Escolar Documentos

Profissional Documentos

Cultura Documentos

Solution AP Test Bank 1

Enviado por

imaDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Solution AP Test Bank 1

Enviado por

imaDireitos autorais:

Formatos disponíveis

SOLUTION - AUDITING PROBLEMS TEST BANK 1

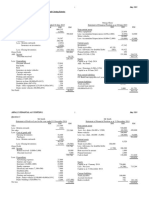

PROBLEM 1 TANYING CORP.

1. B Sales (P1,353,000 + P10,500 Freight) P1,363,500

Sales returns and allowances (11,700)

Sales discounts (2,640)

Net sales P1,349,160

2. C Inventory, Jan. 1 P269,100

Purchases P424,800

Purchase returns and allowances (P424,800 x 6%) (25,488)

Freight in (P16,575 + P1,710) 18,285 417,597

Cost of goods available for sale P686,697

3. D Inventory, Dec. 31, 2017

Per books P 61,650

Goods out on consignment 55,800

Per audit P117,450

4. C Distribution costs:

Sales salaries and commissions (P75,000 + [P9,180 x 3%]) P75,275

Advertising expense (P48,270 + [P5,454 x 2/6]) 50,088

Depreciation expense Sales/delivery equipment (P18,300 + [P23,400 x 10% x 10/12]) 20,250

Freight expense 10,500

Travel expense sales representatives 13,680

Miscellaneous selling expenses 8,220

Total P178,013

5. B Administrative expenses:

Legal services P 6,675

Insurance and licenses 23,040

Depreciation expense office equipment 12,600

Utilities 19,200

Telephone and postage 4,425

Office supplies expense (P6,540 P3,675) 2,865

Officers salaries 109,800

Doubtful accounts expense (P783,000 x 2% = P15,660 P480) 15,180

Total P193,785

6. A Allowance for doubtful accounts (P783,000 x 2%) P15,660

7. D Net sales P1,349,160

Cost of goods sold (P686,697 P117,450) (569,247)

Gross income 779,913

Interest revenue (P1,650 + P1,680) 3,330

Dividend revenue 15,450

Gain on sale of assets 23,460

Total income P822,153

8. C Total income P822,153

Distribution costs (178,013)

Administrative expenses (193,785)

Interest expense

(13,560)

Loss on sale of equipment (217,800)

Income from continuing operations before tax P218,995

9. B Office supplies inventory P3,675

10. A Income before tax P218,995

Income tax (P218,995 x 30) (65,669)

Income from continuing operations 153,296

Income from discontinued operations, net of tax (P120,000 x 70%) 84,000

Net income P237,296

Page 2

PROBLEM 2 BUNCHING COMPANY

Accounts Accounts

Cash Receivable Inventory Payable

Per books P963,200 P2,254,000 P6,050,000 P4,201,000

AJE 1 (654,600) 310,000 --- ---

2 360,000 --- --- 372,400

3 a --- --- --- (175,000)

b --- --- 130,000 ---

c --- --- (637,500) ---

d --- --- 217,500 217,500

e --- --- 275,000 ---

Per audit P668,600 P2,564,000 P6,035,000 P4,615,900

(11 C) (12 B) (13 A) (14 B)

AJES

1. Sales 360,100

Accounts receivable (P294,500 / 95%) 310,000

Sales discounts (P310,000 x 5%) 15,500

Cash 654,600

2. Cash (P372,400 P12,400) 360,000

Purchase discounts 12,400

Accounts payable 372,400

3. a Accounts payable 175,000

Purchases 175,000

b Inventory 130,000

Cost of sales 130,000

c Cost of sales 637,500

Inventory 637,500

d Purchases 217,500

Accounts payable 217,500

Inventory 217,500

Cost of sales 217,500

e Inventory 275,000

Cost of sales 275,000

f No adjusting entry

15. C Current ratio:

Current assets:

Cash P 668,600

Accounts receivable 2,564,000

Inventory 6,035,000 P9,267,600

Current liabilities:

Accounts payable P4,615,900

Accrued expenses 431,000 5,046,900

1.84

Page 3

PROBLEM 3 PAKO COMPANY

16. D Balance, Jan. 1 P1,800,000

June 30 acquisition (P1,080,000 + P48,000) 1,128,000

Sept. 30 sale (150,000)

