Escolar Documentos

Profissional Documentos

Cultura Documentos

Fin 22 A

Enviado por

Clifford Gray0 notas0% acharam este documento útil (0 voto)

47 visualizações2 páginasUses of security for short term borrowing

Título original

Fin22A

Direitos autorais

© © All Rights Reserved

Formatos disponíveis

DOCX, PDF, TXT ou leia online no Scribd

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoUses of security for short term borrowing

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato DOCX, PDF, TXT ou leia online no Scribd

0 notas0% acharam este documento útil (0 voto)

47 visualizações2 páginasFin 22 A

Enviado por

Clifford GrayUses of security for short term borrowing

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato DOCX, PDF, TXT ou leia online no Scribd

Você está na página 1de 2

Name: Carmela Mae C.

Duron III-BSA

Subject/Time/ Room: Fin 22A/8:30-9:30E/BE 312

Professor: Kathleen H. Absin

Topic: Uses of security in short-term financing

Meaning of Security

A security is a financial instrument that represents an ownership position in

a publicly-traded corporation (stock), a creditor relationship with governmental body

or a corporation (bond), or rights to ownership as represented by an option.

Meaning and nature of short-term financing:

Short Term financing is that from of financing which embraces borrowing or

lending of funds for a short period of time. It refers to the finance obtained on short

term basis, usually one year or less in duration. Short term finance is secured for

financing the current assets, for example, inventories. Short term finance is also

known as working capital which is the excess of current assets over current

liabilities. Current liabilities become due within one year and indicate the amount of

short-term credit being utilized by the business.

Interest Rates on Short-Term Loans

In a normal economy, interest rates on short-term loans are higher than

interest rates on long-term loans. In a recessionary economy, however, interest rates

may be low and short-term loan rates may be lower than long-term loan rates. Short-

term loan rates are usually based on the prime interest rate plus some premium. The

bank or other lender determines the premium by determining what risk your

company is to them. They do this by looking at the documentation you provide them

in order to qualify for a short-term loan.

Short-term Loans and Start-up Businesses

It is possible for a start-up company to secure a short-term loan. This is

because short-term loans are less risky than long-term financing simply due to the

fact of their maturity. Start-up firms have to present extensive documentation to the

lender, such as projectedcash flow statements for the next 3-5 years along with

projected financial statements for the same time period. They have to explain where

their revenue will be coming from and how it is expected to be paid.

Most start-up companies will only qualify for secured loans from a lender. In other

words, the start-up firm would have to offer some sort of collateral to secure the loan

with the lender.

Short-term Loans and Small Business

The availability of short-term loans to small businesses is absolutely essential

in order for our economy to operate smoothly. Without short-term financing, small

businesses literally cannot operate. They can't buy their inventory, cover working

capital shortages, expand their customer base or operations, or grow.

When commercial banks tightened up their lending policies during the Great

Recession and afterward, small businesses and the economy suffered because of

these very issues.

Você também pode gostar

- Macroeconomi CS Compiled Topics: in Partial Fulfillment For Economics 2A BE 311/8:00-9:00AM/7172Documento81 páginasMacroeconomi CS Compiled Topics: in Partial Fulfillment For Economics 2A BE 311/8:00-9:00AM/7172Clifford GrayAinda não há avaliações

- RecommendationDocumento2 páginasRecommendationClifford GrayAinda não há avaliações

- ReflectionDocumento2 páginasReflectionClifford GrayAinda não há avaliações

- Enron Scndal Reaction PaperDocumento1 páginaEnron Scndal Reaction PaperClifford Gray50% (8)

- David Packard: "Three Most Charismatic Leaders and Their Contribution"Documento6 páginasDavid Packard: "Three Most Charismatic Leaders and Their Contribution"Clifford GrayAinda não há avaliações

- Flowchart: Charged CustomerDocumento3 páginasFlowchart: Charged CustomerClifford GrayAinda não há avaliações

- Claim LetterDocumento1 páginaClaim LetterClifford GrayAinda não há avaliações

- AFTA Effects To Manufacturing Company and Accounting ProfessionDocumento1 páginaAFTA Effects To Manufacturing Company and Accounting ProfessionClifford GrayAinda não há avaliações

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5784)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (119)

- Investor Prospectus QuinateDocumento9 páginasInvestor Prospectus QuinateRichard WestermannAinda não há avaliações

- Module 1A Revision of Concepts of Value and ReturnDocumento92 páginasModule 1A Revision of Concepts of Value and ReturnJoyal jose100% (1)

