Escolar Documentos

Profissional Documentos

Cultura Documentos

CWTSP 4.8 03-18-20 at 103 - 2017.05.02

Enviado por

pempekplgTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

CWTSP 4.8 03-18-20 at 103 - 2017.05.02

Enviado por

pempekplgDireitos autorais:

Formatos disponíveis

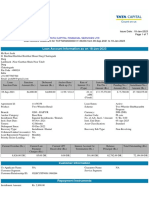

FOR REFERENCE ONLY Bloomberg

Bond to Eq Ticker:

Previous

CWTCoupon

SP Settle Date: 3/18/2017 Month/Day/Year

ISIN: SG6WA5000004 Issuer Parent Company Ticker: CWT SP Trade Date: 5/2/2017

Bond Code: CWTSP 4.8 03/18/20 CWTSP

Parent4.8

Ticker

03-18-20

and Exchange: CWT SP Settlement Date: 5/5/2017

CWTSP 4.8 03/18/20 MTN Ultimate

CWTSPParent

4.8 03.18.20

Company MTN

Ticker: CWT SP

Description

CWT Limited is a supply chain engineering company which provides integrated Sector: Industrials

logistics solutions across multiple markets and geographies. The Company Industry: Air Freight & Logistics

also provides commodity marketing, engineering and financial services Sub-Industry: Air Freight & Logistics

ancillary to its core logistics business. Modified Duration: 2.639

OCBC Issuer Rating: N (as of Dec 2016)

OCBC Issue Rating: N (as of Dec 2016)

Issue Details ###

Issuer Name: CWT Ltd Date Coupon Amount Nominal Amount

Guarantor: N.A. 18-Sep-17 6,049.32

Country of Issue SINGAPORE 18-Mar-18 5,950.69

Country of Risk SG 18-Sep-18 6,049.32

Currency SGD 18-Mar-19 5,950.69

Coupon Rate 4.800% 18-Sep-19 6,049.32

Coupon Type FIXED 18-Mar-20 5,983.56 250,000.00

Coupon Frequency S/A

Issue Date (Month/Day/Year) 3/18/2015

Call Date (Month/Day/Year) N.A.

Maturity 3/18/2020

Years to Next Call #VALUE!

Years to Maturity 2.88

Collateral Type SR UNSECURED

Rating (S & P) N.A.

Rating (Moody's) N.A.

Rating (Fitch) N.A.

Outstanding Issue Size 100,000,000

Minimum Amount 250,000

Incremental Amount 250,000

Stock Exchanges listed on SGX-ST

##

Indicative Subscription Details

Indicative Client Price 103.000 Cashflow SGD 36,032.88 SGD 250,000.00

Indicative Yield to Call N.A.

Indicative Yield to Maturity 3.69%

Nominal Amount 250,000.00

Principal Amount (P) 257,500.00

Accrued Interest (AI) (48 Days) ($32.88 per day) 1,578.08

Total Settlement Amount (P+AI) 259,078.08 Total Cashflow SGD 286,032.88

Net Cash Return SGD 26,954.79

Remarks

N.A.

Coupon Schedule STRUCTURED_NOTE_CPN_FORMULA

Date Formula Day Count Freq N.A. Index Value: #N/A Invalid Security%

N.A. #N/A

#N/A

N/AN/A Index Name: #N/A Field Not Applicable =

#N/A

#N/A

N/AN/A #N/A Invalid Security

#N/A N/A

Disclaimer:

This document is published for information purposes only and does not represent a solicitation to deal in the instruments described. While the information

given is believed to be reliable, OCBC Bank and its' affiliates cannot guarantee its accuracy or completeness, and accepts no responsibility whatsoever

(including any loss suffered by any company or other person) resulting from any company or other person trading on its basis. OCBC Bank may have

positions in or options on the securities mentioned herein which may change at any time. Source: Bloomberg.

Você também pode gostar

- Visha LDocumento2 páginasVisha LUbed QureshiAinda não há avaliações

- Venugopal Invesco PDFDocumento2 páginasVenugopal Invesco PDFV. Manohar LallAinda não há avaliações

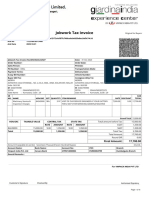

- Tax InvoiceDocumento1 páginaTax InvoiceOnline tally guideAinda não há avaliações

- Assignment 03 Tam3535-Management Studies: R.A.D.S.Niwarthana Center-Colombo DUE-DATE-12/13/2022Documento7 páginasAssignment 03 Tam3535-Management Studies: R.A.D.S.Niwarthana Center-Colombo DUE-DATE-12/13/2022K.A.S.A.pierisAinda não há avaliações