Dec. 1 trade in: old machine (90,000)

new machine 270,000

Balance, Dec. 31 P2,958,000

17. A Remainder of beginning balance (P1,800,000 P150,000 P90,000 =

P1,560,000 x 10%) P156,000

June 30 acquisition (P1,128,000 x 10% x 6/12) 56,400

Sept. 30 sale (P150,000 x 10% x 9/12) 11,250

Dec. 1 trade in: old machine (P90,000 x 10% x 11/12) 8,250

new machine (P270,000 x 10% x 1/12) 2,250

Depreciation expense for 2015 P234,150

GENLUNA COPPERMINES, INC.

18. C Depletion rate per ton (P14,580,000 / 1,620,000) P9

Copper ore mined in 2017 (15,000 x 6 months) x 90,000

Depletion for 2017 P 810,000

Depletion per books 1,215,000

Overstatement of depletion expense P405,000

19. D Depreciable cost of machinery (P1,800,000 x 90%) P1,620,000

Estimated copper ore reserve 1,620,000

Depreciation rate per ton P1

Copper ore mined in 2017 90,000

Depreciation expense for 2017 P 90,000

Depreciation per books 120,000

Overstatement of depreciation expense P 30,000

20. D January 1, 2014

Total cost of machine (P300,000 + P3,000 + P12,000) P315,000

Residual value (12,000)

Depreciable cost P303,000

Estimated useful life 10 years

Annual depreciation P30,300

Depreciable cost P303,000

Depreciation, 2016 2014 (P30,300 x 3 years) (90,000)

Remaining depreciable cost, Jan. 1, 2017 P212,100

Cost of new parts 37,800

Total P249,900

Remaining useful life (10 years 3 years) 7 years

Revised annual depreciation P35,700

PROBLEM 4 HARLINGTON COMPANY

21. A Net income before trading security adjustment P2,700,000

Unrealized loss (P3,465,000 cost P3,195,000 market value) (270,000)

Net income, as adjusted P2,430,000

22. B Net income before trading security adjustment P2,700,000

Unrealized gain (P3,465,000 cost P3,564,000 market value) 99,000

Net income, as adjusted P2,799,000

LABADA CO.

23. D Carrying Value Market Value

Ganda Co. P1,710,000 P1,759,500

Waston, Inc. (P135 x 1,800) 243,000 229,500

P1,953,000 P1,989,000

Unrealized gain (P1,989,000 P1,953,000) P36,000

24. C Net proceeds (P93 x 15,000 = P1,395,000 P13,500) P1,381,500

Carrying value (1,251,000)

Gain on sale P 130,500

25. B Trading securities at fair value P1,989,000

Page 4

PROBLEM 5 SAMSON MFG. CO.

26. C Actual borrowing cost:

Specific borrowing (P5 million x 10%) P500,000

General borrowings:

P25 million x 8% P2,000,000

P15 million x 6% 900,000 2,900,000

Total P3,400,000

Capitalization rate (P2,900,000/P40 million) 7.25%

Average expenditures 2016 P7,250,000

Capitalizable interest 2016:

Specific borrowing (P5 million x 10%) P500,000

General borrowings (P7,250,000 P5,000,000 = P2,250,000 x 7.25%) 163,125

Total P663,125

27. B Average expenditures 2017 P16,163,125

Capitalizable interest 2017:

Specific borrowing (P5 million 10% x 6/12) P250,000

General borrowings (P16,163,125 P5,000,000 = P11,163,125 x 7.25% x 6/12) 404,663

Total P654,663

28. A 2014 interest expense (P3,400,000 P663,125) P2,736,875

29. D 2015 interest expense (P3,400,000 P654,663) P2,745,337

30. B Accumulated expenditures before interest P19,500,000

Interest capitalized in 2016 and 2017 (P663,125 + P654,663) 1,317,788

Total cost of building P20,817,788

PROBLEM 6

Compensation Cumulative

Expense Compensation

Year Calculation for Period Expense

1 30,000 options x P5 fair value x P 50,000 P 50,000

2 30,000 options x P5 fair value x 50,000 100,000

3 30,000 options x P5 fair value x 50,000 150,000

31. C 32. C 33. D 34. D 35. D

PROBLEM 7 BRANDY CO.

