Escolar Documentos

Profissional Documentos

Cultura Documentos

Capital Budgeting Project:: Issues To Be Evaluated Are

Enviado por

Vivek AnandanTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Capital Budgeting Project:: Issues To Be Evaluated Are

Enviado por

Vivek AnandanDireitos autorais:

Formatos disponíveis

CAPITAL BUDGETING PROJECT:

IOCL is Indias one of the largest oil company. It produces oil and

Market leaders for carbonated soft drinks in Mexico are Coca Cola, Pepsi Cola

and Pepper Snapple. These companies accounted for a combined market share of

90%. Bedida Sol decided to start offering private label carbonated soft drinks with

similar taste, but at about half the price. Therefore they came up with a new idea of

introducing a zero calorie product line in Hola Kola.

Issues to be evaluated are:

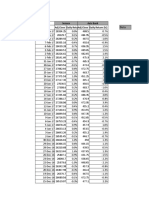

1. A study revealed that the cost estimation of converting fixed roof to floating

roof is estimated to be INR 1.51 crores. The costs incurred in this will be

depreciated for 30 years. The method followed by IOCL is straight line

method.

2. Payback period of investment is 8.6 (Without CDM) & 8.2 (With CDM) Years.

There will be an annual saving of Rs 17.15 lakhs by converting fixed to

floating roof. Decision criteria is IRR and payback period. NPV is not

considered as decision criteria.

3. Cash flows from the project is spread over 10 year period. Cash flow is based

on the demand for the products to be produced in the plant. It also did not

take into account the reduce efficiency of the equipment as it old.

Critical evaluation:

1. While using straight line method will have equal amount of depreciation for

30 years. Newer methods of depreciation would present an accurate picture

of the project. Accelerated depreciation method like WDV method. Because

for projects which consists of equipment and machineries WDV method is

more suitable than straight line method.

2. IOCL uses payback period and IRR method as decision criteria. But if the

multiple discount rates are used IRR will not be an efficient method. Also

there will be a significant difference between NPV and IRR when calculated

over longer durations.

3. While calculating the cash flows for the new project proposal, it has not been

clearly indicated whether they have taken demand projections for the product

in the market. Cash flows may also get affected by price of crude oil and

rupee value against dollar. These factors has not been considered in

calculating the cash flows.

Você também pode gostar

- Capital BudgetingDocumento69 páginasCapital BudgetingMALLIKARJUNAinda não há avaliações

- A Study of Receivable Management and Role of E-Payment in Indian Oil Corporation LTDDocumento34 páginasA Study of Receivable Management and Role of E-Payment in Indian Oil Corporation LTDDipanjan GuhaAinda não há avaliações

- CPChap 3Documento33 páginasCPChap 3K59 Hoang Gia HuyAinda não há avaliações

- Asked 1yr Ago.: Venkateshwar2002Documento21 páginasAsked 1yr Ago.: Venkateshwar2002Ali khanAinda não há avaliações

- CPChap 3Documento33 páginasCPChap 3K59 Nguyen Thi Thuy VanAinda não há avaliações

- Case - Capital BudgetingDocumento2 páginasCase - Capital BudgetingRenz PamintuanAinda não há avaliações

- FMChap 4Documento33 páginasFMChap 4Phương DaoAinda não há avaliações

- Ethics in Budgeting Project AnalysisDocumento5 páginasEthics in Budgeting Project Analysiskartik_ani100% (1)

- Capital BudgetingDocumento12 páginasCapital BudgetingAbs Pangader100% (11)

- New Heritage DollDocumento4 páginasNew Heritage Dolls_gonzalez75Ainda não há avaliações

- "A Study On Capital Budgeting of Honda Co PVT LTD": Title NO. Executive SummaryDocumento44 páginas"A Study On Capital Budgeting of Honda Co PVT LTD": Title NO. Executive SummaryHARI HARIAinda não há avaliações

- Finance II Mid-Term Exam 2020Documento4 páginasFinance II Mid-Term Exam 2020Yash KalaAinda não há avaliações

- Capital Budgeting Evaluation Criteria Exercise Guide - NPV, IRR, Replacement Chain ApproachDocumento4 páginasCapital Budgeting Evaluation Criteria Exercise Guide - NPV, IRR, Replacement Chain ApproachAnshuman AggarwalAinda não há avaliações

- Capital BudgetingDocumento12 páginasCapital BudgetingLambodar PradhanAinda não há avaliações

- Tute5 Capital BudgetingDocumento1 páginaTute5 Capital Budgetingvivek patelAinda não há avaliações

- Super Project - July 2019Documento4 páginasSuper Project - July 2019Wally WannallAinda não há avaliações

- FMA - Tutorial 8 - Capital BudgetingDocumento4 páginasFMA - Tutorial 8 - Capital BudgetingPhuong VuongAinda não há avaliações

- Capital Budgeting TechniquesDocumento6 páginasCapital Budgeting TechniquesMichael ReyesAinda não há avaliações

- 61Fin2Fim - Financial Management Tutorial 9 - Capital BudgetingDocumento4 páginas61Fin2Fim - Financial Management Tutorial 9 - Capital BudgetingThuỳ PhạmAinda não há avaliações

