Escolar Documentos

Profissional Documentos

Cultura Documentos

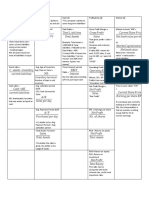

COS Op Exp: Ratios Formula Expressed As Suitability Purpose Remarks SR#

Enviado por

bhanu8686Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

COS Op Exp: Ratios Formula Expressed As Suitability Purpose Remarks SR#

Enviado por

bhanu8686Direitos autorais:

Formatos disponíveis

Nishi Sir's Ratios

Sr # RATIOS FORMULA EXPRESSED AS SUITABILITY PURPOSE Remarks

Gross Profit X 100 Net To Judge

1 Gross Profit Ratio Percentage % High Ratio Operating Effeciency of Co

sales Profitability

2 Net Profit Ratio

a) Op Net Profit Op Net Profit To Judge

X 100 Percentage % High Ratio

Ratio Net sales Profitability

b) Net Profit NPBT To Judge

X 100 Percentage % High Ratio

Before Tax Ratio Net sales Profitability

c) Net Profit After N P A T X 100 Net To Judge

Percentage % High Ratio

Tax Ratio sales Profitability

COS + Op Exp X 100 To know Op cost &

3 Op Ratio Percentage % Low Ratio

Net sales Profit

Adm Exp / S&D EXP / Finc

X 100 To know Op cost & All Operating

4 Expense Ratio exp / Dep Exp Percentage % Low Ratio

Profit Expenses

Net sales

Total Op Exp X 100 To know Op cost &

Percentage % Low Ratio

Net sales Profit

Stock T/O Ratio To know Stock

COS

5 (stock Velocity Average R M Stock Times High Ratio Turnover &

Ratio) Management

Raw Material Consumed To know Stock

a) Raw Material

Average R M Times High Ratio Turnover &

T/O Ratio

Stock Management

b) Work In COP

To know Stock

Progress T/O Average W I P Stock Times High Ratio Turnover & Cost Of Production

Ratio Management

Current Assets Pure Ratio (std To know short term

6 Current Ratio High Ratio

Current Liabilities 2:1) Solvency

To know immediate

Quick Assets Pure Ratio (std CA-STK-PP EXP CL-

7 Quick Ratio High Ratio Solvency

Quick Liabilities 1:1) (LiquidRatio) BankOD-C.C.

Stk Working Closing Stock x 100 Percentage % To know extent of WC = CA - CL (net

8 Low Ratio

Capital Ratio Working Capital (std <100%) WC invested in stock WC)

To judge Long Term

Properietory Ratio Prop's Funds x 100 Percentage %

9 Total Assets High Ratio Solvency & Stability FA + CA + Invt.

/ Equity Ratio (std >50%)

(excl Misc Exp) of Co.

Debt(Long Term Loans) To judge Long Term

Debt / Equity Pure Ratio (std

10 Equity (Share Low Ratio Solvency & Stability

Ratio Holders Funds) <2:1)

of Co.

Funds with Fix Interest To judge Long Term

Capital Gearing Pure Ratio (std < FixInt.=Loans+Pref Sh

11 Funds with Low Ratio Solvency & Stability nonFixInt=EqSh-PrefSh

Ratio Fluctuating Int. 1)

of Co.

Return On Op Net Profit + Int. x 100 To know overall

(Share holders Funds

12 Inestent / Capital Capital Eployed. Percentage % Low Ratio Pfofitability Earned

+ LongTermLoans)

Employed (SHF + Long Term Loans) compared to T.F.

