Escolar Documentos

Profissional Documentos

Cultura Documentos

IC38 Agent Life PDF

Enviado por

dibyaduti_200091970 notas0% acharam este documento útil (0 voto)

120 visualizações4 páginasTítulo original

IC38_Agent_Life.pdf

Direitos autorais

© © All Rights Reserved

Formatos disponíveis

PDF, TXT ou leia online no Scribd

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

0 notas0% acharam este documento útil (0 voto)

120 visualizações4 páginasIC38 Agent Life PDF

Enviado por

dibyaduti_20009197Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

Você está na página 1de 4

SYLLABUS

IC38 INSURANCE AGENTS (LIFE BRANCH)

SECTION I

CHAPTER 1: INTRODUCTION TO INSURANCE: Life insurance History and

evolution - History of insurance - Insurance through the ages - Modern concepts of

insurance - History of insurance in India - Life insurance industry - How

insurance works - Risk management techniques - Risk avoidance - Risk retention -

Risk reduction and control - Risk financing - Insurance vs Assurance - Insurance

as a tool for managing risk - Considerations before opting for Insurance - Role of

insurance in society - Insurance and Social Security.

CHAPTER 2: CUSTOMER SERVICE: General concepts - Why Customer Service -

Quality of service - Customer service and insurance - Insurance agents role in

providing great customer service - The Point of Sale - Best advice - The proposal

stage - Acceptance stage - The claim stage - Grievance redressal - Integrated

Grievance Management System (IGMS) - The Consumer Protection Act, 1986 - The

Insurance Ombudsman - Communication process - Non-verbal communication -

Ethical behavior.

CHAPTER 3: GRIEVANCE REDRESSAL MECHANISM: Consumer courts,

Ombudsman - Integrated Grievance Management System (IGMS) - The Consumer

Protection Act, 1986 - The Insurance Ombudsman.

CHAPTER 4: REGULATORY ASPECTS OF INSURANCE AGENT: Definitions-

Appointment of Insurance Agent by the Insurer- Appointment of Composite

Insurance Agent by the insurer- Insurance Agency Examination- Disqualification

to act as an Insurance Agent- Code of Conduct- Suspension of Appointment of an

Agent- Procedure for Cancellation of Agency- Effect of suspension/cancellation of

Agency appointment- Procedure to be followed in respect of resignation/surrender

of appointment by an insurance agent- General conditions for appointment of

Agents by the insurer-

CHAPTER 5: LEGAL PRINCIPLES OF AN INSURANCE CONTRACT: Insurance

contracts Legal aspects and special features - Legal aspects of an insurance

contract - Elements of a valid contract - Insurance contracts Special features -

Uberrima Fides or Utmost Good Faith - Measures implemented to reduce the risk -

Breach of Utmost Good Faith - Insurable interest - Gambling and insurance -

Proximate Cause - Contract of Adhesion Indemnity Subrogation.

SECTION 2

CHAPTER 6: WHAT LIFE INSURANCE INVOLVES: Life insurance business

Components, human life value, mutuality - The Asset Human Life Value(HLV) -

The Risk - Level premiums - The Principle of Risk Pooling Mutuality - The Life

Insurance Contract.

CHAPTER 7: FINANCIAL PLANNING: Financial planning and the individual life

cycle Definition - Types of Goals - Individuals life cycle - Individual needs -

Financial products - Risk profile and investments - Role of financial planning -

Financial planning - When is the right time to start financial planning - Financial

planning Types - Cash planning - Insurance planning - Investment planning -

Investment parameters - Retirement planning.

CHAPTER 8: LIFE INSURANCE PRODUCT I: Overview of life insurance products

- What is a product - Purpose of life insurance products and needs covered -

Riders in Life Insurance Products - Traditional life insurance products - Term

insurance plans - Variants of Term Assurance - Whole life insurance - Endowment

assurance - Dividend method of profit participation.

CHAPTER 9: LIFE INSURANCE PRODUCT II: Overview of non-traditional life

insurance products - Limitations of traditional products - The shifts - The appeal

Needs met - Non-traditional life insurance products Types.

