Escolar Documentos

Profissional Documentos

Cultura Documentos

Allied Services

Enviado por

Achmad Faizal AzmiDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Allied Services

Enviado por

Achmad Faizal AzmiDireitos autorais:

Formatos disponíveis

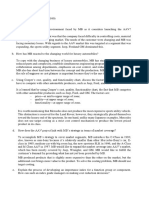

ABC-based services cost for the TFC business

Activity Total Cost Activity Driver Activity Driver Activity Based

Unit Cost

Storage $1,550,000 Number of 350,000 $4.43

Cartons

Requisition $1,801,000 Number of 310,000 $5.81

Handling Requisition

Basic $761,000 Number of 775,000 $0.98

Warehouse Requisition

Stock Selection Lines

Pick-Pack $734,000 Number of Pick 697,500 $1.05

Activity and Req. Lines

Data Entry $612,000 Number of 775,000 $0.79

Requisition

Lines

Desk Top $250,000 Number of 8,500 $29.41

Delivery Desktop

Deliveries

Total $5,708,000

Distribution service costs for Customer A and Customer B

Activity Activity Activity Activity Driver Units Distribution Cost

Based Driver

Cost

Customer A Customer B Customer A Customer B

Storage $4.43 Cartons 350 700 $1,550 $3,100

Requisition $5.81 Requisition 364 790 $2,115 $4,590

Handling s

Basic $0.98 Requisition 910 2,500 $894 $2,455

Warehouse s Lines

Stock

Selection

Pick- $1.05 Lines 910 2,500 $958 $631

Pack Requiring

Activity pick-pack

Data Entry $0.79 Requisition 362 790 $719 $1,974

Lines

Desktop $29.41 Desktop 26 $8,500 $765

Delivery Deliveries

Inventory $315

Handling

Freight $2,250 $7,500

Total $8,486 $23,330

Profitability for Customer A and B

Old Method ABC Method

Profitability Customer A Cutomer B Customer A Customer B

Sales $79,320 $79,320 $79,320 $79,320

Cost of Product 50,000 50,000 50,000 50,000

Services Fee 16,100 16,100 8,486 23,330

Gross Profit 13,220 13,220 20,837 5,999

Percentage of 17% 17% 26% 8%

Profit

Using the ABC Method we were able to calculate a Service Fee Amount of $8,486 for

Customer A, and $23,330 for Customer B. Subtracting these totals from the Service Fee Total

of $16100 found from the old method shows that Customer A was over charged $7,614 and

Customer B was under charged $7,230. It would be fair then to adjust the Service Fees

charged to each customer to the Totals found using the ABC method. Customer A was found

to cost Allied Office Products less money to service, but they were also a smaller source of

potential growth for the company. Customer B was found to use a larger amount of services,

and has a higher opportunity of increasing Allied Office Product s revenue. Our suggestion

would be to maintain the level of usage of Customer B and increase their service fees.

Customer B is more dependent on Allied Office Products, and its unlikely they would take

their business elsewhere. Customer A is less dependent on Allied Office Products since they

use fewer services, and it would be easier for them to take their business elsewhere. We

would also suggest maintaining the amount charged for Customer As service fees and

increasing their level of usage.

In addition we would recommend TFC implementing and applying the sales based

pricing (SBP) system. As it currently stands TFC charges all customers, regardless of size,

the same percentage of service costs. With the current method there are customers who may

be over charged for services they are not using or only use a small amount of services, while

other customers are being under charged for services they use a large amount of. By

switching to the SBP system it will help make the charges that Allied Office Products charges

fair by only charging the customer for what they are actually using, and also helping make

Allied Office Products cost allocation process better. A better cost allocation process allows

for better analysis of customers to have the knowledge of the more profitable customers, and

over time TFC can improve profit by focusing on managing individual accounts in order to

identify the most profitable accounts.