Return On Total N.P.B.T. + Interest To know overall Total Assets =

13 Assets / Total Total Assets (Ecept Percentage % High Ratio Pfofitability Earned FA+Inv+CA OR SHF +

Resoures Misc. Exp) (Total Resources) to T.F. LTL+CL

Return On Prop. NPAT + Interest X 100 % of Profit Earned

14 Share Holders Percentage % High Ratio

Funds Fund on Prop Funds

Return On Eq Sh. NPAT - Pref. Dividend % of Profit Earned

15 Prop Fund - Pref Percentage % High Ratio

Holders Funds Sh Cap on Eq Sh H. Fund

Nishi Sir's Ratios

OpDRS+cl Drs / 2 IF

Debtors Turn Net Credit Sales Collection From

16 Times High Ratio no op DRs given, take

Over Ratio Average Drs & Bills Rec. Debtors in Year

Cl Drs

Avg Colletion Avg Drs & B. R. X 365D Credit Period OR devide by 12 M /

Period / Age of Net Credit Sales D/M Short Period

Allowed to Debtors 52 Weeks

Drs

Creditors Turn Net Credit Purhases Payments to

17 Average Crs & Bills Times High Ratio

Over Ratio Pay. Creditors in Year

Avg Payent

Avg Crs & B. P. X 365D Cr. Period Allowed OR devide by 12 M /

Period /Age of Times High Ratio

Net Credit Sales by Creditors 52 Weeks

Crs

Earning Per NPAT - Pref Diidend No To Know Profit & Kt

18 Of equity Shares Rs High Ratio

Share (E.P.S.) Price of Shares

Price Earning Market Price Of shares Provide guidene for

19 E.P.S Times Low Ratio

Ratio (P.E.) investments

% of NP distributed

a) Total Dividend on Eq

by way of Dividend

& Pref Shares X 100

NPAT High Ratio ~ Liberal

Dividend PayOut

20 Percentage % High Ratio Dividend Policy and

Ratio (D/P Ratio)

Low Ratio ~

b) EQ Dividend Per

Conservative

Share X 100

EPS dividend Policy

Yield Ratio a) Equity Dividend Per it gives dividend and

a) Dividend Yield Share X 100 earning % on the MKT

Price of the shares;

21 Ratio

MKT Price

Percentage % High Ratio also represents the

b) Earning Yield EPS X 100 real dividend rate /

Ratio MKT Price earning rate

NPAT+ Dep. & other non To Judge the

Debt Service cash EXP + Int capacity of

22 > 1 or < 1 High Ratio

Coverage Ratio Interest + Loan Installment Borrower to pay int

p.a. and Loan Instal

To Judge Profit

NPBT-TAX& int. =

Interest Coverage NPBT + Interest availabvle for

23 Times High Ratio NPAT + TAX Int on

Ratio Interest paying interst and

Loans

Installment

FA Turn Over Sales / COS

24

Ratio Net FA

Capital Turnover Sales / COS

25

Ratio Capital Employed

Working Capital Sales / COS

26

TO Ratio Working Capital

Sales

27 Assets T/O ratio Average Assets

Pref Dividend NPAT (before Pref Div)

28 Pref Dividend

Coverage Ratio

Eq Dividend NPAT - Pref Div

29 EQ Dividend

Coverage Ratio

FA to SHFund Fixed Assets

30

Ratio Share Holders Funds

Debt

31 Debt Assets Ratio Assets

Return on Assets Net Profit

32 Average Assets or Sales

Ratio

Você também pode gostar

- RatiosDocumento2 páginasRatiosapi-3758031100% (2)

- Executive's Guide to Fair Value: Profiting from the New Valuation RulesNo EverandExecutive's Guide to Fair Value: Profiting from the New Valuation RulesAinda não há avaliações

- 365+corporate Finance FormulasDocumento6 páginas365+corporate Finance FormulasSouradeep MondalAinda não há avaliações

- Fair Value for Financial Reporting: Meeting the New FASB RequirementsNo EverandFair Value for Financial Reporting: Meeting the New FASB RequirementsAinda não há avaliações

- Current Ratio Current Assets Current Liabilities: Inventory Prep. ExpensesDocumento3 páginasCurrent Ratio Current Assets Current Liabilities: Inventory Prep. Expensesregine bacabagAinda não há avaliações

