Escolar Documentos

Profissional Documentos

Cultura Documentos

Mountain Man Brewing Company Writing Case Analysis

Enviado por

AleksandraDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Mountain Man Brewing Company Writing Case Analysis

Enviado por

AleksandraDireitos autorais:

Formatos disponíveis

Aleksandra Algina, Strategic Brand Marketing

Mountain Man Brewing Company Writing Case Analysis

Position Statement:

Mountain Man Brewing Company (here and after referred to as MMBC) is

currently operating in a market segment with declining revenues and sales,

while other segments of the market are growing and MMBC is overlooking a

possibility to introduce a new product offering to serve the growing segment.

MMBC is at turn of undertaking strategic decision of whether to launch a

brand extension initiative and diversify into Mountain Man Light product line

in order to meet the rising market demand in other product categories.

However, in order to evaluate the feasibility of this marketing initiative we

have to address a variety of arguments involved in this decision making

process.

Argument 1. MMBC current financial performance is deteriorating:

The company is facing declining sales of 2% per year due to customers

preferences changes towards lighter brews. This negative trend can be

explained by several factors:

There is a 4% annual decrease of traditional beer market;

The company relies on a single revenue driver (Mountain Man Lager);

This single revenue driver does not make up for customer outflowinflow balance: the targeted audience of 45+ is aging and shrinking

due to natural deaths, increasing health concerns, etc.;

The company is overlooking market opportunity estimated at 50.4%

and represented by the youth;

70% of current revenues are generated off-site, allowing only for 30%

of revenues generated in restaurants and bars;

MMBC is also facing the pressure of competing with local, regional and

national brewers and their brand awareness.

Aleksandra Algina, Strategic Brand Marketing

Given these factors it will be hard for MMBC to sustain its profitability in the

short and long terms with a single revenue driver represented by Mountain

Man Lange.

Argument 2: There is an unmet market demand.

Historically, MMBCs average customer has been a blue collar, lower to

middle income (between $25,000 and $75,000 a year) male over 45 years of

age, who prefer traditionally brewed beer. This customer base typically

purchases

60%

of

their

beer

from

off-premise

locations,

such

as

supermarkets and liquor stores. Mountain Man Lager drinkers are among the

most loyal customers in the market with a brand loyalty rate of 53%.

However, the only non-super-premium domestic type of beer market that has

been increasing is the light beer market, which has seen a 4% CAGR of light

beer sales over the past 6 years due to the consumption by the youth. First

time drinker demographic (21-27 years) represents the most lucrative

market for the beers companies, as this group accounted for 27% total beer

consumption and has yet been growing, but what is more important from the

marketing perspective is that this group does not have an established brand

preference.

Argument 3: Brand extension would undermine the core of existing

brand equity:

MMBC has been renowned for delivering a premium craft beer and embraces

a status of an independent, family-owned brewery. Given its high brand

loyalty rate, there is a considerable risk associated with diversification into a

new brand category that would serve a completely different customer base.

Aleksandra Algina, Strategic Brand Marketing

The current associations with the brand that probably make up for such a

high customer loyalty are traditions-based, dark craft beer, appropriate to

drink after work with your fellows or in front of TV. But in order to serve the

youth the MMBCs marketing message would have to transform into cool,

easy-to-socialize-with, light and more consumable, trendy beer. These, as

can be seen, represent radically different sides of a brand perception that

can create an ambiguity in consumers mind and by doing so can even

alleviate the sales of existing product.

The brand image would have to

equally involve both the 45+ blue-collars and under 25 jeans-and-T-shirt

people.

Given these three major arguments we can start to evaluate the decision of

either MMBC should undertake a marketing initiative to launch Mountain Man

Light or stay true to its core product.

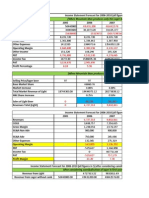

Argument 4: Breakeven Analysis.

