Escolar Documentos

Profissional Documentos

Cultura Documentos

Hyderabad Main Hyderabad Page 9

Enviado por

arunDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Hyderabad Main Hyderabad Page 9

Enviado por

arunDireitos autorais:

Formatos disponíveis

HYDERABAD FRIDAY 3 FEBRUARY 2017 NEWS ANALYSIS 9

SETBACK TO SALARIED CLASS

Budget hikes for rural

major rationalisation has been Overall, it appears that

done in terms of the income tax

increasing farmers

Tax rationalisation laws as promised by the finance

minister in his first Budget such

as reduction in MAT and divi-

incomes as well as area

under irrigation got

India inadequate

dend distribution tax rates and priority but not enough

remains a far cry other amendments in complex

issues which have been the cen-

tre point of litigation between

funds. It is important to

implement these

programmes effectively if

the Income Tax Department

and the tax payers. required with private ing e-NAM by providing Rs 75 lakh

The government has laid em- sector participation under each mandi is also a good step.

phasis on the digital payments CSR to reach benefits to However, the assaying systems

and payments through the small and marginal should have been given priority for

banking channels and proposals farmers and other e-NAM to be fully-functional, but

such as reducing the threshold there is no provision in this regard.

for permitted cash transactions

vulnerable sections of Allocation to agricultural research

to Rs 3 lakhs, provision for dis- rural India and development was increased

allowance of business and capi- marginally, which is too little to

tal expenditure above Rs 10,000 A AMARENDER REDDY meet increasing cost of high-tech

and reduction of rate of pre- research.

S

sumptive taxation to 6 percent till about 95% of the rural

from 8 percent to smaller busi- economy is informal both in Little emphasis on poor

ness are steps towards the same. agriculture and non-agricul- Rural electrication and

The finance minister also pro- ture. Even though agriculture poverty elimination reduce dis-

posed an Aadhaar based pay- contributes only 13% of Indias parities among regions and peo-

ment structure and several GDP, it is a source of livelihoods ple, but increase in allocation is

other initiatives of the govern- for about 50% of the population. marginal. Allocation of only Rs

ment to promote e-payments Agricultural sector growth was ro- tor through innovative schemes Sadak Yojana (PMGSY) at Rs 4,814 crore is not sucient to

ABHISHEK ANEJA change has been provided leav- but the same is difficult to bust at 4.1% in 2016-17, but it was like balanced use of fertilisers by 19,000 crore. make villages 100% electried un-

ing the salaried class empty achieve without any parallel in- at the back of only 1.2% growth in promoting soil health cards, en- der Gram Jyoti Yojana. Rs 4,500

T he salaried middle class

gained some recognition by

Finance Minister Arun Jaitley

handed at the end of the Budget

despite the finance minister

himself recognising the fact that

frastructure and regulations to

safeguard the people by moni-

toring the risks and frauds in-

2015-16 and negative growth (-

0.2%) in 2014-15. Figures indicate

that the rural non-farm sector

suring remunerative prices. Oth-

erwise, farmers end up with in-

debtedness without welfare gain.

Agricultural

development schemes

Fund allocation to green revo-

crore allocation to Deendayal An-

tyodaya Yojana to bring one crore

households out of poverty and to

regarding the compliance re- the major tax compliance is be- volving digital transactions in growth was adversely aected by lution heading ( National Food Se- make 50,000 gram panchayats

lated to filing of returns and ex- ing done by salaried tax payers. India and a lot needs to be done demonetisation. Hence, farmers Rural housing got curity Mission with Rs 1,720 crore poverty free by 2019, the 150th

pectations arose that finance In my view, rationalisation in in this connection. organisations and villagers had big priority and Rastriya Krishi Vikas Yojana birth anniversary of Gandhiji is a

minister will take some steps to the higher tax slabs could have The good thing is that no hopes on the budget 2017-18 to re- Budget allocation to Pradhan with Rs 4,750 crore and others) welcome step, but needs more fo-

reward the honest tax payers been a major boost to the changes have been proposed vive rural economy and aim to- Mantri Awaas Yojana-Grameen was increased by 32.6% to 13,741 cused eorts by bringing private

and may rationalise the per- salaried middle class as well as during the Budget speech in the wards doubling their incomes, but was 23,000 crore, 53% higher than crore. However, provision for funds and expertise if required. In-

sonal income tax structure. other tax payers and would have indirect taxes such as excise and it followed a minimalist approach last year. Allocation to MGNREGA PMFBY was decreased from Rs crease in allocations to National

