Escolar Documentos

Profissional Documentos

Cultura Documentos

Key Highlights of The Finance Budget - 2017

Enviado por

Paymaster ServicesTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Key Highlights of The Finance Budget - 2017

Enviado por

Paymaster ServicesDireitos autorais:

Formatos disponíveis

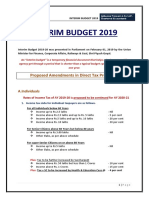

Budget FY 2017-18 -- Key Direct Tax Proposals:

01. Existing tax rate for individuals between Rs. 2.5- Rs 5 lakh is reduced to 5%

from existing 10%.

02. Rebate under Section 87A: The rebate is available to a resident individual if

total income does not exceed Rs. 3,50,000. The amount of rebate shall be 100%

of income-tax or Rs. 2,500, whichever is less.

03. All other categories of tax payers in subsequent brackets will get a benefit of Rs

12,500.

04. New 10 % Surcharge on individual income above Rs. 50 lakh and up to Rs 1

crore. Further, 15 % Surcharge on individual income above Rs. 1 crore to remain.

05. With regard to Capital gain tax, holding period has been reduced from 3 years

to 2 years for transfer of immovable property in the budget. It has also been

proposed to shift the base year of indexation from 1 April 1981 to 1 April 2001 for

all classes of assets including immovable property.

06. For revision of return, time period has been reduced to twelve months from

completion of financial year at par with the time period of filing of return.

07. For scrutiny assessments, time period has been compressed from 21

months to 18 months for Assessment Year 2018-19 and further to 12 months for

Assessment Year 2019-20 and onwards.

08. Simple one page return for people with an annual income of Rs. 5 lakh other

than business income.

09. For professionals going for presumptive taxation with receipts upto Rs. 50

Lakhs, there is now an option to pay advance tax instalment in one go instead of

earlier paying 4 instalments.

10. There is a big and rewarding relief to the small and medium sized enterprises

which account for 96% of our industry. Income tax rate has been reduced from

30% to 25% with turnover upto Rs. 50 crores. Its a boost to SMEs & MSMEs

sector.

11. The Income Tax Act to be amended to ensure that no transaction above Rs 3

lakh is permitted in cash.

12. Expenditure by cash reduced from 20,000 to Rs.10,000 for claiming deduction in

books of account.

13. Base Year for Indexation changed from 01.04.1981 to 01.04.2001

14. Basket of Investments for Capital Gain to be extended by notification.

15. Sec.44AA Maintaining Books of Accounts limit increased from Rs.10 Lakh to

Rs. 25 Lakh.

Você também pode gostar

- Union Budget 2017-18: Janani P FinanceDocumento17 páginasUnion Budget 2017-18: Janani P FinanceJanani ParameswaranAinda não há avaliações

- Bold Step Towards 5 Trillion Economy: CMA Bhogavalli Mallikarjuna GuptaDocumento3 páginasBold Step Towards 5 Trillion Economy: CMA Bhogavalli Mallikarjuna GuptavenkannaAinda não há avaliações

- A Critical Analysis of The Union Budget 2021Documento4 páginasA Critical Analysis of The Union Budget 2021Jamila MustafaAinda não há avaliações

- Tax Planning For Year 2010Documento24 páginasTax Planning For Year 2010Mehak BhargavaAinda não há avaliações

- Amity Global Business School, PuneDocumento15 páginasAmity Global Business School, PuneChand KalraAinda não há avaliações

- Here Are Five Changes in Income Tax Rules, Proposed in Union Budget 2018-19Documento5 páginasHere Are Five Changes in Income Tax Rules, Proposed in Union Budget 2018-19harish nayakAinda não há avaliações

- Budget Highlights February 2013: Economy Assessment: TaxesDocumento3 páginasBudget Highlights February 2013: Economy Assessment: TaxesRobs KhAinda não há avaliações

- Budget HighlightsDocumento10 páginasBudget Highlightsbackup mypcAinda não há avaliações

- Elements of Budget 2017 Which Focuses On Job Creation AreDocumento8 páginasElements of Budget 2017 Which Focuses On Job Creation Arepranjit sarmahAinda não há avaliações

