Escolar Documentos

Profissional Documentos

Cultura Documentos

Civillaw Conclusiveevidenceofownership Heirsofampilvmanahan

Enviado por

Bianca Nerizza A. Infantado IIDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Civillaw Conclusiveevidenceofownership Heirsofampilvmanahan

Enviado por

Bianca Nerizza A. Infantado IIDireitos autorais:

Formatos disponíveis

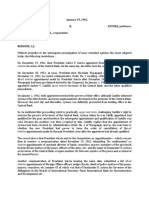

HEIRS OF ALBINA G. AMPIL, namely PRECIOUS A.

ZAVALLA, EDUARDO AMPIL,

PENAFRANCIA A. OLANO, VICENTE G. AMPIL, JR., FROILAN G. AMPIL and EXEQUIEL G.

AMPIL, represented by EXEQUIEL G. AMPIL v. TERESA MANAHAN and MARIO

MANAHANG.R. No. 175990, 11 October 2012, THIRD DIVISION (Mendoza, J.)

While it is true that tax declarations are not conclusive evidence of ownership, they,

nevertheless, constitute at least proof that the holder has a claim of title over the property. In the

absence of any supporting evidence, contentions of peaceful and continuous possession cannot

prevail over the tax declarations and other documentary evidence.

Exequiel Ampil, as representative of the heirs of Albina Ampil, filed a complaint for

ejectment against the Manahans. In the complaint, it was alleged that Albina was the owner of

two adjoining residential lots tax declarations, and that Albina had allowed Perfecto Manahan

and his family to occupy a portion of the properties, on the condition that they would vacate the

same, should the need arise. Since Ampil refused to vacate, the Heirs filed a complaint

for ejectment before the Municipal Trial Court (MTC). To prove ownership over the property, the

Heirs presented the tax declarations covering the properties. The Manahans filed their Answer,

averring that the lots belonged to them, their predecessor in interest having been in peaceful and

continuous possession thereof since time immemorial. The MTC and the Regional Trial Court

(RTC) rendered judgment in favor of the Heirs, on the basis of the tax declarations. The Court of

Appeals (CA) however reversed, ruling that tax declarations and receipts are not conclusive proof

of ownership or right of possession, and only becomes strong evidence of ownership when

accompanied by proof of actual possession.

ISSUE:

Whether or not the heirs have the better right to the physical possession of the disputed

property.

RULING:

YES. The bare allegation of the Manahans, that they had been in peaceful and continuous

possession of the lot in question because their predecessor-in-interest had been in possession

thereof in the concept of an owner from time immemorial, cannot prevail over the tax

declarations and other documentary evidence presented by the Heirs of Ampil. In the absence of

any supporting evidence, the contention of the Heirs deserves more probative value.

Well established is the rule that ownership over the land cannot be acquired by mere

occupation. While it is true that tax declarations are not conclusive evidence of ownership, they,

nevertheless, constitute at least proof that the holder has a claim of title over the property. It

strengthens one's bona fide claim of acquisition of ownership.

Você também pode gostar

- Entry With Motion To ResetDocumento2 páginasEntry With Motion To ResetBianca Nerizza A. Infantado IIAinda não há avaliações

- Motion For Postponement of Hearing: Office For Legal AffairsDocumento1 páginaMotion For Postponement of Hearing: Office For Legal AffairsBianca Nerizza A. Infantado IIAinda não há avaliações

- Postponement and ResettingDocumento1 páginaPostponement and ResettingBianca Nerizza A. Infantado IIAinda não há avaliações

- Additional Case AssignmentDocumento2 páginasAdditional Case AssignmentBianca Nerizza A. Infantado IIAinda não há avaliações

- REPv INCDocumento1 páginaREPv INCBianca Nerizza A. Infantado IIAinda não há avaliações

- Deed of Absolute SaleDocumento1 páginaDeed of Absolute SaleBianca Nerizza A. Infantado IIAinda não há avaliações

- Entry of AppearanceDocumento2 páginasEntry of AppearanceBianca Nerizza A. Infantado IIAinda não há avaliações

- Citibank V Tanco-GabaldonDocumento6 páginasCitibank V Tanco-GabaldonBianca Nerizza A. Infantado IIAinda não há avaliações