36. C Ordinary shares issued and outstanding 72,000

Ordinary shares subscribed 72,000

Total 144,000

Ordinary shares issued to acquire land (24,000)

Ordinary shares originally subscribed 120,000

Par value/share x P10

Total par value P1,200,000

Share premium (P2,850,000 P450,000) 2,400,000

Total subscription price P3,600,000

* P690,000 FV of land P240,000 PV

37. D Subscription of 12,000 preference shares @ P120/share P1,440,000

Subscription of 60,000 preference shares @ P100/share 6,000,000

Total 7,440,000

Year-end balance of subscriptions receivable preference (360,000)

Amount collected from subscribers P7,080,000

38. B Preference Ordinary

Issued P6,600,000 P 720,000

Subscribed 600,000 720,000

Share premium 240,000 2,850,000

Subscriptions receivable (360,000) (1,080,000)

Contributed capital P7,080,000 P3,210,000

Page 5

CONDESSA CO.

1. Dividends payable preference (P8 x 60,000) 480,000

Dividends payable ordinary (P2 x 600,000) 1,200,000

Cash 1,680,000

2. Treasury shares 3,240,000

Cash (P40 x 81,000) 3,240,000

3. Land 900,000

Treasury shares (P40 x 21,000) 840,000

Share premium treasury 60,000

4. Cash (P105 x 15,000) 1,575,000

Preference share capital (P100 x 15,000) 1,500,000

Share premium preference 75,000

5. Retained earnings (P45 x 54,000*) 2,430,000

Stock dividends payable (P5 x 54,000) 270,000

Share premium ordinary 2,160,000

* 600,000 60,000 treasury shares = 540,000 x 10%

6. Stock dividends payable 270,000

Ordinary share capital 270,000

7. Retained earnings 1,788,000

Dividends payable preference (P8 x 75,000) 600,000

Dividends payable ordinary (P2 x 594,000*) 1,188,000

* 540,000 + 54,000

8. Income summary 9,900,000

Retained earnings 9,900,000

Preference share capital (P6,000,000 + P1,500,000) P7,500,000

Ordinary share capital (P3,000,000 + P270,000) 3,270,000

Share premium (P3,750,000 + P60,000 + P75,000 + P2,160,000) 6,045,000

Retained earnings (P3,500,000 P2,430,000 P1,788,000 + P9,900,000) (39 A) 9,182,000

Treasury shares (P3,240,000 P840,000) (2,400,000)

Total (40 B) P23,597,000

PROBLEM 8 CABOOM LABORATORIES

41. D Cost to obtain patent (January 2010) P186,150

2010 amortization (P186,150/17) (10,950)

Carrying value, Dec. 31, 2010 P175,200

42. C Carrying value, Jan. 1, 2011 P175,200

Amortization, 2011-2014 (P10,950 x 4 years) (43,800)

Carrying value, Dec. 31, 2014 P131,400

43. C Carrying value, Jan. 1, 2015 P131,400

Amortization, 2015-2017 (P131,400 x 3/5) (78,840)

Carrying value, Dec. 31, 2017 P 52,560

BARTOLO COMPANY

44. A Cost of patent purchased on Jan. 1, 2016 P4,000,000

2016 amortization (P4,000,000/10) (400,000)

Carrying value, Dec. 31, 2016 3,600,000

2017 amortization (P3,600,000/5) (720,000) P2,880,000

Cost of franchise P960,000

2017 amortization (P960,000/10) (96,000) 864,000

Total carrying value of intangibles P3,744,000

45. B Amortization of patent 2017 P720,000

Amortization of franchise 2017 96,000

Payment to Delco (P5,000,000 x 5%) 250,000

Research and development costs 866,000

Total charges against 2017 income P1,932,000

Page 6

PROBLEM NO. 9 SAMOA COMPANY/CHILE CO.

