Escolar Documentos

Profissional Documentos

Cultura Documentos

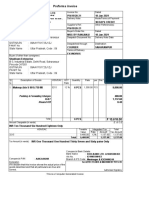

Income Tax Statement T.D.S. For The Year 2015 - 16: D. Deductions Under Chapter Vi - A Deductions U/S 80 C

Enviado por

kannanchammyTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Income Tax Statement T.D.S. For The Year 2015 - 16: D. Deductions Under Chapter Vi - A Deductions U/S 80 C

Enviado por

kannanchammyDireitos autorais:

Formatos disponíveis

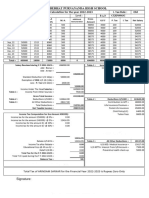

INCOME TAX STATEMENT T.D.S.

FOR THE YEAR 2015 - 16

Name of the Staff Designation Department

K.MUNIYASAMY AP-II EEE

PAN No. (attach Xerox copy) Period from To

BSWPM5920J 8/7/2011 Till Date

I. Gross Salary received during the FY Rs. 494631

(Statement enclosed on page No: 2)

A. Less: LLP (if any) Rs. 0

B. Professional Tax (u/s 16(i)) Rs. 2346

C. Interest paid on Housing Loan Maximum Rs.1,50,000 Rs.

(Under sec-24(b) allowed only for self occcupied property)

II TOTAL DEDUCTIONS (A+B+C) Rs. 2346

III Gross TOTAL INCOME (I - II) Rs. 492285

D. DEDUCTIONS UNDER CHAPTER VI - A

DEDUCTIONS U/S 80 C

A. SAVINGS THROUGH SALARY

1. Life insurance premium for his life and for family members etc. Rs. 89139.6

2. Statutory provident fund contribution Rs. 27000

3. 15 year public provident fund Rs.

4. Sum deposited in 10 year or 15 year account under the post office Rs.

savings Bank account

5. National Savings Certificate VI and VII Issues Rs.

6. Sum paid as subscription to House Loan account scheme. Rs.

7. Payment of Tuition Fees (Excluding book money, uniform, amenities, Rs.

caution deposits etc.,) admission fees, special fees, term fees to any

University, college, school or other Educational Institution for two

children situated within India.

8. Investment in scheduled bank in Fixed deposit for 5 years or more Rs.

qualify for tax deduction under Tax Saver Scheme.

Qualifying amount (Restricted to Rs.1,50,000) Rs. 116139.6

B. U/S 80 E Interest payment on Education Loan avail for self and spouse. Rs.

C. i) U/S 80D - Mediclaim Insurance Premium paid (mediclaim) Rs.

(Maximum Rs. 15000)

ii) Further deduction upto Rs.15,000/- for mediclaim for his parents if Rs.

the parents are senior citizen Rs.20,000/- is deducted

iii) 80 TTA Interest on Savings Bank Account Exempted upto Rs. 10000 Rs.

(Note: Savings bank interest must be added to gross total income)