- Project Report On The Neogi Chemical CompanyDocumento7 páginasProject Report On The Neogi Chemical Companyabhisheknagpal27Ainda não há avaliações

- WCM Project (Working Capital Management)Documento61 páginasWCM Project (Working Capital Management)d82vinoAinda não há avaliações

- IOCL FinalDocumento6 páginasIOCL FinalAnushka JindalAinda não há avaliações

- Project Selection CriteriaDocumento10 páginasProject Selection CriteriaLetsholo MoAinda não há avaliações

- Working Capital Analysis Project ReportDocumento74 páginasWorking Capital Analysis Project ReportPushpender SinghAinda não há avaliações

- Accounting for Carbon Credits in IndiaDocumento2 páginasAccounting for Carbon Credits in IndiaPrramakrishnanRamaKrishnanAinda não há avaliações

- Capital Budgeting (Yoshikawa Components Company)Documento2 páginasCapital Budgeting (Yoshikawa Components Company)Mohamed Hamdy0% (1)

- Falling Short An Evaluation of The Indian Renewable Certificate MarketDocumento22 páginasFalling Short An Evaluation of The Indian Renewable Certificate MarketnishantAinda não há avaliações

- Victoria Chemicals Plc. (A) The Merseyside ProjectDocumento9 páginasVictoria Chemicals Plc. (A) The Merseyside ProjectAs17 As17Ainda não há avaliações

- Corporate Finance Assignment MBSDocumento14 páginasCorporate Finance Assignment MBSSharul IslamAinda não há avaliações

- General Foods Capital Budgeting AnalysisDocumento5 páginasGeneral Foods Capital Budgeting Analysisgpadhye123Ainda não há avaliações

- Capital Budgeting - Adv IssuesDocumento21 páginasCapital Budgeting - Adv IssuesdixitBhavak DixitAinda não há avaliações

- Bme Term PaperdocDocumento6 páginasBme Term PaperdocVamshi Krishna MallelaAinda não há avaliações

- Financial Management Assg-1Documento6 páginasFinancial Management Assg-1Udhay ShankarAinda não há avaliações

- India energy efficiency scheme unlikely to impact CDM marketDocumento1 páginaIndia energy efficiency scheme unlikely to impact CDM marketSegun AdekoyaAinda não há avaliações

- Basic Electrical Engineering LabDocumento8 páginasBasic Electrical Engineering LabAkshayAspalliAinda não há avaliações

- Case Study RevisedDocumento7 páginasCase Study Revisedbhardwaj_manish44100% (3)

- FM 3Documento12 páginasFM 3Rohini rs nairAinda não há avaliações

- Capital BudgetingDocumento12 páginasCapital Budgetingjunhe898Ainda não há avaliações

- Corporate Finance Assignment Questions 2019Documento6 páginasCorporate Finance Assignment Questions 2019Rup Singh Chauhan100% (2)

- SelectionDocumento2 páginasSelectionpradeep_mi2014Ainda não há avaliações

- The Super ProjectDocumento5 páginasThe Super ProjectAbhiAinda não há avaliações

- Risk in Capital BudgetingDocumento17 páginasRisk in Capital BudgetingSabit Ahmed AleemAinda não há avaliações

- Neogi Chemical CompanyDocumento6 páginasNeogi Chemical CompanyVaibhav Kumar100% (1)

- Lecture 9 InvestmentDocumento34 páginasLecture 9 InvestmentCristina IonescuAinda não há avaliações

- HOLA KOLA CAPITAL BUDGET DECISIONDocumento8 páginasHOLA KOLA CAPITAL BUDGET DECISIONAnushka0% (2)

- InternshipDocumento17 páginasInternshipHimanshu Sekhar GuruAinda não há avaliações

- FM DC Lecture 5 Capital Budgeting PDFDocumento7 páginasFM DC Lecture 5 Capital Budgeting PDFRitesh KumarAinda não há avaliações

- Mirr NotesDocumento5 páginasMirr NotesSitaKumariAinda não há avaliações

- Feasibility Report ABC ConstructionDocumento84 páginasFeasibility Report ABC ConstructionHasnainImranAinda não há avaliações

- CV Et QP 2022 - PGPFDocumento7 páginasCV Et QP 2022 - PGPFanish mahtoAinda não há avaliações

- Constructing Purchasing Power Parities Using a Reduced Information Approach: A Research StudyNo EverandConstructing Purchasing Power Parities Using a Reduced Information Approach: A Research StudyAinda não há avaliações

- Handbook for Developing Joint Crediting Mechanism ProjectsNo EverandHandbook for Developing Joint Crediting Mechanism ProjectsAinda não há avaliações

- Innovative Infrastructure Financing through Value Capture in IndonesiaNo EverandInnovative Infrastructure Financing through Value Capture in IndonesiaNota: 5 de 5 estrelas5/5 (1)

- Guidebook for Utilities-Led Business Models: Way Forward for Rooftop Solar in IndiaNo EverandGuidebook for Utilities-Led Business Models: Way Forward for Rooftop Solar in IndiaAinda não há avaliações