46. A Over- (Under-)statement

Understatement of 2016 ending inventory P 48,000

Overstatement of 2017 ending inventory 40,500

Prepaid insurance charged to expense in 2016 (P330,000 3) 110,000

Unrecorded sale of fully depreciated machinery in 2017 (75,000)

Total effect of errors on net income P123,500

47. D Over- (Under-)statement

Overstatement of 2017 ending inventory P 40,500

Prepaid insurance charged to expense in 2016 (110,000)

Unrecorded sale of fully depreciated machinery in 2017 (75,000)

Total effect on working capital (P144,500)

48. C Over- (Under-)statement

Overstatement of 2017 ending inventory P 40,500

Understatement of depreciation expense in 2016 11,500

Prepaid insurance charged to expense in 2016 (110,000)

Unrecorded sale of fully depreciated machinery in 2017 (75,000)

Total effect on retained earnings (P133,000)

2016 2017

Pretax income P505,000 P387,000

Sales revenue erroneously recognized in 2016 (191,000) 191,000

Understatement of 2016 ending inventory 43,200 (43,200)

Understatement of bond interest expense (1) (7,250) (7,758)

Ordinary repairs erroneously capitalized (42,500) (47,000)

Overstatement of depreciation (2) 4,250 8,950

Corrected pretax income P311,700 P488,992

(1)

Book Value Nominal Effective Discount

Year of Bonds Interest Interest Amortization

2016 P1,175,000 P75,000 P82,250 P7,250

2017 1,182,250 75,000 82,758 7,758

(2)

2016 (P42,500 10) P4,250

2017 (P42,500 10) P4,250

(P47,000 10) 4,700 P8,950

49. C 50. D

PROBLEM NO. 10 OMEGA COMPANY/DP, INC.

51. C Containers held by customers at Dec. 31, 2016 from deliveries in 2015 P85,000

Containers returned in 2017 from deliveries in 2015 (57,500)

Revenue from container sales P27,500

52. A Liability for returnable containers, Dec. 31, 2016 P325,000

Deliveries in 2017 430,000

Total 755,000

2017 container returns P354,500

2017 container sales 27,500 (382,000)

Liability for returnable containers P373,000

53. C Unearned warranty revenue:

Current (P810 x 270 x 1/3) P72,900

Non-current (P810 x 270 x 2/3) P145,800

54. D Parts P18,000

Labor 36,000

Total warranty expense P54,000

55. B Unearned warranty revenue:

Current (P810 x 270 x 1/3) P72,900

Non-current (P810 x 270 x 1/3) P72,900

Page 7

PROBLEM 11 TGR Company

56. D Trade-in June 30, 2015

Cost P157,200

Accum. depreciation, 1/1/13 6/30/15 (P157,200 x 20% x 2.5 yrs.) 78,600

Carrying value 78,600

Trade-in value 129,000 P50,400

Sale Jan. 1, 2016

Cost P132,000

Accum. depreciation, 1/1/13 1/1/16 (P132,000 x 20% x 3 yrs.) 79,200

Carrying value 52,800

Net proceeds 71,250 18,450

Sale October 1, 2017

Cost P120,000

Accum. depreciation, 1/1/13 10/1/17 (P120,000 x 20% x 4 9/12) 114,000

Carrying value 6,000

Proceeds 24,000 18,000

Total gain P86,850

57. C Machine acquired on Sept. 30, 2013 (P180,000 + P6,000) P186,000

Machine acquired on June 30, 2014 (P240,000 x 98%) 235,200

Machine acquired on June 30, 2016 (list price) 279,000

Total P700,200

58. C Machine acquired on:

Sept. 30, 2013 (P186,000 x 20% x 4 3/12) P158,100

June 30, 2014 (P235,200 x 20% x 3 6/12) 164,640

June 30, 2015 (P279,000 x 20% x 2 6/12) 139,500

Accumulated depreciation, December 31, 2017 P462,240

59. B

Date of

Acquisition Cost 2013 2014 2015 2016 2017 Total

1/1/2013 P157,200 P31,440 P31,440 P15,720 P0 P0 P 78,600

120,000 24,000 24,000 24,000 24,000 18,000 114,000

132,000 26,400 26,400 26,400 0 0 79,200

9/30/2013 186,000 9,300 37,200 37,200 37,200 37,200 158,100

6/30/2014 235,200 0 23,520 47,040 47,040 47,040 164,640

6/30/2015 279,000 0 0 27,900 55,800 55,800 139,500

Correct depreciation P91,140 P142,560 P178,260 P164,040 P158,040 P734,040

Depreciation per client 97,440 154,752 153,802 108,791 82,233 597,018

Over (under)statement P 6,300 P 12,192 (P 24,458) (P 55,249) (P 75,807) (P 137,022)