CHAPTER 10: APPLICATION OF LIFE INSURANCE: Married Womens Property

Act - Beneficiaries under MWP Act & its features - Key man Insurance Insurable

Losses - Mortgage Redemption Insurance (MRI).

CHAPTER 11: PRICING AND VALUATION OF LIFE INSURANCE: Insurance

pricing Basic elements Premium Rebates - Determining the premium -

Components of Premium - Mortality and Interest - Guiding Principles for

determining Amount of Loading - Expenses and reserves - Determination of

Surplus and bonus - Ways of Valuing Assets - Allocating the surplus - Bonus -

Types of reversionary bonuses.

CHAPTER 12: DOCUMENTATION PROPOSAL STAGE: Life insurance

Proposal stage documentation Prospectus - Proposal form Different Reports -

Anti-Money Laundering (AML) - Know Your Customer (KYC) - Free-look period.

CHAPTER 13: DOCUMENTATION POLICY CONDITION - I: Policy stage

documentation - First Premium Receipt - Policy Document - Policy Document -

Standard Provisions - Specific Policy Provisions.

CHAPTER 14: DOCUMENTATION POLICY CONDITION II: Policy conditions

and privileges - Grace period - Policy revival measures - Non-forfeiture provisions -

Special policy provisions and endorsements - Provisions related to nomination

Assignment - Types of Assignment - Conditions for valid assignment - Nomination

Vs. Assignment - Duplicate Policy Alteration.

CHAPTER 15: UNDERWRITING: Underwriting purpose - Equity among risks -

Risk classification - Selection process - Fraud monitoring and role of agent as

primary underwriter - Methods of underwriting - Non-medical underwriting -

Conditions for non-medical underwriting - Rating factors in underwriting - Sources

of Occupational Hazards - Medical underwriting - Medical Factors that influence

an Underwriters Decision.

CHAPTER 16: PAYMENTS UNDER A LIFE INSURANCE POLICY: Types of claims

and claims procedure - Concept of claims - Risk event and claim - Ascertaining

whether a claim event has occurred - Survival Benefit Payments - Surrender of

Policy - Rider Benefit - Death Claim - Forms to be submitted for Death Claim -

Claim Procedure for Life Insurance Policy - Role of an agent

SECTION 3

CHAPTER 17: INTRODUCTION TO HEALTH INSURANCE: What is health care

Definition of Health Determinants of Health Levels of Healthcare Levels of

health care Types of health care Factors affecting the health systems in India

Evaluation of health insurance in India Employees State Insurance Scheme -

Central Government health scheme Commercial health insurance - Health

Insurance Market Infrastructure Public health sector - Private sector providers

Pharmaceutical industry Insurance Providers Intermediaries Insurance

selling activities Insurance Servicing activities financial product distribution

Other important organizations which form part of the health insurance market

CHAPTER 18: INSURANCE DOCUMENTATION: Proposal forms Standard form

of Declaration Nature of questions in a proposal form - Elements of Proposal

Medical Questionnaire Role of intermediary - Duty of an intermediary towards

prospect (client) Acceptance of the Proposal (Underwriting) Note on

underwriting and processing of proposals Premium receipts Definition

Payment of premium in advance - Method of payment of premium Policy

Document - Conditions and warranties Endorsements - Specimen Endorsements

Interpretation of policies Renewal Notice Anti Money laundering and know

your customer guidelines

CHAPTER 19: HEALTH INSURANCE PRODUCTS: Classification of health

insurance product Introduction Definition Features of health policies Broad

classification of health insurance products IRDA guidelines on standardization in

health insurance Hospitalization indemnity product Top up covers or high

deductible insurance plans Senior citizen policy fixed benefit covers hospital

cash critical illness hospital daily cash policy critical illness policy long term

care insurance combi-products Package policies Micro insurance and health

insurance for poor sections Rashtriya Swasthya Bima Yojana - Pradhan Mantri

Suraksha Bima Yojana - Pradhan Mantri Jan-Dhan Yojana Personal accident

and disability cover- overseas travel insurance Group health cover Special

products Key terns in health policies

CHAPTER 20: HEALTH INSURANCE UNDERWRITING: What is Underwriting

Definition need - Underwriting basic concepts File and use guidelines Other

health insurance regulations of IRDAI Basic Principles of Insurance and tools for