IV TOTAL DEDUCTIONS (A+B+C) Rs. 116139.6

V TOTAL TAXABLE INCOME (III - IV) Rs. 376145.4

COMPUTATION OF TAX

Income Tax on Total Taxable Income

A First Rs. 2,50,000/- Nil

B Rs.2,50,000/- to Rs.5,00,000/- At 10% 12615

C Rs.5,00,000/- to Rs.10,00,000/- At 20% 0

D Above Rs.10,00,000/- At 30% 0

Tax on Total Income 12615

Less: Tax rebate u/s87A if Annual Income is below

Rs.5,00,000/- 2000

Net Tax Payable 10615

Add 3% Educational Cess 318

Total Tax Payable 10933

Advance Tax = Rs. 6000, 10933-6000 RS. 4933 Total Tax payable

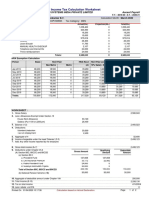

Total Salary received from Employer for the period from 01.04.2015 to 31.03.2016

Grade Deductions

Month Basic Pay D.A. PDA Gross Salary

Pay

L.L.P P.F. Adv. Tax Prof. Tax

Apr-14 18750 7000 14063 39813 2250 500

May-14 18750 7000 14063 39813 2250 500

Jun-14 18750 7000 14063 39813 2250 500

Jul-14 18750 7000 15938 41688 2250 500

Aug-14 18750 7000 15938 41688 2250 500

Sep-14 18750 7000 15938 41688 2250 500 1173

Oct-14 18750 7000 15938 41688 2250 500

Nov-14 18750 7000 15938 41688 2250 500

Dec-14 18750 7000 15938 41688 2250 500

Jan-15 18750 7000 15938 41688 2250 500

Feb-15 18750 7000 15938 41688 2250 500

Mar-15 Admission

18750 allowances

7000 and 15938

other 41688 2250 500 1173

remuneration received from college such

as KLU, KIT.

Total 494631 0 27000 6000 2346

Signature of the Staff

Você também pode gostar

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionAinda não há avaliações

- Income Tax 2008-09Documento10 páginasIncome Tax 2008-09mohan9813032985@yahoo.com100% (16)

- Public Sector Accounting and Administrative Practices in Nigeria Volume 1No EverandPublic Sector Accounting and Administrative Practices in Nigeria Volume 1Ainda não há avaliações

- T K ArumugamDocumento7 páginasT K ArumugamThangamAinda não há avaliações

- Cps Tax Form Format For 23-24Documento11 páginasCps Tax Form Format For 23-24sr91919Ainda não há avaliações

- Salary Extract of The Year 2020-21: Name: Ashwin Loyal Mendonca Designation: Pan: Address: Salary (RS) Deductions (RS)Documento15 páginasSalary Extract of The Year 2020-21: Name: Ashwin Loyal Mendonca Designation: Pan: Address: Salary (RS) Deductions (RS)sharathAinda não há avaliações

- AIBEA - Know Your Service ConditionsDocumento40 páginasAIBEA - Know Your Service ConditionsLvly AngelAinda não há avaliações

- Arindam 2023Documento1 páginaArindam 2023Anupam DasAinda não há avaliações

- Salary On IncomeDocumento22 páginasSalary On IncomeManjunathAinda não há avaliações

- Income Tax Calculation Statement: (Financial Year 2013-2014, and The Assessment Year 2014 - 2015)Documento17 páginasIncome Tax Calculation Statement: (Financial Year 2013-2014, and The Assessment Year 2014 - 2015)saravanand1983Ainda não há avaliações

- ComputationDocumento2 páginasComputationprr technologiesAinda não há avaliações

- Income Tax 2010 11 SatishDocumento5 páginasIncome Tax 2010 11 SatishSatish PalAinda não há avaliações

- 0 - Income-Tax-Calculator-FY-2018-19 Final ProformaaDocumento9 páginas0 - Income-Tax-Calculator-FY-2018-19 Final ProformaaSrinivas PulimamidiAinda não há avaliações

- Sambasiva Rao K 2020-21 Comp 01Documento1 páginaSambasiva Rao K 2020-21 Comp 01hari tejaAinda não há avaliações

- Computation 19-20Documento2 páginasComputation 19-20madali sivareddyAinda não há avaliações

- Computation 19-20Documento2 páginasComputation 19-20madali sivareddyAinda não há avaliações

- Computation of Total Income (Revised) Income From House Property (Chapter IV C) 319200Documento5 páginasComputation of Total Income (Revised) Income From House Property (Chapter IV C) 319200Yogesh SainiAinda não há avaliações

- Epf Ecr Apr'20 371-1Documento20 páginasEpf Ecr Apr'20 371-1K KumarAinda não há avaliações