Você também pode gostar

- AwaDocumento4 páginasAwaAchmad Faizal AzmiAinda não há avaliações

- Removal Jurisdiction - Short EssayDocumento1 páginaRemoval Jurisdiction - Short Essaytreacherousasian657Ainda não há avaliações

- Du Pont Analysis of PT Semen Indonesia TBKDocumento1 páginaDu Pont Analysis of PT Semen Indonesia TBKAchmad Faizal AzmiAinda não há avaliações

- Ias 18Documento1 páginaIas 18Achmad Faizal AzmiAinda não há avaliações

- Accumulating and Assigning Cost To ProductDocumento2 páginasAccumulating and Assigning Cost To ProductAchmad Faizal AzmiAinda não há avaliações

- AwaDocumento4 páginasAwaAchmad Faizal AzmiAinda não há avaliações

- Belajar Awa 1Documento2 páginasBelajar Awa 1Achmad Faizal AzmiAinda não há avaliações

- Accounting Is The Body of Knowledge and Fuctions Concerned With Systematic OriginatingDocumento1 páginaAccounting Is The Body of Knowledge and Fuctions Concerned With Systematic OriginatingAchmad Faizal AzmiAinda não há avaliações

- 8 47Documento2 páginas8 47Achmad Faizal AzmiAinda não há avaliações

- CSDocumento2 páginasCSAchmad Faizal AzmiAinda não há avaliações

- CSDocumento2 páginasCSAchmad Faizal AzmiAinda não há avaliações

- TransriptDocumento1 páginaTransriptAchmad Faizal AzmiAinda não há avaliações

- CSDocumento2 páginasCSAchmad Faizal AzmiAinda não há avaliações

- Ias 18Documento1 páginaIas 18Achmad Faizal AzmiAinda não há avaliações

- Behavioral and Organizational Issues in ManagementDocumento3 páginasBehavioral and Organizational Issues in ManagementAchmad Faizal AzmiAinda não há avaliações

- Du Pont Analysis of PT Semen Indonesia TBKDocumento1 páginaDu Pont Analysis of PT Semen Indonesia TBKAchmad Faizal AzmiAinda não há avaliações

- Measuring and Managing Customer RelationshipsDocumento3 páginasMeasuring and Managing Customer RelationshipsAchmad Faizal AzmiAinda não há avaliações

- Accumulating and Assigning Cost To ProductDocumento3 páginasAccumulating and Assigning Cost To ProductAchmad Faizal AzmiAinda não há avaliações

- 6 32Documento2 páginas6 32Achmad Faizal AzmiAinda não há avaliações

- 8 47Documento2 páginas8 47Achmad Faizal AzmiAinda não há avaliações

- 11 73Documento2 páginas11 73Achmad Faizal AzmiAinda não há avaliações

- Measuring and Managing Process PerformanceDocumento2 páginasMeasuring and Managing Process PerformanceAchmad Faizal AzmiAinda não há avaliações

- The Balanced Scorecard and Strategy MapDocumento2 páginasThe Balanced Scorecard and Strategy MapAchmad Faizal AzmiAinda não há avaliações

- 4 51Documento3 páginas4 51Achmad Faizal AzmiAinda não há avaliações

- 9 95Documento1 página9 95Achmad Faizal AzmiAinda não há avaliações

- Using Costs in Decision MakingDocumento2 páginasUsing Costs in Decision MakingAchmad Faizal AzmiAinda não há avaliações

- ABM Cost ViewDocumento2 páginasABM Cost ViewAchmad Faizal AzmiAinda não há avaliações

- There Is A Growing Body of Literature Which Argues ThatDocumento1 páginaThere Is A Growing Body of Literature Which Argues ThatAchmad Faizal AzmiAinda não há avaliações

- Activity Based CostingDocumento3 páginasActivity Based CostingAchmad Faizal AzmiAinda não há avaliações

- Behavioral and Organizational Issues in ManagementDocumento3 páginasBehavioral and Organizational Issues in ManagementAchmad Faizal AzmiAinda não há avaliações

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5784)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (119)

- Cuba - Year 46 PDFDocumento57 páginasCuba - Year 46 PDFUyen HoangAinda não há avaliações

- Fraser-Ormiston 9e PPT Ch06Documento72 páginasFraser-Ormiston 9e PPT Ch06Shihab HasanAinda não há avaliações

