Escolar Documentos

Profissional Documentos

Cultura Documentos

GVK Power & Infra (GVKPOW) : Consolidation at Present Levels

Enviado por

Kaushal KumarTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

GVK Power & Infra (GVKPOW) : Consolidation at Present Levels

Enviado por

Kaushal KumarDireitos autorais:

Formatos disponíveis

Result Update

May 4, 2010

Rating matrix

Rating : Strong Buy GVK Power & Infra (GVKPOW)

Target : Rs 54

Target Period : 12 months Rs 45

Potential Upside : 20%

WHAT’S CHANGED…

Key Financials PRICE TARGET ............................................................................................. Unchanged

(Rs Crore) FY09 FY10 FY11E FY12E

EPS (FY10) ..................................................................... Changed from Rs 1.1 to Rs 1.0

Net Sales 513.8 1786.6 2073.6 2210.0

EBITDA 176.3 464.5 761.4 901.2 EPS (FY11E) ................................................................... Changed from Rs 1.6 to Rs 1.4

Net Profit 107.6 155.9 217.3 231.0 RATING.......................................................................................................... Unchanged

Valuation summary Consolidation at present levels…

FY09 FY10 FY11E FY12E GVK Power & Infra (GVK) has reported numbers in line with our

PE (x) 85.1 46.6 33.4 31.4 estimates of ~3.5 fold YoY growth in topline from Rs 513 crore to Rs

Target PE (x) 99.5 54.5 39.1 36.8 1,786 crore. Growth was primarily led by a significant jump from the

EV/EBITDA (x) 66.1 25.8 15.8 13.6 power segment, which witnessed ~4.5 fold growth from Rs 355.6 crore

to Rs 1603.3 crore. GVK reported a PAT of Rs 155.9 crore compared to

P/BV (x) 2.8 2.3 2.2 2.0

Rs 107.6 crore in line with our estimates. The operational performance

RoNW (%) 3.4 4.5 7.8 7.7

showed a significant improvement with the EBITDA improving more

RoCE (%) 2.2 4.8 6.1 6.1 than 2.6 folds from Rs 176 crore to Rs 465 crore in FY10.

Expansion in power vertical

Stock data With the regulator stepping in the merchant power plans of GVK, the

Market Capitalisation Rs 6581 Crore opening of merchant power (~100 MW) will be delayed by two

Debt (FY10E) Rs 5047 Crore quarters. However, we believe the delay is not expected to have a

Cash (FY10E) Rs 82 Crore

material impact on the valuation. GVK Power has achieved financial

EV closure for the Tokisud coal mines and also financial closure for the

Rs 11546 Crore

52 week H/L

Goindwal Sahib (540 MW) coal based project in February 2010. GVK

Rs 54/10 Crore

is exploring opportunities to divest part of the stake in the power

Equity capital 158 Crore

vertical that will pave the way for funding further expansions in the

Face value Rs 1

power segment.

MF Holding (%) 5.9

FII Holding (%) 30.1 Clarity to emerge on real estate prospects, regulatory ambiguity

Price movement (Stock vs. Nifty) Real estate prospects at the MIAL land are expected to emerge over

FY11E along with clarity on calculation of revenues at MIAL, which is

60 6500 subject to regulatory clarifications. We believe the valuation of the

50 5500

aviation vertical will depend on regulatory clarifications.

40

Valuation

(In Units)

4500

(In Rs)

30

3500 At the CMP of Rs 45, the stock is trading at FY10 P/BV of 2.3x and FY11E

20

10 2500 P/BV of 2.2x. Clarity on the real estate prospects for the airport property

0 1500 will lead to a re-rating of the stock. Aviation segment (MIAL and BIAL)

Apr-10 Mar-10 Jan-10 Nov-09 Sep-09 showing a good operating performance along with better than expected

growth in the road vertical will continue to offer significant growth

GVK (L.H.S) Nifty (R.H.S)

prospects for GVK. Thus, we continue to maintain our STRONG BUY

Analyst’s name rating on the stock with a price target of Rs 54.

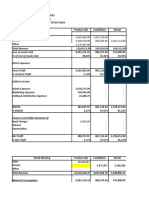

Jitesh Bhanot Exhibit 1: Performance highlights

jitesh.bhanot@icicisecurities.com Q4FY10A Q4FY10E Q4FY09 Q3FY10 QoQ (Chg %) YoY (Chg %)

Net Sales 488.6 493.4 167.0 473.5 3.2 192.7

EBITDA 78.6 164.7 36.1 140.8 -44.2 117.7

EBITDA Margin (%) 16.1 33.4 21.6 29.7 -1365 bps -554 bps

Depreciation 0.0 50.1 19.3 53.0 -100.0 -100.0

Interest 63.3 71.5 9.5 57.9 NA NA

Reported PAT 33.1 32.6 14.2 45.8 -27.7 132.4

EPS (Rs) 0.2 0.2 0.1 0.3 -27.7 132.4

Source: Company, ICICIdirect.com Research

ICICIdirect.com | Equity Research

GVK Power & Infra (GVKPOW)

Result Analysis

For FY10, GVK Power & Infra (GVK) has reported a near ~3.5 fold YoY

growth in topline from Rs 513.8 crore to Rs 1786.6 crore in line with our

expectation. The power segment was the major contributor with ~4.5

fold growth over the same period. The power segment comprises ~90%

of the overall topline.

For FY10, the revenue for the road segment also witnessed a growth of

17.1% YoY mainly led by a ~12.6% jump in volume growth and

remaining due to a change in the mix of traffic.