underwriting -Underwriting process Group health insurance Underwriting of

overseas travel insurance - Underwriting of personal accident insurance

CHAPTER 21: HEALTH INSURANCE CLAIMS: Claims management in insurance

stakeholders in claim process Role of claims management in insurance

company - Management of health insurance claims Challenges in health

insurance claims process in health insurance - Documentation of health

insurance claims Claims reserving Role of third party administrators Claims

management personal accident overseas travel insurance.

Você também pode gostar

- Ic38 Corporate Agents (Composite) : SyllabusDocumento5 páginasIc38 Corporate Agents (Composite) : SyllabusAshutosh RaiAinda não há avaliações

- Web Aggregator SyllabusDocumento5 páginasWeb Aggregator Syllabussam franklinAinda não há avaliações

- Ic 38 Non Life SyllabusDocumento4 páginasIc 38 Non Life SyllabusSKAinda não há avaliações

- Syllabus Ic38 Insurance Agents (Health Insurance) : Section IDocumento2 páginasSyllabus Ic38 Insurance Agents (Health Insurance) : Section IMajhar HussainAinda não há avaliações

- SYLLABUS of Health InsuranceDocumento10 páginasSYLLABUS of Health InsuranceSuchetana SenAinda não há avaliações

- New Syllabus PDFDocumento77 páginasNew Syllabus PDFPrashantAinda não há avaliações

- III 1 8Documento8 páginasIII 1 8Anonymous UYHtL8Ainda não há avaliações

- IPPDocumento77 páginasIPPshanifAinda não há avaliações

- Syllabus PDFDocumento81 páginasSyllabus PDFC RajkumarAinda não há avaliações

- New SyllabusDocumento81 páginasNew SyllabuspranavyesAinda não há avaliações

- SyllabusDocumento76 páginasSyllabusamattirkeyAinda não há avaliações

- Syllabus IIIDocumento85 páginasSyllabus IIIAsħîŞĥLøÝå100% (1)

- Detailed SyllabusDocumento80 páginasDetailed Syllabusshanmuga89Ainda não há avaliações

- Fire Specialised DiplomaDocumento10 páginasFire Specialised DiplomaNeetu Deepak NagalAinda não há avaliações

- Syllab of Dip in Life Ins UnderwritingDocumento17 páginasSyllab of Dip in Life Ins Underwritinganon_303912439100% (1)

- Annexure - I Syllabus For Training and Examination For Insurance BrokersDocumento19 páginasAnnexure - I Syllabus For Training and Examination For Insurance BrokersHanuman MbaliveprojectsAinda não há avaliações

- CPAIM Couse SyllabusDocumento48 páginasCPAIM Couse SyllabussajidtoshibaAinda não há avaliações

- 89bb3principal of InsDocumento3 páginas89bb3principal of InsViplav DasAinda não há avaliações

- Presentation On General InsuranceDocumento17 páginasPresentation On General InsuranceNishita ShahAinda não há avaliações

- 715 - BCom General Computer Applications Semester IVDocumento1 página715 - BCom General Computer Applications Semester IVshaiksufiyan9999Ainda não há avaliações

- M2 Insurance Planning Estate Planning Syllabus FINALDocumento8 páginasM2 Insurance Planning Estate Planning Syllabus FINALIwant MorenewsAinda não há avaliações

- 1 Stage: Subject 01 - Principles of Insurance (Common Subject For Life and General)Documento41 páginas1 Stage: Subject 01 - Principles of Insurance (Common Subject For Life and General)mahender123bodduAinda não há avaliações

- Module No.1: General Principles of Insurance ContractDocumento2 páginasModule No.1: General Principles of Insurance ContractNikhil KasatAinda não há avaliações

- Merchant Banking and Financial ServicesDocumento77 páginasMerchant Banking and Financial ServicespavithragowthamAinda não há avaliações

