Escolar Documentos

Profissional Documentos

Cultura Documentos

Test One

Enviado por

Yusuf Hussein0 notas0% acharam este documento útil (0 voto)

18 visualizações8 páginastest one

Direitos autorais

© © All Rights Reserved

Formatos disponíveis

DOCX, PDF, TXT ou leia online no Scribd

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentotest one

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato DOCX, PDF, TXT ou leia online no Scribd

0 notas0% acharam este documento útil (0 voto)

18 visualizações8 páginasTest One

Enviado por

Yusuf Husseintest one

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato DOCX, PDF, TXT ou leia online no Scribd

Você está na página 1de 8

Test One

Part One: Set up Company Information

Create Company (Final Exam Group B).

Fill the necessary fields.

Business form: Partnership.

Chart of accounting: Manufacturing Company.

Accounting Method: Accruals.

Posting Method: Real Time.

Accounting period: Three months from Oct 2008.

Part Two: Beg. Balance

Petty Cash 60.00

Cash on Hand 45,000.00

Furniture Original Value 13,000.00

Equipments 25,000.00

Maxed Capital Investment 42,060.00

Nahiil Capital Investment 41,000.00

Part Three: Create Customers With Terms

Sn Cu IDCustomer Name Terms

1 CC01 Rammad Group Company 3/40 net 90

2 CC02 Bilaal Company 2/10 net 30

3 CC03 Cash Customer No Terms

Part Four: Create Vendors with Terms

Sn Ve ID Vendor Name Terms

1 VC01 Hilaal Company 2/10 net 30

2 VC02 Luula Company 2/15 net 35

3 VC03 Cash Vendor No Terms

Part Five: Create Inventories

S Product ID Product Name

n

1 PRC01 Bur

2 PRC02 Bariis

3 PRC03 Baasto

Part Six: Set up the components of the Assembly and Assembly Item

Sn Pro ID Product Name Unit Cost

1 PRC04 Sonkor $ 1.00

2 PRC05 Biyo $ 0.6

3 PRC06 Babaay $ 0.3

4 PRC07 Zeytuun $ 0.2

5 PRC08 Cambe $ 0.2

6 PRC09 Qare $ 0.4

7 AssC01 Mushakal

One Liter mushakal contains the following

PRC04 Sonkor 0.5 Kg

PRC05 Biyo 1 Liter

PRC06 Babaay 3 Pc

PRC07 Zeytuun 12 Pc

PRC08 Cambe 4 Pc

PRC09 Qare 2 Pc

Part eight : Daily Activities (Transactions)

On Oct 01 received cash from fund donation amount $3600

On Oct 02 paid office equipment $500 for training phase.

On Oct 02 purchased Bur Quantity 350 sack Cost per sack $12.5 from Hilaal

Company on account.

On Oct 05 paid Employee advance. $100 for Nuur Ali and $50 Caasho Nuur.

On Oct 10 paid $250 cash for Maxed and $300 Nahiil for personal use

On Oct 12 paid car rent amount $50 for implementation phase.

On Oct 15 purchased equipment for cash amount $1050 for training.

On Oct 16 paid labor fees amount $500 for implementation phase

On Oct 16 paid $150 rent for three months

On Oct 17 sold Bur Quantity 250 sack price $18 for Bilaal Company

On Oct 20 paid car rent amount $100 for training phase

On Oct 25 paid labor fees amount $500 for training phase

On Oct 28 paid $800 cash material used for training phase

On Oct 30 paid $ 100 cash car rent for training phase

On Nov 05 Received $4500 cash from service performed

On Nov 09 purchased office supplies by cash amount $500.

On Nov 10 purchased Bariis Quantity 200 Sack cost per sack $15 from Luula

Company

On Nov 15 purchased Baasto Quantity 100 Carton cost per Carton $10 for Cash.

From Cash Vendor.

On Nov 20 sold Baasto Quantity 90 Carton price $15 for cash to cash customer.

On Nov 25 sold Bariis Quantity 150 sack price $20 on credit to Rammad Group

Company.

On Nov 26 Received all cash from Rammad Group Company.

On Nov 27 paid cash to luula Comapany amount $3000.

On Dec 05 received $10,000 cash from service performed

On Dec 10 paid all employee salaries (previous month)

On Dec 11 purchase all goods needed to prepare 70 liter Mushakal as assemble

from Luula Company on account.

