Escolar Documentos

Profissional Documentos

Cultura Documentos

Free Online Commodity Trading Tips Via Experts

Enviado por

Rahul SolankiTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Free Online Commodity Trading Tips Via Experts

Enviado por

Rahul SolankiDireitos autorais:

Formatos disponíveis

Daily Market Reflection

5th June 2017

-

Market Outlook COMDEX

Gold rose to session highs on Friday, buoyed by the return of safe

haven demand, as the U.S. dollar fell to a seven-month low, after

data showed that U.S. economy created fewer jobs than expected

last month. Gold remained on track to post a gain for the week,

fresh on the heels of achieving its longest monthly winning streak

since 2010 in May. Crude futures tumbled more than 1%, as

President Donald Trumps decision to withdraw from the 2015

Paris climate agreement, sparked concerns that U.S. oil

production could expand rapidly in the absence of a stringent Market Updates

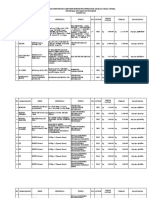

focus on curbing the use of fossil fuels. MCX Date Date % Chg

1-06-17 2-06-17

GOLD 28943 29088 +0.50%

Fundamental News SILVER 39813 40274 +1.16%

Gold hit a session high of $1,278.95 just shy of six-week highs, as COPPER 368.75 367.05 -0.46%

an unexpected dip in U.S. job growth, fuelled concerns about the CRUDE 3159 3081 -2.47%

strength of the U.S. economy, increasing demand for gold, which ALUMINIUM 124.15 123.85 -0.28%

is traditionally used as a safe haven against economic uncertainty LEAD 135.35 135.70 +0.18%

and volatility. NICKEL 570.20 574.10 +0.68%

ZINC 165.10 162.90 -1.36%

Opec and non-Opec members last week agreed to extend NATURALGAS 194.30 193.70 -0.31%

production cuts for a period of nine months until March, but stuck COMEX Date Date % Chg

to production cuts of 1.8 million bpd agreed in November last year. 1-06-17 2-06-17

GOLD 1267.00 1278.77 +0.93%

SILVER 17.281 17.550 +1.56%

Important Data CRUDE 48.36 47.78 -1.20%

COPPER 2.588 2.576 -0.44%

Time Currency Event Foreca Previous $ INDEX 97.16 96.61 -0.57%

st USDINR 64.7050 64.6375 -0.10%

2:00pm GBP Services PMI 55.1 55.8

Revised Nonfarm OUR PREVIOUS CALLS UPDATE

6:00pm USD -0.6% -0.6%

Productivity q/q Intraday super star

Revised Unit Labor Date Commodity Entry Exit P/L

6:00pm USD 3.0% 3.0%

Costs q/q 1/06 NG. - - -

Multibagger

7:15pm USD Final Services PMI 54.1 54.0 Date Commodity Entry Exit P/L

29/0 COPPER 365 361 +4000

ISM Non- 5

7:30pm USD 57.3 57.5 Trifid special

Manufacturing PMI

Date Commodity Entry Exit P/L

6:00pm USD Factory Orders m/m -0.2% 0.2% 2/06 ZINC 165 163 +1000

www.trifidresearch.com | Email id: info@trifidresearch.com | Toll Free: 1800-270-1410 0

For our next calls click here..

Gold and Silver

GOLD COMEX GOLD

Gold showed bullish movement and found the important

resistance level of 29137. Now if it will close above the

PIVOT S1 S2 R1 R2

S important resistance level of 29200 then 29500 will act

MCX 28800 28500 29200 29500 as next resistance level. On the other hand 28800 will

COME 1270 1260 1280 1285 act as a major support level.

SILVER COMEX SILVER

Silver showed bullish movement and found the important

PIVOTS S1 S2 R1 R2 resistance level of 40400. Now if it will close above the

important resistance level of 40500 then 41000 will act

MCX 39500 39000 40500 41000

as next resistance level. On the other hand 39500 will

COMEX 17.20 17.00 17.60 17.80

act as a major support level.

www.trifidresearch.com | Email id: info@trifidresearch.com | Toll Free: 1800-270-1410

Crude and Copper

CRUDE COMEX CRUDE

Crude showed bearish movement and found the

PIVOTS S1 S2 R1 R2 important support level of 3021. Now if it will close

below the important support level of 3000 then 2950 will

MCX 3000 2950 3130 3200

act as next support level. On the other hand 3100 will

COMEX 47.00 46.00 49.00 51.00

act as a major resistance level.