- RimDocumento3 páginasRim29_ramesh170Ainda não há avaliações

- Insurance, regulations and loss prevention :Basic Rules for the industry Insurance: Business strategy books, #5No EverandInsurance, regulations and loss prevention :Basic Rules for the industry Insurance: Business strategy books, #5Ainda não há avaliações

- Principles & Practice of Life Revised)Documento78 páginasPrinciples & Practice of Life Revised)Riya_Biswas_8955Ainda não há avaliações

- Chapter - 1: Insurance Certification Examination NotesDocumento31 páginasChapter - 1: Insurance Certification Examination NotesAnand PadiyaAinda não há avaliações

- Lucknow Unoiversity Syllabus of BBA-302 & BBA-503Documento2 páginasLucknow Unoiversity Syllabus of BBA-302 & BBA-503shailesh tandonAinda não há avaliações

- LIT NotesDocumento737 páginasLIT NotesMegat AlifAinda não há avaliações

- Insurance & Risk Management SyllabusDocumento1 páginaInsurance & Risk Management SyllabuskunkumabalaAinda não há avaliações

- Bfs - Unit V Short NotesDocumento11 páginasBfs - Unit V Short NotesvelmuruganbAinda não há avaliações

- PG - M.com - Finance & Control - 33544 Banking and InsuranceDocumento282 páginasPG - M.com - Finance & Control - 33544 Banking and InsuranceShikha Sidar LLM 2021Ainda não há avaliações

- Syllabus of Basics of Lending PBS - 108: Unit 1Documento1 páginaSyllabus of Basics of Lending PBS - 108: Unit 1Bhartiyam SushilAinda não há avaliações

- POS Training ModuleDocumento81 páginasPOS Training Moduleshalini iyer0% (1)

- Surveyors ExamsDocumento4 páginasSurveyors ExamsPraveen Saini0% (1)

- Ic 72 - Motor InsuranceDocumento2 páginasIc 72 - Motor Insurancepriyarss230% (2)

- Understanding Insurance - A Comprehensive OverviewDocumento3 páginasUnderstanding Insurance - A Comprehensive OverviewRitika SHUKLAAinda não há avaliações

- Risk Management and InsuranceDocumento1 páginaRisk Management and Insuranceanon_196953134Ainda não há avaliações

- Final Dissertation: REFERENCE TO LIFE INSURANCE INDUSTRY Submitted by Me For The PartialDocumento55 páginasFinal Dissertation: REFERENCE TO LIFE INSURANCE INDUSTRY Submitted by Me For The PartialDevesh JangharaAinda não há avaliações

- NEw IC 38 SummaryDocumento80 páginasNEw IC 38 SummaryMadhup tarsolia100% (2)

- Certificate Programme in Advanced Insurance Marketing: Cpaim BL01:-Fundamentals of InsuranceDocumento26 páginasCertificate Programme in Advanced Insurance Marketing: Cpaim BL01:-Fundamentals of InsuranceMs. Namrata JadavAinda não há avaliações

- A Report ON Management Thesis - Ii: Under Guidance ofDocumento37 páginasA Report ON Management Thesis - Ii: Under Guidance ofVikas Sharma100% (1)

- Regulation & Supervision of The Insurance Sector in IndiaDocumento28 páginasRegulation & Supervision of The Insurance Sector in IndiaMohit NagotraAinda não há avaliações

- Chapter - 1: Insurance Certification Examination NotesDocumento35 páginasChapter - 1: Insurance Certification Examination NotesShikha ShuklaAinda não há avaliações

- Particulars Page NumbersDocumento115 páginasParticulars Page NumbersAdv Sunil JoshiAinda não há avaliações

- Birm (501) : Basics of Risk ManagementDocumento4 páginasBirm (501) : Basics of Risk ManagementRajat DebAinda não há avaliações

- Banking & InsuranceDocumento13 páginasBanking & InsuranceHarshita SinghAinda não há avaliações

- Legal Environment of Business: Principle of Insurance, & IRDA, "Should Insurer Compensate Loss From Riots?"Documento33 páginasLegal Environment of Business: Principle of Insurance, & IRDA, "Should Insurer Compensate Loss From Riots?"Kanchan GuptaAinda não há avaliações

