Escolar Documentos

Profissional Documentos

Cultura Documentos

10 - Year - History 1990-2000

Enviado por

catherineposadasDescrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

10 - Year - History 1990-2000

Enviado por

catherineposadasDireitos autorais:

Formatos disponíveis

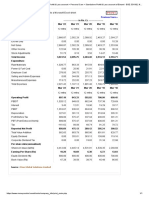

Financial History

(in millions, except per share data, financial ratios and number of shareholders)

YEAR ENDED MAY 31, 2000 1999 1998 1997 1996 1995 1994 1993 1992 1991 1990

Revenues $8,995.1 $8,776.9 $ 9,553.1 $ 9,186.5 $6,470.6 $4,760.8 $3,789.7 $3,931.0 $3,405.2 $3,003.6 $2,235.2

Gross margin 3,591.3 3,283.4 3,487.6 3,683.5 2,563.9 1,895.6 1,488.2 1,544.0 1,316.1 1,153.1 851.1

Gross margin % 39.9% 37.4% 36.5% 40.1% 39.6% 39.8% 39.3% 39.3% 38.7% 38.4% 38.1%

Restructuring charge (2.5) 45.1 129.9 — — — — — — — —

Net income 579.1 451.4 399.6 795.8 553.2 399.7 298.8 365.0 329.2 287.0 243.0

Basic earnings per common share 2.10 1.59 1.38 2.76 1.93 1.38 1.00 1.20 1.09 0.96 0.81

Diluted earnings per common share 2.07 1.57 1.35 2.68 1.88 1.36 0.99 1.18 1.07 0.94 0.80

Average common shares outstanding 275.7 283.3 288.7 288.4 286.6 289.6 298.6 302.9 301.7 300.4 299.1

Diluted average common shares outstanding 279.4 288.3 295.0 297.0 293.6 294.0 301.8 308.3 306.4 304.3 302.7

Cash dividends declared

per common share 0.48 0.48 0.46 0.38 0.29 0.24 0.20 0.19 0.15 0.13 0.10

Cash flow from operations 759.9 961.0 517.5 323.1 339.7 254.9 576.5 265.3 435.8 11.1 127.1

Price range of common stock

High 64.125 65.500 64.125 76.375 52.063 20.156 18.688 22.563 19.344 13.625 10.375

Low 26.563 31.750 37.750 47.875 19.531 14.063 10.781 13.750 8.781 6.500 4.750

MAY 31,

Cash and equivalents $ 254.3 $ 198.1 $ 108.6 $ 445.4 $ 262.1 $ 216.1 $ 518.8 $ 291.3 $ 260.1 $ 119.8 $ 90.4

Inventories 1,446.0 1,170.6 1,396.6 1,338.6 931.2 629.7 470.0 593.0 471.2 586.6 309.5

Working capital 1,456.4 1,818.0 1,828.8 1,964.0 1,259.9 938.4 1,208.4 1,165.2 964.3 662.6 561.6

Total assets 5,856.9 5,247.7 5,397.4 5,361.2 3,951.6 3,142.7 2,373.8 2,186.3 1,871.7 1,707.2 1,093.4

Long-term debt 470.3 386.1 379.4 296.0 9.6 10.6 12.4 15.0 69.5 30.0 25.9

Redeemable Preferred Stock 0.3 0.3 0.3 0.3 0.3 0.3 0.3 0.3 0.3 0.3 0.3

Shareholders’ equity 3,136.0 3,334.6 3,261.6 3,155.9 2,431.4 1,964.7 1,740.9 1,642.8 1,328.5 1,029.6 781.0

Year-end stock price 42.875 60.938 46.000 57.500 50.188 19.719 14.750 18.125 14.500 9.938 9.813

Market capitalization 11,559.1 17,202.2 13,201.1 16,633.0 14,416.8 5,635.2 4,318.8 5,499.3 4,379.6 2,993.0 2,942.7

FINANCIAL RATIOS

Return on equity 17.9% 13.7% 12.5% 28.5% 25.2% 21.6% 17.7% 24.5% 27.9% 31.7% 36.3%

Return on assets 10.4% 8.5% 7.4% 17.1% 15.6% 14.5% 13.1% 18.0% 18.4% 20.5% 25.3%

Inventory turns 4.1 4.3 4.4 4.8 5.0 5.2 4.3 4.5 3.9 4.1 5.2

Current ratio at May 31 1.7 2.3 2.1 2.1 1.9 1.8 3.2 3.6 3.3 2.1 3.1

Price/Earnings ratio at May 31 (diluted) 20.7 38.8 34.1 21.5 26.6 14.5 14.9 15.3 13.5 10.5 12.2

