Escolar Documentos

Profissional Documentos

Cultura Documentos

The Following Are The Constituents of Income Tax Law in Pakistan

Enviado por

Hamza Butt0 notas0% acharam este documento útil (0 voto)

584 visualizações1 páginaLaw in Pakistan

Título original

The Following Are the Constituents of Income Tax Law in Pakistan

Direitos autorais

© © All Rights Reserved

Formatos disponíveis

DOCX, PDF, TXT ou leia online no Scribd

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoLaw in Pakistan

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato DOCX, PDF, TXT ou leia online no Scribd

0 notas0% acharam este documento útil (0 voto)

584 visualizações1 páginaThe Following Are The Constituents of Income Tax Law in Pakistan

Enviado por

Hamza ButtLaw in Pakistan

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato DOCX, PDF, TXT ou leia online no Scribd

Você está na página 1de 1

The following are the constituents of income tax law in Pakistan:

1) The Legislative Law, i.e. The Income Tax Ordinance, 2001.

2) The Procedural Law, i.e. The Income Tax rules, 2002.

3) The notifications, circulars etc. issued by the FBR.

4) The case law

5) Finance Acts or Ordinances.

1) Income Tax Ordinance, 2001:

Income Tax Ordinance, 2001 is the basic component of income tax law in Pakistan. All the

income tax law revolves around the Income Tax Ordinance, 2001. All matters of taxation

regarding computation of taxable income, computation of tax liability, payment of tax,

recovery of tax, appeals, refund, penalties and prosecution etc. have been discussed in the

Ordinance. The Income Tax Ordinance, 2001 has 240 sections which have been discussed

in 13 chapters. Each chapter deals with a particular subject and has been divided into parts.

Many parts have been further subdivided into divisions. There are also Seven Schedules of

the Income Tax Ordinance, 2001. Each Schedule deals with a particular subject and has

been divided into parts. Some parts are further subdivided into divisions. Schedules are also

treated as part of the Ordinance.

2) Income Tax Rules:

The FBR being the regulatory body and the highest income tax executive authority in

Pakistan is empowered to make rules regarding the procedural matters connected with the

implementation of the concerned laws like the Income Tax Ordinance, 2001. These rules are

made for the guidance of its officials as well as the tax payers. The FBR under the authority

of section 237 of the Income Tax Ordinance, 2001 made the Income Tax Rules, 2002. These

rules were published on July1, 2002 in Extraordinary Gazette of Pakistan at pages 1819 to

1966. Income tax rules have the same force as the sections in the Income Tax Ordinance

and such are implemented in the same manner.

3) Notifications, Instructions, Orders, SROs etc.:

Notifications, instructions, orders, SROs etc. are issued by the FBR u/s 206 of the Income

Tax Ordinance, 2001 for the guidance of its officials. Similarly, the Federal Government is

also empowered u/s 53 of the Income Tax Ordinance, 2001 to exempt certain types of

Income or specific persons from income tax and to prescribe special reduced rates for

certain persons or allow a reduction in tax liability by making amendments to the Second

Schedule to the Ordinance. Such amendments are usually made by way of statutory

Regulatory Orders (SROs) issued by the Federal Government by notification in the official

gazette. However, all such amendments during a particular financial year have to be placed

before the national Assembly at the end of that year.

4) Income Tax Case Law:

Different disputes arises in respect of rendering the income tax under the taxable limits,

assessment of persons, payment and recovery of tax, refunds etc. brought about before the

competent authorities for decision in respect of above-mentioned disputes. When such

disputes are decided, these decisions are not only help in setting the present disputes but

also for future decisions and reference to such decisions is subsequently made in order to

get necessary guidance.

5) Finance Acts or Ordinances:

In order to fulfill the budgetary requirements and other social and economic needs of the

country, some important amendments are made in the prevailing income tax ordinance every

year. Such changes should be approved by the assembly, if Assembly is not in existence,

President of Pakistan shall approve these changes. If such annual changes are approved by

the National Assembly, are called Finance Act and if these are approved by President, are

called Finance Ordinance. Finance Act or Ordinance is presented for the guidance regarding

procedure of the computation, assessment and administration etc. for the coming tax year.

For example, Finance Act, 2008 was used to compute taxable income, tax liability etc. of tax

year 2009.