- Miscellaneous Manual 1Documento507 páginasMiscellaneous Manual 1shrey12467% (3)

- Insurance - 6th June 2012Documento2 páginasInsurance - 6th June 2012Shashank BurdeAinda não há avaliações

- RM & I Detailed PDFDocumento187 páginasRM & I Detailed PDFDevikaAinda não há avaliações

- Manonmaniam Sundaranar University: Insurance and Risk ManagementDocumento190 páginasManonmaniam Sundaranar University: Insurance and Risk ManagementDevanshu JulkaAinda não há avaliações

- Insurance Course OutlineDocumento2 páginasInsurance Course OutlinePrabhash Chand100% (1)

- Introduction To InsuranceDocumento22 páginasIntroduction To InsuranceROSHINIAinda não há avaliações

- Effectiveness of Advertisement On Insurance CompanyDocumento78 páginasEffectiveness of Advertisement On Insurance CompanySudhir Singh100% (8)

- Idbi Ic 38 TrainingDocumento74 páginasIdbi Ic 38 TrainingJai Rajesh100% (1)

- Risk Management: How to Use Different Insurance to Your BenefitNo EverandRisk Management: How to Use Different Insurance to Your BenefitAinda não há avaliações

- Risk Management and Insurance - Learn how to Manage Risks and Secure Your FutureNo EverandRisk Management and Insurance - Learn how to Manage Risks and Secure Your FutureAinda não há avaliações

- Wisemoney - 31 Dec. 2018Documento20 páginasWisemoney - 31 Dec. 2018dibyaduti_20009197Ainda não há avaliações

- NSE NMF Debit MandateDocumento1 páginaNSE NMF Debit Mandatedibyaduti_20009197Ainda não há avaliações

- CAMS CKYC Application FormDocumento4 páginasCAMS CKYC Application Formdibyaduti_20009197Ainda não há avaliações

- NMF II Platform: Investor FormDocumento3 páginasNMF II Platform: Investor Formdibyaduti_20009197Ainda não há avaliações

- IC38 Agent LifeDocumento4 páginasIC38 Agent Lifedibyaduti_20009197Ainda não há avaliações

- IC38 Agent LifeDocumento4 páginasIC38 Agent Lifedibyaduti_20009197Ainda não há avaliações

- IC38 Agent LifeDocumento4 páginasIC38 Agent Lifedibyaduti_20009197Ainda não há avaliações

- IC38 Agent LifeDocumento4 páginasIC38 Agent Lifedibyaduti_20009197Ainda não há avaliações

- Municipality of Camalaniugan: Amounting ToDocumento3 páginasMunicipality of Camalaniugan: Amounting ToMelody Frac ZapateroAinda não há avaliações

- FinValley 5.0 Case StudyDocumento3 páginasFinValley 5.0 Case StudyBrennan BarnettAinda não há avaliações

- Future Focus 2015 Contribution: Executive Director Malcolm Hyde BSC (Hons) Dip FR Fcii Fcila FifaaDocumento16 páginasFuture Focus 2015 Contribution: Executive Director Malcolm Hyde BSC (Hons) Dip FR Fcii Fcila Fifaayashtilva00000Ainda não há avaliações

- Formate of Rent Agreement - @mateenDocumento7 páginasFormate of Rent Agreement - @mateenM KashifAinda não há avaliações

- Article 1397 States ThatDocumento1 páginaArticle 1397 States ThatNicole Mari De ChavezAinda não há avaliações

- Notice of Inimationt - Final KshirsagarDocumento2 páginasNotice of Inimationt - Final KshirsagarNitin ThokalAinda não há avaliações

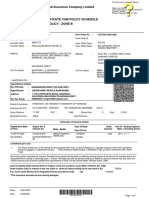

- The Oriental Insurance Company LimitedDocumento3 páginasThe Oriental Insurance Company LimitedBachu Saee RamAinda não há avaliações

