Escolar Documentos

Profissional Documentos

Cultura Documentos

Budget Meeting Materials (May 9)

Enviado por

Statesman Journal0 notas0% acharam este documento útil (0 voto)

3K visualizações28 páginasThe budget materials from the May 9 meeting.

Título original

Budget meeting materials (May 9)

Direitos autorais

© © All Rights Reserved

Formatos disponíveis

PDF ou leia online no Scribd

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoThe budget materials from the May 9 meeting.

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PDF ou leia online no Scribd

0 notas0% acharam este documento útil (0 voto)

3K visualizações28 páginasBudget Meeting Materials (May 9)

Enviado por

Statesman JournalThe budget materials from the May 9 meeting.

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PDF ou leia online no Scribd

Você está na página 1de 28

BuoceT CommmrTee MEETING Sse,

Support Services Center - Room 2 sg os,

2575 Commercial Street SE

Salem, OR 97302

SALEM*KEIZER

AGENDA PUBLIC SCHOOLS

May 9, 2017 ¢ 7:00 PM

1. Call to Order Chairperson Dewey-Thorsett

2. Roll Call Kristy Brooks-Lathers

3. Additional Information Superintendent Perry &

* Career & Technical Education

* Measure 98 Michael Wolfe

* Federal Programs

* Early Childhood Education

* Positive Behavioral Interventions & Supports (PBIS)

* PERS

* Ending Fund Balance & Contingency

* May Adjustment

4. Review Committee Questions Superintendent Perry

5. Changes to the Proposed Budget Michael Wolfe

6. Committee Discussion Chairperson Dewey-Thorsett

7. Next Steps Chairperson Dewey-Thorsett

* Meeting Schedule

Monday ~ Tuesday, May 22-23, 2017 at 6:00 p.m. — Public Comment

The Budget Committee will receive public comment.

Wednesday — Thursday, May 24-25, 2017 at 6:00 p.m. — (If needed) Budget

Deliberations. Public comment will not be taken.

Tuesday — May 30, 2017 — at 6:00 p.m. ~ (If needed) Budget Deliberations. Public

‘comment will not be taken.

‘Tuesday, June 13, 2017 at 6:00 p.m. Schoo! Board Regular Business Meeting

The School Board will take public testimony during the Budget Hearing and take

action on Adoption and Appropriation of the 2017-2018 Budget and Resolution at

their regular business meeting.

8. Adjourn Chairperson Dewey-Thorsett

‘SALEM-KEIZER PUBLIC SCHOOLS « Executive Administration

em. SALEM-KEIZER BUDGET COMMITTEE

2,

“s,

ye MAY 9, 2017

SALEMKEIZER Handout 1 - CAREER and TECHNICAL EDUCATION

PUBLIC SCHOOLS

OVERVIEW

Salem-Keizer has focused on the following strategic approaches to career and technical education:

Provide Modern & Innovative Programs

‘© Program renewal & start-up programs

+ Consulting & Mentor Coaching

‘¢ Facilities Improvements

Clearly Communicate Career Paths

‘© Mark Perna, Consultant, “Tools for Schools"

‘© National Alliance of Partnerships in Equity: Non-traditional gender participation and completion

'* Post-Secondary experiences — field trips to community colleges, universities, apprenticeship programs, trade schools,

ete

© ACTE Conference

Connect Students, Educators, & Industry

‘* Field trips to visit industry partners

© Business & Industry Summit

‘© Student Leadership Organization participation: FBLA, DECA, SkillsUSA

Provide Current & Relevant Instructi

‘© Instructional Technology: wireless devices, Surface Pros with large screen monitors, Printers (graphic arts, large format,

3D}, and program specific software

Curriculum development, alignment and professional development

AVI Institute

Mid-Willamette Education Consortium (MWEC)

‘© Instructional resources, classroom equipment and supplies

Career and Technical Education programs, classes, and pathways are in all of our 6 comprehensive high

schools plus Roberts HS and our Career Technical Education Center (CTEC).

For more information, go to : http://www.salkeiz.k12.or.us/sites/default/files/CTE in Salem-Keizer 2016-17.pdf

FUNDING SOURCES: Grants and General Fund

Carl Perkins Grant: $400,000

Perkins funds have been a consistent resource for decades and are predicted to be relatively stable.

Secondary Pathway Funds: $400,000

Secondary Pathway funds have only been available for the past biennium and are unknown for the future,

Measure 98: approximately $5 Mi

‘Also known as the High School Graduation and College and Career Readiness Act of 2016, Measure 98

provides funds to establish or expand in the following areas within high schools: career and technical

education programs, college-level educational opportunities, and dropout-prevention strategies. We are

presently waiting confirmation that funds are coming to districts this year, and in what dollar amount.

Career and Technical Education classroom FTE is covered in general fund (function 1131). This includes

approximately 46 FTE for CTE courses and pathway at each high school as well as programs at CTEC.

“O}

SK, SALEM-KEIZER BUDGET COMMITTEE

4,

* MAY 9, 2017

SALEMeKEIZER Handout 2 - MEASURE 98

PUBLIC SCHOOLS

‘As written, Measure 98 provides $800 per ADMw, but we are hearing a more likely figure will be about half of that,

resulting in approximately $5 million to the district for the 2017-18 school year.

Career and Technical Education:

‘© CTEC Expansion: Instructional staff and support staff for two new programs ($900,000)

© Instructional Mentor 1.0 FTE

© _UAS/Drones instructor 1.0 FTE

© Collision Repair instructor 1.0 FTE

© Electronics/CNC instructor 1.0 FTE

© English Teacher 1.0 FTE

0 Science Teacher 1.0 FTE (physics and chemistry/environmental studies/earth science)

© School Office Specialist Bhrs./day

© UAS/Drones 1A 65 hrs/day

‘© Collision Repair IA 6.5 hrs./day

© Business Liaison Asst. (Chamber) 4.0 hr./day

New CTE Equipment for programs in comprehensive high schools. ($500,000)

¢ New CTE Program for Roberts HS: 1.5 FTE, equipment, and materials for a Business program at ($200,000)

CTE Program Associate: 1.0 Licensed position that can assist with curriculum and professional development for

CTE across our secondary schools ($100,000).

‘© Additional Staff for high enrollment areas: adding part-time staffing. (Classified hours, $165,000).

College-Level Educational Opportunites:

* Willamette Promise: District participation, teacher travel, and stipends for dual credit courses in high schools.