GEOGRAPHIC REVENUES

United States $5,017.4 $5,042.6 $5,460.0 $5,538.2 $3,964.7 $2,997.9 $2,432.7 $2,528.8 $2,270.9 $ 2,141.5 $1,755.5

Europe 2,350.9 2,255.8 2, 096.1 1,789.8 1,334.3 980.4 927.3 1,085.7 919.8 664.7 334.3

Asia Pacific 955.1 844.5 1,253.9 1,241.9 735.1 515.6 283.4 178.2 75.7 56.2 29.3

Americas (exclusive of United States) 671.7 634.0 743.1 616.6 436.5 266.9 146.3 138.3 138.8 141.2 116.1

Total Revenues $8,995.1 $8,776.9 $ 9,553.1 $ 9,186.5 $6,470.6 $4,760.8 $3,789.7 $3,931.0 $3,405.2 $3,003.6 $2,235.2

All per common share data has been adjusted to reflect the 2-for-1 stock splits paid October 23 , 1996 , October 30 , 1995 and October

5, 1990. The Company’s Class B Common Stock is listed on the New York and Pacific Exchanges and trades under the symbol NKE. At May

31, 2000, there were approximately 153,000 shareholders of Class A and Class B common stock.

22 2000 23

Você também pode gostar

- Government Publications: Key PapersNo EverandGovernment Publications: Key PapersBernard M. FryAinda não há avaliações

- Marriott (2) ..Documento13 páginasMarriott (2) ..veninsssssAinda não há avaliações

- Case 1 MarriottDocumento14 páginasCase 1 Marriotthimanshu sagar100% (1)

- Polaroid Corporation ENGLISHDocumento14 páginasPolaroid Corporation ENGLISHAtul AnandAinda não há avaliações

- Weekends TareaDocumento9 páginasWeekends Tareasergio ramozAinda não há avaliações

- 99 FinanceDocumento23 páginas99 Financeuser111Ainda não há avaliações

- Nike FinancialsDocumento3 páginasNike Financialslrsrz8Ainda não há avaliações

- Nike - Case Study MeenalDocumento9 páginasNike - Case Study MeenalAnchal ChokhaniAinda não há avaliações

- Nike - Case StudyDocumento9 páginasNike - Case StudyAnchal ChokhaniAinda não há avaliações

- Cost of Capital - NikeDocumento6 páginasCost of Capital - NikeAditi KhaitanAinda não há avaliações

- Nike Case Study VrindaDocumento4 páginasNike Case Study VrindaAnchal ChokhaniAinda não há avaliações

- FCFF Vs Fcfe StudentDocumento5 páginasFCFF Vs Fcfe StudentKanchan GuptaAinda não há avaliações

- Summary of Cooper Tire & Rubber Company's Financial and Operating Performance, 2009$2013 (Dollar Amounts in Millions, Except Per Share Data)Documento4 páginasSummary of Cooper Tire & Rubber Company's Financial and Operating Performance, 2009$2013 (Dollar Amounts in Millions, Except Per Share Data)Sanjaya WijesekareAinda não há avaliações

- Annual Report of Acs Group PDFDocumento458 páginasAnnual Report of Acs Group PDFManyAinda não há avaliações

- Cost of Capital - NikeDocumento6 páginasCost of Capital - NikeAnuj SaxenaAinda não há avaliações

- Stryker Corporation: Capital BudgetingDocumento8 páginasStryker Corporation: Capital Budgetinggaurav sahuAinda não há avaliações

- Pe RatiosDocumento6 páginasPe RatiosRakesh SharmaAinda não há avaliações

- Complete P&L Statement TemplateDocumento4 páginasComplete P&L Statement TemplateGolamMostafaAinda não há avaliações

- 14-10 Years HighlightsDocumento1 página14-10 Years HighlightsJigar PatelAinda não há avaliações

- Annual Trading Report: Strictly ConfidentialDocumento3 páginasAnnual Trading Report: Strictly ConfidentialMunazza FawadAinda não há avaliações

- 11yrsCashFlow Website 19Documento1 página11yrsCashFlow Website 19Mei YingAinda não há avaliações

- Tugas Pertemuan 10 - Sopianti (1730611006)Documento12 páginasTugas Pertemuan 10 - Sopianti (1730611006)sopiantiAinda não há avaliações

- Caso 2 Excel 1Documento8 páginasCaso 2 Excel 1Carolina NunezAinda não há avaliações

- Financial Statements-Kingsley AkinolaDocumento4 páginasFinancial Statements-Kingsley AkinolaKingsley AkinolaAinda não há avaliações

- News Release INDY Result 6M22Documento7 páginasNews Release INDY Result 6M22Rama Usaha MandiriAinda não há avaliações

- Pakistan State Oil Company Limited (Pso)Documento6 páginasPakistan State Oil Company Limited (Pso)Maaz HanifAinda não há avaliações