- Marquez Vs Elisan Credit GR No 194642Documento11 páginasMarquez Vs Elisan Credit GR No 194642Jessica SandiAinda não há avaliações

- Green Coffee FOB, C & F, CIF Contract: Specialty Coffee Association of AmericaDocumento5 páginasGreen Coffee FOB, C & F, CIF Contract: Specialty Coffee Association of AmericacoffeepathAinda não há avaliações

- Getting Ready For Initial Margin (IM) Regulatory RequirementsDocumento4 páginasGetting Ready For Initial Margin (IM) Regulatory RequirementsKathir KAinda não há avaliações

- Renters Policy PDFDocumento18 páginasRenters Policy PDFMumy MoraAinda não há avaliações

- Alfred Angelo CH 7 FilingDocumento1.044 páginasAlfred Angelo CH 7 FilingkmccoynycAinda não há avaliações

- Arbitration in FranceDocumento20 páginasArbitration in FranceTomoe GozenAinda não há avaliações

- 42 Sps. Andal vs. PNBDocumento6 páginas42 Sps. Andal vs. PNBRobert Jayson UyAinda não há avaliações

- Pertanggungjawaban Korporasi Dalam Kepailitan Berdasarkan Asas Proporsionalitas (Studi Kasus Kepailitan PT Asuransi Jiwa Bumi Asih Jaya)Documento7 páginasPertanggungjawaban Korporasi Dalam Kepailitan Berdasarkan Asas Proporsionalitas (Studi Kasus Kepailitan PT Asuransi Jiwa Bumi Asih Jaya)Zikri MohamadAinda não há avaliações

- CONTRACT OF LEASE Tibig Silang Revised With Comments 091522correctionsDocumento7 páginasCONTRACT OF LEASE Tibig Silang Revised With Comments 091522correctionsCherie TevesAinda não há avaliações

- Undertaking-Cum-Indemnity To Be Obtained From Unlisted Public / Private Limited CompaniesDocumento4 páginasUndertaking-Cum-Indemnity To Be Obtained From Unlisted Public / Private Limited CompaniesJayesh ShahAinda não há avaliações

- Insurance Law Aquino 2018Documento528 páginasInsurance Law Aquino 2018Israel Bandonill100% (12)

- Sample Simple Contract of LeaseDocumento3 páginasSample Simple Contract of Leasealexandra_lorenceAinda não há avaliações

- Discharge of ContractDocumento15 páginasDischarge of ContractNur HmAinda não há avaliações

- Difference of JKR PWD & PAMDocumento4 páginasDifference of JKR PWD & PAMAzizul Hakim MusaAinda não há avaliações

- Business Law Questions 2Documento7 páginasBusiness Law Questions 2Varsha BalajiAinda não há avaliações

- Quotation: Teikoku South Asia Pte LTDDocumento2 páginasQuotation: Teikoku South Asia Pte LTDARBAAinda não há avaliações

- Pankaj NetObjex NDADocumento6 páginasPankaj NetObjex NDApankaj dalmiaAinda não há avaliações

- Insurance SeguroDocumento8 páginasInsurance SeguroIsaul Jheremy Huaman GarciaAinda não há avaliações

- Amity Business School: Distribution &logistics ManagementDocumento21 páginasAmity Business School: Distribution &logistics ManagementRidhima GuptaAinda não há avaliações

- Lease ExtensionDocumento2 páginasLease ExtensionangiehaircocoAinda não há avaliações

- Philippine National Bank Vs Lilibeth ChanDocumento14 páginasPhilippine National Bank Vs Lilibeth ChanJoatham GenovisAinda não há avaliações

- Mrprintables Printable Board Game Rain Rainbow PDFDocumento2 páginasMrprintables Printable Board Game Rain Rainbow PDFGrace ZafraAinda não há avaliações

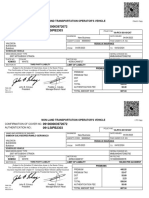

- 091LSIPB2303: Non-Land Transportation Operator'S VehicleDocumento1 página091LSIPB2303: Non-Land Transportation Operator'S VehicleUni Versal ServitechAinda não há avaliações