In order to execute the BE analysis we have to calculate its components. We

are given that MMBCs revenues for 2005 totaled $50,440,000 and they sold

520,000 barrels that year, which bring us to the price of $97 per barrel of

Lager ($50,440,000/$520,000). Contribution margin from lager beer is

calculated at $97 - $66.93 = $30.07. Contribution margin from the light beer

can be calculated as $97 - $66.93 - $4.69 = $25.38. The fixed costs for the

introduction of Light would comprise $2,400,000 ($750,000 first 6-month

advertising) * 2 for annual projection) + $900,000 in annual, incremental SG

& A costs) for the 1 st year. Now given all the necessary components we can

calculate the breakeven point:

1. BEP in units: $2,400,000/$25.38 = 94,563 barrels

Aleksandra Algina, Strategic Brand Marketing

2. BEP in revenues: 94,563 * $97 = $9,172,576.83

Marketing Initiative Evaluation.

Launching Mountain Man Light represents a range of critical advantages,

such as:

Untapping the 50,4% of the market represented by the youth, thus

extending their customer base by attracting young and frequent

drinkers, which could make up for their existing product declining

sales;

Gaining presence in on-premise locations: extending their distribution

channels over off-premise venues, thus hypothetically increasing the

revenue;

Launching the light beer line does not require initial investment in PPE

due to existing excessive capacity;

Promising market demand trends: 4% CAGR.

However, this marketing opportunity has its disadvantages that are

necessary to look at:

Existing brand equity might be damaged;

There is a viable opportunity of cannibalization of the Lager by Light,

as the vendors would probably allocate the same shelf space for all the

products;

An attractive market is attractive for everyone, including major

established players who enjoy larger financial resources and stronger

brand awareness, so given this there can be an anticipation of

increased competition within large domestic beer brands and regional

breweries;

Increased inventory, SG&A, packaging costs;

Increased advertizing costs;

Constant market releases of light beer brands by large brands;

Aleksandra Algina, Strategic Brand Marketing

Absence of experience in product launch;

Absence of a successful precedent among small or medium companies

to introduce a new product within the beer industry.

Marketing program recommendations.

Having considered all the factors listed above, a recommendation to launch

the Light product line can be devised, as even given the disadvantages of it,

it still represents a lucrative opportunity for brand extension of Mountain

Man. Taken the analysis performed above we can devise a marketing

campaign recommendations.

In terms of target audience I would recommend focusing on younger drinkers

(21-27 year old), males and especially females, without an established brand

loyalty, who are willing to experiment with tastes and brands, and who are

frequent beer buyers in large quantities.

The marketing mix:

Product: in order to reach the youth audience MMBC have to readjust

its bottles packaging to meet the target segment expectations and to

communicate the appropriate brand associations;

Price: to stay competitive in the given segment MMBC have to keep

the prices for Light in a line with the competition so that the company

could enjoy enough of sales volume to breakeven;

Place: MMBC have to focus on the means of media communications

that are the most understandable and reachable for youth and

promoting easy lifestyle, such as printed ads in magazines targeted at

youth, billboard ads and TV ads that would address the Light brand

associations;

Aleksandra Algina, Strategic Brand Marketing

Promotion: MMBC have to focus on heavy coverage of Light

advertising campaign in traditional means of communication listed

above, and additionally can undertake a series of performance street

art advertising campaigns that would invoke an interest in Light among

the youth.

Você também pode gostar

- Mountain Man Case Analysis by Group 2Documento2 páginasMountain Man Case Analysis by Group 2Curiosity Killer100% (2)

- Group Assignment 2 Crescent Pure CaseDocumento11 páginasGroup Assignment 2 Crescent Pure CaseKamala MalaAinda não há avaliações

- Mountain Man Brewing Company - Group8Documento3 páginasMountain Man Brewing Company - Group8Akriti Sehgal100% (2)

- Pillsbury Cookie Challenge - IIM-KDocumento5 páginasPillsbury Cookie Challenge - IIM-KDeepu SAinda não há avaliações

- Mountain Man Brewing Company Case Study AnalysisDocumento21 páginasMountain Man Brewing Company Case Study AnalysisRDH100% (9)

- Mountain Man Brewing Company Analysis UpdatedDocumento8 páginasMountain Man Brewing Company Analysis UpdatedSandhya Rajan50% (2)