- Cornerstones of Cost Accounting Canadian 1st Edition Hansen Solutions ManualDocumento10 páginasCornerstones of Cost Accounting Canadian 1st Edition Hansen Solutions Manualsauflyallowerrf1qs100% (28)

- Module 2Documento47 páginasModule 2Manuel ErmitaAinda não há avaliações

- ISO 9001:2000 Goat Production Profitability AnalysisDocumento38 páginasISO 9001:2000 Goat Production Profitability AnalysisJay AdonesAinda não há avaliações

- GIC Report 2019 20 1Documento84 páginasGIC Report 2019 20 1a aaaAinda não há avaliações

- BDA Advises Quasar Medical On Sale of Majority Stake To LongreachDocumento3 páginasBDA Advises Quasar Medical On Sale of Majority Stake To LongreachPR.comAinda não há avaliações

- Financial Statement Analysis of Poh Kong Holdings BerhadDocumento13 páginasFinancial Statement Analysis of Poh Kong Holdings BerhadSHARIFAH BALQIS SYED ROSIDINAinda não há avaliações

- 21 Sian Tuan Avenue ReportDocumento21 páginas21 Sian Tuan Avenue ReportJames YuAinda não há avaliações

- 21933mtp Cptvolu1 Part1Documento208 páginas21933mtp Cptvolu1 Part1arshAinda não há avaliações

- Cpa 1Documento2.011 páginasCpa 1mwanziaAinda não há avaliações

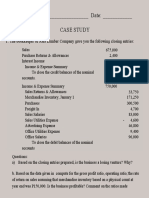

- Case Study AUSCISEDocumento2 páginasCase Study AUSCISEsharielles /Ainda não há avaliações

- Calculating Depreciation and Average Rate of Return for Equipment InvestmentDocumento9 páginasCalculating Depreciation and Average Rate of Return for Equipment Investmentpeter mulilaAinda não há avaliações

- Credit Ratings Provide Insight Into Financial StrengthDocumento6 páginasCredit Ratings Provide Insight Into Financial StrengthvishAinda não há avaliações

- Accounting for Income TaxesDocumento18 páginasAccounting for Income TaxesAndrea Marie CalmaAinda não há avaliações

- List of Uae Insurance CompaniesDocumento9 páginasList of Uae Insurance CompaniesFawad IqbalAinda não há avaliações

- Tax benefits non-profit organisations PakistanDocumento4 páginasTax benefits non-profit organisations PakistanNoor ArfeenAinda não há avaliações

- MANAGEMENT ADVISORY SERVICES TOPICSDocumento19 páginasMANAGEMENT ADVISORY SERVICES TOPICSNovie Marie Balbin AnitAinda não há avaliações

- PT INDOFOOD CBP SUKSES MAKMUR TBK DAN ENTITAS ANAKNYADocumento3 páginasPT INDOFOOD CBP SUKSES MAKMUR TBK DAN ENTITAS ANAKNYARama fauziAinda não há avaliações

- Practice Test Mid Term 1Documento9 páginasPractice Test Mid Term 1Bob ColtonAinda não há avaliações

- CPA Licensure Exam Syllabus for Management Advisory ServicesDocumento16 páginasCPA Licensure Exam Syllabus for Management Advisory ServiceskaderderkaAinda não há avaliações

- Paper 3 - Audit - TP-2Documento6 páginasPaper 3 - Audit - TP-2Suprava MishraAinda não há avaliações

- Marketing of Financial ServicesDocumento10 páginasMarketing of Financial ServicesRohit SoniAinda não há avaliações

- FAR Ocampo/Cabarles/Soliman/Ocampo First Pre-Board OCTOBER 2018Documento5 páginasFAR Ocampo/Cabarles/Soliman/Ocampo First Pre-Board OCTOBER 2018kai luvAinda não há avaliações

- An Auditor's Services: Principles of Auditing: An Introduction To International Standards On Auditing - CH 4Documento47 páginasAn Auditor's Services: Principles of Auditing: An Introduction To International Standards On Auditing - CH 4febtrisia dewantiAinda não há avaliações

- Model Portfolio: DBS Group Research - EquityDocumento12 páginasModel Portfolio: DBS Group Research - EquityFunk33qAinda não há avaliações

- Detailed StatementDocumento2 páginasDetailed Statementnisha.yusuf.infAinda não há avaliações

- 300 - PEI - Jun 2019 - DigiDocumento24 páginas300 - PEI - Jun 2019 - Digimick ryanAinda não há avaliações

- Assignment 1 - Briefing DocumentDocumento4 páginasAssignment 1 - Briefing DocumentMalcolm TumanaAinda não há avaliações

- 17 ErsandiDocumento70 páginas17 Ersandimeds 2ndAinda não há avaliações