Escolar Documentos

Profissional Documentos

Cultura Documentos

Cheat Sheet

Enviado por

Shahid MDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Cheat Sheet

Enviado por

Shahid MDireitos autorais:

Formatos disponíveis

Hector Lopez, a salaried employee of a local bicycle company, quits his job and opens his own bicycle

shop,

Bigwheels Company, on January 2, 20XX. Lets take a look at some transactions of Bigwheels Company and

see how they affect the financial statements.

Initial investment by owners, $400,000 cash. They receive 4,000 shares with a par value of $1 per share.

Loan from bank, $100,000 Acquired store equipment for cash, $15,000

Acquired inventory for cash, $120,000 Acquired inventory on credit, $10,000

Acquired inventory for $10,000 cash plus $20,000 trade credit Sold unneeded equipment for $1,000 cash

Returned inventory for supplier for full credit, $800 Paid cash to creditors, $4,000

A. Sold bicycles to customers on credit, $160,000.

B. The cost to Bigwheels of the inventory sold was $100,000.

During the month, Bigwheels collects $5,000 of its accounts receivables

Paid $6,000 of store rent covering January, February, and March of 20XX at the beginning of month

Recognize $2,000 worth of rent that was a period cost for January 20XX

Recognize a depreciation expense of $100

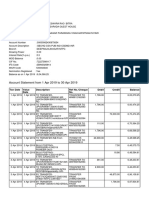

Transactions Debit Credit

5,00,000

1,00,000

1,00,000

4,00,000

4,00,000

5,00,000

5,00,000

Cash 4,00,000

-

Paid-in-capital 4,00,000

(Capital stock issued to Lopez)

Cash 1,00,000

(100)

Notes payable 1,00,000

3,51,000

59,200

14,000

13,900

1,55,000

4,000

25,200

1,00,000

1,25,200

4,00,000

57,900

4,57,900

5,83,100

5,83,100

(Borrowed at 9% interest on a one-year note)

Store equipment 15,000

Cash 15,000

(Acquired store equipment for cash)

Inventory 1,20,000

Par and paid-in-capital

Cash 1,20,000

Liabilities and Equity

Shareholders' equity

(Acquired inventory for cash)

Total liab and SE

Accounts payable

Inventory 10,000

Balance sheet

Equipment, net

Notes payable

Less: AccDep

Total liabilities

Accounts payable 10,000

Total assets

Prepaid rent

Receivables

Equipment

(Acquired inventory on credit )

Inventory

Total SE

Assets

Inventory 30,000

Cash

Cash 10,000

RE

Accounts payable 20,000

(Acquired inventory for cash plus credit )

(2,000)

(100)

(1,00,000)

0

57,900

57,900

57,900

1,60,000

Cash 1,000

Equipment 1,000

(Sold store equipment to business neighbor)

Accounts payable 800

Inventory 800

Beginning RE

Rent expense

(Returned some inventory to supplier)

Depreciation

Net income

Net income

Closing RE

Accounts payable 4,000

Dividends

IS or PL

COGS

Cash 4,000

Sales

(Payments to suppliers)

Accounts receivables 1,60,000

Sales 1,60,000

(Sold goods of credit)

1,00,000

25,200

4,00,000

100

1,60,000

6,85,300

Cost of goods sold 1,00,000

Inventory 1,00,000

Credit

(Record cost of goods sold )

Cash 5,000

3,51,000

59,200

14,000

4,000

100

2,000

1,55,000

1,00,000

6,85,300

Accounts receivable 5,000

(Received cash from AR)

Debit

Prepaid rent 6,000

Cash 6,000

(Paid 3 months rent in advance)

Accounts payable

Rent expense 2,000

Paid-in-capital

Notes payable

Prepaid rent 2,000

Trial balance

Rent expense

Transactions

Depreciation

Prepaid rent

Receivables

(Record rent expense for the month )