- MMBCDocumento5 páginasMMBCSabyasachi Sahu100% (1)

- Mountain Man Brewing Company - BE - TemplateDocumento2 páginasMountain Man Brewing Company - BE - TemplateswapniljsoniAinda não há avaliações

- MMBC - Case AnalysisDocumento28 páginasMMBC - Case AnalysisPhong Phan Thanh100% (1)

- Mountain Man Brewing CompanyDocumento13 páginasMountain Man Brewing CompanySuneetSinghBadla100% (1)

- Mountain Man Brewing CompanyDocumento2 páginasMountain Man Brewing CompanySharon Goh67% (3)

- Mountain Man Beer CompanyDocumento4 páginasMountain Man Beer CompanyAshwin Golapkar100% (1)

- Brand Management Term 5 End Term ExamDocumento9 páginasBrand Management Term 5 End Term ExamRahulSamaddarAinda não há avaliações

- BM MBA06071 Jaswinder SinghDocumento6 páginasBM MBA06071 Jaswinder SinghJaswinder SinghAinda não há avaliações

- MMBC Breakeven AnalysisDocumento11 páginasMMBC Breakeven Analysismrr2012Ainda não há avaliações

- Tanya: Product Life CycleDocumento8 páginasTanya: Product Life CycleJoey G CirilloAinda não há avaliações

- Why Your Advertising Never Makes You MoneyDocumento11 páginasWhy Your Advertising Never Makes You MoneyChristopher Colvin100% (4)

- Internal Communication ReportDocumento53 páginasInternal Communication Reportbryceoliveros100% (2)

- Lipton ProjectDocumento13 páginasLipton ProjectAbdullah SaleemAinda não há avaliações

- The ULTIMATE Promotional Email Campaign Swipe File.Documento109 páginasThe ULTIMATE Promotional Email Campaign Swipe File.ffAinda não há avaliações

- MMBC Case Write-UpDocumento2 páginasMMBC Case Write-UpKundan K100% (1)

- Mountain Man Brewery Case Report UploadDocumento6 páginasMountain Man Brewery Case Report Uploadherediamario100% (1)

- Mountain Man Case StudyDocumento4 páginasMountain Man Case StudyZhijian Huang100% (2)

- Mountain Man Brewing Company - Bringing The Brand To Light PDFDocumento3 páginasMountain Man Brewing Company - Bringing The Brand To Light PDFUdita BasuAinda não há avaliações

- Mountain Man Brewing CoDocumento4 páginasMountain Man Brewing CoMaite Gorostiaga100% (1)

- Mountain Man BeerDocumento29 páginasMountain Man BeerShivam TrivediAinda não há avaliações

- MMBC Marketing PLanDocumento12 páginasMMBC Marketing PLanCuriosity KillerAinda não há avaliações

- Mountain ManDocumento5 páginasMountain ManShrey PandeyAinda não há avaliações

- Mountain Man Brewing Company - CompliedDocumento21 páginasMountain Man Brewing Company - CompliedSukriti Vijay100% (3)

- Mountain Man Brewing CompanyDocumento6 páginasMountain Man Brewing CompanyChida_m100% (3)

- Individual Write Up MMBCDocumento5 páginasIndividual Write Up MMBCchetankabra85Ainda não há avaliações

- Mountain Man Brewing Company Case StudyDocumento3 páginasMountain Man Brewing Company Case StudyPreetam Joga75% (4)

- Mountain Man Brewery Company Case AnalysisDocumento4 páginasMountain Man Brewery Company Case AnalysisAmit PathakAinda não há avaliações

- MM CaseDocumento22 páginasMM Casemusadhiq_yavar100% (1)

- Mountain Man Brewing Company ProjectDocumento41 páginasMountain Man Brewing Company Projectmon309250% (2)

- Mountain Man BrewingDocumento3 páginasMountain Man BrewingAlfred EstacaAinda não há avaliações

- PBM - Mountain Man BrewingDocumento17 páginasPBM - Mountain Man Brewingpreeti jainAinda não há avaliações