- Ratio Analysis Theory and ProblemsDocumento13 páginasRatio Analysis Theory and ProblemsPunit Kuleria100% (1)

- The Formulas of All The Ratios: A. Financial Stability, Solvency, Liquidity, Balance Sheet RatiosDocumento2 páginasThe Formulas of All The Ratios: A. Financial Stability, Solvency, Liquidity, Balance Sheet RatiosAayush AgrawalAinda não há avaliações

- Analisa Ratio Keuangan LatihansoalDocumento4 páginasAnalisa Ratio Keuangan Latihansoalxiao yung12Ainda não há avaliações

- RatiosDocumento2 páginasRatiosMina EskandarAinda não há avaliações

- FM Formulae SheetDocumento4 páginasFM Formulae Sheetatishayjjj123Ainda não há avaliações

- Fundflow and CashflowDocumento10 páginasFundflow and CashflowmaraiaAinda não há avaliações

- Liquidity Debt Management Asset Management Profitability Return To InvestorsDocumento5 páginasLiquidity Debt Management Asset Management Profitability Return To InvestorsJayAinda não há avaliações

- Financial Analysis (Chapter 3)Documento18 páginasFinancial Analysis (Chapter 3)kazamAinda não há avaliações

- Ratio Analysis: A Tool For Analysis and Interpretation of Financial StatementsDocumento54 páginasRatio Analysis: A Tool For Analysis and Interpretation of Financial StatementsAjijur RahmanAinda não há avaliações

- Interpretation of Financial Statements: Ratio Analysis and ReportingDocumento9 páginasInterpretation of Financial Statements: Ratio Analysis and ReportingSania SaeedAinda não há avaliações

- Ratios Notes and ProblemDocumento6 páginasRatios Notes and ProblemAniket WaneAinda não há avaliações

- Financial Analysis (Chapter 3)Documento18 páginasFinancial Analysis (Chapter 3)AsifMughalAinda não há avaliações

- Note On Financial Ratio FormulaDocumento5 páginasNote On Financial Ratio FormulachthakorAinda não há avaliações

- Financial Ratio FormulasDocumento5 páginasFinancial Ratio FormulasBrenden KapoAinda não há avaliações

- Leave A Message Then Pass It On!!Documento43 páginasLeave A Message Then Pass It On!!May RamosAinda não há avaliações

- Distress PDFDocumento65 páginasDistress PDFKhushal UpraityAinda não há avaliações

- Ratio Formula Analysis and InterpretationDocumento5 páginasRatio Formula Analysis and InterpretationGalib Hossain50% (2)

- Ratio Analysis ParticipantsDocumento17 páginasRatio Analysis ParticipantsDeepu MannatilAinda não há avaliações

- Ratio Analysis: 1. Liquidity RatiosDocumento2 páginasRatio Analysis: 1. Liquidity RatiosJawad AliAinda não há avaliações

- Days in Inventory: 365 Days / Times Every DaysDocumento1 páginaDays in Inventory: 365 Days / Times Every DaysV.Prasarnth Raaj Veera RaoAinda não há avaliações

- Gross Profit Net Profit/ EBIT: Return On Capital EmployesDocumento9 páginasGross Profit Net Profit/ EBIT: Return On Capital Employesshekhar371Ainda não há avaliações

- Week 7 Formula SheetDocumento1 páginaWeek 7 Formula SheetHarsahej MokhaAinda não há avaliações

- Ca Inter FM Summary2Documento12 páginasCa Inter FM Summary2Krishna GuptaAinda não há avaliações

- Long Term Financing: After TaxDocumento1 páginaLong Term Financing: After TaxMa. Cristy BroncateAinda não há avaliações

- A) Profitability Ratios: MA Formula Ratio AnalysisDocumento4 páginasA) Profitability Ratios: MA Formula Ratio AnalysisasdAinda não há avaliações

- Accounting RatiosDocumento9 páginasAccounting RatiosRonnie Vond McRyttsson MudyiwaAinda não há avaliações