The Promise replication grant from the state expires this year. $220,000

‘© Equal Opportunity Schools (district collaboration): Focus on continuing and sustaining the work of removing

barriers to access and opportunity for students in AP and 18 classes. ($50,000)

Dropout Prevention and Retention:

‘© Summer Bridge Program: Students rising from eighth grade into ninth, identified with at-risk factors, may

participate in summer learning opportunities to help prepare them for high school. ($1,200,000)

Student Data Dashboard and Analytics: K-12 and Technology & Information Services will collaboratively engage

a team of technology professionals to design a robust data reporting system that helps increase speed and

ease of accessing and monitoring of critical at-risk data for students. ($400,000)

© High School Credit Acceleration and Recovery: 1.5 Licensed FTE plus materials and equipment for the

Replication of “Sophomore Connections” model for students in grade 12, as well as 1.5 Licensed FTE and

chromebooks for some credit recovery in comprehensive high schools. ($425,000)

* Graduation Specialist: This staff member will interact with high schools on strategies to help increase

graduation rate, and reduce dropout rate for African American students. (1.0 Classified FTE $80,000)

‘© Marion County Youth Advocates Partnership: A collaboration with Marion County Youth Advocates, who help

to monitor school success for youth in Salem-Keizer who are engaged in the judicial system. ($10,000)

Middle School: Districts may be allowed to use up to 15% of their Measure 98 funds for students in the 8

grade, although this has not yet been approved by the legislature. In our case, that would amount to

$750,000, which we would use for professional development for middle school CTE teachers, program

equipment, and summer programs for students rising from 7" to 8” grade. ($750,000)

‘OR

Sear, SALEM-KEIZER BUDGET COMMITTEE

»,

i

MAY 9, 2017

SALEMeKEIZER Handout 3 - FEDERAL PROGRAMS

PUBLIC SCHOOLS

OVERVIEW

Federal funds are allocated to the District to supplement state school funds for designated student

‘groups. Title | funds are provided to help low-achieving students at designated high poverty schools meet

rigorous academic standards. Thirty Salem-Keizer schools received Title 1A funds in the 2016-17 fiscal year.

For the 2017-18 school year, an additional 7 elementary schools and 1 middle school will receive Title 1A

funds for the first time, designated as Targeted Assistance Schools.

Title IIA funds provide assistance to districts in preparing, training, and recruiting high quality

teachers and principals. Funds currently pay for school-based instructional coaches and mentors as well as

student teaching mentor support, and professional development pathways for classified staff.

Title i funds support English Language Learners and immigrant students to develop English

Language skills and succeed academically. Funds provide for language instructional programs, professional

development designed to improve instruction for English Language Learners, and parental/community

FUNDING: 2017-18 Federal Grant Summary

Title 1A: $13.7 Million

Title A: $1.3 Million

Title il: $1.2 Million

2017-18 REDUCTIONS / ADDS

In 2017-18, federal funds are expected to be allocated at approximately 10% less than current fiscal year.

Title 1A spending for 2017-18 prioritized moving expenses from central office support to schools.

This reorganization included the elimination of 1.0 FTE curriculum program assistant, 1.0 FTE central office

administrator, and the elimination of 10.5 FTE in English Language Acquisition Specialist (ELAS) positions.

These reductions provided an opportunity for reallocation of Title 1A funds, adding 8 schools as Targeted

Assistance Schools. In the fall, thirty-eight Salem-Keizer schools will receive supplemental Title 1A funds.

Title IIA is not currently funded in the federal budget for education. However, lobbyists and state

funding groups believe itis likely that Title IA will be funded at levels reduced by 5% - 15% compared to

current fiscal year. Reductions up to 10% could be covered through carryover funds from 2017-18. The

Title 11A submission deadline for a spending plan is August, 2017. We will have more detalles

on funding levels prior to that deadline.

Title i proposal for 2017-18 includes the elimination of 7.0 FTE in English Language Acquisition

Specialist (ELAS) positions in exchange for more targeted supports for classroom teachers in the form of

academic language coaches, newcomer support, dual language and ELD program assistants. Title Ill also

supports professional development in the areas of Systematic ELD Instruction, trauma-informed practice,

and ELD and Bilingual curriculum units.

formation

Sere, SALEM-KEIZER BUDGET COMMITTEE

a i

MAY 9, 2017

SALEMeKEIZER Handout 4 - EARLY CHILDHOOD EDUCATION

PUBLIC SCHOOLS

OVERVIEW

The Early Learning programs in Salem-Kelzer served 895 three- and four-year olds during the 2016-17

school year in six distinct preschool settings. HeadStart, Title | Preschool, and Preschool Promise are

programs provided free of charge to qualifying families. Additional programs include services for teen

parents, and a tuition-based preschool program. All programs include bilingual Spanish supports and daily

transportation, Programs are offered as half-day, with the exception of Preschool Promise whi

day program.

isa full

Each preschool program is staffed according to regulations associated with specific grant funding,

Headstart programs utilize the most staff, including classified staff, family advocates, and clerical support.

Title | preschool employs the most licensed teachers with additional classified support.

‘Students entering kindergarten from HeadStart and Title | preschool programs outperform the state

average on the Oregon Kindergarten Assessment in the areas of letter sounds, math, interpersonal skills

and self-regulation.

FUNDING SOURCES

Grants:

Title 1A: $750,000

Headstart: $2,900,000

Preschool Promise: $425,000

Parent Tuition: $360,000

General Fund:

The only general fund allocation for preschool programs in Salem-Keizer include services for teen parents,

providing on-site educational childcare and Early HeadStart classrooms.

2017-18 REDUCTIONS / ADDS

Salem-Keizer will receive an increase in preschool grant funds as well as expected increases in parent

tuition payments. These funds have been allocated for additional FTE in District preschool programs.

No increase or reduction in FTE in general fund preschool supports for Teen parent program. However,

the teen parent program did experience a 5% cut in supplies and materials.

“OR

wa a, SALEM-KEIZER BUDGET COMMITTEE

i MAY 9, 2017

SALEM*KEIZER Handout 5 - POSITIVE BEHAVIORAL

PUBLIC SCHOOLS INTERVENTIONS & SUPPORTS

OVERVIEW

Positive Behavioral Interventions & Supports (PBIS) is a systems approach to support staff and a broad

range of strategies to support students, The goal is to establish a positive and preventative school climate

that allow schools to achieve important social and learning outcomes while preventing problem behavior

with all students, PBIS:

Q Isa framework and not a scripted curriculum

© Relies on evidence-based practices and data-based decision-making

Q Is about building relationships with our students, families and colleagues

PBIS is a multi-tiered framework for matching instruction and support to student needs. Tier | focuses on establishing

a school-wide foundation that will support the success of about 80% of students. Tier I! increases this support for

about 10-15% of students who benefit from additional instruction, support and feedback. Finally, Tier Ill provides

intensive and individualized support to the 1-5% of students whose needs require comprehensive strategies to

increase their ability to succeed.

School-Wide Systems for Student Success:

One re ‘A Response fo Intervention (Rt!) Model

Focused on prevention ep

Q Tier ll Group-based Interventions a ala nurentona 1

Focused on supporting at-risk Progomryad “nen ora pceaes

students to prevent future behavior

concerns =n

Soume

© Tier iil individualized interventions ‘Seneca

focused on reducing the intensity

and impact of student behavioral an eee

arn ‘Sena pace

2017-18 REDUCTIONS / ADDS

Addition of 2.0 FTE Licensed staff for PBIS implementation coaches.

Continued PBIS implementation is sustained through the committed work of our teachers, counselors,

behavior specialists, and building principals.