For FY10, total revenue from Mumbai Airport (MIAL) also witnessed a

growth of 4.9% YoY from Rs 944 crore to Rs 990 crore led by an overall

passenger traffic growth of 9.3% YoY. MIAL also witnessed a substantial

improvement on the cost front with EBITDA witnessing a jump of ~65%

from Rs 190 crore to Rs 313 crore in the same period last year.

For FY10, total revenue for Bengaluru Airport (BIAL) witnessed a growth

of 50% with revenues growing from Rs 309.5 crore to Rs 465 crore. BIAL

has also witnessed a significant jump in the BIAL airport with EBITDA

growing ~2.7 times from Rs 110 crore to Rs 299.2 crore.

For Q4FY10, GVK Power & Infra (GVK) has reported a near ~2.9 fold YoY

growth in topline from Rs 167 crore to Rs 488.6 crore in line with our

expectation. EBITDA margins for the quarters were not comparable owing

to one-off depreciation adjustment conducted at the Jaipur Kishangarh

expressway. PAT margins also witnessed a squeeze owing to additional

interest outflow on account of incremental leverage for infusing

investments for the Bangalore Airport.

Exhibit 2: Financial highlight of GVK Power & Infra

2,000.0

Power & Road segment Consolidated

1,750.0

Growth of ~3.5 fold in topline led by major boost coming

1786.6

from the power segment 1,500.0

1,250.0

Rs Cr

1,000.0

513.8

468.3

750.0

500.0

176.3

155.9

107.6

250.0

0.0

Revenue EBITDA PAT

FY09 FY10

Source: Company, ICICIdirect.com Research

Exhibit 3: Financial highlight of power segment

2,000.0

JP - I & II, Gautami

1,750.0

1,500.0

1603.3

Significant growth witnessed owing to capacity addition of

1,250.0

~684 MW in H1FY10 taking the total generation capacity to

Rs Cr

~901 MW 1,000.0

750.0

404.4

355.6

500.0

65.2

63.0

250.0

7.3

0.0

Revenue EBITDA PAT

FY09 FY10

Source: Company, ICICIdirect.com Research

ICICIdirect.com | Equity Research

Page 2

GVK Power & Infra (GVKPOW)

Exhibit 4: Financial highlight of aviation segment - MIAL

943.8

989.7

1,000.0

Cost efficiencies achieved due to a reduction in employee MIAL

900.0

cost coupled with a lower energy cost and economies of 800.0

scale at MIAL have led to a boost in the EBITDA margin 700.0

600.0

Rs Cr

500.0

313.1

400.0

190.1

300.0

132.8

200.0

85.3

100.0

0.0

Revenue EBITDA PAT

FY09 FY10

Source: Company, ICICIdirect.com Research

Exhibit 5: Financial highlight of aviation segment - BIAL

464.7

500.0

Significant growth of 37.4% from 7.72 million passengers to BIAL

309.5

299.2

9.92 million passengers has improved the operating matrix

400.0

at BIAL. The airport has witnessed a turnaround in 300.0

profitability by achieving profitability of Rs 77.4 crore

110.1

200.0

Rs Cr

77.4

100.0

0.0

(100.0)

(97.3)

(200.0)

Revenue EBITDA PAT

FY09 FY10

Source: Company, ICICIdirect.com Research

Exhibit 6: Financial highlight of road segment

Jaipur Expressway

170.8

200.0

Robust growth of volumes on the Jaipur toll project has led

145.9

175.0

to an improving performance for the road segment. The

150.0

numbers look muted due to the major maintenance expense

105.6

125.0

carried out by the company and have pulled the bottomline

Rs Cr

down by Rs 64 crore. The company has also altered the 100.0

59.2

53.5

amortisation method on toll rights 75.0

45.1

50.0

25.0

0.0

Revenue EBITDA* PAT

FY09 FY10

Source: Company, ICICIdirect.com Research

*EBITDA is adjusted of the major maintenance expense of Rs 64 crore

ICICIdirect.com | Equity Research

Page 3

GVK Power & Infra (GVKPOW)

Margins for different vertical

GVK Power has been witnessing strong margins in all of its verticals.

However, owing to regulatory issues the company has been unable to

kick start their merchant operations. This is impacting the margins of their

power vertical. Aviation is witnessing an improvement with cost savings

starting to kick in due to economies of scale. The road segment has

witnessed a sharp correction due to the one-time major maintenance

incurred during the year. However, post the completion of resurfacing

work in FY11 the margins will be restored to historical levels.

Exhibit 7: Trends of margin in several segments

Margins portrays a strong trajectory for GVK Power

100%

72.4%

64.4%

80%

EBITDA Margin

60%

35.6%

34.3%

31.6%

26.4%

26.2%

40%

20.1%

20%

0%

Power Aviation - MIAL Aviation - BIAL Road*

FY09 FY10

Source: Company, ICICIdirect.com Research

* EBITDA margins for road segment is post the one time major maintenance reserve

Exhibit 8: Trends in monthly generation at various facilities of GVK

350

300

Million Units (MU)

With the improvement in gas availability from the KG D6 the 250

operating numbers are picking up substantially. The PLFs of 200

plants has improved in excess of 90% ever since the

150

availability of gas has improved

100

50

0

Apr 2008

Mar 2009

Mar 2010

May 2008

Aug 2008

Oct 2008

Apr 2009

Aug 2009

Oct 2009

June 2008

Nov 2008

Dec 2008

Jan 2009

Nov 2009

Dec 2009

Jan 2010

July 2008

Sept 2008

Feb 2009

May 2009

June 2009

July 2009

Sept 2009

Feb 2010

JP-I & II - (437 MW) Gautami - (464 MW)