On Dec 12 Production Department prepared 50 Liter of Mushakal as Assembly

On Dec 15 sold 40 liter Mushakal for cash customer on Cash (Sales price is Cost

of Row material Plus 70% mark up).

On Dec 20 Received $2500 cash from Nahiil Additional Investment

On Dec 22 paid Employee advance $50 for Xasan Samater and $150 for Nuur Ali.

On Dec 25 production Department Prepared 20 Liter of Mushakal as Assembly.

On Dec 29 Sold 25 Liter of Mushakal for Bilaal Company on account. (Sales

prices is Cost of Row materials Plus 70% mark up).

Instructions

Prepare all Adjusting Entries (Office Supplies $390 were used).

Prepare Physical Inventories (On hand Bur 98 Sack, On hand Bariis 50 Sack

and Baasto 12 Cartons).

Prepare Inventories on hand Reports

Prepare Customer balances.

Prepare Vendor Balances.

Prepare Adjusted Trial balance (General Ledger Trial Balance).

Prepare job Ledger.

Prepare Balance sheet.

Prepare Income Statement.

Close the fiscal year and modify the next fiscal year do not purge the

transactions.

Distribute the Net income/Net Loss to the Owners (Journalize and post).

Prepare Post Closing Trial balance (General Ledger Trial Balance).

Prepare The Last Balance sheet.

(Convert the reports to Excel and save the desktop for your folder).

Test Two

Part One: Set up Company Information

Create Company (Final Exam Group B).

Fill the necessary fields.

Business form: Partnership.

Chart of accounting: Manufacturing Company.

Accounting Method: Accruals.

Posting Method: Real Time.

Accounting period: Three months from April 2007.

Part Two: Beg. Balance

Petty Cash 150.00

Cash on Hand 50,000.00

Computer Original Value 1,200.00

Equipments 15,200.00

Luula Capital Investment 30,000.00

Liiban Capital Investment 36,550.00

Part Three: Create Customers With Terms

Sn Cu ID Customer Name Terms

1 CC01 Bilaad Group Company 2/10 net 90

2 CC02 Al Nasri Company 2/10 net 30

3 CC03 Cash Customer No Terms

Part Four: Create Vendors with Terms

Sn Ve ID Vendor Name Terms

1 VC01 Al Hijra Company 2/10 net 30

2 VC02 Subeyr Company 2/15 net 35

3 VC03 Cash Vendor No Terms

Part Five: Create Inventories

S Product ID Product Name

n

1 PRC01 Saliid

2 PRC02 Bariis

3 PRC03 Sonkor

Part Six: Set up the components of the Assembly and Assembly Item

Sn Pro ID Product Name Unit Cost

1 PRC04 Alwaax $ 5.00

2 PRC05 Safiito $ 2.5

3 PRC06 Koolo $2

4 PRC07 Masaamiir $ 0.1

5 PRC08 Istuuko $1

6 PRC09 Rinji $4

7 AssC01 Armaajo

One Armaajo contains the following

PRC04 Alwaax 5

PRC05 safiito 8

PRC06 koolo 3

PRC07 Masaamiir 150

PRC08 Istuuko 2

PRC09 Rinji 1

Part Seven: Set up Payroll

S E ID Emp Pay Frequenc Gross Regula Over Special

n Name y r time

1 EmC0 Ali Nuur Salary Monthly

1

2 EmC0 Nimca Salary Monthly

2 Xasan

3 EmC0 Xasan Hourl Monthly $4 $5 $6

3 Aadan y

Part Eight: Set up Fixed Assets

Ass ID Description Cost Salvage Life Method

Value

1 Computer $1,200. 100 10 SLFM

years

2 Equipment $15,200 200 9 year SLFM

Part Nine Job Costing

Prepare job (Seminar) using phases and Cost coding

Phases

Phase Code Phase type

PHC01 Training

PHC02 Implementation

Cost Codes

Cost Code Cost Code Account Cost Code Type

CC01 Labor Labor

CC02 Material Material

CC03 Equipment Equipment

CC04 Others Others

CC05 Subcontract Subcontract

Part Ten: Daily Activities (Transactions)

On April 01 received cash from fund donation amount $1,200

On April 02 paid office equipment $100 for training phase.

On April 02 purchased Sonkor Quantity 450 sack Cost per sack $12 from AL Hijra

Company on account.