- Statement ReportDocumento7 páginasStatement ReportRahulMahajanAinda não há avaliações

- Quote - AFS AGRA KLNDocumento1 páginaQuote - AFS AGRA KLNSatishAinda não há avaliações

- SIBARAMDocumento1 páginaSIBARAMDanara PatelAinda não há avaliações

- SV Roofing-13Documento1 páginaSV Roofing-13bikkumalla shivaprasadAinda não há avaliações

- Laporan Bank Harian Pt. Bintang Laju Samudra Periode April 2018Documento8 páginasLaporan Bank Harian Pt. Bintang Laju Samudra Periode April 2018Budi YantoAinda não há avaliações

- Tax Invoice SteepDocumento1 páginaTax Invoice SteepRamesh GopeAinda não há avaliações

- Sambhav Electronics Provisional Balance SheetDocumento3 páginasSambhav Electronics Provisional Balance SheetSonu YadavAinda não há avaliações

- TaskDocumento1 páginaTaskPawan KeswaniAinda não há avaliações

- Tax Invoice: GSTIN/UIN: 29BISPK3225J1ZT State Name: Karnataka, Code: 29Documento1 páginaTax Invoice: GSTIN/UIN: 29BISPK3225J1ZT State Name: Karnataka, Code: 29sudheer kulkarniAinda não há avaliações

- Accounting Voucher 66Documento1 páginaAccounting Voucher 66PRAVEEN KUMARAinda não há avaliações

- MTL Table Format DraftDocumento23 páginasMTL Table Format DraftDitto AdianantaAinda não há avaliações

- ACFrOgCK6mbpTQpMjmfJDirQoQcokwuy3ZzI4enlXOCp-jJ4LN2T8y4qy_9_Dnoh6s8DUm3Nd9Y3ee6q9G8dm4pkOvJMC8HeEbP4XneEFBQQJDKSNj79qV_vdtemynmTimzDWCZ1HELQBUaLN91QDocumento5 páginasACFrOgCK6mbpTQpMjmfJDirQoQcokwuy3ZzI4enlXOCp-jJ4LN2T8y4qy_9_Dnoh6s8DUm3Nd9Y3ee6q9G8dm4pkOvJMC8HeEbP4XneEFBQQJDKSNj79qV_vdtemynmTimzDWCZ1HELQBUaLN91Qanupamdas12111987Ainda não há avaliações

- Soa Mftecvlons00000520xxxx 18042023 1681800203755Documento8 páginasSoa Mftecvlons00000520xxxx 18042023 1681800203755mohan MudhirajAinda não há avaliações

- E-Banking Ref No: 16-Sep-2019 To Date: 16-Sep-2019Documento1 páginaE-Banking Ref No: 16-Sep-2019 To Date: 16-Sep-2019amalendu sundar mandalAinda não há avaliações

- Reclass of GST For Rental - Motor VehicleDocumento3 páginasReclass of GST For Rental - Motor VehicletiyanlelasAinda não há avaliações

- Tax Invoice DetailsDocumento1 páginaTax Invoice DetailsPoonam RaiAinda não há avaliações

- RHCC Meeting Expense ReportDocumento4 páginasRHCC Meeting Expense ReportAlphaj Yazor MaseeḥAinda não há avaliações

- Tax Invoice CGST SGST Filing FeesDocumento1 páginaTax Invoice CGST SGST Filing FeesDhaval VisariaAinda não há avaliações

- Request For Quotation: Lgu - TampilisanDocumento17 páginasRequest For Quotation: Lgu - TampilisanMary Jane Katipunan CalumbaAinda não há avaliações

- Das BrothersDocumento1 páginaDas BrothersSUJOY DEBNATHAinda não há avaliações

- Repayment ReportDocumento1 páginaRepayment ReportGanesh PeketiAinda não há avaliações

- Computation Sheet BreakdownDocumento1 páginaComputation Sheet BreakdowndianepundavelaAinda não há avaliações

- Weekly Ledger 20230506 V823020664Documento3 páginasWeekly Ledger 20230506 V823020664Mrinal PandeyAinda não há avaliações

- Folio No. 9104 4783 646: Account SummaryDocumento2 páginasFolio No. 9104 4783 646: Account SummarySaurabh BansalAinda não há avaliações

- BillDocumento1 páginaBillritikbhatia530Ainda não há avaliações

- Tax Invoice: Easymix Concrete Solution 1 1-Feb-2023Documento1 páginaTax Invoice: Easymix Concrete Solution 1 1-Feb-2023amit chouguleAinda não há avaliações