Source: CEA, ICICIdirect.com Research

ICICIdirect.com | Equity Research

Page 4

GVK Power & Infra (GVKPOW)

Exhibit 9: Growth in passengers for MIAL - Annual

34.0

29.6

27.5

30.0

25.6

Million Passengers

25.9

26.0

23.4

22.2

YoY growth in the passenger traffic has turned positive and

MIAL is expected to reach 29.5 million passengers by FY12E 22.0

18.4

18.0

14.0

10.0

FY06 FY07 FY08 FY09 FY10 FY11E FY12E

Passenger traffic (MIAL)

Source: Company, ICICIdirect.com Research

Exhibit 10: Growth in yearly traffic at JKEL

24,000

20,000

10564

10061

9492

Vehicles per day

16,000

8030

8003

6563

5276

12,000 2405 2453

2358

2819 2438

3369 1304 1343

8,000 3827 1266

1118 1153

1026

8321

7887

917

7303

4,000

6441

5832

FY07 5234

FY06 4434

0

FY08

FY09

FY10E

FY11E

FY12E

Cars LCVs Buses 2 - Axle MAV / 3 - Axle HCM/EME

Source: Company, ICICIdirect.com Research

Developments during the quarter

GVK Power achieved financial closure for the Goindwal Sahib project, a

540 MW thermal power project in Punjab and has also achieved financial

closure for the Tokisud mine to support the generation at Goindwal

Sahib. The mine is expected to commence production in the next 26

months in line with the projections for commissioning of the thermal

plant. The mine will supply ~2 MT per annum and has a mineable reserve

of 52 MT and is located in Jharkhand.

GVK Power is the preferred bidder for the 690 MW hydropower Rattle

project located on the Chenab river in Jammu and Kashmir. It is expected

to be awarded to GVK power in Q1FY11.

MIAL has inaugurated a new domestic terminal 1C. The terminal is spread

over 3,00,000 square feet across three levels and six new passenger

boarding bridges with connectivity between terminal 1A and 1B.

ICICIdirect.com | Equity Research

Page 5

GVK Power & Infra (GVKPOW)

Outlook & earnings revision

The MIAL revenues are subject to vagueness on the regulatory front. We

expect any framework for calculation of revenues to require at least 12

months. With the acquisition of stake in BIAL, GVK is now controlling

~29% in the fast growing Indian aviation market. The prospects will be

marred by the ambiguity in the computation of returns from the airport

vertical. Real estate monetisation at the Mumbai airport will ease the

funding concerns for MIAL expansion. The process of monetisation is

expected to commence in Q3FY11E.

Valuations

At the CMP of Rs 45, the stock is trading at FY10E P/BV of 2.2x and FY11E

P/BV of 2.0x. We have fine-tuned our earnings for FY11E and FY12E

based on delays in the addition of merchant power and better profitability

from the acquisition of further stake in Gautami. Cost benefit will continue

to trickle down in the financial numbers of the airport segment. Thus, we

continue to maintain our STRONG BUY rating on the stock with an SOTP

based target of Rs 54.

Exhibit 11: SOTP based pricing for GVK power & Infrastructure

Particulars Rs Cr Per Share

Road Segment 846 5

Power & Coal segment 3,588 23

Airport - MIAL 1,350 9

Airport Real estate - MIAL 1,391 9

Airport - BIAL (incl. real estate) 1,171 7

SEZ 108 1

Cash & Cash equivalents 39 0

Total Value 8,493 54

Source: ICICIdirect.com Research

ICICIdirect.com | Equity Research

Page 6

GVK Power & Infra (GVKPOW)

ICICIdirect.com coverage universe (Power & Infrastructure)

Sales EPS PE EV/E PB RoNW RoCE

NTPC (Rs cr) (Rs) (x) (x) (x) (%) (%)

Idirect Code NTPC CMP 205 FY08 40,017.7 9.0 22.8 16.6 3.1 14.6 15.8

Target 241 FY09 45,272.8 9.9 20.6 17.9 2.8 14.9 13.3

Mcap(Rs cr) 168,867.1 % Upside 17.7 FY10E 49,596.7 10.5 19.5 14.3 2.6 14.5 13.3

FY11E 53,976.0 10.8 18.9 12.7 2.4 13.8 12.2

FY12E 62,773.4 12.3 16.7 10.1 2.2 14.3 12.2

Sales EPS PE EV/E PB RoNW RoCE

Lanco Infratech (Rs cr) (Rs) (x) (x) (x) (%) (%)

Idirect Code LANINF CMP 63 FY08 3,241.3 1.5 42.7 31.6 6.7 21.2 9.3

Target 70 FY09 6,072.0 1.2 53.9 28.9 7.2 14.3 5.8

Mcap(Rs cr) 15,117.1 % Upside 11.9 FY10E 7,580.3 2.1 29.8 18.3 4.6 18.7 6.5

FY11E 14,383.7 5.4 11.6 5.7 3.4 33.5 13.8

FY12E 16,178.2 5.7 11.1 4.9 2.6 26.9 12.2

GMR Sales EPS PE EV/E PB RoNW RoCE

Infrastructure (Rs cr) (Rs) (x) (x) (x) (%) (%)