On April 05 paid Employee advance. $50 for Ali Nuur and $50 Nimca Xasan.

On April 10 paid $500 cash for Luula and $400 Liiban for personal use

On April 12 paid car rent amount $90 for implementation phase.

On April 15 purchased equipment for cash amount $160 for training.

On April 16 paid labor fees amount $200 for implementation phase

On April 16 paid $300 rent for three months

On April 17 sold Sonkor Quantity 420 sack price $19 for Al Nasri Company

On April 20 paid car rent amount $100 for training phase

On April 25 paid labor fees amount $300 for training phase

On April 28 paid $200 cash material used for training phase

On April 29 paid $ 50 cash car rent for training phase

On April 30 received the following payroll sheet and paid for cash.

S E ID Emp Pay Frequenc Gross Regula Over Special

n Name y r time

1 EmC0 Ali Nuur Salary Monthly $300

1

2 EmC0 Nimca Salary Monthly $500

2 Xasan

3 EmC0 Xasan Hourl Monthly 60 15 6

3 Aadan y

On May 05 Received $5500 cash from service performed

On May 09 purchased office supplies by cash amount $600.

On May 10 purchased Bariis Quantity 100 Sack cost per sack $17 from Al Hijra

Company

On May 15 purchased Saliid Quantity 120 Carton cost per Carton $10 for Cash,

From Cash Vendor.

On May 20 sold Bariis Quantity 90 sack price $20 for cash to cash customer.

On May 25 sold Saliid Quantity 115 Carton price $15 on credit to Al Nasri

Company.

On May 26 received all cash from al Nasri Company.

On May 27 paid cash to Al Hijra Comapany amount.

On May 31 received payroll sheet as following but not paid

S E ID Emp Pay Frequenc Gross Regula Over Special

n Name y r time

1 EmC0 Ali Nuur Salary Monthly $300

1

2 EmC0 Nimca Salary Monthly $500

2 Xasan

3 EmC0 Xasan Hourl Monthly 65 20

3 Aadan y

On Jun 05 received $12,000 cash from service performed

On Jun 10 paid all employee salaries (previous month)

On Jun 11 purchase all goods needed to prepare 50 Armaajo as assemble from Al

Hijra Company on account.

On Jun 12 Production Department prepared 30 Armaajo as Assembly

On Jun 15 sold 20 liter Armaajo for cash customer on Cash (Sales price is Cost of

Row material Plus 80% mark up).

On Jun 20 Received $3500 cash from Liiban Addition Investment

On Jun 22 paid Employee advances $150 for Ali Nur and $250 for Nimca Xasan.

On Jun 25 production Department Prepared 20 Armaajo as Assembly.

On Jun 29 Sold 25 Armaajo for Bilaal Company on account. (Sales prices is Cost

of Row materials Plus 80% mark up).

On Jun 31 received the following payroll sheet and paid for cash

S E ID Emp Pay Frequenc Gross Regula Over Special

n Name y r time

1 EmC0 Ali Nuur Salary Monthly $300

1

2 EmC0 Nimca Salary Monthly $500

2 Xasan

3 EmC0 Xasan Hourl Monthly 70 30 5

3 Aadan y

Instructions

Prepare all Adjusting Entries (Office Supplies $410 were used).

Prepare Physical Inventories (On hand Sonkor 30 Sack, On hand Bariis 12

Sack and Saliid 2 Cartons).

Prepare Inventories on hand Reports

Prepare Customer balances.

Prepare Vendor Balances.

Prepare Adjusted Trial balance (General Ledger Trial Balance).

Prepare job Ledger

Prepare Unbilled Job Expense.

Prepare Balance sheet.

Prepare Income Statement.

Close the fiscal year and modify the next fiscal year do not purge the

transactions.

Distribute the Net income/Net Loss to the Owners (Journalize and post).

Prepare Post Closing Trial balance (General Ledger Trial Balance).

Prepare The Last Balance sheet.

(Convert the reports to Excel and save the desktop for your folder).