- 10th Bipartite at A Glance: Clerk - 700,600,450 & Sub-Staff - 500,400,250Documento1 página10th Bipartite at A Glance: Clerk - 700,600,450 & Sub-Staff - 500,400,250Kuldeep KushwahaAinda não há avaliações

- Main TablesDocumento1 páginaMain Tablesvishalbharatshah2776Ainda não há avaliações

- Income Tax of A K Sahoo For AY-2017-18.&18-19Documento2 páginasIncome Tax of A K Sahoo For AY-2017-18.&18-19priyadarshi1228Ainda não há avaliações

- 9 - Sample - Income TaxDocumento2 páginas9 - Sample - Income TaxShreyash MoharirAinda não há avaliações

- Pre F.chap.5 NewDocumento9 páginasPre F.chap.5 NewVee Gabiana GoAinda não há avaliações

- LNL Iklcqd /: Page 1 of 6Documento6 páginasLNL Iklcqd /: Page 1 of 6amitsaha70Ainda não há avaliações

- 1135-Know Your Service Condition - 2015 Canara Bank New - MailDocumento42 páginas1135-Know Your Service Condition - 2015 Canara Bank New - Mailraju vermaAinda não há avaliações

- Computation of Total Income (As Per Section 115BAC (New Tax Regime) ) Income From Business or Profession (Chapter IV D) 916408Documento3 páginasComputation of Total Income (As Per Section 115BAC (New Tax Regime) ) Income From Business or Profession (Chapter IV D) 916408S K GUPTA & ASSOCIATESAinda não há avaliações

- Compu TationDocumento7 páginasCompu TationRaj KumarAinda não há avaliações

- Income Tax Calculation Worksheet: Ellucian Higher Education Systems India Private Limited Ascent PayrollDocumento2 páginasIncome Tax Calculation Worksheet: Ellucian Higher Education Systems India Private Limited Ascent PayrollShiva098Ainda não há avaliações

- B) Excess of Rent Paid Over 10% of Basic+DADocumento4 páginasB) Excess of Rent Paid Over 10% of Basic+DAHaresh RajputAinda não há avaliações

- How To YourDocumento45 páginasHow To YourfarjanabegumAinda não há avaliações

- Earnings: 10 Ca (PH Allowance)Documento15 páginasEarnings: 10 Ca (PH Allowance)asrahaman9Ainda não há avaliações

- Motilal Excel PlanDocumento8 páginasMotilal Excel Plansourajit kunduAinda não há avaliações

- Income Tax 2023-24 Statement - Mahesh R1Documento2 páginasIncome Tax 2023-24 Statement - Mahesh R1akhilhed100% (1)

- Salary PDFDocumento83 páginasSalary PDFGaurav BeniwalAinda não há avaliações

- Particulars of Salary: If You Are A Handicapped Employee, Yes/NoDocumento13 páginasParticulars of Salary: If You Are A Handicapped Employee, Yes/NoMushtaq AhmadAinda não há avaliações

- Tax CalculatorDocumento10 páginasTax Calculatorgsagar879Ainda não há avaliações

- Tahap 3Documento14 páginasTahap 3Akmal MaulanaAinda não há avaliações

- Tax CalculationDocumento4 páginasTax CalculationRajat SharmaAinda não há avaliações

- Main Tables (Lower Version)Documento2 páginasMain Tables (Lower Version)vishalbharatshah2776Ainda não há avaliações

- Ashok Garg PDFDocumento3 páginasAshok Garg PDFGourav sheelAinda não há avaliações

- CpaDocumento37 páginasCparav danoAinda não há avaliações

- Jawaban Siklus AkuntansiDocumento9 páginasJawaban Siklus AkuntansiRendyyyAinda não há avaliações

- M/S. Sunil Tour and Travels Mr. Sunil Nebulal Chauhan: Statement of Total IncomeDocumento8 páginasM/S. Sunil Tour and Travels Mr. Sunil Nebulal Chauhan: Statement of Total IncomeAnil ChauhanAinda não há avaliações