Idirect Code GMRINF CMP 64 FY08 2,294.7 0.6 110.8 54.8 3.8 3.4 3.0

Target 74 FY09 4,019.2 0.8 83.3 30.9 3.6 4.3 3.2

Mcap(Rs cr) 23,448.5 % Upside 16.0 FY10E 5,374.1 0.0 NA 21.1 3.6 -0.2 3.7

FY11E 6,509.7 0.8 79.4 15.8 3.5 4.4 4.4

FY12E 7,710.4 0.8 82.3 12.3 3.3 4.0 3.9

Sales EPS PE EV/E PB RoNW RoCE

Neyveli Lignite (Rs cr) (Rs) (x) (x) (x) (%) (%)

Idirect Code NEYLIG CMP 153 FY08 2,981.7 6.6 23.0 19.7 2.7 12.8 7.3

Target 141 FY09 2,825.1 5.0 30.2 24.6 2.7 9.1 4.6

Mcap(Rs cr) 21,810.2 % Upside (7.6) FY10E 3,951.3 7.1 21.4 17.2 2.4 11.9 7.2

FY11E 4,826.9 7.7 19.7 12.2 2.3 11.9 7.3

FY12E 5,399.0 7.5 20.3 10.5 2.1 10.7 7.3

Sales EPS PE EV/E PB RoNW RoCE

PTC (Rs cr) (Rs) (x) (x) (x) (%) (%)

Idirect Code POWTRA CMP 114 FY08 3,906.1 2.2 52.7 126.0 1.8 5.6 6.8

Target 136 FY09 6,528.9 3.9 28.9 97.6 1.7 5.9 7.5

Mcap(Rs cr) 3,352.6 % Upside 18.9 FY10E 7,772.3 3.2 35.7 37.1 1.6 5.1 7.2

FY11E 9,976.3 4.4 26.0 23.3 1.5 6.0 8.3

FY12E 10,701.4 7.1 16.1 11.1 1.5 9.3 12.9

GVK Power & Sales EPS PE EV/E PB RoNW RoCE

Infra (Rs cr) (Rs) (x) (x) (x) (%) (%)

Idirect Code GVKPOW CMP 45 FY08 470.0 0.7 61.8 62.2 62.2 7.5 3.8

Target 54 FY09 513.8 0.5 77.1 65.5 2.5 3.4 2.2

Mcap(Rs cr) 6,581.1 % Upside 20.0 FY10E 1,786.6 0.7 63.2 22.7 2.1 4.5 4.8

FY11E 2,073.6 1.4 30.3 15.2 1.9 7.7 6.1

FY12E 2,194.1 1.2 34.7 13.0 1.9 6.5 5.9

Sales EPS PE EV/E PB RoNW RoCE

NHPC (Rs cr) (Rs) (x) (x) (x) (%) (%)

Idirect Code NHPC CMP 31 FY08 2,475.7 0.9 34.5 24.3 2.2 5.9 5.6

Target 39 FY09 2,923.1 1.0 30.7 23.9 2.1 6.4 4.9

Mcap(Rs cr) 37,432.0 % Upside 28.3 FY10E 4,103.9 1.4 21.4 14.5 1.6 8.4 6.6

FY11E 3,634.0 1.0 29.4 16.9 1.5 5.3 4.5

FY12E 4,975.3 1.3 22.7 11.8 1.5 6.7 6.3

Sales EPS PE EV/E PB RoNW RoCE

JP Power (Rs cr) (Rs) (x) (x) (x) (%) (%)

Idirect Code JAIHYD CMP 74 FY08 300.8 1.5 50.1 70.3 3.5 20.9 12.2

Target 72 FY09 296.7 1.2 63.2 70.9 3.4 13.3 11.8

Mcap(Rs cr) 15,487.1 % Upside (2.9) FY10E 704.8 2.0 36.7 29.9 4.6 6.7 10.7

FY11E 724.0 3.9 18.8 29.1 4.3 7.5 5.5

FY12E 2,405.2 4.7 15.8 9.2 3.6 15.1 12.0

Source: Company, ICICIdirect.com Research

ICICIdirect.com | Equity Research

Page 7

GVK Power & Infra (GVKPOW)

RATING RATIONALE

ICICIdirect.com endeavours to provide objective opinions and recommendations. ICICIdirect.com assigns

ratings to its stocks according to their notional target price vs. current market price and then categorises them

as Strong Buy, Buy, Add, Reduce, and Sell. The performance horizon is two years unless specified and the

notional target price is defined as the analysts' valuation for a stock.

Strong Buy: 20% or more;

Buy: Between 10% and 20%;

Add: Up to 10%;

Reduce: Up to -10%

Sell: -10% or more;

Pankaj Pandey Head – Research pankaj.pandey@icicisecurities.com

ICICIdirect.com Research Desk,

ICICI Securities Limited,

7th Floor, Akruti Centre Point,

MIDC Main Road, Marol Naka

Andheri (East)

Mumbai – 400 093

research@icicidirect.com

ANALYST CERTIFICATION

We /I, Jitesh Bhanot (ACA) research analysts, authors and the names subscribed to this report, hereby certify that all of the views expressed in this research report accurately reflect our personal views

about any and all of the subject issuer(s) or securities. We also certify that no part of our compensation was, is, or will be directly or indirectly related to the specific recommendation(s) or view(s) in this

report. Analysts aren't registered as research analysts by FINRA and might not be an associated person of the ICICI Securities Inc.

Disclosures:

ICICI Securities Limited (ICICI Securities) and its affiliates are a full-service, integrated investment banking, investment management and brokerage and financing group. We along with affiliates are leading

underwriter of securities and participate in virtually all securities trading markets in India. We and our affiliates have investment banking and other business relationship with a significant percentage of

companies covered by our Investment Research Department. Our research professionals provide important input into our investment banking and other business selection processes. ICICI Securities

generally prohibits its analysts, persons reporting to analysts and their dependent family members from maintaining a financial interest in the securities or derivatives of any companies that the analysts

cover.