- Union Budget Group 6Documento18 páginasUnion Budget Group 6GayatriAinda não há avaliações

- Tax PlanningDocumento7 páginasTax PlanningCharan AdharAinda não há avaliações

- Interim Budget 2019: Proposed Amendments in Direct Tax ProvisionsDocumento4 páginasInterim Budget 2019: Proposed Amendments in Direct Tax ProvisionsaaAinda não há avaliações

- Tax AmendmentsDocumento5 páginasTax AmendmentsLipi ThapliyalAinda não há avaliações

- Key Highlights of The Union Budget 2012-13: A Full Service Corporate Law FirmDocumento5 páginasKey Highlights of The Union Budget 2012-13: A Full Service Corporate Law FirmCn NatarajanAinda não há avaliações

- Intrim Union Budget 2019-20Documento12 páginasIntrim Union Budget 2019-20Rukmani GuptaAinda não há avaliações

- DTC HighlightsDocumento9 páginasDTC HighlightsAditi DugarAinda não há avaliações

- Union Budget Analysis 2023 24Documento8 páginasUnion Budget Analysis 2023 24minakshi malviyaAinda não há avaliações

- Name Azeem Khaliq ROLL NUM 121 BBA/13-F 3Rd Batch Subject Corporate Finance Assignment Study Budget 2016-17Documento7 páginasName Azeem Khaliq ROLL NUM 121 BBA/13-F 3Rd Batch Subject Corporate Finance Assignment Study Budget 2016-17Azeem KhaliqAinda não há avaliações

- Key Features of BUDGET 2010-11: Presented To, Prof .BhaodasDocumento27 páginasKey Features of BUDGET 2010-11: Presented To, Prof .Bhaodasbhavu_ashAinda não há avaliações

- India: Budget 2015-16 - For The Corporates: Corporate Tax RateDocumento4 páginasIndia: Budget 2015-16 - For The Corporates: Corporate Tax RateraghuAinda não há avaliações

- Budget 2014-RS AND CO FINALDocumento23 páginasBudget 2014-RS AND CO FINALRaghavendhar AaravamudhanAinda não há avaliações

- Budget Chemistry 2010Documento44 páginasBudget Chemistry 2010Aq SalmanAinda não há avaliações

- Budget 2019 Key PointsDocumento2 páginasBudget 2019 Key Pointsrathishsrk03Ainda não há avaliações

- Penalty For Underpayment of TaxDocumento5 páginasPenalty For Underpayment of Taxjwasundara1654Ainda não há avaliações

- IT&STDocumento2 páginasIT&STPraveen DsouzaAinda não há avaliações

- General: GDP Is Expected To Grow in The Region of 8.75% To 9.25%. The MinisterDocumento5 páginasGeneral: GDP Is Expected To Grow in The Region of 8.75% To 9.25%. The MinisterSuraj NaikAinda não há avaliações

- Finance Budget 2023Documento4 páginasFinance Budget 2023SakshamAinda não há avaliações

- India Highlights of Budget 2016 at A GlanceDocumento5 páginasIndia Highlights of Budget 2016 at A GlanceKARTHIK145Ainda não há avaliações

- Press Information Bureau Government of India Ministry of FinanceDocumento3 páginasPress Information Bureau Government of India Ministry of Financekumar45caAinda não há avaliações

- Budget 2011Documento4 páginasBudget 2011viv_nitjAinda não há avaliações

- Budget BOOK FinalDocumento19 páginasBudget BOOK FinalAmin ChhipaAinda não há avaliações

- Tax FileDocumento3 páginasTax FileBook wormAinda não há avaliações

- The Proposed Direct Tax Code Is A Combination of Major Tax Relief and Removal of Most TaxDocumento3 páginasThe Proposed Direct Tax Code Is A Combination of Major Tax Relief and Removal of Most TaxRohit YadavAinda não há avaliações

- Union Budget 2012Documento4 páginasUnion Budget 2012Siddhant SekharAinda não há avaliações

- Union Budget 2015 AnalysisDocumento10 páginasUnion Budget 2015 Analysisvenkatesh_financeAinda não há avaliações