- CivPro Case ListDocumento7 páginasCivPro Case ListBianca Nerizza A. Infantado IIAinda não há avaliações

- Telefast Communications/Philippine Wireless, Inc. V. Ignacio Castro, Et - Al, G.R. No. 73867, February 29, 1988, J. PadillaDocumento1 páginaTelefast Communications/Philippine Wireless, Inc. V. Ignacio Castro, Et - Al, G.R. No. 73867, February 29, 1988, J. PadillaBianca Nerizza A. Infantado IIAinda não há avaliações

- Siochi Vs GozonDocumento1 páginaSiochi Vs GozonBianca Nerizza A. Infantado IIAinda não há avaliações

- Aytona Vs CastilloDocumento4 páginasAytona Vs CastilloBianca Nerizza A. Infantado IIAinda não há avaliações

- Dreamwork Construction, Inc. V. Cleofe S. Janiola G.R. No. 184861, June 30, 2009, VELASCO, JR., JDocumento1 páginaDreamwork Construction, Inc. V. Cleofe S. Janiola G.R. No. 184861, June 30, 2009, VELASCO, JR., JBianca Nerizza A. Infantado IIAinda não há avaliações

- Dinah Tonog Vs CADocumento2 páginasDinah Tonog Vs CABianca Nerizza A. Infantado IIAinda não há avaliações

- 2012mendoza Landtitlesanddeeds Carl VianzonvmacaraegDocumento1 página2012mendoza Landtitlesanddeeds Carl VianzonvmacaraegBianca Nerizza A. Infantado IIAinda não há avaliações

- Ethics Misconduct BarengvdagunaDocumento1 páginaEthics Misconduct BarengvdagunaBianca Nerizza A. Infantado IIAinda não há avaliações

- 352 INFANTADO ETHICS CLERKABUSEOFAUTHORITY ILUPAvABDULLAHDocumento1 página352 INFANTADO ETHICS CLERKABUSEOFAUTHORITY ILUPAvABDULLAHBianca Nerizza A. Infantado IIAinda não há avaliações

- Ethics Clerksofcourt DbpvjoaquinoDocumento1 páginaEthics Clerksofcourt DbpvjoaquinoBianca Nerizza A. Infantado IIAinda não há avaliações

- Coca Colavdel VillarDocumento1 páginaCoca Colavdel VillarBianca Nerizza A. Infantado IIAinda não há avaliações

- CORP 393 4thassign PuavCitibankDocumento1 páginaCORP 393 4thassign PuavCitibankBianca Nerizza A. Infantado IIAinda não há avaliações

- Smart Communications, Inc. V. Regina M. Astorga G.R. No. 148132, January 28, 2008, NACHURA, JDocumento1 páginaSmart Communications, Inc. V. Regina M. Astorga G.R. No. 148132, January 28, 2008, NACHURA, JBianca Nerizza A. Infantado IIAinda não há avaliações

- Margarita Ambre Y Cayuni V. People of The Philippines G.R. No. 191532, 15 August 2012, THIRD DIVISION (Mendoza, J.)Documento1 páginaMargarita Ambre Y Cayuni V. People of The Philippines G.R. No. 191532, 15 August 2012, THIRD DIVISION (Mendoza, J.)Bianca Nerizza A. Infantado IIAinda não há avaliações

- PNB Vs RBLDocumento2 páginasPNB Vs RBLBianca Nerizza A. Infantado IIAinda não há avaliações

- Pablo P. Garcia V. Yolanda Valdez Villar G.R. No. 158891, June 27, 2012, J. Leonardo-DecastroDocumento2 páginasPablo P. Garcia V. Yolanda Valdez Villar G.R. No. 158891, June 27, 2012, J. Leonardo-DecastroBianca Nerizza A. Infantado IIAinda não há avaliações

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- GNLU Detention Case JudgementDocumento46 páginasGNLU Detention Case Judgementraghul_sudheeshAinda não há avaliações

- Amelor V RTCDocumento15 páginasAmelor V RTCJoseph Tiña Ford100% (1)

- Torts CodalDocumento22 páginasTorts CodalVada De Villa RodriguezAinda não há avaliações

- S V Mupunga and Another (41 of 2024) 2024 ZWHHC 17 (25 January 2024)Documento21 páginasS V Mupunga and Another (41 of 2024) 2024 ZWHHC 17 (25 January 2024)Panganayi JamesAinda não há avaliações