- Mutual FundDocumento1 páginaMutual FundAmith NMAinda não há avaliações

- GR1RI2223197823Documento1 páginaGR1RI2223197823fohivep503Ainda não há avaliações

- Fyers Securities Private Limited: Rahul Kumar Gupta FR2162 Bangalore Branch Code: Branch NameDocumento1 páginaFyers Securities Private Limited: Rahul Kumar Gupta FR2162 Bangalore Branch Code: Branch NameAbhishek GuptaAinda não há avaliações

- MP 1451 23 24Documento1 páginaMP 1451 23 24minarplastic200Ainda não há avaliações

- News Release CFP 20220905 2208220701 EngDocumento4 páginasNews Release CFP 20220905 2208220701 EngAnnabelle chanelAinda não há avaliações

- Debit/Credit Memo Debit/Credit Memo: Lcs Caraga Distributor Inc. Lcs Caraga Distributor IncDocumento1 páginaDebit/Credit Memo Debit/Credit Memo: Lcs Caraga Distributor Inc. Lcs Caraga Distributor IncJames IgayAinda não há avaliações

- StatementDocumento10 páginasStatementchefrinkuAinda não há avaliações

- Export Invoice for Iron Ore PelletsDocumento1 páginaExport Invoice for Iron Ore PelletsPunyasloka RayAinda não há avaliações

- E Servey InvoiceDocumento1 páginaE Servey InvoicesagarAinda não há avaliações

- Axis Mutual Fund PDFDocumento2 páginasAxis Mutual Fund PDFSunil KoricherlaAinda não há avaliações

- Tax InvoiceDocumento1 páginaTax Invoicepiyush1809Ainda não há avaliações

- Loan StatementDocumento3 páginasLoan StatementNityananda SahuAinda não há avaliações

- Accounting Voucher Aluminium GlassDocumento1 páginaAccounting Voucher Aluminium GlassPRIYA KUMARIAinda não há avaliações

- Networking equipment proforma invoiceDocumento1 páginaNetworking equipment proforma invoiceTula rashi videosAinda não há avaliações

- Receivables Open Items ReportDocumento61 páginasReceivables Open Items ReportShakhir MohunAinda não há avaliações

- Waterfront Philippines, Inc - Sec Form 17-Q RevisedDocumento28 páginasWaterfront Philippines, Inc - Sec Form 17-Q Reviseddawijawof awofnafawAinda não há avaliações

- Sample CD LadderDocumento6 páginasSample CD Ladderbee benAinda não há avaliações

- Raazshaw23 1631293910741Documento3 páginasRaazshaw23 1631293910741Gaurav ShawAinda não há avaliações

- SOAFin One in PDFDocumento4 páginasSOAFin One in PDFSohel RanaAinda não há avaliações

- Tax Invoice: 34 Rath Danga Road Ranaghat Gstin/Uin: 19BYRPS9845M1ZZ State Name: West Bengal, Code: 19Documento1 páginaTax Invoice: 34 Rath Danga Road Ranaghat Gstin/Uin: 19BYRPS9845M1ZZ State Name: West Bengal, Code: 19Online tally guideAinda não há avaliações

- Weekly Ledger 20230506 V 823020664Documento3 páginasWeekly Ledger 20230506 V 823020664Mrinal PandeyAinda não há avaliações

- Vehicle Repayment ScheduleDocumento6 páginasVehicle Repayment ScheduleusmanthesaviorAinda não há avaliações

- Morph Ser202324027 31102023 277Documento6 páginasMorph Ser202324027 31102023 277gokulpics1Ainda não há avaliações

- UntitDocumento1 páginaUntitVaijnathAinda não há avaliações

- Statement ReportDocumento17 páginasStatement Reportindasijames06Ainda não há avaliações

- GrandFatherGainLossDeatils Fncl1275Documento1 páginaGrandFatherGainLossDeatils Fncl1275Ashish SinghAinda não há avaliações

- Bank Artha Graha Payment DocumentDocumento180 páginasBank Artha Graha Payment DocumentImc TeknoAinda não há avaliações

- Orbit BioscientificDocumento2 páginasOrbit BioscientificSales Nandi PrintsAinda não há avaliações

- 6 Rent BillDocumento1 página6 Rent BillBhavik DaveAinda não há avaliações

- DVD Recorder RH497M-P - GBRLLK - MFL42689424 PDFDocumento44 páginasDVD Recorder RH497M-P - GBRLLK - MFL42689424 PDFpempekplgAinda não há avaliações