Equipment

Inventory

Depreciation expense 100

COGS

Sales

Cash

Accumulated depreciation 100

Acc

( Record depreciation expense for the month)

Você também pode gostar

- InteractionsDocumento1 páginaInteractionsShahid MAinda não há avaliações

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Vendor - Warehouse Interaction: InteractionsDocumento1 páginaVendor - Warehouse Interaction: InteractionsShahid MAinda não há avaliações

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- To Eat IPO Cake Zomato Needs To Expand Its Menu PDFDocumento9 páginasTo Eat IPO Cake Zomato Needs To Expand Its Menu PDFShahid MAinda não há avaliações

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (890)

- Vendor Warehouse InteractionsDocumento2 páginasVendor Warehouse InteractionsShahid MAinda não há avaliações

- Fixedline and broadband bill detailsDocumento2 páginasFixedline and broadband bill detailsShahid MAinda não há avaliações

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- 1311DEDocumento1 página1311DEShahid MAinda não há avaliações

- 1311DEDocumento1 página1311DEShahid MAinda não há avaliações

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- 1311DEDocumento1 página1311DEShahid MAinda não há avaliações

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- 201708Documento1 página201708Shahid MAinda não há avaliações

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- To Eat IPO Cake Zomato Needs To Expand Its Menu PDFDocumento9 páginasTo Eat IPO Cake Zomato Needs To Expand Its Menu PDFShahid MAinda não há avaliações

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- 1311DEDocumento1 página1311DEShahid MAinda não há avaliações

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- 1311DEDocumento1 página1311DEShahid MAinda não há avaliações

- PDFDocumento1 páginaPDFShahid MAinda não há avaliações

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (265)

- 15 Body Language Blunders Successful People Never Make PDFDocumento4 páginas15 Body Language Blunders Successful People Never Make PDFShahid MAinda não há avaliações

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2219)

- Placement Prep 101: The Resume: Anmol Joneja ISB Co 2011Documento13 páginasPlacement Prep 101: The Resume: Anmol Joneja ISB Co 2011Shahid MAinda não há avaliações

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- PDFDocumento1 páginaPDFShahid MAinda não há avaliações

- SatishDocumento4 páginasSatishShahid MAinda não há avaliações

- Term 4Documento1 páginaTerm 4Shahid MAinda não há avaliações

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- 201703Documento1 página201703Shahid MAinda não há avaliações

- Virtuso Kiran Aidhi SessionDocumento1 páginaVirtuso Kiran Aidhi SessionShahid MAinda não há avaliações

- 15 Body Language Blunders Successful People Never Make PDFDocumento4 páginas15 Body Language Blunders Successful People Never Make PDFShahid MAinda não há avaliações

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- 4 Bit MultiplierDocumento21 páginas4 Bit MultiplierShahid MAinda não há avaliações

- District Consumer CourtDocumento1 páginaDistrict Consumer CourtShahid MAinda não há avaliações

- Midland Energy Resources Income Statement AnalysisDocumento19 páginasMidland Energy Resources Income Statement AnalysisSteven Hyosup KimAinda não há avaliações

- 201702Documento1 página201702Shahid MAinda não há avaliações

- Meter Readings For Meter ID 7751533786: Present Reading 01-02-2017 1147.11 1275.33 .168 0.92Documento1 páginaMeter Readings For Meter ID 7751533786: Present Reading 01-02-2017 1147.11 1275.33 .168 0.92Shahid MAinda não há avaliações

- Mobile Number Approval FormDocumento1 páginaMobile Number Approval FormPrabhas_Raju_9300Ainda não há avaliações

- Tamba HanaDocumento2 páginasTamba HanaircasinagaAinda não há avaliações

- The Cestui Que Vie Act (1666) - People Are Owned Under Old English LawDocumento9 páginasThe Cestui Que Vie Act (1666) - People Are Owned Under Old English Lawzimaios100% (2)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (119)

- Indemnity BondDocumento3 páginasIndemnity BondPoojitha sAinda não há avaliações