60. A Depreciation expense (2017) 75,807

Retained earnings (2013 2016) 61,215

Accumulated depreciation 137,022

---END---

Você também pode gostar

- AP Problems 2016Documento26 páginasAP Problems 2016RosejaneLim100% (1)

- AP Solutions 2016Documento13 páginasAP Solutions 2016Mary Ann Gumpay Rago100% (1)

- YowDocumento35 páginasYowJane Michelle Eman100% (1)

- Audit of EquityDocumento5 páginasAudit of EquityKarlo Jude Acidera0% (1)

- Audit of SheDocumento3 páginasAudit of ShegbenjielizonAinda não há avaliações

- Auditing Problems AP 007 to 010 SolutionsDocumento6 páginasAuditing Problems AP 007 to 010 SolutionsSerena Van der WoodsenAinda não há avaliações

- CPA Review School of the Philippines Auditing Problems Final Preboard Examination Set September 2013Documento18 páginasCPA Review School of the Philippines Auditing Problems Final Preboard Examination Set September 2013Herald Gangcuangco0% (1)

- Accounting for Liquidation and Foreign ExchangeDocumento8 páginasAccounting for Liquidation and Foreign Exchangeprecious mlb100% (1)

- EXCEL Professional Services Management Firm PTRC Open Final Preboard ProblemsDocumento37 páginasEXCEL Professional Services Management Firm PTRC Open Final Preboard ProblemsAnonymous Lih1laaxAinda não há avaliações

- 4 - Audit of InvestmentsDocumento11 páginas4 - Audit of InvestmentsSharmaine Clemencio0Ainda não há avaliações

- Ap105 InvestmentsDocumento5 páginasAp105 InvestmentsVandix100% (1)

- Measurement of Inventory and Inventory Shortage5Documento3 páginasMeasurement of Inventory and Inventory Shortage5CJ alandyAinda não há avaliações

- IntangiblesDocumento15 páginasIntangiblesJ RodriguezAinda não há avaliações

- T R S A: Ap-200Q: Quizzer On Financing Cycle: Audit of Stockholders' EquityDocumento12 páginasT R S A: Ap-200Q: Quizzer On Financing Cycle: Audit of Stockholders' Equityprincess sibugAinda não há avaliações

- Auditing Problem ReviewerDocumento10 páginasAuditing Problem ReviewerTina Llorca83% (6)

- Some Advac Problems by DayagDocumento6 páginasSome Advac Problems by DayagElijah Montefalco100% (1)

- PRTC Cup 2017Documento18 páginasPRTC Cup 2017Sherrizah Ferrer MaribbayAinda não há avaliações

- Chapter 3Documento11 páginasChapter 3Christlyn Joy BaralAinda não há avaliações

- P2 1PB 2nd Sem 1314 With SolDocumento15 páginasP2 1PB 2nd Sem 1314 With SolRhad EstoqueAinda não há avaliações

- RFBT AssessmentDocumento9 páginasRFBT AssessmentJirah Bernal100% (1)

- Chapter 03Documento30 páginasChapter 03ajbalcitaAinda não há avaliações

- CBS Corporation Purchased 10Documento12 páginasCBS Corporation Purchased 10Stella SabaoanAinda não há avaliações

- Items 1Documento7 páginasItems 1RYANAinda não há avaliações

- Audit of Ppe ModuleDocumento19 páginasAudit of Ppe ModuleEunice Enriquez100% (4)

- AuditingDocumento8 páginasAuditingmagoimoiAinda não há avaliações

- The Shareholders' Equity Section of Dawson Corporation's Statement of Financial Position As of December 31, 2019, Is As FollowsDocumento4 páginasThe Shareholders' Equity Section of Dawson Corporation's Statement of Financial Position As of December 31, 2019, Is As FollowsAnn louAinda não há avaliações

- Ho BRDocumento3 páginasHo BRSummer Star33% (3)

- A6 Share 221 eDocumento2 páginasA6 Share 221 eNika Ella SabinoAinda não há avaliações

- Audit Receivables SalesDocumento13 páginasAudit Receivables SalesRegina Rebulado40% (5)