- Mountain Man Brewing CompanyDocumento32 páginasMountain Man Brewing CompanyFez Research Laboratory83% (12)

- Case Project - Mountain ManDocumento2 páginasCase Project - Mountain ManSubhrodeep Das100% (1)

- Individual Write Up - MMBCDocumento5 páginasIndividual Write Up - MMBCmradulraj50% (2)

- Mountain Man Brewing CompanyDocumento3 páginasMountain Man Brewing CompanySajal Gupta100% (1)

- Case Analysis: Mountain Man Brewing Company: Marketing Management IDocumento10 páginasCase Analysis: Mountain Man Brewing Company: Marketing Management Iarushi_78198Ainda não há avaliações

- Market Analysis: We Need To Perform Market Analysis For All 3 Places (California, Washington andDocumento3 páginasMarket Analysis: We Need To Perform Market Analysis For All 3 Places (California, Washington andshivam chughAinda não há avaliações

- Mountain Man Brewing CompanyDocumento1 páginaMountain Man Brewing Companynarender sAinda não há avaliações

- Group 10 Addon: Targeting Impulse Case Analysis Important FactsDocumento3 páginasGroup 10 Addon: Targeting Impulse Case Analysis Important FactsAnamika GputaAinda não há avaliações

- Correction Mountain Man Brewing Company - Group2 Sec H 2014Documento12 páginasCorrection Mountain Man Brewing Company - Group2 Sec H 2014Tatsat Pandey100% (2)

- Mountain Man Brewing Case StudyDocumento4 páginasMountain Man Brewing Case StudyrcrsanowAinda não há avaliações

- Bbva CaseDocumento2 páginasBbva CasePankaj AgarwalAinda não há avaliações

- Team Members: Sri Lakshmi Yedlapalli, Parthraj Jadeja, Sabila Rafique, Alexis WangDocumento4 páginasTeam Members: Sri Lakshmi Yedlapalli, Parthraj Jadeja, Sabila Rafique, Alexis WangRehanaAinda não há avaliações

- Report For CrescentPureDocumento15 páginasReport For CrescentPurefiqa100% (1)

- Recommendations & Conclusion: Execute NICHE Market Positioning StrategyDocumento5 páginasRecommendations & Conclusion: Execute NICHE Market Positioning Strategysoldasters100% (1)

- Clean Edge Razor CaseDocumento9 páginasClean Edge Razor Casecarla@escs100% (1)

- Mountain Dew Case AnalysisDocumento2 páginasMountain Dew Case AnalysisPraveenAinda não há avaliações

- Group 4 Giant Consumer ProductsDocumento9 páginasGroup 4 Giant Consumer ProductsTanveer Gagnani100% (1)

- Clean Edge RazorDocumento5 páginasClean Edge RazorSahil Anand100% (1)

- Clean Edge RazorDocumento3 páginasClean Edge RazorRoma Rahaim GrahamAinda não há avaliações

- RKS Guitars AnalysisDocumento6 páginasRKS Guitars AnalysisSiddhesh GandhiAinda não há avaliações

- JC Penny - Strategia de Rebranding 2014Documento14 páginasJC Penny - Strategia de Rebranding 2014Teodora RădulescuAinda não há avaliações

- Case - Laura Ashley and Federal Express Strategic AllianceDocumento6 páginasCase - Laura Ashley and Federal Express Strategic Alliancerobin709290% (1)

- Ratio Calculations of Reject ShopDocumento3 páginasRatio Calculations of Reject ShopSurya ChandraAinda não há avaliações

- Mountain Man Brewing Company Case StudyDocumento3 páginasMountain Man Brewing Company Case StudyKundhan Karunakar AdariAinda não há avaliações

- Mountain Man Brewing Bringing Brand To Light Marketing EssayDocumento7 páginasMountain Man Brewing Bringing Brand To Light Marketing EssayRaghavendra NaduvinamaniAinda não há avaliações

- EPGP 301 - Marketing Management Assignment - EPGP-14A-134 - Mountain Man BrewingDocumento3 páginasEPGP 301 - Marketing Management Assignment - EPGP-14A-134 - Mountain Man BrewingKundhan Karunakar AdariAinda não há avaliações