- Ratio Analysis ch-6Documento11 páginasRatio Analysis ch-6IP MAXAinda não há avaliações

- Formula Financial RatioDocumento4 páginasFormula Financial RatioRubiatul Adawiah Zainal AriffinAinda não há avaliações

- PAPER Key Equations PDFDocumento3 páginasPAPER Key Equations PDFIan BaswanaAinda não há avaliações

- UEU Penilaian Asset Bisnis Pertemuan 14Documento67 páginasUEU Penilaian Asset Bisnis Pertemuan 14Saputra SanjayaAinda não há avaliações

- Financial Ratio AnalysisDocumento18 páginasFinancial Ratio Analysissarangpethe100% (4)

- FM Rocks ChartDocumento21 páginasFM Rocks ChartDivyasha PathakAinda não há avaliações

- 2017 Level II Formula Sheet PDFDocumento33 páginas2017 Level II Formula Sheet PDFrpunAinda não há avaliações

- ACC Cement Ratio AnalysisDocumento5 páginasACC Cement Ratio Analysisgaurav_sharma_19900Ainda não há avaliações

- Finance 1665265099Documento19 páginasFinance 1665265099hicham ABOUYOUBAinda não há avaliações

- List of Formulas: in PVDocumento2 páginasList of Formulas: in PVTAinda não há avaliações

- Activity RatioDocumento8 páginasActivity RatiovenugopalAinda não há avaliações

- CH 10 - Working Capital Management (Chart 10.1) : Operating CycleDocumento2 páginasCH 10 - Working Capital Management (Chart 10.1) : Operating Cyclek kakkarAinda não há avaliações

- Fixed and Variable CostDocumento12 páginasFixed and Variable CostRohitSuryaAinda não há avaliações

- Ratio Analysis:: Liquidity Measurement RatiosDocumento8 páginasRatio Analysis:: Liquidity Measurement RatiossammitAinda não há avaliações

- RATIODocumento2 páginasRATIODave ChowtieAinda não há avaliações

- Analisis Laporan KeuanganDocumento3 páginasAnalisis Laporan KeuanganAryaAinda não há avaliações

- Analisis Laporan KeuanganDocumento3 páginasAnalisis Laporan KeuanganRiska AAinda não há avaliações

- Day 5 Ratios and Examples 2024Documento18 páginasDay 5 Ratios and Examples 2024Kit KatAinda não há avaliações

- Review: Corporate Finance FB5040Documento62 páginasReview: Corporate Finance FB5040Koey TseAinda não há avaliações

- FM SethDocumento30 páginasFM SethUtsav MehtaAinda não há avaliações

- BUSFIN FinancialRatios PDFDocumento6 páginasBUSFIN FinancialRatios PDFTermin CheeseAinda não há avaliações

- Ratio AnalysisDocumento25 páginasRatio AnalysisJulveAinda não há avaliações

- Updated FSA Ratio SheetDocumento4 páginasUpdated FSA Ratio Sheetmoussa toureAinda não há avaliações

- Financial Statements AnalysisDocumento10 páginasFinancial Statements AnalysisKanishka IreshanAinda não há avaliações

- LU 1 - Analysis and Interpretation of Financial Statements - NotesDocumento4 páginasLU 1 - Analysis and Interpretation of Financial Statements - NotesSherly Zanele SamboAinda não há avaliações

- Mindmap Chapter 5 Cost-Volumn Profit AnalysisDocumento1 páginaMindmap Chapter 5 Cost-Volumn Profit AnalysisSimon Erick0% (1)

- 2017 Accounting Examination PaperDocumento30 páginas2017 Accounting Examination PaperAccount NiceAinda não há avaliações

- Excel Keyboard ShortcutsDocumento2 páginasExcel Keyboard Shortcutsapi-3740045Ainda não há avaliações

- Excel VillageDocumento112 páginasExcel Villagebhanu8686Ainda não há avaliações

- Excel - FormulaesDocumento205 páginasExcel - Formulaesbhanu8686Ainda não há avaliações