FOR

Sar, SALEM-KEIZER BUDGET COMMITTEE

>,

Ys,

4 ° MAY 9, 2017

SALEMeKEIZER Handout 6 - Public Employees Retirement System (PERS)

PUBLIC SCHOOLS

OVERVIEW

PERS rates are set by the PERS Board and based on the December valuation of odd years for the next

biennium. For example, the 2017 -19 biennial rates were based on the December 2015 actuarial valuation

and were released in September 2016.

Salem-Keizer Budgeted PERS Rates

PERS Rates 2015-16 2016-17 2017-18

Tier 1/2 8.48%" 9.5196" 16.38%

‘OPSRP 8.48%" 9.5196" 11.05%

Employee Pick Up 6.00% 6.00% 6.00%

Debt Service 9.02% 9.02% 9.02%

PERS Rate Range 23.50% 24.54% 26.08% - 31.41%

* Tier 1/2 and OPSRP PERS rates were blended based on the number of employees in each group until 2017-

18, when actual rates were used for each employee group.

‘The district PERS Debt Service Fund maintains a reserve target of approximately 50% to 75% of the five

year average annual debt service payment. This is not a financial policy, but rather a target to address

increasing debt service requirements and potential settlements posed by legal challenges to current and

future reforms.

The PERS Pension Debt Service Fund begins on page 170 of the 2017-18 Proposed Budget.

eof SALEM-KEIZER BUDGET COMMITTEE

a

\ MAY 9, 2017

SALEMe*KEIZER Handout 7 - GF Ending Fund Balance and Contingency

PUBLIC SCHOOLS

OVERVIEW

The actual Ending Fund Balance (EFB) for any given fiscal year will not be known until the financial audits

are completed and published in the District’s Comprehensive Annual Financial Report (CAFR) in December

of that year. For example, the actual 2016-17 EFB will not be official until December of 2017. The 2018-19

budget development process begins in October of 2017 before the CAFR is completed, so the District must

estimate the budgeted beginning fund balance based on an analysis of projected revenues and expenses

from July 1, 2017 through June 30, 2018 (2017-18 proposed budget). Quarterly financial reports are

provided to the board throughout the year in accordance with Executive Limitation #8. The quarterly

reports monitor changes in revenues and expenses and forecasts a projected EFB.

‘The chart below describes the relationship between the budgeted contingency and the actual/projected

ending fund balance:

Budgeted and Proposed Contingency 2017-18* | 2016-17 | 2015-16 | 2014-15

‘Adopted Budget - Contingency 22,251,694 | 14,279,785 _| 12,171,602 | 13,206,479

‘Supplemental Budget - Contingency (560,600)

Final Budget - Contingency 22,251,694 | 14,279,785 | 12,171,602 | 12,645,879

*2017-18 amount is proposed

Ending and Projected Fund Balance 2017-18 | 2016-17** | 2015-16 | 2014-15

‘Actual Ending Fund Balance TBD 41,879,917 | 49,445,457 | 44,431,284

*#2016-17 5 0 projected amount os of YA/i7

Budgeted and Actual Percentages 2017-18" | 2016-17°* | 2015-16 | 2014-15

Budgeted Contingency 4.74% 3.08% 2.81% 3.18%

‘Actual Ending Fund Balance 8.97% 11.13% 10.97%

"2017-18 amount is Proposed Budget

¥2016-17 s.a projected amount os of ai/A7

The implementation of the budgeting and position control functions of the financial management system

has allowed more precise forecasting of labor expenses. As a result, the budgeted amounts are closer to

projected actual costs. The 2017-18 budgeted contingency is higher than previous years to reflect the

Projected drop in underspending from historical trends. The 2017-18 proposed budget represents anew

baseline in projected spending.

Executive Limitation #8 can be found at: http://www.salkeiz.k12.or.us/content/gam/school-board-policies

Please refer to handout 7A for a twelve-year comparison of budgeted and actual contingencies and actual

and projected ending fun d balances.

TIT WOT ET FTE

lua assays nes sex use MSE ETT KB

\usco__wo0__ware_—serT Ise MAE Ewe wt BOE

R00 aE LOTS TOE eTOCs STS ARTE a COE

swvavst_vveste orscovee _uvvivee_sovzare vetasie WER se eeree_satTEN NY _LSYeN costuTY—~

Tso — arlooe ame oven —_teomee _ehvvoe —_eveioe erat stevie arse _.aravee aria

fered waver mecvecewsortr_eseunetE eursevor ows aus oyun saree

c Toe — OOF

soos sfesver_ aac suressor_omoorn_suvearst_ 2 swveerne ‘ouetunues

0 ooo ower Trowe erro erie —sreloe — sr9v0e TESTO i

‘Aoua8unuo9 pue eaueyeg pung Buypua puna Jes0U29

‘WEanopuey

SALEMeKEIZER

PUBLIC SCHOOLS

SALEM-KEIZER BUDGET COMMITTEE

MAY 9, 2017

BUDGET COMMITTEE QUESTIONS

Additional Information

Measure 98 & Career and Technical Educat

n- See Handouts 1 & 2

1. How are Career Tech positions shown in the budget, both in comprehensive high schools and

CTEC? Does it relate to the 14 licensed positions added under grant funding (pp.138-9)?

Coreer Tech positions are part of the High School Instruction function 1131 shown in both the

General Fund on page 44 and the Grants Fund on pages 138-139. There is not a separate function

{for CTE positions or expenses. The Measure 98 FTE additions are displayed on page 133.

2. Regarding Career and Technical Education:

a. How many CTE classes (counting each period as a class) in each high school?

b. How many CTE teachers (different people and FTE on CTE) in each high school?

Total for CTE teachers at all locations is approximately 46 FTE.

c. How many CTE students (taking at least one CTE class and concentrating on CTE) in each high

school?

d. Please provide the same counts for the CTE Center.

e. How many total student classes (students times periods in CTE)

f. What is the total budget for CTE in 2017-2018?

The budget for CTE at all locations in 2017-18, excluding Measure 98, is approximately $6.6M.

. What's the projected per student, per class cost of CTE to the budget?

3. Do we know how many students take more than one CTE class a year? And, does this budget project a

growth in those students? Oris there a limitation by the availability of classes/space, etc.?

4, Is there growth in this budget for the CTE School? (Meas 98? Answer May 9%?)

Yes, there is growth for CTE funded by Measure 98 in the Grants Fund.

5. What is the cost per student of CTE Concentrators? Vs Regular students? In this Budget.

|

|

BUDGET COMMITTEE QUESTIONS

6. Is there a coordinating program (thru cte?) that is an apprenticeship program, ie. welding, hvac,

plumbing, etc. that is in this Budget?

CTE program information can be found online:

http://worw.solkeiz.k12.or.us/sites/default/files/CTE_in_Salem-Keizer_2016-17.pdf

HSections Students Teacher FTE

cTec 72 6.00

Mckay 96 8.67

McNary = 151 7.10

North 109 7.50

South 104

Sprague 119

West 101

Totals 752

teachers have “stacked” sections (more than one section scheduled the same period)

© # Students is inflated, again duplicated for each semester and students taking CTE classes at CTEC and

their resident school

© This is the first time we have attempted to pull this data so data validation has not been performed.