- 582 14Documento7 páginas582 14pempekplgAinda não há avaliações

- LG Washing Machine ManualDocumento61 páginasLG Washing Machine ManualpempekplgAinda não há avaliações

- 345483-An-01-En-lg Rh397h DVD HDD Recorder 160gbDocumento36 páginas345483-An-01-En-lg Rh397h DVD HDD Recorder 160gbGeorge MoonAinda não há avaliações

- AIP Heel Pain Book 2016Documento14 páginasAIP Heel Pain Book 2016pempekplgAinda não há avaliações

- Soal Un Ipa SMP Kode Ipa - SP - 35 Massamassae28093besie2809317c PDFDocumento11 páginasSoal Un Ipa SMP Kode Ipa - SP - 35 Massamassae28093besie2809317c PDFpempekplgAinda não há avaliações

- Sample STDDocumento1 páginaSample STDpempekplgAinda não há avaliações

- Megamix Solution PDFDocumento8 páginasMegamix Solution PDFSugan NallaAinda não há avaliações

- Last 2 Edges Algorithms 5x5Documento2 páginasLast 2 Edges Algorithms 5x5Joshua VictorAinda não há avaliações

- Kho Ping HooDocumento3 páginasKho Ping HoopempekplgAinda não há avaliações

- CPU-Z REPORTDocumento28 páginasCPU-Z REPORTpempekplgAinda não há avaliações

- Buffalo Linkstation LS 420 Manual LONGDocumento140 páginasBuffalo Linkstation LS 420 Manual LONGpempekplgAinda não há avaliações

- Katalog Maspion 2019 PDFDocumento35 páginasKatalog Maspion 2019 PDFpempekplgAinda não há avaliações

- Asoal Un Ipa SMP Kode Ipa - SP - 35 Massamassae28093besie2809317c PDFDocumento11 páginasAsoal Un Ipa SMP Kode Ipa - SP - 35 Massamassae28093besie2809317c PDFpempekplgAinda não há avaliações

- Bahan Merakit DroneDocumento9 páginasBahan Merakit DronepempekplgAinda não há avaliações

- Kode Barang Warna PhilipsDocumento1 páginaKode Barang Warna PhilipspempekplgAinda não há avaliações

- New Kube-User ManualDocumento1 páginaNew Kube-User ManualpempekplgAinda não há avaliações

- InstallatioDocumento8 páginasInstallatioFellipe Miranda MartinsAinda não há avaliações

- TENS Device Instruction ManualDocumento24 páginasTENS Device Instruction Manualenergetiko15Ainda não há avaliações

- FU-Z31E: Air Purifier Operation Manual Petunjuk Pengoperasian Air PurifierDocumento15 páginasFU-Z31E: Air Purifier Operation Manual Petunjuk Pengoperasian Air PurifierpempekplgAinda não há avaliações

- Heel Pain CPGDocumento20 páginasHeel Pain CPGpempekplgAinda não há avaliações

- Plextor - PX W4824tu OmDocumento30 páginasPlextor - PX W4824tu OmpempekplgAinda não há avaliações

- About Air PurifiersDocumento51 páginasAbout Air PurifierspempekplgAinda não há avaliações

- 317 - HUAWEI E5372 Mobile WiFi Product DescriptionDocumento20 páginas317 - HUAWEI E5372 Mobile WiFi Product DescriptionpempekplgAinda não há avaliações

- Lennart Nilsson-Incredible PhotosDocumento26 páginasLennart Nilsson-Incredible PhotospempekplgAinda não há avaliações

- Lennart Nilsson-Incredible PhotosDocumento26 páginasLennart Nilsson-Incredible PhotospempekplgAinda não há avaliações

- Last ChristmasDocumento1 páginaLast ChristmaspempekplgAinda não há avaliações

- Start School at Later Hour-Today-20160615Documento2 páginasStart School at Later Hour-Today-20160615pempekplgAinda não há avaliações

- Excel 2007 VBADocumento103 páginasExcel 2007 VBAAtul SartapeAinda não há avaliações

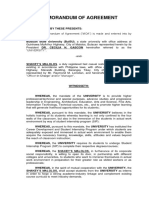

- Joanne Mae VDocumento5 páginasJoanne Mae VAndrea Denise VillafuerteAinda não há avaliações

- Law of Contract Zzds (Part I)Documento27 páginasLaw of Contract Zzds (Part I)Yi JieAinda não há avaliações