COPPER COMEX COPPER

Copper showed bearish movement and found the

important support level of 360.65. Now if it will close

PIVOTS S1 S2 R1 R2

below the important support level of 360 then 355 will

MCX 360 355 372 380 act as next support level. On the other hand 372 will act

COMEX 2.5440 2.5200 2.5560 2.6100 as a major resistance level.

www.trifidresearch.com | Email id: info@trifidresearch.com | Toll Free: 1800-270-1410

Other Commodities

PIVOT

COMMODITIE S1 S2 R1 R2 VOLUME OI TREND

S

ALUMINIUM 123 120 126 128 6374 1524 Bearish

LEAD 134 132 138 140 12964 2106 Bullish

NICKEL 560 550 585 600 35769 46937 Bullish

ZINC 160 158 164 167 20607 4400 Bearish

NATURAL GAS 192 190 197 200 49044 7460 Bearish

LME INVENTORY

dasdasdinkjjlfcnl

Due to Summer

COMMODITIES Bank Holiday NO LME

26/05/2017 DATA TODAY

30/05/2017 31/05/2017 1/06/2017 2/06/2017

ALUMINIUM +25900 -8750 -13775 -6550 +12350

COPPER -2925 -3450 -4050 -3150 -2450

LEAD -500 +275 -1925 -975 -600

NICKEL -1470 -1812 -1308 +5982 -1674

ZINC -1650 -1425 -1575 -1300 -250

www.trifidresearch.com | Email id: info@trifidresearch.com | Toll Free: 1800-270-1410

Agri Commodity Updates

GUARSEED

Guarseed showed bearish movement and found the

important support level of 3325. If prices sustains

below 3325 level in next trading session then this

momentum can take prices to 3300 level. If it breaks

the resistance level of 3375 then 3425 will act as

next resistance level.

PIVOTS S1 S2 R1 R2

3325 3300 3375 3425

JEERA

Jeera showed sideways movement today and found

the resistance level of 17800. If prices sustain below

17600 levels in next trading session then this

momentum can take prices to 17300 levels. If it

breaks the resistance level of 17800 then 18000 will

act as next resistance level.

PIVOTS S1 S2 R1 R2

17600 17300 17800 18000

SOYABEAN

Soyabean showed bearish movement and found the

important support level of 2720. If prices sustain

below 2700 level in next trading session then this

bearish momentum can take prices to 2660 level. If

it breaks the resistance level of 2775 then 2820 will

act as next resistance level.

PIVOTS S1 S2 R1 R2

2700 2660 2775 2820

www.trifidresearch.com | Email id: info@trifidresearch.com | Toll Free: 1800-270-1410

Intraday Super Star

(Premium Section)

CALL: SELL NATURAL GAS BELOW 193 TARGETS 190/187 SL 197.

www.trifidresearch.com | Email id: info@trifidresearch.com | Toll Free: 1800-270-1410

Multibagger Call

(Premium Section)

CALL: SELL CRUDE BELOW 3030 TARGETS 3000/2970 SL 3070.

www.trifidresearch.com | Email id: info@trifidresearch.com | Toll Free: 1800-270-1410

Trifid Special

(Premium Section)

CALL: SELL ZINC BELOW 162 TARGETS 161/160 SL 163.50.

www.trifidresearch.com | Email id: info@trifidresearch.com | Toll Free: 1800-270-1410

Trifid Research respects and values the Right to Policy of each and every individual. We are

esteemed by the relationship and by becoming our clients; you have a promise from our side

that we shall remain loyal to all our clients and non-clients whose information resides with us.

This Privacy Policy of Trifid Research applies to the current clients as well as former clients.

Below are the word by word credentials of our Privacy Policy:

1. Your information, whether public or private, will not be sold, rented, exchanged,

transferred or given to any company or individual for any reason without your consent.

2. The only use we will be bringing to your information will be for providing the services to

you for which you have subscribed to us.

3. Your information given to us represents your identity with us. If any changes are brought

in any of the fields of which you have provided us the information, you shall bring it to

our notice by either calling us or dropping a mail to us.

4. In addition to the service provided to you, your information (mobile number, E-mail ID

etc.) can be brought in use for sending you newsletters, surveys, contest information, or

information about any new services of the company which will be for your benefit and

while subscribing for our services, you agree that Trifid Research has the right to do so.

5. By subscribing to our services, you consent to our Privacy Policy and Terms of Use.

6. Trifid research does not guarantee or is responsible in any which way, for the trade

execution of our recommendations, this is the sole responsibility of the client.

7. Due to the markets volatile nature, the trader may/ may not get appropriate opportunity

to execute the trades at the mentioned prices and Trifid Research holds no liability for

any profit/ loss incurred whatsoever in this case.

8. It is the responsibility of the client to view the report timely from our Premium member

section on our website: www.trifidresearch.com and the same will also be mailed to this

registered email id.

9. Trifid research does not hold any liability or responsibility of delay in mail delivery of

reports, as this depends on our mail service providers network infrastructure.