- Retail Marketing and Branding: A Definitive Guide to Maximizing ROINo EverandRetail Marketing and Branding: A Definitive Guide to Maximizing ROIAinda não há avaliações

- Social Media Strategy - Zainab Al-TouqDocumento9 páginasSocial Media Strategy - Zainab Al-TouqZaynpanAinda não há avaliações

- BSTD Grade Week 7 Concept of Quality GR 10 Notes-Term 2Documento4 páginasBSTD Grade Week 7 Concept of Quality GR 10 Notes-Term 2v8yfv6nw4fAinda não há avaliações

- MM QP N AnsDocumento45 páginasMM QP N AnsSheeja RamakrishnanAinda não há avaliações

- Eureka Forbes Direct Selling MethodDocumento3 páginasEureka Forbes Direct Selling MethodVipin TitoriaAinda não há avaliações

- Product Placement Journal of Management and Marketing ResearchDocumento24 páginasProduct Placement Journal of Management and Marketing ResearchJason RekkerAinda não há avaliações

- Integrated Marketing Communication PlanDocumento49 páginasIntegrated Marketing Communication PlanAbdul QayoomAinda não há avaliações

- Model Q.paper IMC I&IIDocumento6 páginasModel Q.paper IMC I&IIShailendra SrivastavaAinda não há avaliações

- Bisleri FDocumento61 páginasBisleri FManoj Kumar B100% (1)

- Advertising Effectiveness of TATA MotorsDocumento72 páginasAdvertising Effectiveness of TATA MotorsAmit0% (1)

- Tofan GroupDocumento10 páginasTofan GroupKing StoneAinda não há avaliações

- Venkat MMDocumento11 páginasVenkat MMvenkat 25Ainda não há avaliações

- H M ProjectDocumento59 páginasH M ProjectOlicik@Ainda não há avaliações

- Marketing Plan For Mobile News Games LLC: 1.0 Executive SummaryDocumento20 páginasMarketing Plan For Mobile News Games LLC: 1.0 Executive SummaryshoaibAinda não há avaliações

- Case Problem Linear ProgrammingDocumento3 páginasCase Problem Linear ProgrammingCarmela Jimenez0% (1)

- Nike Brand AuditDocumento11 páginasNike Brand AuditWajih Jarnane100% (1)

- Thai Thi Huong Giang - s3117184Documento21 páginasThai Thi Huong Giang - s3117184Beo ThaiAinda não há avaliações

- 1 57654 Marketing ReseaDocumento21 páginas1 57654 Marketing ReseaAsad BilalAinda não há avaliações

- If Brands Are Built Over Years, Why Are They Managed Over Quarters?Documento18 páginasIf Brands Are Built Over Years, Why Are They Managed Over Quarters?SONALI HAinda não há avaliações

- Pasta Restaurant Marketing PlanDocumento19 páginasPasta Restaurant Marketing PlanPalo Alto Software100% (7)

- Nike - 5p, Swot, Pest AnalysisDocumento6 páginasNike - 5p, Swot, Pest AnalysisTahira YaseenAinda não há avaliações

- India: 2-Minute Tagline and Fast To Cook, Good To Eat Helped Maggi To Create ADocumento4 páginasIndia: 2-Minute Tagline and Fast To Cook, Good To Eat Helped Maggi To Create AMeetika MalhotraAinda não há avaliações

- CBS Case Competition 2022 Pitch DeckDocumento16 páginasCBS Case Competition 2022 Pitch DeckAkash Kumar100% (1)

- 10 Big Business Breakthroughs Action GuideDocumento27 páginas10 Big Business Breakthroughs Action GuideAnthony Gay100% (3)

- SWOT AnaysisDocumento3 páginasSWOT AnaysishodaAinda não há avaliações

- Project ReportDocumento14 páginasProject Reportsee248985Ainda não há avaliações

- Marketing Plan On Mountain DEWDocumento52 páginasMarketing Plan On Mountain DEWM.WASEEM YOUSAF100% (2)