The information and opinions in this report have been prepared by ICICI Securities and are subject to change without any notice. The report and information contained herein is strictly confidential and

meant solely for the selected recipient and may not be altered in any way, transmitted to, copied or distributed, in part or in whole, to any other person or to the media or reproduced in any form, without

prior written consent of ICICI Securities. While we would endeavour to update the information herein on reasonable basis, ICICI Securities, its subsidiaries and associated companies, their directors and

employees (“ICICI Securities and affiliates”) are under no obligation to update or keep the information current. Also, there may be regulatory, compliance or other reasons that may prevent ICICI Securities

from doing so. Non-rated securities indicate that rating on a particular security has been suspended temporarily and such suspension is in compliance with applicable regulations and/or ICICI Securities

policies, in circumstances where ICICI Securities is acting in an advisory capacity to this company, or in certain other circumstances.

This report is based on information obtained from public sources and sources believed to be reliable, but no independent verification has been made nor is its accuracy or completeness guaranteed. This

report and information herein is solely for informational purpose and may not be used or considered as an offer document or solicitation of offer to buy or sell or subscribe for securities or other financial

instruments. Though disseminated to all the customers simultaneously, not all customers may receive this report at the same time. ICICI Securities will not treat recipients as customers by virtue of their

receiving this report. Nothing in this report constitutes investment, legal, accounting and tax advice or a representation that any investment or strategy is suitable or appropriate to your specific

circumstances. The securities discussed and opinions expressed in this report may not be suitable for all investors, who must make their own investment decisions, based on their own investment

objectives, financial positions and needs of specific recipient. This may not be taken in substitution for the exercise of independent judgment by any recipient. The recipient should independently evaluate

the investment risks. The value and return of investment may vary because of changes in interest rates, foreign exchange rates or any other reason. ICICI Securities and affiliates accept no liabilities for any

loss or damage of any kind arising out of the use of this report. Past performance is not necessarily a guide to future performance. Investors are advised to see Risk Disclosure Document to understand the

risks associated before investing in the securities markets. Actual results may differ materially from those set forth in projections. Forward-looking statements are not predictions and may be subject to

change without notice.

ICICI Securities and its affiliates might have managed or co-managed a public offering for the subject company in the preceding twelve months. ICICI Securities and affiliates might have received

compensation from the companies mentioned in the report during the period preceding twelve months from the date of this report for services in respect of public offerings, corporate finance, investment

banking or other advisory services in a merger or specific transaction. ICICI Securities and affiliates expect to receive compensation from the companies mentioned in the report within a period of three

months following the date of publication of the research report for services in respect of public offerings, corporate finance, investment banking or other advisory services in a merger or specific

transaction. It is confirmed that Jitesh Bhanot (ACA) research analysts and the authors of this report have not received any compensation from the companies mentioned in the report in the preceding

twelve months. Our research professionals are paid in part based on the profitability of ICICI Securities, which include earnings from Investment Banking and other business.

ICICI Securities or its subsidiaries collectively do not own 1% or more of the equity securities of the Company mentioned in the report as of the last day of the month preceding the publication of the

research report.

It is confirmed that Jitesh Bhanot (ACA) research analysts and the authors of this report or any of their family members does not serve as an officer, director or advisory board member of the companies

mentioned in the report.

ICICI Securities may have issued other reports that are inconsistent with and reach different conclusion from the information presented in this report. ICICI Securities and affiliates may act upon or make use

of information contained in the report prior to the publication thereof.

This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction, where such distribution,

publication, availability or use would be contrary to law, regulation or which would subject ICICI Securities and affiliates to any registration or licensing requirement within such jurisdiction. The securities

described herein may or may not be eligible for sale in all jurisdictions or to certain category of investors. Persons in whose possession this document may come are required to inform themselves of and

to observe such restriction.

ICICIdirect.com | Equity Research

Page 8

Você também pode gostar

- Sterlite Technologies (STEOPT) : Growth Delayed Long Term Growth IntactDocumento6 páginasSterlite Technologies (STEOPT) : Growth Delayed Long Term Growth IntactAtul RajoraAinda não há avaliações

- JSW Energy: Fully PricedDocumento13 páginasJSW Energy: Fully Pricedmihir_ajAinda não há avaliações

- Bharat Heavy Electricals Limited (BHEL) : Sector StalwartDocumento23 páginasBharat Heavy Electricals Limited (BHEL) : Sector Stalwartshaifali24Ainda não há avaliações

- Voltamp Transformers LTD: Invest ResearchDocumento8 páginasVoltamp Transformers LTD: Invest ResearchDarwish MammiAinda não há avaliações

- Welspun Corp (WELGUJ) : Volumes To Grow, Margins To ContractDocumento6 páginasWelspun Corp (WELGUJ) : Volumes To Grow, Margins To Contract5vipulsAinda não há avaliações

- Adhunik Metaliks Ltd. (ADHMET) : Robust PerformanceDocumento7 páginasAdhunik Metaliks Ltd. (ADHMET) : Robust Performancejassu75Ainda não há avaliações

- Kalpataru Power - 1QFY20 Result - EdelDocumento14 páginasKalpataru Power - 1QFY20 Result - EdeldarshanmadeAinda não há avaliações

- LG Balakrishnan Bros - HSL - 180923 - EBRDocumento11 páginasLG Balakrishnan Bros - HSL - 180923 - EBRSriram RanganathanAinda não há avaliações