7. Why is S-K only targeting $400/student for Measure 98 funding? If the legislature approves

$600/student, will S-K pursue higher levels of funding?

The $400/student is a budget assumption that many districts are using as an initial number to plan

{for M98 funding, If more resources become available, we will adjust the budget accordingly. This is

@ reimbursable grant, not an allocation through the State School Fund (SSF).

Positive Behavioral Interventions & Supports (PBIS) - See Handout 5

8. Please provide more information about the Positive Behavior Intervention & Support Program (Tier |

and 112) and how itis funded in the budget.

PBIS is one component of behavioral learning. Behavioral learning including PBIS is funded in

multiple ways:

1. Behavioral Specialist FTE

2. Behavioral Learning Department (some new and existing FTE), including some FTE specific to

PBIS

3. Self-Contained Classrooms - Special Education

«© #Sections is inflated as this represents the total number of sections 1 and 2" semester and some

BUDGET COMMITTEE QUESTIONS

9. Can you outline the funding for the PBIS program and what the proposed funding will pay for?

As it has been explained to me, the current levels of PBIS funding do not provide enough money to

cover substitute teachers. In situations such as this, there is no teacher involvement in the training,

and subsequently no teacher investment (or buy in) in the program. This would appear to be a critical

component in trying to change the culture of a school, region, district, ete.

PBIS is a way of doing things, not a specific budget. Substitute teachers are all funded in Licensed

Substitutes in the appropriate function for the age of the students. This is correct in that this is a

critical component of changing a school’s culture. This year we made a difficult decision regarding

the use of substitutes for professional development to address the substitute shortage. It was not

related to the budget. We've had some early discussions about how we can allow substitutes for

classroom teachers for professional development related to our strategic plan.

10. What is “PBIS?” Didn’t see it in the Glossary.

PBIS stands for Positive Behavioral Interventions & Supports.

PERS- See Handout 6

11. PERS: | am concerned about the 6 mil. | would like a sit down with both of you to get a complete

understanding of PERS... From how much comes out of each pay check, where it goes, what we

actually pay out at retirement etc.

12. Page 55: Social Security is down but PERS is up???

PERS costs are up, as discussed, but in some areas Social Security costs went down with

implementation of automation because the budget system adjusts Social Security based on the

employee's actual benefits and deductions. Some deductions, such as, insurance or health savings

account contributions are exempt from Social Security calculations.

13. | know that PERS costs have gone up significantly, in part because the courts rules against the last “fix.”

‘Am | right that the district has been putting money into a reserve to help cover this increase? If so,

where in the budget does this appear? And what is the plan for spending it down?

14, How does the PERS debt service fit in? Are these loans that were taken out to deal with a previous

PERS issue?

School districts and governmental entities in Oregon have the authority to issue pension obligation

bonds (debt) to pay down their assigned Unfunded Actuarial Liability (UAL). The district has paid

down its UAL three times from 2002 to 2015 and refinanced a small portion in 2011. This

information can be found beginning on page 173.

BUDGET COMMITTEE QUESTIONS

Completed

15. How have the three teaching enhancement programs (Mentors, Instructional Coaches and Effective

Learning Teachers) been consolidated in the budget?

The school based ones are still budgeted the same as they are in the current year. The 3 FTE for the

Districtwide Instructional Mentors are in the General Fund budget included in function 2210

Improvement of Instruction Services on page 63. You can also see the transfers between funds on

page 96.

16. This budget eliminates both science program associates (curriculum specialists). Are there other

programmatic areas that have been significantly impacted?

Yes, due to budgetary reductions as well as the need for some organizational redesign, we are

changing our model for supporting English Language Development (ELD) in our schools. There will

be fewer centralized staff, known as English Language Acquisition Specialists, responsible for

coaching ELD; the majority of these staff members will be providing instruction inside classrooms.

When we analyzed the federal Title | budget, we determined it was better to push more funding out

to schools. This change resulted in the addition of seven elementary and one middle school to Title

which will provide more direct service to students out in schools. We have also reduced the three

Effective Learning Teachers in technology.

17. The district has made significant investments in textbooks the past two years and much less is included

in this budget. What is the status of textbooks at this time? Is the district reducing its reliance on

textbooks?

While we are well into the implementation of using the new elementary literacy curriculum

resources we have recently purchased, we know that more purchases will be needed in coming

years. We anticipate a possible adoption of elementary math curriculum in the near future, as well

4s possible new materials for secondary schools in social studies and science. These resources might

come in the form of textbooks, printed materials in other formats, or even web-based. We have not

actively pursued digital textbooks as a major investment strategy.

It may be useful to refer to the Instructional Materials portion of the Infrastructure Report of May

10, 2016. Will be sent in a separate email.

18. The summer school program (Code 1400 - p. 55) is being substantially increased both from the general

fund and in restricted funds. Please describe.

a. General Fund has gone up due to an add package to the General Fund in a prior year after the

conclusion of the High School Graduation Initiative Grant. For 2017-18, there is another add

package as well for Middle School Math Accel.

BUDGET COMMITTEE QUESTIONS

b. Grants have increased because more and more of our grants have expanded upon summer

school opportunities. For example, last summer Title |A started Kinder Jumpstart at roughly 20

elementary Title schools. Also, our Migrant Summer School grant received more dollars for 2017

summer school than we did for 2016. We also have added some dollars due to the Measure 98 -

High Schoo! Graduation and College and Career Readiness Act.

cc. We've also seen a rise in CTE summer activities which would increase both General Fund and

Grants.

19. Can you describe the significant changes that appear on pages 84-85 on the following object

codes: Employee Insurance (240), Student Transportation Services (330) and Consumable Supplies and

Services (410)?

The 2014-15 and 2015-16 columns are actual expenses while the 2016-17 and 2017-18 columns are

budgeted figures. For the purpose of answering this question, we are assuming that you are

referring to the budgeted columns.

Employee Insurance 240 - The decrease from $65,873,252 to $63,194,121 is a reflection of the

implementation of our financial management system. The budget more accurately reflects

insurance packages chosen by employees and does not assume maximum cost for all employees.

There is no decline in benefits offered to the employees. The FTE reductions also caused a decrease

in this amount.

Student Transportation Services 330 —The increase from $613,550 to $748,928 reflects the increase

in middle school athletics budget. The previous budget was not properly covering the expenses for

existing athletics activities. This shows in the Middle School Extracurricular function 1122 near the

top of page 44 with the budget increasing from $113,179 to $234,535.

Consumable Supplies and Services 410 — Overall budgets for Purchased Services and Supplies and

Materials were decreased 5% from the prior year’s budget. This decrease is more obvious here

because it is such a significant amount.

20. General Fund instructional Staff Development (p. 66) includes $500K for sabbaticals and huge drops in

Differentials and Additional Earnings. Explanation?