- List-Of-Changes-In-The-Nirc-Under-Ra-10963 (1) 2Documento7 páginasList-Of-Changes-In-The-Nirc-Under-Ra-10963 (1) 2Sittie Nor ZacariaAinda não há avaliações

- TDS Calculation Sheet in Excel and Slabs For FY 2017-18 and AY 2018-19Documento5 páginasTDS Calculation Sheet in Excel and Slabs For FY 2017-18 and AY 2018-19Nishit MarvaniaAinda não há avaliações

- Taxpayer UB 2016Documento1 páginaTaxpayer UB 2016Pawan SharmaAinda não há avaliações

- PressRelease 22ndGSTCMeeting PDFDocumento2 páginasPressRelease 22ndGSTCMeeting PDFSaurabh SinghAinda não há avaliações

- PressRelease 22ndGSTCMeetingDocumento2 páginasPressRelease 22ndGSTCMeetingShail MehtaAinda não há avaliações

- Press Release: Composition SchemeDocumento2 páginasPress Release: Composition SchemeRojalin BiswsasAinda não há avaliações

- Highlights of Budget 2016 17Documento3 páginasHighlights of Budget 2016 17muntaquirAinda não há avaliações

- New Delhi: Finance Minister Pranab Mukherjee Presented The Union Budget For The YearDocumento3 páginasNew Delhi: Finance Minister Pranab Mukherjee Presented The Union Budget For The YearTapas KumarAinda não há avaliações

- Microeconomics Budget Line GoodsDocumento12 páginasMicroeconomics Budget Line GoodsRahul DubeyAinda não há avaliações

- Income Tax - Major Highlights of Union Budget - 2011-12: Prasad V Sawant Roll No:96 Tax AssignmentDocumento5 páginasIncome Tax - Major Highlights of Union Budget - 2011-12: Prasad V Sawant Roll No:96 Tax AssignmentJohn DoinAinda não há avaliações

- Union Budget Analysis: HighlightsDocumento3 páginasUnion Budget Analysis: HighlightsGarvit TrivediAinda não há avaliações

- Highlights of Union BudgetDocumento2 páginasHighlights of Union BudgetsamsworldrocksAinda não há avaliações

- BDO Budget Snapshot - 2012-13Documento9 páginasBDO Budget Snapshot - 2012-13Pulluri Ravikumar YugandarAinda não há avaliações

- The Financial Kaleidoscope - July 19 PDFDocumento8 páginasThe Financial Kaleidoscope - July 19 PDFhemanth1128Ainda não há avaliações

- Highlights On Union Budget 2012 - 2013 - A Corporate Glance: S Dhanapal & AssociatesDocumento10 páginasHighlights On Union Budget 2012 - 2013 - A Corporate Glance: S Dhanapal & AssociatesShivprasad ParnattiAinda não há avaliações

- BUDGET 2017 by Taxpert Professionals Private LimitedDocumento48 páginasBUDGET 2017 by Taxpert Professionals Private LimitedTaxpert mukeshAinda não há avaliações

- Direct Tax CodeDocumento13 páginasDirect Tax CodeabunaventanaAinda não há avaliações

- Direct Tax CodeDocumento13 páginasDirect Tax CodeabunaventanaAinda não há avaliações

- Tax PlanningDocumento7 páginasTax PlanningJyoti SinghAinda não há avaliações

- The New Direct Tax Code (DTC)Documento18 páginasThe New Direct Tax Code (DTC)aggarwalajay2Ainda não há avaliações

- Tax Lift Goes Down, You're Up One Floor: Take A Home Loan, Take Home MoreDocumento1 páginaTax Lift Goes Down, You're Up One Floor: Take A Home Loan, Take Home MoreIna PawarAinda não há avaliações

- BudgetDocumento21 páginasBudgetshweta_narkhede01Ainda não há avaliações

- Budget Synopsis 2015-16 PDFDocumento12 páginasBudget Synopsis 2015-16 PDFBhagwan PalAinda não há avaliações