However, as he moved ahead further increased the tax com- service tax, which have a direct with no big-bang initiatives. was Rs 48,000 crore, marginally 13,240 crore in 2016-17(RE) to Rs Livelihood Mission Ajeevika,

with his Budget speech, no ma- pliance. impact on the prices of various higher compared to 2015-16 (RE) 9,000 crore. Projection of increase white revolution (dairy sector)

jor change was proposed except Though some relief has been commodities, due to the intro- Fund increase marginal but focus on creating productivity in coverage from 30% to 40% of and blue revolution (sheries) is

that to reduce the rate of tax provided to the people having duction of GST in the coming The total allocation for the ru- enhancing assets like farm ponds the cropped area needs explana- marginal.

from 10 percent to 5 percent in investment in immovable prop- year. ral, agriculture and allied sectors and compost pits is a welcome tion. Strengthening of soil health

the slab of Rs. 2.5 lakhs to Rs 5 erty by reducing the holding pe- Overall the focus of Budget in 2017-18 is Rs 1.87 lakh crore, step. There was no change in funds card scheme by involving 648 Policy Reforms

lakhs with some changes in re- riod from three years to two has been towards expenditure which was only 11.6% higher than allocated to Prime Minister Gram KVKs is a good step. Strengthen- Budget also talked about market

bate under Section 87A thereby years for the computation of side leaving the revenue side the 2016-17(Revised estimates). reforms like introduction of new

resulting in the tax free income long-term capital gains having without much changes. The Out of this, allocation to agricul- Budget allocation for agship programmes of model law on contract farming to

of upto Rs 3 lakhs. Besides, 10 lower tax rate of 20 percent and Budget, in my view seems to be ture was Rs 58,663 crore which agriculture and rural development (Rs. cr) open up agricultural markets and

percent surcharge has been im- the shift of year for indexation on track, but a lot needs to be was 11.1% higher and for rural de- create competitive market struc-

posed on the individuals having from 1981 to 2001. This will im- delivered by the finance minis- velopment was Rs 1,28,560 crore 2016-17 2017-18 % change over tures. However there was no men-

Component

(RE) (BE) 2016-17(RE)

income between Rs 50 lakh and pact the real estate sector in ter. The rationalisation of in- which was again 11.8% higher than tion of implementation of Model

Rs 1 crore. positive manner and people will come tax laws is the need of the the 2016-17 (RE). This marginal Mahatma Gandhi National Rural Employment Agricultural Land Leasing Act,

47499 48000 1.1

The hopes of the salaried mid- be keen to invest in immovable hour and will only complement increase of about 11% in both the Guarantee Act (MGNREGA) 2016. Overall, it appears that in-

dle class was quite high prior to property or liquidate their hold- the expenditure side by increas- sectors indicates little emphasis Pradhan Mantri Awas Yojna (PMAY)-grameen 15,000 23,000 53.3 creasing farmers incomes as well

the Budget and there were ings. ing the tax compliance and rais- on rural sector, despite lofty goals. Pradhan Mantri Gram Sadak Yojna (PMGSY) 19000 19000 0.0

as area under irrigation got prior-

hopes of tax benefits such as in- The MSME sector gained ing the tax collection in the long ity but not enough funds. Private

crease in tax free allowances, some attention from the finance run. Rural credit Green Revolution (including NFSM, RKVY) 10360 13741 32.6

sector help may be taken under

reintroduction of standard de- minister and has been lucky for (The writer is a Chartered The Budget has, however, given Pradhan Mantri Fasal Bima Yojana (PMFBY) 13240 9000 -32.0 CSR to reach the benets to small

duction, increase in limits of de- getting the lower 25 percent cor- Accountant; This article was big thrust to credit availability to Pradhan Mantri Krishi Sinchai Yojana (PMKSY) 5189 7377 42.2 and marginal farmers and other

ductions under Section 80C and porate tax rate. This is likely to first published at the farm sector with a target of Rs National Rural Drinking Water Mission 6000 6050 0.8 vulnerable sections of rural India.