Você também pode gostar

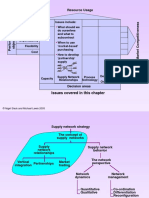

- Resource Usage: Issues Covered in This ChapterDocumento21 páginasResource Usage: Issues Covered in This ChapterYusuf HusseinAinda não há avaliações

- Ch02 LeadershipDocumento60 páginasCh02 LeadershipYusuf HusseinAinda não há avaliações

- Statistics and Research MethodsDocumento5 páginasStatistics and Research MethodsYusuf HusseinAinda não há avaliações

- Acc 255 Final Exam Review Packet (New Material)Documento6 páginasAcc 255 Final Exam Review Packet (New Material)Tajalli FatimaAinda não há avaliações

- QuizzDocumento1 páginaQuizzYusuf HusseinAinda não há avaliações

- Format of The ResearchDocumento2 páginasFormat of The ResearchYusuf HusseinAinda não há avaliações

- Lesson ThreeDocumento14 páginasLesson ThreeYusuf HusseinAinda não há avaliações

- Final Exam Research Methods ANTH 410/510Documento7 páginasFinal Exam Research Methods ANTH 410/510Yusuf HusseinAinda não há avaliações

- Linear Regression Is An Important Concept in Finance and Practically All Forms of ResearchDocumento10 páginasLinear Regression Is An Important Concept in Finance and Practically All Forms of ResearchYusuf HusseinAinda não há avaliações

- Lec 1 - Introduction To Wireless CommunicationDocumento60 páginasLec 1 - Introduction To Wireless CommunicationYusuf HusseinAinda não há avaliações

- Exam 2 Sample SolutionDocumento6 páginasExam 2 Sample SolutionYusuf HusseinAinda não há avaliações

- RSH - Qam11 - Excel and Excel QM Explsm2010Documento153 páginasRSH - Qam11 - Excel and Excel QM Explsm2010Yusuf HusseinAinda não há avaliações

- Except The: Income Sharing RatioDocumento1 páginaExcept The: Income Sharing RatioYusuf HusseinAinda não há avaliações

- Abdc Journal Quality List 2013Documento32 páginasAbdc Journal Quality List 2013PratikJainAinda não há avaliações

- BankingDocumento20 páginasBankingYusuf HusseinAinda não há avaliações

- Data and Process Modeling: Husein OsmanDocumento17 páginasData and Process Modeling: Husein OsmanYusuf HusseinAinda não há avaliações

- Chapter Four: Entering Beginning BalancesDocumento4 páginasChapter Four: Entering Beginning BalancesYusuf HusseinAinda não há avaliações

- Yaaqshiid: 1 Xaafadaha, Laamaha Iyo Waax-AhaDocumento4 páginasYaaqshiid: 1 Xaafadaha, Laamaha Iyo Waax-AhaYusuf HusseinAinda não há avaliações

- Example DVDDocumento17 páginasExample DVDYusuf HusseinAinda não há avaliações

- Accounting for Islamic Banks: Mudharabah FinancingDocumento32 páginasAccounting for Islamic Banks: Mudharabah FinancingYusuf Hussein40% (5)

- Ackoff's Management Misinformation SystemsDocumento5 páginasAckoff's Management Misinformation SystemsAnna KarousiotiAinda não há avaliações

- Chapter EightDocumento11 páginasChapter EightYusuf HusseinAinda não há avaliações

- Capital BudgetDocumento124 páginasCapital BudgetYusuf HusseinAinda não há avaliações

- Chapter 1Documento29 páginasChapter 1Yusuf Hussein100% (2)

- Islamic Banking Ideal N RealityDocumento19 páginasIslamic Banking Ideal N RealityIbnu TaimiyyahAinda não há avaliações

- 6 - 2 - Lectures NotesDocumento103 páginas6 - 2 - Lectures NotesYusuf HusseinAinda não há avaliações

- Key Concepts: Week 5 Lesson 3: Economic Order Quantity (EOQ) ExtensionsDocumento5 páginasKey Concepts: Week 5 Lesson 3: Economic Order Quantity (EOQ) ExtensionsYusuf HusseinAinda não há avaliações

- Simplex Method Solves Linear Programming ProblemsDocumento34 páginasSimplex Method Solves Linear Programming ProblemsYusuf HusseinAinda não há avaliações

- Mcom Ac Paper IIDocumento282 páginasMcom Ac Paper IIAmar Kant Pandey100% (1)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5782)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (119)

- HR & Training Professional with 13+ Years ExperienceDocumento4 páginasHR & Training Professional with 13+ Years ExperienceIm__NehaThakurAinda não há avaliações