- Lecture 3Documento22 páginasLecture 3ahmed qazzafiAinda não há avaliações

- COI - AY - 23-24 - (Hemant Kumar Jain)Documento4 páginasCOI - AY - 23-24 - (Hemant Kumar Jain)vikash pandeyAinda não há avaliações

- Office of The Accountant General (A&E) Karnataka BengaluruDocumento2 páginasOffice of The Accountant General (A&E) Karnataka Bengalurukotresha komaragoudraAinda não há avaliações

- Income Tax Calculator and Form 16Documento10 páginasIncome Tax Calculator and Form 16vsmnglAinda não há avaliações

- Details of Salary Paid and Any Other Income and Tax DeductedDocumento2 páginasDetails of Salary Paid and Any Other Income and Tax DeductedMadhur PanditaAinda não há avaliações

- India Post Payments Bank Limited Income Tax Computation For The Financial Year 2019-2020Documento4 páginasIndia Post Payments Bank Limited Income Tax Computation For The Financial Year 2019-2020Swati Rohan JadhavAinda não há avaliações

- Kunci NL PD - SejahteraDocumento7 páginasKunci NL PD - SejahteraWidya Putri DamayantiAinda não há avaliações

- Ud Buana Work Sheet: For Month Ended December 31, 2019Documento12 páginasUd Buana Work Sheet: For Month Ended December 31, 2019fitryna99Ainda não há avaliações

- Method of Calculation of Relief U/s 89 (I)Documento3 páginasMethod of Calculation of Relief U/s 89 (I)ssvrAinda não há avaliações

- Old Scheme: Radhamani K SDocumento4 páginasOld Scheme: Radhamani K SSUREMAN FINANCIAL SERVICESAinda não há avaliações

- Government of Tamil Nadu Govt Rajaji TB Hospital Income Statement For The Year 2015-2016Documento2 páginasGovernment of Tamil Nadu Govt Rajaji TB Hospital Income Statement For The Year 2015-2016prastacharAinda não há avaliações

- Computation of Total Income Income From Salary (Chapter IV A) 258850Documento2 páginasComputation of Total Income Income From Salary (Chapter IV A) 258850Kumar Chandan JhaAinda não há avaliações

- Income Tax Calculation For The Year 2018-2019.: Government Junior College, ChiralaDocumento2 páginasIncome Tax Calculation For The Year 2018-2019.: Government Junior College, ChiralaShaikvaahidhaAinda não há avaliações

- Amit Kumar Mudgal ComputationDocumento4 páginasAmit Kumar Mudgal ComputationSHELESH GARGAinda não há avaliações

- New ItDocumento9 páginasNew Itஇரா.மே.கார்த்திக் ராசாAinda não há avaliações

- Profit or Loss1 PDFDocumento7 páginasProfit or Loss1 PDFdanishahmed2126Ainda não há avaliações

- Case Study 3 SolutionDocumento2 páginasCase Study 3 Solutiongaurilakhmani2003Ainda não há avaliações

- DocScanner 17-Mar-2024 1-11 PMDocumento1 páginaDocScanner 17-Mar-2024 1-11 PMkannanchammyAinda não há avaliações

- Kalasalingam University: (Kalasalingam Academy of Research and Education)Documento5 páginasKalasalingam University: (Kalasalingam Academy of Research and Education)kannanchammyAinda não há avaliações

- BP No.29 (AB) Dated 15.03.2024Documento3 páginasBP No.29 (AB) Dated 15.03.2024kannanchammyAinda não há avaliações

- List of SS & TRFS - 24.01.24 - Final - 1-1Documento5 páginasList of SS & TRFS - 24.01.24 - Final - 1-1kannanchammyAinda não há avaliações

- 145Documento2 páginas145kannanchammyAinda não há avaliações

- EEE381 QuestionDocumento16 páginasEEE381 QuestionkannanchammyAinda não há avaliações