- Indian Income Tax Calculator: Double Click The IT Calculator - IT Will Automatically Calculate The Taxable AmountDocumento23 páginasIndian Income Tax Calculator: Double Click The IT Calculator - IT Will Automatically Calculate The Taxable AmountshankarinsideAinda não há avaliações

- Cost Inflation IndexDocumento1 páginaCost Inflation IndexPaymaster ServicesAinda não há avaliações

- LTA DeclarationDocumento1 páginaLTA DeclarationPaymaster ServicesAinda não há avaliações

- New - Cost Inflation IndexDocumento1 páginaNew - Cost Inflation IndexPaymaster ServicesAinda não há avaliações

- Proof of Investment - Y.E. 31.03.2011Documento5 páginasProof of Investment - Y.E. 31.03.2011Paymaster ServicesAinda não há avaliações

- LTA Claim Form - Period 1.jan.2006 To 31.dec.2009Documento1 páginaLTA Claim Form - Period 1.jan.2006 To 31.dec.2009Paymaster Services100% (1)

- Gratuity Types & Tax ExemptionsDocumento1 páginaGratuity Types & Tax ExemptionsPaymaster Services100% (1)

- Taxability of GiftsDocumento6 páginasTaxability of GiftsPaymaster ServicesAinda não há avaliações

- Tax Declaration Form For Tax Relief Form - Ye 31.03.2012Documento1 páginaTax Declaration Form For Tax Relief Form - Ye 31.03.2012Paymaster ServicesAinda não há avaliações

- Budget Speech by Finance Minister On 28 February, 2011Documento35 páginasBudget Speech by Finance Minister On 28 February, 2011Paymaster ServicesAinda não há avaliações

- Employee State Insurance - ESICDocumento3 páginasEmployee State Insurance - ESICPaymaster ServicesAinda não há avaliações

- Tax Declaration Form For Tax Relief Form - Ye 31.03.2012Documento1 páginaTax Declaration Form For Tax Relief Form - Ye 31.03.2012Paymaster ServicesAinda não há avaliações

- Tax Declaration Form For Tax Relief Form - Ye 31.03.2012Documento1 páginaTax Declaration Form For Tax Relief Form - Ye 31.03.2012Paymaster ServicesAinda não há avaliações

- Challan 281Documento2 páginasChallan 281Paymaster ServicesAinda não há avaliações

- Tution Fees Sec 80cDocumento4 páginasTution Fees Sec 80cPaymaster ServicesAinda não há avaliações

- Form ITR-1Documento3 páginasForm ITR-1Rajeev PuthuparambilAinda não há avaliações

- Enhancement in Gratuity Limit Under Payment of Gratuity ActDocumento4 páginasEnhancement in Gratuity Limit Under Payment of Gratuity ActPaymaster ServicesAinda não há avaliações

- Interest For Non-Payment of Tax After DeductionDocumento1 páginaInterest For Non-Payment of Tax After DeductionPaymaster ServicesAinda não há avaliações

- Mediclaim 80dDocumento5 páginasMediclaim 80dPaymaster ServicesAinda não há avaliações

- PPF Section 80cDocumento8 páginasPPF Section 80cPaymaster ServicesAinda não há avaliações

- Interest On Loan 80eDocumento2 páginasInterest On Loan 80ePaymaster ServicesAinda não há avaliações

- Corporate Finance Theory and Practice 10th EditionDocumento674 páginasCorporate Finance Theory and Practice 10th EditionrahafAinda não há avaliações

- Econ282 F11 PS5 AnswersDocumento7 páginasEcon282 F11 PS5 AnswersVishesh GuptaAinda não há avaliações

- Swiss Challenge Method by Govt of Madhya Pradesh - SCM11022013FinalDocumento46 páginasSwiss Challenge Method by Govt of Madhya Pradesh - SCM11022013FinalkpindiaAinda não há avaliações

- Deposit SlipDocumento2 páginasDeposit Slipsoly2k12Ainda não há avaliações

- List of Project Topics For Accountancy DDocumento4 páginasList of Project Topics For Accountancy DnebiyuAinda não há avaliações

