Escolar Documentos

Profissional Documentos

Cultura Documentos

BNWM

Enviado por

Hussain AliDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

BNWM

Enviado por

Hussain AliDireitos autorais:

Formatos disponíveis

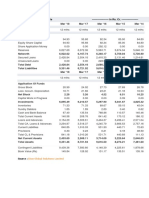

Pakistan Stock Exchange Limited

Formerly: Karachi Stock Exchange Limited

S.No.

Bannu Woollen Mills Limited

CHAIRMAN 2012 2013 2014 2015

RAZA KULI KHAN KHATTAK FINANCIAL POSITION (Rs. In Million)

Paid-Up Capital 76.05 76.05 95.06 95.06

CHIEF EXECUTIVE/MANAGING DIRECTOR Reserves & Surplus 585.29 680.55 806.86 881.44

MRS. SHAHNAZ SAJJAD AHMAD Sharholder's Equity 661.34 756.60 901.92 976.50

Capital Reserves 19.45 19.45 19.45 19.45

BOARD OF DEIRECTORS: Deferred Taxation / Liabilities 89.93 84.28 83.39 74.00

Long Term Loans / Deposits 0.00 0.00 12.50 2.50

RAZA KULI KHAN KHATTAK

Current Liabilities 88.37 254.75 218.01 238.92

AHMED KULI KHAN KHATTAK Total Assets 1482.28 1786.12 1918.19 2009.41

MUSHTAQ AHMED KHAN Fixed Assets (Gross) 1011.86 1045.41 1127.33 1131.06

LT.GEN.(RETD) ALI KULI KHAN KHATTAK Accumulated Depreciation / 199.09 232.42 267.16 302.65

MRS. SHAHNAZ SAJJAD AHMED Amortization

Fixed Assets (Net) 812.77 812.99 860.17 828.41

MRS. ZEB GOHAR AYUB 0.00 1.69 1.98 33.83

Capital work in Progress

DR. SHAHEEN KULI KHAN Long Term Investment 209.06 294.48 362.46 364.23

SYED ZUBAIR AHMED SHAH Current Assets 457.20 674.16 689.88 779.45

AHMAD ZEB KHAN OPERATING POSITION (Rs. In Million)

REGISTERED OFFICE: Sales (Net) / Revenues 663.41 807.73 788.88 796.98

Cost of Sales 470.89 577.29 562.53 548.63

D. I. Khan Road, Gross Profit 192.52 230.44 226.35 248.35

Operating Expenses 94.14 123.00 121.42 134.65

Bannu Operating Profit / (Loss) 98.35 107.44 104.93 113.70

Financial Charges 16.03 10.93 7.40 12.30

HEAD OFFICE: 53.35 88.13 64.03 3.27

Other Income

D. I. Khan Road, Prior Year Adjustment 0.00 0.00 0.00 0.00

Profit / (Loss) Before Taxation 135.69 176.13 152.08 96.33

Taxation Current & Deff 6.31 30.06 21.98 30.12

Bannu Prior Years -7.78 0.00 -1.55 3.31

Total -1.47 30.06 20.43 33.43

AUDITORS: Profit / (Loss) After Taxation 137.16 146.07 131.65 62.90

Hameed Chaudhri & Co RATIOS

LOCATION OF FACTORY / PLANT Book Value 86.96 99.49 94.88 102.72

D. I. Khan Road, Assets Turnover 0.45 0.45 0.41 0.40

Bannu. Current Ratio 5.17 2.65 3.16 3.26

Earning Per Share Pre Tax 17.84 23.16 16.00 10.13

YEAR ENDING:

Earning Per Share After Tax 18.04 19.21 13.85 6.62

June Payout Ratio After Tax 16.63 13.16 0.00 45.32

AUTHORISED CAPITAL: Market Capitalization 298.72 513.72 669.79 565.70

200 mil

DISTRIBUTION

Rs:

Cash Dividend % 30.00 0.00 0.00 30.00

PAID VALUE: Stock Dividend % 0.00 25.00 0.00 0.00

Rs: 10 Total % 30.00 25.00 0.00 30.00

SHARES TRADED: SHARE PRICE Rs.

High 64.40 91.70 88.72 82.02

20.713 mil 14.15 43.40 52.20 37.00

Low

No.of SHAREHOLDERS: Average 39.28 67.55 70.46 59.51

1255

CAPACITY UTILISATION:

Multi Products

COMPANY INFORMATION

The Company was incorporated in Pakistan as a public

limited company in 1960.