Sabbaticals are part of the licensed labor agreement and we are budgeted as per this

agreement. The first two columns are Actual (not Budget figures) so those columns show how much

was actually spent. Historically there are very few if any sabbaticals. Per the agreement money not

used for sabbaticals is redirected to fund additional tuition reimbursement and to pay for additional

teacher mentor positions. We are in conversations with SKEA regarding the allocation of these

dollars. However, bottom line is this money is budgeted and allocated according to the collective

bargaining agreement (CBA).

Differentials and Additional Earnings vary quite a bit from the prior year budget due to the move

from Excel to the integrated payroll system. The intent was to budget conservatively, but cover all

needed differentials and additional earnings. The decrease in Additional Earnings is due to the

removal of the 2016-17 one-time add Ready Gen Textbook Adoption (T8003). There was $900K

budgeted for Licensed Additional Earnings and $512K budgeted for Classified Additional Earnings in

2016-17 as one-time adds for Ready Gen Textbook trainings.

BUDGET COMMITTEE QUESTIONS |

21. Elementary Instruction (1111), Consumables (410) and Non-Consumables (460), there appears to be a

reclassification of $400k between the Account Codes. Is this a simple accounting correction, or is there

some other intention behind the difference in 2016 and the proposed budget?

The 2014-15 and 2015-16 columns are actual expenses while the 2016-17 and 2017-18 columns are |

budgeted figures. In comparing 2016-17 Budget and 2017-18 Proposed Budget, there is no

$400,000 variance. However, in comparing the 2015-16 Actual to the 2017-18 Proposed Budget, |

there is about $400,000 variance between Consumable (410) and Non-consumable (460). If the

question is referring to the $400,000 variance between 2015-16 Actual and 2017-18 Proposed

Budget, the Non-consumable Items (460) was significantly high due to the implementation of the All

Day Kindergarten in 2015-16, equating to about $378,000 in Non-consumable expenses. The All Day

Kindergarten Implementation was budgeted in 2015-16.

2. Instructional Staff Development (2240) line item 130 (Licensed Additional Earnings) shows a reduction

of $800,000. What is behind this reduction?

|

|

|

The decrease in Additional Earnings is due to the removal of the 2016-17 one-time add Ready Gen

Textbook Adoption (T8003). There was $900K budgeted for Licensed Additional Earnings and $512K

budgeted for Classified Additional Earnings in 2016-17 as one-time adds for Ready Gen Textbook

trainings.

23. Operations and Maintenance of Plant Services (2540) shows a $700k reduction in Property Services |

(320). Can you identify if this is a permanent reduction or a realignment of this cost closer to 2014-

2015/2015-2016 levels.

The reduction is due to several factors:

7 about a $235,000 decrease in lease/rental payments compared to 2016-17 budget

per information from Facilities

b @ $185,000 reduction/cut

= about $59,000 was re-aligned to Overtime and APC to allocate more dollars for staff

and $300,000 was re-aligned to Non-Instructional Professional Services to allocate

‘more dollars. The $300,000 increase in Non-Instructional Professional Services will

not show because it offsets against a $315,000 reduction of a one-time add

(landscaping) in 2016-17.

24.

25.

26.

27.

BUDGET COMMITTEE QUESTIONS

Internal Services ~ Purchasing and Material (2570) shows a reduction in regular classified from 10.50

FTE to 10.0 FTE. However the proposed budget item for this is approximately $316,000 in

savings. How is half an FTE worth $316,000?

The reduction is a reflection of the automation of the staffing budget. The budget more accurately

reflects actual wages of the employees. In addition, the Transportation Shop Salaries allocation was

overstated in 2016-17 budget by about $278,000 and the 2017-18 reflects the correct allocation.

Personal Services (2640) shows an increase in FTE of 1 (from 31.00 to 32.00), but a reduction in budget

of approximately $88,000. Can you clarify how adding a headcount results in a savings?

This isa result of an automated budget. In previous years, the labor calculations were done in

Excel, The departments that are represented in this function had a large amount of retirees in the

last year, because of that, the new hires cost much less even though the FTE went up.

‘Supplemental Retirement Program (2700) shows a reduction in budget of just shy of $1M from 2016-

2017 and the proposed budget. The Superintendent identified that much of the reduction in

employees in the proposed budget will be through the attrition of retirees. Can you discuss how this

can be accomplished if the early retiree budget is reduced by such a significant amount.

This expense is specific to the early retirement program and is reaching the end of its eligibility

period so expense is projected to decline. The Superintendent was referring to typical attrition and

retirements, not a focus on early retirement offerings.

Page 44: Why such an increase in Student Transportation Services and Extra Curricular? We get

money for use of our buses for extra curricular....where is the money coming in shown?

Student Transportation Services 330-The previous budget was not properly covering the expenses

for existing athletics activities. This was one of the add packages for this year, though in practice, it

is just adjusting the budget to cover the current service level.

Any funds we receive are shown in revenue, budget law does not allow us to post related revenue

and expense in the same account.

BUDGET COMMITTEE QUESTIONS

28, Page 45: Student Transportation services, why did it go down? Won't it go up with more CTE offerings?

Overall budgets for Purchased Services and Supplies and Materials were decreased 5% from the

prior year’s budget, including this line item.

CTE offerings occur both at our center (CTEC), but also at all of our high schools. The only

transportation costs occur for those students being transported from their home high school to

CTEC. However, the addition of 2 programs at CTEC does not immediately equate to an addition of

transportation costs because we are already transporting students from each high school for the

existing programs.

29, Page 63: Consumable Supplies and Materials: went way up? More Curriculum?

The increase is due to add packages for 2017-18:

d. $234,525 —ECRI— Elementary Foundational Skills Material

e. $39,640 - CORE Elementary Diagnostic Assessment

30. Page 175: Legal Debt Limit:.....”of their Real Market Value” ~ Whose Real market value? What does

our budget to so with the City? “the city has $182.3 million”

School districts in Oregon that serve K-12 have a legal debt limit on General Obligation debt equal

to 7.95% of real market value of all taxable property within their district. For the Salem-Keizer

School District, this limit calculates to $2.2 billion. At the beginning of this budget cycle, the District

had $182.3 million in General Obligation debt, which is 8.3% of the borrowing limit. The available

amount of additional debt the District can borrow would be $2.0 billion.

31. Page 181: Tech services but no FTE listed? Both 190k and 750k. are these consultants?

These are not associated with our staff. Yes, $190K would be services provided by vendors. It is

under the heading of Purchased Services and the account is Non-Instructional Profess & Tech

Services.

The $750K is under the heading Capital Outlay and the account is Improvements Other Than

Buildings so this would be copital improvements at our facilities, which would likely be done by

contractors.

32. Page 182: Payroll costs.....there is no FTE yet there are PERS costs?

The labor associated with the PERS costs at the top of page 182 is shown at the bottom of page

181.

|

\

BUDGET COMMITTEE QUESTIONS |

33, Page 183: 3400k for new technology? |

|

|

This is for the Fiber Project.