- Cityam 2011-09-21Documento36 páginasCityam 2011-09-21City A.M.Ainda não há avaliações

- SG ITAD Ruling No. 019-03Documento4 páginasSG ITAD Ruling No. 019-03Paul Angelo TombocAinda não há avaliações

- Perspectivespaper ESGinBusinessValuationDocumento12 páginasPerspectivespaper ESGinBusinessValuationsreerahAinda não há avaliações

- Solar Farm Business Plan ExampleDocumento34 páginasSolar Farm Business Plan Examplejackson jimAinda não há avaliações

- PG - M.com - Commerce (English) - 31031 Investment Analysis and Portfolio ManagementDocumento166 páginasPG - M.com - Commerce (English) - 31031 Investment Analysis and Portfolio ManagementDeeAinda não há avaliações

- I-Byte Business Services July 2021Documento64 páginasI-Byte Business Services July 2021IT ShadesAinda não há avaliações

- In The United States Bankruptcy Court For The District of Delaware in Re:) Chapter 11 Pacific Energy Resources LTD., Et Al.,') Case No. 09-10785 (KJC) ) (Jointly Administered) Debtor.)Documento67 páginasIn The United States Bankruptcy Court For The District of Delaware in Re:) Chapter 11 Pacific Energy Resources LTD., Et Al.,') Case No. 09-10785 (KJC) ) (Jointly Administered) Debtor.)Chapter 11 DocketsAinda não há avaliações

- Global Risk Risk Methodology - Model Validation Risk Stress TestingDocumento4 páginasGlobal Risk Risk Methodology - Model Validation Risk Stress TestingRaj AgarwalAinda não há avaliações

- Comprehensive Quiz No. 007-Hyperinflation Current Cost Acctg - GROUP-3Documento4 páginasComprehensive Quiz No. 007-Hyperinflation Current Cost Acctg - GROUP-3Jericho VillalonAinda não há avaliações

- Pifra Business Finance ProjectDocumento17 páginasPifra Business Finance ProjectWaqas AhmedAinda não há avaliações

- Credit RatingDocumento24 páginasCredit RatingpsnithyaAinda não há avaliações

- Chapter One Extinction of ObligationsDocumento46 páginasChapter One Extinction of ObligationsHemen zinahbizuAinda não há avaliações

- Transfer Pricing II: Rajan Baa 3257Documento15 páginasTransfer Pricing II: Rajan Baa 3257Rajan BaaAinda não há avaliações

- Commerzbank AG: Issuer Rating ReportDocumento12 páginasCommerzbank AG: Issuer Rating ReportvaishnaviAinda não há avaliações

- Badze Tongai Accountancy PDFDocumento58 páginasBadze Tongai Accountancy PDFmosab mAinda não há avaliações

- 1000 Assets: Account # Account NameDocumento24 páginas1000 Assets: Account # Account NameGomv ConsAinda não há avaliações

- Suppose The Government Borrows 20 Billion More Next Year ThanDocumento2 páginasSuppose The Government Borrows 20 Billion More Next Year ThanMiroslav GegoskiAinda não há avaliações

- Tools and Techniques of NPADocumento9 páginasTools and Techniques of NPAPruthviraj RathoreAinda não há avaliações

- HRMM GuidenceDocumento6 páginasHRMM GuidencenadliesaAinda não há avaliações

- Your Guide To Perfect CreditDocumento168 páginasYour Guide To Perfect Creditwhistjenn100% (5)

- Week 1 MSTA Notes PDFDocumento93 páginasWeek 1 MSTA Notes PDFMohd Najmi HuzaiAinda não há avaliações

- SAP MiningDocumento2 páginasSAP Miningsaikiran100% (1)

- BIR Ruling No. 317-18 (BVI Law)Documento3 páginasBIR Ruling No. 317-18 (BVI Law)Liz100% (1)

- CV Rudi Pasaribu UpdateDocumento5 páginasCV Rudi Pasaribu UpdateDitto Dwi PurnamaAinda não há avaliações

- SOE11144 Global Business Economics and FinanceDocumento12 páginasSOE11144 Global Business Economics and FinanceNadia RiazAinda não há avaliações