It is principally engaged in manufacture and sale of

wollen yarn, cloth and blankets.

Você também pode gostar

- Pakistan CablesDocumento2 páginasPakistan CablesSaad SiddiquiAinda não há avaliações

- Atlas HondaDocumento2 páginasAtlas HondasaranidoAinda não há avaliações

- Location of Factory / PlantDocumento1 páginaLocation of Factory / PlantGhulam AhmadAinda não há avaliações

- Pakistan Stock Exchange Limited: The Searle Company LimitedDocumento1 páginaPakistan Stock Exchange Limited: The Searle Company LimitederfanxpAinda não há avaliações

- Pakistan Stock Exchange LimitedDocumento1 páginaPakistan Stock Exchange LimitederfanxpAinda não há avaliações

- Analysis Reports PDFDocumento1 páginaAnalysis Reports PDFFaizan AhmadAinda não há avaliações

- Analysis ReportsDocumento1 páginaAnalysis Reportsfari khAinda não há avaliações

- Feroze1888 Mills Limited: Formerly: Karachi Stock Exchange LimitedDocumento1 páginaFeroze1888 Mills Limited: Formerly: Karachi Stock Exchange LimitedHussain AliAinda não há avaliações

- Pakistan Stock Exchange LimitedDocumento1 páginaPakistan Stock Exchange LimitederfanxpAinda não há avaliações

- Analysis ReportsDocumento1 páginaAnalysis ReportsMuiz SaddozaiAinda não há avaliações

- Pakistan Stock Exchange Limited: Indus Motor Company LimitedDocumento1 páginaPakistan Stock Exchange Limited: Indus Motor Company Limitedmusab nawazAinda não há avaliações

- Bestway Cement Limited: Location of Factory / PlantDocumento1 páginaBestway Cement Limited: Location of Factory / PlantBurhan Ahmed MayoAinda não há avaliações

- Pakistan Stock Exchange Limited: D. G. Khan Cement Company LimitedDocumento1 páginaPakistan Stock Exchange Limited: D. G. Khan Cement Company LimitederfanxpAinda não há avaliações

- Maple Leaf Cement Factory Limited: Formerly: Karachi Stock Exchange LimitedDocumento1 páginaMaple Leaf Cement Factory Limited: Formerly: Karachi Stock Exchange LimitedHussain AliAinda não há avaliações

- Analysis Report PsoDocumento3 páginasAnalysis Report PsoMuhammad Waqas HafeezAinda não há avaliações

- Pakistan Stock Exchange LimitedDocumento1 páginaPakistan Stock Exchange LimitedayazAinda não há avaliações

- MCBDocumento1 páginaMCBAbdul Habib MirAinda não há avaliações

- Annual-Report-FY-2019-20 QDocumento76 páginasAnnual-Report-FY-2019-20 Qhesax93983Ainda não há avaliações

- Ch-3 Finance Department Trading & P&L AccountDocumento4 páginasCh-3 Finance Department Trading & P&L AccountMit MehtaAinda não há avaliações

- (XI) Bibliography and AppendixDocumento5 páginas(XI) Bibliography and AppendixSwami Yog BirendraAinda não há avaliações

- Income Statement 2018-2019 %: Sources of FundsDocumento8 páginasIncome Statement 2018-2019 %: Sources of FundsDebanjan MukherjeeAinda não há avaliações

- Industry Segment of Bajaj CompanyDocumento4 páginasIndustry Segment of Bajaj CompanysantunusorenAinda não há avaliações

- Lakshmi Machine Works: PrintDocumento9 páginasLakshmi Machine Works: Printlaxmi joshiAinda não há avaliações

- ABB India: PrintDocumento2 páginasABB India: PrintAbhay Kumar SinghAinda não há avaliações

- P & L A/C Sanghicement Amt. %: IncomeDocumento5 páginasP & L A/C Sanghicement Amt. %: IncomeMansi VyasAinda não há avaliações

- Key Financial Ratios of HCL TechnologiesDocumento9 páginasKey Financial Ratios of HCL TechnologiesshirleyAinda não há avaliações

- Illustration Acc FMDocumento22 páginasIllustration Acc FMHEMACAinda não há avaliações