- Audit of Investments - Set ADocumento4 páginasAudit of Investments - Set AZyrah Mae SaezAinda não há avaliações

- Stockholders' Equity Calculations for Multiple CompaniesDocumento20 páginasStockholders' Equity Calculations for Multiple CompaniesKarlovy DalinAinda não há avaliações

- Practical Accounting II - 2nd PreboardDocumento9 páginasPractical Accounting II - 2nd PreboardKim Cristian Maaño0% (1)

- Set ADocumento5 páginasSet ASomersAinda não há avaliações

- Advanced Acounting QizDocumento3 páginasAdvanced Acounting QizJamhel MarquezAinda não há avaliações

- SY1920 1st Sem ACCO4083 - 3rd EvaluationDocumento9 páginasSY1920 1st Sem ACCO4083 - 3rd EvaluationPaul Adriel BalmesAinda não há avaliações

- PRTC 1st Preboard Solution GuideDocumento48 páginasPRTC 1st Preboard Solution GuideAnonymous Lih1laax100% (2)

- Ap-300S: Solutions To Quizzer On Financing, Expenditure/Purchase & Disbursement Cycles: Audit of LiabilitiesDocumento9 páginasAp-300S: Solutions To Quizzer On Financing, Expenditure/Purchase & Disbursement Cycles: Audit of Liabilitiesryan rosalesAinda não há avaliações

- Nfjpia R12 Mock Board Examination: Page 1 of 8Documento8 páginasNfjpia R12 Mock Board Examination: Page 1 of 8Leane MarcoletaAinda não há avaliações

- Practical Accounting - Part 1Documento17 páginasPractical Accounting - Part 1Kenneth Bryan Tegerero Tegio100% (1)

- Adv AFARDocumento145 páginasAdv AFARDvcLouisAinda não há avaliações

- PRTC - AT3 - The Professional Practice of Public AccountingDocumento4 páginasPRTC - AT3 - The Professional Practice of Public Accountingelle868Ainda não há avaliações

- This Study Resource Was: Afar de Leon/De Leon/De Leon Quiz 2 Set A Batch: M A Y 2018Documento2 páginasThis Study Resource Was: Afar de Leon/De Leon/De Leon Quiz 2 Set A Batch: M A Y 2018Jamaica DavidAinda não há avaliações

- Audit Problems CashDocumento18 páginasAudit Problems CashYenelyn Apistar Cambarijan0% (1)

- Auditing ProblemsDocumento5 páginasAuditing ProblemsJayr BVAinda não há avaliações

- Auditing Problems MC Quizzer 02Documento15 páginasAuditing Problems MC Quizzer 02anndyAinda não há avaliações

- ToaDocumento6 páginasToarain06021992Ainda não há avaliações

- Quizzer Answers KeyDocumento4 páginasQuizzer Answers KeyDaneen GastarAinda não há avaliações

- Solution - Auditing Problems Test Bank 1: Problem 1 - Tanying CorpDocumento3 páginasSolution - Auditing Problems Test Bank 1: Problem 1 - Tanying CorpJayvee BalinoAinda não há avaliações

- Ap Solutions 2016Documento15 páginasAp Solutions 2016Shariefia MagondacanAinda não há avaliações

- Auditing Problem Test Bank 1 AnsDocumento9 páginasAuditing Problem Test Bank 1 AnsJayson CerradoAinda não há avaliações

- Chapter18 - Answer PDFDocumento25 páginasChapter18 - Answer PDFAvon Jade RamosAinda não há avaliações

- Chapter18 - Answer PDFDocumento25 páginasChapter18 - Answer PDFJONAS VINCENT SamsonAinda não há avaliações

- Solution AP Test Bank 2Documento9 páginasSolution AP Test Bank 2imaAinda não há avaliações

- T12 - ABFA1153 (Extra)Documento2 páginasT12 - ABFA1153 (Extra)LOO YU HUANGAinda não há avaliações

- 2016 Vol 3 CH 6 AnsDocumento6 páginas2016 Vol 3 CH 6 Ansjohn lloyd JoseAinda não há avaliações

- 1-1hkg 2002 Dec ADocumento8 páginas1-1hkg 2002 Dec AWing Yan KatieAinda não há avaliações