- B.P. No.176 SB Dated 30.10.2023Documento15 páginasB.P. No.176 SB Dated 30.10.2023kannanchammyAinda não há avaliações

- Dr.D.Devaraj: EEE305 EEE305 EEE305 EEE305 EEE305Documento18 páginasDr.D.Devaraj: EEE305 EEE305 EEE305 EEE305 EEE305kannanchammyAinda não há avaliações

- Dr.D.Devaraj: EEE305 EEE305 EEE305 EEE305 EEE305Documento18 páginasDr.D.Devaraj: EEE305 EEE305 EEE305 EEE305 EEE305kannanchammyAinda não há avaliações

- Guest FormDocumento1 páginaGuest FormkannanchammyAinda não há avaliações

- EEE202Documento2 páginasEEE202kannanchammyAinda não há avaliações

- FADocumento1 páginaFAkannanchammyAinda não há avaliações

- Workload Update 16.12.2016Documento35 páginasWorkload Update 16.12.2016kannanchammyAinda não há avaliações

- Department of Electrical and Electronics EngineeringDocumento2 páginasDepartment of Electrical and Electronics EngineeringkannanchammyAinda não há avaliações

- Cyber Physical SystemDocumento40 páginasCyber Physical Systemkannanchammy100% (1)

- Kalasalingam University - 30!01!2017Documento4 páginasKalasalingam University - 30!01!2017kannanchammyAinda não há avaliações

- Kalasalingam University: Course Name/Code Date & Session: / Degree/Branch Duration Semester/Section Max. MarksDocumento3 páginasKalasalingam University: Course Name/Code Date & Session: / Degree/Branch Duration Semester/Section Max. MarkskannanchammyAinda não há avaliações

- Coaching ScheduleDocumento4 páginasCoaching SchedulekannanchammyAinda não há avaliações

- M & I 2mDocumento25 páginasM & I 2mkannanchammyAinda não há avaliações

- Green Army UpdatedDocumento8 páginasGreen Army UpdatedkannanchammyAinda não há avaliações

- Muniyasamy EEE Syllabus 4 SubjectsDocumento8 páginasMuniyasamy EEE Syllabus 4 SubjectskannanchammyAinda não há avaliações

- KM TaxDocumento6 páginasKM TaxkannanchammyAinda não há avaliações

- Measurements and Instrumentation Objective Type QuestionsDocumento18 páginasMeasurements and Instrumentation Objective Type QuestionsDinesh Panchal67% (3)

- Department of Electrical and Electronics Engineering: Kalasalingam UniversityDocumento8 páginasDepartment of Electrical and Electronics Engineering: Kalasalingam UniversitykannanchammyAinda não há avaliações

- Circular For Staff MembersDocumento1 páginaCircular For Staff MemberskannanchammyAinda não há avaliações

- Ret LabDocumento2 páginasRet LabkannanchammyAinda não há avaliações

- Chapter 3Documento31 páginasChapter 3Geovany CarchiAinda não há avaliações

- Electric LightingDocumento10 páginasElectric LightingSarah FrazierAinda não há avaliações

- 1 - 3.3 - Burning FuelsDocumento19 páginas1 - 3.3 - Burning FuelskannanchammyAinda não há avaliações

- 5.2 Answer Key - FWT and CGTDocumento6 páginas5.2 Answer Key - FWT and CGTRezhel Vyrneth Turgo100% (1)

- Shubham PIDocumento1 páginaShubham PIVarsha JiAinda não há avaliações

- Pay Slip Jan, Feb, MarchDocumento3 páginasPay Slip Jan, Feb, Marchprateek gangwaniAinda não há avaliações

- Intax FINAL EXAMDocumento20 páginasIntax FINAL EXAMSteph TubuAinda não há avaliações