10. The clients can call us for any query related to buying/selling the securities, based on

our recommendations.

www.trifidresearch.com | Email id: info@trifidresearch.com | Toll Free: 1800-270-1410

Você também pode gostar

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- Barista Skills Foundation Curriculum enDocumento4 páginasBarista Skills Foundation Curriculum enCezara CarteșAinda não há avaliações

- Stochastic ProcessesDocumento264 páginasStochastic Processesmanosmill100% (1)

- DLI Watchman®: Vibration Screening Tool BenefitsDocumento2 páginasDLI Watchman®: Vibration Screening Tool Benefitssinner86Ainda não há avaliações

- ProbDocumento10 páginasProbKashif JawaidAinda não há avaliações

- June 2014 (v3) QP - Paper 3 CIE Physics IGCSEDocumento20 páginasJune 2014 (v3) QP - Paper 3 CIE Physics IGCSECole KhantAinda não há avaliações

- Vintage Airplane - May 1982Documento24 páginasVintage Airplane - May 1982Aviation/Space History LibraryAinda não há avaliações

- Switching Lab-05b Configuring InterVLAN RoutingDocumento2 páginasSwitching Lab-05b Configuring InterVLAN RoutingHernan E. SalvatoriAinda não há avaliações

- Astm D2000 PDFDocumento38 páginasAstm D2000 PDFMariano Emir Garcia OdriozolaAinda não há avaliações

- Caso Estudio: Reliability Analysis of Power Distribution System. A Case StudyDocumento6 páginasCaso Estudio: Reliability Analysis of Power Distribution System. A Case StudyCarlos HernandezAinda não há avaliações

- Jones Et - Al.1994Documento6 páginasJones Et - Al.1994Sukanya MajumderAinda não há avaliações

- D. Das and S. Doniach - Existence of A Bose Metal at T 0Documento15 páginasD. Das and S. Doniach - Existence of A Bose Metal at T 0ImaxSWAinda não há avaliações

- Atom SDDocumento5 páginasAtom SDatomsa shiferaAinda não há avaliações

- Ransomware: Prevention and Response ChecklistDocumento5 páginasRansomware: Prevention and Response Checklistcapodelcapo100% (1)

- Heart Rate Variability Threshold As An Alternative.25Documento6 páginasHeart Rate Variability Threshold As An Alternative.25Wasly SilvaAinda não há avaliações

- Ariba Collaborative Sourcing ProfessionalDocumento2 páginasAriba Collaborative Sourcing Professionalericofx530Ainda não há avaliações

- Uts Cmo Module 5Documento31 páginasUts Cmo Module 5Ceelinah EsparazAinda não há avaliações

- BluePrint & High Pressure Pascalization (HPP)Documento3 páginasBluePrint & High Pressure Pascalization (HPP)Prof C.S.PurushothamanAinda não há avaliações

- 2432 - Test Solutions - Tsol - 2432 - 21702Documento5 páginas2432 - Test Solutions - Tsol - 2432 - 21702Anmol PanchalAinda não há avaliações

- 6 Uec ProgramDocumento21 páginas6 Uec Programsubramanyam62Ainda não há avaliações

- Windows System Shortcut CommandsDocumento2 páginasWindows System Shortcut CommandsVenkatesh YerraAinda não há avaliações

- SodiumBenzoate PDFDocumento3 páginasSodiumBenzoate PDFyotta024Ainda não há avaliações

- Rin Case StudyDocumento4 páginasRin Case StudyReha Nayyar100% (1)

- Taxation Law 1Documento7 páginasTaxation Law 1jalefaye abapoAinda não há avaliações

- Bathinda - Wikipedia, The Free EncyclopediaDocumento4 páginasBathinda - Wikipedia, The Free EncyclopediaBhuwan GargAinda não há avaliações

- Functions PW DPPDocumento4 páginasFunctions PW DPPDebmalyaAinda não há avaliações

- 1st Problem Solving Assignment - Barrels of Apples - M383 Sp22.docx-2Documento4 páginas1st Problem Solving Assignment - Barrels of Apples - M383 Sp22.docx-2Kor16Ainda não há avaliações

- Afzal ResumeDocumento4 páginasAfzal ResumeASHIQ HUSSAINAinda não há avaliações

- CUET 2022 General Test 6th October Shift 1Documento23 páginasCUET 2022 General Test 6th October Shift 1Dhruv BhardwajAinda não há avaliações

- Controlador DanfossDocumento2 páginasControlador Danfossfrank.marcondes2416Ainda não há avaliações

- Rab Sikda Optima 2016Documento20 páginasRab Sikda Optima 2016Julius Chatry UniwalyAinda não há avaliações