the increase in allowability of in- favour entrepreneurs and will http://www.firstpost.com. 10 lakh crore. It can only work if (Writer is Director, National

National Livelihood Mission - Ajeevika 3334 4849 45.4

terest on self occupied house also boost foreign investment in Reprinted with their we are able to reduce costs and in- Institute of Agricultural Exten-

property. However, no major the MSME sector. However, no permission) crease protability in farming sec- Price Stabilisation Fund for pulses 3400 3500 2.9 sion Management, Hyderabad)

AJAY SINGH There is little doubt that However, the decision to make it

I f Union Finance Minister Arun

Jaitley thinks that his move to re-

with Rs 2,000 limitation,

the capacity to raise

mandatory for parties to le I-T re-

turn and allow scrutiny of their ac-

count may act as deterrent for parties

Core issues neglected

duce individual contribution to po- money would be reduced initially. In Jaitley's speech, he made

litical parties from Rs 20,000 to Rs

2,000 would check inux of corrupt

ten times. But it can be it clear that the non-compliance of

the process would rob political par-

T he Association for Democratic Reforms

(ADR) on Thursday said the union

true income," the ADR said, pointing to

the budget not promising scrutiny of in-

compensated by increas- budget failed to address the issues of come declared by political parties from

money into the political system, he ing the list of supporters ties of their exemption from the In- transparency, disclosure and penalties of various sources.

may nd himself pursuing a chimera. come Tax. Obviously the regular political parties. "The budget does not propose that the

Long before such provision came

by ten times. It is a simple scrutiny of the account would entail It also claimed the proposals on political details of all donors who donate above Rs

into existence, political parties have mathematical calculation a lot of ground work to cover up ill- funding reforms fell short of the recom- 2,000 be made available to the Income Tax

devised mechanism to bypass any which may not be difficult gotten wealth by political leaders. mendations by the Election Commission department and/or an external body au-

scrutiny of their account by creating for political ingenuity to The scheme of allowing the RBI to and the Law Commission. "While this is diting the accounts of political parties," it

list of ctitious donations. For in- overcome issue bonds for political funding is the first union budget to raise the issue of said. "Unless complete information is

stance in Uttar Pradesh, regional par- quite innovative and would ensure transparency in political funding, it is un- available for audit scrutiny, the sources of

ties are believed to have developed a they can create this list to show as amples of regional parties claiming secrecy of the donors. Those who fortunate to note that complete trans- donations below Rs 20,000 to political par-

skill in creating a ctitious list of con- donors in large numbers. huge collections from their support- want to contribute to political parties parency in the finances of political parties ties will continue to stay hidden," it con-

tributors. There are several instances of ers. above board can opt for these bonds has still not been adopted in the budget of tended.

Insiders admit that most of these Mayawati claiming to build proper- There is little doubt that with Rs that can be cashed by registered par- 2017-18 and the proposed reforms are in- The ADR also said the ruling Bharatiya

parties which have collected ill-got- ties and creating wealth with the help 2,000 limitation, the capacity to raise ties. Apparently these scheme sounds consequential as the political funding will Janata Party (BJP) topped the chart in de-

ten money through various commer- of contribution from her countless money would be reduced ten times. too good for those who believe in continue to remain opaque," ADR said. faulting in submitting its audit reports to

cial deals have created an army of supporters. And it would be next to But it can be compensated by in- transparent political conduct. Given "Unless scrutiny of accounts of political the poll panel. Between 2010-11 and 2014-

people who create the list of their impossible to check the antecedents creasing the list of supporters by ten a history of opaque behaviour of par- parties is taken up by a body approved by 15, BJP defaulted in the submission of its

contributors in lakhs to turn their and nancial condition of each con- times. It is a simple mathematical cal- ties and their contributors, it seems Comptroller and Auditor General or the audit report with the Election Commission

black money into white. Since politi- tributor. Similarly in West Bengal, culation which may not be dicult quite unlikely that the scheme would Election Commission, the parties' de- by an average of 182 days while the Con-

cal parties have any army of cadre, Tamil Nadu and Bihar, there are ex- for political ingenuity to overcome. get the traction it truly deserves. clared income is unlikely to reflect their gress defaulted by 166 days on average.