- Excel - FormulaesDocumento205 páginasExcel - Formulaesbhanu8686Ainda não há avaliações

- Learn ExcelDocumento250 páginasLearn Excelkermech21607Ainda não há avaliações

- Excel Formula For CADocumento61 páginasExcel Formula For CArameshritikaAinda não há avaliações

- Changing Sheetnames in Formula Using Cell Reference ExampleDocumento5 páginasChanging Sheetnames in Formula Using Cell Reference Examplebhanu8686Ainda não há avaliações

- Excel DictionaryDocumento207 páginasExcel Dictionarybhanu8686Ainda não há avaliações

- Excel Function DictionaryDocumento206 páginasExcel Function Dictionarybhanu8686Ainda não há avaliações

- Excel - FormulaesDocumento205 páginasExcel - Formulaesbhanu8686Ainda não há avaliações

- Excel DictionaryDocumento207 páginasExcel Dictionarybhanu8686Ainda não há avaliações

- Ratio AnalysisDocumento30 páginasRatio Analysisapi-377709850% (2)

- Changing Sheetnames in Formula Using Cell Reference ExampleDocumento5 páginasChanging Sheetnames in Formula Using Cell Reference Examplebhanu8686Ainda não há avaliações

- Adv ExcelDocumento250 páginasAdv Excelbhanu8686Ainda não há avaliações

- Pivot Tables - Tamanations PDFDocumento5 páginasPivot Tables - Tamanations PDFbhanu8686Ainda não há avaliações

- Excel Formula For CADocumento61 páginasExcel Formula For CArameshritikaAinda não há avaliações

- Basic Excel 2007 Formula TutorialDocumento4 páginasBasic Excel 2007 Formula Tutorialkaushik168100% (1)

- Outlook 2013compressedDocumento112 páginasOutlook 2013compressedbhanu8686Ainda não há avaliações

- Ms-Excel - Introduction To Pivot Tables PDFDocumento5 páginasMs-Excel - Introduction To Pivot Tables PDFbhanu8686Ainda não há avaliações

- Keys For Moving and Scrolling in A Worksheet or WorkbookDocumento60 páginasKeys For Moving and Scrolling in A Worksheet or Workbookbhanu8686Ainda não há avaliações

- Power Point SlidesfacilitationDocumento12 páginasPower Point Slidesfacilitationbhanu8686Ainda não há avaliações

- PivotDocumento1 páginaPivotbhanu8686Ainda não há avaliações

- Power Point SlidestraintrainerDocumento12 páginasPower Point Slidestraintrainerbhanu8686Ainda não há avaliações

- Pde Data Summit Data Dashboards Using Excel and Ms Word 508ccompressed 1 PDFDocumento48 páginasPde Data Summit Data Dashboards Using Excel and Ms Word 508ccompressed 1 PDFbhanu8686Ainda não há avaliações

- Pivot Tables - Tamanations PDFDocumento5 páginasPivot Tables - Tamanations PDFbhanu8686Ainda não há avaliações

- SalaryDocumento5 páginasSalarybhanu8686Ainda não há avaliações

- !"#$%&' +,-./010!2, +. 34567,819:3, 4/9 ?@) ABCDEFGH'IJ (3 KLM375 3ndopDocumento27 páginas!"#$%&' +,-./010!2, +. 34567,819:3, 4/9 ?@) ABCDEFGH'IJ (3 KLM375 3ndopbhanu8686Ainda não há avaliações

- First Quarter 2022 Earnings Presentation May 5, 2022Documento30 páginasFirst Quarter 2022 Earnings Presentation May 5, 2022ignaciaAinda não há avaliações

- Exam1 WS1213Documento10 páginasExam1 WS1213Faisal AzizAinda não há avaliações

- Cadet College Hasanabdal: Fee Deposit SlipDocumento1 páginaCadet College Hasanabdal: Fee Deposit Slipamjad wahidAinda não há avaliações