- Axial - Standard NDADocumento2 páginasAxial - Standard NDAcubanninjaAinda não há avaliações

- Lesson 5Documento10 páginasLesson 5Jane AntonioAinda não há avaliações

- Limited Liability Partnership ActDocumento45 páginasLimited Liability Partnership Act2022474209.ayushAinda não há avaliações

- Unit-9 Performance of ContractDocumento3 páginasUnit-9 Performance of ContractAdith BinoyAinda não há avaliações

- Borromeo V DescallarDocumento2 páginasBorromeo V DescallarSamuel WalshAinda não há avaliações

- Latin Terminology English Translation Special Laws ApplicableDocumento2 páginasLatin Terminology English Translation Special Laws ApplicableCarmelie CumigadAinda não há avaliações

- Magma General Insurance Co. LTD vs. Nanu Ram Alias Chuhru RamDocumento14 páginasMagma General Insurance Co. LTD vs. Nanu Ram Alias Chuhru RamAmrit chutiaAinda não há avaliações

- United States v. Booth, 1st Cir. (1996)Documento19 páginasUnited States v. Booth, 1st Cir. (1996)Scribd Government DocsAinda não há avaliações

- Ramon E. Reyes and Clara R. Pastor vs. Bancom Development Corp.Documento2 páginasRamon E. Reyes and Clara R. Pastor vs. Bancom Development Corp.aa100% (1)

- League of Minnesota Cities Memo On Meetings of City CouncilsDocumento46 páginasLeague of Minnesota Cities Memo On Meetings of City CouncilsinforumdocsAinda não há avaliações

- Election CodeDocumento12 páginasElection CodeJem SantosAinda não há avaliações

- Stipulated Protective OrderDocumento5 páginasStipulated Protective OrderChad BrewbakerAinda não há avaliações

- Javellana Vs Executive Sec G.R. No. L-36142 March 31, 1973Documento14 páginasJavellana Vs Executive Sec G.R. No. L-36142 March 31, 1973Emrico Cabahug100% (1)

- JQC Complaint No. 13573 Judge Martha Jean CookDocumento42 páginasJQC Complaint No. 13573 Judge Martha Jean CookNeil GillespieAinda não há avaliações

- Deposit and GuarantyDocumento4 páginasDeposit and GuarantyDeejae HerreraAinda não há avaliações

- Evidence CRE MemoDocumento14 páginasEvidence CRE MemoAmita SinwarAinda não há avaliações

- United Polyresins v. PinuelaDocumento3 páginasUnited Polyresins v. PinuelaIge OrtegaAinda não há avaliações

- Supreme Court: Reyes v. COMELEC G.R. No. 207264Documento9 páginasSupreme Court: Reyes v. COMELEC G.R. No. 207264Jopan SJAinda não há avaliações

- Instructions To Guardian:: Guardian'S Report - Minor Current Reporting Period From - ToDocumento5 páginasInstructions To Guardian:: Guardian'S Report - Minor Current Reporting Period From - ToLaurena ThompsonAinda não há avaliações

- Petition Correction Live Birth EntryDocumento3 páginasPetition Correction Live Birth Entryabogado101Ainda não há avaliações

- Perricone DisbarredDocumento22 páginasPerricone DisbarredEthan BrownAinda não há avaliações

- LAND BANK OF THE PHILIPPINES Vs CACAYURANDocumento2 páginasLAND BANK OF THE PHILIPPINES Vs CACAYURANJyrus CimatuAinda não há avaliações

- ABS-CBN Broadcasting Corporation vs. World Interactive Network Systems (WINS) Japan Co. LTD 544 SCRA 308 (2008)Documento3 páginasABS-CBN Broadcasting Corporation vs. World Interactive Network Systems (WINS) Japan Co. LTD 544 SCRA 308 (2008)apremsAinda não há avaliações

- The Honorable Brian MclaurinDocumento6 páginasThe Honorable Brian MclaurinCraig O'DonnellAinda não há avaliações

- Medical Marijuana LawsuitDocumento27 páginasMedical Marijuana LawsuitOKCFOXAinda não há avaliações

- Chloe Pledge ContractDocumento3 páginasChloe Pledge ContractTan-Uy Jefferson Jay100% (2)