- SWM V1i1 BrazilDocumento92 páginasSWM V1i1 BraziltevissampleAinda não há avaliações

- JoB rOtaTiONDocumento9 páginasJoB rOtaTiONBuddha 2.OAinda não há avaliações

- Growing Importance of Green Economy for BusinessDocumento15 páginasGrowing Importance of Green Economy for BusinesssinghsanyaAinda não há avaliações

- Alfred Marshall'sDocumento25 páginasAlfred Marshall'snytAinda não há avaliações

- Explain The History of Operations ManagementsDocumento4 páginasExplain The History of Operations ManagementsasmatarannumAinda não há avaliações

- ACCT 4410-Wk3a-Salaries-Scope of Charge+Source of Income (2020S)Documento25 páginasACCT 4410-Wk3a-Salaries-Scope of Charge+Source of Income (2020S)Elaine LingxAinda não há avaliações

- Labor Union Personality Despite DisaffiliationDocumento3 páginasLabor Union Personality Despite DisaffiliationDeaAinda não há avaliações

- Business Writing SkillsDocumento99 páginasBusiness Writing SkillsvijayAinda não há avaliações

- IrmaDocumento221 páginasIrmaSaket BanteAinda não há avaliações

- MBA 106 - Human Resource ManagementDocumento8 páginasMBA 106 - Human Resource ManagementRahul YadavAinda não há avaliações

- Angel 1Documento4 páginasAngel 1Angel gargarAinda não há avaliações

- Things To Remember Approvals Will Only Be Applicable For Payroll Transfer Cases. No Email Follow Ups RequiredDocumento10 páginasThings To Remember Approvals Will Only Be Applicable For Payroll Transfer Cases. No Email Follow Ups RequiredVaibhav MAinda não há avaliações

- Yethi Consulting Private Limited: Signature Not VerifiedDocumento6 páginasYethi Consulting Private Limited: Signature Not VerifiedmanishAinda não há avaliações

- Lakehouse Hotel Job Appointment Offer Letter To Mr. Kumar PradeepDocumento2 páginasLakehouse Hotel Job Appointment Offer Letter To Mr. Kumar PradeepPradeep Singh TomarAinda não há avaliações

- 1 Introduction To Accounting Concepts and Structure UDDocumento9 páginas1 Introduction To Accounting Concepts and Structure UDERICK MLINGWAAinda não há avaliações

- Policing Mergers - Remedies & ProcedureDocumento36 páginasPolicing Mergers - Remedies & ProcedureSurya KumarAinda não há avaliações

- SAP Brazil Localization PortfolioDocumento31 páginasSAP Brazil Localization Portfoliosatishkr14Ainda não há avaliações

- How To Write Job OfferDocumento24 páginasHow To Write Job Offerm_moiceanuAinda não há avaliações

- Comb Merit PRT JR Engineer ElectricalDocumento18 páginasComb Merit PRT JR Engineer Electricalrampw14581Ainda não há avaliações

- A Tracer Study On The Employment Status 1Documento64 páginasA Tracer Study On The Employment Status 1Lei DiAinda não há avaliações

- CH 5Documento31 páginasCH 5a.vidyanandAinda não há avaliações

- Learn Legal English in 40 StepsDocumento119 páginasLearn Legal English in 40 StepsLan Anh HoaAinda não há avaliações

- SB3 Audio ScriptDocumento14 páginasSB3 Audio ScriptThanh ThuyAinda não há avaliações

- Taking Risks and Making Profits Within The Dynamic Business EnvironmentDocumento46 páginasTaking Risks and Making Profits Within The Dynamic Business EnvironmentMhmd KaramAinda não há avaliações

- Pension Withdrawal GuideDocumento6 páginasPension Withdrawal GuideKathleen Catubay SamsonAinda não há avaliações

- Court upholds service incentive leave for bus driverDocumento5 páginasCourt upholds service incentive leave for bus drivercha chaAinda não há avaliações

- Labor Cases Digest KCD1Documento2 páginasLabor Cases Digest KCD1Ka RenAinda não há avaliações

- CF Fcs Advancednutritionwellness1Documento5 páginasCF Fcs Advancednutritionwellness1api-243920578Ainda não há avaliações

- Supreme Court upholds regular status of employee dismissed after demanding regularizationDocumento10 páginasSupreme Court upholds regular status of employee dismissed after demanding regularizationEddie LeeakaAinda não há avaliações