Corporate Tax Will govt meet disease eradication targets?

DTE STAFF quarter of the worlds tuberculosis

T he

startup com-

have to pay a mini-

mum alternate tax at Previous targets have gone unmet cases. The organisation increased its

munity has unani-

mously welcomed

lower corporate tax

18.5% ((excluding

surcharge, education

cess, and secondary

T he Finance Minister announced

that the government has action

plans to eliminate kala-azar by 2017

Other major targets achieved in 2005, PM Narendra Modi

said on January 30. A total of 86,000

estimate of the number of new TB pa-

tients in India, from 2.2 million in 2014

to 2.8 million in 2015. India has been

for enterprises with and higher educa- and tuberculosis by 2025, among oth- cases are on record as on April 1, 2014, funding public health programmes to

a turnover of up to tion cess). MAT is a ers. giving a prevalence rate of 0.68 per control the incidences of TB since the

Rs 50 crore as well way of making com- Outlining ambitious healthcare 10,000 populations, as per data from 1990s, but eradication seems distant.

as the move to ex- panies pay mini- plans for the country, Finance Minister The Leprosy Mission Trust of India. Many cases of TB remain undetected

tend the three-year mum amount of tax, Arun Jaitley, in his budget speech, set A World Health Organization making it dicult to cure patients. In-

tax exemption for according to India Infoline. Corporate tax targets for elimination of crucial com- (WHO) report from 2016 says that In- creasing drug resistance is causing

startups in its first seven years from pre- in India is levied on both domestic as well municable diseases. While addressing dia, along with Brazil and Indonesia, complications and adding to the chal-

viously five years. The move to reduce the as foreign companies. Like all individuals the Parliament on February 1, he said B) injection, with an ecacy rate of 98 account for 81 per cent of the newly di- lenge of TB control.

corporate tax to 25 per cent for compa- earning income are supposed to pay a tax that the government has prepared an per cent, would be provided free of cost agnosed and reported patients globally.

nies with a turnover of under Rs 50 crore on their income, business houses too are action plan to eliminate kala-azar and to kala-azar patients. In its pathway to eradicate the stig- Filariasis

was the biggest highlight of the budget as supposed to pay as tax a certain portion lariasis by 2017, leprosy by 2018 and Athough there has been a decline in matised disease, the government India also laid down the target to

it covers over 96 per cent of the (startup) of their income earned. This tax is known measles by 2020. Elimination of tuber- the number of cases from 25,222 in launched programmes to screen and eliminate lariasis by the year 2015 in

landscape currently, they said. But the as corporate tax, corporation tax or com- culosis by 2025 is also targeted. 2011 to 6,280 in 2015 hurdles remain detect cases under National Health its National Health Policy of 2002a

same benefit was not offered to larger pany tax. PwC says a resident company is Similarly, action plan has been pre- in attaining complete eradication. New Mission in 2016. As a result, more than target that was not met. The govern-

companies which strongly demanded cut- taxed on its worldwide income. A non-res- pared to reduce infant mortality rate cases associated with kala-azar com- 32,000 cases were conrmed and put ment has now claimed to achieve it by

ting tax rate as it would help them be- ident company is taxed only on income from 39 in 2014 to 28 by 2019 and ma- plications are emerging. In January on treatment. In August 2016, India 2017.

come competitive in the global market. that is received in India, or that accrues ternal mortality rate from 167 in 2011- 2016, about 340 primary kala-azar also developed and launched its own Currently, annual mass drug admin-