Você também pode gostar

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- AssignmentDocumento16 páginasAssignmentHamza ButtAinda não há avaliações

- Toyota As Number One:-: Case Study Questions Q 1Documento3 páginasToyota As Number One:-: Case Study Questions Q 1Hamza ButtAinda não há avaliações

- AssignmentDocumento1 páginaAssignmentHamza ButtAinda não há avaliações

- Answers To Homework 5 Summer 2012Documento1 páginaAnswers To Homework 5 Summer 2012Hamza ButtAinda não há avaliações

- Shezan ReportDocumento20 páginasShezan Reportsubash03100% (2)

- Q. How Is TPS Interconnected With The Culture at Toyota? Are TPS and Toyota's Cultureinterdependent? Could One Exist Without The Other?Documento1 páginaQ. How Is TPS Interconnected With The Culture at Toyota? Are TPS and Toyota's Cultureinterdependent? Could One Exist Without The Other?Hamza ButtAinda não há avaliações

- How Many Methods We Can Use Collecting Job Analysis?: ObservationDocumento5 páginasHow Many Methods We Can Use Collecting Job Analysis?: ObservationHamza ButtAinda não há avaliações

- Supp DDocumento16 páginasSupp DHamza ButtAinda não há avaliações

- Assignemnt 2Documento2 páginasAssignemnt 2Hamza ButtAinda não há avaliações

- Assignemnt 2Documento2 páginasAssignemnt 2Hamza ButtAinda não há avaliações

- Question 3Documento4 páginasQuestion 3Hamza ButtAinda não há avaliações

- BF Assignment 2Documento8 páginasBF Assignment 2Hamza ButtAinda não há avaliações

- ListDocumento14 páginasListHamza Butt0% (1)

- Ansar Burney: Missing and Kidnapped Children/person in Karachi)Documento4 páginasAnsar Burney: Missing and Kidnapped Children/person in Karachi)Hamza ButtAinda não há avaliações

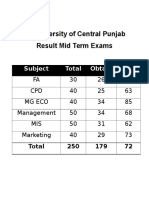

- University of Central PunjabDocumento1 páginaUniversity of Central PunjabHamza ButtAinda não há avaliações

- Course: Management Information System (MIS) Course Instructor: Omair Gull Title: Business AnalysisDocumento1 páginaCourse: Management Information System (MIS) Course Instructor: Omair Gull Title: Business AnalysisHamza ButtAinda não há avaliações

- Ansar Burney: Missing and Kidnapped Children/person in Karachi)Documento4 páginasAnsar Burney: Missing and Kidnapped Children/person in Karachi)Hamza ButtAinda não há avaliações

- 1 Assignment Submitted To: Submitted By: 0008, 0025, 0038, 0057, 0078, 0080 Submitted OnDocumento2 páginas1 Assignment Submitted To: Submitted By: 0008, 0025, 0038, 0057, 0078, 0080 Submitted OnHamza ButtAinda não há avaliações

- Ansar Burney: Missing and Kidnapped Children/person in Karachi)Documento4 páginasAnsar Burney: Missing and Kidnapped Children/person in Karachi)Hamza ButtAinda não há avaliações

- 1st Assignment Organizational BehaviourDocumento1 página1st Assignment Organizational BehaviourHamza ButtAinda não há avaliações

- Define Proble M Analyz e Alter-Native S Make A Choice Take Action Evalua Te Result SDocumento1 páginaDefine Proble M Analyz e Alter-Native S Make A Choice Take Action Evalua Te Result SHamza ButtAinda não há avaliações

- Organization StructureDocumento6 páginasOrganization StructuresamacsterAinda não há avaliações

- 1-4 Starch Amylose: AmylasesDocumento15 páginas1-4 Starch Amylose: AmylasesHamza ButtAinda não há avaliações

- Assignment: (Zong) Sir Sajid AliDocumento2 páginasAssignment: (Zong) Sir Sajid AliHamza ButtAinda não há avaliações

- Table of ContentDocumento1 páginaTable of ContentHamza ButtAinda não há avaliações

- Information SystemDocumento5 páginasInformation SystemHamza ButtAinda não há avaliações

- Formullah Economic PDFDocumento7 páginasFormullah Economic PDFHamza ButtAinda não há avaliações

- Returns To ScaleDocumento4 páginasReturns To ScaleSachin SahooAinda não há avaliações

- PM CH 02 Company & MKTG StrategyDocumento33 páginasPM CH 02 Company & MKTG StrategyihgdownlaodAinda não há avaliações

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (120)

- BluefrogDocumento3 páginasBluefrogRafat AliAinda não há avaliações

- Gacal Vs PALDocumento2 páginasGacal Vs PALKirsten Denise B. Habawel-VegaAinda não há avaliações