- SC Rules Civil Case for Nullity Not a Prejudicial Question to Bigamy CaseDocumento3 páginasSC Rules Civil Case for Nullity Not a Prejudicial Question to Bigamy CaseHazel Grace AbenesAinda não há avaliações

- NOTIFICATION FOR GRAMIN DAK SEVAK POSTSDocumento68 páginasNOTIFICATION FOR GRAMIN DAK SEVAK POSTSShubham VermaAinda não há avaliações

- Terminals & Connectors: Delphi Packard Metri-Pack 150 Series Sealed ConnectorsDocumento1 páginaTerminals & Connectors: Delphi Packard Metri-Pack 150 Series Sealed ConnectorsTrần Long VũAinda não há avaliações

- 0452 w16 Ms 13Documento10 páginas0452 w16 Ms 13cheah_chinAinda não há avaliações

- Millionaire EdgarDocumento20 páginasMillionaire EdgarEdgar CemîrtanAinda não há avaliações

- Separation, Delegation, and The LegislativeDocumento30 páginasSeparation, Delegation, and The LegislativeYosef_d100% (1)

- Lucky Chops - CocoDocumento6 páginasLucky Chops - CocoLe Poulet De KFCAinda não há avaliações

- Obligations of The VendeeDocumento55 páginasObligations of The VendeerchllmclnAinda não há avaliações

- TeSys D - LC1DWK12M7Documento3 páginasTeSys D - LC1DWK12M7anm bAinda não há avaliações

- For Session DTD 5th Sep by CA Alok Garg PDFDocumento46 páginasFor Session DTD 5th Sep by CA Alok Garg PDFLakshmi Narayana Murthy KapavarapuAinda não há avaliações

- 32A Registration LegalDocumento1 página32A Registration LegalChaitram200925% (4)

- Money Mastermind Vol 1 PDFDocumento283 páginasMoney Mastermind Vol 1 PDFKatya SivkovaAinda não há avaliações

- FOI Disclosure Log 374 AnnexDocumento1.204 páginasFOI Disclosure Log 374 AnnexSAMEERAinda não há avaliações

- 2 Presentation On Supplemental Guidelines1Documento18 páginas2 Presentation On Supplemental Guidelines1Muhammad Alsharif Aming AlihAinda não há avaliações

- APPLICATION FORM FOR Short Service Commission ExecutiveDocumento1 páginaAPPLICATION FORM FOR Short Service Commission Executivemandhotra87Ainda não há avaliações

- Building Code PDFDocumento11 páginasBuilding Code PDFUmrotus SyadiyahAinda não há avaliações

- High Commission of India: Visa Application FormDocumento2 páginasHigh Commission of India: Visa Application FormShuhan Mohammad Ariful HoqueAinda não há avaliações

- Choa Tiek Seng Vs CADocumento2 páginasChoa Tiek Seng Vs CAReg Yu0% (1)

- America's Health Insurance Plans PAC (AHIP) - 8227 - VSRDocumento2 páginasAmerica's Health Insurance Plans PAC (AHIP) - 8227 - VSRZach EdwardsAinda não há avaliações

- Compassion and Choices Fall 2015Documento27 páginasCompassion and Choices Fall 2015Kathleen JaneschekAinda não há avaliações

- Swap RevisedDocumento36 páginasSwap RevisedrigilcolacoAinda não há avaliações

- DIPLOMA EXAMS MUSIC ENTRYDocumento4 páginasDIPLOMA EXAMS MUSIC ENTRYmutiseusAinda não há avaliações

- Solomon Islands School Certificate 2007 New Testament Studies Question BookletDocumento14 páginasSolomon Islands School Certificate 2007 New Testament Studies Question BookletAndrew ArahaAinda não há avaliações

- Bank Officer's Handbook of Commercial Banking Law 5thDocumento363 páginasBank Officer's Handbook of Commercial Banking Law 5thCody Morgan100% (5)

- A Study On Maintenance Under Muslim Law: Haridharan SDocumento10 páginasA Study On Maintenance Under Muslim Law: Haridharan SSaurabh YadavAinda não há avaliações

- Biography On Mahatma Gandhi MitaliDocumento11 páginasBiography On Mahatma Gandhi Mitaligopal kesarwaniAinda não há avaliações

- City Limits Magazine, August/September 1991 IssueDocumento24 páginasCity Limits Magazine, August/September 1991 IssueCity Limits (New York)Ainda não há avaliações

- SENSE AND SENSIBILITY ANALYSIS - OdtDocumento6 páginasSENSE AND SENSIBILITY ANALYSIS - OdtannisaAinda não há avaliações