- PSP Projects LTD - Q1FY24 Result Update - 28072023 - 28-07-2023 - 10Documento8 páginasPSP Projects LTD - Q1FY24 Result Update - 28072023 - 28-07-2023 - 10samraatjadhavAinda não há avaliações

- Idfc (Idfc) : Strong Growth Ahead, Dilution ExpectedDocumento7 páginasIdfc (Idfc) : Strong Growth Ahead, Dilution ExpectedKaushal KumarAinda não há avaliações

- Kalpataru Power Transmission LTD.: Edelweiss Professional Investor ResearchDocumento19 páginasKalpataru Power Transmission LTD.: Edelweiss Professional Investor ResearchDhavalAinda não há avaliações

- HMCL-20240211-MOSL-RU-PG012Documento12 páginasHMCL-20240211-MOSL-RU-PG012Realm PhangchoAinda não há avaliações

- Coal India Update Drives Profitability With VolumesDocumento12 páginasCoal India Update Drives Profitability With VolumesSandy SandyAinda não há avaliações

- JK Tyres Buy Rating on Rock Bottom Margins, 24% Upside PotentialDocumento8 páginasJK Tyres Buy Rating on Rock Bottom Margins, 24% Upside Potentialvipin51Ainda não há avaliações

- Man Industries LTD.: CMP Rs.58 (2.0X Fy22E P/E) Not RatedDocumento5 páginasMan Industries LTD.: CMP Rs.58 (2.0X Fy22E P/E) Not RatedshahavAinda não há avaliações

- 1 BHEL 13nov23 Kotak InstDocumento10 páginas1 BHEL 13nov23 Kotak InstRajesh SinghAinda não há avaliações

- Deepak Nitrite - FinalDocumento24 páginasDeepak Nitrite - Finalvajiravel407Ainda não há avaliações

- Nomura - May 6 - CEATDocumento12 páginasNomura - May 6 - CEATPrem SagarAinda não há avaliações

- CDSL TP: 750: in Its Own LeagueDocumento10 páginasCDSL TP: 750: in Its Own LeagueSumangalAinda não há avaliações

- DB Corp Limited (DBCORP) : Better-Than-Expected NumbersDocumento5 páginasDB Corp Limited (DBCORP) : Better-Than-Expected Numbersjass200910Ainda não há avaliações

- TVS Motor: New Margin Territory To Expand Valuation FurtherDocumento10 páginasTVS Motor: New Margin Territory To Expand Valuation FurtherSatya JagadishAinda não há avaliações

- CESC Limited: Improving Performance of Subsidiaries Valuation AttractiveDocumento6 páginasCESC Limited: Improving Performance of Subsidiaries Valuation Attractiveiam pruthvi tradingAinda não há avaliações

- Stock Report On JSW Steel in India PDFDocumento8 páginasStock Report On JSW Steel in India PDFPranavPillaiAinda não há avaliações

- Bharti Airtel (BHATE) : Case For A Strong BuyDocumento9 páginasBharti Airtel (BHATE) : Case For A Strong BuyRicha GargAinda não há avaliações

- InvestmentIdea TataMotors041021Documento5 páginasInvestmentIdea TataMotors041021Vaseem KhanAinda não há avaliações

- Star Cement Limited - Q3FY24 Result Update - 09022024 - 09!02!2024 - 11Documento9 páginasStar Cement Limited - Q3FY24 Result Update - 09022024 - 09!02!2024 - 11varunkul2337Ainda não há avaliações

- JM - Jindal SteelDocumento12 páginasJM - Jindal SteelSanjay PatelAinda não há avaliações

- JK Tyre and Industries (JKIND) : High Rubber Prices Eating Into BottomlineDocumento7 páginasJK Tyre and Industries (JKIND) : High Rubber Prices Eating Into Bottomlinejass200910Ainda não há avaliações

- CMP: INR141 TP: INR175 (+24%) Biggest Beneficiary of Improved PricingDocumento10 páginasCMP: INR141 TP: INR175 (+24%) Biggest Beneficiary of Improved PricingPratik PatilAinda não há avaliações

- Unichem Lab (UNILAB) : Riding Strong On Base BusinessDocumento6 páginasUnichem Lab (UNILAB) : Riding Strong On Base Businesscos.secAinda não há avaliações

- Waaree Energies Rating Outlook RevisedDocumento7 páginasWaaree Energies Rating Outlook RevisedKomori YahatruAinda não há avaliações

- ICICI Securities LTD ResultDocumento8 páginasICICI Securities LTD Resultchandan_93Ainda não há avaliações

- Bharat Forge (BHFC IN) : Q4FY21 Result UpdateDocumento6 páginasBharat Forge (BHFC IN) : Q4FY21 Result UpdateEquity NestAinda não há avaliações

- UPL ChokseyDocumento6 páginasUPL Chokseypranab.gupta.kwicAinda não há avaliações

- Sona BLW Precision Forgings: Order Book Leaps New Product Elongates Growth VisibilityDocumento9 páginasSona BLW Precision Forgings: Order Book Leaps New Product Elongates Growth VisibilityVivek S MayinkarAinda não há avaliações

- Poonawalla Fincorp: A Multibagger in the Making (38 charactersDocumento7 páginasPoonawalla Fincorp: A Multibagger in the Making (38 characterssameer bakshiAinda não há avaliações

- Latest Ceat ReportDocumento6 páginasLatest Ceat Reportshubhamkumar.bhagat.23mbAinda não há avaliações