- Assingment SCM SEM4 - 1Documento17 páginasAssingment SCM SEM4 - 1KARTHIYAENI VAinda não há avaliações

- HDFC Bank LTD.: Profit and Loss A/CDocumento4 páginasHDFC Bank LTD.: Profit and Loss A/CsureshkarnaAinda não há avaliações

- Account Assigment DDDocumento6 páginasAccount Assigment DDlubna ghazalAinda não há avaliações

- Apollo Hospitals Enterprise LimitedDocumento4 páginasApollo Hospitals Enterprise Limitedpaigesh1Ainda não há avaliações

- Presented by Harichandana Y (2001MBA018) Sanskriti Bharti (2001MBA022) Pragati Upadhya (2001MBA110)Documento23 páginasPresented by Harichandana Y (2001MBA018) Sanskriti Bharti (2001MBA022) Pragati Upadhya (2001MBA110)Harichandana YAinda não há avaliações

- Ashok Leyland Balane SheetDocumento2 páginasAshok Leyland Balane SheetNaresh Kumar NareshAinda não há avaliações

- CA2Documento22 páginasCA2aryanvaish64Ainda não há avaliações

- Financial Management II ProjectDocumento11 páginasFinancial Management II ProjectsimlimisraAinda não há avaliações

- Term Paper Sandeep Anurag GautamDocumento13 páginasTerm Paper Sandeep Anurag GautamRohit JainAinda não há avaliações

- Group 1 Adani PortsDocumento12 páginasGroup 1 Adani PortsshreechaAinda não há avaliações

- Balance Sheet of Indiabulls - in Rs. Cr.Documento3 páginasBalance Sheet of Indiabulls - in Rs. Cr.MubeenAinda não há avaliações

- Apollo Tyres: PrintDocumento2 páginasApollo Tyres: PrintTiaAinda não há avaliações

- Financial Statement AnalysisDocumento18 páginasFinancial Statement AnalysisEashaa SaraogiAinda não há avaliações

- Jubilant FoodworksDocumento6 páginasJubilant FoodworksManan GuptaAinda não há avaliações

- Asian Paints BsDocumento2 páginasAsian Paints BsPriyalAinda não há avaliações

- Profit and Loss Account For The Year Ended 31st December, 2006Documento8 páginasProfit and Loss Account For The Year Ended 31st December, 200622165228Ainda não há avaliações

- Balance Sheet of Life Insurance Corporation of IndiaDocumento5 páginasBalance Sheet of Life Insurance Corporation of IndiaPuru JainAinda não há avaliações

- Binani Cement LTD Profit and Loss A/c: Mar '06 Mar '07 IncomeDocumento8 páginasBinani Cement LTD Profit and Loss A/c: Mar '06 Mar '07 IncomemrupaniAinda não há avaliações

- Company Info - Print FinancialsDocumento2 páginasCompany Info - Print FinancialsDivya PandeyAinda não há avaliações

- Jubilant CompleteDocumento16 páginasJubilant CompleteShivamKhareAinda não há avaliações

- Balance Sheet - in Rs. Cr.Documento3 páginasBalance Sheet - in Rs. Cr.jelsiya100% (1)

- 4808 Rishab Bansal Excel 39919 1194528774Documento27 páginas4808 Rishab Bansal Excel 39919 1194528774Rishab BansalAinda não há avaliações

- Financial+Statements+ +Maruti+Suzuki+&+Tata+MotorsDocumento5 páginasFinancial+Statements+ +Maruti+Suzuki+&+Tata+MotorsApoorv GuptaAinda não há avaliações

- Income Latest: Financials (Standalone)Documento3 páginasIncome Latest: Financials (Standalone)Vishwavijay ThakurAinda não há avaliações

- Raymond P&LDocumento2 páginasRaymond P&LSJAinda não há avaliações

- Accountancy ProjectDocumento27 páginasAccountancy ProjectSherin nashwaAinda não há avaliações

- Profit Loss AccountDocumento8 páginasProfit Loss AccountAbhishek JenaAinda não há avaliações

- Company Info - Print FinancialsDocumento2 páginasCompany Info - Print FinancialsDhruv NarangAinda não há avaliações

- Financial Analysis Report On Ambuja Cement LTD.: Submitted To: Ak AggarwalDocumento6 páginasFinancial Analysis Report On Ambuja Cement LTD.: Submitted To: Ak Aggarwalsehrawat009mAinda não há avaliações