- Guidelines for the Economic Analysis of ProjectsNo EverandGuidelines for the Economic Analysis of ProjectsAinda não há avaliações

- Improving Energy Efficiency and Reducing Emissions through Intelligent Railway Station BuildingsNo EverandImproving Energy Efficiency and Reducing Emissions through Intelligent Railway Station BuildingsAinda não há avaliações

- Career Change From Real Estate to Oil and Gas ProjectsNo EverandCareer Change From Real Estate to Oil and Gas ProjectsNota: 5 de 5 estrelas5/5 (1)

- Carbon Pricing for Energy Transition and DecarbonizationNo EverandCarbon Pricing for Energy Transition and DecarbonizationAinda não há avaliações

- Guidelines for Estimating Greenhouse Gas Emissions of ADB Projects: Additional Guidance for Clean Energy ProjectsNo EverandGuidelines for Estimating Greenhouse Gas Emissions of ADB Projects: Additional Guidance for Clean Energy ProjectsAinda não há avaliações

- 2nd-yr-b.com_Documento13 páginas2nd-yr-b.com_Vivek Anandan0% (1)

- DCF Valuation Lecture NotesDocumento59 páginasDCF Valuation Lecture NotesVivek AnandanAinda não há avaliações

- Bond DurationDocumento88 páginasBond DurationVivek AnandanAinda não há avaliações

- Brand Management Role DescriptionDocumento1 páginaBrand Management Role DescriptionVivek AnandanAinda não há avaliações

- Perceptions of MOOC Learning For Employability: Public Education As MicrocosmDocumento146 páginasPerceptions of MOOC Learning For Employability: Public Education As MicrocosmVivek AnandanAinda não há avaliações

- ConneCtor PDA 2001 Data (Segmentation)Documento24 páginasConneCtor PDA 2001 Data (Segmentation)Vivek AnandanAinda não há avaliações

- ME FinalDocumento22 páginasME FinalVivek AnandanAinda não há avaliações

- FAQUoS PDFDocumento9 páginasFAQUoS PDFmyfoot1991Ainda não há avaliações

- PGP2 Contact DetailsDocumento9 páginasPGP2 Contact DetailsVivek AnandanAinda não há avaliações

- Dealing With China: A Grand Strategy EssayDocumento8 páginasDealing With China: A Grand Strategy EssayKuber BogatiAinda não há avaliações

- OutDocumento117 páginasOutVivek AnandanAinda não há avaliações

- Identifying Predictive Variables That Forecast Student Success in MoocsDocumento142 páginasIdentifying Predictive Variables That Forecast Student Success in MoocsVivek AnandanAinda não há avaliações

- 1Documento1 página1Vivek AnandanAinda não há avaliações

- Country analysis-IRELAND: Group 10: Vivekanandan A Suman HaldarDocumento1 páginaCountry analysis-IRELAND: Group 10: Vivekanandan A Suman HaldarVivek AnandanAinda não há avaliações

- Annual Performance Appraisal Improves Your Outcome 10 Reimbursement and Other AllowanceDocumento3 páginasAnnual Performance Appraisal Improves Your Outcome 10 Reimbursement and Other AllowanceVivek AnandanAinda não há avaliações

- Globe Corporation problem assignment solutionDocumento4 páginasGlobe Corporation problem assignment solutionVivek AnandanAinda não há avaliações

- Pgp32345 - FM Axis Bank BetaDocumento57 páginasPgp32345 - FM Axis Bank BetaVivek AnandanAinda não há avaliações

- RC 2016 Winning RPT Univ of WaterlooDocumento53 páginasRC 2016 Winning RPT Univ of WaterlooVivek AnandanAinda não há avaliações

- MCDDocumento365 páginasMCDVivek AnandanAinda não há avaliações

- Comprehensive Business Analysis: Ryder's System Inc.: by Vivekanandan A (PGP32345)Documento10 páginasComprehensive Business Analysis: Ryder's System Inc.: by Vivekanandan A (PGP32345)Vivek AnandanAinda não há avaliações

- Equity ResearchDocumento4 páginasEquity ResearchChandanAinda não há avaliações

- 2016 ArDocumento124 páginas2016 ArFfedsw NicksAinda não há avaliações

- Thirukkural Puthiya UraiDocumento306 páginasThirukkural Puthiya UraiBestwick Braveen SylvesterAinda não há avaliações

- CRISIL Research - Ier Report Apollo Hospitals Enterprise LTD 2016Documento32 páginasCRISIL Research - Ier Report Apollo Hospitals Enterprise LTD 2016Vivek AnandanAinda não há avaliações

- Emp Id and Name ListDocumento64 páginasEmp Id and Name ListVivek AnandanAinda não há avaliações

- RARBGDocumento1 páginaRARBGVivek AnandanAinda não há avaliações

- EastDocumento16 páginasEastVivek AnandanAinda não há avaliações

- LamDocumento1 páginaLamVivek AnandanAinda não há avaliações

- Financial Accounting 05Documento68 páginasFinancial Accounting 05Dheeraj Suntha100% (1)