- Human Resources Director in Los Angeles CA Resume Trudy WestDocumento2 páginasHuman Resources Director in Los Angeles CA Resume Trudy WestTrudyWestAinda não há avaliações

- HSBC BankDocumento40 páginasHSBC BankPrasanjeet PoddarAinda não há avaliações

- Understanding Customer Behavior at SCBDocumento78 páginasUnderstanding Customer Behavior at SCBHimanshu Saini0% (1)

- Internship Report On Credit Management of MTBLDocumento61 páginasInternship Report On Credit Management of MTBLtanvir100% (1)

- Bofa Approval LetterDocumento3 páginasBofa Approval LetterSteve Mun GroupAinda não há avaliações

- Faith & Finance The Change of Face of Isalmic BankingDocumento13 páginasFaith & Finance The Change of Face of Isalmic BankingDr-Mohammed FaridAinda não há avaliações

- The Concept of Free MarketDocumento6 páginasThe Concept of Free MarketDavidAinda não há avaliações

- Business Development at Pernia's Pop-Up ShopDocumento80 páginasBusiness Development at Pernia's Pop-Up ShopAnonymous GKqp4Hn50% (2)

- Cholamandalam Investment and Finance Initiation ReportDocumento44 páginasCholamandalam Investment and Finance Initiation ReportgirishrajsAinda não há avaliações

- A Study On Cashless Economy and Its ImpactDocumento34 páginasA Study On Cashless Economy and Its ImpactTehreem RehmanAinda não há avaliações

- Lges Job Request FormDocumento3 páginasLges Job Request Formabubakarwahabi30Ainda não há avaliações

- Atal Pension YojanaDocumento2 páginasAtal Pension YojanakrithikAinda não há avaliações

- 15624702052231UoGssBO9TQOUnD5 PDFDocumento5 páginas15624702052231UoGssBO9TQOUnD5 PDFvenkateshbitraAinda não há avaliações

- Rizwan & Co.: Chartered AccountantsDocumento2 páginasRizwan & Co.: Chartered AccountantsfaheemAinda não há avaliações

- © Oxford University Press 2013. All Rights ReservedDocumento10 páginas© Oxford University Press 2013. All Rights ReservedakankshaAinda não há avaliações

- How To Set Up Intercompany Balancing Rules For Bank Account TransfersDocumento9 páginasHow To Set Up Intercompany Balancing Rules For Bank Account TransfersflavioAinda não há avaliações

- Tutorial QuestionsDocumento3 páginasTutorial QuestionsJaden EuAinda não há avaliações

- Orion POS - Guide - Training Guide PDFDocumento37 páginasOrion POS - Guide - Training Guide PDFcaplusinc100% (2)

- Senior Regional Sales Manager in York PA Resume Dawn AllenDocumento2 páginasSenior Regional Sales Manager in York PA Resume Dawn AllenDawnAllenAinda não há avaliações

- Cima F1 Questions Answers PDF - Test Engine With 100% Passing Guarantee.Documento22 páginasCima F1 Questions Answers PDF - Test Engine With 100% Passing Guarantee.Nelson JobsAinda não há avaliações

- Bank Statement09-2020Documento6 páginasBank Statement09-2020Tnt SolutionsAinda não há avaliações

- Mca 21 Case StudyDocumento7 páginasMca 21 Case StudySapna SharmaAinda não há avaliações

- The Books OF AccountingDocumento37 páginasThe Books OF AccountingediwowAinda não há avaliações

- CLVDocumento17 páginasCLVAbhijeet GangulyAinda não há avaliações

- Nifty Day Trader March 28, 2019Documento7 páginasNifty Day Trader March 28, 2019RogerAinda não há avaliações

- Banking 3EFinals1920Documento9 páginasBanking 3EFinals1920Mary Grace ChewAinda não há avaliações

- Intern Report - Sanima BankDocumento11 páginasIntern Report - Sanima BankRajan ParajuliAinda não há avaliações