- Income Statement For The Year Ended, December, 31, 2016: Pt. ZaliaDocumento4 páginasIncome Statement For The Year Ended, December, 31, 2016: Pt. ZaliaNofi Nurlaila0% (1)

- MARCH 2020 AnswerDocumento16 páginasMARCH 2020 AnswerXianFa WongAinda não há avaliações

- Cpa Reviewschool of The Phlppnes Man It A Auditeng Problems Fena Pre-Board Examination Problem2 - Everlasting CompanyDocumento6 páginasCpa Reviewschool of The Phlppnes Man It A Auditeng Problems Fena Pre-Board Examination Problem2 - Everlasting CompanyLexuz Mar DyAinda não há avaliações

- Part 1 Examination - Paper 1.1 (INT) Preparing Financial Statements (InternationalDocumento8 páginasPart 1 Examination - Paper 1.1 (INT) Preparing Financial Statements (InternationalAUDITOR97Ainda não há avaliações

- Cor 015 Reviewer 2nd PEDocumento2 páginasCor 015 Reviewer 2nd PEimaAinda não há avaliações

- SHE ExamDocumento12 páginasSHE ExamimaAinda não há avaliações

- Case Study Rating Form11Documento1 páginaCase Study Rating Form11imaAinda não há avaliações

- DocumentationDocumento4 páginasDocumentationimaAinda não há avaliações

- Solution AP Test Bank 2Documento9 páginasSolution AP Test Bank 2imaAinda não há avaliações

- NSRP Form 1Documento2 páginasNSRP Form 1ima100% (1)

- Policies and Guidelines of The UmbilicusDocumento3 páginasPolicies and Guidelines of The UmbilicusimaAinda não há avaliações

- A Narrative Report in On-The-Job Training Undertaken at Bureau of Internal Revenue at Municipality of Lingayen, PangasinanDocumento1 páginaA Narrative Report in On-The-Job Training Undertaken at Bureau of Internal Revenue at Municipality of Lingayen, PangasinanimaAinda não há avaliações

- Henri Fayol PrinciplesDocumento3 páginasHenri Fayol PrinciplesimaAinda não há avaliações

- Ngaslecture NewDocumento56 páginasNgaslecture NewGenelyn LangoteAinda não há avaliações

- Chapter 18 States and Local Govermental UnitsDocumento14 páginasChapter 18 States and Local Govermental UnitsHyewon100% (1)

- Daily JournalDocumento29 páginasDaily JournalimaAinda não há avaliações

- Me Before YouDocumento3 páginasMe Before YouimaAinda não há avaliações

- Mama FilesDocumento9 páginasMama FilesimaAinda não há avaliações

- Audit PlanningDocumento42 páginasAudit PlanningimaAinda não há avaliações

- Relevant Costing by A BobadillaDocumento43 páginasRelevant Costing by A BobadillaAngelu Amper56% (18)

- PsaDocumento2 páginasPsaMarikh RianoAinda não há avaliações

- Other Psychological Effects of Drug Addiction InclDocumento4 páginasOther Psychological Effects of Drug Addiction InclimaAinda não há avaliações

- Advanced Accounting Baker Test Bank - Chap020Documento31 páginasAdvanced Accounting Baker Test Bank - Chap020donkazotey100% (2)

- Pfrs For SmesDocumento6 páginasPfrs For SmesimaAinda não há avaliações

- PoemsDocumento3 páginasPoemsimaAinda não há avaliações

- Case HistoryDocumento1 páginaCase HistoryimaAinda não há avaliações

- PoemsDocumento3 páginasPoemsimaAinda não há avaliações

- Multiple Choice Test and Tax ProblemsDocumento6 páginasMultiple Choice Test and Tax ProblemsimaAinda não há avaliações

- Me Before YouDocumento3 páginasMe Before YouimaAinda não há avaliações

- PsaDocumento2 páginasPsaMarikh RianoAinda não há avaliações

- Financial AnalysisDocumento211 páginasFinancial AnalysisimaAinda não há avaliações

- Foreign Capital and ForeignDocumento11 páginasForeign Capital and Foreignalu_tAinda não há avaliações

- Comparitive Analysis of Certain Sections of Companies Act, 1956 & Companies Act, 2013Documento11 páginasComparitive Analysis of Certain Sections of Companies Act, 1956 & Companies Act, 2013MOUSOM ROYAinda não há avaliações