- PC - JSW Q4FY21 Update - May 2021 20210522171333Documento6 páginasPC - JSW Q4FY21 Update - May 2021 20210522171333Aniket DhanukaAinda não há avaliações

- Power Finance Corporation - Elara Securities - 27 June 2023Documento48 páginasPower Finance Corporation - Elara Securities - 27 June 2023SudharsanAinda não há avaliações

- Axis Securities Sees 2% DOWNSIDE in Bajaj Auto Another Robust QuarterDocumento8 páginasAxis Securities Sees 2% DOWNSIDE in Bajaj Auto Another Robust QuarterDhaval MailAinda não há avaliações

- PFC Q1 UpdateDocumento6 páginasPFC Q1 UpdateAjay SolankiAinda não há avaliações

- Oppenheimer RUN RUN Growth Continues With Strong DemandDocumento10 páginasOppenheimer RUN RUN Growth Continues With Strong DemandBrian AhuatziAinda não há avaliações

- Tanla Solutions (TANSOL) : Rebound in Core Business SegmentsDocumento5 páginasTanla Solutions (TANSOL) : Rebound in Core Business SegmentsashishkrishAinda não há avaliações

- Simplex Infrastructures: Performance HighlightsDocumento11 páginasSimplex Infrastructures: Performance Highlightskrishna615Ainda não há avaliações

- DB Corp Limited (DBCORP) : Impressive Ad GrowthDocumento5 páginasDB Corp Limited (DBCORP) : Impressive Ad GrowthIqbal KhanAinda não há avaliações

- Opto Circuits (India) (OPTCIR) : Strong Performance Improves OutlookDocumento4 páginasOpto Circuits (India) (OPTCIR) : Strong Performance Improves OutlookhitpunAinda não há avaliações

- Alkyl Amines Report 2020Documento7 páginasAlkyl Amines Report 2020SRINIVASAN TAinda não há avaliações

- SJVN - Initiating CoverageDocumento15 páginasSJVN - Initiating Coveragesantanu_1310Ainda não há avaliações

- Shiv Vani - IIFLDocumento10 páginasShiv Vani - IIFLjunejagauravAinda não há avaliações

- Cesc - Buy: Demerger in Sight!Documento10 páginasCesc - Buy: Demerger in Sight!AshokAinda não há avaliações

- BGR Energy Delivers Strong Q3 Results But Order Backlog DeclinesDocumento6 páginasBGR Energy Delivers Strong Q3 Results But Order Backlog DeclinesmittleAinda não há avaliações

- PVR LTD: Strong Fundamentals To Withstand UncertaintiesDocumento4 páginasPVR LTD: Strong Fundamentals To Withstand UncertaintiesVinay HonnattiAinda não há avaliações

- KEC International - : Benefit From US$233bn Investment in The T&D SegmentDocumento8 páginasKEC International - : Benefit From US$233bn Investment in The T&D Segmentharshul yadavAinda não há avaliações

- HFCL - Initiating Coverage - KSL 210521Documento14 páginasHFCL - Initiating Coverage - KSL 210521Dhiren DesaiAinda não há avaliações

- MSA 1 Winter 2021Documento12 páginasMSA 1 Winter 2021gohar azizAinda não há avaliações

- Ashok Leyland: Preparing To Reap Fruits When The Recovery StartsDocumento10 páginasAshok Leyland: Preparing To Reap Fruits When The Recovery StartsKiran KudtarkarAinda não há avaliações

- HDFC Securities Sees 24% UPSIDE in IDFC LTDDocumento14 páginasHDFC Securities Sees 24% UPSIDE in IDFC LTDTarunAinda não há avaliações

- Diwali Dhanotsav Portfolio 2023Documento22 páginasDiwali Dhanotsav Portfolio 2023pramodkgowda3Ainda não há avaliações

- Tata Motors LTD: Result Update Aiming Near Net Debt Free (Automotive) by FY24Documento5 páginasTata Motors LTD: Result Update Aiming Near Net Debt Free (Automotive) by FY24Shiv NarangAinda não há avaliações

- Strengthening Fiscal Decentralization in Nepal’s Transition to FederalismNo EverandStrengthening Fiscal Decentralization in Nepal’s Transition to FederalismAinda não há avaliações

- INDIRECT in Excel - Powerful Range ReferencesDocumento1 páginaINDIRECT in Excel - Powerful Range ReferencesKaushal KumarAinda não há avaliações

- Arvind Trade SystemDocumento144 páginasArvind Trade SystemKaushal KumarAinda não há avaliações

- Microsoft Power Query For Excel - Release Notes: System Requirements Known IssuesDocumento4 páginasMicrosoft Power Query For Excel - Release Notes: System Requirements Known IssuesCarlos AyamamaniAinda não há avaliações

- Telemetry in MS OfficeDocumento1 páginaTelemetry in MS OfficekashifnooraniAinda não há avaliações

- Free Excel Tutorials and CoursesDocumento13 páginasFree Excel Tutorials and CoursesKaushal KumarAinda não há avaliações

- Essential Excel FunctionsDocumento21 páginasEssential Excel FunctionsKaushal KumarAinda não há avaliações

- The Trader Business PlanDocumento4 páginasThe Trader Business Planmitesh100% (4)

- Haryana MW W.E.F July 2019Documento4 páginasHaryana MW W.E.F July 2019Kaushal KumarAinda não há avaliações

- Fin 1 PDFDocumento26 páginasFin 1 PDFsurabhi jainAinda não há avaliações

- Gprs SettingDocumento67 páginasGprs Settinghkc_2008Ainda não há avaliações

- ) It'ifi3m, : Bank BarodaDocumento5 páginas) It'ifi3m, : Bank BarodaKaushal KumarAinda não há avaliações