- Polaroid 1996 CalculationDocumento8 páginasPolaroid 1996 CalculationDev AnandAinda não há avaliações

- Bbby 4Q2014Documento3 páginasBbby 4Q2014RahulBakshiAinda não há avaliações

- JODY2 - 0 - Financial Statement Analysis - MC - CorrectedDocumento6 páginasJODY2 - 0 - Financial Statement Analysis - MC - Correctedkunal bajajAinda não há avaliações

- Hyundai Construction Equipment (IR 4Q20)Documento17 páginasHyundai Construction Equipment (IR 4Q20)girish_patkiAinda não há avaliações

- Dec 2021 enDocumento21 páginasDec 2021 enMohammed ShbairAinda não há avaliações

- D.statistical - Appendix (English-2020)Documento98 páginasD.statistical - Appendix (English-2020)ArthurAinda não há avaliações

- Harley-Davidson, Inc. (HOG) Stock Financials - Annual Income StatementDocumento5 páginasHarley-Davidson, Inc. (HOG) Stock Financials - Annual Income StatementThe Baby BossAinda não há avaliações

- 08 AnsDocumento13 páginas08 AnsAnonymous 8ooQmMoNs1Ainda não há avaliações

- S9 - XLS069-XLS-ENG MarriottDocumento12 páginasS9 - XLS069-XLS-ENG MarriottCarlosAinda não há avaliações

- NIKE Inc Ten Year Financial History FY19Documento1 páginaNIKE Inc Ten Year Financial History FY19Moisés Ríos RamosAinda não há avaliações

- Netflix Vs Blockbuster Financials 10.30.22Documento4 páginasNetflix Vs Blockbuster Financials 10.30.22Melissa ChanAinda não há avaliações

- TVS Motors Credit Risk AnalysisDocumento21 páginasTVS Motors Credit Risk AnalysisBharat ChaudharyAinda não há avaliações

- Sibanye Stillwater Q32020 Historical StatsDocumento14 páginasSibanye Stillwater Q32020 Historical StatsMashudu MbulayeniAinda não há avaliações

- SPS Sample ReportsDocumento61 páginasSPS Sample Reportsphong.parkerdistributorAinda não há avaliações

- Consolidated 11-Year Summary: ANA HOLDINGS INC. and Its Consolidated Subsidiaries (Note 1)Documento62 páginasConsolidated 11-Year Summary: ANA HOLDINGS INC. and Its Consolidated Subsidiaries (Note 1)MUHAMMAD ISMAILAinda não há avaliações

- Company Name Most Recent Fiscal Year Date of Coverage AnalystDocumento79 páginasCompany Name Most Recent Fiscal Year Date of Coverage AnalystPassmore DubeAinda não há avaliações

- Growth, Profitability, and Financial Ratios For Starbucks Corp (SBUX) From MorningstarDocumento2 páginasGrowth, Profitability, and Financial Ratios For Starbucks Corp (SBUX) From Morningstaraboubakr soultanAinda não há avaliações

- Sag Annual Report 2016 e Data PDFDocumento184 páginasSag Annual Report 2016 e Data PDFÁkos SlezákAinda não há avaliações

- XLS EngDocumento26 páginasXLS EngcellgadizAinda não há avaliações

- Bear Stearns 4q2005 - TablesDocumento4 páginasBear Stearns 4q2005 - Tablesjoeyn414Ainda não há avaliações

- Ten Year Review - Standalone: Asian Paints LimitedDocumento10 páginasTen Year Review - Standalone: Asian Paints Limitedmaruthi631Ainda não há avaliações

- Review: Ten Year (Standalone)Documento10 páginasReview: Ten Year (Standalone)maruthi631Ainda não há avaliações

- Caso PolaroidDocumento45 páginasCaso PolaroidByron AlarcònAinda não há avaliações

- Emami PNLDocumento1 páginaEmami PNLsZCCSZcAinda não há avaliações

- Allegion FinancilasDocumento2 páginasAllegion FinancilasMy PassionsAinda não há avaliações

- Chapter:-3 Finance Department: 3.1. Trading and P&L Account (How They Maintain, What Is The Present Status Etc.)Documento6 páginasChapter:-3 Finance Department: 3.1. Trading and P&L Account (How They Maintain, What Is The Present Status Etc.)Ashfaq ShaikhAinda não há avaliações

- BIOCON Ratio AnalysisDocumento3 páginasBIOCON Ratio AnalysisVinuAinda não há avaliações

- ASIAN PAINTS ValuationDocumento20 páginasASIAN PAINTS ValuationAtharva OrpeAinda não há avaliações

- P&L Profits and LostDocumento12 páginasP&L Profits and LostMarcelo RodaoAinda não há avaliações