34, Page 66: Sabbaticals. Last year and upcoming, quite a large amount. In a year of cuts, this looks BAD.

Sabbaticals are part of the licensed labor agreement and we are budgeted as per this

agreement. The first two columns are Actual (not Budget figures) so those columns show how much

was actually spent. Historically there are very few if any sabbaticals granted. Per the agreement |

money not used for sabbaticals is redirected to fund additional tuition reimbursement and to pay

for additional teacher mentor positions. We are in conversations with SKEA regarding the

allocation of these dollars. However, bottom line is this money is budgeted and allocated according

to the collective bargaining agreement (CBA). |

35. Can you explain the huge jump in Sabbatical cost this year? |

See answer to question 35 above.

36. In the Fee Based Program Fund there are very large amounts budgeted for “Allowance for Increased |

Activities & Growth” (Account code 390). These amounts “disappear” once the fiscal year is closed in

the “Actuals”. | understand that this is not new, but would appreciate an explanation?

This is a line item that we identified during the budget development process that we are phasing

out next year. It was intended to be an expenditure limit that could be triggered if revenues hit |

certain targets. The Actual would be recorded in specific line items they relate to, not the Allowance

line itself.

37. Please explain what “Allowance for Increased Activities & Growth” means, and why such huge

additions in just the last two years? (I can’t remember if it was explained last year.)

See answer to question 36 above.

38. What is the Faculty to Administrator ratio in this Budget? Compared to past two Budgets?

Year Faculty Admin Ratio

2017-18 4,184.85 153.00 27.35:1

2016-17 4,154.49 151.50 27.42:1

2015-16 4,020.04 143.50 28.01:1 |

BUDGET COMMITTEE QUESTIONS

39. A reduction of $2.6M in the budget for Materials and Services was called out in the Superintendent's

presentation. However there appears to be a more significant reduction in the budget for Textbooks

{as an example, $2.6 M in line 420 on page 85). | understand this is due to the fact that Textbooks

were purchased over the prior two budget years, but can you discuss why this reduction was not called

out as a budgetary savings?

The figures in textbooks last year included one-time adds, well above our current service

levels. Those were automatically removed at the beginning of this budget cycle and were not

intended to be an annual figure. While it is less than the prior year budget, it is not a decrease to

the service level, nor were staff expecting those resources to be available in 2017-18.

40. What is the run rate of the 2017-2018 budget into the 2018-2019 budget? How does that fit into the

legislatures biennial budget? Assuming no additional statewide budget cuts in a year, will this budget

put us on a path for no additional cuts in 2018-2019?

The 2017-18 budget was designed to minimize impacts in the second year of the biennium, but it

cannot guarantee there won’t be any cuts next year because there are still a number of uncertain

factors. The intent was to minimize wage growth as much as possible because that has the greatest

positive impact on the biennium and reduce cuts in year two of the biennium.

41, The Deferred Maintenance Fund appears to be on a steep upward curve. What's the mid to long-term

plan for managing this issue and fund?

Our goal has been to increase the resources for this fund even more, but this year we were not able

to continue our strategy of adding $250K each year until we reach an annual transfer of $2.5M.

There is a $1.25M transfer from the General Fund on page 82 to Preventative & Deferred

Maintenance Fund.

42, Can you describe the process of allocation of discretionary budgets to school principals? What

amounts or ranges are allocated for each level of school? |f ranges are used, what is the basis for these

different allocations? What types of uses are intended for these budgets? Are there areas that will not

be covered anywhere else in the district spending plan except in these discretionary budgets?

‘Schools have Instruction and Support allocations. These dollars have been calculated in the past

based on a per pupil dollar amount. The schools can choose how to spend their dollars, but need to

stay within the appropriate function as budgeted. Instructional dollars are often used when a schoo!

is providing supplies to a classroom where as their Support dollars are mainly used for Professional

Learning and their office expenses, There are reserve type accounts that the Level Offices may be

able to contribute from if there is a need that comes up that a school is unable to support within

their own budget.

43, thought there was a Pie Chart in the past that showed how many licensed, IA, Admin etc we had. Isit

there and I didn’t see it? It is very helpful to have one that is both salary based and FTE based for those

that think we are top heavy.

10

BUDGET COMMITTEE QUESTIONS

The Summary of FTE and Salary table on page 87 may address this question.

44, Can you give us a sense of the cost in 2017-2018 of standardized testing? Please include direct margin

costs to the district beyond those we would have without standardized testing, as well as the cost

equivalent staff time associated with administering the tests. Finally, please provide the number of

instructional hours devoted to taking the standardized test at each grade level.

The District had a cost of $3,800 for the two required school test coordinator trainings this year

and may purchase some headsets as they wear out. There are no other hard costs to the District

for state testing.

Estimated testing times for Smarter Balanced Assessments:

Test Type Grades Total

English Language Arts/Literacy | 3-5 5:00

68 210

11 355

Mathematics 35 2:40

68 3:00

it 235,

45, Please show a graduation rate comparison between SKSD, Beaverton, and Portland School Districts,

and maybe Eugene, too? And, over a few budget cycles?

http://www.ode.state.or.us/data/reportcard/reports.aspx

46, Could you show a per pupil cost comparison for same in above.

http://www.ode.state.or.us/data/reportcard/reports.aspx

11

BUDGET COMMITTEE QUESTIONS

47. Given the recently adopted Board Equity Lens, can you outline for the Budget Committee the process

used for constructing the proposed budget and where the budget was reshaped in light of the Equity

Lens and feedback from that process?

The Equity Lens was recently adopted by the School Board. The budget process begins in October

ond was well underway prior to board action adopting an equity lens. However, in the budget

‘message there was an intentional message with data on the areas for improvement for our

students. This immediately focused you on equity. The more difficult thing to analyze as a budget

committee member is that intentional investments happen in many places outside the general fund

and these funds are specifically designated to provide certain instructional supports to our

students. A few examples:

a. Early Childhood Education ~ Outcome is to increase Kindergarten Readiness (Title |,

Headstart, Preschool Promise)

b. Title | targeted additional funding for schools with 70% and greater free and reduced

lunch. For 2017-18 reallocation of these funds from central office support to schools.

Added 8 schools that will receive additional funding.

¢. M98—focused on CTE, dropout recovery and rigorous course options. Notice the

intentionality of addition of program to Roberts and 8” grade (if the law is changed)

d. School wide Title Elementary Schools are provided FTE for 2 less students per classroom.

e. North High School and McKay High School are provided 1 additional FTE for intervention

support (2016-17 and 2017-18)

48. Does this budget expand Early College High School classroom sizes? How many students will be served

with this budget in Early College High School and how does that compare to previous years?

There were no reductions in FTE at Early College High School.

49. “27 years ago we were ahead of other states by 5%, and now we're below by 15%.” Can you show the

changes in student demographics from 27 years ago to now? Or even the past 15 years?

27 years ago we were ahead of other states by 5% in pupil spending.

The charts below show Salem-Keizer School District data over ten years.