Corporate tax is a form of tax levied on or arises, or is deemed to accrue or arise, 13 to 100 by 2018-2020. 1.5 lakh Health cases were reported in Bihar, a state leprosy vaccine, piloting it in ve dis- istration (MDA) is carried out to inter-

profits earned by businessmen in a partic- in India. The basic corporate income tax Sub Centres will be transformed into which accounts for nearly 76 per cent tricts across Bihar and Gujarat. The rupt transmission of the disease. In

ular period of time. Also, while the indus- for Indian companies is 30 per cent (25% Health and Wellness Centres. of all cases in the country, Down To rst-of-its-kind leprosy vaccine was de- 2015, the coverage of MDA was 88.96

try expected exemption from Minimum for MSMEs) and it is 40 per cent for for- While it is not clear what the gov- Earth earlier reported. veloped as patients were showing signs per cent in the eligible population, as

Alternate Tax (MAT), it has accepted the eign companies. Surcharge, education ernments action plan will look like, the of resistance against the conventional per government data. Micro aria rate

provision to allow MAT credit to be car- cess and secondary and higher education government has, time and again given Leprosy multi-drug therapy. has fallen from 1.2 in 2004 to 0.3 in

ried forward from 10 years to 15 years as cess (effective tax rate) vary from 0.9 per targets it nds unable to meet. In Sep- The programme to eradicate leprosy 2015, claims the Ministry of Health and

a positive step forward. As per the Sec- cent to 4.6 per cent for Indian companies tember 2014, months after the NDA was launched way back in 1955. The Tuberculosis Family Welfare.

tion 115JA introduced from assessment depending on the income of the company. government took over, the then Health goal of leprosy elimination as a public Tuberculosis (TB) continues to (Courtesy: Down To Earth;

year 1997-98, all companies having book For foreign companies, it is between 1.2 Minister Harsh Vardhan claimed that health problem that its prevalence rate claim many thousands of lives in India http://www.downtoearth.org.in/news

profits under the Companies Act shall per cent and 3.26 per cent. kala-azar would be eliminated by 2015. of less than one case per 10,000 popu- each year. A recent estimate by WHO /disease-eradication-targets-will-

He said that AmBisome (amphotericin lation at the national level, was suggests that India accounts for over a they-be-met--56933)

Você também pode gostar

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

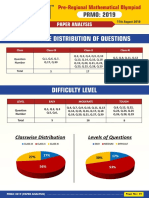

- PRMO 2019 Paper AnalysisDocumento3 páginasPRMO 2019 Paper AnalysisarunAinda não há avaliações

- Information BookletDocumento16 páginasInformation BookletarunAinda não há avaliações

- Vinayak - Bhise@Nic - Co.In 240700@nic - Co.In Smitas - Patil@Nic - Co.In Rachanak - Singh@Nic - Co.InDocumento10 páginasVinayak - Bhise@Nic - Co.In 240700@nic - Co.In Smitas - Patil@Nic - Co.In Rachanak - Singh@Nic - Co.InarunAinda não há avaliações

- Chap 7Documento24 páginasChap 7AmmarNikAinda não há avaliações

- MIT16 07F09 Lec14 Rocket MassDocumento12 páginasMIT16 07F09 Lec14 Rocket Masscentaurus553587Ainda não há avaliações

- SMHDocumento18 páginasSMHnalliminiAinda não há avaliações

- Electrostatics: 11.1 Basic Concepts and FormulaeDocumento2 páginasElectrostatics: 11.1 Basic Concepts and FormulaearunAinda não há avaliações

- Water CycleDocumento15 páginasWater CyclearunAinda não há avaliações

- Rmo PDFDocumento84 páginasRmo PDFarunAinda não há avaliações

- Tuesday February 10 20155 22 58 Pmenglish Catalogue 2015Documento123 páginasTuesday February 10 20155 22 58 Pmenglish Catalogue 2015vivektonapiAinda não há avaliações

- ICAR Telephone DirectoryDocumento218 páginasICAR Telephone DirectoryarunAinda não há avaliações

- Mapping Matrik PenelitianDocumento2 páginasMapping Matrik PenelitianKatarina BernardaAinda não há avaliações

- The Times 20-11-2018 PDFDocumento12 páginasThe Times 20-11-2018 PDFSoufiane NabilAinda não há avaliações

