

(/disclaimer.asp)

%2Fwww%2Ecaclubindia%2Ecom%2Farticles%2Fgst%2Da%2Ddetailed%2Dexplanation%2Dwith%2Dexamples

(article_display_list_by_category.asp?cat_id=41)

/tweet?url=http

(/default.asp)

Blog

Privacy Policy

https://plus.google.com

%2D%2D23835%2Easp%3Futm%5Fsource%3Darticles%26utm%5Fmedium%3Dsharebar%26utm%5Fcampaign%3Dsoci

%3A%2F

/share?url=http

Service Tax

(http://www.caclubindiablog.com/)(/privacy_policy.asp)

%2Fwww%2Ecaclubindia%2Ecom%2Farticles%2Fgst%2Da%2Ddetailed%2Dexplanation%2Dwith%2Dexamples

(article_display_list_by_category.asp?cat_id=6)

%3A%2F

https://www.linkedin.com

Advertise

Contact Us

%2D%2D23835%2Easp%3Futm%5Fsource%3Darticles%26utm%5Fmedium%3Dsharebar%26utm%5Fcampaign%3Dsoci

%2Fwww%2Ecaclubindia%2Ecom%2Farticles%2Fgst%2Da%2Ddetailed%2Dexplanation%2Dwith%2Dexamples

/shareArticle?url=http

Corporate Law

text=GST

(/advertise_with_us.asp)

(/contact_us.asp)

%2D%2D23835%2Easp%3Futm%5Fsource%3Darticles%26utm%5Fmedium%3Dsharebar%26utm%5Fcampaign%3Dsoci

(article_display_list_by_category.asp?cat_id=7)

%3A%2F

-/includes

A

%2Fwww%2Ecaclubindia%2Ecom%2Farticles%2Fgst%2Da%2Ddetailed%2Dexplanation%2Dwith%2Dexamples

detailed Info Technology

/share_inc_more.asp?mod_id=23835&

%2D%2D23835%2Easp%3Futm%5Fsource%3Darticles%26utm%5Fmedium%3Dsharebar%26utm%5Fcampaign%3Dsoci

(article_display_list_by_category.asp?cat_id=9)

module_name=articles&

explanation

Our Network Sites

with

share_title2=GST

Excise

-examples!

A