- Republic v. Drugmaker's Laboratories, Inc.Documento3 páginasRepublic v. Drugmaker's Laboratories, Inc.Cristelle Elaine Collera100% (4)

- 7.13.22 House GOP Letter To Mayorkas On Privacy WaiversDocumento2 páginas7.13.22 House GOP Letter To Mayorkas On Privacy WaiversFox NewsAinda não há avaliações

- On Perestroika Deception, 1995 by Anatoliy GolitsynDocumento28 páginasOn Perestroika Deception, 1995 by Anatoliy Golitsynkabud67% (3)

- Panama House Rules PDFDocumento5 páginasPanama House Rules PDFGerdAinda não há avaliações

- Client Counselling FormDocumento5 páginasClient Counselling FormzainabAinda não há avaliações

- Proceedings-NOTIFICATION FOR THE GDC - CONTRACT LECTURERSDocumento4 páginasProceedings-NOTIFICATION FOR THE GDC - CONTRACT LECTURERSNarasimha Sastry100% (1)

- CCA Notice - December 2022Documento1 páginaCCA Notice - December 2022Wews WebStaffAinda não há avaliações

- Social Security System 2017Documento35 páginasSocial Security System 2017NJ Geerts100% (1)

- Preamble: Atish Mathur: MATHUR10Documento8 páginasPreamble: Atish Mathur: MATHUR10shammi jangraAinda não há avaliações

- Articles of IncorporationDocumento8 páginasArticles of IncorporationKlein FerdieAinda não há avaliações

- Bergado v. Court of Appeals, 172 SCRA 497Documento2 páginasBergado v. Court of Appeals, 172 SCRA 497Micho DiezAinda não há avaliações

- JVD 5 Step Verification ApplicationDocumento2 páginasJVD 5 Step Verification ApplicationRaj Tej75% (4)

- State Board of Medical Examiners V MaxwellDocumento1 páginaState Board of Medical Examiners V MaxwellAlvin HalconAinda não há avaliações

- N o T I C e - Deepak Shirbhate GratuityDocumento5 páginasN o T I C e - Deepak Shirbhate GratuityDIPAK VINAYAK SHIRBHATEAinda não há avaliações

- G2M Fintech - by LawsDocumento12 páginasG2M Fintech - by LawsAdi Cruz100% (1)

- Sunrise Movement FinalDocumento5 páginasSunrise Movement Finalapi-302512100Ainda não há avaliações

- Towards Local Democracy in Nepal - by Damodar AdhikariDocumento1 páginaTowards Local Democracy in Nepal - by Damodar Adhikaridamodar.adhikari@gmail.com100% (2)

- Causes of The Civil War: Chapter 16, Section 2Documento9 páginasCauses of The Civil War: Chapter 16, Section 2E. GarciaAinda não há avaliações

- Alternative Dispute Resolution System Internal Assessment-IIDocumento6 páginasAlternative Dispute Resolution System Internal Assessment-IIdevendra singh100% (1)

- 12 - Chapter 5Documento72 páginas12 - Chapter 5VishakaRajAinda não há avaliações

- 109 People Vs CogaedDocumento4 páginas109 People Vs CogaedRae Angela GarciaAinda não há avaliações

- Walter J. Lovett, Jr. v. Fred Butterworth, Superintendent, Massachusetts Correctional Institution at Walpole, 610 F.2d 1002, 1st Cir. (1979)Documento8 páginasWalter J. Lovett, Jr. v. Fred Butterworth, Superintendent, Massachusetts Correctional Institution at Walpole, 610 F.2d 1002, 1st Cir. (1979)Scribd Government DocsAinda não há avaliações

- Defense Brief in Rintala CaseDocumento72 páginasDefense Brief in Rintala CaseNew England Public RadioAinda não há avaliações

- Handouts in Philippine Government and ConstitutionDocumento8 páginasHandouts in Philippine Government and ConstitutionSherry Lyn Fernandez Lamsen-OrjaloAinda não há avaliações

- PDFDocumento131 páginasPDFUnni Krishnan100% (1)

- SALNDocumento7 páginasSALNVangie AntonioAinda não há avaliações

- Crisostomo Vs SECDocumento1 páginaCrisostomo Vs SECJessie Albert CatapangAinda não há avaliações

- Human Resource Manual IIIDocumento182 páginasHuman Resource Manual IIIDewald Murray100% (5)