- MCR 2012 WebDocumento228 páginasMCR 2012 WebIulia PotorAinda não há avaliações

- Different Types of BudgetDocumento9 páginasDifferent Types of BudgetDIVYA DUBEY100% (1)

- Sample Real Estate Agent Chart of AccountDocumento6 páginasSample Real Estate Agent Chart of AccountJohn Abebrese50% (2)

- Income Statement: (Company Name)Documento3 páginasIncome Statement: (Company Name)ChristianAinda não há avaliações

- Receivables OverviewDocumento14 páginasReceivables OverviewCale Robert RascoAinda não há avaliações

- Example 8: Appendix - Answers To Examples and End-Of-Chapter QuestionsDocumento8 páginasExample 8: Appendix - Answers To Examples and End-Of-Chapter QuestionsDewan Mahid Raza ChowdhuryAinda não há avaliações

- Statement of Management - S Responsibility - ITRDocumento1 páginaStatement of Management - S Responsibility - ITRJastine MalapitanAinda não há avaliações

- The Future of The Accounting FirmDocumento6 páginasThe Future of The Accounting Firmomohammed20071477Ainda não há avaliações

- Accounting For Revenue and Other Receipts: Instructor: Rey C. Ramonal, CPADocumento13 páginasAccounting For Revenue and Other Receipts: Instructor: Rey C. Ramonal, CPACarlo manejaAinda não há avaliações

- 4 2 Endless Company PDFDocumento3 páginas4 2 Endless Company PDFJulius Mark Carinhay TolitolAinda não há avaliações

- IAS 21 Foreign SubsidiaryDocumento14 páginasIAS 21 Foreign SubsidiaryRoqayya FayyazAinda não há avaliações

- SHELLDocumento6 páginasSHELLAbdullah QureshiAinda não há avaliações

- Culture and CongruenceDocumento28 páginasCulture and Congruencedanimedanime100% (1)

- C10 - PAS 7 Statement of Cash FlowsDocumento15 páginasC10 - PAS 7 Statement of Cash FlowsAllaine Elfa100% (2)

- Corporate Income TaxDocumento8 páginasCorporate Income TaxClaire BarbaAinda não há avaliações

- Audit Evidence and Audit Program by KonrathDocumento21 páginasAudit Evidence and Audit Program by KonrathDominic Earl AblanqueAinda não há avaliações

- LAPORAN KEUANGAN 2020 TrioDocumento3 páginasLAPORAN KEUANGAN 2020 TrioMT Project EnokAinda não há avaliações

- Garr Ard Market Study July 222010Documento268 páginasGarr Ard Market Study July 222010garychen72Ainda não há avaliações

- RFP Template A111Documento9 páginasRFP Template A111Azree Mohd NoorAinda não há avaliações

- Long term construction quizDocumento3 páginasLong term construction quizRed YuAinda não há avaliações

- Dumaguete Cathedral Credit Cooperative vs. CIRDocumento3 páginasDumaguete Cathedral Credit Cooperative vs. CIRrejine mondragonAinda não há avaliações

- International Trade Financing ReportDocumento93 páginasInternational Trade Financing Reportrubal0468Ainda não há avaliações

- Excel File For Financial Ratio Activities UpdatedDocumento4 páginasExcel File For Financial Ratio Activities Updated0a0lvbht4Ainda não há avaliações

- Adjusting Entries QuestionsDocumento8 páginasAdjusting Entries Questionssadia saeedAinda não há avaliações

- Accounting Instructions 3Documento1 páginaAccounting Instructions 3Ely DanelAinda não há avaliações

- Caro - Companies (Auditor's Report) Order, 2020Documento16 páginasCaro - Companies (Auditor's Report) Order, 2020Ekansh AgarwalAinda não há avaliações

- Advance Account MCQ BookDocumento78 páginasAdvance Account MCQ Bookcloudstorage567Ainda não há avaliações

- Financial Analysis: Metro Pacific Investment Corporation 2018Documento27 páginasFinancial Analysis: Metro Pacific Investment Corporation 2018Trixie HicaldeAinda não há avaliações