- An Investor Guide To Shareholder Meetings in IndiaDocumento61 páginasAn Investor Guide To Shareholder Meetings in IndiaKaushal KumarAinda não há avaliações

- How to tackle Math Olympiad questions using general practices and specific techniquesDocumento8 páginasHow to tackle Math Olympiad questions using general practices and specific techniquesKaushal KumarAinda não há avaliações

- How to tackle Math Olympiad questions using general practices and specific techniquesDocumento8 páginasHow to tackle Math Olympiad questions using general practices and specific techniquesKaushal KumarAinda não há avaliações

- Durga Chalisa Hindi LyricsDocumento2 páginasDurga Chalisa Hindi LyricsKaushal KumarAinda não há avaliações

- Education Plan Block WiseDocumento2 páginasEducation Plan Block WiseKaushal KumarAinda não há avaliações

- BOB Mbarara QuotationDocumento1 páginaBOB Mbarara QuotationKaushal KumarAinda não há avaliações

- ICICIdirect JaiprakashAssociates Q4FY10Documento8 páginasICICIdirect JaiprakashAssociates Q4FY10Kaushal KumarAinda não há avaliações

- Idfc (Idfc) : Strong Growth Ahead, Dilution ExpectedDocumento7 páginasIdfc (Idfc) : Strong Growth Ahead, Dilution ExpectedKaushal KumarAinda não há avaliações

- Project Report PDFDocumento13 páginasProject Report PDFAparnaAinda não há avaliações

- Financial and Management Accounting-1 PDFDocumento108 páginasFinancial and Management Accounting-1 PDFAugastusBwalyaLombeAinda não há avaliações

- Draft Resolution For Society-TrustDocumento2 páginasDraft Resolution For Society-Trustammaiappar0% (2)

- Auditing Theory EssentialsDocumento4 páginasAuditing Theory EssentialsZvioule Ma FuentesAinda não há avaliações

- CHAPTER 9 - Earnings Management SummaryDocumento3 páginasCHAPTER 9 - Earnings Management SummaryVanadisa SamuelAinda não há avaliações

- Group 7 - FPT - Financial AnalysisDocumento2 páginasGroup 7 - FPT - Financial AnalysisNgọcAnhAinda não há avaliações

- Bond Valuation 1Documento37 páginasBond Valuation 1Nitesh SolankiAinda não há avaliações

- Equity Note - Aftab Automobiles Limited - March 2017Documento2 páginasEquity Note - Aftab Automobiles Limited - March 2017Sarwar IqbalAinda não há avaliações

- Libroalex145pags PDFDocumento145 páginasLibroalex145pags PDFAlexander Orjuela MárquezAinda não há avaliações

- Greg Simon #1 v7Documento9 páginasGreg Simon #1 v7ogangurelAinda não há avaliações

- Managing the Finance Function for Engineering FirmsDocumento6 páginasManaging the Finance Function for Engineering FirmsGillianne Mae VargasAinda não há avaliações

- Ch16 Salvatore PPPDocumento40 páginasCh16 Salvatore PPPRyan J Anward0% (1)

- A Study On The Effect of Working Capital On The Firm'S Profitability of InfosysDocumento11 páginasA Study On The Effect of Working Capital On The Firm'S Profitability of InfosysDr Abhijit ChakrabortyAinda não há avaliações

- Richard Branson's Adversity Led to Virgin Business OpportunitiesDocumento25 páginasRichard Branson's Adversity Led to Virgin Business OpportunitiesjayannaparkAinda não há avaliações

- Powerol - Monthly MIS FormatDocumento34 páginasPowerol - Monthly MIS Formatdharmender singhAinda não há avaliações

- Ecofys 2014 Potential For Shore Side Electricity in EuropeDocumento111 páginasEcofys 2014 Potential For Shore Side Electricity in EuropeCarlos DiazAinda não há avaliações

- Icici Cheque PayinslipDocumento1 páginaIcici Cheque PayinslipSHAM LAL0% (1)

- Lecture 2a - Construction EquipmentDocumento37 páginasLecture 2a - Construction EquipmentLouise Luy100% (1)

- 4th Complt Ist Fed PT 1Documento40 páginas4th Complt Ist Fed PT 1piratetwinsAinda não há avaliações

- Blackstone Engagement Letter PDFDocumento21 páginasBlackstone Engagement Letter PDFtanveertk100% (2)

- Marketing Chapter NineDocumento35 páginasMarketing Chapter Ninenupurk890% (1)

- Odel AssignmentDocumento13 páginasOdel Assignmentsam71367% (3)

- Introduction To Financial StatementsDocumento10 páginasIntroduction To Financial StatementsRalph H. VillanuevaAinda não há avaliações

- RH Perennial - Nov 21Documento46 páginasRH Perennial - Nov 21sambitAinda não há avaliações

- 2011 Kenya Budget NewsletterDocumento9 páginas2011 Kenya Budget NewsletterImran OsmanAinda não há avaliações

- Final Non Budgetary KrasDocumento548 páginasFinal Non Budgetary KrasRakesh KushwahaAinda não há avaliações

- Dividend PolicyDocumento45 páginasDividend PolicyBusHra Alam0% (1)

- Assigment Financial ManagementDocumento5 páginasAssigment Financial ManagementMuhammad A IsmaielAinda não há avaliações

- FinCap Solar Power SolutionsDocumento2 páginasFinCap Solar Power SolutionspkchandaliaAinda não há avaliações