2

BUDGET COMMITTEE QUESTIONS

Who We Are: Then and Now

2005-06 2015-16

38,981 Students 41,464 Students

. . Asian Poel Aldean

jatceanAverean 2% lander Aeverean American

No eipense american: Indian/Alaskan Te loa

Avance x

‘slander

*

Mute etnaie

%

% Nawwe ——Mutlegthok

1” st

andatie

%

50, Are students allowed to graduate early, and if so, how many students do so? Is there a way we are

budgeting to help students complete their education early if they are motivated, besides the Early

College High School?

Eligibility for an Oregon diploma is not related to age. Satisfaction of 25 credits and the three

essential skills earns a diploma. We do not track age of graduates.

51. Do any students graduate by age 16? What would the district have to do to allow or increase students

graduating by age 16? How would that affect Budget?

While we don’t track the age of graduates, we do allow students to graduate by age 16. This is not

currently a factor in our budget decision making,

52. Do we know, or can we project, if any attrition will impact the District's efforts of increasing diversity

on the staff meaning, could this attrition come about because of resignations, layoffs, or not rehiring

of People of Color or Bilingual/Bicultural staff?

We do not project that attrition will negatively impact the District's efforts. See Strategic Plan

Report on May 9th School Board Agenda.

53. Please provide a 10 year tracking on each fund.

Prior budgets and annual reports are available on the District’s website. The link to the documents

is: http://www.salkeiz,k12.or.us/departments/business-support-services. Click on Adopted Budgets

{for budget documents or Financial Reports for Consolidated Annual Financial Reports (CAFR).

2B

BUDGET COMMITTEE QUESTIONS

The question does not specify whether the 10 year tracking would show budget or actuals or

designate the desired level of detail. There are 10 year summaries of the General Fund actual

revenues and expenditures found in the annual report, which the requestor may find useful. See

page 154-157 of the June 30, 2016 CAFR.

54, Staff hopes that the reduction in FTE can be achieved through natural attrition, rather than layoffs. Is

there a projection of where these retirements or resignations will most likely occur in the District -

Licensed vs classified? New vs. experienced teachers? Economically Disadvantaged schools? etc.

To facilitate a reduction in FTE through natural attrition, rather than reduction in force, the District

has undertaken a review of staffing levels and transfers across all schools and sites. Staff in need of

placement have been placed with consideration given to their licensure and endorsements, prior

experience, and the needs of our schools and programs. This reassignment process includes

consideration for the placement of staff members with high levels of classroom teaching and

instructional coaching skill in schools that need their expertise the most, such as our Title-identified

schools.

55, Please provide more detail on why the major swings in the Fee-Based Services Fund?

The fee based programs summary on page 101 shows some of the major changes from the current

budget to the proposed budget. A reduction in the beginning fund balance (5400) and the

contributions and donations (1800) accounts for the majority of the difference. These are normal

adjustments through the budget development process.

56. How much “non retirement” turnover do we have?

Considering attrition with an effective date of March or later, see table below:

Retirement | Resignation | Total

Classified 17 14 31

licensed 61 3B 134

Total 8 7 165

57. The budget includes an assumption that there will be a decrease in Elementary enrollment. How did

District staff arrive at this projection?

The Portland State University population study can be found at: https://www.pdx.edu/pre/home

4

BUDGET COMMITTEE QUESTIONS

58. Can staff make a projection of which schools or which parts of town will see less enrollment or higher

enrollment?

See answer to question 57 above.

59. One strategy for dealing with an additional funding shortage once the legislature has finalized its job

would be for the Budget Committee to authorize a budget that is higher than available funds and leave

decision making to district staff when there is a shortfall. Can you give the Budget Committee a rough

outline of what $21 million of additional cuts would look like from this current proposed budget?

The estimated additional $21 million 2017-19 deficit would result from a $7.8 billion K-12 State

School Fund and would equate to approximately $10.5 million per year. The basic approach would

be to reduce additional spending, transfer additional resources from outside of the General Fund

such as the PERS Debt Service Reserve and Preventative and Deferred Maintenance Funds, increase

class size, eliminate electives or extra-curricular programs and work toward concessions with our

labor groups.

15

0

~~ en SALEM-KEIZER BUDGET COMMITTEE

7 Vi

MAY 9, 2017

SALEMeKEIZER ADDITIONAL QUESTIONS

PUBLIC SCHOOLS

Refer to Committee

1

10.

1.

Please provide a chart listing the largest and smallest class size in each school building. If there are

special kinds of classes that distort these numbers (PE on the large side and special education on the

small side?), please exclude those from the analysis but note that they were excluded.

Do we have a maximum or minimum class size policy? If so, what is it?

Please provide a census of the number of teachers within different bands of tenure (5 year

increments).

Please provide an analysis of this data that will give us a sense of the curve and plateaus of likely

retirements and what this will mean over the coming years in terms of the District's personnel

expenses.

What is the approximate cost of recruitment per teacher?

‘Are some of these funds cyclical in nature? (Intentionally high and then low and then high)

Which funds should be planned to be flat to increasing and the fluctuation is based on budget issues?

Is “personalized education technology” in the budget as has been stated in recent candidate

forums? Ifso, how much? Please describe the program and the breadth of intended use.

We often talk about the ratio of students to teachers. What are these other ratios:

a. What is the ratio of teachers (direct contact with students) to district staff?

What is the ratio of teachers to support personnel?

What is the ratio of teachers to instructional aides?

Ratio of teachers to instructional coaches?

For each of these ratios, are they increasing or decreasing in recent years?

peos

Please detail category and pricing structure for fees charged to Salem-Keizer Charter schools. (P. 38

reference) Are these fees contractual?

Can you outline additions in the proposed budget that would specifically address both an improvement

in 3rd grade reading and a reduction in the dropout rate (other than the addition of FTE in the form of

behavioral counselors}? It would appear as if the graduation rates and student progress would remain

at stagnant levels until these major issues are addressed.

ADDITIONAL QUESTIONS

12. In regards to class sizes, in general, higher class sizes are not conducive to learning, 1s there a guideline

that the District uses to determine what's the highest class size that is acceptable and not as disruptive

to the learning experience? If so, what is it for elementary, middle and high school?

om :

‘SALEMeKEIZER

PUBLIC SCHOOLS

Budget Committee Protocols for Questions and Deliberations

‘The budget committee chair and vice-chair serve as a leadership team for agenda planning and

meeting management purposes. Facilitating requests for information is an important function

of the budget committee leadership team.

= Questions and Requests for Information Raised Prior to the May 9, 2017 Meeti

If possible, committee members should submit questions and requests for information

about the proposed budget to the budget officer at (wolfe_michael@salkeiz.k12.or.us) no

later than May 3. Questions requiring significant staff work will be reviewed by the budget

committee leadership team in consultation with district staff, to determine which would

benefit the budget committee. Questions and requests for information not answered can

be raised at the May 9 meeting for consideration by the full committee.