- Income Taxation On Individuals ModuleDocumento18 páginasIncome Taxation On Individuals ModuleCza PeñaAinda não há avaliações

- Amazon BlazerDocumento1 páginaAmazon BlazerRomAinda não há avaliações

- Module 3 - Government ExpendituresDocumento8 páginasModule 3 - Government ExpendituresTumaob Julito Jr.Ainda não há avaliações

- Budget 2K19: Made By: 17BCS1907 17BCS1908 17BCS1909 17BCS1910 17BCS1911Documento9 páginasBudget 2K19: Made By: 17BCS1907 17BCS1908 17BCS1909 17BCS1910 17BCS1911Sameer KhullarAinda não há avaliações

- 2023 Tax Deduction Cheat Sheet and LoopholesDocumento24 páginas2023 Tax Deduction Cheat Sheet and LoopholesKrisstian AnyaAinda não há avaliações

- Taxation Ch3Documento27 páginasTaxation Ch3sabit hussenAinda não há avaliações

- Sample Chart of AccountsDocumento5 páginasSample Chart of AccountsGraceeyAinda não há avaliações

- GROUP 10 (Corporation Income Taxation - Regular Corporation)Documento16 páginasGROUP 10 (Corporation Income Taxation - Regular Corporation)Denmark David Gaspar NatanAinda não há avaliações

- PIT09 Tax ReducersDocumento8 páginasPIT09 Tax ReducersAlellie Khay D JordanAinda não há avaliações

- Conciliacion Edl Diciembre 2022Documento348 páginasConciliacion Edl Diciembre 2022Aliados 1AAinda não há avaliações

- VATDocumento5 páginasVATCyril John RamosAinda não há avaliações

- Ketentuan Terbaru PBB-P2 JakartaDocumento2 páginasKetentuan Terbaru PBB-P2 JakartaDaisy Anita SusiloAinda não há avaliações

- Achieving Public Policy Goals Via Tobacco Taxation in IndonesiaDocumento6 páginasAchieving Public Policy Goals Via Tobacco Taxation in IndonesiaJosua PardedeAinda não há avaliações

- Taxation Notes MergedDocumento227 páginasTaxation Notes MergedPRANARITA BHOLAinda não há avaliações

- Noise Watch Invoice - 221018 - 120234Documento1 páginaNoise Watch Invoice - 221018 - 120234farhanAinda não há avaliações

- Sin TaxDocumento1 páginaSin TaxVj Lentejas IIIAinda não há avaliações

- Solved Refer To The Financial Information Given in E13 7 For PuffyDocumento1 páginaSolved Refer To The Financial Information Given in E13 7 For PuffyAnbu jaromiaAinda não há avaliações

- 0217 File SampleDocumento2 páginas0217 File SampleRaven blackAinda não há avaliações

- Chapter 3Documento8 páginasChapter 3Eunice SerneoAinda não há avaliações

- Basic Understanding of Composition Scheme Under GST Law - Taxguru - in PDFDocumento2 páginasBasic Understanding of Composition Scheme Under GST Law - Taxguru - in PDFSanthanakrishnan VenkatAinda não há avaliações

- Tax AuditDocumento16 páginasTax AuditArifin FuAinda não há avaliações

- APSAF TERM PAPER CompleteDocumento15 páginasAPSAF TERM PAPER CompleteOyeleye TofunmiAinda não há avaliações

- AP Macro 3-8 Problems With Fiscal PolicyDocumento21 páginasAP Macro 3-8 Problems With Fiscal PolicyJohn KimAinda não há avaliações

- 45362010Documento4 páginas45362010Kamal SoniAinda não há avaliações

- CA Inter GST Summary BookDocumento211 páginasCA Inter GST Summary BookPRATHAM AGGARWALAinda não há avaliações

- Tax 2 Notes Midterms LamosteDocumento6 páginasTax 2 Notes Midterms LamosteRoji Belizar HernandezAinda não há avaliações