- Financial Accounting 1 by HaroldDocumento392 páginasFinancial Accounting 1 by HaroldRobertKimtaiAinda não há avaliações

- Accounting in Action: Adopted From: Accounting Principles, 13 EditionDocumento57 páginasAccounting in Action: Adopted From: Accounting Principles, 13 EditionDimas Rizalul100% (1)

- DFCCIL Railway Questions: SEO-Optimized TitleDocumento33 páginasDFCCIL Railway Questions: SEO-Optimized Titleop nAinda não há avaliações

- PMS - Data TTM Return Till May16bDocumento15 páginasPMS - Data TTM Return Till May16bMoneylife FoundationAinda não há avaliações

- Bernabe Accounting-FirmDocumento33 páginasBernabe Accounting-FirmElla Ramos100% (1)

- Project Report On TDS PDFDocumento35 páginasProject Report On TDS PDFPriti gupta50% (2)

- St Hannah's Preparatory School Fees Structure 2020Documento1 páginaSt Hannah's Preparatory School Fees Structure 2020RUTIYOMBA Eustache100% (1)

- 3.3.2.2 Explain Stock Valuation Alolod DelicanoDocumento11 páginas3.3.2.2 Explain Stock Valuation Alolod DelicanoaiahAinda não há avaliações

- Chapter 6 Terms and DatingsDocumento26 páginasChapter 6 Terms and Datingshtagle0% (1)

- TFI InternationalDocumento43 páginasTFI InternationalJenny QuachAinda não há avaliações

- Arab Region Fintech GuideDocumento54 páginasArab Region Fintech GuideHisham DaelAinda não há avaliações

- FIN 302 Notes 1Documento55 páginasFIN 302 Notes 1Tekego TlakaleAinda não há avaliações

- Application For A Bank Guarantee: Please SelectDocumento6 páginasApplication For A Bank Guarantee: Please SelectGulrana AlamAinda não há avaliações

- Payment CheckoutDocumento1 páginaPayment Checkoutyahya vhsAinda não há avaliações

- PPF LoanwithdrawlDocumento1 páginaPPF LoanwithdrawlNagalakshmiAinda não há avaliações

- Standard 3 (A, B, C, D, E)Documento19 páginasStandard 3 (A, B, C, D, E)Sana TahirAinda não há avaliações

- Lecture Notes 3Documento38 páginasLecture Notes 3Jonathan Tran100% (1)

- Solved The Adjusted Trial Balance of Pacific Scientific Corporation On DecemberDocumento1 páginaSolved The Adjusted Trial Balance of Pacific Scientific Corporation On DecemberAnbu jaromiaAinda não há avaliações

- South City Homes vs BA Financial Trust Receipts CaseDocumento2 páginasSouth City Homes vs BA Financial Trust Receipts CaseFloyd MagoAinda não há avaliações

- Megast India Solutions Pvt. LTD.: Tax InvoiceDocumento1 páginaMegast India Solutions Pvt. LTD.: Tax InvoiceDivya GowdaAinda não há avaliações

- Japan TaxesDocumento72 páginasJapan Taxesmagasara123Ainda não há avaliações

- INTRODUCTION To NPADocumento3 páginasINTRODUCTION To NPApradeeppinku50% (4)

- Review of International Accounting Information SystemsDocumento6 páginasReview of International Accounting Information SystemsMarwa RabieAinda não há avaliações

- The Impact of Credit Management On SmallDocumento14 páginasThe Impact of Credit Management On SmallPia CallantaAinda não há avaliações

- Direct DebitDocumento24 páginasDirect Debitatifhassansiddiqui100% (3)

- Pilipinas Bank v. Ong and LimDocumento4 páginasPilipinas Bank v. Ong and LimKeej DalonosAinda não há avaliações

- M.phil Register Final1Documento53 páginasM.phil Register Final1Anonymous dfy2iDZAinda não há avaliações

- Session 2-2: Credit Risk Database (CRD) For SME Financial Inclusion by Lan Hoang NguyenDocumento18 páginasSession 2-2: Credit Risk Database (CRD) For SME Financial Inclusion by Lan Hoang NguyenADBI EventsAinda não há avaliações