- Module 4 - Ia2 FinalDocumento43 páginasModule 4 - Ia2 FinalErika EsguerraAinda não há avaliações

- Foreign Exchange Exposures - IFMDocumento7 páginasForeign Exchange Exposures - IFMDivya SindheyAinda não há avaliações

- Implementing Corporate Strategy: Managing The Multi Business FirmDocumento15 páginasImplementing Corporate Strategy: Managing The Multi Business FirmArjay MolinaAinda não há avaliações

- Dabur India LTDDocumento7 páginasDabur India LTDdheeraj_raj_jainAinda não há avaliações

- Capital StructureDocumento60 páginasCapital StructureSayeedMdAzaharulIslamAinda não há avaliações

- Sea Rule 15c3 1 InterpretationsDocumento236 páginasSea Rule 15c3 1 Interpretationsdestinylam123Ainda não há avaliações

- Research PaperDocumento43 páginasResearch PaperJankiAinda não há avaliações

- IFRS 16 13102022 100655am 1Documento3 páginasIFRS 16 13102022 100655am 1Adnan MaqboolAinda não há avaliações

- Financial Accounting Workbook PDFDocumento89 páginasFinancial Accounting Workbook PDFDianne Jonnalyn Cuba100% (1)

- Mergers & Acquisitions: Merger Evaluation: RIL & Network 18Documento13 páginasMergers & Acquisitions: Merger Evaluation: RIL & Network 18DilipSamantaAinda não há avaliações

- Ethics Has No Place in BusinessDocumento5 páginasEthics Has No Place in BusinessYahleeni Meena Raja Deran100% (3)

- Project Report: Submitted byDocumento68 páginasProject Report: Submitted bySammy GaurAinda não há avaliações

- Instructor Questionaire AccountingDocumento4 páginasInstructor Questionaire AccountingjovelioAinda não há avaliações

- Rasuwagadhi Hydropower Company LimitedDocumento3 páginasRasuwagadhi Hydropower Company LimitedSubhash MishraAinda não há avaliações

- Gadang - Annual Report 2018 PDFDocumento284 páginasGadang - Annual Report 2018 PDFMohd FazlanAinda não há avaliações

- Who Owns and Manages AirportsDocumento48 páginasWho Owns and Manages AirportsZX LeeAinda não há avaliações

- Ma 1Documento36 páginasMa 1Project SiteAinda não há avaliações

- The Financial Services EnvironmentDocumento6 páginasThe Financial Services EnvironmentNeelam Sharma0% (1)

- Exide IndustriesDocumento236 páginasExide IndustriesManas Kumar SahooAinda não há avaliações

- Bank Al-Falah 5 Year Income Statement, Balance Sheet and Ratio AnalysisDocumento95 páginasBank Al-Falah 5 Year Income Statement, Balance Sheet and Ratio AnalysisUMAIR CH0% (1)

- Topic 10 Porter's Generic StrategiesDocumento24 páginasTopic 10 Porter's Generic StrategiesAziz.3251Ainda não há avaliações

- The Brand Equity Approach To Marketing of Malaysian Palm ProductDocumento138 páginasThe Brand Equity Approach To Marketing of Malaysian Palm ProductEndi SingarimbunAinda não há avaliações

- Joint Venture AgreementDocumento12 páginasJoint Venture AgreementPeter K Njuguna100% (1)

- Serving Humanity, Saving LivesDocumento72 páginasServing Humanity, Saving LivesDavid LeongAinda não há avaliações

- Technical Guide On Financial Statements of Limited Liability Partnerships (LLPS)Documento80 páginasTechnical Guide On Financial Statements of Limited Liability Partnerships (LLPS)Veneela ReddyAinda não há avaliações

- Mock Exam 2023 #1 Second Session Corporate Finance, Equity, FixedDocumento88 páginasMock Exam 2023 #1 Second Session Corporate Finance, Equity, Fixedvedant.diwan26100% (1)

- Fra Project FinalllDocumento23 páginasFra Project Finalllshahtaj khanAinda não há avaliações

- Rotissa FO SummitDocumento17 páginasRotissa FO SummitKevin G. DavisAinda não há avaliações