- A Summer Project Report OnDocumento17 páginasA Summer Project Report OnHarsh MidhaAinda não há avaliações

- Birla CableDocumento4 páginasBirla Cablejanam shahAinda não há avaliações

- Adani Green Balance SheetDocumento2 páginasAdani Green Balance SheetTaksh DhamiAinda não há avaliações

- The Organic Meat Company Limited: Half Yearly Progress ReportDocumento7 páginasThe Organic Meat Company Limited: Half Yearly Progress ReportHussain AliAinda não há avaliações

- CDA Release Order No.40 - Road-III Short Tender Notice February 2023Documento1 páginaCDA Release Order No.40 - Road-III Short Tender Notice February 2023Hussain AliAinda não há avaliações

- Lesco301 282Documento2 páginasLesco301 282Hussain AliAinda não há avaliações

- ND Acc 202329marDocumento1 páginaND Acc 202329marHussain AliAinda não há avaliações

- CDA Release Order No.40 - Road-III Short Tender Notice February 2023Documento1 páginaCDA Release Order No.40 - Road-III Short Tender Notice February 2023Hussain AliAinda não há avaliações

- Contract O2672 1548Documento1 páginaContract O2672 1548Hussain AliAinda não há avaliações

- 181656Documento42 páginas181656Hussain AliAinda não há avaliações

- 201550Documento1 página201550Hussain AliAinda não há avaliações

- Afghanistan Economic Monitor 25 August 2022Documento7 páginasAfghanistan Economic Monitor 25 August 2022Hussain AliAinda não há avaliações

- Annual Report 2022Documento222 páginasAnnual Report 2022Hussain AliAinda não há avaliações

- The General Manager: Material InformationDocumento1 páginaThe General Manager: Material InformationHussain AliAinda não há avaliações

- Rakesh JhunJhunwalaDocumento51 páginasRakesh JhunJhunwalaPavan VasaAinda não há avaliações

- Quarter Ended: (Un-Audited) For TheDocumento27 páginasQuarter Ended: (Un-Audited) For TheHussain AliAinda não há avaliações

- Kohinoor Mills Lic ModificationDocumento14 páginasKohinoor Mills Lic ModificationHussain AliAinda não há avaliações

- First Quarter Report March 2022: Enabling A Digital TomorrowDocumento43 páginasFirst Quarter Report March 2022: Enabling A Digital TomorrowHussain AliAinda não há avaliações

- Interim Financial Information: Quarter Ended September 30, 2022 (Unaudited)Documento42 páginasInterim Financial Information: Quarter Ended September 30, 2022 (Unaudited)Hussain AliAinda não há avaliações

- 193721Documento4 páginas193721Hussain AliAinda não há avaliações

- 195240Documento2 páginas195240Hussain AliAinda não há avaliações

- VedicReport5 22 20225 22 01PMDocumento55 páginasVedicReport5 22 20225 22 01PMHussain AliAinda não há avaliações

- JS-TPLP 12oct22Documento3 páginasJS-TPLP 12oct22Hussain AliAinda não há avaliações

- 195320Documento2 páginas195320Hussain AliAinda não há avaliações

- 186867Documento43 páginas186867Hussain AliAinda não há avaliações

- Industrial Component CatalogueDocumento103 páginasIndustrial Component CatalogueHussain AliAinda não há avaliações

- 187006Documento19 páginas187006Hussain AliAinda não há avaliações

- Quote 202108decDocumento43 páginasQuote 202108decHussain AliAinda não há avaliações

- GEM Board PresentationDocumento18 páginasGEM Board PresentationHussain AliAinda não há avaliações

- Posts Detail: Pakistan Aeronautical ComplexDocumento41 páginasPosts Detail: Pakistan Aeronautical ComplexHussain AliAinda não há avaliações

- Account Activity Generated Through HBL MobileDocumento1 páginaAccount Activity Generated Through HBL MobileHussain AliAinda não há avaliações

- GHGL and GVGL: Steadily Expanding Portfolios: GHGL - Further Diversifying Its Product PortfolioDocumento3 páginasGHGL and GVGL: Steadily Expanding Portfolios: GHGL - Further Diversifying Its Product PortfolioHussain AliAinda não há avaliações