- Accounting 202 Chapter 9 NotesDocumento15 páginasAccounting 202 Chapter 9 NotesnitinAinda não há avaliações

- JPM - XilinxDocumento14 páginasJPM - XilinxAvid HikerAinda não há avaliações

- Tutorial QuestionsDocumento15 páginasTutorial QuestionsWowKid50% (2)

- 2019 IntAcc Vol 3 CH 4 AnswersDocumento9 páginas2019 IntAcc Vol 3 CH 4 AnswersRizalito SisonAinda não há avaliações

- Shareholder EquityDocumento26 páginasShareholder Equityismailhasan85Ainda não há avaliações

- Over-The-Counter (Finance) : OTC-traded StocksDocumento6 páginasOver-The-Counter (Finance) : OTC-traded StocksRohan ShettyAinda não há avaliações

- Financial Accounting 3rd Edition Spiceland Test Bank 1Documento69 páginasFinancial Accounting 3rd Edition Spiceland Test Bank 1richard100% (36)

- FDGFDSGDFGDocumento3 páginasFDGFDSGDFGJesus Colin CampuzanoAinda não há avaliações

- Materi Kuliah Ke 4 - ObligasiDocumento50 páginasMateri Kuliah Ke 4 - ObligasiIndah PrasetyantiAinda não há avaliações

- Strauss Printing Services Statement of Cash Flows For The Year Ended December 31, 2013 Cash Flow From Operating ActivitiesDocumento2 páginasStrauss Printing Services Statement of Cash Flows For The Year Ended December 31, 2013 Cash Flow From Operating ActivitiesChristian Shino Delos SantosAinda não há avaliações

- Q&a CfasDocumento16 páginasQ&a CfasRyan Malanum AbrioAinda não há avaliações

- YubarajDocumento4 páginasYubarajYubraj ThapaAinda não há avaliações

- Ultimate Book of Accountancy: Brilliant ProblemsDocumento9 páginasUltimate Book of Accountancy: Brilliant ProblemsPramod VasudevAinda não há avaliações

- CH 13 QuizDocumento8 páginasCH 13 QuizTrentTravers100% (1)

- Chapter 1 - Fundamentals of Logistics and Supply Chain ManagementDocumento29 páginasChapter 1 - Fundamentals of Logistics and Supply Chain ManagementTrần Thanh TrúcAinda não há avaliações

- FR Ind As 102Documento56 páginasFR Ind As 102Dheeraj TurpunatiAinda não há avaliações

- Case Studies in Financial Management PDFDocumento2 páginasCase Studies in Financial Management PDFGrand Overall100% (2)

- Mzumbe University Selection Round One Bachelor Programmes-2019-20Documento166 páginasMzumbe University Selection Round One Bachelor Programmes-2019-20BISEKOAinda não há avaliações

- Cash Bank Recon and ReceivablesDocumento16 páginasCash Bank Recon and ReceivablesBilkie MinalidAinda não há avaliações

- Cogent Analytics M&A ManualDocumento19 páginasCogent Analytics M&A Manualvan070100% (1)

- Three Largest Stock Market Indexes in The US-A4Documento3 páginasThree Largest Stock Market Indexes in The US-A4鄭茗秋Ainda não há avaliações

- Home Office Books Mandaue Books Date Account Title Debit Credit DateDocumento27 páginasHome Office Books Mandaue Books Date Account Title Debit Credit DateVon Andrei MedinaAinda não há avaliações

- Navana CNG Annual Report 2019Documento147 páginasNavana CNG Annual Report 2019lerosadoAinda não há avaliações

- This Study Resource Was: Case: San Miguel in The New MillenniumDocumento2 páginasThis Study Resource Was: Case: San Miguel in The New MillenniumBaby BabeAinda não há avaliações

- A231 MC 4 IP - QuestionsDocumento4 páginasA231 MC 4 IP - QuestionsAmirul HaiqalAinda não há avaliações