- GilletteDocumento14 páginasGilletteapi-3702531Ainda não há avaliações

- Nasdaq Aaon 2018Documento92 páginasNasdaq Aaon 2018gaja babaAinda não há avaliações

- Yayen, Michael - MEM601Documento85 páginasYayen, Michael - MEM601MICHAEL YAYENAinda não há avaliações

- Obejera vs. Iga Sy DigestDocumento2 páginasObejera vs. Iga Sy DigestFairyssa Bianca Sagot100% (5)

- Ecm Type 5 - 23G00019Documento1 páginaEcm Type 5 - 23G00019Jezreel FlotildeAinda não há avaliações

- K. A. Abbas v. Union of India - A Case StudyDocumento4 páginasK. A. Abbas v. Union of India - A Case StudyAditya pal100% (2)

- Apostolic United Brethren Standards For Members/YouthDocumento60 páginasApostolic United Brethren Standards For Members/YouthKatie JoyAinda não há avaliações

- VMA FCC ComplaintsDocumento161 páginasVMA FCC ComplaintsDeadspinAinda não há avaliações

- EssayDocumento3 páginasEssayapi-358785865100% (3)

- MHRC Internal MemoDocumento1 páginaMHRC Internal MemoJacob RodriguezAinda não há avaliações

- Bagabuyo v. Comelec, GR 176970Documento2 páginasBagabuyo v. Comelec, GR 176970Chester Santos SoniegaAinda não há avaliações

- The Daily Tar Heel For Nov. 5, 2014Documento8 páginasThe Daily Tar Heel For Nov. 5, 2014The Daily Tar HeelAinda não há avaliações

- Bookkeeping PresentationDocumento20 páginasBookkeeping Presentationrose gabonAinda não há avaliações

- Plaintiff-Appellee Vs Vs Defendants-Appellants Claro M. Recto Solicitor General Pompeyo Diaz Solicitor Meliton G. SolimanDocumento9 páginasPlaintiff-Appellee Vs Vs Defendants-Appellants Claro M. Recto Solicitor General Pompeyo Diaz Solicitor Meliton G. Solimanvienuell ayingAinda não há avaliações

- Csec Physics Study ChecklistDocumento10 páginasCsec Physics Study ChecklistBlitz Gaming654100% (1)

- Two-Nation TheoryDocumento6 páginasTwo-Nation TheoryAleeha IlyasAinda não há avaliações

- KMPDU Private Practice CBA EldoretDocumento57 páginasKMPDU Private Practice CBA Eldoretapi-175531574Ainda não há avaliações

- 1 Types of Life Insurance Plans & ULIPSDocumento40 páginas1 Types of Life Insurance Plans & ULIPSJaswanth Singh RajpurohitAinda não há avaliações

- Navarro Vs DomagtoyDocumento3 páginasNavarro Vs Domagtoykvisca_martinoAinda não há avaliações

- 016 - Neda SecretariatDocumento4 páginas016 - Neda Secretariatmale PampangaAinda não há avaliações

- HSN Table 12 10 22 Advisory NewDocumento2 páginasHSN Table 12 10 22 Advisory NewAmanAinda não há avaliações

- RDA ProcessingDocumento112 páginasRDA Processingkaushi123Ainda não há avaliações

- Gun Control and Genocide - Mercyseat - Net-16Documento16 páginasGun Control and Genocide - Mercyseat - Net-16Keith Knight100% (2)

- Calalang Vs WilliamsDocumento2 páginasCalalang Vs Williamsczabina fatima delicaAinda não há avaliações

- Lancesoft Offer LetterDocumento5 páginasLancesoft Offer LetterYogendraAinda não há avaliações

- KW Branding Identity GuideDocumento44 páginasKW Branding Identity GuidedcsudweeksAinda não há avaliações

- Architect / Contract Administrator's Instruction: Estimated Revised Contract PriceDocumento6 páginasArchitect / Contract Administrator's Instruction: Estimated Revised Contract PriceAfiya PatersonAinda não há avaliações

- Midnights Children LitChartDocumento104 páginasMidnights Children LitChartnimishaAinda não há avaliações

- Allied Banking Corporation V BPIDocumento2 páginasAllied Banking Corporation V BPImenforever100% (3)

- SSC CGL Updates - Validity of OBC CertificateDocumento1 páginaSSC CGL Updates - Validity of OBC CertificateKshitijaAinda não há avaliações

- IOPC Decision Letter 14 Dec 18Documento5 páginasIOPC Decision Letter 14 Dec 18MiscellaneousAinda não há avaliações

- Nampicuan, Nueva EcijaDocumento2 páginasNampicuan, Nueva EcijaSunStar Philippine NewsAinda não há avaliações