- FarsiDocumento102 páginasFarsiHussain AliAinda não há avaliações

- Alteria ActivateDocumento10 páginasAlteria Activatenitesh kumarAinda não há avaliações

- Research Report For Kenya AirwaysDocumento25 páginasResearch Report For Kenya AirwaysShammah Wanyonyi100% (3)

- ESE400/540 Midterm Exam #1Documento7 páginasESE400/540 Midterm Exam #1Kai LingAinda não há avaliações

- Portfolio Management: Case StudyDocumento8 páginasPortfolio Management: Case StudyharterAinda não há avaliações

- Fisher Vs TrinidadDocumento3 páginasFisher Vs TrinidadMark AlfredAinda não há avaliações

- SipDocumento24 páginasSippooja36Ainda não há avaliações

- Mishkin 6ce TB Ch20Documento32 páginasMishkin 6ce TB Ch20JaeDukAndrewSeo100% (1)

- Chaitanya Godavari Grameena Bank - Economic Value AddDocumento3 páginasChaitanya Godavari Grameena Bank - Economic Value AddPhaniee Kumar VicharapuAinda não há avaliações

- Implementation Support and Follow-Up Unit: LogisticsDocumento88 páginasImplementation Support and Follow-Up Unit: LogisticsMuhammed MuhammedAinda não há avaliações

- A Case Analysis of Farnsworth Furniture IndustriesDocumento20 páginasA Case Analysis of Farnsworth Furniture IndustriesHimalaya Ban100% (1)

- Accounting PrinciplesDocumento8 páginasAccounting PrinciplesNitish BatraAinda não há avaliações

- Ugba 101b Test 2 2008Documento12 páginasUgba 101b Test 2 2008Minji KimAinda não há avaliações

- KirkDocumento1 páginaKirkNina OlesenAinda não há avaliações

- Cochan Singapore Pte. Ltd. - Annual Report 2011Documento30 páginasCochan Singapore Pte. Ltd. - Annual Report 2011aliciawittmeyerAinda não há avaliações

- Yogesh Verma 140701639Documento3 páginasYogesh Verma 140701639Kuldeep GiriAinda não há avaliações

- Investment Banking WORDDocumento4 páginasInvestment Banking WORD123SumAinda não há avaliações

- Horngren Ima15 Inppt01Documento21 páginasHorngren Ima15 Inppt01Ahmed HusseinAinda não há avaliações

- Financial Analysis of Manila Water and MayniladDocumento37 páginasFinancial Analysis of Manila Water and MayniladWo Rance100% (1)

- VolatilityDocumento21 páginasVolatilityRajput JaysinhAinda não há avaliações

- Project CycleDocumento11 páginasProject CycleLitsatsi Ayanda100% (2)

- FINANCIAL MANAGEMENT For Agribusiness CPU 2nd Sem 2018-2019Documento221 páginasFINANCIAL MANAGEMENT For Agribusiness CPU 2nd Sem 2018-2019Joyce Wendam100% (2)

- Chap016 PDFDocumento249 páginasChap016 PDFJazzmin Rose NgAinda não há avaliações

- AKSI Annual Report 2018Documento126 páginasAKSI Annual Report 2018Rahmi AnggianiAinda não há avaliações

- The Acceptance Level On GST Implementation in Malaysia: Gading Journal For The Social Sciences Vol 1 No 2 (2016)Documento6 páginasThe Acceptance Level On GST Implementation in Malaysia: Gading Journal For The Social Sciences Vol 1 No 2 (2016)Harshini RamasAinda não há avaliações

- Vouching Summary PDFDocumento7 páginasVouching Summary PDFAjay GiriAinda não há avaliações

- A Study of The Critical Success Factors and Drawbacks For Cross Border Investments - A Case For The Banking Sector in Zimbabwe.Documento110 páginasA Study of The Critical Success Factors and Drawbacks For Cross Border Investments - A Case For The Banking Sector in Zimbabwe.Omen_Muza100% (1)

- Marriott-Corporation - HBR CaseDocumento4 páginasMarriott-Corporation - HBR CaseAsif RahmanAinda não há avaliações

- Summer Training ReportDocumento52 páginasSummer Training ReportShikha SinghalAinda não há avaliações

- Islamic Forex ForwardDocumento10 páginasIslamic Forex Forwardjmfaleel100% (1)

- World RichestDocumento16 páginasWorld RichestCrist-my Lord JixuxAinda não há avaliações