= Questions and Requests for Information Raised at Budget Committee Meetings:

Most questions asked during a budget meeting can be addressed quickly, sometimes even

at the meeting. However, some questions or requests for information may require

significant staff time to research. Therefore, budget committee leadership has agreed that

there must be sufficient committee interest in a question or request for information before

itis assigned to staff for a response. By committee vote, the Chair will make the assignment

to staff if there are at least six members interested in receiving a response.

All committee members will receive the same inform:

Changing the Superintendent's Proposed Budget:

After the budget committee has heard public testimony, there may be a desire for members to

recommend changes to the Superintendent's proposed budget.

‘The procedures for changing the proposed budget will be as follows:

1. Members of the committee will have the opportunity to identify changes they would like to

be considered. If an item is identified that will increase the budget, the committee member

must also be prepared to identify a funding source. Each item will be recorded on an initial

list.

‘SALEM-KEIZER PUBLIC SCHOOLS « Budget Committee « April 25, 2017

2. Beginning with the first item, the budget committee member who recommended the

change will give a brief (three to five minute) explanation of why they believe the change

should be made. After the explanation, other members will be asked (by a show of hands)

if they would like that item to move to a master list for further consideration. Six members

must concur in order for the item to be included on the master list.

3. After the master list is established, the chairperson will accept a formal motion on each

item identified on the list. Robert's Rules of Order will be used in considering each item on

the master list and will require at least eight (8) votes from the budget committee to change

the proposed budget.

4. Changes to the proposed budget may require additional staff work to modify the document

and an opportunity for additional public testimony may be necessary.

‘SALEM-KEIZER PUBLIC SCHOOLS + Budget Committee » April 25, 2017

Você também pode gostar

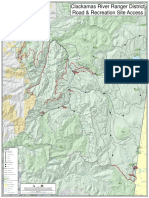

- Roads and Trails of Cascade HeadDocumento1 páginaRoads and Trails of Cascade HeadStatesman JournalAinda não há avaliações

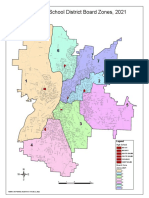

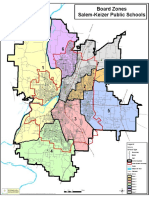

- School Board Zones Map 2021Documento1 páginaSchool Board Zones Map 2021Statesman JournalAinda não há avaliações

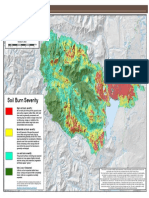

- Cedar Creek Vegitation Burn SeverityDocumento1 páginaCedar Creek Vegitation Burn SeverityStatesman JournalAinda não há avaliações

- Letter To Judge Hernandez From Rural Oregon LawmakersDocumento4 páginasLetter To Judge Hernandez From Rural Oregon LawmakersStatesman JournalAinda não há avaliações

- Cedar Creek Fire Soil Burn SeverityDocumento1 páginaCedar Creek Fire Soil Burn SeverityStatesman JournalAinda não há avaliações

- Matthieu Lake Map and CampsitesDocumento1 páginaMatthieu Lake Map and CampsitesStatesman JournalAinda não há avaliações

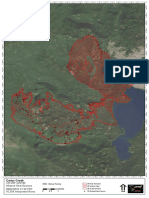

- Cedar Creek Fire Sept. 3Documento1 páginaCedar Creek Fire Sept. 3Statesman JournalAinda não há avaliações

- Oregon Annual Report Card 2020-21Documento71 páginasOregon Annual Report Card 2020-21Statesman JournalAinda não há avaliações

- Complaint Summary Memo To Superintendent Re 8-9 BD Meeting - CB 9-14-22Documento4 páginasComplaint Summary Memo To Superintendent Re 8-9 BD Meeting - CB 9-14-22Statesman JournalAinda não há avaliações

- Mount Hood National Forest Map of Closed and Open RoadsDocumento1 páginaMount Hood National Forest Map of Closed and Open RoadsStatesman JournalAinda não há avaliações

- Windigo Fire ClosureDocumento1 páginaWindigo Fire ClosureStatesman JournalAinda não há avaliações

- Revised Closure of The Beachie/Lionshead FiresDocumento4 páginasRevised Closure of The Beachie/Lionshead FiresStatesman JournalAinda não há avaliações

- LGBTQ Proclaimation 2022Documento1 páginaLGBTQ Proclaimation 2022Statesman JournalAinda não há avaliações

- Proclamation Parent & Guardian Engagement in Education 1-11-22 Final, SignedDocumento1 páginaProclamation Parent & Guardian Engagement in Education 1-11-22 Final, SignedStatesman JournalAinda não há avaliações

- Salem-Keizer Parent and Guardian Engagement in Education Month ProclamationDocumento1 páginaSalem-Keizer Parent and Guardian Engagement in Education Month ProclamationStatesman JournalAinda não há avaliações

- SIA Report 2022 - 21Documento10 páginasSIA Report 2022 - 21Statesman JournalAinda não há avaliações

- Salem-Keizer Discipline Data Dec. 2021Documento13 páginasSalem-Keizer Discipline Data Dec. 2021Statesman JournalAinda não há avaliações

- Resource List For Trauma Responses: Grounding Breathing Exercises To Take You Out of "Fight/Flight" ModeDocumento3 páginasResource List For Trauma Responses: Grounding Breathing Exercises To Take You Out of "Fight/Flight" ModeStatesman JournalAinda não há avaliações

- Gcab - Personal Electronic Devices and Social Media - StaffDocumento2 páginasGcab - Personal Electronic Devices and Social Media - StaffStatesman JournalAinda não há avaliações

- Crib Midget Day Care Emergency Order of SuspensionDocumento6 páginasCrib Midget Day Care Emergency Order of SuspensionStatesman JournalAinda não há avaliações

- SB Agenda 20210415 EnglishDocumento1 páginaSB Agenda 20210415 EnglishStatesman JournalAinda não há avaliações

- School Board Zone MapDocumento1 páginaSchool Board Zone MapStatesman JournalAinda não há avaliações

- Op Ed - Anthony MedinaDocumento2 páginasOp Ed - Anthony MedinaStatesman JournalAinda não há avaliações

- 2021 Ironman 70.3 Oregon Traffic ImpactDocumento2 páginas2021 Ironman 70.3 Oregon Traffic ImpactStatesman JournalAinda não há avaliações

- Statement From Marion County Medical Examiner's Office On Heat-Related DeathsDocumento1 páginaStatement From Marion County Medical Examiner's Office On Heat-Related DeathsStatesman JournalAinda não há avaliações

- Schools, Safe Learners (RSSL) Guidance. We Have Established A Statewide Rapid Testing ProgramDocumento3 páginasSchools, Safe Learners (RSSL) Guidance. We Have Established A Statewide Rapid Testing ProgramStatesman Journal100% (1)

- Zone Resolution PDFDocumento2 páginasZone Resolution PDFStatesman JournalAinda não há avaliações

- City of Salem Photo Red Light Program 2021 Legislative ReportDocumento8 páginasCity of Salem Photo Red Light Program 2021 Legislative ReportStatesman JournalAinda não há avaliações

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)